Sports Optic Market Size, Share, and Trends Analysis Report

CAGR :

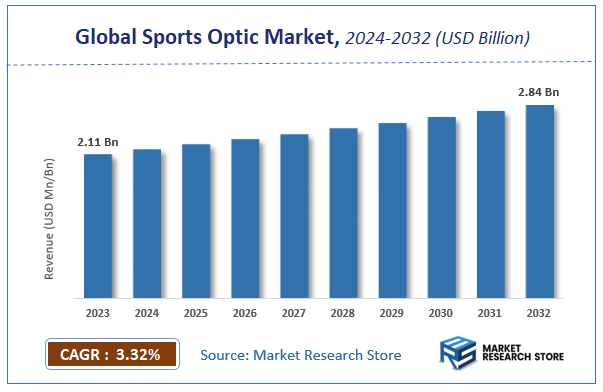

| Market Size 2023 (Base Year) | USD 2.11 Billion |

| Market Size 2032 (Forecast Year) | USD 2.84 Billion |

| CAGR | 3.32% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Sports Optic Market Insights

According to Market Research Store, the global sports optic market size was valued at around USD 2.11 billion in 2023 and is estimated to reach USD 2.84 billion by 2032, to register a CAGR of approximately 3.32% in terms of revenue during the forecast period 2024-2032.

The sports optic report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Sports Optic Market: Overview

Sports optics refers to high-performance optical devices specifically designed to enhance visual clarity, precision, and accuracy in sports and outdoor activities such as hunting, birdwatching, shooting, golf, archery, and various field sports. These devices include binoculars, riflescopes, spotting scopes, rangefinders, and monoculars, many of which are engineered with features such as high-definition lenses, anti-reflective coatings, waterproof and fog-proof housing, and image stabilization to ensure reliable performance in varied and often challenging environmental conditions. Sports optics are valued for enabling users to view distant objects in greater detail and with better contrast, which is essential for accuracy and success in both recreational and competitive sports.

The growth of the sports optics market is driven by the rising popularity of outdoor recreational activities and adventure sports, as well as increased participation in hunting, wildlife observation, and shooting competitions. Technological advancements—such as laser rangefinding, digital enhancements, integrated GPS, and smart optics with ballistic calculators—are elevating user experience and attracting both hobbyists and professionals. Additionally, growing consumer interest in eco-tourism and nature-based experiences is increasing the demand for lightweight, durable, and high-quality optical gear. Manufacturers are also focusing on ergonomic designs and rugged construction to appeal to a broader customer base, further fueling market expansion across sporting and outdoor segments.

Key Highlights

- The sports optic market is anticipated to grow at a CAGR of 3.32% during the forecast period.

- The global sports optic market was estimated to be worth approximately USD 2.11 billion in 2023 and is projected to reach a value of USD 2.84 billion by 2032.

- The growth of the sports optic market is being driven by the increasing participation in outdoor recreational activities and sports globally

- Based on the products, the telescopes segment is growing at a high rate and is projected to dominate the market.

- On the basis of games, the shooting sports segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Sports Optic Market: Dynamics

Key Growth Drivers:

- Increasing Participation in Outdoor Activities and Sports: A growing global interest in activities like hunting, birdwatching, hiking, wildlife observation, golf, shooting sports, and various outdoor recreational pursuits directly fuels the demand for high-quality sports optics (binoculars, spotting scopes, rangefinders, riflescopes) to enhance viewing and performance.

- Technological Advancements and Innovation: Continuous innovation in optics, lens coatings, image stabilization, and the integration of smart technologies (GPS, Bluetooth connectivity, digital rangefinding, night vision, thermal imaging) are significantly improving the performance, clarity, precision, and versatility of sports optics, attracting consumers seeking cutting-edge features.

- Rising Disposable Incomes and Consumer Spending on Leisure: As global disposable incomes increase, particularly in emerging economies, consumers are more willing to invest in premium sporting equipment and accessories, including advanced sports optics, to enhance their recreational and professional experiences.

- Enhanced Fan Engagement at Live Sporting Events: Spectators at large sporting events (e.g., horse racing, football, motorsports) are increasingly using binoculars and other optics to get a clearer, magnified view of the action, driving demand for specialized optics that enhance the in-person fan experience.

- Growth of E-commerce and Online Distribution: The expansion of online retail platforms provides greater accessibility and a wider selection of sports optics to consumers globally, making it easier to research, compare, and purchase products, thereby contributing to market growth.

Restraints:

- High Cost of Advanced Sports Optics: The premium pricing of high-performance and technologically advanced sports optics remains a significant barrier for many consumers, especially casual users or those on a budget. This limits mass-market penetration and often restricts adoption to professional users and dedicated enthusiasts.

- Availability of Substitutes and Cheaper Alternatives: The market faces competition from more affordable, lower-quality optics, or even increasingly capable digital cameras and smartphone zoom features that can serve basic viewing needs for some users, potentially diverting demand from specialized sports optics.

- Complexity of Product Selection and Technical Understanding: The wide array of specifications (magnification, objective lens size, field of view, coatings) and the technical nature of sports optics can be daunting for average consumers, leading to confusion and hesitant purchasing decisions.

Opportunities:

- Development of Smart and Connected Optics: Integrating features like augmented reality overlays, real-time data display, and seamless connectivity with smartphones or other devices presents a significant opportunity to offer enhanced functionality and a more immersive user experience.

- Customization and Personalization: Offering tailored optics based on specific user needs, activities, or even biometric data (e.g., eye relief) could cater to a growing demand for personalized sporting equipment.

- Expansion in Emerging Markets: Rapidly growing economies in regions like Asia-Pacific offer substantial untapped potential due to increasing disposable incomes, rising participation in outdoor activities, and growing awareness of sports optics.

- Focus on Compact, Lightweight, and Durable Optics: There's an ongoing opportunity to develop products that are highly portable, robust, and weather-resistant to meet the demands of outdoor enthusiasts and professionals in various challenging environments.

- Strategic Partnerships and Collaborations: Collaborating with sports organizations, events, or outdoor adventure companies can create new distribution channels and marketing opportunities, reaching target audiences more effectively.

Challenges:

- Intense Market Competition: The sports optic market is highly competitive, with numerous established brands and new entrants vying for market share. This fierce competition puts pressure on pricing, innovation cycles, and marketing spend, making differentiation challenging.

- Rapid Technological Obsolescence: The fast pace of technological advancement means that products can quickly become outdated. This necessitates continuous investment in research and development, posing a financial challenge for manufacturers to keep pace with or stay ahead of trends.

- Counterfeit Products: The market faces a challenge from counterfeit or low-quality imitation products that can damage brand reputation, erode consumer trust, and lead to safety concerns, particularly for optics used in precision activities like hunting or shooting.

- Supply Chain Disruptions and Raw Material Costs: Geopolitical events, natural disasters, or disruptions in the supply chain for specialized optical glass, coatings, and electronic components can impact production costs and lead times, affecting market stability.

- Regulatory Compliance and Environmental Concerns: Adhering to varying international regulations regarding material safety, manufacturing processes, and environmental impact (e.g., lead-free glass) can increase production costs and complexity for manufacturers.

Sports Optic Market: Report Scope

This report thoroughly analyzes the Sports Optic Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Sports Optic Market |

| Market Size in 2023 | USD 2.11 Billion |

| Market Forecast in 2032 | USD 2.84 Billion |

| Growth Rate | CAGR of 3.32% |

| Number of Pages | 196 |

| Key Companies Covered | Nikon (Japan), Carl Zeiss (Germany), Leupold & Stevens (US), Bushnell (US), Trijicon (US), Celestron (US), Burris (US), Leica Camera (Germany), Swarovski Optik (Austria), ATN (US) |

| Segments Covered | By Products, By Games, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sports Optic Market: Segmentation Insights

The global sports optic market is divided by products, games, and region.

Segmentation Insights by Products

Based on products, the global sports optic market is divided into telescopes, binoculars, rifle scopes, and rangefinder.

Telescopes dominate the Sports Optic Market due to their widespread usage across various outdoor and sporting activities such as bird watching, hiking, wildlife observation, and spectator sports. are primarily used for astronomical observation and have gained popularity among amateur astronomers and hobbyists. While they do not have the same volume of demand as binoculars, their application in stargazing and educational institutions contributes steadily to market growth. With improvements in optical precision, lightweight materials, and smartphone compatibility, telescopes are becoming more user-friendly and affordable, attracting new customer segments.

Binoculars their dual-lens design provides a wider field of view and greater depth perception, making them especially valuable for real-time action tracking. Binoculars are favored for their portability, ease of use, and availability across a wide price range, which makes them accessible to both casual users and professional enthusiasts. Technological advancements such as image stabilization, waterproofing, and night vision compatibility have further strengthened their position in the market. As demand rises from nature tourism, hunting, and sports events, binoculars continue to drive the largest revenue share in this segment.

Rifle Scopes cater mainly to the hunting and shooting sports segment and are growing in adoption due to increasing interest in recreational shooting, wildlife management, and defense training simulations. Precision, clarity, and magnification strength are critical to this product segment, and ongoing innovations like laser range indication and ballistic compensation features are expanding their appeal. Regulatory approvals and safety compliance also influence this segment’s dynamics across different regions.

Rangefinders are niche products that are essential for activities requiring distance measurement such as golfing, hunting, and archery. Their compact size and advanced features such as angle compensation, GPS integration, and laser precision make them invaluable tools for accurate targeting. While the user base is smaller compared to binoculars, the segment is experiencing steady growth due to increasing participation in precision sports.

Segmentation Insights by Games

On the basis of games, the global sports optic market is bifurcated into shooting sports, golf, water sport, wheel sport, snow sport, horse racing, and others.

Shooting Sports represent the most dominant segment in the Sports Optic Market due to their critical reliance on precision optics. Products such as rifle scopes, spotting scopes, red dot sights, and rangefinders are widely used in target shooting, hunting, military training, and law enforcement. The rising popularity of competitive shooting events and regulated hunting seasons has significantly increased the demand for high-performance optics. Moreover, technological advancements such as night vision scopes, laser rangefinders, and integrated ballistics software further enhance targeting accuracy, attracting both recreational users and professional marksmen.

Golf holds a substantial share of the sports optic market, primarily driven by the widespread use of laser rangefinders and GPS-enabled optical devices. These optics assist golfers in measuring distances to hazards, flags, and greens, thus improving shot selection and performance. The increasing global participation in golf, especially in regions like North America, Europe, and parts of Asia-Pacific, is fueling the adoption of portable, weather-resistant, and user-friendly optical tools. The availability of high-tech features such as slope calculation and smartphone integration further expands the consumer base.

Water Sport applications in the sports optic market are steadily growing, particularly for activities such as sailing, kayaking, fishing, and marine wildlife observation. Waterproof and fog-proof binoculars, often with floatable housings and anti-reflective coatings, are essential for visibility and safety on open water. These optics are typically designed to withstand harsh environments and offer high magnification and field-of-view capabilities. The growth in water-based recreational tourism and offshore sporting events contributes to the rising demand in this niche segment.

Wheel Sport, including cycling and motorsports, has a more limited but emerging role in the sports optic market. While direct use of optics during competition is minimal, spectators and coaches often use compact binoculars and action cameras to monitor and record events. Additionally, wearable optics and HUD (Heads-Up Display) systems are gaining traction among cyclists for performance analytics and navigation. As smart optics become more integrated with fitness and GPS technologies, their relevance in wheel sports is expected to expand gradually.

Snow Sport activities such as skiing, snowboarding, and mountaineering require optics that can perform reliably in cold, high-altitude conditions. Compact binoculars with anti-fog lenses and durable housings are frequently used for terrain assessment and long-distance viewing. The demand is particularly strong in alpine regions where winter sports are highly popular. Additionally, snow sport enthusiasts benefit from optical goggles and smart glasses integrated with tracking and safety features, indicating a trend toward multifunctional optics.

Horse Racing utilizes sports optics mainly among spectators, trainers, and media personnel. High-definition binoculars with image stabilization and long-range clarity are essential for tracking fast-moving horses over large tracks. These devices enhance viewing experiences and allow for performance monitoring during live events. Though smaller in volume compared to shooting and golf optics, the horse racing segment maintains consistent demand due to the sport's global presence and enthusiastic fan base.

Sports Optic Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Sports Optic Market due to the region's strong outdoor recreational culture, high disposable income, and advanced retail distribution networks. The United States, in particular, is a major consumer of sports optics like binoculars, rifle scopes, rangefinders, and spotting scopes, driven by hunting, wildlife observation, and shooting sports. The presence of established brands such as Leupold, Vortex Optics, and Bushnell, combined with strong e-commerce penetration, supports consistent market growth. Additionally, increasing interest in tactical and adventure sports fuels demand for technologically advanced optics featuring image stabilization, night vision, and digital enhancements.

Europe holds a significant share of the Sports Optic Market, with countries like Germany, the UK, and France showing high adoption rates. Europe’s rich tradition of hunting, birdwatching, and outdoor activities underpins demand for quality optical instruments. The market benefits from stringent quality and environmental standards that push manufacturers to innovate in lightweight, durable, and eco-friendly designs. Germany leads in manufacturing and exports of sports optics, while the UK and Scandinavian countries show strong consumer interest in advanced features such as laser rangefinding and thermal imaging.

Asia-Pacific is witnessing rapid growth in the Sports Optic Market due to increasing disposable incomes, rising awareness of outdoor recreational activities, and expanding middle-class populations in countries like China, India, Japan, and South Korea. The surge in adventure tourism, wildlife safaris, and shooting sports contributes to market expansion. Local manufacturers are emerging alongside global brands to cater to price-sensitive consumers. Technological advancements such as smartphone connectivity and compact design appeal to younger demographics in urban centers.

Latin America is an emerging market for sports optics, with Brazil, Mexico, and Argentina leading the region. Growing participation in hunting, birdwatching, and eco-tourism drives demand for affordable yet reliable optics. However, economic fluctuations and limited distribution channels pose challenges for market penetration. Brazil's large biodiversity and ecotourism industry stimulate interest in optics for wildlife observation, while Mexico and Argentina see increasing popularity of tactical sports optics for shooting and outdoor activities.

Middle East and Africa show gradual adoption of sports optics, primarily driven by increasing interest in hunting and wildlife photography. The Middle East, particularly the UAE and Saudi Arabia, exhibits growing demand for high-end optics used in desert and mountainous terrains. In Africa, countries like South Africa experience moderate growth due to wildlife safaris and hunting traditions. Nevertheless, limited availability, high import costs, and lack of awareness restrict broader market growth across many parts of Africa and the Middle East.

Sports Optic Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the sports optic market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global sports optic market include:

- Nikon (Japan)

- Carl Zeiss (Germany)

- Leupold & Stevens (US)

- Bushnell (US)

- Trijicon (US)

- Celestron (US)

- Burris (US)

- Leica Camera (Germany)

- Swarovski Optik (Austria)

- ATN (US)

The global sports optic market is segmented as follows:

By Products

- Telescopes

- Binoculars

- Rifle scopes

- Rangefinder

By Games

- Shooting Sports

- Golf

- Water Sport

- Wheel Sport

- Snow Sport

- Horse Racing

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Sports Optic

Request Sample

Sports Optic