Roller Method Iron and Steel Slag Market Size, Share, and Trends Analysis Report

CAGR :

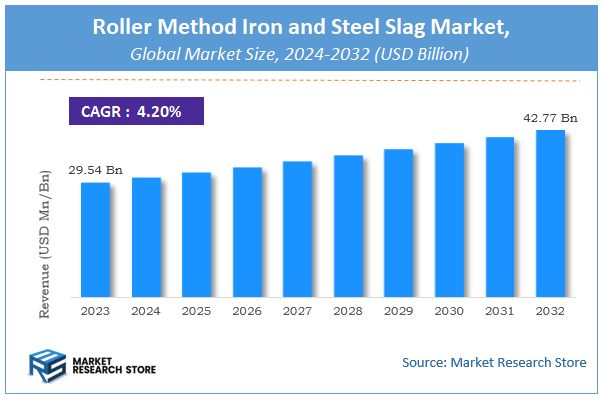

| Market Size 2023 (Base Year) | USD 29.54 Billion |

| Market Size 2032 (Forecast Year) | USD 42.77 Billion |

| CAGR | 4.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Roller Method Iron and Steel Slag Market Insights

According to Market Research Store, the global roller method iron and steel slag market size was valued at around USD 29.54 billion in 2023 and is estimated to reach USD 42.77 billion by 2032, to register a CAGR of approximately 4.2% in terms of revenue during the forecast period 2024-2032.

The roller method iron and steel slag report provide a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Roller Method Iron and Steel Slag Market: Overview

Roller method iron and steel slag refers to the by-products generated during the production of iron and steel using roller technology, which involves crushing and grinding slag using high-pressure roller mills. This method enhances the fineness, uniformity, and reactivity of slag, making it more suitable for use in various downstream applications such as cement manufacturing, road construction, and soil stabilization. The roller method is preferred for its energy efficiency, lower environmental impact, and ability to produce high-quality ground slag compared to traditional ball milling or other grinding techniques.

Key Highlights

- The roller method iron and steel slag market is anticipated to grow at a CAGR of 4.2% during the forecast period.

- The global roller method iron and steel slag market was estimated to be worth approximately USD 29.54 billion in 2023 and is projected to reach a value of USD 42.77 billion by 2032.

- The growth of the roller method iron and steel slag market is being driven by increasing demand for sustainable construction materials and the rising emphasis on circular economy practices in the metal and construction industries.

- Based on the process type, the hot rolling segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the construction segment is projected to swipe the largest market share.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Roller Method Iron and Steel Slag Market: Dynamics

Key Growth Drivers:

- Rising Demand in Construction and Infrastructure Projects: The roller method iron and steel slag is increasingly used in road construction, cement production, and civil engineering due to its strength, durability, and cost-effectiveness.

- Sustainable and Eco-Friendly Material Usage: With growing environmental concerns, industries are adopting slag as a substitute for natural aggregates, reducing carbon footprints and promoting recycling in the steel industry.

- Increased Steel Production Worldwide: As global steel production rises, the availability of slag as a byproduct increases, supporting consistent supply for roller method processing and market growth.

- Cost-Effectiveness Compared to Natural Aggregates: Roller method slag products often come at a lower cost than traditional construction materials, appealing to cost-conscious industries and governments.

Restraints:

- Limited Awareness and Acceptance: Despite its benefits, there is still a lack of awareness and acceptance among end users regarding the use of iron and steel slag, especially in developing regions.

- Variability in Quality and Composition: Inconsistent slag properties depending on the steel production process can affect product reliability, making standardization a challenge.

- Initial Processing and Handling Complexity: The roller method requires specific equipment and processing conditions, which might deter smaller players due to additional investment needs.

Opportunities:

- Growing Focus on Circular Economy: Governments and industries are encouraging sustainable practices, providing opportunities for slag reuse and roller method applications in various sectors.

- Expansion in Emerging Economies: Countries in Asia-Pacific, Africa, and Latin America are experiencing rapid urbanization and infrastructure development, creating high demand for alternative and low-cost building materials.

- Research and Development in Material Engineering: Advancements in slag processing techniques and applications, including blending methods and improved performance, can open new avenues in specialized construction uses.

Challenges:

- Regulatory and Environmental Compliance: Varying regulations regarding the classification and reuse of slag in different countries can pose compliance hurdles for manufacturers and exporters.

- Competition from Alternative Materials: Slag-based products face competition from other recycled materials and natural aggregates, especially where those are more readily available.

- Logistics and Transportation Costs: Transporting slag from steel production facilities to processing sites or construction areas can be expensive due to its bulk nature, impacting overall cost benefits.

Roller Method Iron and Steel Slag Market: Report Scope

This report thoroughly analyzes the Roller Method Iron and Steel Slag Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Roller Method Iron and Steel Slag Market |

| Market Size in 2023 | USD 29.54 Billion |

| Market Forecast in 2032 | USD 42.77 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 170 |

| Key Companies Covered | ArcelorMittal, Nippon Steel Corporation, POSCO, Tata Steel, China Baowu Steel Group, JFE Steel Corporation, Thyssenkrupp AG, Nucor Corporation, Hyundai Steel Company, JSW Steel Ltd., Gerdau S.A., United States Steel Corporation, Voestalpine AG, Severstal, |

| Segments Covered | By Process Type, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Roller Method Iron and Steel Slag Market: Segmentation Insights

The global roller method iron and steel slag market is divided by process type, application, end-user, and region.

Segmentation Insights by Process Type

Based on process type, the global roller method iron and steel slag market is divided into hot rolling and cold rolling.

In the roller method iron and steel slag market, hot rolling is the most dominant segment by process type. Hot rolling is a process where iron and steel slag is treated at extremely high temperatures, typically above the recrystallization point of the metal. This method allows for easier shaping and forming of the material into various forms such as sheets, rods, and structural components. The high temperature makes the slag more malleable, improving the overall efficiency of processing and making it more suitable for construction and infrastructure applications. The dominance of the hot rolling segment can be attributed to its widespread use in large-scale steel manufacturing operations, especially where the final products require robust mechanical properties and structural integrity. Additionally, hot rolling tends to be more cost-effective in mass production due to reduced energy consumption during reheating phases.

On the other hand, cold rolling is a secondary process carried out at or near room temperature, usually after hot rolling. It is primarily used for refining the surface finish, enhancing dimensional accuracy, and improving mechanical properties like tensile strength and hardness. Although cold rolling adds significant value to the final product, its application is more limited due to higher operational costs and more specialized uses. Cold rolled slag products are generally preferred in precision manufacturing or in industries where surface finish and exact dimensions are critical, such as automotive and electronics. Despite its advantages, the cold rolling segment holds a smaller share of the market compared to hot rolling, primarily due to its limited scope and the added costs involved in the process.

Segmentation Insights by Application

On the basis of application, the global roller method iron and steel slag market is bifurcated into construction, railways, fertilizers, cement production, and others.

In the roller method iron and steel slag market, construction is the most dominant application segment. This dominance stems from the widespread use of processed slag as a substitute for natural aggregates in building roads, foundations, embankments, and other structural elements. The roller method enhances the slag’s mechanical stability and size consistency, making it highly suitable for infrastructure projects. Its durability, load-bearing capacity, and cost-effectiveness make it a popular choice in both commercial and residential construction sectors, especially in regions with high demand for sustainable construction materials.

Cement production follows as the second most significant segment. Iron and steel slag is a valuable raw material in cement manufacturing due to its cementitious properties. When processed through the roller method, the slag becomes finer and more reactive, improving the performance of blended cement and reducing the need for clinker, thereby lowering carbon emissions. This not only contributes to environmental sustainability but also reduces production costs for cement manufacturers.

The railways segment holds a substantial share in the market as well. Processed slag is used as track ballast under railway tracks to provide stability and drainage. The roller method ensures the slag has the proper gradation and mechanical strength required for withstanding the dynamic loads of passing trains. Its long-lasting performance and resistance to weathering make it a reliable material for railway infrastructure.

Fertilizers represent a niche but growing application area. Certain types of slag contain valuable nutrients like calcium, magnesium, and phosphorus, making them suitable for use as soil conditioners. The roller method helps refine the slag into a usable form for agricultural applications, although its use is still limited by geographic and regulatory factors.

Roller Method Iron and Steel Slag Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific region is the most dominant in the roller method iron and steel slag market. This dominance is fueled by rapid industrialization, expansive infrastructure projects, and the high volume of steel production, especially in countries like China, India, and Japan. China, being the world’s largest steel producer, generates substantial slag, which is repurposed for construction and road building. India’s growing urban development and Japan’s mature recycling infrastructure also contribute significantly. The focus on sustainable material usage and environmental conservation further amplifies the demand for processed slag products in this region.

The North America region holds a strong position, led primarily by the United States and Canada. The U.S. showcases growing adoption of sustainable construction practices, where slag is widely used in road base, cement production, and soil stabilization. Environmental regulations and the push toward carbon footprint reduction have driven the incorporation of iron and steel slag in public infrastructure projects. Canada's support for industrial recycling and growing awareness about slag’s environmental benefits further enhances the region’s market performance.

The Europe region maintains steady growth in the market due to well-established recycling frameworks and strict environmental directives. Countries such as Germany, the United Kingdom, and France have implemented policies that favor slag reutilization in construction and cement industries. Germany leads within the region, supported by its strong steel production and eco-conscious infrastructure developments. European efforts to transition to circular economies continue to support the use of iron and steel slag as a sustainable material alternative.

The Latin America region is emerging steadily, supported by ongoing infrastructure expansion and urbanization. Nations like Brazil, Mexico, and Argentina are investing heavily in housing, roads, and industrial facilities, which has created a growing demand for alternative construction materials such as processed slag. The presence of regional steel manufacturing hubs and rising awareness about sustainable building materials are gradually boosting slag market adoption across the region.

The Middle East and Africa region, while currently the least dominant, is showing growth potential driven by urban expansion and industrialization. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are advancing large-scale infrastructure projects. These initiatives are beginning to incorporate slag as an eco-friendly material for cement, roads, and building applications. Increased government focus on sustainability and cost-efficient construction solutions contributes to the region’s growing interest in iron and steel slag products.

Roller Method Iron and Steel Slag Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the roller method iron and steel slag market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global roller method iron and steel slag market include:

- ArcelorMittal

- Nippon Steel Corporation

- POSCO

- Tata Steel

- China Baowu Steel Group

- JFE Steel Corporation

- Thyssenkrupp AG

- Nucor Corporation

- Hyundai Steel Company

- JSW Steel Ltd.

- Gerdau S.A.

- United States Steel Corporation

- Voestalpine AG

- Severstal

- SAIL (Steel Authority of India Limited)

- Ansteel Group Corporation

- HBIS Group

- Shougang Group

- Evraz Group

- Liberty Steel Group

The global roller method iron and steel slag market is segmented as follows:

By Process Type

- Hot Rolling

- Cold Rolling

By Application

- Construction

- Railways

- Fertilizers

- Cement Production

- Others

By End-User

- Construction

- Agriculture

- Transportation

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Roller Method Iron and Steel Slag

Request Sample

Roller Method Iron and Steel Slag