Specialty & High Performance Films Market Size, Share, and Trends Analysis Report

CAGR :

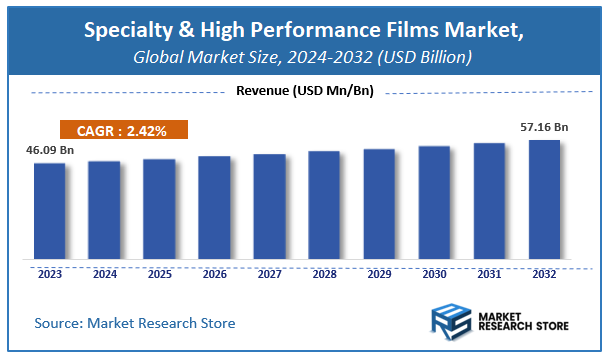

| Market Size 2023 (Base Year) | USD 46.09 Billion |

| Market Size 2032 (Forecast Year) | USD 57.16 Billion |

| CAGR | 2.42% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Specialty & High Performance Films Market Insights

According to Market Research Store, the global specialty & high performance films market size was valued at around USD 46.09 billion in 2023 and is estimated to reach USD 57.16 billion by 2032, to register a CAGR of approximately 2.42% in terms of revenue during the forecast period 2024-2032.

The specialty & high performance films report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Specialty & High Performance Films Market: Overview

Specialty and high performance films refer to advanced plastic films engineered to offer superior physical, mechanical, chemical, and barrier properties compared to conventional plastic films. These films are designed for specific, high-demand applications across diverse industries including packaging, electronics, automotive, aerospace, construction, and medical. Made from high-quality polymers such as polyethylene terephthalate (PET), polyimide, polycarbonate, fluoropolymers, and polyolefins, these films exhibit attributes such as high tensile strength, thermal resistance, UV stability, optical clarity, and chemical inertness. Their unique characteristics make them suitable for protecting sensitive electronic components, enhancing product shelf-life in food packaging, improving fuel efficiency through lightweight automotive components, and enabling high-temperature insulation in industrial applications.

Key Highlights

- The specialty & high performance films market is anticipated to grow at a CAGR of 2.42% during the forecast period.

- The global specialty & high performance films market was estimated to be worth approximately USD 46.09 billion in 2023 and is projected to reach a value of USD 57.16 billion by 2032.

- The growth of the specialty & high performance films market is being driven by increasing demand for durable and functional materials in advanced packaging and emerging technologies.

- Based on the product, the polyester films segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the barrier segment is projected to swipe the largest market share.

- In terms of end use, the packaging segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Specialty & High Performance Films Market: Dynamics

Key Growth Drivers:

- Rising Demand from Packaging Industry: The growing need for advanced packaging materials with improved barrier properties, durability, and shelf-life extension is fueling the demand for specialty and high performance films.

- Advancements in Film Technology: Continuous innovations in film formulations and production techniques are enabling the development of films with enhanced thermal, mechanical, and chemical resistance, attracting various industrial applications.

- Increasing Use in Electronics and Automotive Sectors: Specialty films are widely used in electronic displays, insulation, and automotive interiors due to their flexibility, heat resistance, and high tensile strength.

- Sustainability and Environmental Regulations: The shift toward eco-friendly and recyclable films, driven by regulatory pressures and consumer demand for sustainable packaging, is promoting growth in this market.

- Growing Application in Medical and Pharmaceutical Fields: These films are essential in medical packaging and device manufacturing due to their barrier properties and chemical inertness, supporting the expanding healthcare sector.

Restraints:

- High Production and Raw Material Costs: The cost of specialty polymers and advanced manufacturing processes can lead to high product prices, limiting adoption among cost-sensitive end-users.

- Complex Manufacturing Processes: Producing high performance films often requires sophisticated equipment and skilled labor, which can be a barrier for new entrants and smaller manufacturers.

- Recyclability Challenges: Some specialty films are difficult to recycle due to multi-layered structures and material compositions, which can hinder their acceptance in environmentally conscious markets.

Opportunities:

- Emerging Markets in Asia-Pacific and Latin America: Rapid industrialization, urbanization, and growth in the packaging and electronics sectors across emerging economies present significant growth prospects.

- Development of Biodegradable and Compostable Films: There is a growing opportunity for manufacturers to innovate eco-friendly alternatives that meet both performance standards and sustainability goals.

- Expanding Use in Solar Energy and Optoelectronics: Specialty films with UV resistance and high transparency are increasingly used in solar panels and optoelectronic devices, opening up new application areas.

- Customization and Specialty Applications: Demand for customized films tailored to specific functions such as anti-fog, anti-static, or flame-retardant properties provides room for niche product development.

Challenges:

- Intense Market Competition: The presence of numerous global and regional players intensifies price competition, pressuring margins and pushing companies toward continuous innovation.

- Stringent Regulatory Compliance: Complying with strict industry standards and safety regulations, especially in food contact and medical applications, can complicate the product development process.

- Volatile Raw Material Prices: Fluctuations in the prices of raw materials like polyethylene, PET, and other polymers can impact profitability and pricing strategies.

- Technical Barriers to Entry for New Players: The need for advanced R&D capabilities and capital-intensive manufacturing limits market entry for smaller firms and startups.

Specialty & High Performance Films Market: Report Scope

This report thoroughly analyzes the Specialty & High Performance Films Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Specialty & High Performance Films Market |

| Market Size in 2023 | USD 46.09 Billion |

| Market Forecast in 2032 | USD 57.16 Billion |

| Growth Rate | CAGR of 2.42% |

| Number of Pages | 180 |

| Key Companies Covered | BASF SE, Clariant AG, Albemarle Corporation, Songwon Industrial Co., Ltd., Nouryon, LANXESS AG, Evonik Industries AG, Kaneka Corporation, The Dow Chemical Company, and ExxonMobil Corporation |

| Segments Covered | By Product, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Specialty & High Performance Films Market: Segmentation Insights

The global specialty & high performance films market is divided by product, application, end use, and region.

Segmentation Insights by Product

Based on product, the global specialty & high performance films market is divided into polyester, nylon, fluoropolymer, polycarbonate, and others.

In the specialty and high-performance films market, polyester films hold the dominant position among all product segments. Their superior strength, durability, dimensional stability, and excellent barrier properties against moisture and gases make them highly versatile and widely used across industries such as packaging, electronics, and automotive. Polyester films are especially favored in flexible packaging due to their clarity, printability, and thermal stability, which significantly contribute to their market leadership.

Following polyester, nylon films take the next prominent spot. Nylon films are known for their excellent toughness, puncture resistance, and superior oxygen barrier properties. These qualities make them ideal for vacuum packaging, industrial applications, and food packaging where extended shelf life is crucial. Their higher cost compared to polyester keeps them from being the most widely used, but their specific advantages maintain strong demand in critical sectors.

Fluoropolymer films are next in the hierarchy, widely recognized for their outstanding chemical resistance, UV stability, and non-stick properties. These films are essential in highly demanding applications like aerospace, chemical processing, and photovoltaics. Despite their premium pricing, their performance in extreme environments ensures a consistent market presence, particularly in industrial and high-tech domains.

Polycarbonate films follow closely, valued for their optical clarity, impact resistance, and heat resistance. They are commonly used in electronic displays, automotive interiors, and ID cards. While their performance characteristics are impressive, polycarbonate films are more niche in comparison, limiting their dominance in broader applications like packaging.

Segmentation Insights by Application

On the basis of application, the global specialty & high performance films market is bifurcated into barrier, safety & security, decorative, microporous, and others.

In terms of application, the barrier films segment is the most dominant in the specialty and high-performance films market. These films are widely used across food packaging, pharmaceuticals, and electronics due to their excellent ability to prevent the passage of moisture, oxygen, light, and other contaminants. Their critical role in extending product shelf life and maintaining product integrity makes them indispensable in both consumer and industrial markets. As sustainability gains traction, barrier films are also evolving with recyclable and biodegradable options, further fueling their dominance.

Next in line is the safety & security films segment. These films are essential in applications where impact resistance, shatterproofing, and protection from UV or infrared radiation are required—such as in automotive windows, architectural glass, and protective coverings. The demand for enhanced safety features in buildings and vehicles, along with increased regulations, continues to drive growth in this segment.

The decorative films segment follows, used primarily for aesthetic enhancement and surface protection in consumer electronics, automotive interiors, and furniture. These films combine visual appeal with functionality such as scratch resistance and UV protection. Although the market size is smaller compared to barrier and safety films, demand is steady, particularly in sectors where design and branding are crucial.

Microporous films are next, known for their breathability and selective permeability. These films are used in applications like medical dressings, protective clothing, hygiene products, and filtration. Their specialized nature limits their usage to niche markets, but within those sectors, they provide essential functionality, especially in healthcare and industrial applications.

Segmentation Insights by End Use

On the basis of end use, the global specialty & high performance films market is bifurcated into packaging, personal care products, electrical and electronic, automotive, construction, and others.

In the specialty and high-performance films market, packaging stands out as the most dominant end-use segment. These films are heavily utilized for food, pharmaceutical, and industrial packaging due to their exceptional barrier properties, durability, and versatility. They offer extended shelf life, protection from moisture and contaminants, and are often designed to be heat-sealable and printable, making them indispensable in modern packaging solutions. As demand for lightweight, sustainable, and high-functionality packaging grows, especially in e-commerce and food sectors, this segment continues to lead the market.

Following packaging, the personal care products segment holds a significant share. Specialty films are used in hygiene applications such as diapers, sanitary napkins, and adult incontinence products. Their microporous structure, softness, and breathability enhance comfort and performance, driving demand in both developed and emerging markets. As population demographics shift and hygiene awareness increases, the need for high-performance films in personal care continues to expand steadily.

The electrical and electronic segment comes next, leveraging specialty films for insulation, dielectric properties, and protection in devices such as smartphones, tablets, capacitors, and flexible circuits. Films like polyimide and polyester are particularly valued for their thermal stability and electrical insulation, making them critical components in high-tech and miniaturized electronics.

Automotive is another important end-use sector, where high-performance films are used for window tinting, interior decoration, paint protection, and insulation. With growing emphasis on vehicle aesthetics, comfort, and safety—alongside rising adoption of electric vehicles—demand for specialty films in automotive applications is experiencing steady growth.

The construction segment follows, where films are applied in safety glazing, vapor barriers, insulation wraps, and decorative elements. Their contribution to energy efficiency, safety, and aesthetics in buildings enhances their value, though this sector lags behind others in terms of overall consumption due to longer lifecycle and installation cycles.

Specialty & High Performance Films Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific region is the most dominant in the specialty and high-performance films market. Its leadership stems from rapid industrial growth, urbanization, and strong demand across sectors such as construction, packaging, and electronics. Countries like China, India, and Japan are major contributors due to their expanding manufacturing bases and increasing consumption of advanced materials. Government initiatives supporting local production, especially in electronics and renewable energy, also contribute to the region's robust market position.

North America follows closely, driven by well-established industries such as automotive, aerospace, electronics, and healthcare. The demand for high-performance films in applications requiring superior barrier properties, durability, and chemical resistance continues to rise. Innovations in film technologies and growing interest in sustainable, lightweight materials further fuel regional market expansion, especially in the U.S. and Canada.

Europe represents a significant market, supported by advanced manufacturing capabilities and stringent regulations encouraging the use of environmentally friendly and high-performance materials. The region's strong presence in automotive, consumer electronics, and e-commerce drives the need for specialty films in protective packaging and insulation. Countries like Germany, France, and the UK are key contributors due to their technological innovation and investment in high-performance applications.

Latin America shows moderate growth in the specialty and high-performance films market, propelled by infrastructure development and rising consumer demand for packaged products. The construction and food & beverage sectors are primary drivers, although economic instability in some countries may hamper long-term growth. Brazil and Mexico are among the leading markets in this region, benefiting from foreign investments and expanding industrial sectors.

Middle East and Africa is the least dominant region in the market, with slower adoption of specialty films due to limited industrialization and infrastructural challenges. However, gradual development in sectors like construction, food packaging, and energy is fostering demand for high-performance materials. Growth is primarily seen in countries with emerging economies and urban development initiatives.

Specialty & High Performance Films Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the specialty & high performance films market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global specialty & high performance films market include:

- BASF SE

- Clariant AG

- Albemarle Corporation

- Songwon Industrial Co.Ltd.

- Nouryon

- LANXESS AG

- Evonik Industries AG

- Kaneka Corporation

- The Dow Chemical Company

- ExxonMobil Corporation

The global specialty & high performance films market is segmented as follows:

By Product

- Polyester

- Nylon

- Fluoropolymer

- Polycarbonate

- Others

By Application

- Barrier

- Safety and Security

- Decorative

- Microporous

- Others

By End Use

- Packaging

- Personal Care Products

- Electrical and electronic

- Automotive

- Construction

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Specialty & High Performance Films

Request Sample

Specialty & High Performance Films