Self-cleaning Surfaces Glass Market Size, Share, and Trends Analysis Report

CAGR :

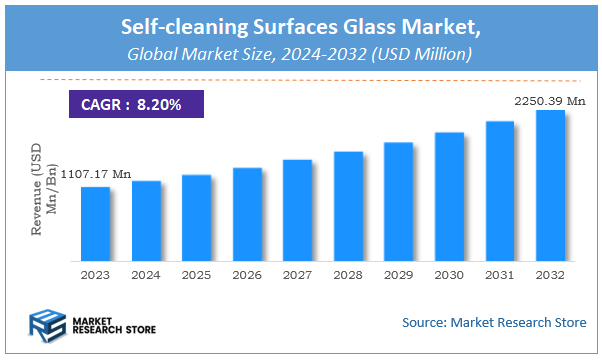

| Market Size 2023 (Base Year) | USD 1107.17 Million |

| Market Size 2032 (Forecast Year) | USD 2250.39 Million |

| CAGR | 8.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Self-cleaning Surfaces Glass Market Insights

According to Market Research Store, the global self-cleaning surfaces glass market size was valued at around USD 1107.17 million in 2023 and is estimated to reach USD 2250.39 million by 2032, to register a CAGR of approximately 8.2% in terms of revenue during the forecast period 2024-2032.

The self-cleaning surfaces glass report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Self-cleaning Surfaces Glass Market: Overview

Self-cleaning surfaces glass refers to glass that has been engineered with a special coating or surface treatment designed to reduce the need for manual cleaning. This type of glass typically utilizes a combination of hydrophobic (water-repellent) and photocatalytic (light-reacting) properties to break down dirt, grime, and organic contaminants. The hydrophobic layer repels water, causing it to form droplets that wash away dirt, while the photocatalytic layer uses UV light to break down organic materials into smaller, less sticky compounds. This combination of properties makes self-cleaning glass highly beneficial for applications in windows, facades, and other glass surfaces exposed to the elements. It is particularly useful in reducing maintenance costs and improving the longevity of glass surfaces, especially in high-rise buildings, commercial structures, and homes in areas prone to dirt and pollution.

Key Highlights

- The self-cleaning surfaces glass market is anticipated to grow at a CAGR of 8.2% during the forecast period.

- The global self-cleaning surfaces glass market was estimated to be worth approximately USD 1107.17 million in 2023 and is projected to reach a value of USD 2250.39 million by 2032.

- The growth of the self-cleaning surfaces glass market is being driven by increasing demand for convenience, sustainability, and cost-efficiency in maintenance.

- Based on the material type, the coated glass segment is growing at a high rate and is projected to dominate the market.

- On the basis of technology, the photo-catalytic technology segment is projected to swipe the largest market share.

- In terms of application, the commercial segment is expected to dominate the market.

- Based on the end-user, the building and construction sector segment is expected to dominate the market.

- In terms of distribution channel, the offline segment is expected to dominate the market.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Self-cleaning Surfaces Glass Market: Dynamics

Key Growth Drivers:

- Rising Demand for Low-Maintenance Solutions: As consumers and businesses look for convenient, low-maintenance options, self-cleaning glass surfaces are gaining popularity for their ability to reduce cleaning time and effort.

- Increased Awareness of Sustainability and Eco-Friendly Products: Growing awareness of environmental issues has led to a preference for self-cleaning glass, as it reduces the need for harmful cleaning chemicals and frequent water usage.

- Technological Advancements in Nanotechnology: Innovations in nanotechnology, which enable the development of self-cleaning coatings for glass, are driving market growth by improving the effectiveness and durability of self-cleaning surfaces.

- Expansion in Construction and Architecture Sectors: The demand for self-cleaning glass is growing in the construction and architectural industries, particularly in building facades, windows, and skylights, due to their aesthetic appeal and maintenance benefits.

- Government Regulations on Energy Efficiency: Many governments are introducing regulations encouraging the use of energy-efficient materials, and self-cleaning glass offers improved solar efficiency, which can contribute to meeting these regulations.

Restraints:

- High Production and Installation Costs: The manufacturing process of self-cleaning glass, along with its specialized coatings and treatments, can result in higher costs compared to conventional glass, limiting adoption in cost-sensitive applications.

- Limited Application Scope: While self-cleaning glass is ideal for certain applications like windows and facades, its functionality is limited in areas where direct sunlight or rain cannot activate the cleaning mechanism, thus restricting its widespread use.

- Durability Issues Over Time: While self-cleaning glass is designed to reduce maintenance, its effectiveness can decline over time, especially in areas with heavy pollution or extreme weather conditions, leading to customer dissatisfaction.

Opportunities:

- Expanding Urbanization and Infrastructure Development: As urbanization increases globally, particularly in emerging economies, the demand for self-cleaning glass in residential, commercial, and industrial buildings is expected to grow.

- Rising Adoption in Automotive Industry: Self-cleaning glass technology is gaining traction in the automotive sector, particularly in windshields and side windows, as it reduces the need for manual cleaning and improves vehicle aesthetics.

- Integration with Smart Glass Technologies: The integration of self-cleaning glass with smart glass technologies, such as electrochromic or thermochromic glass, offers new opportunities for the development of multifunctional glass that can adapt to changing environmental conditions.

- Growing Demand in Solar Panel Cleaning: The demand for self-cleaning glass extends to solar panels, where it can significantly reduce maintenance efforts and enhance the efficiency of renewable energy systems.

Challenges:

- Performance in Extreme Weather Conditions: Self-cleaning glass may face limitations in areas with extreme weather conditions (e.g., heavy snow, extreme heat), where its cleaning mechanism may not work effectively or may degrade faster.

- Competition from Traditional Cleaning Methods: Despite the advantages, traditional cleaning methods such as pressure washing or manual cleaning are still widely used, and many consumers may not see a significant enough benefit to switch to self-cleaning glass.

- High Maintenance in Certain Environments: In highly polluted or dusty environments, the self-cleaning effect may not be as efficient as anticipated, leading to higher-than-expected maintenance costs for users.

- Regulatory and Safety Concerns: The long-term effects of certain chemical coatings used in self-cleaning glass are not fully understood, and concerns about safety regulations could impact the market’s growth.

Self-cleaning Surfaces Glass Market: Report Scope

This report thoroughly analyzes the Self-cleaning Surfaces Glass Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Self-cleaning Surfaces Glass Market |

| Market Size in 2023 | USD 1107.17 Million |

| Market Forecast in 2032 | USD 2250.39 Million |

| Growth Rate | CAGR of 8.2% |

| Number of Pages | 176 |

| Key Companies Covered | Merck KGaA, AGC Glass, JX Nippon Mining Metals, Kuraray, 3M, Corning, Pilkington, Asahi Glass, Nippon Sheet Glass, SaintGobain Glass, Dow Chemical, Guardian Industries, PPG Industries, Schott AG, Heraeus |

| Segments Covered | By Material Type, By Technology, By Application, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Self-cleaning Surfaces Glass Market: Segmentation Insights

The global self-cleaning surfaces glass market is divided by material type, technology, application, end-user, distribution channel, and region.

Segmentation Insights by Material Type

Based on material type, the global self-cleaning surfaces glass market is divided into tempered glass, laminated glass, coated glass, and others.

In the self-cleaning surfaces glass market by material type, coated glass stands out as the most dominant segment. Coated glass is specially treated with hydrophobic or hydrophilic coatings that allow dirt, water, and other contaminants to either slide off or be easily washed away by rainwater. This type of glass is widely used in construction, automotive, and solar panel industries due to its efficiency in maintaining cleanliness with minimal maintenance, making it highly attractive for both residential and commercial applications. The increasing focus on sustainable building practices and energy-saving solutions further amplifies the demand for coated glass, solidifying its leadership position in the market.

Following coated glass, tempered glass holds a significant share. Tempered glass is known for its strength and safety features, being up to five times stronger than standard glass. When integrated with self-cleaning technologies, tempered glass becomes an excellent choice for exterior building facades, high-rise windows, and public infrastructure projects where durability and low maintenance are crucial. Its resistance to thermal stress and mechanical impact makes it particularly suitable for outdoor applications, although it typically requires additional coating treatments to achieve full self-cleaning properties.

Laminated glass comes next in the hierarchy. Laminated glass consists of two or more layers of glass bonded with an interlayer, often made of polyvinyl butyral (PVB), which holds the layers together if shattered. While laminated glass provides superior safety, sound insulation, and UV protection, its application in self-cleaning technologies is somewhat limited compared to coated glass, as it usually needs additional surface modifications or coatings to exhibit self-cleaning behavior. Nevertheless, its growing use in premium architectural projects and automotive windshields contributes to its steady market presence.

Segmentation Insights by Technology

On the basis of technology, the global self-cleaning surfaces glass market is bifurcated into photo-catalytic technology, hydrophilic technology, self-polishing technology, and others.

In the self-cleaning surfaces glass market by technology, photo-catalytic technology is the most dominant segment. Photo-catalytic technology primarily uses coatings of titanium dioxide (TiO₂), which react with ultraviolet (UV) light to break down organic materials and dirt on the glass surface. This broken-down debris is then easily washed away by rainwater. Its strong efficiency, durability, and ability to significantly reduce maintenance costs make photo-catalytic self-cleaning glass highly attractive across commercial buildings, residential properties, and solar panels. Growing demand for eco-friendly and low-maintenance architectural solutions is driving the wide adoption of this technology, solidifying its top position in the market.

Next is hydrophilic technology, which also plays a major role but holds a slightly smaller share compared to photo-catalytic technology. Hydrophilic self-cleaning glass encourages water to spread evenly over the surface rather than forming droplets. This water sheet collects dirt particles and rinses them away effectively. Hydrophilic technology is often combined with photo-catalytic coatings to enhance cleaning efficiency. It is particularly favored in regions with frequent rainfall and is widely applied in residential windows, glass facades, and automotive windshields. However, its standalone effectiveness is generally considered slightly lower than that of photo-catalytic systems.

Self-polishing technology follows, occupying a smaller portion of the market. In this technology, the surface material gradually erodes at a microscopic level, continuously exposing a fresh, clean layer of glass. While innovative, self-polishing solutions are more complex and expensive to manufacture, which limits their widespread adoption. They are mainly used in highly specialized or luxury applications, such as in premium architectural projects and some marine or aerospace environments where top-tier self-cleaning performance is required.

Segmentation Insights by Application

On the basis of application, the global self-cleaning surfaces glass market is bifurcated into residential, commercial, automotive, and others.

In the self-cleaning surfaces glass market by application, the commercial sector is the most dominant segment. Commercial applications include office buildings, shopping malls, airports, hospitals, and hotels, where maintaining large glass facades and windows clean without frequent manual intervention is a major concern. Self-cleaning glass reduces the need for regular cleaning services, leading to significant cost savings over time. Additionally, the aesthetic appeal and sustainability features associated with self-cleaning glass align well with the growing emphasis on green buildings and LEED certifications, further boosting its adoption in the commercial sector.

The residential segment follows closely behind. Homeowners increasingly value self-cleaning glass for windows, skylights, and conservatories due to the convenience and reduced maintenance it offers. Rising disposable incomes, greater awareness of smart and sustainable building materials, and the desire for low-maintenance homes contribute to the growing use of self-cleaning glass in residential applications. While the initial cost can be higher than standard glass, the long-term benefits of lower cleaning costs and improved home aesthetics drive its demand steadily upward.

Automotive applications come next. In the automotive sector, self-cleaning glass is used for windshields, windows, sunroofs, and mirrors to enhance visibility and safety while reducing maintenance. Some high-end vehicles already offer self-cleaning or easy-clean glass options as part of their premium features. However, the adoption rate remains relatively lower compared to the building and construction sectors, largely due to cost considerations and the need for extremely durable and scratch-resistant coatings that can withstand harsh road conditions.

Segmentation Insights by End-User

Based on end-user, the global self-cleaning surfaces glass market is divided into building & construction, automotive, consumer electronics, aerospace, healthcare, and others.

In the self-cleaning surfaces glass market by end-user, the building and construction sector is the most dominant segment. This sector extensively utilizes self-cleaning glass for exterior facades, windows, atriums, skylights, and curtain walls in both commercial and residential buildings. With the global emphasis on sustainable architecture, green buildings, and smart cities, demand for self-cleaning glass has surged, particularly because it significantly reduces maintenance costs, conserves water, and enhances the aesthetic appearance of buildings over time. Its use is especially strong in skyscrapers and modern complexes, where manual window cleaning is costly, difficult, and sometimes hazardous.

The automotive industry follows as a major end-user. Automakers are increasingly integrating self-cleaning glass technologies in vehicles, especially in windshields, side windows, and mirrors, to improve driver visibility and safety while reducing maintenance needs. Luxury and high-end vehicle manufacturers, in particular, are early adopters of such innovations as part of their premium feature packages. Although it still represents a smaller portion compared to construction, the automotive segment is growing steadily as technology becomes more cost-effective and consumer demand for convenience increases.

Consumer electronics come next, where self-cleaning glass is being used in devices such as smartphones, tablets, wearable technology, and display screens. The goal is to reduce smudges, fingerprints, and dust accumulation, enhancing user experience and device durability. While the current market size for self-cleaning glass in consumer electronics is smaller than in construction and automotive, it is expected to expand quickly due to the relentless push for advanced and low-maintenance gadget surfaces.

The aerospace sector also utilizes self-cleaning surfaces, though it represents a niche market. In aerospace applications, self-cleaning glass can be applied to airplane windows, cockpit displays, and cabin surfaces to improve visibility, reduce cleaning cycles, and maintain hygiene standards. However, strict regulatory standards and high-performance requirements limit its widespread application, keeping it a specialized but promising sector.

Healthcare is another emerging end-user category, where self-cleaning glass is used for hospital windows, partitions, and equipment screens to promote hygiene and reduce the risk of infections. In environments where cleanliness is critical, self-cleaning technologies offer a practical solution to minimize manual cleaning efforts and improve patient safety. Although adoption is still at an early stage compared to other sectors, it is gaining traction with the increasing focus on infection control.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global self-cleaning surfaces glass market is bifurcated into online and offline.

In the self-cleaning surfaces glass market by distribution channel, the offline segment is the most dominant. Most self-cleaning glass products are sold through traditional offline channels such as direct sales, specialty stores, authorized distributors, and construction material suppliers. Offline distribution allows for face-to-face consultation, customization based on project requirements, and the handling of large, delicate products that often require professional installation. Architects, construction companies, automotive manufacturers, and large buyers prefer offline purchasing because they can directly inspect the quality, negotiate bulk pricing, and ensure proper handling and delivery, making offline sales the preferred channel for the majority of transactions.

The online segment follows, but currently holds a smaller share of the market. However, its presence is growing steadily. Online distribution includes e-commerce platforms, manufacturer websites, and B2B marketplaces where self-cleaning glass can be ordered for smaller projects, DIY installations, or specific consumer needs. The convenience of browsing a wide range of products, comparing prices, and accessing detailed product specifications online is attracting more residential users and small contractors. Still, due to challenges like the complexity of shipping large and fragile glass panels and the need for professional installation, online sales are yet to match offline channels in volume for large-scale or high-end applications.

Self-cleaning Surfaces Glass Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

Asia-Pacific is the most dominant region in the global self-cleaning glass market. This is driven by rapid urbanization, large-scale infrastructure development, and a rising demand for energy-efficient and sustainable building materials. Countries such as China, India, and Japan lead the charge, with significant growth driven by increased awareness of eco-friendly solutions and high adoption rates in construction projects. The region's large population and increasing disposable incomes further boost the market expansion.

Europe follows closely as a strong market player, with a well-established preference for energy-efficient building materials and sustainability. Countries like Germany, the United Kingdom, and France are leading consumers of self-cleaning glass. Europe's market is supported by stringent environmental regulations and a high degree of technological innovation, which pushes the adoption of advanced construction materials like self-cleaning glass in both residential and commercial sectors.

North America also experiences strong growth in the self-cleaning glass sector, particularly in the United States and Canada. The demand for self-cleaning glass in North America is mainly driven by advancements in construction technologies, a focus on reducing maintenance costs, and the desire for high-performance building materials. The region's established infrastructure and consumer preference for cutting-edge solutions further foster the growth of the market.

Latin America sees steady, albeit slower, growth compared to other regions, with Brazil and Mexico being the primary contributors. Economic growth, urbanization, and a growing awareness of the benefits of self-cleaning glass are fueling the demand for these products. However, the market in this region faces challenges such as economic fluctuations and regional disparities, which may hinder more widespread adoption.

Middle East and Africa represent emerging markets for self-cleaning glass. Key countries like the United Arab Emirates, Saudi Arabia, and South Africa are showing potential for growth driven by infrastructural developments, economic diversification, and a young urbanizing population. However, challenges such as economic volatility and varying levels of market awareness slow down the overall growth in this region.

Self-cleaning Surfaces Glass Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the self-cleaning surfaces glass market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global self-cleaning surfaces glass market include:

- Merck KGaA

- AGC Glass

- JX Nippon Mining Metals

- Kuraray

- 3M

- Corning

- Pilkington

- Asahi Glass

- Nippon Sheet Glass

- SaintGobain Glass

- Dow Chemical

- Guardian Industries

- PPG Industries

- Schott AG

- Heraeus

The global self-cleaning surfaces glass market is segmented as follows:

By Material Type

- Tempered Glass

- Laminated Glass

- Coated Glass

- Others

By Technology

- Photo-catalytic Technology

- Hydrophilic Technology

- Self-Polishing Technology

- Others

By Application

- Residential

- Commercial

- Automotive

- Others

By End-User

- Building and Construction

- Automotive

- Consumer Electronics

- Aerospace

- Healthcare

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Self-cleaning Surfaces Glass

Request Sample

Self-cleaning Surfaces Glass