SaaS Sales Software Market Size, Share, and Trends Analysis Report

CAGR :

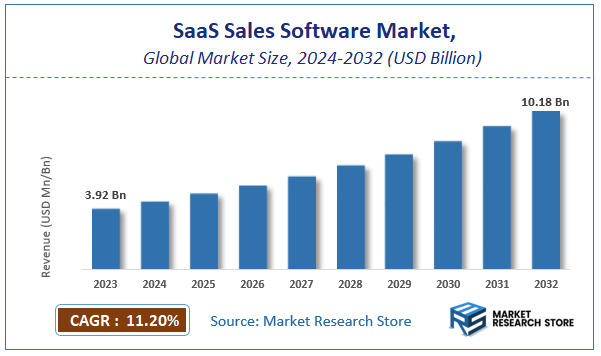

| Market Size 2023 (Base Year) | USD 3.92 Billion |

| Market Size 2032 (Forecast Year) | USD 10.18 Billion |

| CAGR | 11.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

SaaS Sales Software Market Insights

According to Market Research Store, the global SaaS sales software market size was valued at around USD 3.92 billion in 2023 and is estimated to reach USD 10.18 billion by 2032, to register a CAGR of approximately 11.2% in terms of revenue during the forecast period 2024-2032.

The SaaS sales software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global SaaS Sales Software Market: Overview

SaaS (Software as a Service) sales software refers to cloud-based tools designed to streamline and enhance the sales process for businesses. These platforms are hosted online and accessed via a subscription model, allowing sales teams to manage customer relationships, track leads, automate repetitive tasks, forecast revenue, and analyze performance without the need for on-premise infrastructure. Common features include CRM (Customer Relationship Management), email integration, pipeline management, sales analytics, and AI-driven insights. The primary goal is to boost productivity, close deals faster, and improve customer engagement.

Key Highlights

- The SaaS sales software market is anticipated to grow at a CAGR of 11.2% during the forecast period.

- The global SaaS sales software market was estimated to be worth approximately USD 3.92 billion in 2023 and is projected to reach a value of USD 10.18 billion by 2032.

- The growth of the SaaS sales software market is being driven by digital transformation, remote work trends, and the increasing demand for scalable, cost-effective business solutions.

- Based on the user type, the large corporations segment is growing at a high rate and is projected to dominate the market.

- On the basis of industry, the information technology segment is projected to swipe the largest market share.

- In terms of deployment type, the cloud-based solutions segment is expected to dominate the market.

- Based on the feature set, the customer relationship management (CRM) segment is expected to dominate the market.

- In terms of pricing model, the subscription-based pricing segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

SaaS Sales Software Market: Dynamics

Key Growth Drivers

- Digital Transformation in Sales Operations The increasing adoption of digital tools by sales teams to streamline processes, enhance productivity, and improve customer engagement is propelling market growth.

- Integration of Artificial Intelligence The incorporation of AI and machine learning in SaaS sales software provides predictive analytics and automates routine tasks, enhancing decision-making and efficiency.

- Cloud-Based Deployment Models The shift towards cloud-based software offers scalability, flexibility, and cost-effectiveness, allowing businesses to streamline operations without extensive IT infrastructure.

- Growing Demand for CRM Solutions The need for effective customer relationship management tools is driving the adoption of SaaS sales software that offers comprehensive CRM functionalities.

Restraints

- Data Security and Privacy Concerns As sales software handles sensitive customer data, concerns over data breaches and compliance with privacy regulations can hinder adoption.

- High Implementation Costs The significant upfront costs associated with implementing comprehensive SaaS sales software solutions can be a barrier for small and medium-sized enterprises.

- Integration Challenges Integrating SaaS sales software with existing systems and workflows can be complex, potentially leading to operational disruptions.

Opportunities

- Emerging Markets Expansion Rapid digital transformation and increasing internet penetration in emerging economies present significant growth opportunities for SaaS sales software providers.

- Customization and Flexibility Offering customizable solutions that cater to specific industry needs can attract a broader range of businesses seeking tailored software.

- Mobile Accessibility Developing mobile-friendly SaaS sales applications can cater to the growing number of sales professionals working remotely or on-the-go.

Challenges

- Intense Market Competition The market is highly competitive, with numerous players offering similar solutions, making differentiation and customer retention challenging.

- Rapid Technological Changes Keeping up with fast-paced technological advancements requires continuous innovation and can strain resources.

- Regulatory Compliance Navigating varying regulatory environments across different regions can be complex and may impede market expansion.

SaaS Sales Software Market: Report Scope

This report thoroughly analyzes the SaaS Sales Software Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | SaaS Sales Software Market |

| Market Size in 2023 | USD 3.92 Billion |

| Market Forecast in 2032 | USD 10.18 Billion |

| Growth Rate | CAGR of 11.2% |

| Number of Pages | 173 |

| Key Companies Covered | Salesmate, LinkedIn Sales Navigator, Hunter, Clearbit, Optimizely, Intercom, Mailchimp, Buffer, Zapier, GoToMeeting, Slack, PandaDoc, Hotjar, Hoopla, Plecto, Skype, Ringcentral, Google, HootSuite, BuzzSumo |

| Segments Covered | By User Type, By Industry, By Deployment Type, By Feature Set, By Pricing Model, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

SaaS Sales Software Market: Segmentation Insights

The global SaaS sales software market is divided by user type, industry, deployment type, feature set, pricing model, and region.

Segmentation Insights by User Type

Based on user type, the global SaaS sales software market is divided into small businesses, medium enterprises, large corporations, sales teams, and individual sales representatives.

In the SaaS (Software as a Service) sales software market, large corporations represent the most dominant segment, primarily due to their substantial budgets, complex sales operations, and greater need for comprehensive CRM and sales enablement platforms. These organizations often require robust features such as AI-powered analytics, deep integration with ERP systems, scalability, and multi-level user access—all of which SaaS platforms are well-suited to deliver. With large, geographically dispersed sales teams, these corporations rely on cloud-based sales software to streamline operations, maintain data consistency, and ensure global coordination.

Following closely are medium enterprises, which are experiencing rapid digital transformation and increasingly adopting SaaS solutions to stay competitive. While their needs are less complex than those of large corporations, medium enterprises still require advanced features like pipeline management, lead tracking, and reporting capabilities. The affordability and flexibility of SaaS solutions make them particularly attractive for this segment, allowing for growth without major upfront investments in IT infrastructure.

Sales teams, as a segment, come next in terms of market dominance. These groups may span across businesses of varying sizes but are defined by their shared function. Sales teams often seek out SaaS solutions that offer collaboration tools, real-time performance tracking, and automation features to boost efficiency. Their usage is driven by performance metrics and the ability to integrate sales tools with marketing and customer service platforms, enhancing the overall customer journey.

Small businesses occupy a smaller yet steadily growing share of the market. They are typically more price-sensitive and may only need basic CRM and sales automation features. SaaS providers targeting this group often offer simplified, scalable solutions with intuitive interfaces and lower-tier pricing models. Despite limited resources, many small businesses are increasingly turning to SaaS platforms as they recognize the productivity and organizational gains these tools can bring.

Lastly, individual sales representatives from the least dominant segment. Their adoption is generally limited due to budget constraints and a preference for free or freemium tools. However, some individual reps—especially consultants, freelancers, or those in niche sales roles—use SaaS platforms for lead generation, contact management, and email tracking. Their influence on the overall market remains minimal compared to larger, organizational users.

Segmentation Insights by Industry

On the basis of industry, the global SaaS sales software market is bifurcated into information technology, retail, healthcare, finance, real estate, manufacturing, and education.

In the SaaS sales software market, Information Technology (IT) stands out as the most dominant industry segment. IT companies are typically early adopters of cloud technologies and place high value on data-driven decision-making, automation, and integration across platforms. The complexity and speed of tech sales, including software licensing, hardware distribution, and consulting services, make SaaS sales tools indispensable for managing customer relationships, sales cycles, and forecasts. Additionally, tech companies often resell or build on SaaS platforms, further embedding these tools into their operations.

Next is the Finance industry, where firms leverage SaaS sales software to manage client portfolios, track investment opportunities, and ensure compliance with regulatory requirements. The financial sector demands secure, scalable, and customizable solutions that offer robust analytics and reporting capabilities. Sales software is critical for wealth managers, insurance brokers, and financial advisors, especially in maintaining CRM systems, pipeline management, and customer retention strategies.

The Retail sector follows, driven by the need to manage high volumes of customer interactions across online and physical channels. SaaS sales software helps retail businesses personalize marketing, track sales campaigns, and optimize customer loyalty programs. Omnichannel retailing, dynamic pricing strategies, and customer segmentation analytics have made SaaS solutions increasingly essential for sales teams in this industry.

Healthcare is gaining traction as a SaaS sales software user, primarily among medical equipment providers, pharmaceutical reps, and service providers. This industry values tools that streamline B2B sales processes, manage long and complex sales cycles, and maintain HIPAA-compliant communications. While traditionally slow to adopt digital tools due to strict regulations, healthcare is catching up fast thanks to SaaS platforms that ensure security and efficiency.

Real Estate ranks slightly lower in dominance but still shows strong SaaS adoption, especially among brokerages and property management firms. Sales software helps real estate professionals track leads, automate listings, manage open houses, and communicate effectively with buyers and renters. Cloud CRM systems tailored for real estate needs have become increasingly popular, especially as the industry embraces digital marketing and remote showings.

The Manufacturing industry uses SaaS sales tools primarily for B2B sales enablement, distributor management, and channel sales. Adoption is growing but somewhat slower compared to other industries due to legacy systems and a traditional reliance on in-person sales. However, as manufacturers increasingly embrace Industry 4.0, many are integrating SaaS solutions to gain real-time visibility into sales performance and customer demand forecasting.

Lastly, the Education sector represents the least dominant segment in this market. While educational institutions and edtech providers are adopting SaaS tools, their use is typically limited to enrollment tracking, fundraising, and partner engagement. Budget constraints and longer approval cycles can hinder adoption. However, with the growth of online learning and digital course sales, the potential for increased SaaS sales software use in education is promising.

Segmentation Insights by Deployment Type

Based on deployment type, the global SaaS sales software market is divided into cloud-based solutions, on-premise solutions, and hybrid solutions.

In the SaaS sales software market, cloud-based solutions are by far the most dominant deployment type. Their popularity stems from the core advantages of the SaaS model itself: accessibility, scalability, low upfront costs, and continuous updates. Cloud-based sales software allows teams to access data and collaborate in real time from anywhere, a crucial capability in today’s mobile, remote, and globally distributed work environments. These solutions also offer faster implementation, easier integration with other cloud tools, and automatic maintenance, making them especially attractive to startups, SMBs, and even large enterprises.

Hybrid solutions rank second in terms of market share. These deployments combine elements of both cloud and on-premise systems, offering businesses the flexibility to store sensitive data on local servers while still benefiting from cloud-based features such as remote access and system automation. Hybrid models are particularly appealing to industries like finance, healthcare, and government, where data privacy regulations or legacy systems may necessitate some on-premise control. They serve as a transitional option for organizations not yet ready to fully move to the cloud.

On-premise solutions, once the standard, are now the least dominant and continue to decline in adoption. These systems require companies to install and manage the software on their own servers, which leads to higher upfront costs, longer implementation times, and greater IT resource demands. While still used by some large organizations with specific security or compliance requirements, on-premise solutions lack the agility, scalability, and cost-efficiency that modern sales operations demand. Their limited adaptability in a rapidly evolving digital landscape has made them less attractive compared to their cloud-based counterparts.

Segmentation Insights by Feature Set

On the basis of feature set, the global SaaS sales software market is bifurcated into customer relationship management (CRM), lead generation and management, sales analytics & reporting, automated email marketing, integrations with other tools, and pipeline management.

In the SaaS sales software market, Customer Relationship Management (CRM) is the most dominant feature set, serving as the core functionality around which most sales platforms are built. CRM systems enable businesses to centralize customer data, track interactions, and manage relationships across the entire sales cycle. This feature is critical for improving customer engagement, retention, and sales team productivity, making it indispensable across industries and business sizes.

Next in importance is Pipeline Management, which allows sales teams to visualize, organize, and control the flow of deals from lead to close. This feature supports forecasting, prioritization, and strategic decision-making. It is particularly valued in organizations with complex or long sales cycles, as it helps ensure no opportunity is lost and team members stay aligned on deal progression.

Lead Generation and Management follows closely, focusing on attracting, capturing, qualifying, and nurturing potential buyers. These tools automate lead scoring, segmentation, and assignment, helping sales reps focus on high-potential prospects. In today’s competitive environment, efficient lead management can directly influence conversion rates, making it a critical feature set for growing businesses and outbound sales teams.

Sales Analytics & Reporting ranks next, providing actionable insights through dashboards, KPIs, and trend analysis. These features help sales managers monitor performance, identify bottlenecks, and optimize strategy based on data. As sales becomes increasingly data-driven, this feature set is becoming more vital, especially for mid-sized and large enterprises that require detailed performance metrics.

Automated Email Marketing is another important, though less dominant, feature. It streamlines outreach, follow-ups, and campaign execution, often integrated with CRM and lead management functions. While highly useful for nurturing leads and maintaining engagement, its impact is often secondary to core sales operations tools unless the company relies heavily on inbound marketing.

Lastly, Integrations with Other Tools is the least dominant standalone feature set, although it plays a supporting role in enhancing the effectiveness of the entire software ecosystem. Integrations with tools like marketing platforms, accounting software, communication apps, and ERP systems are essential for workflow efficiency and data consistency. However, it is typically seen as a complementary capability rather than a primary driver of software adoption.

Segmentation Insights by Pricing Model

On the basis of pricing model, the global SaaS sales software market is bifurcated into subscription-based pricing, freemium model, pay-as-you-go, and tiered pricing.

In the SaaS sales software market, subscription-based pricing is the most dominant pricing model. This model offers predictable, recurring revenue for providers and affordability and budgeting simplicity for customers. Businesses pay a monthly or annual fee for access to the software, typically based on user count or feature tier. Subscription pricing supports scalability, which makes it attractive to startups, mid-sized companies, and large enterprises alike. It also fosters long-term customer relationships, encouraging providers to continuously update and support their platforms.

Tiered pricing is the second most prevalent model, often layered into subscription plans. This model allows users to select a package that fits their specific needs—ranging from basic features at a lower cost to premium capabilities for larger or more complex organizations. Tiered pricing is particularly effective at capturing a broad customer base, enabling SaaS vendors to serve small teams and enterprise clients under one pricing structure. It also promotes upselling as businesses grow or require more advanced functionality.

The freemium model ranks next in popularity and is commonly used to attract small businesses, individual sales professionals, or startups. It offers basic functionality at no cost, with the goal of converting users to paid plans as their needs grow. While freemium is excellent for user acquisition and brand awareness, it can be challenging for vendors to convert free users into paying customers or ensure profitability without robust upsell mechanisms.

Pay-as-you-go pricing is the least dominant model in the sales software market. It charges users based on actual usage—such as number of contacts managed, emails sent, or data processed. While it offers maximum flexibility and is ideal for companies with fluctuating or unpredictable usage patterns, it can lead to cost uncertainty. As a result, this model is more common in niche or API-driven platforms rather than in mainstream sales software.

SaaS Sales Software Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the SaaS sales software market, driven by its mature digital ecosystem and widespread adoption of cloud-based technologies. The United States leads this growth, with a high concentration of SaaS providers, advanced IT infrastructure, and a business culture that strongly embraces innovation and automation. Enterprises across various sectors rely heavily on SaaS solutions to streamline operations, boost customer engagement, and enhance sales performance. The presence of leading tech hubs and continuous investment in cloud infrastructure and AI-driven analytics further reinforce North America's market leadership.

Europe holds a significant position in the SaaS sales software market, supported by strong regulatory frameworks and growing digital transformation across industries. Countries such as the United Kingdom, Germany, and France are spearheading the adoption of SaaS platforms to meet evolving customer needs and operational demands. Emphasis on data privacy and compliance has driven the development of secure, region-specific SaaS solutions. Additionally, the rise of remote work and increasing demand for scalable cloud applications among SMEs contribute to the region's steady growth in the market.

Asia Pacific is emerging as one of the fastest-growing regions in the SaaS sales software landscape, with countries like China, India, Japan, and several Southeast Asian nations embracing digital solutions at a rapid pace. Factors such as increasing internet penetration, growing mobile usage, and government support for digital infrastructure are accelerating SaaS adoption. The region's booming startup culture and the need for cost-effective, agile software tools among enterprises have made it a focal point for SaaS vendors aiming to expand their global presence.

Latin America is witnessing gradual growth in the SaaS sales software market as awareness of digital solutions spreads and cloud infrastructure improves. Brazil and Mexico lead the region in adoption, driven by rising demand for efficiency, automation, and digital engagement among businesses. Despite macroeconomic challenges and infrastructural limitations in some areas, the growing interest in SaaS products from SMEs and startups indicates a positive trajectory for the region’s market development.

Middle East and Africa are in the early stages of SaaS sales software adoption but show increasing potential, particularly in the Gulf countries such as the UAE and Saudi Arabia. National strategies focusing on economic diversification and digital transformation are encouraging cloud adoption in both public and private sectors. As internet access and mobile connectivity continue to improve, businesses are beginning to explore SaaS tools to optimize their sales and customer service operations. However, disparities in technological infrastructure and regulatory challenges still pose barriers to more rapid market growth.

SaaS Sales Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the SaaS sales software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global SaaS sales software market include:

- Salesmate

- LinkedIn Sales Navigator

- Hunter

- Clearbit

- Optimizely

- Intercom

- Mailchimp

- Buffer

- Zapier

- GoToMeeting

- Slack

- PandaDoc

- Hotjar

- Hoopla

- Plecto

- Skype

- Ringcentral

- HootSuite

- BuzzSumo

The global SaaS sales software market is segmented as follows:

By User Type

- Small Businesses

- Medium Enterprises

- Large Corporations

- Sales Teams

- Individual Sales Representatives

By Industry

- Information Technology

- Retail

- Healthcare

- Finance

- Real Estate

- Manufacturing

- Education

By Deployment Type

- Cloud-Based Solutions

- On-Premise Solutions

- Hybrid Solutions

By Feature Set

- Customer Relationship Management (CRM)

- Lead Generation and Management

- Sales Analytics and Reporting

- Automated Email Marketing

- Integrations with Other Tools

- Pipeline Management

By Pricing Model

- Subscription-Based Pricing

- Freemium Model

- Pay-As-You-Go

- Tiered Pricing

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

SaaS Sales Software

Request Sample

SaaS Sales Software