Specialty Grade DWP Market Size, Share, and Trends Analysis Report

CAGR :

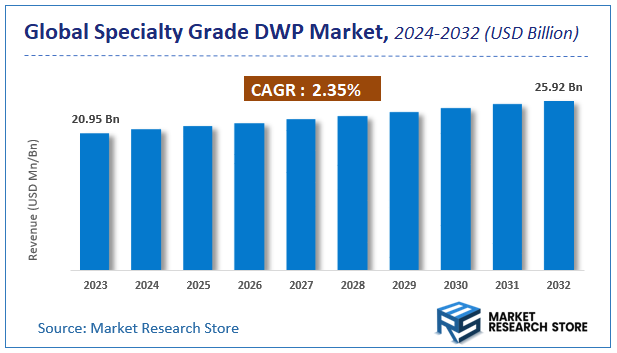

| Market Size 2023 (Base Year) | USD 20.95 Billion |

| Market Size 2032 (Forecast Year) | USD 25.92 Billion |

| CAGR | 2.35% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Specialty Grade DWP Market Insights

According to Market Research Store, the global specialty grade DWP market size was valued at around USD 20.95 billion in 2023 and is estimated to reach USD 25.92 billion by 2032, to register a CAGR of approximately 2.35% in terms of revenue during the forecast period 2024-2032.

The specialty grade DWP report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Specialty Grade DWP Market: Overview

Specialty grade Dissolving Wood Pulp (DWP) is a high-purity form of cellulose extracted from wood, specifically designed for use in value-added, non-commodity applications that demand superior quality and performance. Unlike commodity-grade DWP, which is often used for viscose fiber production, specialty grade DWP is characterized by its exceptionally low impurity content, high alpha cellulose content (typically above 95%), and tailored molecular weight distribution. These qualities make it ideal for applications in pharmaceuticals, food additives, high-performance plastics, cellophane, rayon yarns, and specialty papers, as well as for producing cellulose ethers and esters like cellulose acetate and carboxymethyl cellulose (CMC).

Key Highlights

- The specialty grade DWP market is anticipated to grow at a CAGR of 2.35% during the forecast period.

- The global specialty grade DWP market was estimated to be worth approximately USD 20.95 billion in 2023 and is projected to reach a value of USD 25.92 billion by 2032.

- The growth of the specialty grade DWP market is being driven by increasing demand for bio-based and sustainable raw materials in various high-end industrial sectors.

- Based on the end-user industry, the construction industry segment is growing at a high rate and is projected to dominate the market.

- On the basis of product type, the polymer-based DWP segment is projected to swipe the largest market share.

- In terms of technology, the traditional DWP segment is expected to dominate the market.

- Based on the application, the surface protection segment is expected to dominate the market.

- In terms of performance characteristics, the durability segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Specialty Grade DWP Market: Dynamics

Key Growth Drivers:

- Rising Demand for Sustainable and Bio-Based Products: Specialty grade DWP, derived from wood, is increasingly favored as a renewable alternative to petroleum-based raw materials in textiles, hygiene products, and food additives.

- Expansion of the Textile Industry: The growing popularity of eco-friendly textiles such as viscose, lyocell, and modal—which are made using specialty DWP—is fueling market growth, especially in Asia-Pacific.

- Increasing Use in Pharmaceuticals and Food Applications: Specialty DWP is used in producing microcrystalline cellulose, a key ingredient in pharmaceutical excipients and food stabilizers, driving its demand.

- Technological Advancements in Pulp Processing: Innovations in wood pulp extraction and purification techniques have improved the quality and consistency of specialty DWP, enhancing its market acceptance across industries.

- Government Push for Biodegradable Alternatives: Regulatory support and environmental policies aimed at reducing plastic use are boosting the demand for specialty DWP in bioplastics and packaging.

Restraints:

- High Production Costs: Manufacturing specialty-grade DWP involves intensive processing and strict purity standards, leading to higher production costs compared to commodity-grade pulp.

- Environmental Concerns Related to Deforestation: The sourcing of raw wood material raises concerns over deforestation and ecological impact, which could hinder market growth without sustainable forestry practices.

- Competition from Alternative Bio-Based Materials: Other bio-based alternatives, such as bamboo fiber and cotton, pose competitive threats to the use of specialty DWP in certain applications.

Opportunities:

- Emerging Markets in Asia and Latin America: Rapid industrialization and growing textile demand in emerging economies are creating new avenues for specialty DWP consumption.

- Growth in Eco-Friendly Packaging Solutions: As industries seek biodegradable packaging options, specialty DWP is increasingly being considered for use in molded fiber and flexible packaging solutions.

- Product Innovation in Personal Care and Hygiene: Opportunities exist in expanding the use of specialty DWP in tampons, wipes, and diapers, where its softness, absorbency, and biodegradability are key advantages.

- Strategic Partnerships and Sustainable Certifications: Collaborations between pulp producers and textile manufacturers, along with certification (e.g., FSC, PEFC), can strengthen market presence and consumer trust.

Challenges:

- Volatility in Raw Material Supply and Pricing: Fluctuations in timber availability and pricing can affect the stability of supply chains and profit margins for specialty DWP producers.

- Stringent Quality and Regulatory Requirements: Meeting the high purity standards required for applications in pharmaceuticals and food additives can be technically demanding and costly.

- Limited Awareness and Adoption in End-Use Sectors: In some industries, especially in developing regions, awareness of specialty DWP benefits remains low, limiting its potential market penetration.

- Dependency on a Few Major Suppliers: A concentrated supply base increases vulnerability to disruptions and may reduce bargaining power for end-users.

Specialty Grade DWP Market: Report Scope

This report thoroughly analyzes the Specialty Grade DWP Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Specialty Grade DWP Market |

| Market Size in 2023 | USD 20.95 Billion |

| Market Forecast in 2032 | USD 25.92 Billion |

| Growth Rate | CAGR of 2.35% |

| Number of Pages | 181 |

| Key Companies Covered | Bracell, Grasim, LENZING, Rayonier Advanced Materials, Sappi |

| Segments Covered | By End-User Industry, By Product Type, By Technology, By Application, By Performance Characteristics, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Specialty Grade DWP Market: Segmentation Insights

The global specialty grade DWP market is divided by end-user industry, product type, technology, application, performance characteristics, and region.

Segmentation Insights by End-User Industry

Based on end-user industry, the global specialty grade DWP market is divided into construction, aerospace, automotive, marine, and manufacturing.

In the specialty grade DWP market, the construction industry stands as the most dominant end-user segment. This dominance is driven by the extensive use of DWP in manufacturing high-strength cellulose derivatives, which are used in construction materials like specialty concrete additives, reinforcing agents in insulation, and wallboard products. Its superior purity and chemical reactivity make it valuable for enhancing the performance and sustainability of construction applications, especially in regions focusing on eco-friendly infrastructure and building materials.

Following closely is the automotive industry, which leverages specialty grade DWP for manufacturing lightweight, high-performance bio-based composites, upholstery materials, and interior components. As the industry pivots toward sustainability and reducing carbon emissions, DWP offers a renewable alternative to petrochemical-based polymers. Its use is particularly pronounced in electric and hybrid vehicle components, which benefit from its strength-to-weight ratio and biodegradability.

The aerospace sector comes next, relying on specialty DWP for niche applications such as flame-retardant materials, lightweight composites, and high-performance insulation components. The demand here is more specialized and lower in volume compared to construction and automotive, but DWP’s purity and performance characteristics make it suitable for critical aerospace materials requiring stringent standards.

The manufacturing industry occupies the next tier, utilizing specialty DWP for producing industrial cellulose derivatives like cellulose acetate, viscose, and nitrocellulose used in coatings, films, and adhesives. While this sector contributes significantly, its share is smaller than construction and automotive due to a broader mix of alternative materials and suppliers.

Lastly, the marine industry holds the least share in the specialty grade DWP market. It primarily uses DWP in the production of coatings, sealants, and ropes where high performance and environmental resistance are essential. However, its demand is limited in scale and scope compared to other segments, making it the least dominant among the listed end-user industries.

Segmentation Insights by Product Type

On the basis of product type, the global specialty grade DWP market is bifurcated into polymer-based DWP, metal-based DWP, ceramic-based DWP, and hybrid DWP.

In the specialty grade DWP market, segmented by product type, polymer-based DWP emerges as the most dominant segment. This type is extensively used due to its excellent compatibility with cellulose-based polymers and derivatives, such as viscose, lyocell, and cellulose acetate. These materials are widely utilized in textiles, packaging, and films, making polymer-based DWP the preferred choice across industries. Its renewable nature, combined with strong mechanical properties and biodegradability, supports its growing adoption in eco-conscious manufacturing sectors.

Hybrid DWP follows as the second most dominant segment. It combines properties of multiple material bases—such as polymers, metals, and ceramics—to deliver enhanced performance. Hybrid DWP is valued for its adaptability in specialized applications, including high-strength composite structures, specialty filtration, and engineered biomaterials. These applications span various industries such as automotive, aerospace, and advanced manufacturing, where tailored performance characteristics are critical.

Metal-based DWP ranks next, used for its structural strength, conductivity, and resistance to environmental stress. It is typically integrated into composite materials for aerospace and high-performance automotive parts. While offering advantages in thermal and mechanical properties, the market for metal-based DWP is more limited due to higher production costs and specialized use cases.

Lastly, ceramic-based DWP represents the least dominant product type. This segment is primarily used in niche applications requiring high thermal resistance, such as insulation in aerospace or high-temperature filtration. Despite its advantages in extreme environments, the demand remains constrained due to the brittleness of ceramics and the limited number of applications where such high thermal thresholds are necessary.

Segmentation Insights by Technology

Based on technology, the global specialty grade DWP market is divided into traditional DWP and advanced DWP.

In the specialty grade dissolving wood pulp (DWP) market segmented by technology, traditional DWP remains the most dominant segment. This dominance is rooted in its long-standing use in producing conventional cellulose derivatives like viscose rayon, cellulose acetate, and nitrocellulose. Traditional DWP technology typically involves standard sulfite or kraft pulping methods that focus on achieving high cellulose purity and low hemicellulose content. Industries such as textiles, packaging, and consumer goods heavily rely on this well-established DWP type due to its proven performance, widespread availability, and cost-effectiveness.

On the other hand, advanced DWP is an emerging segment gaining traction due to its superior purity, consistency, and enhanced functional properties. This category includes DWP produced through enzymatic pre-treatments, closed-loop systems, and other eco-friendly or precision-controlled technologies. Advanced DWP is particularly appealing for high-end applications in bioplastics, medical-grade products, and specialty membranes. While it currently holds a smaller share than traditional DWP, its adoption is expected to accelerate with the increasing demand for sustainable and high-performance materials in industries like healthcare, biotechnology, and advanced textiles.

Segmentation Insights by Application

On the basis of application, the global specialty grade DWP market is bifurcated into surface protection, functional coating, and aesthetic coating.

In the specialty grade DWP market segmented by application, surface protection is the most dominant segment. DWP is widely utilized in producing protective coatings that shield surfaces from environmental factors such as moisture, UV radiation, chemicals, and abrasion. This application is especially prominent in construction, automotive, and industrial manufacturing, where maintaining the durability and longevity of materials is critical. The strength, film-forming capability, and biodegradability of DWP make it an ideal component in developing high-performance protective coatings.

Functional coating is the next significant segment, leveraging DWP for its ability to impart specific characteristics to surfaces such as anti-microbial properties, flame retardancy, or moisture resistance. These coatings are used in sectors like electronics, packaging, and aerospace, where performance features beyond protection are needed. The adaptability of specialty DWP in blending with other advanced materials allows for highly customized coating solutions, which are increasingly in demand in high-tech and precision-driven industries.

The aesthetic coating segment holds the smallest market share among the three. Although DWP is used in applications such as paints, decorative finishes, and surface texturizing—where visual appeal is key—the volume and frequency of use are lower compared to protective and functional coatings. This segment is more dependent on design trends and end-user preferences, which can fluctuate and limit large-scale demand.

Segmentation Insights by Performance Characteristics

On the basis of performance characteristics, the global specialty grade DWP market is bifurcated into durability, environmental resistance, and application performance.

In the specialty grade DWP market segmented by performance characteristics, durability is the most dominant attribute driving product adoption. DWP is highly valued for its contribution to producing robust, long-lasting materials, particularly in construction, automotive, and industrial manufacturing applications. Its excellent mechanical strength, high cellulose purity, and compatibility with polymer matrices make it essential in creating products that retain integrity over time under stress or repeated use.

Environmental resistance ranks as the second most influential performance characteristic. Specialty DWP is often chosen for its resistance to moisture, UV exposure, chemicals, and biological degradation. This makes it especially suitable for use in coatings, packaging, and outdoor applications where materials are exposed to harsh environmental conditions. Its renewable origin also supports growing demand for sustainable materials, further reinforcing its role in eco-conscious industries.

Application performance—including aspects such as printability, surface smoothness, and chemical reactivity—comes next. While critical in specialized sectors like pharmaceuticals, filtration, and electronics, this characteristic plays a more niche role. It ensures that DWP-based materials meet specific technical requirements for high-precision or sensitive applications, but the volume demand is generally smaller compared to segments focused on durability and environmental resilience.

Specialty Grade DWP Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific region is the most dominant market for specialty grade dissolving wood pulp (DWP), driven by high demand from the textile, pharmaceutical, and personal care industries. Countries like China and India have abundant raw material availability, low production costs, and a strong manufacturing base, which significantly support market growth. Additionally, large-scale investments in environmentally sustainable products and technologies further boost regional dominance. The increasing shift towards eco-friendly alternatives in industries such as viscose staple fiber production strengthens the region’s leading position in the global market.

North America holds a prominent share in the specialty grade DWP market, supported by advanced industrial infrastructure and a strong emphasis on sustainable production. The demand for biodegradable and bio-based materials is high, particularly in sectors such as food packaging, pharmaceuticals, and hygiene products. Technological innovations and the presence of major pulp manufacturers contribute to the region’s stable market performance. Strategic expansions and modernizations in pulp mills across the United States and Canada also enhance market competitiveness.

Europe maintains a strong position in the market due to its stringent environmental regulations and established pulp and paper industry. Countries such as Finland, Sweden, and Germany are key contributors, known for their sustainable forestry practices and cutting-edge production technologies. The demand for specialty DWP is growing in the textile and packaging industries, with an increasing preference for renewable and recyclable materials. Initiatives promoting the circular economy and green sourcing have reinforced Europe’s role in the global market.

Latin America is emerging as a growing region in the specialty grade DWP market, with Brazil and Chile at the forefront due to their vast forest reserves and cost-efficient production capabilities. The region is benefiting from investments in modern pulp mills and sustainability initiatives aimed at responsible forestry. The export-oriented nature of the industry in this region also supports its growing role in the global market. However, dependency on a limited number of exporting countries may pose challenges to regional expansion.

Middle East and Africa represent the least dominant region in the specialty grade DWP market. Although demand is increasing for hygiene products and sustainable packaging, growth is constrained by limited forestry resources and underdeveloped manufacturing infrastructure. Some countries, such as South Africa and Saudi Arabia, are making progress through investments in local production facilities and environmentally conscious development. Nonetheless, the region remains in the early stages of market evolution compared to others.

Specialty Grade DWP Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the specialty grade DWP market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global specialty grade DWP market include:

- Bracell

- Grasim

- LENZING

- Rayonier Advanced Materials

- Sappi

The global specialty grade DWP market is segmented as follows:

By End-User Industry

- Construction

- Aerospace

- Automotive

- Marine

- Manufacturing

By Product Type

- Polymer-based DWP

- Metal-based DWP

- Ceramic-based DWP

- Hybrid DWP

By Technology

- Traditional DWP

- Advanced DWP

By Application

- Surface Protection

- Functional Coating

- Aesthetic Coating

By Performance Characteristics

- Durability

- Environmental Resistance

- Application Performance

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Specialty Grade DWP Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Specialty Grade DWP Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Specialty Grade DWP Overall Market Size 2.1 Global Specialty Grade DWP Market Size: 2021 VS 2028 2.2 Global Specialty Grade DWP Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Specialty Grade DWP Sales: 2017-2028 3 Company Landscape 3.1 Top Specialty Grade DWP Players in Global Market 3.2 Top Global Specialty Grade DWP Companies Ranked by Revenue 3.3 Global Specialty Grade DWP Revenue by Companies 3.4 Global Specialty Grade DWP Sales by Companies 3.5 Global Specialty Grade DWP Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Specialty Grade DWP Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Specialty Grade DWP Product Type 3.8 Tier 1, Tier 2 and Tier 3 Specialty Grade DWP Players in Global Market 3.8.1 List of Global Tier 1 Specialty Grade DWP Companies 3.8.2 List of Global Tier 2 and Tier 3 Specialty Grade DWP Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Specialty Grade DWP Market Size Markets, 2021 & 2028 4.1.2 Alkali Wood Pulp Or Sulfate Wood Pulp 4.1.3 Wood Pulp Of Sulfite 4.2 By Type - Global Specialty Grade DWP Revenue & Forecasts 4.2.1 By Type - Global Specialty Grade DWP Revenue, 2017-2022 4.2.2 By Type - Global Specialty Grade DWP Revenue, 2023-2028 4.2.3 By Type - Global Specialty Grade DWP Revenue Market Share, 2017-2028 4.3 By Type - Global Specialty Grade DWP Sales & Forecasts 4.3.1 By Type - Global Specialty Grade DWP Sales, 2017-2022 4.3.2 By Type - Global Specialty Grade DWP Sales, 2023-2028 4.3.3 By Type - Global Specialty Grade DWP Sales Market Share, 2017-2028 4.4 By Type - Global Specialty Grade DWP Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Specialty Grade DWP Market Size, 2021 & 2028 5.1.2 Paper Industry 5.1.3 Chemical 5.1.4 Other 5.2 By Application - Global Specialty Grade DWP Revenue & Forecasts 5.2.1 By Application - Global Specialty Grade DWP Revenue, 2017-2022 5.2.2 By Application - Global Specialty Grade DWP Revenue, 2023-2028 5.2.3 By Application - Global Specialty Grade DWP Revenue Market Share, 2017-2028 5.3 By Application - Global Specialty Grade DWP Sales & Forecasts 5.3.1 By Application - Global Specialty Grade DWP Sales, 2017-2022 5.3.2 By Application - Global Specialty Grade DWP Sales, 2023-2028 5.3.3 By Application - Global Specialty Grade DWP Sales Market Share, 2017-2028 5.4 By Application - Global Specialty Grade DWP Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Specialty Grade DWP Market Size, 2021 & 2028 6.2 By Region - Global Specialty Grade DWP Revenue & Forecasts 6.2.1 By Region - Global Specialty Grade DWP Revenue, 2017-2022 6.2.2 By Region - Global Specialty Grade DWP Revenue, 2023-2028 6.2.3 By Region - Global Specialty Grade DWP Revenue Market Share, 2017-2028 6.3 By Region - Global Specialty Grade DWP Sales & Forecasts 6.3.1 By Region - Global Specialty Grade DWP Sales, 2017-2022 6.3.2 By Region - Global Specialty Grade DWP Sales, 2023-2028 6.3.3 By Region - Global Specialty Grade DWP Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Specialty Grade DWP Revenue, 2017-2028 6.4.2 By Country - North America Specialty Grade DWP Sales, 2017-2028 6.4.3 US Specialty Grade DWP Market Size, 2017-2028 6.4.4 Canada Specialty Grade DWP Market Size, 2017-2028 6.4.5 Mexico Specialty Grade DWP Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Specialty Grade DWP Revenue, 2017-2028 6.5.2 By Country - Europe Specialty Grade DWP Sales, 2017-2028 6.5.3 Germany Specialty Grade DWP Market Size, 2017-2028 6.5.4 France Specialty Grade DWP Market Size, 2017-2028 6.5.5 U.K. Specialty Grade DWP Market Size, 2017-2028 6.5.6 Italy Specialty Grade DWP Market Size, 2017-2028 6.5.7 Russia Specialty Grade DWP Market Size, 2017-2028 6.5.8 Nordic Countries Specialty Grade DWP Market Size, 2017-2028 6.5.9 Benelux Specialty Grade DWP Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Specialty Grade DWP Revenue, 2017-2028 6.6.2 By Region - Asia Specialty Grade DWP Sales, 2017-2028 6.6.3 China Specialty Grade DWP Market Size, 2017-2028 6.6.4 Japan Specialty Grade DWP Market Size, 2017-2028 6.6.5 South Korea Specialty Grade DWP Market Size, 2017-2028 6.6.6 Southeast Asia Specialty Grade DWP Market Size, 2017-2028 6.6.7 India Specialty Grade DWP Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Specialty Grade DWP Revenue, 2017-2028 6.7.2 By Country - South America Specialty Grade DWP Sales, 2017-2028 6.7.3 Brazil Specialty Grade DWP Market Size, 2017-2028 6.7.4 Argentina Specialty Grade DWP Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Specialty Grade DWP Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Specialty Grade DWP Sales, 2017-2028 6.8.3 Turkey Specialty Grade DWP Market Size, 2017-2028 6.8.4 Israel Specialty Grade DWP Market Size, 2017-2028 6.8.5 Saudi Arabia Specialty Grade DWP Market Size, 2017-2028 6.8.6 UAE Specialty Grade DWP Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 Bracell 7.1.1 Bracell Corporate Summary 7.1.2 Bracell Business Overview 7.1.3 Bracell Specialty Grade DWP Major Product Offerings 7.1.4 Bracell Specialty Grade DWP Sales and Revenue in Global (2017-2022) 7.1.5 Bracell Key News 7.2 Grasim 7.2.1 Grasim Corporate Summary 7.2.2 Grasim Business Overview 7.2.3 Grasim Specialty Grade DWP Major Product Offerings 7.2.4 Grasim Specialty Grade DWP Sales and Revenue in Global (2017-2022) 7.2.5 Grasim Key News 7.3 LENZING 7.3.1 LENZING Corporate Summary 7.3.2 LENZING Business Overview 7.3.3 LENZING Specialty Grade DWP Major Product Offerings 7.3.4 LENZING Specialty Grade DWP Sales and Revenue in Global (2017-2022) 7.3.5 LENZING Key News 7.4 Rayonier Advanced Materials 7.4.1 Rayonier Advanced Materials Corporate Summary 7.4.2 Rayonier Advanced Materials Business Overview 7.4.3 Rayonier Advanced Materials Specialty Grade DWP Major Product Offerings 7.4.4 Rayonier Advanced Materials Specialty Grade DWP Sales and Revenue in Global (2017-2022) 7.4.5 Rayonier Advanced Materials Key News 7.5 Sappi 7.5.1 Sappi Corporate Summary 7.5.2 Sappi Business Overview 7.5.3 Sappi Specialty Grade DWP Major Product Offerings 7.5.4 Sappi Specialty Grade DWP Sales and Revenue in Global (2017-2022) 7.5.5 Sappi Key News 8 Global Specialty Grade DWP Production Capacity, Analysis 8.1 Global Specialty Grade DWP Production Capacity, 2017-2028 8.2 Specialty Grade DWP Production Capacity of Key Manufacturers in Global Market 8.3 Global Specialty Grade DWP Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Specialty Grade DWP Supply Chain Analysis 10.1 Specialty Grade DWP Industry Value Chain 10.2 Specialty Grade DWP Upstream Market 10.3 Specialty Grade DWP Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Specialty Grade DWP Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Specialty Grade DWP

Request Sample

Specialty Grade DWP