Reusable Storage Containers Market Size, Share, and Trends Analysis Report

CAGR :

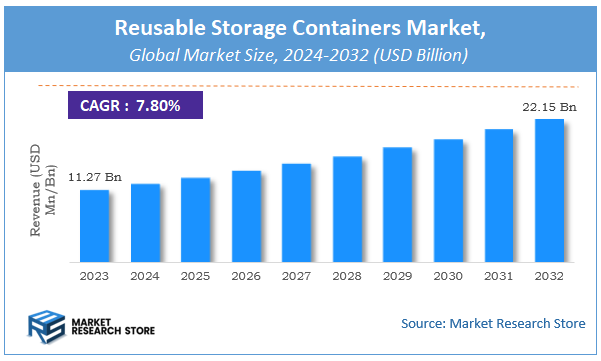

| Market Size 2023 (Base Year) | USD 11.27 Billion |

| Market Size 2032 (Forecast Year) | USD 22.15 Billion |

| CAGR | 7.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Reusable Storage Containers Market Insights

According to Market Research Store, the global reusable storage containers market size was valued at around USD 11.27 billion in 2023 and is estimated to reach USD 22.15 billion by 2032, to register a CAGR of approximately 7.8% in terms of revenue during the forecast period 2024-2032.

The reusable storage containers report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032

To Get more Insights, Request a Free Sample

Reusable Storage Containers Market: Overview

Reusable storage containers are durable containers designed to be used multiple times for the purpose of storing, transporting, or organizing various goods and materials. These containers are typically made from robust materials like plastic, metal, or heavy-duty fabric that can withstand repeated use and cleaning cycles. Unlike single-use or disposable packaging, reusable storage containers are environmentally friendly alternatives that reduce waste and support sustainability. They come in various sizes, shapes, and configurations, including bins, totes, crates, and stackable boxes, catering to residential, commercial, and industrial applications. These containers are popular in households for organization, in logistics for transporting goods, and in retail or manufacturing sectors for storage and inventory management.

Key Highlights

- The reusable storage containers market is anticipated to grow at a CAGR of 7.8% during the forecast period.

- The global reusable storage containers market was estimated to be worth approximately USD 11.27 billion in 2023 and is projected to reach a value of USD 22.15 billion by 2032.

- The growth of the reusable storage containers market is being driven by increasing environmental awareness, regulations promoting sustainability, and the need for cost-effective storage solutions across industries.

- Based on the material type, the plastic segment is growing at a high rate and is projected to dominate the market.

- On the basis of product type, the food storage containers segment is projected to swipe the largest market share.

- In terms of end-user, the residential segment is expected to dominate the market.

- Based on the distribution channel, the supermarkets/hypermarkets segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Reusable Storage Containers Market: Dynamics

Key Growth Drivers:

- Growing Environmental Awareness and Sustainability Initiatives: Increasing consumer and corporate focus on reducing single-use plastics and promoting sustainable practices is a major driver for the adoption of reusable containers.

- Cost-Effectiveness Over the Long Term: While the initial investment might be higher, reusable containers can be more cost-effective in the long run compared to disposable options due to their multiple uses.

- Durability and Protection of Goods: Reusable containers, often made from sturdy materials like plastic, metal, or glass, offer better protection for stored items compared to flimsy disposable packaging.

- Government Regulations and Bans on Single-Use Plastics: Regulations and outright bans on certain single-use plastic items in various regions are compelling businesses and consumers to switch to reusable alternatives.

- Improved Aesthetics and Branding Opportunities: Reusable containers often offer better design options and allow for branding, enhancing the visual appeal and marketing potential for businesses.

Restraints:

- Higher Upfront Costs: The initial investment in purchasing reusable containers can be significantly higher than buying disposable options, which can be a barrier for budget-conscious consumers and businesses.

- Cleaning and Maintenance Requirements: Reusable containers require regular cleaning and maintenance to ensure hygiene and longevity, which can be time-consuming and resource-intensive.

- Reverse Logistics and Return Systems: For businesses using reusable containers in their supply chains, establishing efficient reverse logistics and return systems can be complex and costly.

- Risk of Loss or Damage: Reusable containers are susceptible to loss, theft, or damage during use and transportation, adding to the overall cost.

- Consumer Convenience and Portability: In some situations, disposable containers are perceived as more convenient for on-the-go consumption or single-use applications.

Opportunities:

- Development of Innovative and Sustainable Materials: Research and development in new, more sustainable, and durable materials for reusable containers can enhance their appeal and performance.

- Implementation of Deposit-Return Schemes: Expanding and standardizing deposit-return schemes for reusable containers can incentivize their return and reuse, improving circularity.

- Growth of Subscription and Rental Models: Offering reusable containers through subscription or rental services can lower the initial cost barrier and streamline the cleaning and return process.

- Smart and Trackable Containers: Integrating technology like RFID or QR codes into reusable containers can enable tracking, inventory management, and optimization of return logistics.

- Customization and Personalization: Offering customized reusable containers for specific applications or consumer preferences can add value and drive adoption.

Challenges:

- Changing Consumer Behavior and Habits: Encouraging a shift from ingrained habits of using disposable items to embracing reusable alternatives requires consumer education and behavioral change initiatives.

- Establishing Standardized Systems and Infrastructure: Creating standardized systems for collection, cleaning, and redistribution of reusable containers across different industries and regions is a significant logistical challenge.

- Ensuring Hygiene and Food Safety Standards: Maintaining high hygiene and food safety standards for reusable containers throughout their lifecycle is crucial and requires robust cleaning and sanitation protocols.

- Balancing Cost and Sustainability: Finding a balance between the environmental benefits of reusable containers and their economic viability for both businesses and consumers is essential for widespread adoption.

- Addressing Concerns about Cross-Contamination: In food and beverage applications, addressing concerns about potential cross-contamination when using reusable containers is paramount and requires effective cleaning and tracking systems.

Reusable Storage Containers Market: Report Scope

This report thoroughly analyzes the Reusable Storage Containers Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Reusable Storage Containers Market |

| Market Size in 2023 | USD 11.27 Billion |

| Market Forecast in 2032 | USD 22.15 Billion |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 195 |

| Key Companies Covered | Amcor Limited, Anchor Hocking Company, Ball Corporation, Berry Global Inc., Cambro Manufacturing Company, Clip-Lok SimPak, DS Smith Plastics, Easylock, Eltete TPM, George Utz Holding, Huhtamaki Group, IKEA, Lock & Lock Co., Ltd., Loscam, Newell Brands Inc |

| Segments Covered | By Material Type, By Product Type, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Reusable Storage Containers Market: Segmentation Insights

The global reusable storage containers market is divided by material type, product type, end-user, distribution channel, and region.

Segmentation Insights by Material Type

Based on material type, the global reusable storage containers market is divided into plastic, glass, silicone, stainless steel, and others.

In the reusable storage containers market, plastic is the most dominant material type. Its widespread use is primarily attributed to its affordability, versatility, lightweight nature, and durability. Plastic containers are available in a wide variety of shapes and sizes, making them ideal for storing different types of items ranging from food to household goods. Their microwave and dishwasher-safe properties, coupled with innovations such as BPA-free materials, have made them a popular choice for consumers seeking both convenience and safety.

Following plastic, glass holds a significant share in the market. Consumers are increasingly favoring glass containers due to their non-toxic, non-reactive properties, making them a safer alternative for food storage. Glass does not absorb odors or stains, and it is also considered more environmentally friendly due to its recyclability and reusability over long periods. However, its heavier weight and higher risk of breakage limit its usage in some scenarios, especially for on-the-go purposes.

Silicone is the next material type gaining traction in the market. Known for its flexibility, durability, and resistance to extreme temperatures, silicone containers are especially popular for storing baby food, lunches, and for use in baking. They are collapsible and space-saving, appealing to consumers with limited storage space. Although more expensive than plastic, their reusable and eco-friendly characteristics are attracting a growing number of environmentally conscious buyers.

Stainless steel follows, catering to a niche but growing customer base that prioritizes sustainability and durability. These containers are rust-resistant, long-lasting, and excellent at maintaining temperature, which makes them ideal for meal prep and lunch boxes. However, they are less transparent, which can make it harder to identify contents without opening, and their higher price point has restrained widespread adoption.

Segmentation Insights by Product Type

On the basis of product type, the global reusable storage containers market is bifurcated into food storage containers, beverage containers, lunch boxes, and others.

In the reusable storage containers market, food storage containers represent the most dominant product type. Their widespread use in both household and commercial settings is driven by the growing need for organized, long-lasting food preservation. These containers are available in various sizes and materials, designed for storing leftovers, meal preps, dry goods, and perishables. Their utility in reducing food waste and promoting home cooking trends has further propelled their dominance in the market.

Beverage containers come next in terms of market share. This category includes reusable water bottles, thermoses, and travel mugs, which have seen rising demand due to increasing environmental awareness and the global push to reduce single-use plastic bottles. Consumers appreciate their portability, temperature retention capabilities, and stylish designs. Innovations like insulated stainless steel bottles and collapsible silicone cups are also attracting a broader audience, from fitness enthusiasts to office workers.

Lunch boxes follow closely behind, driven by the rising trend of home-packed meals for school, work, and travel. With increasing awareness around healthy eating and budget-friendly living, more consumers are opting to bring meals from home. Lunch boxes come in a variety of designs, including multi-compartment, insulated, and microwave-safe options, catering to both children and adults. Their appeal is also supported by an increase in eco-conscious choices, with materials ranging from stainless steel to BPA-free plastics and silicone.

Segmentation Insights by End-User

Based on end-user, the global reusable storage containers market is divided into residential, commercial, and industrial.

In the reusable storage containers market, the residential segment is the most dominant end-user category. Households around the world extensively use these containers for food preservation, meal prepping, organizing leftovers, and storing dry goods. With rising consumer interest in sustainability, health-conscious lifestyles, and kitchen organization, demand for reusable storage containers in homes continues to grow. The convenience, cost-efficiency, and environmental benefits of reusable options are particularly appealing to families, students, and urban dwellers, solidifying the residential sector’s leading position.

The commercial segment follows, driven by demand from restaurants, cafes, catering services, and other foodservice businesses. These establishments require reliable, food-safe, and often standardized containers for storing ingredients, transporting meals, and minimizing food waste. Reusable containers help reduce long-term packaging costs and support environmentally responsible practices, especially as regulations around single-use plastics tighten globally. Additionally, commercial-grade containers are typically more durable and temperature-resistant to meet professional standards.

The industrial segment, while the smallest among the three, serves specific needs in sectors such as manufacturing, logistics, and agriculture. In this context, reusable containers are used for storing and transporting raw materials, components, and bulk goods. They are often made from high-strength materials like industrial-grade plastic or metal to withstand heavy-duty use. Although the segment has a narrower scope compared to residential and commercial use, the push for sustainable packaging and efficient supply chain solutions is gradually encouraging adoption in industrial settings.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global reusable storage containers market is bifurcated into online stores, supermarkets/hypermarkets, specialty stores, and others.

In the reusable storage containers market, supermarkets/hypermarkets are the most dominant distribution channel. These large retail outlets offer a wide selection of storage containers in various sizes, materials, and price points, making them a convenient one-stop destination for consumers. Shoppers often prefer purchasing such items in person to assess the quality, size, and design firsthand. The visibility and accessibility of these products in high-traffic areas of supermarkets contribute significantly to their sales volume.

Online stores are rapidly gaining ground and now hold the second-largest share in the distribution landscape. E-commerce platforms offer an extensive range of products, competitive pricing, and the convenience of home delivery, which appeals to a broad consumer base. The ability to compare reviews, brands, and features online, combined with the increasing use of smartphones and digital payments, continues to drive growth in this channel. Online marketplaces like Amazon, Walmart, and specialized kitchenware websites are particularly influential in shaping consumer choices.

Specialty stores, such as home improvement and kitchenware retailers, occupy a smaller but significant portion of the market. These stores cater to customers seeking higher-quality or niche storage solutions, such as premium glass or silicone containers, eco-friendly brands, or custom-designed products. The staff expertise and curated product range in these stores often appeal to consumers who prioritize quality over cost.

Reusable Storage Containers Market: Regional Insights

- North America is expected to dominates the global market

The North America region is the most dominant in the reusable storage containers market. Its leadership position is supported by high consumer awareness regarding environmental sustainability and well-developed recycling infrastructure. Companies across industries such as food and beverage, pharmaceuticals, and e-commerce are widely adopting reusable packaging due to cost-effectiveness and regulatory pressure. The presence of key market players and innovation in sustainable packaging further accelerates regional growth and adoption.

The Europe market closely follows, driven by strict environmental policies and government-backed sustainability initiatives. The European Union’s regulations on plastic usage and waste disposal have led to a significant increase in the use of reusable storage containers across sectors such as logistics, automotive, and retail. Countries like Germany, France, and the Netherlands are at the forefront, with industries prioritizing eco-conscious packaging solutions and contributing to steady market expansion.

The Asia Pacific region is witnessing the fastest growth rate due to rapid urbanization, industrial development, and growing e-commerce. Emerging economies such as China and India are leading the adoption, fueled by increasing consumer awareness and supportive government policies. The demand for cost-efficient, sustainable packaging in manufacturing and logistics has created a booming market for reusable containers, especially in large urban centers.

The Latin America market is gradually expanding, driven by a growing interest in sustainable alternatives and the development of food, beverage, and retail sectors. Countries like Brazil and Argentina are leading regional growth, supported by increased corporate efforts to reduce environmental impact. Though still emerging, the market is showing promising potential as awareness and infrastructure improve.

The Middle East and Africa region shows modest but growing interest in reusable storage containers. The shift is influenced by environmental awareness campaigns and the gradual modernization of industries such as chemicals, food processing, and pharmaceuticals. While infrastructure limitations pose some challenges, increasing investment and policy focus on sustainability are paving the way for future growth.

Reusable Storage Containers Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the reusable storage containers market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global reusable storage containers market include:

- Amcor Limited

- Anchor Hocking Company

- Ball Corporation

- Berry Global Inc.

- Cambro Manufacturing Company

- Clip-Lok SimPak

- DS Smith Plastics

- Easylock

- Eltete TPM

- George Utz Holding

- Huhtamaki Group

- IKEA

- Lock & Lock Co. Ltd.

- Loscam

- Newell Brands Inc.

- OXO International Ltd.

- Plastico Limited

- Presto Products Company

- Pyrex (World Kitchen LLC)

- Rubbermaid Commercial Products LLC

- Schoeller Allibert

- Sealed Air Corporation

- Sistema Plastics Limited

- Snapware Corporation

- Sonoco Products Company

- The Clorox Company

- Thermos

- Tiger Corporation

- Tupperware Brands Corporation

- World Kitchen

- ZIP TOP

- Ziploc (SC Johnson & Son Inc.)

- Zojirushi

The global reusable storage containers market is segmented as follows:

By Material Type

- Plastic

- Glass

- Silicone

- Stainless Steel

- Others

By Product Type

- Food Storage Containers

- Beverage Containers

- Lunch Boxes

- Others

By End-User

- Residential

- Commercial

- Industrial

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Reusable Storage Containers

Request Sample

Reusable Storage Containers