Satellite Communication in the Defense Sector Market Size, Share, and Trends Analysis Report

CAGR :

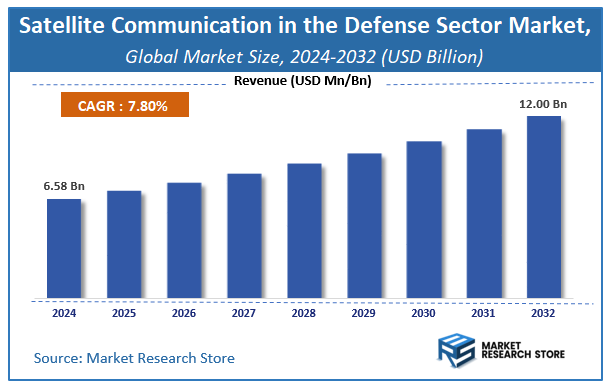

| Market Size 2024 (Base Year) | USD 6.58 Billion |

| Market Size 2032 (Forecast Year) | USD 12.00 Billion |

| CAGR | 7.8% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global satellite communication in the defense sector market size was valued at approximately USD 6.58 Billion in 2024. The market is projected to grow significantly, reaching USD 12.00 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.8% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the satellite communication in the defense sector industry.

To Get more Insights, Request a Free Sample

Satellite Communication in the Defense Sector Market: Overview

The growth of the satellite communication in the defense sector market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The satellite communication in the defense sector market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the satellite communication in the defense sector market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global satellite communication in the defense sector market is estimated to grow annually at a CAGR of around 7.8% over the forecast period (2025-2032).

- In terms of revenue, the global satellite communication in the defense sector market size was valued at around USD 6.58 Billion in 2024 and is projected to reach USD 12.00 Billion by 2032.

- The market is projected to grow at a significant rate due to Rising demand for secure, reliable, and real-time communication systems in defense, along with modernization of military operations, is driving the Satellite Communication in the Defense Sector market.

- Based on the Products, the Ground Equipment segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the Surveillance and Tracking segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Satellite Communication in the Defense Sector Market: Report Scope

This report thoroughly analyzes the satellite communication in the defense sector market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Satellite Communication in the Defense Sector Market |

| Market Size in 2024 | USD 6.58 Billion |

| Market Forecast in 2032 | USD 12.00 Billion |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 213 |

| Key Companies Covered | Thuraya Telecommunications Company, VT iDirect Inc, L3 Technologies Inc., Inmarsat Communications, Orbcomm Inc., ViaSat Inc, Cobham Plc, Baker Hughes Incorporated, Iridium Communications, Globecomm Systems |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Satellite Communication in the Defense Sector Market: Dynamics

Key Growth Drivers :

The Satellite Communication (SatCom) in the Defense Sector market is experiencing significant growth, primarily driven by the increasing need for secure, reliable, and global communication capabilities in modern military operations. The growing complexity of warfare, requiring real-time intelligence sharing, command and control (C2) functionalities, and precision-guided munitions across vast geographical areas, makes SatCom indispensable. The proliferation of unmanned aerial vehicles (UAVs), remote sensors, and networked battlefield systems (e.g., net-centric warfare) demands robust satellite links for data transmission and operational coordination. Furthermore, the rising investment in military modernization programs by nations worldwide, aimed at enhancing their ISR (Intelligence, Surveillance, and Reconnaissance) capabilities and maintaining a technological edge, directly fuels the demand for advanced SatCom terminals, services, and ground infrastructure. The ability of satellites to provide communication in remote, austere, or denied environments where terrestrial networks are unavailable or compromised further solidifies their critical role.

Restraints :

Despite the clear demand, the SatCom in the Defense Sector market faces several significant restraints. The extremely high cost associated with developing, launching, and maintaining military-grade satellite systems, including the ground infrastructure, is a major barrier for many nations. This substantial financial outlay often leads to reliance on commercial satellite services, which may not always meet stringent security or resilience requirements. The vulnerability of satellite communication to jamming, spoofing, and cyberattacks by adversaries poses a significant security challenge. Protecting these critical assets from electronic warfare and cyber threats requires continuous investment in robust countermeasures, which adds to operational complexity and cost. Furthermore, the limited bandwidth availability on some existing military satellite constellations, coupled with the increasing demand for data, can lead to network congestion and latency issues, impacting critical mission operations. Regulatory complexities and international agreements regarding spectrum allocation and satellite orbital slots also present a hurdle.

Opportunities :

The SatCom in the Defense Sector market presents numerous opportunities for innovation and expansion. The advent of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations offers significant opportunities for enhanced bandwidth, reduced latency, and increased resilience compared to traditional Geostationary Orbit (GEO) satellites. These constellations can provide global coverage and dynamic routing capabilities essential for future military operations. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into SatCom systems for autonomous network management, predictive maintenance, and adaptive resource allocation can significantly improve efficiency, security, and operational responsiveness. Opportunities also exist in the development of highly secure, jam-resistant, and quantum-safe communication technologies to safeguard sensitive military data from sophisticated threats. Furthermore, the increasing demand for tactical SatCom on the move (SOTM) solutions for vehicles, aircraft, and dismounted troops, enabling continuous connectivity in dynamic environments, drives innovation in compact and ruggedized terminal designs. Leveraging commercial off-the-shelf (COTS) satellite technology while enhancing security and resilience offers cost-effective solutions.

Challenges :

The SatCom in the Defense Sector market is confronted with several critical challenges that require strategic navigation. Ensuring interoperability and seamless communication across different military branches, allied forces, and various satellite systems (military and commercial) remains a persistent challenge, particularly during joint operations. The rapid pace of technological advancements by potential adversaries in electronic warfare and cyber capabilities necessitates continuous investment in defensive measures and the development of more resilient SatCom systems, creating an ongoing technological arms race. Managing the vast amounts of data generated by ISR assets and effectively integrating it into actionable intelligence for decision-makers in real-time is another significant challenge, requiring robust data processing, dissemination, and fusion capabilities. Lastly, the increasing congestion in orbital space due to the proliferation of satellites and space debris poses risks of collisions, potentially disrupting critical military SatCom services and requiring advanced space situational awareness and debris mitigation strategies.

Satellite Communication in the Defense Sector Market: Segmentation Insights

The global satellite communication in the defense sector market is segmented based on Products, Applications, and Region. All the segments of the satellite communication in the defense sector market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global satellite communication in the defense sector market is divided into Ground Equipment, Service.

On the basis of Applications, the global satellite communication in the defense sector market is bifurcated into Surveillance and Tracking, Remote Sensing, Disaster Recovery, Others.

Satellite Communication in the Defense Sector Market: Regional Insights

The North America region, led by the United States, is the dominant force in the global defense satellite communication market, holding the largest revenue share, estimated at over 50% as of 2023. This leadership is propelled by the world's largest defense budget, which funds advanced programs for secure, resilient, and jam-resistant satellite constellations (such as MILSTAR, AEHF, and the new-generation GPS III). Heavy investment in modernizing military communications to support global C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) operations and the presence of leading defense contractors like Lockheed Martin and Viasat solidify its position. While Europe and Asia-Pacific are growing markets due to rising geopolitical tensions and sovereign satellite initiatives, North America's technological edge and substantial procurement spending ensure its continued market dominance.

Satellite Communication in the Defense Sector Market: Competitive Landscape

The satellite communication in the defense sector market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Satellite Communication in the Defense Sector Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Thuraya Telecommunications Company

- VT iDirect Inc

- L3 Technologies Inc.

- Inmarsat Communications

- Orbcomm Inc.

- ViaSat Inc

- Cobham Plc

- Baker Hughes Incorporated

- Iridium Communications

- Globecomm Systems

The Global Satellite Communication in the Defense Sector Market is Segmented as Follows:

By Products

- Ground Equipment

- Service

By Applications

- Surveillance and Tracking

- Remote Sensing

- Disaster Recovery

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

What will be the value of the satellite communication in the defense sector market during 2025-2032?

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Satellite Communication in the Defense Sector Market Share by Type (2020-2026) 1.5.2 Ground Equipment 1.5.3 Service 1.6 Market by Application 1.6.1 Global Satellite Communication in the Defense Sector Market Share by Application (2020-2026) 1.6.2 Surveillance and Tracking 1.6.3 Remote Sensing 1.6.4 Disaster Recovery 1.6.5 Others 1.7 Satellite Communication in the Defense Sector Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Satellite Communication in the Defense Sector Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Satellite Communication in the Defense Sector Market 3.1 Value Chain Status 3.2 Satellite Communication in the Defense Sector Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Satellite Communication in the Defense Sector 3.2.3 Labor Cost of Satellite Communication in the Defense Sector 3.2.3.1 Labor Cost of Satellite Communication in the Defense Sector Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Thuraya Telecommunications Company 4.1.1 Thuraya Telecommunications Company Basic Information 4.1.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.1.3 Thuraya Telecommunications Company Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.1.4 Thuraya Telecommunications Company Business Overview 4.2 VT iDirect, Inc 4.2.1 VT iDirect, Inc Basic Information 4.2.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.2.3 VT iDirect, Inc Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.2.4 VT iDirect, Inc Business Overview 4.3 L3 Technologies, Inc. 4.3.1 L3 Technologies, Inc. Basic Information 4.3.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.3.3 L3 Technologies, Inc. Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.3.4 L3 Technologies, Inc. Business Overview 4.4 Inmarsat Communications 4.4.1 Inmarsat Communications Basic Information 4.4.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.4.3 Inmarsat Communications Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.4.4 Inmarsat Communications Business Overview 4.5 Orbcomm Inc. 4.5.1 Orbcomm Inc. Basic Information 4.5.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.5.3 Orbcomm Inc. Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.5.4 Orbcomm Inc. Business Overview 4.6 ViaSat Inc 4.6.1 ViaSat Inc Basic Information 4.6.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.6.3 ViaSat Inc Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.6.4 ViaSat Inc Business Overview 4.7 Cobham Plc 4.7.1 Cobham Plc Basic Information 4.7.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.7.3 Cobham Plc Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.7.4 Cobham Plc Business Overview 4.8 Baker Hughes Incorporated 4.8.1 Baker Hughes Incorporated Basic Information 4.8.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.8.3 Baker Hughes Incorporated Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.8.4 Baker Hughes Incorporated Business Overview 4.9 Iridium Communications 4.9.1 Iridium Communications Basic Information 4.9.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.9.3 Iridium Communications Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.9.4 Iridium Communications Business Overview 4.10 Globecomm Systems 4.10.1 Globecomm Systems Basic Information 4.10.2 Satellite Communication in the Defense Sector Product Profiles, Application and Specification 4.10.3 Globecomm Systems Satellite Communication in the Defense Sector Market Performance (2015-2020) 4.10.4 Globecomm Systems Business Overview 5 Global Satellite Communication in the Defense Sector Market Analysis by Regions 5.1 Global Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Regions 5.1.1 Global Satellite Communication in the Defense Sector Sales by Regions (2015-2020) 5.1.2 Global Satellite Communication in the Defense Sector Revenue by Regions (2015-2020) 5.2 North America Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 5.3 Europe Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 5.6 South America Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 6 North America Satellite Communication in the Defense Sector Market Analysis by Countries 6.1 North America Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Countries 6.1.1 North America Satellite Communication in the Defense Sector Sales by Countries (2015-2020) 6.1.2 North America Satellite Communication in the Defense Sector Revenue by Countries (2015-2020) 6.1.3 North America Satellite Communication in the Defense Sector Market Under COVID-19 6.2 United States Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 6.2.1 United States Satellite Communication in the Defense Sector Market Under COVID-19 6.3 Canada Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 6.4 Mexico Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 7 Europe Satellite Communication in the Defense Sector Market Analysis by Countries 7.1 Europe Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Countries 7.1.1 Europe Satellite Communication in the Defense Sector Sales by Countries (2015-2020) 7.1.2 Europe Satellite Communication in the Defense Sector Revenue by Countries (2015-2020) 7.1.3 Europe Satellite Communication in the Defense Sector Market Under COVID-19 7.2 Germany Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 7.2.1 Germany Satellite Communication in the Defense Sector Market Under COVID-19 7.3 UK Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 7.3.1 UK Satellite Communication in the Defense Sector Market Under COVID-19 7.4 France Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 7.4.1 France Satellite Communication in the Defense Sector Market Under COVID-19 7.5 Italy Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 7.5.1 Italy Satellite Communication in the Defense Sector Market Under COVID-19 7.6 Spain Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 7.6.1 Spain Satellite Communication in the Defense Sector Market Under COVID-19 7.7 Russia Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 7.7.1 Russia Satellite Communication in the Defense Sector Market Under COVID-19 8 Asia-Pacific Satellite Communication in the Defense Sector Market Analysis by Countries 8.1 Asia-Pacific Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Satellite Communication in the Defense Sector Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Satellite Communication in the Defense Sector Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Satellite Communication in the Defense Sector Market Under COVID-19 8.2 China Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 8.2.1 China Satellite Communication in the Defense Sector Market Under COVID-19 8.3 Japan Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 8.3.1 Japan Satellite Communication in the Defense Sector Market Under COVID-19 8.4 South Korea Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 8.4.1 South Korea Satellite Communication in the Defense Sector Market Under COVID-19 8.5 Australia Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 8.6 India Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 8.6.1 India Satellite Communication in the Defense Sector Market Under COVID-19 8.7 Southeast Asia Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Satellite Communication in the Defense Sector Market Under COVID-19 9 Middle East and Africa Satellite Communication in the Defense Sector Market Analysis by Countries 9.1 Middle East and Africa Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Satellite Communication in the Defense Sector Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Satellite Communication in the Defense Sector Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Satellite Communication in the Defense Sector Market Under COVID-19 9.2 Saudi Arabia Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 9.3 UAE Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 9.4 Egypt Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 9.5 Nigeria Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 9.6 South Africa Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 10 South America Satellite Communication in the Defense Sector Market Analysis by Countries 10.1 South America Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Countries 10.1.1 South America Satellite Communication in the Defense Sector Sales by Countries (2015-2020) 10.1.2 South America Satellite Communication in the Defense Sector Revenue by Countries (2015-2020) 10.1.3 South America Satellite Communication in the Defense Sector Market Under COVID-19 10.2 Brazil Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 10.2.1 Brazil Satellite Communication in the Defense Sector Market Under COVID-19 10.3 Argentina Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 10.4 Columbia Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 10.5 Chile Satellite Communication in the Defense Sector Sales and Growth Rate (2015-2020) 11 Global Satellite Communication in the Defense Sector Market Segment by Types 11.1 Global Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Satellite Communication in the Defense Sector Sales and Market Share by Types (2015-2020) 11.1.2 Global Satellite Communication in the Defense Sector Revenue and Market Share by Types (2015-2020) 11.2 Ground Equipment Sales and Price (2015-2020) 11.3 Service Sales and Price (2015-2020) 12 Global Satellite Communication in the Defense Sector Market Segment by Applications 12.1 Global Satellite Communication in the Defense Sector Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Satellite Communication in the Defense Sector Sales and Market Share by Applications (2015-2020) 12.1.2 Global Satellite Communication in the Defense Sector Revenue and Market Share by Applications (2015-2020) 12.2 Surveillance and Tracking Sales, Revenue and Growth Rate (2015-2020) 12.3 Remote Sensing Sales, Revenue and Growth Rate (2015-2020) 12.4 Disaster Recovery Sales, Revenue and Growth Rate (2015-2020) 12.5 Others Sales, Revenue and Growth Rate (2015-2020) 13 Satellite Communication in the Defense Sector Market Forecast by Regions (2020-2026) 13.1 Global Satellite Communication in the Defense Sector Sales, Revenue and Growth Rate (2020-2026) 13.2 Satellite Communication in the Defense Sector Market Forecast by Regions (2020-2026) 13.2.1 North America Satellite Communication in the Defense Sector Market Forecast (2020-2026) 13.2.2 Europe Satellite Communication in the Defense Sector Market Forecast (2020-2026) 13.2.3 Asia-Pacific Satellite Communication in the Defense Sector Market Forecast (2020-2026) 13.2.4 Middle East and Africa Satellite Communication in the Defense Sector Market Forecast (2020-2026) 13.2.5 South America Satellite Communication in the Defense Sector Market Forecast (2020-2026) 13.3 Satellite Communication in the Defense Sector Market Forecast by Types (2020-2026) 13.4 Satellite Communication in the Defense Sector Market Forecast by Applications (2020-2026) 13.5 Satellite Communication in the Defense Sector Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Satellite Communication in the Defense Sector

Request Sample

Satellite Communication in the Defense Sector