Rhenium and Molybdenum Market Size, Share, and Trends Analysis Report

CAGR :

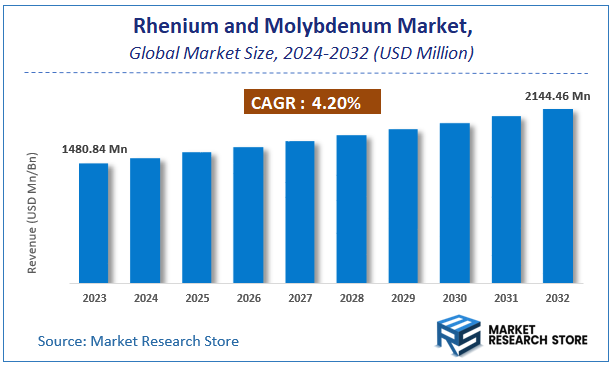

| Market Size 2023 (Base Year) | USD 1480.84 Million |

| Market Size 2032 (Forecast Year) | USD 2144.46 Million |

| CAGR | 4.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Rhenium and Molybdenum Market Insights

According to Market Research Store, the global rhenium and molybdenum market size was valued at around USD 1480.84 million in 2023 and is estimated to reach USD 2144.46 million by 2032, to register a CAGR of approximately 4.2% in terms of revenue during the forecast period 2024-2032.

The rhenium and molybdenum report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Rhenium and Molybdenum Market: Overview

Rhenium and molybdenum are both refractory metals known for their exceptional strength, high melting points, and resistance to corrosion. Rhenium is a rare, dense, silver-white metal with one of the highest melting points among all elements, primarily obtained as a byproduct of copper and molybdenum mining. It is mainly used in high-temperature superalloys and catalytic applications. Molybdenum, more abundant than rhenium, is a silvery-grey metal widely used to improve the strength, toughness, and corrosion resistance of steel and other alloys. It also plays important roles in the production of lubricants, pigments, and fertilizers.

Key Highlights

- The rhenium and molybdenum market is anticipated to grow at a CAGR of 4.2% during the forecast period.

- The global rhenium and molybdenum market was estimated to be worth approximately USD 1480.84 million in 2023 and is projected to reach a value of USD 2144.46 million by 2032.

- The growth of the rhenium and molybdenum market is being driven by their critical applications in industries such as aerospace, automotive, energy, electronics, and chemicals.

- Based on the product, the alloys segment is growing at a high rate and is projected to dominate the market.

- On the basis of grade, the high-performance molybdenum alloys segment is projected to swipe the largest market share.

- In terms of source, the by-product of other metal processing segment is expected to dominate the market.

- Based on the application, the aerospace industry segment is expected to dominate the market.

- In terms of end-user, the manufacturing sector segment is expected to dominate the market.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Rhenium and Molybdenum Market: Dynamics

Key Growth Drivers:

- Rising Demand from Aerospace and Defense Industries: Rhenium and molybdenum are crucial in the production of high-temperature superalloys used in jet engines and turbines, which is driving demand due to increased aircraft production and defense investments.

- Growing Use in the Electronics and Semiconductor Industry: Molybdenum is widely used in semiconductor devices and thin-film transistors, while rhenium’s high melting point makes it suitable for precision electrical components.

- Expansion of Oil and Gas Refining Activities: Rhenium-based catalysts are essential in reforming processes for producing high-octane fuels, fueling growth in regions with active refining industries.

- Increasing Demand for Energy-Efficient and High-Strength Alloys: Industries such as automotive, energy, and construction are increasingly using molybdenum alloys due to their strength, corrosion resistance, and thermal stability.

- Industrial Growth in Emerging Economies: The rapid industrialization in countries such as India, China, and Brazil is leading to greater consumption of specialty metals including molybdenum and rhenium for infrastructure and heavy machinery.

Restraints:

- High Production Costs and Limited Availability of Rhenium: Rhenium is rare and primarily recovered as a by-product of molybdenum mining, making it expensive and supply-limited.

- Volatility in Raw Material Prices: Fluctuations in mining output and global demand lead to unpredictable pricing, affecting profitability and investment planning.

- Environmental Concerns and Regulatory Pressures: Mining and refining of these metals can have significant environmental impacts, resulting in stricter regulations and increased compliance costs.

Opportunities:

- Advancements in Recycling Technologies: Improved techniques for recovering rhenium and molybdenum from scrap and industrial waste can help reduce dependency on primary sources and stabilize supply.

- Increased Research in Medical and Nuclear Applications: Molybdenum-99 is used in nuclear medicine, and further development in these fields could open up high-value applications.

- Strategic Collaborations and Joint Ventures: Partnerships between mining companies, research institutions, and end-user industries can accelerate innovation and secure long-term supply contracts.

- Growth in Renewable Energy Sector: Molybdenum’s use in solar panels, energy storage systems, and other green technologies presents a long-term opportunity amid the global clean energy transition.

Challenges:

- Supply Chain Disruptions and Geopolitical Risks: Concentrated production of rhenium and molybdenum in a few regions makes the market vulnerable to geopolitical instability and export restrictions.

- Substitution Risk from Alternative Materials: Technological advances in materials science may lead to the replacement of molybdenum or rhenium in certain applications, impacting long-term demand.

- Limited Awareness in Emerging Applications: Despite potential in advanced manufacturing and electronics, lack of awareness or technical expertise can hinder adoption in some markets.

- Capital-Intensive Extraction and Processing: The infrastructure and technology required to extract and process these metals economically remains a significant barrier for new entrants.

Rhenium and Molybdenum Market: Report Scope

This report thoroughly analyzes the Rhenium and Molybdenum Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Rhenium and Molybdenum Market |

| Market Size in 2023 | USD 1480.84 Million |

| Market Forecast in 2032 | USD 2144.46 Million |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 179 |

| Key Companies Covered | Molymet, Freeport MCMoRan, KGHM, KAZ Minerals, LS-Nikko, Jiangxi Copper, Codelco, Grupo Mexico, China Molybdenum, Thompson Creek Metals Company, Anglo American Plc, Antofagasta PLC, Jinduicheng Molybdenum |

| Segments Covered | By Product, By Grade, By Source, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rhenium and Molybdenum Market: Segmentation Insights

The global rhenium and molybdenum market is divided by product, grade, source, application, end-user, and region.

Segmentation Insights by Product

Based on product, the global rhenium and molybdenum market is divided into pure metal, alloys, compounds, sheets & plates, and bars & wires.

In the rhenium and molybdenum market, the Alloys segment emerges as the most dominant product type. This dominance is largely driven by the widespread use of rhenium and molybdenum in superalloys, especially in aerospace and defense applications. These alloys are highly valued for their exceptional strength, heat resistance, and corrosion resistance, making them essential in the manufacturing of turbine blades, jet engines, and other components that endure extreme conditions. The increasing demand for fuel-efficient aircraft and high-performance industrial equipment further propels the growth of this segment.

Following alloys, the Pure Metal segment holds a significant share in the market. Rhenium and molybdenum in their pure form are crucial for specialized uses in electronics, medical equipment, and nuclear applications due to their high melting points and excellent thermal conductivity. Molybdenum, in particular, is widely used in the production of electrodes, semiconductors, and x-ray tubes. The demand for high-purity metals continues to grow with technological advancements and the push toward miniaturization and efficiency in electronics.

The Compounds segment comes next, catering to the chemical and catalyst industries. Molybdenum compounds, such as molybdenum disulfide (MoS₂), are extensively used as solid lubricants, catalysts in petroleum refining, and in agricultural fertilizers. Rhenium compounds, although less common, are used in catalysts for reforming gasoline and in thermocouples. This segment benefits from the expansion of the chemical processing industry and the growing emphasis on cleaner fuel production.

The Sheets & Plates segment has a more moderate market share, primarily used in high-temperature structural applications in industrial furnaces and heat shields. These forms are favored for their dimensional stability, strength, and ability to withstand thermal cycling. Industries such as glass manufacturing, metal processing, and power generation drive demand for molybdenum sheets and plates due to their durability under extreme thermal environments.

Finally, the Bars & Wires segment represents the smallest share among the product types. These forms are mostly utilized in specialized welding applications, lighting (like filaments), and medical instruments. While important in niche markets, the overall demand volume is lower compared to other forms due to limited application breadth. However, technological advancements in additive manufacturing and medical device innovation may offer new opportunities for growth in this segment.

Segmentation Insights by Grade

On the basis of grade, the global rhenium and molybdenum market is bifurcated into standard grade, high purity grade, specialty grade, tungsten-rhenium alloys, and high-performance molybdenum alloys.

In the rhenium and molybdenum market, the High-Performance Molybdenum Alloys segment stands out as the most dominant by grade. These alloys are specifically engineered to perform under extreme mechanical and thermal stress, making them indispensable in aerospace, energy, and advanced manufacturing applications. Their superior mechanical strength, corrosion resistance, and high melting point enable their use in demanding environments such as turbine engines, nuclear reactors, and space exploration components. The rise in advanced defense and space technologies continues to boost demand for this grade.

Following closely is the Tungsten-Rhenium Alloys segment, which commands a significant market share due to its critical role in high-temperature thermocouples, electronic components, and aerospace applications. These alloys combine the high melting point of tungsten with the ductility of rhenium, making them ideal for extreme environments such as rocket nozzles and nuclear instrumentation. Their high cost is offset by their unmatched performance in ultra-high temperature applications, driving steady demand from niche but high-value industries.

The High Purity Grade segment is also a key player, especially in the electronics, medical, and semiconductor industries, where material contamination must be minimized. This grade is crucial for the fabrication of microelectronic components, medical imaging devices, and high-precision laboratory instruments. As industries place increasing importance on purity standards, particularly in semiconductor manufacturing, this segment is expected to maintain strong demand.

The Specialty Grade segment serves specific customized applications where tailored chemical compositions or mechanical properties are required. This includes components for defense systems, customized medical tools, and industrial catalysts. Although smaller in market share compared to more standardized grades, specialty grades hold strong relevance for bespoke engineering and R&D-based solutions where precision is critical.

At the lower end of the market hierarchy is the Standard Grade segment. While still essential, standard-grade rhenium and molybdenum are mostly used in less demanding applications, such as construction-grade components, general-purpose machinery, or moderate temperature environments. The comparatively lower cost makes it suitable for bulk applications, but limited performance under extreme conditions reduces its share in high-value industries.

Segmentation Insights by Source

Based on source, the global rhenium and molybdenum market is divided into primary mining, recycling & reclamation, synthetic production, by-product of other metal processing, and secondary supply from storage/stocks.

In the rhenium and molybdenum market, the By-Product of Other Metal Processing segment is the most dominant source. Both rhenium and molybdenum are primarily recovered as by-products during the processing of other metal ores—rhenium from molybdenite concentrates in copper mining, and molybdenum often from porphyry copper deposits. This method offers a cost-effective and scalable source, benefiting from the established infrastructure of large-scale copper mining operations. As global demand for copper remains high, this by-product pathway ensures a steady and significant supply of both metals.

The Primary Mining segment follows, contributing notably to the overall market. This involves direct extraction of molybdenum ores from molybdenite-rich deposits, especially in countries like China, the U.S., and Chile. Primary mining ensures a relatively high-purity yield of molybdenum and plays a crucial role in meeting industrial demand for molybdenum-specific applications. However, rhenium is rarely mined independently due to its scarce natural occurrence, limiting the dominance of this source for that metal.

Recycling & Reclamation holds the third-largest share and is increasingly important as sustainability and resource efficiency become global priorities. Spent catalysts from petroleum refining (especially those containing rhenium), scrap alloys, and industrial waste from high-performance components are key recycling sources. The growing capability to reclaim these metals with minimal purity loss makes this segment economically and environmentally attractive, particularly as mining costs rise and regulatory pressures increase.

The Secondary Supply from Storage/Stocks is a smaller yet strategic source. Governments and private industries maintain strategic reserves of critical materials like rhenium and molybdenum to mitigate supply chain disruptions. This buffer can be tapped during periods of high demand or restricted mining output, though it is not a regular source and therefore contributes less consistently to the market.

Finally, the Synthetic Production segment remains the least dominant, especially in the case of rhenium and molybdenum, which are naturally occurring and difficult to synthesize economically. While laboratory-based or small-scale synthetic techniques exist for specialized applications or R&D purposes, this source lacks the scalability and cost-efficiency of natural extraction or recycling and thus plays a negligible role in current market dynamics.

Segmentation Insights by Application

On the basis of application, the global rhenium and molybdenum market is bifurcated into aerospace industry, electronics & electrical components, chemical processing, defense & military applications, and medical technology.

In the rhenium and molybdenum market, the Aerospace Industry is the most dominant application segment. These metals, especially in alloy form, are essential in the production of high-performance turbine engines, combustion chambers, and afterburners due to their exceptional heat resistance, strength, and corrosion resistance. Rhenium’s presence in superalloys significantly enhances engine efficiency and lifespan, making it indispensable in both commercial and military aviation. The ongoing global push for fuel-efficient aircraft and expansion of the aerospace sector continue to drive this segment’s dominance.

The Electronics & Electrical Components segment follows closely, leveraging the excellent conductivity, thermal stability, and electron emission properties of molybdenum and rhenium. Molybdenum is widely used in thin-film transistors, electrodes, semiconductors, and heat sinks, while rhenium is found in electrical contacts and filaments. With increasing demand for compact, high-performance electronic devices and advances in semiconductor manufacturing, this segment maintains robust growth.

Chemical Processing is another significant application, particularly for molybdenum compounds used in catalysts for petroleum refining, desulfurization, and other industrial reactions. Rhenium, too, is valued as a catalyst in high-octane gasoline production. The increasing emphasis on cleaner fuels and efficient industrial processes supports steady demand in this segment.

The Defense & Military Applications segment plays a crucial yet more specialized role. Rhenium and molybdenum are used in armor plating, missile components, and high-temperature propulsion systems due to their ability to withstand extreme conditions. While the volume demand is lower than in aerospace or electronics, the strategic value of these materials in national defense maintains consistent investment and demand.

Lastly, Medical Technology represents the smallest but growing application area. Molybdenum is used in x-ray tubes and imaging equipment due to its excellent x-ray transparency and thermal properties. Rhenium has emerging roles in radiopharmaceuticals and medical imaging, though its high cost and limited availability restrict broader adoption. As medical technology advances, this segment is likely to gain traction, particularly in precision diagnostics and cancer treatments.

Segmentation Insights by End-User

On the basis of end-user, the global rhenium and molybdenum market is bifurcated into manufacturing sector, research & development institutions, renewable energy sector, and telecommunications.

In the rhenium and molybdenum market, the Manufacturing Sector is the most dominant end-user. This sector extensively utilizes both metals for producing components that require high strength, heat resistance, and durability—particularly in industries like automotive, aerospace, metal processing, and electronics. Molybdenum is critical in steel alloying for structural parts and tools, while rhenium is used in superalloys for jet engines and industrial turbines. The sheer scale and diversity of manufacturing applications ensure this segment holds the largest market share.

The Research & Development Institutions segment follows, driven by the continued exploration of advanced material properties and innovation in high-performance applications. Universities, laboratories, and private R&D facilities regularly use rhenium and molybdenum for experimental purposes in areas like nanotechnology, high-temperature physics, semiconductors, and emerging alloy formulations. Although the volume consumed is smaller than manufacturing, the high value and specificity of usage make this a vital segment for long-term innovation and material development.

Next in line is the Renewable Energy Sector, where molybdenum is gaining traction in solar panels, fuel cells, and advanced battery technologies. Its electrical conductivity and corrosion resistance are key advantages in clean energy systems. While rhenium has more limited applications in renewables due to cost and availability, it may be used in specific high-efficiency turbine components within advanced geothermal or hybrid energy systems. As the global transition to renewable energy accelerates, this segment is expected to grow steadily in importance.

The Telecommunications segment currently represents the smallest share of end-users. Molybdenum is used in certain connectors, microwave devices, and thermal management components in telecom infrastructure, but the use of rhenium is minimal in this sector. While the demand is stable, it lacks the scale or material dependency seen in other segments, making its overall impact on market dynamics relatively limited.

Rhenium and Molybdenum Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

The Asia-Pacific region is the most dominant in the global rhenium and molybdenum market, driven primarily by China’s leadership in both production and consumption. Industrial growth, especially in steel production for construction, transportation, and heavy industries, significantly boosts molybdenum demand. Additionally, Japan and South Korea contribute with high-end applications in electronics, automotive, and specialty steel manufacturing. Expanding infrastructure and ongoing urban development across Southeast Asian countries further strengthen the region’s hold on the market.

North America plays a major role in both molybdenum and rhenium markets, with the United States being a leading producer. The demand is driven by advanced aerospace, defense, and energy sectors requiring molybdenum and rhenium for high-temperature alloys and precision components. Rhenium, often extracted as a by-product of molybdenum mining, is extensively used in jet engines and superalloys. The region also benefits from increasing investment in nuclear and renewable energy applications.

Europe holds a solid share in the market, supported by its strong automotive, energy, and aerospace sectors. Germany, the United Kingdom, and France are major users of molybdenum-based steel and rhenium-enhanced materials. The use of rhenium isotopes in medical treatments and Europe’s focus on recycling and sustainability contribute to stable demand. However, limited local mining resources lead to reliance on imports for rhenium.

Middle East and Africa see moderate growth, driven by infrastructure development and energy projects, particularly in oil and gas exploration. Molybdenum is used in pipelines and drilling tools due to its corrosion resistance. While industrial activity is rising, especially in countries like Saudi Arabia and the UAE, rhenium production remains minimal, requiring imports for advanced manufacturing applications.

Latin America, particularly Chile, contributes significantly to global molybdenum supply through large-scale mining operations. However, downstream processing and industrial consumption are limited compared to other regions. For rhenium, although Chile has reserves due to its molybdenum production, the region lacks advanced industries to drive substantial demand. Political and regulatory uncertainties also impact market stability and growth potential.

Rhenium and Molybdenum Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the rhenium and molybdenum market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global rhenium and molybdenum market include:

- Molymet

- Freeport MCMoRan

- KGHM

- KAZ Minerals

- LS-Nikko

- Jiangxi Copper

- Codelco

- Grupo Mexico

- China Molybdenum

- Thompson Creek Metals Company

- Anglo American Plc

- Antofagasta PLC

- Jinduicheng Molybdenum

The global rhenium and molybdenum market is segmented as follows:

By Product

- Pure Metal

- Alloys

- Compounds

- Sheets and Plates

- Bars and Wires

By Grade

- Standard Grade

- High Purity Grade

- Specialty Grade

- Tungsten-Rhenium Alloys

- High-Performance Molybdenum Alloys

By Source

- Primary Mining

- Recycling and Reclamation

- Synthetic Production

- By-Product of Other Metal Processing

- Secondary Supply from Storage/Stocks

By Application

- Aerospace Industry

- Electronics and Electrical Components

- Chemical Processing

- Defense and Military Applications

- Medical Technology

By End-User

- Manufacturing Sector

- Research and Development Institutions

- Renewable Energy Sector

- Telecommunications

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Rhenium and Molybdenum

Request Sample

Rhenium and Molybdenum