Rubber Bullets Market Size, Share, and Trends Analysis Report

CAGR :

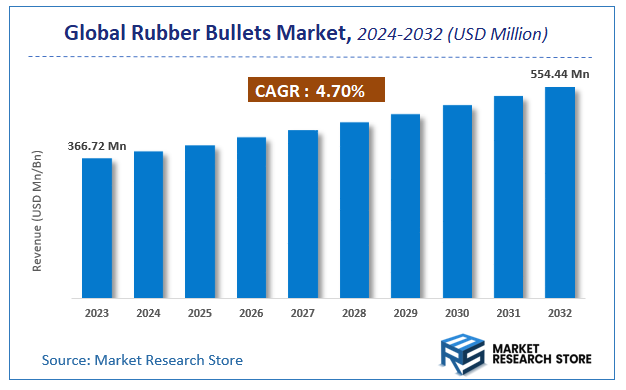

| Market Size 2023 (Base Year) | USD 366.72 Million |

| Market Size 2032 (Forecast Year) | USD 554.44 Million |

| CAGR | 4.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Rubber Bullets Market Insights

According to Market Research Store, the global rubber bullets market size was valued at around USD 366.72 million in 2023 and is estimated to reach USD 554.44 million by 2032, to register a CAGR of approximately 4.7% in terms of revenue during the forecast period 2024-2032.

The rubber bullets report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Rubber Bullets Market: Overview

Rubber bullets, also known as rubber projectiles, are a type of non-lethal ammunition designed to incapacitate or deter individuals without causing permanent harm or fatal injuries. They are typically made of rubber or rubber-coated metal and are used by law enforcement agencies and military personnel for riot control, crowd dispersion, and other non-lethal interventions. Rubber bullets are fired from standard firearms or specialized launchers and are intended to cause pain, bruising, or temporary incapacitation. While considered non-lethal, they can still cause serious injuries, especially if fired at close range or aimed at sensitive body parts like the eyes or head.

Key Highlights

- The rubber bullets market is anticipated to grow at a CAGR of 4.7% during the forecast period.

- The global rubber bullets market was estimated to be worth approximately USD 366.72 million in 2023 and is projected to reach a value of USD 554.44 million by 2032.

- The growth of the rubber bullets market is being driven by rising demand for non-lethal methods of law enforcement and crowd management.

- Based on the application, the law enforcement segment is growing at a high rate and is projected to dominate the market.

- On the basis of type, the standard rubber bullets segment is projected to swipe the largest market share.

- In terms of end user, the government agencies segment is expected to dominate the market.

- Based on the size and design, the standard size bullets segment is expected to dominate the market.

- In terms of material composition, the rubber segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Rubber Bullets Market: Dynamics

Key Growth Drivers:

- Rising Demand for Non-Lethal Crowd Control Solutions: Law enforcement agencies around the world are increasingly relying on rubber bullets as a non-lethal means of managing protests and civil unrest, fueling market growth.

- Growing Focus on Minimizing Civilian Casualties: Rubber bullets provide a less-lethal alternative to live ammunition, aligning with global efforts to reduce fatalities and severe injuries during policing operations.

- Increased Military and Police Modernization Programs: Many countries are investing in the modernization of their armed forces and police units, which includes acquiring advanced non-lethal weapons like rubber bullets.

- Regulatory Approvals and Standardization: The presence of regulatory frameworks and testing standards has increased trust in the safe deployment of rubber bullets, supporting their wider acceptance.

Restraints:

- Public Backlash and Ethical Concerns: The use of rubber bullets has faced criticism for causing serious injuries in some instances, which can lead to negative public perception and reduced deployment.

- Risk of Misuse and Overuse by Law Enforcement: Improper use of rubber bullets can escalate violence rather than control it, raising concerns and potentially prompting restrictions or bans in some regions.

- Availability of Alternative Non-Lethal Weapons: The market also faces competition from other non-lethal options such as pepper spray, tasers, and acoustic weapons, which may reduce the demand for rubber bullets.

Opportunities:

- Expansion in Emerging Economies: Developing nations are increasingly investing in law enforcement capabilities, presenting new markets for rubber bullet manufacturers.

- Technological Advancements in Non-Lethal Ammunition: Innovations in materials and designs are making rubber bullets more accurate and less harmful, which can improve adoption rates.

- Growing Demand from Private Security Sectors: Beyond state use, private security firms and institutions are showing increased interest in non-lethal tools for property protection and riot control.

Challenges:

- Legal Restrictions and Policy Variations: Different countries have varying laws and restrictions regarding the use of rubber bullets, making it difficult for manufacturers to operate universally.

- Difficulty in Balancing Effectiveness with Safety: Designing rubber bullets that are both effective in stopping threats and safe enough to avoid long-term injuries remains a key technical challenge.

- Negative Media Coverage and Human Rights Scrutiny: Incidents involving serious injuries or misuse often receive widespread media attention, prompting investigations and calls for stricter regulations.

Rubber Bullets Market: Report Scope

This report thoroughly analyzes the Rubber Bullets Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Rubber Bullets Market |

| Market Size in 2023 | USD 366.72 Million |

| Market Forecast in 2032 | USD 554.44 Million |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 178 |

| Key Companies Covered | Vista Outdoors, Nonlethal Technologies, Combined Systems, Companhia Brasileira De Cartuchos (CBC), Fiocchi Munizioni, Federal Ammunition, Rheinmetall, Lightfield Ammunition, Security Devices International, The Safariland Group, Amtec Less Lethal Systems, Sage Control Ordnance, Nobel Sport Security, Olin Corporation, Verney-Carron, Maxam Outdoors, Industrial Cartridge, China North Industries Corporation |

| Segments Covered | By Application, By Type, By End User, By Size and Design, By Material Composition, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rubber Bullets Market: Segmentation Insights

The global rubber bullets market is divided by application, type, end user, size and design, material composition, and region.

Segmentation Insights by Application

On the basis of application, the global rubber bullets market is bifurcated into law enforcement, military operations, crowd control, self-defense, and recreational use.

In the rubber bullets market, law enforcement stands out as the most dominant application segment. This dominance stems from the increasing emphasis on non-lethal crowd control and riot management tools by police forces globally. Rubber bullets offer a means of incapacitating individuals while reducing the risk of fatalities, making them a preferred choice for law enforcement agencies, especially during civil unrest, protests, or large public gatherings. Many governments are investing in modernizing their police arsenals with less-lethal weapons to comply with human rights standards, further propelling the demand in this segment.

Crowd control is closely aligned with law enforcement but functions as a broader category, encompassing both civilian and private security responses to protests, riots, or disturbances. This segment includes usage by private security firms or in large event management scenarios where maintaining public order without escalating violence is critical. As social demonstrations and political movements increase globally, so does the demand for effective non-lethal crowd control measures, positioning this segment as a strong contributor to market growth.

Military operations form the next significant segment, primarily focusing on peacekeeping missions, detainee management, and operations in civilian areas where minimizing collateral damage is essential. While the military traditionally relies on lethal force, modern combat doctrines now incorporate rubber bullets and other non-lethal methods to deal with non-combatants or volatile situations requiring restraint. This niche but growing use-case gives the military segment a moderate share in the overall market.

Self-defense is a smaller but emerging segment in the rubber bullets market, driven by civilian demand for non-lethal personal protection. Rubber bullet-firing guns are increasingly marketed to civilians who seek effective self-defense tools without the legal and ethical complexities of carrying lethal firearms. However, this segment remains restricted in many regions due to stringent firearm regulations, which limit its overall market penetration.

Recreational use is the least dominant application segment. While rubber bullets are occasionally used in controlled environments for training, simulation, or tactical games, their use in recreational activities is minimal due to safety concerns and limited consumer interest compared to other non-lethal training tools like paintball or airsoft. The regulatory challenges and risk factors involved with rubber bullet use in casual settings further constrain the growth of this segment.

Segmentation Insights by Type

Based on type, the global rubber bullets market is divided into standard rubber bullets, high-velocity rubber bullets, low-velocity rubber bullets, and non-lethal projectiles.

In the rubber bullets market, standard rubber bullets represent the most dominant type segment. These are widely used across various applications, especially by law enforcement and security personnel for riot control and crowd dispersal. Their balanced design, combining effective impact force with reduced lethality, makes them the go-to choice for organizations aiming to subdue targets without causing fatal injuries. Standard rubber bullets are versatile, relatively cost-effective, and have long-standing usage history, contributing significantly to their dominance in the market.

Non-lethal projectiles come next in market importance. This segment includes a broader category of less-lethal ammunition made not just from rubber but also from foam, plastic, and other composite materials. These projectiles are often engineered to minimize injury while still achieving compliance from a target, making them ideal for sensitive operations, including correctional facility management, peacekeeping missions, and urban policing. Their specialized designs cater to various tactical needs, giving this segment a growing presence in the market.

High-velocity rubber bullets occupy a smaller yet specialized segment. These bullets are designed for scenarios where greater force and distance are required, such as controlling large, aggressive crowds or penetrating soft barriers. However, due to the increased risk of serious injury associated with high-velocity impacts, their usage is often limited and subject to strict protocols. This restricts their deployment primarily to military operations or high-risk law enforcement scenarios.

Low-velocity rubber bullets represent the least dominant segment. These are typically used in extremely controlled environments, such as close-range crowd control or training exercises, where the risk of injury needs to be minimized. Their limited stopping power and range reduce their utility in more volatile or large-scale applications, resulting in lower demand compared to other types. Additionally, concerns over their effectiveness in deterring threats further confine their use to niche applications.

Segmentation Insights by End User

On the basis of end user, the global rubber bullets market is bifurcated into government agencies, private security firms, individuals/consumers, and non-governmental organizations (NGOs).

In the rubber bullets market, government agencies are by far the most dominant end-user segment. This includes law enforcement departments, homeland security, and military forces, which are the primary purchasers and users of rubber bullets for crowd control, riot management, peacekeeping, and non-lethal engagements. Governments allocate significant budgets for equipping their agencies with non-lethal weapons to ensure public order and comply with international human rights standards. The scale of procurement and the frequency of deployment in civil unrest situations give this segment the largest market share.

Private security firms form the second most prominent segment. These firms provide services for corporate, event, and personal security and increasingly rely on non-lethal solutions to ensure safety without crossing legal boundaries. With the rise in private sector involvement in critical infrastructure protection, public event security, and corporate facility safety, demand from private security firms for rubber bullets and other non-lethal weapons is steadily growing. However, access and usage are subject to local regulations, which can influence the extent of market penetration.

Individuals/consumers represent a smaller, yet gradually expanding end-user group. Civilian interest in non-lethal self-defense solutions, including rubber bullet firearms, is increasing in some regions, particularly where regulations permit their possession. The growth of this segment is influenced by rising concerns over personal safety, home defense, and crime rates. However, strict laws regarding weapon ownership, training requirements, and safety concerns significantly limit the overall reach of this segment in many parts of the world.

Non-Governmental Organizations (NGOs) account for the least dominant segment. While NGOs typically do not use rubber bullets directly, they may engage with the market through training, monitoring, or supplying equipment for peacekeeping operations or humanitarian missions in volatile regions. Their role is often more advisory or supportive, focusing on appropriate use-of-force protocols and promoting the ethical deployment of non-lethal weapons. As such, their direct demand for rubber bullets remains minimal but contextually important for policy and ethical standards shaping the market.

Segmentation Insights by Size and Design

Based on size and design, the global rubber bullets market is divided into standard size bullets, custom design bullets, compact bullets, and full-size bullets.

In the rubber bullets market, standard size bullets are the most dominant segment by size and design. These bullets are designed to fit most non-lethal firearms used by law enforcement and military units, making them widely compatible, easy to produce at scale, and cost-effective. Their balanced impact, proven reliability, and wide adoption across tactical units for crowd control and riot management reinforce their leading position in the market. They are the default choice in procurement contracts due to their regulation-compliant dimensions and performance.

Full-size bullets follow as the second most dominant segment. These are typically used in situations requiring greater stopping power or visibility, such as dispersing aggressive crowds or in military operations where stronger impact is required without resorting to lethal force. Their size contributes to increased impact area, which can improve effectiveness at short-to-medium ranges. However, their larger form factor can restrict magazine capacity and limit versatility across different deployment platforms.

Compact bullets are gaining popularity in specialized scenarios, particularly for use in close-quarters situations or where discreet equipment is needed. These bullets are designed for lighter, more concealable launchers often used by private security or for civilian self-defense. Although their reduced size can lower impact force, they offer advantages in portability and ease of handling. The market share of this segment is growing but remains limited compared to standard and full-size formats.

Custom design bullets represent the least dominant segment, primarily due to their niche application and higher production costs. These bullets are often developed for specific operational needs, including unique launcher systems, environmental constraints, or advanced training purposes. They may include variations in shape, material composition, or internal design to fulfill precise tactical requirements. While valued for specialized operations, their bespoke nature restricts mass adoption, keeping this segment relatively small.

Segmentation Insights by Material Composition

Based on material composition, the global rubber bullets market is divided into rubber, plastic, composite materials, and metal-plated rubber.

In the rubber bullets market, rubber is the most dominant material composition segment. Traditional rubber bullets are favored for their affordability, availability, and proven safety profile in non-lethal applications. Rubber, being flexible yet firm enough to deliver a controlled impact, makes it ideal for crowd control, law enforcement, and military operations. It is also widely available, allowing for mass production, which contributes to its position as the leading material in the market. Rubber's ability to absorb shock while minimizing injuries is crucial in its widespread use.

Plastic follows as the second most significant material composition segment. Plastic projectiles are often used as an alternative to rubber due to their durability and ability to maintain a consistent shape and size, especially in high-velocity applications. Plastic can be molded into more complex shapes and is sometimes preferred in situations where a lighter projectile is needed. However, plastic bullets are less forgiving than rubber and carry a higher risk of injury upon impact, which limits their widespread adoption compared to rubber bullets. Despite this, plastic is used in certain applications where precision and consistency are paramount.

Composite materials represent an emerging segment in the market. These projectiles are made from a blend of materials such as rubber, plastic, and other synthetic substances, designed to combine the best properties of each. Composite projectiles can offer improved performance, greater durability, and reduced risk of injury compared to pure rubber or plastic bullets. They are becoming increasingly popular for specialized applications, including military and law enforcement, where higher performance and reduced injury risks are important. However, due to higher manufacturing costs, this segment remains smaller than rubber and plastic-based projectiles.

Metal-plated rubber is the least dominant material composition segment. These bullets typically feature a rubber core with a metal coating or plating, designed to enhance durability and increase penetration capabilities. While metal-plated rubber can be more effective in certain scenarios, such as in controlled military or law enforcement operations, their higher risk of injury and cost make them less commonly used than other materials. The metal plating can cause these bullets to be harder and more dangerous upon impact, restricting their use to specific situations where higher force is needed without resorting to fully lethal ammunition.

Rubber Bullets Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the rubber bullets market, owing to its advanced law enforcement infrastructure and regular demand for non-lethal crowd control technologies. The United States leads this demand due to recurrent protests, public demonstrations, and civil disturbances, which have driven the need for safer alternatives to lethal force. Additionally, strong government budgets for defense and homeland security, combined with a well-established domestic manufacturing base for non-lethal weapons, have further cemented the region's leadership position. The U.S. military and police forces are early adopters of advanced rubber bullet technologies, including smart delivery systems and precision impact rounds, making the region a global hub for innovation in this sector.

Europe holds the second-largest share in the rubber bullets market, largely due to its progressive approach to law enforcement and emphasis on human rights. European countries such as the United Kingdom, Germany, and France have adopted rubber bullets as a standard tool for riot control and civil unrest situations. Stricter government regulations regarding the use of force have accelerated the demand for non-lethal options like rubber bullets. Moreover, regional efforts to enhance police training and equip officers with modern tactical tools have driven procurement from both public and private security sectors. Ongoing research into more effective and ethically compliant rubber ammunition also supports market growth across the continent.

Asia Pacific is emerging as a rapidly growing region in the rubber bullets market, driven by increasing political activism, urbanization, and internal security challenges. Countries like India, China, South Korea, and Japan are actively expanding their law enforcement capabilities to manage both domestic protests and large-scale public gatherings. This has led to a growing interest in non-lethal methods of crowd management, including the use of rubber bullets. Rapid technological advancements, coupled with increased defense budgets and modernization of police forces, have contributed to market growth. Despite regulatory hurdles in some countries, the region is expected to see continued expansion as governments prioritize civilian safety and social stability.

Latin America is witnessing moderate growth in the rubber bullets market, primarily fueled by social unrest, rising crime rates, and the need to address public security without escalating violence. Countries like Brazil, Argentina, and Mexico are facing frequent public demonstrations and violent crime, which has led law enforcement agencies to invest in non-lethal options such as rubber bullets. While infrastructure and logistics challenges exist, ongoing collaborations with international defense contractors and NGOs are helping to improve access to modern policing tools. Public demand for transparency and less aggressive law enforcement also contributes to a growing interest in non-lethal alternatives.

Middle East and Africa (MEA) represents the smallest but gradually developing market for rubber bullets. The region’s adoption of non-lethal ammunition is largely driven by civil disturbances, counter-terrorism efforts, and political instability. Countries such as South Africa, Israel, and Saudi Arabia have shown interest in deploying rubber bullets for riot control and border security. However, growth in this region is limited by economic disparities, inconsistent regulatory frameworks, and restricted access to international defense technologies. Despite these challenges, increasing investment in internal security and peacekeeping missions is expected to foster slow but steady market development over the coming years.

Rubber Bullets Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the rubber bullets market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global rubber bullets market include:

- Vista Outdoors

- Nonlethal Technologies

- Combined Systems

- Companhia Brasileira De Cartuchos (CBC)

- Fiocchi Munizioni

- Federal Ammunition

- Rheinmetall

- Lightfield Ammunition

- Security Devices International

- The Safariland Group

- Amtec Less Lethal Systems

- Sage Control Ordnance

- Nobel Sport Security

- Olin Corporation

- Verney-Carron

- Maxam Outdoors

- Industrial Cartridge

- China North Industries Corporation

The global rubber bullets market is segmented as follows:

By Application

- Law Enforcement

- Military Operations

- Crowd Control

- Self-Defense

- Recreational Use

By Type

- Standard Rubber Bullets

- High-Velocity Rubber Bullets

- Low-Velocity Rubber Bullets

- Non-Lethal Projectiles

By End User

- Government Agencies

- Private Security Firms

- Individuals/Consumers

- Non-Governmental Organizations (NGOs)

By Size and Design

- Standard Size Bullets

- Custom Design Bullets

- Compact Bullets

- Full-Size Bullets

By Material Composition

- Rubber

- Plastic

- Composite Materials

- Metal-Plated Rubber

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Rubber Bullets

Request Sample

Rubber Bullets