Returnable Glass Bottle Ink Market Size, Share, and Trends Analysis Report

CAGR :

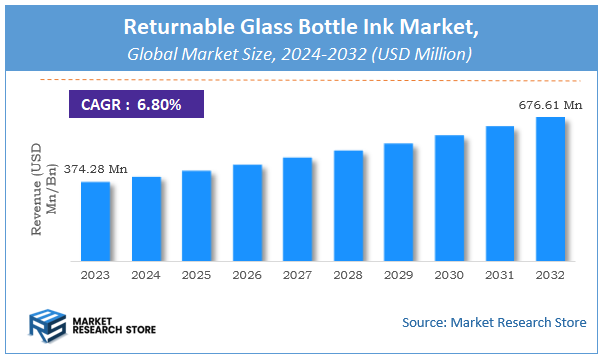

| Market Size 2023 (Base Year) | USD 374.28 Million |

| Market Size 2032 (Forecast Year) | USD 676.61 Million |

| CAGR | 6.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Returnable Glass Bottle Ink Market Insights

According to Market Research Store, the global returnable glass bottle ink market size was valued at around USD 374.28 million in 2023 and is estimated to reach USD 676.61 million by 2032, to register a CAGR of approximately 6.8% in terms of revenue during the forecast period 2024-2032.

The returnable glass bottle ink report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Returnable Glass Bottle Ink Market: Overview

Returnable glass bottle ink refers to the specialized ink formulations used for printing labels, barcodes, batch numbers, or branding information on returnable glass bottles, typically used in the beverage and dairy industries. These inks are uniquely designed to offer high adhesion and resistance to washing, abrasion, and chemical exposure during the multiple life cycles of a returnable bottle. However, they are also engineered to be removable during industrial cleaning processes without leaving residues, ensuring the bottles can be reused and rebranded efficiently. Common types include solvent-based, UV-curable, and water-based inks, depending on the printing method and bottle washing processes employed.

Key Highlights

- The returnable glass bottle ink market is anticipated to grow at a CAGR of 6.8% during the forecast period.

- The global returnable glass bottle ink market was estimated to be worth approximately USD 374.28 million in 2023 and is projected to reach a value of USD 676.61 million by 2032.

- The growth of the returnable glass bottle ink market is being driven by the rising demand for sustainable and eco-friendly packaging solutions, particularly in the beverage and food sectors.

- Based on the ink type, the water-based inks segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the beverage bottles segment is projected to swipe the largest market share.

- In terms of color, the black segment is expected to dominate the market.

- Based on the end-use, the food and beverage segment is expected to dominate the market.

- By region, Europe is expected to dominate the global market during the forecast period.

Returnable Glass Bottle Ink Market: Dynamics

Key Growth Drivers

- Sustainability Trends: Growing demand for circular economy practices drives adoption of returnable bottles, necessitating durable inks that withstand multiple wash cycles.

- Regulatory Push: Governments enforcing plastic reduction and reuse mandates (e.g., EU Single-Use Plastics Directive) incentivize reusable packaging solutions.

- Consumer Preference for Eco-Labels: Brands adopting eco-friendly packaging seek non-toxic, long-lasting inks to align with green branding.

- Ink Durability Innovations: Advances in chemical-resistant, fade-proof inks enhance longevity, reducing relabeling costs for manufacturers.

Restraints

- High Development Costs: R&D for wash-resistant, food-safe inks increases production expenses, limiting affordability for SMEs.

- Raw Material Scarcity: Dependency on specialized pigments/binders (e.g., ceramic-based inks) faces supply chain bottlenecks.

- Safety Compliance: Strict food-contact regulations (e.g., FDA, EFSA) require rigorous testing, delaying market entry.

- Limited Bottle Standardization: Variability in bottle designs/compositions complicates ink adhesion consistency.

Opportunities

- Smart Inks: Development of temperature-sensitive or sterilization-indicating inks to add functionality for logistics/quality control.

- Partnerships with Beverage Giants: Collaboration with Coca-Cola, Heineken, etc., to co-develop tailored solutions for high-volume reuse systems.

- Emerging Markets: Expansion in Asia-Pacific and Africa, where reusable bottle systems are gaining traction in beverages and cosmetics.

- Bio-Based Inks: Plant-derived or water-based formulations to meet zero-waste goals and reduce environmental footprint.

Challenges

- Competition from Laser Etching: Alternative labeling methods reduce reliance on inks, threatening market share.

- Logistical Complexity: Inconsistent bottle return rates and cleaning processes impact ink performance reliability.

- Quality Degradation: Repeated washing cycles risk ink wear, affecting brand visibility and consumer trust.

- Regional Regulatory Fragmentation: Divergent safety and environmental standards across markets complicate global scaling.

Returnable Glass Bottle Ink Market: Report Scope

This report thoroughly analyzes the Returnable Glass Bottle Ink Market Insights, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Returnable Glass Bottle Ink Market Insights |

| Market Size in 2023 | USD 374.28 Million |

| Market Forecast in 2032 | USD 676.61 Million |

| Growth Rate | CAGR of 6.8% |

| Number of Pages | 170 |

| Key Companies Covered | Flint Group, Sakata Inx Corporation, TOYO INK SC HOLDINGS CO. LTD., Toyo Offset Printing Ink Mfg. Co. Ltd., Siegwerk Druckfarben AG Co. KGaA, DIC Corporation, Kinyo Printing Inks Co. Ltd., BASF SE, Zhejiang Hengfeng Ink Co. Ltd., HUBERGROUP AG, Meihua Ink |

| Segments Covered | By Ink Type, By Application, By Color, By End-use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Returnable Glass Bottle Ink Market: Segmentation Insights

The global returnable glass bottle ink market is divided by ink type, application, color, end-use, and region.

Segmentation Insights by Ink Type

Based on ink type, the global returnable glass bottle ink market is divided into water-based inks, solvent-based inks, UV-curable inks, and electron beam-curable inks.

In the returnable glass bottle ink market, water-based inks are the most dominant segment. These inks are widely preferred due to their low environmental impact, non-toxic nature, and ease of cleaning, making them suitable for industries with strict environmental and safety regulations. They are particularly popular in food and beverage packaging applications, where compliance with health standards is critical. Water-based inks also offer good adhesion to glass surfaces when used with appropriate pretreatments, making them a reliable and sustainable choice.

Following water-based inks, UV-curable inks represent the next most dominant segment. These inks are cured instantly under ultraviolet light, which speeds up the production process and provides excellent durability and adhesion on glass surfaces. Their resistance to smudging, scratching, and chemical exposure makes them ideal for high-end product packaging where both aesthetics and performance are important. Moreover, the ability to print sharp, vibrant images contributes to their growing popularity in branding-focused applications.

Solvent-based inks come next in the hierarchy. Known for their strong adhesion and durability, these inks are effective on non-porous surfaces like glass. However, their use has declined somewhat due to environmental concerns and strict VOC (volatile organic compound) regulations. Despite this, they are still employed in applications where durability and chemical resistance are prioritized, such as industrial or heavy-duty product labeling.

Electron beam-curable inks occupy the smallest market share among the segments. These inks offer similar performance benefits to UV-curable inks but require more complex and expensive curing equipment. Their use is typically limited to specialized applications where superior resistance and long-term durability are essential, such as in pharmaceutical packaging or high-value consumer goods. Due to the high cost of implementation and relatively low demand, they remain a niche segment in the returnable glass bottle ink market.

Segmentation Insights by Application

On the basis of application, the global returnable glass bottle ink market is bifurcated into beverage bottles, food jars, pharmaceutical bottles, cosmetic bottles, and other applications.

In the returnable glass bottle ink market, beverage bottles constitute the most dominant application segment. This dominance is primarily driven by the high consumption of bottled beverages such as beer, soft drinks, and mineral water, especially in regions where returnable bottle systems are well-established. Inks used on beverage bottles must withstand frequent washing, sterilization, and handling, making durability and print clarity crucial. Water-based and UV-curable inks are commonly used in this segment due to their strong adhesion and environmental friendliness.

Food jars follow as the second most prominent segment. Returnable glass jars for items like sauces, jams, and condiments are popular in both commercial and artisanal markets. The inks used in this application must be food-safe and resistant to washing processes, which is why water-based inks are especially favored here. Branding and labeling are also important for consumer appeal, contributing to the need for vivid, high-quality prints.

Pharmaceutical bottles represent the next significant segment. These bottles require ink that complies with stringent regulatory standards for health and safety. The inks must not leach harmful substances and must remain legible throughout the product’s life cycle. UV-curable and electron beam-curable inks are often chosen for their durability, high-resolution print capabilities, and non-migratory characteristics, though the market share for this segment remains moderate due to the smaller volume of returnable use compared to food and beverage industries.

Cosmetic bottles are a growing but relatively smaller segment. In this space, aesthetics and brand image are highly important, so the demand for high-resolution, vibrant ink is key. Inks used must also be durable enough to withstand frequent handling and exposure to light or oils. UV-curable inks are commonly used for their ability to produce striking finishes on glass, but the returnable trend is not yet as mature in the cosmetics sector, which limits market size.

Segmentation Insights by Color

Based on color, the global returnable glass bottle ink market is divided into black, white, clear, red, blue, green, yellow, and other colors.

In the returnable glass bottle ink market, black ink is the most dominant color segment. Its popularity stems from its excellent visibility and contrast on glass surfaces, making it ideal for printing essential information such as batch numbers, expiration dates, barcodes, and brand identifiers. Black ink is also compatible with a wide range of substrates and curing methods, including water-based, solvent-based, and UV-curable systems, further contributing to its widespread use across beverage, food, and pharmaceutical packaging.

White ink follows as the second most dominant color. White ink is particularly important for creating a base layer on dark-colored bottles or for enabling full-color printing on clear or tinted glass. It is widely used in branding and decorative applications, especially in the cosmetic and beverage industries where visual appeal is critical. UV-curable white inks are favored for their opacity, brightness, and adherence to glass surfaces.

Clear ink ranks next and is commonly used as a protective or gloss coating rather than for labeling or decoration. Clear coatings help preserve printed content and enhance the aesthetic finish of the bottle, giving it a polished and premium look. This ink type is typically applied over other printed colors and is more prevalent in cosmetic and specialty beverage packaging.

Red, blue, and green inks are used primarily for branding and visual differentiation. Among them, red is the most frequently used due to its high visibility and association with energy and attention-grabbing labels. Blue and green follow closely, often used by brands looking to convey freshness, purity, or eco-friendliness. These colors are typically applied in logos, promotional text, or decorative patterns, especially in the food and cosmetic segments.

Yellow ink sees comparatively less usage but still plays a role in decorative and branding applications, especially when used in combination with other colors to create eye-catching designs. However, its low contrast on clear or light-colored glass can limit its practicality for functional labeling.

Segmentation Insights by End-use

On the basis of end-use, the global returnable glass bottle ink market is bifurcated into food and beverage, pharmaceuticals, cosmetics, and other industries.

In the returnable glass bottle ink market, the food and beverage industry is the most dominant end-use segment. This is largely due to the widespread adoption of returnable glass packaging for products like beer, soft drinks, milk, sauces, and condiments. The high turnover of bottles in this sector requires inks that can withstand repeated washing, sterilization, and handling without fading or smudging. Water-based and UV-curable inks are especially favored for their durability, safety compliance, and cost-effectiveness. Additionally, branding, regulatory information, and expiry details must remain legible, further driving demand for high-performance ink solutions.

The pharmaceutical industry follows as a significant segment, though smaller in scale compared to food and beverage. In this sector, the focus is on ink formulations that meet strict regulatory requirements for safety, non-toxicity, and print permanence. Returnable glass bottles are used for a range of medicinal liquids and supplements, and the ink must ensure data like batch numbers, expiration dates, and dosage instructions remain intact through multiple uses. UV-curable and electron beam-curable inks are commonly employed due to their excellent adhesion and resistance to chemicals and high temperatures.

The cosmetics industry comes next, with growing interest in sustainable packaging pushing the adoption of returnable glass containers for items like perfumes, lotions, and essential oils. Aesthetics are key in this industry, and high-resolution, vibrant inks are needed to enhance brand appeal. UV-curable inks are preferred here for their ability to deliver fine detail and premium finishes. However, the returnable trend is still emerging in this sector, limiting the overall market size for inks used on these products.

Returnable Glass Bottle Ink Market: Regional Insights

- Europe is expected to dominates the global market

Europe is the most dominant region in the returnable glass bottle ink market, driven by strong environmental policies and a mature circular economy infrastructure. Countries like Germany, France, and the United Kingdom are pioneers in adopting returnable glass bottle systems, especially within the beverage industry. The increasing focus on sustainability and reusable packaging has led to a robust demand for high-quality, durable inks that can withstand repeated cleaning and refilling cycles. European manufacturers are also investing in eco-compliant ink formulations to align with regulatory standards and consumer expectations.

North America follows as a major market, particularly due to the rise in eco-conscious consumer behavior and growth in the craft beverage sector. The United States and Canada are witnessing increased adoption of returnable glass bottles by local breweries, soda companies, and premium beverage brands. This shift is fueling the need for resilient inks that maintain legibility and branding across multiple reuses. Innovation in packaging and growing support for sustainable alternatives are further strengthening the regional market.

Asia-Pacific is a rapidly growing region in the returnable glass bottle ink market, supported by expanding beverage industries and heightened awareness of environmental issues. Countries such as China, India, and Japan are progressively moving toward reusable packaging models, spurred by urbanization and evolving regulatory landscapes. The demand for cost-effective yet durable inks is rising in tandem with efforts to curb single-use plastics and promote circular packaging solutions.

Latin America is an emerging market where the shift to returnable glass bottles is gaining momentum, especially in countries like Brazil and Mexico. These nations are witnessing increased participation from beverage manufacturers in sustainable packaging initiatives. Although the market is still developing, there is a growing preference for inks that are compatible with high-volume reuse and cleaning processes.

Middle East & Africa represent the least dominant region in the market, though interest is growing due to increasing sustainability awareness and the gradual implementation of eco-friendly packaging policies. While returnable glass systems are not yet widespread, early adoption in parts of South Africa and the Gulf countries is beginning to drive modest demand for specialized bottle inks suitable for repeated application.

Returnable Glass Bottle Ink Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the returnable glass bottle ink market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global returnable glass bottle ink market include:

- Flint Group

- Sakata Inx Corporation

- TOYO INK SC HOLDINGS CO. LTD.

- Toyo Offset Printing Ink Mfg. Co. Ltd.

- Siegwerk Druckfarben AG Co. KGaA

- DIC Corporation

- Kinyo Printing Inks Co. Ltd.

- BASF SE

- Zhejiang Hengfeng Ink Co. Ltd.

- HUBERGROUP AG

- Meihua Ink (Shenzhen) Co. Ltd.

- Tianjin Shield Ink Co. Ltd.

- Chengtu Huafu Ink Co. Ltd.

- T TOKA

The global returnable glass bottle ink market is segmented as follows:

By Ink Type

- Water-based inks

- Solvent-based inks

- UV-curable inks

- Electron beam-curable inks

By Application

- Beverage bottles

- Food jars

- Pharmaceutical bottles

- Cosmetic bottles

- Other applications

By Color

- Black

- White

- Clear

- Red

- Blue

- Green

- Yellow

- Other colors

By End-use

- Food and beverage

- Pharmaceuticals

- Cosmetics

- Other industries

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Returnable Glass Bottle Ink

Request Sample

Returnable Glass Bottle Ink