Roll-your-own Cigarette (RYO) Market Size, Share, and Trends Analysis Report

CAGR :

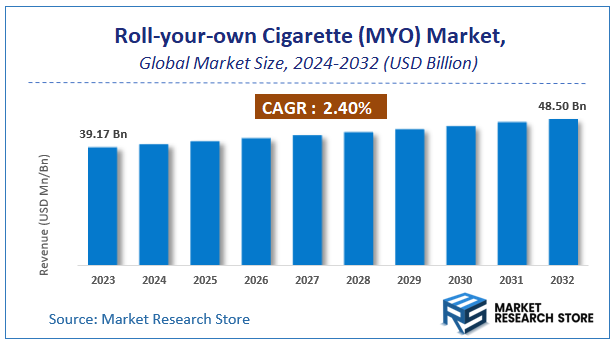

| Market Size 2023 (Base Year) | USD 39.17 Billion |

| Market Size 2032 (Forecast Year) | USD 48.50 Billion |

| CAGR | 2.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Roll-your-own Cigarette (RYO) Market Insights

According to Market Research Store, the global roll-your-own cigarette (RYO) market size was valued at around USD 39.17 billion in 2023 and is estimated to reach USD 48.50 billion by 2032, to register a CAGR of approximately 2.4% in terms of revenue during the forecast period 2024-2032.

The roll-your-own cigarette (RYO) report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Roll-your-own Cigarette (RYO) Market: Overview

The Roll-Your-Own Cigarette (RYO) market comprises products and accessories enabling consumers to manually assemble cigarettes, including loose tobacco, rolling papers, filters, and rolling devices. This segment appeals primarily through cost advantages and customization options, allowing users to adjust tobacco blends and dosage. Market dynamics reflect shifting consumer behaviors influenced by pricing considerations and personalization trends, though no inherent health benefits differentiate RYO from manufactured cigarettes. The sector faces operational challenges from increasing regulatory parity with pre-made cigarettes, as authorities apply similar taxation and packaging requirements. Product innovation focuses on enhancing user experience through improved rolling mechanisms and material quality, while manufacturers explore hybrid concepts integrating RYO with alternative tobacco formats.

Key Highlights

- The roll-your-own cigarette (RYO) market is anticipated to grow at a CAGR of 2.4% during the forecast period.

- The global roll-your-own cigarette (RYO) market was estimated to be worth approximately USD 39.17 billion in 2023 and is projected to reach a value of USD 48.50 billion by 2032.

- The growth of the roll-your-own cigarette (RYO) market is being driven by the increasing awareness of the quality and variety of available loose tobacco and evolving demographic consumption patterns also play a role in market expansion.

- Based on the product type, the tobacco segment is growing at a high rate and is projected to dominate the market.

- On the basis of distribution channel, the online stores segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Roll-your-own Cigarette (RYO) Market: Dynamics

Key Growth Drivers

- Significant Price Advantage Over Manufactured Cigarettes: The primary driver is the substantial cost saving compared to purchasing packs of ready-made cigarettes, especially in regions with high cigarette taxes. This makes RYO attractive to budget-conscious smokers.

- Perceived Control Over Ingredients and Tobacco Quality: Some smokers believe RYO allows them to use "purer" or less processed tobacco and control the type and amount of tobacco in their cigarettes.

- Customization of Cigarette Characteristics: RYO enables smokers to tailor the size, density, and potentially the flavor (by choosing specific tobaccos or adding flavorings where legal) of their cigarettes.

- Circumventing Regulations on Manufactured Cigarettes: In markets with strict regulations on manufactured cigarettes (e.g., plain packaging, flavor bans), RYO offers a way for smokers to have more control over these aspects.

- Cultural or Habitual Preference: For some individuals, rolling their own cigarettes is a long-standing habit or even a cultural practice.

- Availability in Smaller Outlets: Loose tobacco and rolling supplies might be more readily available in local shops or tobacconists compared to specific manufactured cigarette brands.

- Lower Tax Rates (in some regions): While increasingly targeted, some regions still have lower tax rates on loose tobacco compared to manufactured cigarettes, maintaining the price differential.

- DIY and Craft Culture: A broader trend towards "do-it-yourself" and a desire for a more hands-on approach can extend to how some individuals choose to consume tobacco.

Restraints

- Inconvenience and Time Commitment: Rolling cigarettes manually is less convenient and more time-consuming than simply taking one from a pack of manufactured cigarettes.

- Negative Social Stigma Associated with Smoking: The general and increasing social disapproval of smoking impacts all forms of tobacco consumption, including RYO cigarettes.

- Lack of Perceived Health Benefit: There is no scientific evidence to suggest that RYO cigarettes are any safer than manufactured ones; both carry significant health risks.

- Increasing Taxation and Regulatory Scrutiny: Governments are actively working to reduce the price advantage of RYO by increasing taxes and applying similar regulations as manufactured cigarettes.

- Declining Overall Smoking Rates: The global trend of decreasing smoking prevalence naturally reduces the potential market for RYO cigarettes as well.

- Restrictions on Sale and Marketing: Regulations on advertising, display, and minimum purchase ages apply to RYO tobacco and accessories, limiting their promotion and accessibility.

- Messiness and Skill Required for Rolling: Handling loose tobacco and learning to roll cigarettes effectively can be messy and require some practice.

- Limited Portability Compared to Packaged Cigarettes: Carrying loose tobacco, papers, and filters separately can be less convenient than carrying a ready-made pack.

Opportunities

- Development of Easier-to-Use Rolling Accessories: Innovations like automatic rolling machines, pre-rolled cones, and user-friendly filter applicators can make RYO more accessible.

- Marketing the Cost Savings Explicitly: Emphasizing the financial benefits of switching to RYO cigarettes can attract price-sensitive smokers.

- Offering a Wider Variety of Tobacco Blends and Flavors (where legal): Providing diverse tobacco options can cater to individual preferences and offer alternatives to regulated manufactured cigarettes.

- Online Sales and Subscription Models (where permitted): E-commerce platforms can offer convenient purchasing options for RYO supplies.

- Positioning as a "More Natural" Alternative (with caveats): While health risks remain, marketing "natural" or additive-free loose tobacco might appeal to a niche segment.

- Bundling Deals and Starter Kits: Offering bundled packages of tobacco, papers, and filters can encourage trial and adoption by new users.

- Educational Content on Rolling Techniques: Providing tutorials and guides on how to roll cigarettes effectively can lower the initial barrier for new users.

- Focus on Specific Demographics: Tailoring marketing efforts towards demographics particularly sensitive to price or seeking more control over their smoking experience.

Challenges

- Counteracting the Inconvenience Factor: Making the rolling process as quick and easy as possible is crucial to compete with the convenience of manufactured cigarettes.

- Navigating Increasing and Harmonized Taxation: As tax advantages diminish, the primary driver for RYO weakens.

- Addressing Negative Health Perceptions: Communicating any perceived benefits (e.g., control over additives, even if not health-related) while acknowledging the inherent risks of smoking.

- Preventing Illicit Trade and Tax Evasion: Ensuring compliance with tax regulations and preventing the sale of untaxed or counterfeit RYO tobacco.

- Adapting to Potential Flavor Bans Extending to RYO: If flavor restrictions broaden to include loose tobacco, it could significantly impact consumer appeal.

- Maintaining Profitability with Rising Costs and Regulations: Balancing pricing to attract consumers while managing increasing costs due to taxes and regulatory compliance.

- Competing with the Strong Branding and Convenience of Manufactured Cigarettes: Overcoming the established market presence and ease of use of traditional cigarette brands.

- Responding to Declining Smoking Rates and Public Health Initiatives: Operating in a market with a shrinking consumer base and facing strong public health opposition.

Roll-your-own Cigarette (MYO) Market: Report Scope

This report thoroughly analyzes the Roll-your-own Cigarette (MYO) Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Roll-your-own Cigarette (MYO) Market |

| Market Size in 2023 | USD 39.17 Billion |

| Market Forecast in 2032 | USD 48.50 Billion |

| Growth Rate | CAGR of 2.4% |

| Number of Pages | 197 |

| Key Companies Covered | Imperial Brands, Japan Tobacco Inc., Philip Morris International, British American Tobacco, Altria Group Inc., Scandinavian Tobacco Group, Gallaher Group Plc, Reynolds American Inc., Donskoy Tabak, Eastern Company S.A.E., Habanos S.A., KT&G Corporation, C |

| Segments Covered | By Product Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Roll-your-own Cigarette (RYO) Market: Segmentation Insights

The global roll-your-own cigarette (RYO) market is divided by product type, distribution channel, and region.

Segmentation Insights by Product Type

Based on product type, the global roll-your-own cigarette (RYO) market is divided into tobacco, rolling papers, filters, and others.

Tobacco holds the dominant position in the Roll-Your-Own Cigarette (RYO) market by product type. This segment includes loose-leaf tobacco blends that consumers manually roll into cigarettes. The popularity of this product is driven by cost-effectiveness, as RYO tobacco is generally cheaper than pre-manufactured cigarettes. Additionally, consumers appreciate the control they have over the strength and quantity of tobacco used per cigarette. The growing inclination towards customized smoking experiences has contributed to the continued dominance of this segment, particularly in regions with high tobacco taxes or among price-sensitive smokers.

Rolling Papers are a crucial component of the RYO process and come in various materials such as rice, hemp, and flax. Although this segment does not dominate the market by volume, it plays an essential supportive role. The variety in rolling papers allows users to further personalize their smoking experience based on taste, burn rate, and environmental preferences (e.g., biodegradable papers). Innovative branding and organic or flavored variants have helped expand this segment’s appeal, especially among younger users and those seeking alternatives to traditional cigarette products.

Filters are the smallest segment by volume but are increasingly gaining attention due to rising health consciousness among consumers. While many traditional RYO users roll filter-less cigarettes, demand for pre-cut and biodegradable filters is growing. This shift is driven by efforts to reduce harshness and tar intake during smoking. Filters are often sold as separate accessories, and their usage varies greatly by region and user preference. Though not yet dominant, the filters segment is experiencing steady growth and is expected to gain a stronger foothold as health trends influence smoking habits.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global roll-your-own cigarette (RYO) market is bifurcated into online stores, supermarkets/hypermarkets, tobacco shops, and others.

Online Stores dominate the Roll-Your-Own Cigarette (RYO) market by distribution channel due to increasing consumer preference for convenience and discreet purchasing options. E-commerce platforms offer a wide range of RYO products, including tobacco blends, rolling papers, filters, and kits, with the added benefit of home delivery. The ability to compare prices, access user reviews, and find specialty or international brands online has significantly boosted this segment. As digital retail infrastructure improves and regulations for online tobacco sales evolve, this channel is expected to maintain its lead.

Supermarkets/Hypermarkets serve as key physical points of sale for RYO products, especially in urban and suburban areas. They offer consumers the convenience of purchasing tobacco-related products alongside regular groceries. This segment benefits from high footfall and impulse buying behavior. However, its share has slightly declined with the rise of online alternatives and growing tobacco sales restrictions in major retail chains.

Tobacco Shops are traditional and specialized retail outlets offering a focused range of RYO products and expert customer service. While they cater to loyal or seasoned users looking for premium or niche items, their reach is geographically limited. These shops continue to play a crucial role in markets with strong smoking cultures and are particularly popular among older consumers who prefer in-person purchases.

Roll-your-own Cigarette (RYO) Market: Regional Insights

- North America is expected to dominate the global market.

North America dominates the global roll-your-own cigarette (RYO) market due to widespread cultural acceptance and high taxation on factory-made cigarettes. A significant portion of consumers in the United States and Canada are shifting toward roll-your-own cigarettes due to perceived cost savings and the belief that these products offer more control over ingredients. While factory-made cigarettes still dominate the region, increasing awareness of alternative tobacco products is gradually expanding the RYO consumer base. Additionally, changing smoking habits and a desire for personalization are contributing to this trend.

Asia Pacific is emerging as the fastest-growing region in the roll-your-own cigarette (RYO) market. The region’s vast population, growing middle class, and high prevalence of tobacco use create favorable conditions for RYO market expansion. Countries such as India, Indonesia, and the Philippines are seeing increased demand for affordable tobacco options. Additionally, the availability of a wide range of RYO materials and the presence of a large rural consumer base support growth in this region.

Europe is witnessing steady growth in the RYO segment. Many consumers in this region prefer RYO products as a cost-effective alternative. Countries like the United Kingdom, Germany, and France have seen strong adoption, especially among younger adults who are drawn to the customization and affordability of hand-rolled cigarettes. The maturity of the market and the established presence of well-known RYO brands further support Europe’s leading position.

Latin America presents a developing opportunity for the roll-your-own cigarette (RYO) market. Economic constraints and increasing prices of manufactured cigarettes have encouraged smokers in countries like Brazil and Argentina to explore RYO alternatives. Though still a relatively small segment, the growing popularity of RYO cigarettes is supported by informal distribution channels and an expanding tobacco-using population looking for cheaper options.

Middle East & Africa are also experiencing gradual growth in the RYO market. The appeal of lower-cost tobacco products, coupled with shifting consumer preferences in countries like South Africa and select Gulf nations, is supporting the market’s expansion. However, the region's growth is tempered by regulatory challenges and the dominance of traditional smoking products.

Roll-your-own Cigarette (RYO) Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the roll-your-own cigarette (RYO) market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global roll-your-own cigarette (RYO) market include:

- Imperial Brands

- Japan Tobacco Inc.

- Philip Morris International

- British American Tobacco

- Altria Group Inc.

- Scandinavian Tobacco Group

- Gallaher Group Plc

- Reynolds American Inc.

- Donskoy Tabak

- Eastern Company S.A.E.

- Habanos S.A.

- KT&G Corporation

- China National Tobacco Corporation

- ITC Limited

- Godfrey Phillips India Ltd.

- Swedish Match AB

- PT Gudang Garam Tbk

- VST Industries Limited

- Mac Baren Tobacco Company

- JTI-Macdonald Corp.

The global roll-your-own cigarette (RYO) market is segmented as follows:

By Product Type

- Tobacco

- Rolling Papers

- Filters

- Others

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Tobacco Shops

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Roll-your-own Cigarette (RYO)

Request Sample

Roll-your-own Cigarette (RYO)