Risk Analytics Market Size, Share, and Trends Analysis Report

CAGR :

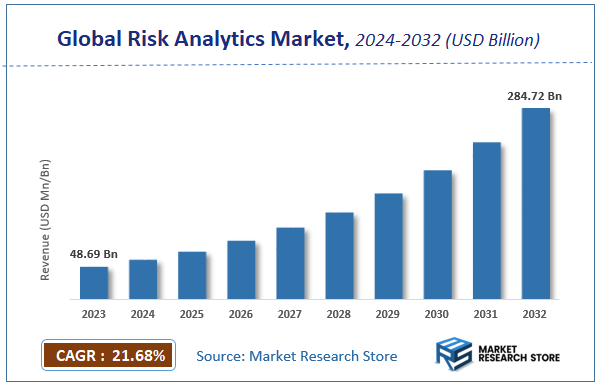

| Market Size 2023 (Base Year) | USD 48.69 Billion |

| Market Size 2032 (Forecast Year) | USD 284.72 Billion |

| CAGR | 21.68% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Risk Analytics Market Insights

According to Market Research Store, the global risk analytics market size was valued at around USD 48.69 billion in 2023 and is estimated to reach USD 284.72 billion by 2032, to register a CAGR of approximately 21.68% in terms of revenue during the forecast period 2024-2032.

The risk analytics report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Risk Analytics Market: Overview

Risk analytics refers to the systematic process of identifying, assessing, and mitigating potential risks within an organization using advanced data analysis, statistical modeling, and predictive tools. It enables businesses to anticipate and manage uncertainties related to financial losses, operational disruptions, regulatory compliance, cybersecurity threats, and market volatility. Risk analytics combines historical data, real-time information, and machine learning algorithms to offer actionable insights, improve decision-making, and support proactive risk management strategies across sectors such as banking, insurance, healthcare, manufacturing, and IT.

Key Highlights

- The risk analytics market is anticipated to grow at a CAGR of 21.68% during the forecast period.

- The global risk analytics market was estimated to be worth approximately USD 48.69 billion in 2023 and is projected to reach a value of USD 284.72 billion by 2032.

- The growth of the risk analytics market is being driven by rising complexity of business environments, increased reliance on digital infrastructure, and tightening regulatory requirements.

- Based on the component, the software segment is growing at a high rate and is projected to dominate the market.

- On the basis of deployment type, the cloud segment is projected to swipe the largest market share.

- In terms of organization size, the large enterprises segment is expected to dominate the market.

- Based on the risk type, the financial risk segment is expected to dominate the market.

- In terms of industry vertical, the BFSI segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Risk Analytics Market: Dynamics

Key Growth Drivers

• Increasing Cybersecurity Threats: Rising incidents of data breaches and cyberattacks are compelling organizations to adopt risk analytics solutions for real-time threat detection and preventive action.

• Stringent Regulatory Compliance Requirements: Tightening rules in sectors like banking, healthcare, and energy are driving demand for analytics tools that ensure timely reporting, compliance tracking, and audit preparedness.

• Digital Transformation Across Industries: As companies digitize operations and workflows, the complexity and volume of data increase, fueling the need for risk analytics to manage financial, operational, and reputational risks.

• Integration of AI and Machine Learning: Advanced technologies such as AI and ML enhance predictive accuracy, automate risk identification, and provide deeper, data-driven insights for strategic decision-making.

Restraints

• High Implementation Costs: The upfront investment for licenses, integration, and customization of risk analytics platforms can be substantial, especially for small and mid-sized enterprises.

• Complexity of Data Management: Handling diverse, siloed, and unstructured data from multiple sources poses challenges in aggregation, cleansing, and analysis.

• Lack of Skilled Professionals: There is a shortage of talent capable of leveraging risk analytics platforms effectively, which limits the impact of analytics initiatives in many organizations.

Opportunities

• Adoption in Emerging Markets: As digitalization spreads in developing regions, there's significant untapped potential for risk analytics adoption in financial services, healthcare, and manufacturing.

• Cloud-Based Risk Analytics Solutions: Cloud deployments offer scalable, real-time analytics capabilities with reduced infrastructure costs, making them attractive to businesses of all sizes.

• Expansion into Non-Traditional Sectors: Industries like logistics, retail, and energy are beginning to use risk analytics for managing operational disruptions, supply chain uncertainty, and performance risks.

• Focus on ESG and Climate Risk: Companies are increasingly incorporating analytics to assess environmental, social, and governance risks, in line with growing investor and regulatory focus on sustainability.

Challenges

• Data Privacy and Security Concerns: Using sensitive data in analytics raises compliance concerns with global data protection laws like GDPR and industry-specific privacy mandates.

• Interoperability Issues: Legacy IT systems and siloed infrastructures can hinder seamless integration of modern risk analytics tools across departments.

• Resistance to Change: Organizations often face internal pushback or lack of executive buy-in when transitioning from traditional risk management practices to analytics-driven solutions.

• Uncertainty in Regulatory Landscapes: Frequent changes in international and regional regulations make it challenging to maintain consistent and future-proof risk analytics strategies.

Risk Analytics Market: Report Scope

This report thoroughly analyzes the Risk Analytics Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Risk Analytics Market |

| Market Size in 2023 | USD 48.69 Billion |

| Market Forecast in 2032 | USD 284.72 Billion |

| Growth Rate | CAGR of 21.68% |

| Number of Pages | 160 |

| Key Companies Covered | IBM, Oracle, SAP, SAS Institute, FIS, Moody’s Analytics, Verisk Analytics, AxiomSL, Gurucul, Provenir, Risk Edge Solutions, BRIDGEi2i, Recorded Future, DataFactZ, Alteryx, AcadiaSoft, Qlik, CubeLogic, Equarius Risk Analytics, Quantifi, Actify Data Labs, Amlgo Labs, Zesty.ai, Artivatic, Attestiv, RiskVille, Quantexa, Spin Analytics, Kyvos Insights, and Imply among others |

| Segments Covered | By Component, By Deployment, By Organization Size, By Risk Type, By Industry Verticals, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Risk Analytics Market: Segmentation Insights

The global risk analytics market is divided by component, deployment type, organization size, risk type, industry vertical, and region.

Based on component, the global risk analytics market is divided into software and services. The Software segment holds the dominant position, accounting for the largest share of overall revenue. This dominance is attributed to the increasing demand for advanced analytical tools that can process vast amounts of structured and unstructured data, deliver real-time risk insights, and support predictive modeling. Organizations across industries such as banking, healthcare, insurance, and manufacturing are investing in risk analytics software to enhance decision-making, ensure regulatory compliance, and automate risk identification processes. These software solutions often include capabilities like fraud detection, credit risk analysis, operational risk assessment, and cybersecurity monitoring, making them indispensable in today’s complex and data-driven business environment.

On the basis of deployment type, the global risk analytics market is bifurcated into on-premise and cloud. The Cloud segment has emerged as the most dominant deployment type, driven by its flexibility, scalability, and cost-efficiency. Cloud-based risk analytics solutions allow organizations to access real-time data, integrate with various systems, and scale resources as needed without significant infrastructure investments. This deployment model is particularly attractive to small and medium-sized enterprises and fast-growing businesses seeking quick implementation, minimal IT overhead, and seamless updates. The rise of remote work, increasing cyber threats, and the need for centralized risk monitoring have further accelerated the shift toward cloud-based platforms.

Based on organization size, the global risk analytics market is divided into large enterprises and small & medium enterprises. Large Enterprises dominate in terms of market share due to their greater financial resources, complex risk environments, and the need to comply with stringent regulatory frameworks. These organizations typically operate across multiple geographies and industries, requiring robust risk analytics platforms capable of handling vast datasets, integrating with enterprise systems, and supporting advanced modeling and simulation. Large enterprises also invest heavily in AI-driven solutions, in-house analytics teams, and custom-built platforms to proactively manage financial, operational, compliance, and cyber risks.

In terms of risk type, the global risk analytics market is bifurcated into strategic risk, operational risk, financial risk, and others. Financial Risk is the most dominant risk type segment, driven by the critical need across industries—especially in banking, insurance, and capital markets—to manage credit risk, market volatility, liquidity risk, and fraud. Financial institutions and large corporations rely heavily on analytics to assess potential losses, forecast financial stability, and comply with strict regulatory frameworks like Basel III and IFRS. Advanced financial risk analytics tools help in modeling various scenarios, detecting anomalies, and optimizing capital allocation, making this segment central to the market.

On the basis of industry vertical, the global risk analytics market is bifurcated into BFSI, IT & telecom, retail & consumer goods, healthcare, energy & utilities, manufacturing, government, defense, and others. The BFSI (Banking, Financial Services, and Insurance) sector holds the largest market share. This dominance is driven by the industry's high exposure to financial, compliance, credit, and fraud-related risks, all of which demand advanced analytics tools for real-time monitoring and decision-making. Regulatory frameworks like Basel III, Solvency II, and anti-money laundering (AML) guidelines have further fueled the need for robust risk analytics solutions to ensure transparency and stability in financial operations.

Risk Analytics Market: Regional Insights

- North America is expected to dominates the global market

North America leads the global risk analytics market due to strong digital infrastructure, a mature financial services sector, and early adoption of advanced technologies like artificial intelligence and machine learning. The region benefits from strict regulatory requirements in industries such as banking, insurance, and healthcare, which drive the demand for robust risk assessment and mitigation tools. The presence of major market players and high investments in cybersecurity, fraud detection, and compliance solutions also contribute significantly to the region’s dominance.

Europe ranks second, driven by a strong regulatory environment and heightened awareness of data privacy and governance. Financial institutions, energy companies, and public sector organizations are major adopters of risk analytics solutions to manage regulatory risks and ensure operational continuity. The enforcement of data protection frameworks and sustainability regulations has further increased the adoption of integrated risk platforms. Countries like Germany, the UK, and France lead regional demand due to their focus on digital transformation and financial security.

Asia Pacific holds the third-largest share and is the fastest-growing regional market. Rapid digitalization, expanding banking and insurance sectors, and increasing awareness of cyber threats are key drivers. Countries such as China, India, Japan, and Australia are investing heavily in risk analytics tools for fraud detection, credit risk evaluation, and regulatory compliance. The adoption of Industry 4.0 technologies in manufacturing and smart cities is also boosting demand for predictive and real-time risk monitoring systems.

Latin America represents a smaller share of the global market but is experiencing steady growth. Risk analytics adoption is being driven by the modernization of financial services, the growth of digital transactions, and increased focus on operational and credit risk management. Countries like Brazil, Mexico, and Argentina are expanding the use of analytics in banking and retail sectors, while regulatory reforms are encouraging the adoption of compliance and anti-fraud solutions.

Middle East and Africa has the smallest share but shows promising potential for growth. Governments and enterprises are increasingly investing in digital infrastructure, particularly in the Gulf region and South Africa, which is driving the uptake of risk analytics. The financial services, energy, and public sectors are beginning to adopt risk management tools to address cyber threats, regulatory compliance, and operational risks. Growing interest in smart governance and data security is expected to support future market expansion.

Risk Analytics Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the risk analytics market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global risk analytics market include:

- IBM

- Oracle

- SAP

- SAS Institute

- FIS

- Moody’s Analytics

- Verisk Analytics

- AxiomSL

- Gurucul

- Provenir

- Risk Edge Solutions

- BRIDGEi2i

- Recorded Future

- DataFactZ

- Alteryx

- AcadiaSoft

- Qlik

- CubeLogic

- Equarius Risk Analytics

- Quantifi

- Actify Data Labs

- Amlgo Labs

- Zesty.ai

- Artivatic

- Attestiv

- RiskVille

- Quantexa

- Spin Analytics

- Kyvos Insights

- Imply

The global risk analytics market is segmented as follows:

By Component

- Software

- Services

By Deployment Type

- On-Premise

- Cloud

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Risk Type

- Strategic Risk

- Operational Risk

- Financial Risk

- Others

By Industry Vertical

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Healthcare

- Energy & Utilities

- Manufacturing

- Government

- Defense

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Risk Analytics

- 1.2. Global Risk Analytics Market, 2020 & 2026 (USD Million)

- 1.3. Global Risk Analytics Market, 2016 – 2026 (USD Million)

- 1.4. Global Risk Analytics Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Risk Analytics Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- 1.6. COVID-19 Impacts on Risk Analytics Market

- 1.6.1. COVID-19 Impact on the Players

- 1.6.2. Business Strategies and Recommendations

- Chapter 2 Risk Analytics Market – Component Analysis

- 2.1. Global Risk Analytics Market – Component Overview

- 2.2. Global Risk Analytics Market Share, by Component, 2020 & 2026 (USD Million)

- 2.3. Software Sulution

- 2.3.1. Global Software Sulution Risk Analytics Market, 2016 – 2026 (USD Million)

- 2.4. Services

- 2.4.1. Global Services Risk Analytics Market, 2016 – 2026 (USD Million)

- Chapter 3 Risk Analytics Market – Deployment Type Analysis

- 3.1. Global Risk Analytics Market – Deployment Type Overview

- 3.2. Global Risk Analytics Market Share, by Deployment Type, 2020 & 2026 (USD Million)

- 3.3. On-Premise

- 3.3.1. Global On-Premise Risk Analytics Market, 2016 – 2026 (USD Million)

- 3.4. Cloud

- 3.4.1. Global Cloud Risk Analytics Market, 2016 – 2026 (USD Million)

- Chapter 4 Risk Analytics Market – Organization Size Analysis

- 4.1. Global Risk Analytics Market – Organization Size Overview

- 4.2. Global Risk Analytics Market Share, by Organization Size, 2020 & 2026 (USD Million)

- 4.3. Large Enterprises

- 4.3.1. Global Large Enterprises Risk Analytics Market, 2016 – 2026 (USD Million)

- 4.4. Small & Medium Enterprises

- 4.4.1. Global Small & Medium Enterprises Risk Analytics Market, 2016 – 2026 (USD Million)

- Chapter 5 Risk Analytics Market – Software Type Analysis

- 5.1. Global Risk Analytics Market – Software Type Overview

- 5.2. Global Risk Analytics Market Share, by Software Type, 2020 & 2026 (USD Million)

- 5.3. ETL

- 5.3.1. Global ETL Risk Analytics Market, 2016 – 2026 (USD Million)

- 5.4. Risk Calculation Engines

- 5.4.1. Global Risk Calculation Engines Risk Analytics Market, 2016 – 2026 (USD Million)

- Chapter 6 Risk Analytics Market – Risk Type Analysis

- 6.1. Global Risk Analytics Market – Risk Type Overview

- 6.2. Global Risk Analytics Market Share, by Risk Type, 2020 & 2026 (USD Million)

- 6.3. Portfulio Risk

- 6.3.1. Global Portfulio Risk Analytics Market, 2016 – 2026 (USD Million)

- 6.4. Strategic Risk

- 6.4.1. Global Strategic Risk Analytics Market, 2016 – 2026 (USD Million)

- 6.5. Operational Risk

- 6.5.1. Global Operational Risk Analytics Market, 2016 – 2026 (USD Million)

- 6.6. Financial Risk

- 6.6.1. Global Financial Risk Analytics Market, 2016 – 2026 (USD Million)

- 6.7. Compliance Risks

- 6.7.1. Global Compliance Risks Risk Analytics Market, 2016 – 2026 (USD Million)

- 6.8. Others

- 6.8.1. Global Others Risk Analytics Market, 2016 – 2026 (USD Million)

- Chapter 7 Risk Analytics Market – Industry Vertical Analysis

- 7.1. Global Risk Analytics Market – Industry Vertical Overview

- 7.2. Global Risk Analytics Market Share, by Industry Vertical, 2020 & 2026 (USD Million)

- 7.3. BFSI

- 7.3.1. Global BFSI Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.4. IT & Telecom

- 7.4.1. Global IT & Telecom Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.5. Retail & Consumer Goods

- 7.5.1. Global Retail & Consumer Goods Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.6. Healthcare

- 7.6.1. Global Healthcare Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.7. Energy & Utilities

- 7.7.1. Global Energy & Utilities Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.8. Manufacturing

- 7.8.1. Global Manufacturing Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.9. Government

- 7.9.1. Global Government Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.10. Defense

- 7.10.1. Global Defense Risk Analytics Market, 2016 – 2026 (USD Million)

- 7.11. Others

- 7.11.1. Global Others Risk Analytics Market, 2016 – 2026 (USD Million)

- Chapter 8 Risk Analytics Market – Regional Analysis

- 8.1. Global Risk Analytics Market Regional Overview

- 8.2. Global Risk Analytics Market Share, by Region, 2020 & 2026 (USD Million)

- 8.3. North America

- 8.3.1. North America Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.3.1.1. North America Risk Analytics Market, by Country, 2016 - 2026 (USD Million)

- 8.3.2. North America Risk Analytics Market, by Component, 2016 – 2026

- 8.3.2.1. North America Risk Analytics Market, by Component, 2016 – 2026 (USD Million)

- 8.3.3. North America Risk Analytics Market, by Deployment Type, 2016 – 2026

- 8.3.3.1. North America Risk Analytics Market, by Deployment Type, 2016 – 2026 (USD Million)

- 8.3.4. North America Risk Analytics Market, by Organization Size, 2016 – 2026

- 8.3.4.1. North America Risk Analytics Market, by Organization Size, 2016 – 2026 (USD Million)

- 8.3.5. North America Risk Analytics Market, by Software Type, 2016 – 2026

- 8.3.5.1. North America Risk Analytics Market, by Software Type, 2016 – 2026 (USD Million)

- 8.3.6. North America Risk Analytics Market, by Risk Type, 2016 – 2026

- 8.3.6.1. North America Risk Analytics Market, by Risk Type, 2016 – 2026 (USD Million)

- 8.3.7. North America Risk Analytics Market, by Industry Vertical, 2016 – 2026

- 8.3.7.1. North America Risk Analytics Market, by Industry Vertical, 2016 – 2026 (USD Million)

- 8.3.8. U.S.

- 8.3.8.1. U.S. Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.3.9. Canada

- 8.3.9.1. Canada Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.3.1. North America Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4. Europe

- 8.4.1. Europe Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4.1.1. Europe Risk Analytics Market, by Country, 2016 - 2026 (USD Million)

- 8.4.2. Europe Risk Analytics Market, by Component, 2016 – 2026

- 8.4.2.1. Europe Risk Analytics Market, by Component, 2016 – 2026 (USD Million)

- 8.4.3. Europe Risk Analytics Market, by Deployment Type, 2016 – 2026

- 8.4.3.1. Europe Risk Analytics Market, by Deployment Type, 2016 – 2026 (USD Million)

- 8.4.4. Europe Risk Analytics Market, by Organization Size, 2016 – 2026

- 8.4.4.1. Europe Risk Analytics Market, by Organization Size, 2016 – 2026 (USD Million)

- 8.4.5. Europe Risk Analytics Market, by Software Type, 2016 – 2026

- 8.4.5.1. Europe Risk Analytics Market, by Software Type, 2016 – 2026 (USD Million)

- 8.4.6. Europe Risk Analytics Market, by Risk Type, 2016 – 2026

- 8.4.6.1. Europe Risk Analytics Market, by Risk Type, 2016 – 2026 (USD Million)

- 8.4.7. Europe Risk Analytics Market, by Industry Vertical, 2016 – 2026

- 8.4.7.1. Europe Risk Analytics Market, by Industry Vertical, 2016 – 2026 (USD Million)

- 8.4.8. Germany

- 8.4.8.1. Germany Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4.9. France

- 8.4.9.1. France Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4.10. U.K.

- 8.4.10.1. U.K. Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4.11. Italy

- 8.4.11.1. Italy Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4.12. Spain

- 8.4.12.1. Spain Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4.13. Rest of Europe

- 8.4.13.1. Rest of Europe Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.4.1. Europe Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5. Asia Pacific

- 8.5.1. Asia Pacific Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5.1.1. Asia Pacific Risk Analytics Market, by Country, 2016 - 2026 (USD Million)

- 8.5.2. Asia Pacific Risk Analytics Market, by Component, 2016 – 2026

- 8.5.2.1. Asia Pacific Risk Analytics Market, by Component, 2016 – 2026 (USD Million)

- 8.5.3. Asia Pacific Risk Analytics Market, by Deployment Type, 2016 – 2026

- 8.5.3.1. Asia Pacific Risk Analytics Market, by Deployment Type, 2016 – 2026 (USD Million)

- 8.5.4. Asia Pacific Risk Analytics Market, by Organization Size, 2016 – 2026

- 8.5.4.1. Asia Pacific Risk Analytics Market, by Organization Size, 2016 – 2026 (USD Million)

- 8.5.5. Asia Pacific Risk Analytics Market, by Software Type, 2016 – 2026

- 8.5.5.1. Asia Pacific Risk Analytics Market, by Software Type, 2016 – 2026 (USD Million)

- 8.5.6. Asia Pacific Risk Analytics Market, by Risk Type, 2016 – 2026

- 8.5.6.1. Asia Pacific Risk Analytics Market, by Risk Type, 2016 – 2026 (USD Million)

- 8.5.7. Asia Pacific Risk Analytics Market, by Industry Vertical, 2016 – 2026

- 8.5.7.1. Asia Pacific Risk Analytics Market, by Industry Vertical, 2016 – 2026 (USD Million)

- 8.5.8. China

- 8.5.8.1. China Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5.9. Japan

- 8.5.9.1. Japan Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5.10. India

- 8.5.10.1. India Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5.11. South Korea

- 8.5.11.1. South Korea Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5.12. South-East Asia

- 8.5.12.1. South-East Asia Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5.13. Rest of Asia Pacific

- 8.5.13.1. Rest of Asia Pacific Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.5.1. Asia Pacific Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.6. Latin America

- 8.6.1. Latin America Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.6.1.1. Latin America Risk Analytics Market, by Country, 2016 - 2026 (USD Million)

- 8.6.2. Latin America Risk Analytics Market, by Component, 2016 – 2026

- 8.6.2.1. Latin America Risk Analytics Market, by Component, 2016 – 2026 (USD Million)

- 8.6.3. Latin America Risk Analytics Market, by Deployment Type, 2016 – 2026

- 8.6.3.1. Latin America Risk Analytics Market, by Deployment Type, 2016 – 2026 (USD Million)

- 8.6.4. Latin America Risk Analytics Market, by Organization Size, 2016 – 2026

- 8.6.4.1. Latin America Risk Analytics Market, by Organization Size, 2016 – 2026 (USD Million)

- 8.6.5. Latin America Risk Analytics Market, by Software Type, 2016 – 2026

- 8.6.5.1. Latin America Risk Analytics Market, by Software Type, 2016 – 2026 (USD Million)

- 8.6.6. Latin America Risk Analytics Market, by Risk Type, 2016 – 2026

- 8.6.6.1. Latin America Risk Analytics Market, by Risk Type, 2016 – 2026 (USD Million)

- 8.6.7. Latin America Risk Analytics Market, by Industry Vertical, 2016 – 2026

- 8.6.7.1. Latin America Risk Analytics Market, by Industry Vertical, 2016 – 2026 (USD Million)

- 8.6.8. Brazil

- 8.6.8.1. Brazil Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.6.9. Mexico

- 8.6.9.1. Mexico Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.6.10. Rest of Latin America

- 8.6.10.1. Rest of Latin America Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.6.1. Latin America Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.7. The Middle-East and Africa

- 8.7.1. The Middle-East and Africa Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.7.1.1. The Middle-East and Africa Risk Analytics Market, by Country, 2016 - 2026 (USD Million)

- 8.7.2. The Middle-East and Africa Risk Analytics Market, by Component, 2016 – 2026

- 8.7.2.1. The Middle-East and Africa Risk Analytics Market, by Component, 2016 – 2026 (USD Million)

- 8.7.3. The Middle-East and Africa Risk Analytics Market, by Deployment Type, 2016 – 2026

- 8.7.3.1. The Middle-East and Africa Risk Analytics Market, by Deployment Type, 2016 – 2026 (USD Million)

- 8.7.4. The Middle-East and Africa Risk Analytics Market, by Organization Size, 2016 – 2026

- 8.7.4.1. The Middle-East and Africa Risk Analytics Market, by Organization Size, 2016 – 2026 (USD Million)

- 8.7.5. The Middle-East and Africa Risk Analytics Market, by Software Type, 2016 – 2026

- 8.7.5.1. The Middle-East and Africa Risk Analytics Market, by Software Type, 2016 – 2026 (USD Million)

- 8.7.6. The Middle-East and Africa Risk Analytics Market, by Risk Type, 2016 – 2026

- 8.7.6.1. The Middle-East and Africa Risk Analytics Market, by Risk Type, 2016 – 2026 (USD Million)

- 8.7.7. The Middle-East and Africa Risk Analytics Market, by Industry Vertical, 2016 – 2026

- 8.7.7.1. The Middle-East and Africa Risk Analytics Market, by Industry Vertical, 2016 – 2026 (USD Million)

- 8.7.8. GCC Countries

- 8.7.8.1. GCC Countries Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.7.9. South Africa

- 8.7.9.1. South Africa Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.7.10. Rest of Middle-East Africa

- 8.7.10.1. Rest of Middle-East Africa Risk Analytics Market, 2016 – 2026 (USD Million)

- 8.7.1. The Middle-East and Africa Risk Analytics Market, 2016 – 2026 (USD Million)

- Chapter 9 Risk Analytics Market – Competitive Landscape

- 9.1. Competitor Market Share – Revenue

- 9.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 9.3. Strategic Developments

- 9.3.1. Acquisitions and Mergers

- 9.3.2. New Products

- 9.3.3. Research & Development Activities

- Chapter 10 Company Profiles

- 10.1. IBM

- 10.1.1. Company Overview

- 10.1.2. Product/Service Portfulio

- 10.1.3. IBM Sales, Revenue, and Gross Margin

- 10.1.4. IBM Revenue and Growth Rate

- 10.1.5. IBM Market Share

- 10.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.2. Oracle

- 10.2.1. Company Overview

- 10.2.2. Product/Service Portfulio

- 10.2.3. Oracle Sales, Revenue, and Gross Margin

- 10.2.4. Oracle Revenue and Growth Rate

- 10.2.5. Oracle Market Share

- 10.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.3. SAP

- 10.3.1. Company Overview

- 10.3.2. Product/Service Portfulio

- 10.3.3. SAP Sales, Revenue, and Gross Margin

- 10.3.4. SAP Revenue and Growth Rate

- 10.3.5. SAP Market Share

- 10.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.4. SAS Institute

- 10.4.1. Company Overview

- 10.4.2. Product/Service Portfulio

- 10.4.3. SAS Institute Sales, Revenue, and Gross Margin

- 10.4.4. SAS Institute Revenue and Growth Rate

- 10.4.5. SAS Institute Market Share

- 10.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.5. FIS

- 10.5.1. Company Overview

- 10.5.2. Product/Service Portfulio

- 10.5.3. FIS Sales, Revenue, and Gross Margin

- 10.5.4. FIS Revenue and Growth Rate

- 10.5.5. FIS Market Share

- 10.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.6. Moody’s Analytics

- 10.6.1. Company Overview

- 10.6.2. Product/Service Portfulio

- 10.6.3. Moody’s Analytics Sales, Revenue, and Gross Margin

- 10.6.4. Moody’s Analytics Revenue and Growth Rate

- 10.6.5. Moody’s Analytics Market Share

- 10.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.7. Verisk Analytics

- 10.7.1. Company Overview

- 10.7.2. Product/Service Portfulio

- 10.7.3. Verisk Analytics Sales, Revenue, and Gross Margin

- 10.7.4. Verisk Analytics Revenue and Growth Rate

- 10.7.5. Verisk Analytics Market Share

- 10.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.8. AxiomSL

- 10.8.1. Company Overview

- 10.8.2. Product/Service Portfulio

- 10.8.3. AxiomSL Sales, Revenue, and Gross Margin

- 10.8.4. AxiomSL Revenue and Growth Rate

- 10.8.5. AxiomSL Market Share

- 10.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.9. Gurucul

- 10.9.1. Company Overview

- 10.9.2. Product/Service Portfulio

- 10.9.3. Gurucul Sales, Revenue, and Gross Margin

- 10.9.4. Gurucul Revenue and Growth Rate

- 10.9.5. Gurucul Market Share

- 10.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.10. Provenir

- 10.10.1. Company Overview

- 10.10.2. Product/Service Portfulio

- 10.10.3. Provenir Sales, Revenue, and Gross Margin

- 10.10.4. Provenir Revenue and Growth Rate

- 10.10.5. Provenir Market Share

- 10.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.11. Risk Edge Sulutions

- 10.11.1. Company Overview

- 10.11.2. Product/Service Portfulio

- 10.11.3. Risk Edge Sulutions Sales, Revenue, and Gross Margin

- 10.11.4. Risk Edge Sulutions Revenue and Growth Rate

- 10.11.5. Risk Edge Sulutions Market Share

- 10.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.12. BRIDGEi2i

- 10.12.1. Company Overview

- 10.12.2. Product/Service Portfulio

- 10.12.3. BRIDGEi2i Sales, Revenue, and Gross Margin

- 10.12.4. BRIDGEi2i Revenue and Growth Rate

- 10.12.5. BRIDGEi2i Market Share

- 10.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.13. Recorded Future

- 10.13.1. Company Overview

- 10.13.2. Product/Service Portfulio

- 10.13.3. Recorded Future Sales, Revenue, and Gross Margin

- 10.13.4. Recorded Future Revenue and Growth Rate

- 10.13.5. Recorded Future Market Share

- 10.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.14. DataFactZ

- 10.14.1. Company Overview

- 10.14.2. Product/Service Portfulio

- 10.14.3. DataFactZ Sales, Revenue, and Gross Margin

- 10.14.4. DataFactZ Revenue and Growth Rate

- 10.14.5. DataFactZ Market Share

- 10.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.15. Alteryx

- 10.15.1. Company Overview

- 10.15.2. Product/Service Portfulio

- 10.15.3. Alteryx Sales, Revenue, and Gross Margin

- 10.15.4. Alteryx Revenue and Growth Rate

- 10.15.5. Alteryx Market Share

- 10.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.16. AcadiaSoft

- 10.16.1. Company Overview

- 10.16.2. Product/Service Portfulio

- 10.16.3. AcadiaSoft Sales, Revenue, and Gross Margin

- 10.16.4. AcadiaSoft Revenue and Growth Rate

- 10.16.5. AcadiaSoft Market Share

- 10.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.17. Qlik

- 10.17.1. Company Overview

- 10.17.2. Product/Service Portfulio

- 10.17.3. Qlik Sales, Revenue, and Gross Margin

- 10.17.4. Qlik Revenue and Growth Rate

- 10.17.5. Qlik Market Share

- 10.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.18. CubeLogic

- 10.18.1. Company Overview

- 10.18.2. Product/Service Portfulio

- 10.18.3. CubeLogic Sales, Revenue, and Gross Margin

- 10.18.4. CubeLogic Revenue and Growth Rate

- 10.18.5. CubeLogic Market Share

- 10.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.19. Equarius Risk Analytics

- 10.19.1. Company Overview

- 10.19.2. Product/Service Portfulio

- 10.19.3. Equarius Risk Analytics Sales, Revenue, and Gross Margin

- 10.19.4. Equarius Risk Analytics Revenue and Growth Rate

- 10.19.5. Equarius Risk Analytics Market Share

- 10.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.20. Quantifi

- 10.20.1. Company Overview

- 10.20.2. Product/Service Portfulio

- 10.20.3. Quantifi Sales, Revenue, and Gross Margin

- 10.20.4. Quantifi Revenue and Growth Rate

- 10.20.5. Quantifi Market Share

- 10.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.21. Actify Data Labs

- 10.21.1. Company Overview

- 10.21.2. Product/Service Portfulio

- 10.21.3. Actify Data Labs Sales, Revenue, and Gross Margin

- 10.21.4. Actify Data Labs Revenue and Growth Rate

- 10.21.5. Actify Data Labs Market Share

- 10.21.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.22. Amlgo Labs

- 10.22.1. Company Overview

- 10.22.2. Product/Service Portfulio

- 10.22.3. Amlgo Labs Sales, Revenue, and Gross Margin

- 10.22.4. Amlgo Labs Revenue and Growth Rate

- 10.22.5. Amlgo Labs Market Share

- 10.22.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.23. Zesty.ai

- 10.23.1. Company Overview

- 10.23.2. Product/Service Portfulio

- 10.23.3. Zesty.ai Sales, Revenue, and Gross Margin

- 10.23.4. Zesty.ai Revenue and Growth Rate

- 10.23.5. Zesty.ai Market Share

- 10.23.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.24. Artivatic

- 10.24.1. Company Overview

- 10.24.2. Product/Service Portfulio

- 10.24.3. Artivatic Sales, Revenue, and Gross Margin

- 10.24.4. Artivatic Revenue and Growth Rate

- 10.24.5. Artivatic Market Share

- 10.24.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.25. Attestiv

- 10.25.1. Company Overview

- 10.25.2. Product/Service Portfulio

- 10.25.3. Attestiv Sales, Revenue, and Gross Margin

- 10.25.4. Attestiv Revenue and Growth Rate

- 10.25.5. Attestiv Market Share

- 10.25.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.26. RiskVille

- 10.26.1. Company Overview

- 10.26.2. Product/Service Portfulio

- 10.26.3. RiskVille Sales, Revenue, and Gross Margin

- 10.26.4. RiskVille Revenue and Growth Rate

- 10.26.5. RiskVille Market Share

- 10.26.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.27. Quantexa

- 10.27.1. Company Overview

- 10.27.2. Product/Service Portfulio

- 10.27.3. Quantexa Sales, Revenue, and Gross Margin

- 10.27.4. Quantexa Revenue and Growth Rate

- 10.27.5. Quantexa Market Share

- 10.27.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.28. Spin Analytics

- 10.28.1. Company Overview

- 10.28.2. Product/Service Portfulio

- 10.28.3. Spin Analytics Sales, Revenue, and Gross Margin

- 10.28.4. Spin Analytics Revenue and Growth Rate

- 10.28.5. Spin Analytics Market Share

- 10.28.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.29. Kyvos Insights

- 10.29.1. Company Overview

- 10.29.2. Product/Service Portfulio

- 10.29.3. Kyvos Insights Sales, Revenue, and Gross Margin

- 10.29.4. Kyvos Insights Revenue and Growth Rate

- 10.29.5. Kyvos Insights Market Share

- 10.29.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.30. Imply

- 10.30.1. Company Overview

- 10.30.2. Product/Service Portfulio

- 10.30.3. Imply Sales, Revenue, and Gross Margin

- 10.30.4. Imply Revenue and Growth Rate

- 10.30.5. Imply Market Share

- 10.30.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.1. IBM

- Chapter 11 Risk Analytics — Industry Analysis

- 11.1. Introduction and Taxonomy

- 11.2. Risk Analytics Market – Key Trends

- 11.2.1. Market Drivers

- 11.2.2. Market Restraints

- 11.2.3. Market Opportunities

- 11.3. Porter’s Five Forces Model

- 11.3.1. Bargaining Power of Buyers

- 11.3.2. Bargaining Power of Suppliers

- 11.3.3. Threat of Substitute

- 11.3.4. Threat of New Entrants

- 11.3.5. Rivalry among Existing Competitors

- 11.4. PESTEL Analysis

- 11.5. Key Mandates and Regulations

- 11.6. Technulogy Roadmap and Timeline

- 11.7. Risk Analytics Market – Attractiveness Analysis

- 11.7.1. By Component

- 11.7.2. By Deployment Type

- 11.7.3. By Organization Size

- 11.7.4. By Software Type

- 11.7.5. By Risk Type

- 11.7.6. By Industry Vertical

- 11.7.7. By Region

- Chapter 12 Report Conclusion & Key Insights

- 12.1. Key Insights from Primary Interviews & Surveys Respondents

- 12.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 13 Research Approach & Methodulogy

- 13.1. Report Description

- 13.2. Research Scope

- 13.3. Research Methodulogy

- 13.3.1. Secondary Research

- 13.3.2. Primary Research

- 13.3.3. Statistical Models

- 13.3.3.1. Company Share Analysis Model

- 13.3.3.2. Revenue Based Modeling

- 13.3.4. Research Limitations

Inquiry For Buying

Risk Analytics

Request Sample

Risk Analytics