Smart Clothing and Textile Technologies and Market Size, Share, and Trends Analysis Report

CAGR :

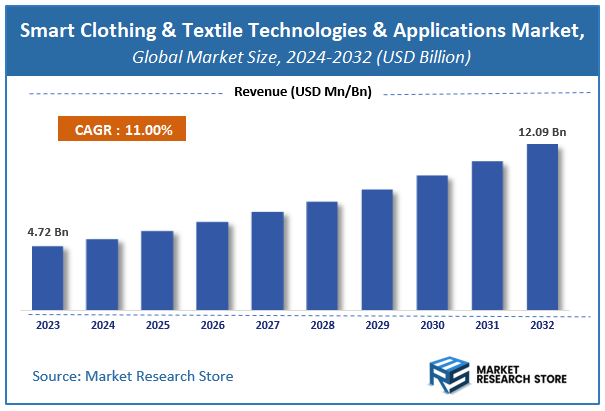

| Market Size 2023 (Base Year) | USD 4.72 Billion |

| Market Size 2032 (Forecast Year) | USD 12.09 Billion |

| CAGR | 11% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Smart Clothing and Textile Technologies and Applications Market Insights

According to Market Research Store, the global smart clothing and textile technologies and applications market size was valued at around USD 4.72 billion in 2023 and is estimated to reach USD 12.09 billion by 2032, to register a CAGR of approximately 11% in terms of revenue during the forecast period 2024-2032.

The smart clothing and textile technologies and applications report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032

To Get more Insights, Request a Free Sample

Smart Clothing and Textile Technologies and Applications Market: Overview

Smart clothing and textile technologies represent a dynamic fusion of traditional textile materials with advanced electronic components, sensors, and actuators to create functional garments and fabrics capable of sensing, reacting, and adapting to environmental stimuli or user inputs. These textiles are embedded with conductive fibers, microcontrollers, or nanomaterials that allow for various functions such as temperature regulation, biometric monitoring, posture correction, and even energy harvesting.

Applications of smart textiles span across diverse sectors including healthcare (e.g., monitoring patient vitals), sports and fitness (e.g., tracking performance metrics), defense and military (e.g., camouflage and health tracking), fashion (e.g., interactive or color-changing garments), and industrial use (e.g., hazard detection or protective gear).

Key Highlights

- The smart clothing and textile technologies and applications market is anticipated to grow at a CAGR of 11% during the forecast period.

- The global smart clothing and textile technologies and applications market was estimated to be worth approximately USD 4.72 billion in 2023 and is projected to reach a value of USD 12.09 billion by 2032.

- The growth of the smart clothing and textile technologies and applications market is being driven by the increasing demand for wearable technology and the integration of IoT in everyday life.

- Based on the technology, the sensors segment is growing at a high rate and is projected to dominate the market.

- On the basis of material, the conductive fibers segment is projected to swipe the largest market share.

- In terms of connectivity, the bluetooth segment is expected to dominate the market.

- Based on the application, the sports & fitness segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Smart Clothing and Textile Technologies and Applications Market: Dynamics

Key Growth Drivers:

- Rising Awareness of Health and Wellness: Increasing consumer interest in personal health monitoring, fitness tracking, and well-being is driving the demand for smart clothing that can track vital signs, activity levels, and sleep patterns.

- Growing Demand in Sports and Fitness: Athletes and fitness enthusiasts are increasingly adopting smart apparel to monitor performance metrics, optimize training, and prevent injuries through real-time data collection.

- Expanding Applications in Healthcare: Smart textiles are finding applications in remote patient monitoring, rehabilitation, and therapeutic clothing, offering continuous and unobtrusive health data collection.

- Increasing Integration of IoT and Wearable Technology: The broader trend of connected devices and the Internet of Things is fueling the adoption of smart clothing as a natural and comfortable interface for data capture and interaction.

- Advancements in Textile Manufacturing and Electronics Miniaturization: Innovations in conductive fibers, flexible sensors, low-power microelectronics, and seamless integration techniques are making smart clothing more practical and appealing.

Restraints:

- High Production Costs: Integrating electronic components and sensors into textiles using specialized manufacturing processes can result in higher production costs compared to conventional clothing.

- Durability and Washability Concerns: Ensuring the durability and washability of embedded electronics and sensors in clothing remains a significant technical challenge for long-term consumer use.

- Battery Life and Power Management: Providing sufficient and long-lasting power to embedded electronics without adding bulk or discomfort to the clothing is a key constraint.

- Data Privacy and Security Concerns: Smart clothing collects personal and potentially sensitive data, raising concerns about data privacy, security, and the potential for misuse.

- Comfort and Aesthetics: Achieving a balance between functionality and the comfort, feel, and appearance of smart clothing is crucial for widespread consumer acceptance.

Opportunities:

- Development of Fashion-Forward Smart Apparel: Designing smart clothing that is both technologically advanced and aesthetically appealing can attract a broader consumer base.

- Focus on Specific Niche Applications: Tailoring smart textile solutions for specialized needs in areas like military wear, industrial safety, and assistive technologies can address specific market demands.

- Integration with Augmented and Virtual Reality (AR/VR): Smart clothing with haptic feedback and motion tracking capabilities can enhance immersion and interaction in AR/VR experiences.

- Advancements in Energy Harvesting Technologies: Developing methods to power smart clothing through body heat, movement, or ambient light could address battery life limitations.

- Creation of Data-Driven Services and Platforms: Leveraging the data collected by smart clothing to offer personalized insights, coaching, and health recommendations can create new revenue streams.

Challenges:

- Standardization and Interoperability: The lack of industry-wide standards for communication protocols and data formats can hinder the seamless integration of smart clothing with other devices and platforms.

- Ensuring Biocompatibility and Safety of Materials: Materials used in smart clothing that come into direct contact with the skin must be biocompatible and safe for prolonged use.

- Developing User-Friendly Interfaces and Data Visualization: Presenting the data collected by smart clothing in an intuitive and actionable manner for users is crucial for driving adoption.

- Scaling Production and Reducing Costs: Achieving mass production of smart clothing at competitive prices remains a significant hurdle for widespread market penetration.

- Building Consumer Trust and Addressing Ethical Concerns: Educating consumers about the benefits and addressing concerns related to data privacy and the potential for surveillance are essential for building trust in smart clothing technologies.

Smart Clothing and Textile Technologies and Applications Market: Report Scope

This report thoroughly analyzes the smart clothing and textile technologies and applications market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Clothing and Textile Technologies and Applications Market |

| Market Size in 2023 | USD 4.72 Billion |

| Market Forecast in 2032 | USD 12.09 Billion |

| Growth Rate | CAGR of 11% |

| Number of Pages | 150 |

| Key Companies Covered | Sensoria (U.S.), Athos (U.S.), Owlet (U.S.), Myzone (U.S.), Wearable X (U.S.), Under Armour Inc (U.S.), OMsignal (Canada), Hexoskin (Canada), Adidas AG (Germany), Tamicare (UK), Emglare (Switzerland), Myontec (Finland), Vulpes Electronics (Japan), Asahi k |

| Segments Covered | By Technology, By Material, By Connectivity, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smart Clothing and Textile Technologies and Applications Market: Segmentation Insights

The global smart clothing and textile technologies and applications market is divided by technology, material, connectivity, application, and region.

Segmentation Insights by Technology

Based on technology, the global smart clothing and textile technologies and applications market is divided into sensors, conductive textiles, e-textiles, and bio-integrated textiles.

In the smart clothing and textile technologies and applications market, sensors represent the most dominant technology segment. These embedded components serve as the foundation for many smart textile applications, including health monitoring, fitness tracking, and military usage. Sensors are highly adaptable and can be integrated into fabrics to detect parameters such as heart rate, temperature, motion, and posture. Their versatility and relatively mature development compared to other technologies have led to widespread adoption in both consumer and professional markets.

Following sensors, conductive textiles occupy the second most dominant position. These textiles are made from fabrics that can conduct electricity, usually through the integration of metallic fibers or conductive polymers. They serve as key enablers of electronic functionality in garments, allowing for the creation of circuits within the fabric itself. Conductive textiles are extensively used in sportswear, military uniforms, and wearable medical devices due to their flexibility and durability.

The next segment, e-textiles, includes textiles that are embedded with digital components and electronics. E-textiles often incorporate both sensors and conductive threads to provide interactive features such as light, sound, or haptic feedback. While promising, e-textiles face challenges related to power supply, washability, and user comfort, which has somewhat limited their market penetration compared to sensors and conductive textiles.

Bio-integrated textiles represent the least dominant segment currently but hold significant long-term potential. These textiles are designed to integrate directly with the human body, often using biocompatible materials that can monitor biological functions like glucose levels or hydration. Still in the early stages of research and commercialization, bio-integrated textiles are primarily found in advanced healthcare and research settings. Their development is constrained by complex manufacturing requirements and high costs, but ongoing innovation may elevate their future role in the market.

Segmentation Insights by Material

On the basis of material, the global smart clothing and textile technologies and applications market is bifurcated into conductive fibers, shape-memory alloys, and piezoelectric materials.

In the smart clothing and textile technologies and applications market, conductive fibers are the most dominant material segment. These fibers, which include materials such as silver-coated threads, carbon-based yarns, and metallic blends, are crucial for enabling electronic functions within textiles. Their ability to carry electrical signals while maintaining flexibility and comfort makes them ideal for integrating sensors, LEDs, and heating elements into fabrics. Conductive fibers are widely used across fitness wearables, health monitoring garments, and military uniforms due to their proven performance and scalability.

Shape-memory alloys (SMAs) come next in terms of dominance. These advanced materials have the unique ability to return to a pre-defined shape when exposed to certain stimuli, typically heat or electricity. In smart textiles, SMAs are often used to enable responsive behavior—such as tightening or loosening a garment automatically for better fit or support. Though their applications are more specialized compared to conductive fibers, SMAs are gaining attention in medical, athletic, and fashion tech sectors for their dynamic capabilities.

Piezoelectric materials are the least dominant in the market currently, although they offer exciting possibilities. These materials can generate an electric charge in response to mechanical stress, and vice versa, making them useful for energy harvesting and tactile sensing in textiles. However, challenges like brittleness, complex integration processes, and relatively high costs have limited their widespread adoption. Most applications of piezoelectric materials in textiles are still in research or prototype stages, but their potential for powering wearable electronics without external batteries could be a game-changer in the long term.

Segmentation Insights by Connectivity

Based on connectivity, the global smart clothing and textile technologies and applications market is divided into bluetooth, wi-fi, and NFC.

In the smart clothing and textile technologies and applications market, Bluetooth is the most dominant connectivity technology. Its low power consumption, widespread compatibility with smartphones and wearable devices, and stable short-range communication make it the preferred choice for smart garments. Bluetooth is commonly used in fitness and health monitoring wearables, allowing real-time data transmission to mobile apps and cloud platforms. Its ease of integration into compact circuits embedded in clothing has helped it maintain a leading position in the market.

Wi-Fi follows as the second most dominant connectivity option. While it offers higher data transfer speeds and a broader communication range than Bluetooth, its higher power requirements make it less ideal for battery-sensitive wearables. Wi-Fi is typically used in smart textile applications where continuous, high-bandwidth data transmission is essential—such as hospital-grade patient monitoring systems or smart uniforms used in high-tech work environments. Its presence is growing, particularly in professional and industrial use cases.

NFC (Near Field Communication) is the least dominant among the three but serves important niche functions. NFC allows for ultra-short-range communication and is valued for its secure data exchange and tap-to-connect features. In smart clothing, NFC is primarily used for authentication, payment functions, and identity verification—such as smart uniforms that grant access to secure areas or garments that store medical history. While not suitable for continuous data transfer, its ease of use and low power consumption make it a useful complement to Bluetooth and Wi-Fi in specific applications.

Segmentation Insights by Application

On the basis of application, the global smart clothing and textile technologies and applications market is bifurcated into sports & fitness, healthcare, military & defense, workplace safety, and entertainment & fashion.

In the smart clothing and textile technologies and applications market, sports and fitness is the most dominant application segment. The surge in health-conscious consumers and the popularity of wearable fitness technology have driven strong demand for garments that can monitor biometric data like heart rate, respiration, and muscle activity. Smart activewear and compression clothing embedded with sensors or conductive fibers are widely used by both amateur and professional athletes for performance tracking and injury prevention. The segment benefits from mass-market appeal and frequent product innovation.

Healthcare ranks as the second most dominant application. Smart textiles in this segment are utilized for continuous health monitoring, post-surgical care, and managing chronic conditions. Garments integrated with sensors can track vital signs such as ECG, body temperature, and oxygen levels, enabling remote patient monitoring and reducing the need for frequent hospital visits. The aging population and growing focus on personalized healthcare are major drivers in this space, although stringent regulatory requirements can slow down deployment.

Military and defense follow closely, benefiting from steady investments in wearable tech designed for soldier safety, situational awareness, and enhanced communication. Smart uniforms equipped with sensors can detect environmental hazards, monitor soldier vitals, and even deliver real-time updates to command centers. While the market size is smaller than consumer sectors, the demand for advanced and ruggedized solutions keeps this segment technologically advanced and strategically important.

Workplace safety is gaining traction as smart textiles are increasingly used in hazardous environments like construction, mining, and manufacturing. These garments help monitor worker health, posture, fatigue levels, or exposure to toxic gases. Although not as widespread as sports or healthcare applications, the increasing emphasis on occupational health and safety standards is driving growth in this segment, particularly in industrialized regions.

Entertainment and fashion is currently the least dominant application, but it represents a space of high creativity and innovation. Designers and tech companies collaborate to develop interactive clothing that responds to music, light, or movement—mostly for events, performances, or limited-edition fashion lines. Although adoption remains niche and mostly experimental, this segment showcases the artistic potential of smart textiles and may become more commercially viable as materials and technologies mature.

Smart Clothing and Textile Technologies and Applications Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the smart clothing and textile technologies and applications market. This leadership is largely attributed to its advanced technological infrastructure, high consumer adoption of wearable tech, and the presence of major industry players. The region has seen widespread integration of smart textiles in sectors such as healthcare, military, and sports. The demand is further propelled by increasing health awareness and interest in fitness monitoring, which has led to the development of smart apparel capable of tracking biometric data.

Asia Pacific follows closely, with rapid growth fueled by industrial expansion, rising urbanization, and technological advancements across emerging economies. Countries such as China, Japan, and South Korea are at the forefront due to their robust electronics manufacturing capabilities and growing investments in research and development. Increasing disposable income and consumer interest in fitness and wellness technologies contribute to the strong demand for smart clothing, especially in urban centers.

Europe holds a significant position in the market, supported by its focus on sustainability, innovation, and quality in textile manufacturing. The region benefits from government-supported R&D programs that encourage the development of advanced textile solutions. European countries are especially active in integrating smart textiles into fashion and healthcare, with a strong emphasis on eco-friendly and high-performance materials.

South America shows emerging potential in the smart textile space, with Brazil leading the regional market due to its developed textile sector. Rising awareness of health and wellness, along with an increasing middle-class population, is driving demand for wearable technologies. Although still in the early stages compared to other regions, growing investment in innovation and manufacturing capabilities indicates a promising future for the market here.

Middle East and Africa remain the least dominant in the smart clothing and textile technologies and applications market. The region is still developing in terms of technological adoption and industrial capacity, which limits its current market share. However, with ongoing urbanization and an increasing focus on digital health and wearable tech, gradual growth is expected over time as infrastructure and awareness improve.

Smart Clothing and Textile Technologies and Applications Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the smart clothing and textile technologies and applications market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global smart clothing and textile technologies and applications market include:

- Sensoria (U.S.)

- Athos (U.S.)

- Owlet (U.S.)

- Myzone (U.S.)

- Wearable X (U.S.)

- Under Armour Inc (U.S.)

- OMsignal (Canada)

- Hexoskin (Canada)

- Adidas AG (Germany)

- Tamicare (UK)

- Emglare (Switzerland)

- Myontec (Finland)

- Vulpes Electronics (Japan)

- Asahi kasei Corporation (Japan)

- AiQ Smart Clothing (Taiwan)

- AdvanPro

- Advanced Nano Products (ANP)

- Alexium

- Alphabet

- Alltracel Pharmaceuticals

- Applied DNA Sciences

- ARC Outdoors

- Avelana

- Balton

- BASF

The global smart clothing and textile technologies and applications market is segmented as follows:

By Technology

- Sensors

- Conductive Textiles

- E-Textiles

- Bio-Integrated Textiles

By Material

- Conductive Fibers

- Shape-Memory Alloys

- Piezoelectric Materials

By Connectivity

- Bluetooth

- Wi-Fi

- NFC

By Application

- Sports & Fitness

- Healthcare

- Military & Defense

- Workplace Safety

- Entertainment & Fashion

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

What will be the CAGR of the global smart clothing and textile technologies and applications market?

Table Of Content

Inquiry For Buying

Smart Clothing and Textile Technologies and Applications

Request Sample

Smart Clothing and Textile Technologies and Applications