Roofing Software Market Size, Share, and Trends Analysis Report

CAGR :

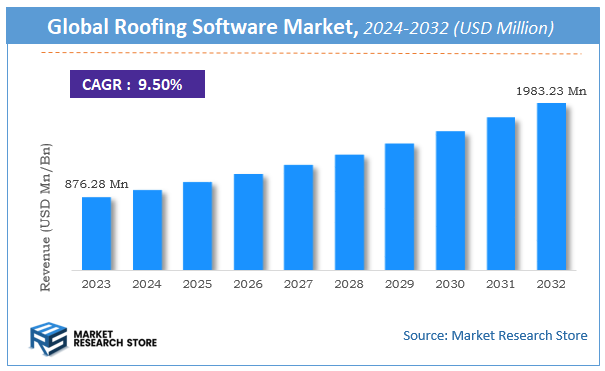

| Market Size 2023 (Base Year) | USD 876.28 Million |

| Market Size 2032 (Forecast Year) | USD 1983.23 Million |

| CAGR | 9.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Roofing Software Market Insights

According to Market Research Store, the global roofing software market size was valued at around USD 876.28 million in 2023 and is estimated to reach USD 1983.23 million by 2032, to register a CAGR of approximately 9.5% in terms of revenue during the forecast period 2024-2032.

The roofing software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Roofing Software Market: Overview

Roofing software is a specialized digital solution designed to assist roofing contractors, construction professionals, and service companies in streamlining their business operations related to roof installation, repair, maintenance, and project management. This software typically includes features such as aerial measurement tools, project estimating, material ordering, customer relationship management (CRM), job scheduling, invoicing, and photo documentation. Many modern roofing software platforms also integrate with drones, satellite imagery, and 3D modeling to provide accurate roof dimensions and visualizations, enhancing the precision and efficiency of inspections and estimates.

The growth of roofing software is driven by the increasing demand for operational efficiency, accuracy, and customer transparency in the construction and home improvement sectors. As competition intensifies and labor costs rise, roofing contractors are turning to digital tools to reduce errors, save time, and manage multiple projects simultaneously. Cloud-based and mobile-friendly platforms have become especially popular, enabling field workers and office teams to collaborate in real time. In addition, the push toward automation, digital documentation, and integration with accounting or enterprise resource planning (ERP) systems is further accelerating the adoption of roofing software. As the construction industry continues to digitize, roofing software is becoming an essential tool for improving productivity, enhancing customer satisfaction, and driving business growth.

Key Highlights

- The roofing software market is anticipated to grow at a CAGR of 9.5% during the forecast period.

- The global roofing software market was estimated to be worth approximately USD 876.28 million in 2023 and is projected to reach a value of USD 1983.23 million by 2032.

- The growth of the roofing software market is being driven by the increasing demand for operational efficiency and streamlined project management within the roofing industry.

- Based on the application, the roofing contractors segment is growing at a high rate and is projected to dominate the market.

- On the basis of product, the estimating software segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Roofing Software Market: Dynamics

Key Growth Drivers:

- Increasing Digitization in the Construction Industry: The broader construction sector is undergoing a significant digital transformation. Roofing companies are increasingly adopting software solutions to improve operational efficiency, move away from paper-based processes, and leverage data for better decision-making.

- Growing Demand for Accurate Cost Control and Project Estimation: Roofing projects involve complex calculations for materials, labor, and overhead. Software provides precise estimating tools, helping contractors create accurate bids, manage costs effectively, minimize material waste, and improve profitability.

- Need for Improved Workflow Automation and Project Management: Roofing businesses often juggle multiple projects, crews, and deadlines. Roofing software automates tasks like scheduling, task assignment, job tracking, and progress monitoring, leading to more efficient workflows and timely project completion.

- Rising Adoption of Cloud-Based Solutions and Mobile Apps: Cloud-based roofing software offers unparalleled accessibility, scalability, and real-time collaboration capabilities. Mobile applications empower field technicians to access project details, update statuses, and communicate from job sites, enhancing productivity and communication between office and field.

- Emphasis on Enhanced Customer Relationship Management (CRM): Integrated CRM functionalities within roofing software help companies manage leads, track customer interactions, automate follow-ups, and strengthen client relationships, leading to improved customer satisfaction and repeat business.

- Integration of Advanced Technologies (AI, Drones, 3D Modeling): The incorporation of AI for forecasting and anomaly detection, drones for precise roof measurements and inspections, and 3D modeling for visualization and planning, is enhancing the capabilities of roofing software and driving its adoption.

- Demand for Better Reporting and Analytics: Roofing companies are seeking data-driven insights to identify areas for improvement, optimize resource allocation, and enhance profitability. Roofing software provides robust reporting and analytics features to meet this need.

Restraints:

- High Initial Investment and Implementation Costs: For small and medium-sized enterprises (SMEs) in particular, the upfront cost of purchasing roofing software licenses, subscription fees, and associated training can be a significant financial barrier.

- Resistance to Technology Adoption by Traditional Contractors: Many established roofing contractors have long relied on manual methods or traditional business practices. Overcoming this inertia and reluctance to embrace new digital solutions can be a significant challenge.

- Complexity and Lack of User-Friendliness in Some Solutions: While modern software aims for simplicity, some comprehensive roofing software platforms can be complex to learn and navigate, requiring significant training and technical expertise, which can deter adoption.

- Data Security Concerns: Roofing companies handle sensitive client and project data. Concerns about data breaches, unauthorized access, and the overall security of cloud-based platforms can act as a restraint for some businesses.

- Integration Challenges with Existing Systems: Integrating new roofing software with legacy accounting systems, CRM platforms, or other existing tools can be complex and require significant IT effort, leading to implementation hurdles.

- Availability of General Project Management Software: Roofing businesses might opt for more generic project management or CRM software that is not industry-specific, perceiving it as a more cost-effective or readily available alternative, thus diverting market share.

Opportunities:

- Further Integration of AI and Machine Learning: Deepening AI capabilities for predictive maintenance, optimized scheduling, automated material ordering based on project scope, and even intelligent proposal generation can revolutionize efficiency and decision-making.

- Specialized Solutions for Niche Markets and Sustainable Roofing: Developing software tailored for specific roofing types (e.g., commercial flat roofs, green roofs, solar panel integration) or focusing on supporting sustainable and energy-efficient roofing practices can open new market segments.

- Enhanced Mobile Functionality and Field Connectivity: Continuing to improve the mobile experience for field teams, including offline capabilities, advanced photo/video documentation, and real-time communication tools, will further boost productivity.

- Focus on Comprehensive All-in-One Solutions: Developing platforms that seamlessly integrate all aspects of a roofing business – from lead to completion to post-project follow-up – to eliminate data silos and improve overall efficiency.

- Subscription-as-a-Service (SaaS) Models: The shift towards SaaS models makes software more accessible and affordable, particularly for SMEs, by reducing upfront costs and offering scalable solutions.

- Leveraging Data Analytics for Business Intelligence: Providing advanced analytics and reporting features that allow roofing companies to gain deeper insights into their profitability, project performance, sales pipelines, and customer trends.

- Expansion in Emerging Markets: As construction industries grow and digitize in developing economies, there's a significant opportunity for roofing software providers to penetrate these new markets.

Challenges:

- Educating the Market and Demonstrating ROI: A key challenge is effectively communicating the tangible benefits and clear return on investment (ROI) of adopting roofing software to contractors who may be hesitant to change established practices.

- Adapting to Evolving Industry Standards and Materials: The roofing industry is constantly seeing new materials, building codes, and installation techniques. Software providers must continuously update their platforms to reflect these changes and ensure accuracy.

- Addressing the Skills Gap: There's a need to bridge the skills gap among roofing professionals in effectively utilizing new software functionalities, requiring ongoing training and user support.

- Ensuring Data Interoperability: Creating seamless connections and data exchange between different software solutions (e.g., accounting, CRM, aerial measurement) can be challenging due to varying data formats and APIs.

- Competition from Large Enterprise Software Providers: While specialized, roofing software companies face competition from larger, more generalized construction management software providers who might also offer modules relevant to roofing.

- Maintaining Cybersecurity Amidst Cloud Adoption: With more sensitive data residing in the cloud, continuously enhancing cybersecurity measures to protect against breaches and ensure compliance with data privacy regulations is paramount.

Roofing Software Market: Report Scope

This report thoroughly analyzes the Roofing Software Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Roofing Software Market |

| Market Size in 2023 | USD 876.28 Million |

| Market Forecast in 2032 | USD 1983.23 Million |

| Growth Rate | CAGR of 9.5% |

| Number of Pages | 195 |

| Key Companies Covered | Tenderfield, Oracle, Buildertrend, STACK, PlanSwift, UDA Technologies, Trimble, Sage, FOUNDATION, Raken, Sigma, Plexxis, CMiC, Spectrum, ProEst, JOBPOWER, AccuLynx, EagleView, RoofSnap, JobNimbus, Xactimate, CoConstruct, Roofr, Red Rhino |

| Segments Covered | By Application, By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Roofing Software Market: Segmentation Insights

The global roofing software market is divided by application, product, and region.

Segmentation Insights by Application

Based on application, the global roofing software market is divided into roofing contractors, construction management, material estimation, and project planning.

Roofing Contractors are the primary users of roofing software, and this segment dominates the market due to its widespread need for streamlined job site operations and customer management. Roofing contractors use these platforms to manage job estimates, schedule crews, monitor job progress, generate invoices, and communicate with clients. Advanced roofing software often includes mobile compatibility, drone integrations, digital blueprint imports, and aerial measurement tools, allowing contractors to conduct remote inspections and accurate takeoffs. By automating workflows and eliminating paperwork, roofing contractors significantly reduce operational overhead and improve service delivery timelines.

Construction Management applications in roofing software are tailored to support end-to-end project coordination across large-scale developments and multi-phase roofing projects. These tools facilitate collaboration between project managers, subcontractors, suppliers, and clients. Key features include budget tracking, document control, real-time dashboards, resource allocation, and risk management. Integration with accounting systems and ERP solutions further enhances efficiency. These platforms allow for better adherence to timelines, reduction of project delays, and proactive issue resolution—making them essential for managing commercial or institutional roofing projects.

Material Estimation tools are a specialized segment within roofing software designed to calculate quantities and costs of roofing materials with high accuracy. These tools use satellite imagery, CAD drawings, or on-site measurements to determine the dimensions, pitch, and complexity of a roof. Users can then generate detailed material lists for shingles, tiles, underlayment, flashing, and fasteners. With built-in pricing catalogs and waste factor calculators, estimators can produce competitive bids quickly while minimizing cost overruns and material shortages. This capability improves procurement planning and cost control, especially important for large contractors and roofing distributors.

Project Planning features help contractors visualize, organize, and execute roofing projects from pre-construction through post-installation. These planning modules typically include Gantt charts, task assignments, milestone tracking, and calendar integration. Roofing-specific planning also accounts for weather patterns, delivery schedules, inspection dates, and compliance documentation. Software that supports forecasting, contingency planning, and productivity tracking enables users to adjust to changes in real time and avoid costly project interruptions. This segment is especially critical in ensuring that roofing projects remain on schedule and within budget.

Segmentation Insights by Product

On the basis of product, the global roofing software market is bifurcated into estimating software, design software, and project management software.

Estimating Software dominates the Roofing Software Market due to its critical role in helping contractors generate fast, accurate, and competitive bids. Estimating software solutions enable users to input measurements, material prices, labor rates, and other variables to create comprehensive cost projections. These tools often incorporate satellite imagery, aerial measurement integrations, and predefined templates for different roof types. They also help calculate waste factors and apply markups automatically, reducing human error and saving time. The ability to generate instant quotes and modify estimates based on client requirements makes this product type indispensable for both residential and commercial roofing contractors.

Design Software plays a vital role in assisting architects, engineers, and roofing professionals with the visualization and structural planning of roofing systems. These platforms support 2D and 3D modeling, integration with CAD systems, and simulation of roof loads, drainage, and environmental conditions. Design software allows for customized roof configurations based on factors such as slope, materials, insulation, and energy efficiency standards. As sustainability and green building practices grow, this segment is gaining momentum by enabling professionals to design roofs that align with LEED or energy codes, enhancing building performance and compliance.

Project Management Software is essential for coordinating roofing projects across multiple teams, job sites, and timelines. This segment includes tools for scheduling, resource allocation, budgeting, document management, and real-time communication. Roofing-specific project management software often integrates with accounting systems and ERP platforms to support end-to-end operations. It helps contractors monitor crew productivity, manage subcontractor deliverables, track work orders, and ensure on-time delivery. With features like mobile access, automated alerts, and customizable dashboards, these tools significantly improve efficiency and oversight, especially in large-scale or multi-phase roofing projects.

Roofing Software Market: Regional Insights

- North America is expected to dominate the global market

North America leads the Roofing Software Market, primarily due to the presence of a large number of roofing contractors, advanced construction technologies, and high adoption of digital tools for project estimation, scheduling, and customer relationship management (CRM). The U.S. is at the forefront, with roofing companies increasingly integrating cloud-based software to streamline workflows, manage leads, and automate invoicing and inspections. Key providers like JobNimbus, AccuLynx, and EagleView operate extensively in the region. The push for digitization among small-to-medium roofing businesses and increasing demand for mobile-friendly platforms has further fueled market expansion. Moreover, the rising frequency of extreme weather events in the U.S. has led to higher roofing activity, boosting the demand for efficient software solutions.

Europe represents a growing market for roofing software, supported by modern construction practices and a regulatory focus on energy-efficient and sustainable buildings. Countries like Germany, the UK, France, and the Netherlands are adopting advanced building information modeling (BIM) and estimation tools to comply with green building standards and improve project accuracy. Cloud-based roofing software is increasingly used by contractors to manage workflows, track materials, and provide digital reports for both residential and commercial projects. Local software vendors also offer GDPR-compliant features, enabling better data management and customer protection.

Asia-Pacific is witnessing rapid growth in the Roofing Software Market, particularly in developing construction hubs such as India, China, and Southeast Asia. The region's construction boom, driven by urbanization and infrastructure development, is pushing roofing contractors to adopt digital platforms that support job costing, drawing tools, and client communication features. While adoption remains lower than in Western markets, cloud and mobile software solutions are becoming popular among SMEs seeking to improve operational efficiency. In developed markets like Japan and Australia, companies are integrating roofing software with drone-based inspections and 3D modeling, aligning with advanced construction practices.

Latin America is an emerging market with increasing interest in roofing software, especially in Brazil, Mexico, and Chile. Adoption is primarily driven by mid-sized roofing companies seeking better project tracking and client management tools. Cloud-based and mobile-compatible solutions are in demand due to affordability and flexibility, with local language support being a critical factor for market penetration. Despite challenges like limited digital infrastructure and a fragmented construction sector, the market is expected to grow steadily as digital literacy improves and competitive pressures increase.

Middle East and Africa are gradually entering the roofing software landscape, supported by ongoing construction activity in urban centers such as Dubai, Riyadh, and Johannesburg. In the Middle East, large-scale commercial and residential projects are fueling demand for roofing estimation and project management software, especially those that integrate with BIM and CAD tools. Africa’s growth is modest but notable in South Africa and Kenya, where roofing companies are beginning to explore digital tools to manage labor, budgets, and client data. The shift toward solar-integrated roofing solutions also supports the adoption of specialized software in green building projects.

Roofing Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the roofing software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global roofing software market include:

- Tenderfield

- Oracle

- Buildertrend

- STACK

- PlanSwift

- UDA Technologies

- Trimble

- Sage

- FOUNDATION

- Raken

- Sigma

- Plexxis

- CMiC

- Spectrum

- ProEst

- JOBPOWER

- AccuLynx

- EagleView

- RoofSnap

- JobNimbus

- Xactimate

- CoConstruct

- Roofr

- Red Rhino

The global roofing software market is segmented as follows:

By Application

- Roofing Contractors

- Construction Management

- Material Estimation

- Project Planning

By Product

- Estimating Software

- Design Software

- Project Management Software

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Roofing Software

Request Sample

Roofing Software