Satellite Digital Set-Top Box Market Size, Share, and Trends Analysis Report

CAGR :

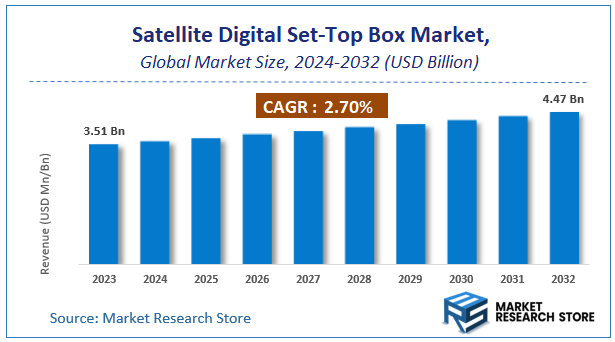

| Market Size 2023 (Base Year) | USD 3.51 Billion |

| Market Size 2032 (Forecast Year) | USD 4.47 Billion |

| CAGR | 2.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Satellite Digital Set-Top Box Market Insights

According to Market Research Store, the global satellite digital set-top box market size was valued at around USD 3.51 billion in 2023 and is estimated to reach USD 4.47 billion by 2032, to register a CAGR of approximately 2.7% in terms of revenue during the forecast period 2024-2032.

The satellite digital set-top box report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Satellite Digital Set-Top Box Market: Overview

The Satellite Digital Set-Top Box market involves devices that decode satellite signals to provide television content, including standard and high-definition channels. These devices are integral to satellite television services, offering advanced features such as digital video recording (DVR), interactive user interfaces, and support for various broadcast standards. Satellite set-top boxes enable users to access a wide range of TV channels, and they are often equipped with additional functions like on-demand content and internet connectivity, which enhance the viewing experience.

The market is driven by factors such as increasing demand for high-quality content, the growing popularity of satellite television services, and advancements in digital broadcasting technologies. Additionally, innovations like support for 4K content, integration with internet services, and enhanced user experience features are fueling the adoption of satellite STBs. The expansion of satellite TV networks, particularly in emerging markets where internet infrastructure is still developing, further supports the market's growth. While the market faces competition from alternative streaming services, satellite STBs remain essential in regions where satellite television is the primary means of broadcasting.

Key Highlights

- The satellite digital set-top box market is anticipated to grow at a CAGR of 2.7% during the forecast period.

- The global satellite digital set-top box market was estimated to be worth approximately USD 3.51 billion in 2023 and is projected to reach a value of USD 4.47 billion by 2032.

- The growth of the satellite digital set-top box market is being driven by the demand for enhanced viewing experiences and the expansion of pay TV services, the satellite digital set-top box segment remains a crucial component, particularly in regions with limited cable infrastructure.

- Based on the type, the OTT (over the top) segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the home use segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Satellite Digital Set-Top Box Market: Dynamics

Key Growth Drivers

- Penetration of Direct-to-Home (DTH) Services in Rural and Remote Areas: Satellite TV often provides the only viable option for digital television access in areas with limited terrestrial or cable infrastructure, driving STB demand in these regions.

- Affordability of Satellite TV Packages in Certain Markets: In many developing economies, DTH services offer relatively affordable subscription packages compared to cable or IPTV, making satellite STBs a cost-effective way to access a wide range of channels.

- Demand for High-Definition (HD) and Ultra-High-Definition (UHD) Content: As consumer preference for higher quality video content grows, the demand for STBs capable of receiving and decoding HD and UHD signals increases.

- Bundling of STBs with Subscription Packages: DTH service providers often bundle STBs with their subscription packages, making the initial hardware cost lower for consumers and driving adoption.

- Multi-TV Households: Households with multiple television sets often require additional STBs for each TV to access satellite services independently.

- Integration of Value-Added Services: Some satellite STBs offer additional features like electronic program guides (EPGs), parental controls, interactive services, and personal video recording (PVR) functionality, enhancing their appeal.

- Government Initiatives to Digitize Television Broadcasting: In some regions, government mandates to switch off analog broadcasts and adopt digital television drive the demand for digital STBs, including satellite ones.

- Availability of a Wide Range of Channels and Content: Satellite TV providers often offer a broader selection of channels, including international and niche content, which attracts specific viewer segments and necessitates STBs for access.

Restraints

- Growing Competition from Over-the-Top (OTT) Streaming Services: The increasing popularity of internet-based streaming platforms like Netflix, Amazon Prime Video, and Disney+ offers consumers on-demand content without the need for a traditional satellite subscription or STB.

- Expansion of Terrestrial Digital Television (DTT) and Cable Networks: In urban and densely populated areas, the expansion of DTT and cable infrastructure provides alternative digital television options, potentially limiting the growth of satellite STB demand.

- Increasing Availability and Affordability of Smart TVs: Smart TVs with built-in internet connectivity allow direct access to streaming services, reducing the reliance on external STBs.

- High Subscription Costs in Some Regions: In certain markets, the monthly subscription fees for satellite TV can be relatively high, making it less attractive compared to cheaper or one-time cost OTT services.

- Installation Requirements and Aesthetic Concerns: Installing satellite dishes can be complex and may face aesthetic objections from homeowners or building regulations.

- Weather Dependency and Signal Interference: Satellite TV signals can be susceptible to disruption due to adverse weather conditions, which can be a disadvantage compared to more stable terrestrial or wired connections.

- Technological Obsolescence: The rapid pace of technological advancements in media consumption devices can lead to the obsolescence of older STB models.

- Piracy and Illegal Content Consumption: The availability of illegal streaming options can deter some consumers from subscribing to legitimate satellite TV services and purchasing STBs.

Opportunities

- Development of Hybrid STBs Integrating OTT Services: Combining satellite reception with access to internet-based streaming services in a single STB can cater to consumers who want both linear TV and on-demand content.

- Focus on Enhanced User Experience and Interface: Developing more intuitive and user-friendly interfaces with advanced search and recommendation features can improve the appeal of satellite TV.

- Integration with Smart Home Ecosystems: Enabling satellite STBs to interact with other smart home devices and platforms can enhance their functionality and convenience.

- Offering Targeted and Personalized Content: Leveraging data analytics to provide personalized channel recommendations and targeted advertising can improve viewer engagement.

- Expanding into Interactive Services and E-commerce: Integrating interactive features like online shopping and gaming into satellite STBs can create new revenue streams.

- Providing High-Speed Internet Access via Satellite: In areas with limited broadband infrastructure, satellite operators can offer bundled internet and TV services through advanced STBs.

- Developing STBs with Advanced Compression Technologies: Implementing more efficient video compression standards can allow for the delivery of more channels and higher quality content within the existing satellite bandwidth.

- Focusing on Niche Markets and Specific Demographics: Tailoring content packages and STB features to cater to specific cultural or linguistic groups or demographics.

Challenges

- Retaining Subscribers in the Face of OTT Competition: DTH providers need to innovate and offer compelling value propositions to prevent subscriber churn to streaming services.

- Reducing Subscriber Acquisition Costs: The cost of acquiring new satellite TV subscribers, including the provision of STBs and installation, can be high.

- Managing Content Rights and Licensing Fees: Securing and managing the rights for a diverse range of content can be complex and expensive.

- Maintaining and Upgrading Infrastructure: Satellite operators need to continuously invest in and upgrade their satellite and ground infrastructure.

- Combating Piracy and Illegal Content Distribution: Implementing effective measures to prevent unauthorized access to and distribution of satellite TV content.

- Adapting to Changing Consumer Viewing Habits: Understanding and catering to the evolving ways in which consumers prefer to watch television and video content.

- Dealing with Regulatory Uncertainty and Policy Changes: The regulatory landscape for broadcasting and telecommunications can be subject to change.

- Competing with the Convenience and Flexibility of IP-Based Services: Matching the ease of access and on-demand nature of internet-based video services.

Satellite Digital Set-Top Box Market: Report Scope

This report thoroughly analyzes the Satellite Digital Set-Top Box Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Satellite Digital Set-Top Box Market |

| Market Size in 2023 | USD 3.51 Billion |

| Market Forecast in 2032 | USD 4.47 Billion |

| Growth Rate | CAGR of 2.7% |

| Number of Pages | 187 |

| Key Companies Covered | Arris (CommScope), Technicolor (Cisco), Apple, Echostar, Humax, Sagemcom, Samsung, Roku, Netgem, Skyworth Digital, Huawei, Jiuzhou, Coship, Changhong, Unionman, Yinhe, ZTE, Hisense |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Satellite Digital Set-Top Box Market: Segmentation Insights

The global satellite digital set-top box market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global satellite digital set-top box market is divided into OTT (over the top), and DTT (direct terrestrial transmission).

OTT (Over the Top) set-top boxes are becoming increasingly dominant in the Satellite Digital Set-Top Box market. This type allows users to access content directly via the internet without the need for traditional satellite or cable services. OTT set-top boxes support a wide range of streaming platforms, including Netflix, Amazon Prime, and YouTube, among others. Their growth is largely driven by increasing consumer preference for on-demand content, as well as the shift towards cord-cutting trends. The affordability, ease of use, and the large variety of content offered via OTT platforms contribute to the widespread adoption of these devices.

DTT (Direct Terrestrial Transmission) set-top boxes are designed for users to receive digital television signals transmitted via terrestrial networks, such as digital terrestrial television (DTT). Though DTT devices hold a significant share of the market, their growth is slower compared to OTT devices, mainly due to the increasing popularity of internet-based content and the wider availability of broadband services. However, DTT set-top boxes continue to serve essential roles in regions with less internet penetration, where satellite or terrestrial transmission remains the primary method of accessing digital television services. Additionally, DTT is often preferred for free-to-air content without the need for subscription-based services.

Segmentation Insights by Application

On the basis of application, the global satellite digital set-top box market is bifurcated into home use and commercial use.

Home Use is the dominant segment in the Satellite Digital Set-Top Box market, as most consumers use these devices for personal entertainment. These set-top boxes are installed in households for viewing television content, accessing streaming platforms, and enjoying interactive services. The demand for home-use set-top boxes is increasing due to the growing trend of cord-cutting, where consumers are moving away from traditional cable subscriptions in favor of internet-based content. Additionally, smart homes and increasing internet penetration further drive the adoption of these devices in residential settings.

Commercial Use refers to the application of set-top boxes in businesses, hotels, restaurants, and public spaces. These systems are used to provide entertainment and information services to large numbers of people. The commercial use of set-top boxes often involves larger-scale setups that can manage multiple users, offer customized content, and provide interactive services. In sectors like hospitality and retail, commercial-grade set-top boxes are utilized to enhance customer experience by offering a wide variety of channels and on-demand content. This segment, though smaller than home use, is growing as businesses increasingly seek ways to improve customer engagement through entertainment systems.

Satellite Digital Set-Top Box Market: Regional Insights

- North America is expected to dominate the global market.

North America remains the dominant region in the satellite digital set-top box market, largely due to the presence of well-established pay-TV operators such as DIRECTV and DISH Network in the United States, and Shaw Direct in Canada. These major service providers have significantly driven the demand for advanced satellite set-top boxes, which are essential for accessing high-quality television content. North American consumers have a strong preference for premium and high-definition content, which fuels the adoption of next-generation set-top boxes capable of handling 4K and 8K video resolution, multi-screen functionalities, and enhanced user interfaces. Additionally, the increasing penetration of OTT platforms like Netflix and Hulu, and the demand for hybrid devices that support both satellite TV and streaming services, is further supporting market growth. Furthermore, the region is also at the forefront of integrating smart technologies, such as voice control and smart home connectivity, into set-top boxes, making them more versatile. The combination of robust infrastructure, advanced technology, and consumer demand for high-quality entertainment makes North America the largest market for satellite digital set-top boxes.

Asia-Pacific is rapidly expanding as a major player in the satellite digital set-top box market. Countries like China, India, Japan, and South Korea are experiencing robust growth driven by increasing internet penetration, urbanization, and rising disposable incomes, which allow more consumers to access satellite TV services. In countries like India, where satellite TV remains a popular choice due to lower infrastructure costs compared to cable TV, the market for satellite set-top boxes has grown significantly. The region also has a large rural population that depends on satellite TV for access to media content, further supporting market demand. Moreover, with the growing trend of adopting high-definition (HD) and ultra-high-definition (UHD) televisions, the demand for advanced set-top boxes that can deliver these services has surged. The proliferation of smart TV technology, combined with consumer demand for a wider array of entertainment options, has also contributed to the market’s growth. However, the price sensitivity of consumers in emerging markets like India and Indonesia is pushing manufacturers to focus on affordable and feature-rich set-top boxes that cater to this price-conscious demographic. Technological advancements in satellite communications, including the launch of new satellite networks, also fuel the demand for more advanced digital set-top boxes.

Europe holds a significant share in the satellite digital set-top box market, with countries like the United Kingdom, Germany, and France leading the charge. The transition from standard-definition (SD) to high-definition (HD) and ultra-high-definition (UHD) content across Europe has created strong demand for advanced satellite set-top boxes. In Europe, satellite TV is highly popular in countries with challenging topographies and remote areas where cable infrastructure may not be feasible. Furthermore, European consumers are increasingly adopting hybrid set-top boxes that combine satellite TV with access to internet-based services such as OTT platforms. The integration of OTT services, including Netflix, Amazon Prime Video, and local services, into traditional satellite TV offerings is a major driver in the region. The focus on sustainability and energy efficiency in Europe has led manufacturers to develop environmentally friendly set-top boxes with lower power consumption. Additionally, the European market is influenced by strong regulatory bodies that ensure high-quality content delivery, which further supports the growth of the satellite set-top box market.

Latin America, the satellite digital set-top box market is growing steadily, driven by a rising demand for affordable and accessible TV options. Countries like Brazil, Mexico, and Argentina, where cable infrastructure is limited or expensive, are increasingly turning to satellite TV as an affordable alternative. The widespread use of satellite dishes, particularly in rural areas, fuels the demand for set-top boxes that can receive high-quality signals from satellites. As disposable incomes rise, there is a shift towards high-definition and even 4K content, further pushing the need for more advanced set-top boxes. The region’s diverse consumer preferences, including a variety of local and international content, create opportunities for tailored set-top box solutions that offer features like multiple language options, support for local content, and personalized interfaces. Moreover, governments across Latin America are focusing on expanding access to digital television, which will likely increase the adoption of satellite digital set-top boxes in the coming years. However, price sensitivity remains a critical factor, and manufacturers continue to focus on providing cost-effective solutions that cater to the region’s economic diversity.

Middle East & Africa region is gradually expanding its satellite digital set-top box market. In the Middle East, high-income countries such as Saudi Arabia, the United Arab Emirates, and Qatar are driving demand for high-quality television content, including HD and UHD channels. Satellite TV is particularly popular in these regions due to the vast geographic areas and the desire for a reliable, high-quality entertainment option. In Africa, the market is primarily driven by infrastructure development, including the rollout of digital terrestrial television (DTT) and satellite services, especially in remote and rural areas. Countries like South Africa, Nigeria, and Kenya have seen growth in satellite TV services as consumers shift away from traditional cable television. The growing demand for premium content, such as sports and international entertainment, is also contributing to market growth. However, affordability remains a challenge, particularly in sub-Saharan Africa, where many consumers are price-sensitive. To address this, manufacturers are offering affordable set-top box options with essential features that cater to the local market’s needs.

Satellite Digital Set-Top Box Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the satellite digital set-top box market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global satellite digital set-top box market include:

- Arris (CommScope)

- Technicolor (Cisco)

- Apple

- Echostar

- Humax

- Sagemcom

- Samsung

- Roku

- Netgem

- Skyworth Digital

- Huawei

- Jiuzhou

- Coship

- Changhong

- Unionman

- Yinhe

- ZTE

- Hisense

The global satellite digital set-top box market is segmented as follows:

By Type

- OTT (Over the Top)

- DTT (Direct Terrestrial Transmission)

By Application

- Home Use

- Commercial Use

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Satellite Digital Set-Top Box

Request Sample

Satellite Digital Set-Top Box