SGP Film Market Size, Share, and Trends Analysis Report

CAGR :

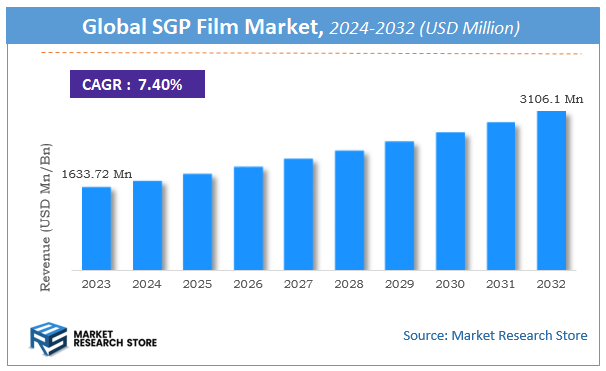

| Market Size 2023 (Base Year) | USD 1633.72 Million |

| Market Size 2032 (Forecast Year) | USD 3106.1 Million |

| CAGR | 7.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

SGP Film Market Insights

According to Market Research Store, the global SGP film market size was valued at around USD 1633.72 million in 2023 and is estimated to reach USD 3106.1 million by 2032, to register a CAGR of approximately 7.4% in terms of revenue during the forecast period 2024-2032.

The SGP film report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global SGP Film Market: Overview

SGP film, or SentryGlas Plus film, is a type of high-performance interlayer used in laminated glass applications. Developed primarily for the architectural and construction industries, SGP film offers enhanced safety, strength, and durability compared to traditional polyvinyl butyral (PVB) interlayers. It is made from ionoplast polymer, which provides superior resistance to moisture, chemicals, and UV exposure. Unlike PVB, SGP retains its structural integrity even after glass breakage, making it ideal for applications requiring high security, such as glass facades, skylights, railings, hurricane-resistant windows, and bulletproof glass. The clarity and toughness of SGP film also contribute to its growing adoption in premium glass installations.

Key Highlights

- The SGP film market is anticipated to grow at a CAGR of 7.4% during the forecast period.

- The global SGP film market was estimated to be worth approximately USD 1633.72 million in 2023 and is projected to reach a value of USD 3106.1 million by 2032.

- The growth of the SGP film market is being driven by the rising demand for advanced laminated glass solutions in both commercial and residential construction.

- Based on the film type, the feature films segment is growing at a high rate and is projected to dominate the market.

- On the basis of distribution channel, the streaming platforms segment is projected to swipe the largest market share.

- In terms of genre, the drama segment is expected to dominate the market.

- Based on the production stage, the production segment is expected to dominate the market.

- In terms of audience type, the general audience segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

SGP Film Market: Dynamics

Key Growth Drivers:

- Rising Demand for Laminated Safety Glass in Construction and Automotive Sectors: The increasing need for durable, impact-resistant safety glass in buildings and vehicles is driving the use of SGP (SentryGlas® Plus) interlayer films.

- Superior Performance Compared to Traditional PVB Films: SGP films offer enhanced structural integrity, better edge stability, and improved resistance to weathering, making them the preferred choice in premium applications.

- Growth in Infrastructure and Smart Cities: The global push toward modern urban development and infrastructure improvement is fueling demand for high-performance glazing materials like SGP films.

- Increased Awareness of Safety and Security Standards: Stricter building codes and consumer awareness about safety and storm/hurricane protection are encouraging the adoption of laminated glass using SGP films.

- Advancements in Glazing Technology: Continuous innovation in architectural glass and façade design is boosting the need for high-strength interlayer materials to support new design possibilities.

Restraints:

- High Cost Compared to Conventional Interlayers: The premium pricing of SGP films over PVB films may discourage price-sensitive consumers, especially in developing markets.

- Complex Installation and Processing Requirements: SGP interlayers require specific lamination and handling conditions, which can increase manufacturing complexity and costs.

- Limited Adoption in Low-End Markets: Due to their specialized features and higher price point, SGP films are mostly used in high-end or critical safety applications, limiting their broader adoption.

Opportunities:

- Expansion in Emerging Markets: As construction and automotive sectors grow in regions like Asia-Pacific, Latin America, and the Middle East, new markets for SGP films are opening up.

- Increasing Use in High-Rise Buildings and Structural Glazing: The trend toward sleek, transparent building façades in commercial architecture is driving the need for strong, clear interlayers like SGP.

- Growing Demand for Green and Sustainable Building Materials: SGP films contribute to energy efficiency and sustainability goals, creating opportunities in eco-friendly construction projects.

- Potential in Aerospace and Marine Applications: The superior mechanical properties of SGP films also make them suitable for use in specialized transportation segments like aircraft and marine vessels.

Challenges:

- Availability of Cheaper Alternatives: PVB and EVA interlayer films, while not as strong, offer cost-effective solutions that can compete with SGP in non-critical applications.

- Supply Chain Disruptions and Raw Material Price Volatility: The global supply chain issues and fluctuations in raw material costs can affect the availability and pricing of SGP films.

- Technical Know-How and Skilled Labor Requirement: Proper installation and lamination require skilled technicians and advanced equipment, posing a barrier in less developed regions.

- Long Certification and Approval Cycles: Architectural and automotive applications involving safety glass often require rigorous certification, which can delay product adoption and rollout.

SGP Film Market: Report Scope

This report thoroughly analyzes the SGP Film Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | SGP Film Market |

| Market Size in 2023 | USD 1633.72 Million |

| Market Forecast in 2032 | USD 3106.1 Million |

| Growth Rate | CAGR of 7.4% |

| Number of Pages | 185 |

| Key Companies Covered | DuPont, Kuraray, Shenbo Glass, Huakai, Dongguan Qun'an Plastic Industrial, Sager Tech |

| Segments Covered | By Film Type, By Distribution Channel, By Genre, By Production Stage, By Audience Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

SGP Film Market: Segmentation Insights

The global SGP film market is divided by film type, distribution channel, genre, production stage, audience type, and region.

Segmentation Insights by Film Type

Based on film type, the global SGP film market is divided into feature films, short films, documentary films, animated films, and independent films.

In the SGP film market, Feature Films hold the dominant position among all film types. These full-length films typically run over 60 minutes and are widely released in cinemas, often backed by higher budgets and extensive marketing campaigns. Feature films in Singapore benefit from strong government support, international collaborations, and growing interest in both local and regional storytelling. They enjoy widespread audience appeal, substantial box office returns, and prominent visibility at film festivals and streaming platforms, making them the cornerstone of the SGP film industry.

Documentary Films follow as the second most prominent segment. Singapore has seen a rise in interest for thought-provoking, culturally rich documentaries that explore social issues, history, and the nation's development. These films often attract international attention and critical acclaim, with support from institutions and grants encouraging filmmakers to explore meaningful subjects. The educational and informational value of documentaries has also made them popular in academic and niche circles.

Animated Films are growing in significance, occupying the third position in the market. Although the local animation industry is relatively young, the rise of digital platforms and improvements in animation technology have allowed Singapore-based creators to gain traction. Animation appeals strongly to younger audiences and families, and it often transcends language barriers, providing international opportunities for Singaporean talent.

Short Films hold the fourth spot, often serving as a testing ground for new talent and experimental ideas. While short films may not enjoy widespread commercial release, they are crucial in the indie circuit and film festivals. Many emerging Singaporean filmmakers start with short films to hone their storytelling and production skills before moving on to longer formats.

Independent Films represent the smallest yet creatively rich segment. These films are typically produced outside of the major studio system with limited budgets but offer artistic freedom and innovation. In Singapore, independent filmmakers often tackle unconventional themes and push cinematic boundaries. Although they face distribution and funding challenges, they contribute significantly to the diversity and vibrancy of the local film landscape.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global SGP film market is bifurcated into cinema/theatrical, television, streaming platforms, DVD/blu-ray, and VOD (video on demand).

In the SGP film market, Streaming Platforms have emerged as the most dominant distribution channel. With the rise of digital consumption and the convenience of on-demand viewing, platforms like Netflix, Disney+, Amazon Prime, and local services such as meWATCH have gained massive popularity. Audiences in Singapore increasingly prefer the flexibility and variety offered by streaming, allowing them to access both local and international content anytime and anywhere. The COVID-19 pandemic accelerated this trend, solidifying streaming as the go-to medium for film consumption across all age groups.

Cinema/Theatrical distribution remains the second most influential channel. While traditional movie-going faced a temporary dip during the pandemic, cinemas have made a strong comeback in Singapore due to a loyal audience base, especially for big-budget blockbusters, local releases, and festival screenings. The theatrical experience continues to hold cultural significance and serves as a critical launchpad for feature films, helping build buzz and generate box office revenue.

Television is the third most popular distribution channel, particularly for documentary films and made-for-TV features. Free-to-air and cable TV channels, including MediaCorp channels, still cater to a significant portion of the population, particularly older demographics. While younger audiences are shifting online, television continues to serve as an important channel for mass outreach and educational content.

VOD (Video on Demand) services rank fourth. This model allows users to rent or purchase films for a one-time viewing, often through telecom providers or digital platforms. Though it lacks the subscription-based appeal of streaming services, VOD remains relevant for accessing newly released titles or niche content not included in subscription libraries.

DVD/Blu-Ray is the least dominant channel in the current landscape. Physical media has seen a sharp decline due to the convenience and affordability of digital formats. However, it still holds a niche market among collectors and for archival purposes. In Singapore, the demand for DVDs and Blu-Rays has diminished significantly, though certain films and limited editions continue to circulate in specialty stores or as memorabilia.

Segmentation Insights by Genre

Based on genre, the global SGP film market is divided into action, comedy, drama, horror, romance, thriller, science fiction, and fantasy.

In the SGP film market, Drama stands out as the most dominant genre. Local audiences are highly receptive to stories that explore human emotions, relationships, and societal themes, which are central to the drama genre. Singaporean drama films often touch on culturally relevant issues such as family dynamics, generational conflict, identity, and socio-economic challenges. The relatability and emotional depth of these films have allowed drama to consistently perform well in both domestic cinemas and international film festivals.

Comedy is the second most popular genre. Singaporeans appreciate humor that reflects everyday life, local culture, and shared experiences, making comedy films especially resonant. Local hits in the comedy genre often weave in dialects, social commentary, and multicultural references, resulting in strong audience engagement and box office success. Comedy’s universal appeal also makes it suitable for a wide age range and diverse viewership.

Action films come next, driven by both local productions and the import of high-octane international titles. While producing large-scale action films requires higher budgets, the genre enjoys consistent demand for its adrenaline-pumping sequences and spectacle. In Singapore, action films often include martial arts or crime-driven storylines, which attract audiences looking for entertainment and excitement.

Romance holds a significant share of the market as well, especially among younger viewers. Romantic films often blend with other genres such as drama and comedy, focusing on themes of love, friendship, and emotional growth. They do particularly well around festive seasons or as date-night features, making them a dependable genre in terms of viewership.

Thriller follows closely behind, with psychological, crime, and mystery thrillers gaining traction in recent years. The genre’s gripping narratives and suspenseful pacing appeal to audiences looking for intellectually stimulating content. Singaporean thrillers are increasingly experimenting with dark themes and innovative storytelling, adding diversity to the local film scene.

Horror films, though niche, have a dedicated fanbase in Singapore. Often inspired by Asian folklore or supernatural elements, horror movies tend to perform well in cinemas during specific seasons such as the Hungry Ghost Festival. Local horror films blend cultural beliefs with eerie storytelling, creating a unique space in the market.

Science Fiction occupies a smaller segment, limited by high production costs and niche appeal. While sci-fi concepts captivate tech-savvy and younger audiences, local productions in this genre are less frequent. Nonetheless, international sci-fi films continue to perform well in Singapore, especially those with strong visual effects and futuristic themes.

Fantasy is the least dominant genre in the market. Despite its global popularity, fantasy films in Singapore are often imported rather than locally produced, due to the genre’s demanding production requirements. However, fantasy elements are sometimes incorporated into animated films or blended with other genres to appeal to younger demographics.

Segmentation Insights by Production Stage

On the basis of production stage, the global SGP film market is bifurcated into pre-production, production, post-production, and marketing & distribution.

In the SGP film market, the Production stage holds the most dominant position among all stages of film development. This is where the actual filming takes place, involving the cast, crew, equipment, and on-location or studio shooting. Given its resource intensity—requiring coordination of actors, cinematographers, set designers, and more—this stage commands the largest share of budgets and attention. In Singapore, strong government support through agencies like the Infocomm Media Development Authority (IMDA) helps ensure that local productions are well-resourced during this critical phase. It is the core of film creation, transforming written scripts into visual content.

Post-production follows closely in importance and scale. This stage involves editing, sound design, visual effects, color grading, and final mastering. For many Singaporean films, particularly those aiming for international standards or global platforms, post-production is essential in elevating quality. Local studios are equipped with advanced editing software and increasingly collaborate with regional partners for specialized tasks like CGI or dubbing, enhancing the professional polish of Singaporean content.

Pre-production is the third most prominent stage. This phase includes scriptwriting, casting, securing locations, budgeting, and scheduling. While it might seem less visible to the audience, its role is foundational—laying the groundwork for a smooth production. In Singapore, pre-production benefits from structured government grants and co-production frameworks, which enable local filmmakers to plan thoroughly and attract talent and funding.

Marketing & Distribution ranks last but remains critical for a film’s commercial success. After the film is completed, it must be promoted through trailers, social media campaigns, media events, and partnerships to generate buzz and secure theatrical or streaming release slots. In Singapore’s competitive market, especially with the growing dominance of streaming platforms, effective marketing can determine a film’s reach and profitability. However, due to smaller marketing budgets compared to Hollywood standards, this stage tends to be leaner in scale.

Segmentation Insights by Audience Type

On the basis of audience type, the global SGP film market is bifurcated into general audience, family audience, young adults, adults, and children.

In the SGP film market, the General Audience segment is the most dominant, as films catering to a broad, inclusive viewership tend to attract the highest attendance and streaming views. These films typically span genres like drama, comedy, romance, and action—balancing entertainment and relatability without heavy restrictions. They are often rated PG or PG13, making them accessible to a wide demographic. General audience films are favored by producers and distributors for their commercial viability and adaptability across platforms, including cinemas, television, and streaming services.

Next is the Family Audience, which includes parents and children watching together. This segment is crucial in Singapore, particularly for holiday and weekend releases. Films in this category often lean toward animated features, light-hearted comedies, or heartwarming dramas with universal themes. The rise of quality animation and local productions with moral or cultural stories has strengthened this segment. Family-friendly content is especially popular in cinema outings and among streaming subscriptions.

Young Adults form the third-largest audience type, driving demand for edgier, trend-driven content. This group—typically aged 18 to 35—is tech-savvy and active on streaming platforms and social media. They favor genres such as thrillers, romance, science fiction, and coming-of-age dramas. Their preferences often reflect global entertainment trends, making this group a key target for international and indie filmmakers aiming to tap into urban, educated, and culturally aware viewership.

Adults, particularly those aged 35 and above, follow next. This audience prefers more serious and reflective content such as historical dramas, biopics, and documentaries. While they may not be as active in theaters, they are consistent consumers on television and streaming platforms, especially for content that aligns with local heritage or social issues. Adults in Singapore tend to support local productions and often seek substance and storytelling depth over flashy visuals.

Children represent the smallest segment in terms of independent viewership. Their consumption is largely influenced by parental choices and is concentrated around animation, fantasy, and educational content. Though not a dominant force in terms of purchasing decisions, children’s films still hold a niche space—especially through family viewership and targeted content during school holidays. Content creators often integrate child-friendly content into broader family releases to engage this demographic indirectly.

SGP Film Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific region is the most dominant in the SGP film market, fueled by rapid urbanization, expanding infrastructure, and strong growth in the construction and automotive sectors. Countries like China, India, and Japan are at the forefront, with China leading in both consumption and production due to its vast construction projects and increasing use of laminated glass in vehicles. Additionally, government initiatives supporting sustainable construction and energy-efficient building materials continue to drive demand for SGP films across the region.

The North America market holds a significant share, primarily driven by advanced building regulations and high safety standards. The United States plays a pivotal role, with increasing adoption of laminated glass in both commercial and residential buildings, as well as in the automotive sector for enhanced performance and safety. Emphasis on green building certifications and technological advancements in glass lamination also contribute to sustained market growth.

The Europe region maintains a strong position due to its mature construction industry and stringent environmental and safety regulations. Countries such as Germany, the United Kingdom, and France promote the use of energy-efficient and durable building materials, which drives the adoption of SGP films. Ongoing renovation of aging infrastructure and rising investments in sustainable construction support the stable growth of the market in this region.

The Latin America market is gradually expanding, supported by increasing infrastructure development and modernization efforts in countries like Brazil and Mexico. There is growing awareness of safety and energy efficiency in construction, which encourages the adoption of laminated glass. Although the market is smaller in scale compared to more developed regions, it shows potential for growth with rising investments in real estate and commercial projects.

The Middle East and Africa region is the least dominant in the SGP film market but is witnessing steady progress due to large-scale construction projects, especially in the Gulf Cooperation Council countries. Nations such as the United Arab Emirates and Saudi Arabia are incorporating high-specification building materials into luxury and commercial developments. However, broader market growth is limited by comparatively lower awareness and slower adoption outside major urban centers.

SGP Film Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the SGP film market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global SGP film market include:

- DuPont

- Kuraray

- Shenbo Glass

- Huakai

- Dongguan Qun'an Plastic Industrial

- Sager Tech

The global SGP film market is segmented as follows:

By Film Type

- Feature Films

- Short Films

- Documentary Films

- Animated Films

- Independent Films

By Distribution Channel

- Cinema/Theatrical

- Television

- Streaming Platforms

- DVD/Blu-Ray

- VOD (Video on Demand)

By Genre

- Action

- Comedy

- Drama

- Horror

- Romance

- Thriller

- Science Fiction

- Fantasy

By Production Stage

- Pre-production

- Production

- Post-production

- Marketing and Distribution

By Audience Type

- General Audience

- Family Audience

- Young Adults

- Adults

- Children

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

SGP Film

Request Sample

SGP Film