Stainless Steel Valve Tag Market Size, Share, and Trends Analysis Report

CAGR :

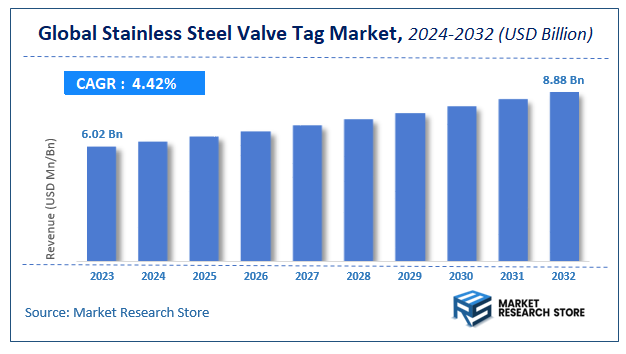

| Market Size 2023 (Base Year) | USD 6.02 Billion |

| Market Size 2032 (Forecast Year) | USD 8.88 Billion |

| CAGR | 4.42% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Stainless Steel Valve Tag Market Insights

According to Market Research Store, the global stainless steel valve tag market size was valued at around USD 6.02 billion in 2023 and is estimated to reach USD 8.88 billion by 2032, to register a CAGR of approximately 4.42% in terms of revenue during the forecast period 2024-2032.

The stainless steel valve tag report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Stainless Steel Valve Tag Market: Overview

A stainless steel valve tag is a specially designed identification plate made from high-quality stainless steel, used to label and mark valves in industrial settings. These tags carry essential information such as valve specifications, serial numbers, manufacturing details, and safety instructions. The use of stainless steel makes these tags highly resistant to corrosion, heat, and mechanical wear, ensuring longevity and reliability even in harsh environments like oil and gas refineries, chemical plants, power stations, and water treatment facilities. Valve tags play a crucial role in asset management, helping technicians quickly identify valves during inspections, maintenance, or emergencies, thereby improving operational efficiency and safety compliance.

Key Highlights

- The stainless steel valve tag market is anticipated to grow at a CAGR of 4.42% during the forecast period.

- The global stainless steel valve tag market was estimated to be worth approximately USD 6.02 billion in 2023 and is projected to reach a value of USD 8.88 billion by 2032.

- The growth of the stainless steel valve tag market is being driven by increasing industrialization and the demand for efficient asset tracking and management systems.

- Based on the product type, the engraved segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the industrial segment is projected to swipe the largest market share.

- In terms of end-user, the oil and gas segment is expected to dominate the market.

- Based on the distribution channel, the offline segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Stainless Steel Valve Tag Market: Dynamics

Key Growth Drivers:

- Increasing Industrialization: Rapid growth in industries such as oil & gas, chemical, and power generation boosts demand for reliable valve identification to enhance safety and operational efficiency.

- Stringent Safety Regulations: Regulatory mandates for asset tagging and maintenance in various sectors compel companies to adopt durable stainless steel valve tags.

- Technological Advancements: Innovations like laser engraving and RFID integration improve traceability and durability, encouraging market adoption.

Restraints:

- High Initial Cost: Stainless steel valve tags tend to be more expensive than alternative tagging materials, which can limit their use in cost-sensitive projects.

- Complex Installation: In some cases, the installation and maintenance of valve tags in harsh or hard-to-reach environments can be challenging and time-consuming.

Opportunities:

- Emerging Markets Expansion: Growing industrial infrastructure in developing countries presents significant opportunities for market growth.

- Smart Tagging Solutions: Integration with IoT and digital asset management systems offers new avenues for enhanced monitoring and maintenance.

Challenges:

- Corrosive and Extreme Environments: Although stainless steel is durable, extremely harsh conditions may still impact tag longevity, requiring continuous innovation.

- Market Fragmentation: Presence of many small players and varying standards across regions can complicate market consolidation and uniform adoption.

Stainless Steel Valve Tag Market: Report Scope

This report thoroughly analyzes the Stainless Steel Valve Tag Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Stainless Steel Valve Tag Market |

| Market Size in 2023 | USD 6.02 Billion |

| Market Forecast in 2032 | USD 8.88 Billion |

| Growth Rate | CAGR of 4.42% |

| Number of Pages | 149 |

| Key Companies Covered | Brimar Industries, Seton Identification Products, National Marker Company, Accuform Manufacturing, Kaiser & Kraft, Label Source, Metal Marker Manufacturing, Pipe Marker.com, J. L. Industries, Tech Products Inc, Industrial Safety Solutions, Brady Corporation, Camcode, EMEDCO, Marking Services Inc, ID Solutions, Big City Manufacturing, Custom Equipment Company, Indian Valley Industries, Maverick Label |

| Segments Covered | By Product Type, By Application, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Stainless Steel Valve Tag Market: Segmentation Insights

The global stainless steel valve tag market is divided by product type, application, end-user, distribution channel, and region.

Segmentation Insights by Product Type

Based on product type, the global stainless steel valve tag market is divided into embossed, engraved, and printed.

In the stainless steel valve tag market, the engraved segment holds the dominant position due to its precision, durability, and clarity. Engraved tags are created by etching information directly onto the stainless steel surface using laser or mechanical engraving techniques. This process produces highly legible, permanent markings that resist fading, corrosion, and abrasion, making them ideal for harsh industrial environments where long-term identification is crucial. The ability to include detailed information and customization options further drives the preference for engraved valve tags across industries such as oil and gas, power generation, and chemical processing.

The embossed segment follows as the second most prominent product type. Embossed tags are manufactured by stamping raised or recessed characters onto the stainless steel surface. These tags offer good durability and visibility, particularly in rugged settings where tactile feedback or a raised profile is beneficial for quick identification. While embossing is less flexible than engraving in terms of intricate details, it remains popular due to its cost-effectiveness and strong resistance to wear and tear, making it suitable for heavy industrial applications where tags face mechanical stress.

The printed segment accounts for a smaller share of the market and is generally used in applications where short-term or moderate durability is sufficient. Printed stainless steel valve tags involve applying ink or thermal transfer printing on the surface. Although printing can offer vibrant colors and quick production turnaround, these tags are more prone to fading, scratching, and damage under extreme environmental conditions. Therefore, printed tags are commonly used in less demanding environments or where frequent tag replacement is feasible. Due to their relatively lower durability compared to engraved and embossed tags, printed valve tags occupy the smallest portion of the market.

Segmentation Insights by Application

On the basis of application, the global stainless steel valve tag market is bifurcated into industrial, commercial, and residential.

In the stainless steel valve tag market, the industrial segment dominates due to the extensive use of valves in heavy industries such as oil and gas, chemical processing, power generation, and water treatment. Industrial applications demand highly durable and corrosion-resistant tags that can withstand extreme temperatures, harsh chemicals, and mechanical wear. Stainless steel valve tags in this sector are critical for ensuring safety, regulatory compliance, and efficient asset management, driving strong and sustained demand.

The commercial segment holds the second position, covering applications in sectors like HVAC systems, commercial buildings, manufacturing facilities, and infrastructure projects. Although the environment is generally less harsh compared to heavy industry, commercial applications still require reliable valve tagging to support maintenance, safety checks, and operational efficiency. Tags used here may not face as extreme conditions as industrial ones but still benefit from stainless steel’s durability and resistance to corrosion and wear.

The residential segment represents the smallest share of the market. Stainless steel valve tags in residential settings are primarily used in plumbing systems, heating units, and water management installations where identification and safety labeling are necessary but environmental conditions are relatively mild. The demand in this segment is lower compared to industrial and commercial uses because the complexity and criticality of valve management are less intense, and the need for highly durable tags is reduced.

Segmentation Insights by End-User

Based on end-user, the global stainless steel valve tag market is divided into oil & gas, chemical, water & wastewater treatment, food & beverage, pharmaceuticals, and others.

In the stainless steel valve tag market, the oil and gas sector is the most dominant end-user segment. This is due to the critical need for durable, corrosion-resistant valve tags in oil rigs, refineries, and pipelines where harsh environmental conditions and stringent safety regulations demand reliable identification and tracking of valves. The high value of assets and the necessity for precise maintenance schedules further drive the adoption of stainless steel valve tags in this industry.

The chemical industry holds the second-largest share, as chemical plants require robust valve tagging solutions to withstand exposure to aggressive chemicals, high temperatures, and corrosive environments. Accurate valve identification is vital for operational safety and process control, making stainless steel tags a preferred choice for durability and longevity in this sector.

The water and wastewater treatment segment also contributes significantly to market demand. Valves in these facilities are frequently exposed to moisture, varying temperatures, and chemicals used in treatment processes, necessitating corrosion-resistant tagging for effective asset management and regulatory compliance.

The food and beverage industry is another key end-user, where hygiene standards and traceability are crucial. Stainless steel valve tags are favored here for their resistance to contamination, ease of cleaning, and compliance with food safety regulations.

The pharmaceutical segment uses stainless steel valve tags to ensure precise valve identification in cleanroom and manufacturing environments, where contamination control and traceability are critical.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global stainless steel valve tag market is bifurcated into online and offline.

In the stainless steel valve tag market, the offline distribution channel remains the most dominant segment. This is largely because industrial buyers often prefer direct interactions with suppliers or distributors to ensure product quality, customization options, and after-sales support. Offline channels include authorized dealers, industrial supply stores, and specialized distributors who provide personalized service, technical guidance, and bulk purchase capabilities. Many end-users in sectors like oil and gas, chemical, and water treatment rely on trusted local suppliers to meet their stringent requirements efficiently.

The online distribution channel is growing steadily but holds a smaller share compared to offline sales. Increasing digitization, e-commerce platforms, and the convenience of ordering customized tags online are driving growth in this segment. Online channels enable buyers to compare products easily, access detailed specifications, and benefit from faster procurement cycles, especially for smaller orders or standard valve tags. However, concerns over product authenticity, customization needs, and technical support still limit the widespread adoption of online purchasing in some industrial sectors, keeping offline channels predominant in this market.

Stainless Steel Valve Tag Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific (APAC) region leads the stainless steel valve tag market, driven primarily by rapid industrialization, expanding manufacturing sectors, and increasing infrastructure investments in countries like China, India, Japan, and South Korea. The growth of oil and gas, petrochemical, power generation, and water treatment industries fuels the demand for durable valve tagging solutions to ensure safety and operational efficiency. Additionally, governments in the region are enforcing stricter safety and quality regulations, which is further accelerating the adoption of stainless steel valve tags. The presence of numerous valve manufacturers and suppliers in APAC also supports the growing market.

North America holds a significant position in the market due to its well-established industrial base, including sectors like oil and gas, chemicals, power generation, and pharmaceuticals. The region benefits from advanced technological adoption such as RFID-enabled valve tags and laser engraving techniques, which improve asset management and tracking capabilities. Strong regulatory frameworks focused on workplace safety and environmental compliance also boost demand for stainless steel valve tags. Furthermore, ongoing infrastructure upgrades and maintenance activities in the U.S. and Canada contribute to steady market growth.

Europe maintains a robust market presence due to its mature industrial sectors and emphasis on safety and quality standards. Countries such as Germany, the U.K., and France have extensive chemical processing, energy production, and manufacturing facilities that require reliable valve identification systems. The region's focus on digital transformation, including smart tagging solutions and integration with Industry 4.0 initiatives, is expanding the scope for advanced stainless steel valve tags. Environmental regulations and the push for sustainable industrial practices further drive market demand in Europe.

The Middle East and Africa region shows growing interest in stainless steel valve tags, primarily driven by the expansive oil and gas industry concentrated in countries like Saudi Arabia, UAE, and South Africa. Infrastructure development and increasing investments in power and water sectors also contribute to market growth. However, the market is relatively nascent compared to more industrialized regions, with demand increasing as safety standards and industrial maintenance practices improve. The harsh environmental conditions in this region particularly highlight the importance of corrosion-resistant stainless steel valve tags.

Latin America holds a smaller share of the market but is gradually growing as industrial activities and infrastructure projects increase in countries such as Brazil, Mexico, and Argentina. The expanding oil and gas exploration, petrochemical production, and energy sectors are key drivers for the adoption of durable valve tagging solutions. Market growth is supported by ongoing modernization of industrial facilities and rising awareness of safety compliance and asset management best practices. However, economic and political fluctuations in the region can influence the pace of market expansion.

Stainless Steel Valve Tag Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the stainless steel valve tag market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global stainless steel valve tag market include:

- Brimar Industries

- Seton Identification Products

- National Marker Company

- Accuform Manufacturing

- Kaiser & Kraft

- Label Source

- Metal Marker Manufacturing

- Pipe Marker.com

- J. L. Industries

- Tech Products Inc

- Industrial Safety Solutions

- Brady Corporation

- Camcode

- EMEDCO

- Marking Services Inc

- ID Solutions

- Big City Manufacturing

- Custom Equipment Company

- Indian Valley Industries

- Maverick Label

The global stainless steel valve tag market is segmented as follows:

By Product Type

- Embossed

- Engraved

- Printed

By Application

- Industrial

- Commercial

- Residential

By End-User

- Oil & Gas

- Chemical

- Water & Wastewater Treatment

- Food & Beverage

- Pharmaceuticals

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Stainless Steel Valve Tag

Request Sample

Stainless Steel Valve Tag