Startup Manager Software Market Size, Share, and Trends Analysis Report

CAGR :

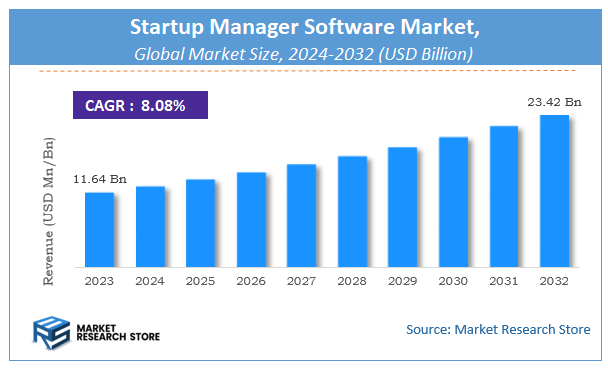

| Market Size 2023 (Base Year) | USD 11.64 Billion |

| Market Size 2032 (Forecast Year) | USD 23.42 Billion |

| CAGR | 8.08% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Startup Manager Software Market Insights

According to Market Research Store, the global startup manager software market size was valued at around USD 11.64 billion in 2023 and is estimated to reach USD 23.42 billion by 2032, to register a CAGR of approximately 8.08% in terms of revenue during the forecast period 2024-2032.

The startup manager software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Startup Manager Software Market: Overview

Startup manager software is a utility application designed to control and manage the programs that automatically launch when a computer boots up. These tools allow users to enable, disable, or delay the startup of specific applications, helping to optimize system performance, reduce boot times, and enhance user control over system resources. Startup manager software is widely used by both individual users and IT professionals to maintain cleaner and faster-running systems. It can also be instrumental in identifying unnecessary or malicious startup entries, thereby contributing to better cybersecurity and system efficiency.

Key Highlights

- The startup manager software market is anticipated to grow at a CAGR of 8.08% during the forecast period.

- The global startup manager software market was estimated to be worth approximately USD 11.64 billion in 2023 and is projected to reach a value of USD 23.42 billion by 2032.

- The growth of the startup manager software market is being driven by increasing demand for PC optimization tools, especially as users become more aware of the impact of unnecessary background applications on system performance.

- Based on the type of software, the cloud-based solutions segment is growing at a high rate and is projected to dominate the market.

- On the basis of functionality, the project management segment is projected to swipe the largest market share.

- In terms of target audience, the growth stage startups segment is expected to dominate the market.

- Based on the deployment model, the public cloud segment is expected to dominate the market.

- In terms of pricing model, the subscription-based pricing segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Startup Manager Software Market: Dynamics

Key Growth Drivers

- Digital Transformation in Startups The rising adoption of digital tools by startups to streamline operations, improve efficiency, and enhance customer experience is fueling demand for startup manager software.

- Cloud-Based Deployment Models The shift toward cloud solutions offers scalability, flexibility, and cost savings, making them highly attractive to startups with limited infrastructure.

- Integration of Artificial Intelligence AI and machine learning are increasingly being integrated to offer advanced analytics and automation, which help startups make faster, data-driven decisions.

- Growing Number of Startups The global increase in startup activity, fueled by entrepreneurial support and funding, expands the target market for such software solutions.

Restraints

- High Initial Investment Costs Comprehensive startup management software often requires substantial upfront investment, which can be a barrier for early-stage or bootstrapped startups.

- Availability of Open Source Alternatives Free and open-source management tools provide cost-effective options, limiting market potential for paid solutions.

- Data Security Concerns Startups dealing with sensitive business and customer data may hesitate to adopt software due to fears over data breaches and privacy issues.

Opportunities

- Emerging Markets Expansion Rapid digital adoption in regions like Asia-Pacific, Latin America, and Africa presents growth potential for startup software providers.

- Customization and Flexibility Offering highly customizable solutions tailored to different industries and business sizes can appeal to a broader startup audience.

- Integration with Business Ecosystems Seamless integration with tools such as CRMs, accounting software, and project management platforms increases the software’s value and utility.

Challenges

- Intense Market Competition The market is crowded with vendors offering similar functionalities, making it challenging to differentiate and retain customers.

- Rapid Technological Changes Continuous innovation is required to stay current with fast-evolving tech trends, putting pressure on development resources.

- Regulatory Compliance Adhering to various global data and software regulations is complex and can hinder international market entry or operations.

Startup Manager Software Market: Report Scope

This report thoroughly analyzes the Startup Manager Software Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Startup Manager Software Market |

| Market Size in 2023 | USD 11.64 Billion |

| Market Forecast in 2032 | USD 23.42 Billion |

| Growth Rate | CAGR of 8.08% |

| Number of Pages | 170 |

| Key Companies Covered | Systweak Software, MacPaw, Piriform, Corel Corporation, IObit, Nir Soft, Codestuff |

| Segments Covered | By Type of Software, By Functionality, By Target Audience, By Deployment Model, By Pricing Model, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Startup Manager Software Market: Segmentation Insights

The global startup manager software market is divided by type of software, functionality, target audience, deployment model, pricing model, and region.

Segmentation Insights by Type of Software

Based on type of software, the global startup manager software market is divided into cloud-based solutions, on-premise solutions, mobile applications, and hybrid solutions.

Cloud-based Solutions lead the market due to their ability to offer real-time access, easy scalability, lower upfront costs, and reduced IT maintenance. Startups often favor cloud deployments because they enable teams to collaborate remotely, integrate with other cloud-based tools, and scale resources as their needs evolve. The shift to remote and hybrid work environments has further fueled the adoption of cloud-based startup management tools.

Next in line are Mobile Applications, which have seen significant growth due to the increasing reliance on smartphones and the need for on-the-go business management. These solutions empower startup founders and managers to track operations, communicate with teams, and make decisions from virtually anywhere. The accessibility and convenience of mobile apps make them especially attractive to agile startup teams.

Hybrid Solutions, which combine elements of both cloud-based and on-premise systems, are gaining traction but remain less dominant. They are often adopted by startups with specific security or compliance needs that require certain functions to remain on-site, while still benefiting from the flexibility of the cloud. However, the complexity and higher cost of hybrid deployments limit their widespread adoption among early-stage companies.

Finally, On-premise Solutions are the least dominant in the current market landscape. Their requirement for substantial infrastructure, higher upfront costs, and limited scalability make them less appealing to startups. While they may still be used by companies with stringent data control needs or in industries with specific regulatory requirements, their overall market share continues to decline in favor of more agile and modern alternatives.

Segmentation Insights by Functionality

On the basis of functionality, the global startup manager software market is bifurcated into project management, team collaboration, time tracking, financial management, customer relationship management (CRM), and reporting & analytics.

Project Management is the leading functionality because startups typically juggle multiple initiatives simultaneously, requiring structured planning, task delegation, and progress tracking. Tools offering Gantt charts, Kanban boards, and workflow automation help teams stay organized and ensure timely project delivery—key to maintaining competitiveness and meeting investor expectations.

Second is Team Collaboration, which plays a critical role in ensuring communication across dispersed teams, especially in remote-first or hybrid work models. Features like real-time messaging, file sharing, and collaborative document editing enable faster decision-making and cohesive teamwork, essential for startup agility and innovation.

Time Tracking follows, as startups increasingly recognize the importance of optimizing team productivity and ensuring accurate billing for client-based projects. Time tracking tools help monitor workload distribution, identify inefficiencies, and improve accountability, making them a valued feature, especially in service-based or consultancy startups.

Next is Customer Relationship Management (CRM), which is vital for managing leads, nurturing customer relationships, and driving sales. While crucial, CRM functionality is often integrated later in a startup's growth journey, once the business shifts focus from product development to customer acquisition and retention.

Financial Management ranks slightly lower, as early-stage startups often rely on basic accounting or outsourced finance services. However, tools that offer budgeting, expense tracking, and cash flow management become increasingly important as startups scale and seek funding or profitability.

Lastly, Reporting & Analytics is the least dominant functionality. While undeniably valuable for strategic decision-making, it tends to be adopted after other operational systems are in place. Startups initially focus on execution rather than data analysis, making advanced reporting tools more relevant in later growth stages when performance measurement becomes critical.

Segmentation Insights by Target Audience

Based on target audience, the global startup manager software market is divided into startups in early stage, growth stage startups, established startups, and industry-specific startups (e.g., tech, health, and retail).

Growth Stage Startups dominate this segment because they face the most complex operational challenges—scaling teams, managing multiple projects, securing funding, and entering new markets. At this stage, startups have usually validated their business models and now require robust software tools to manage expanding workflows, team collaboration, financial tracking, and customer engagement. The demand for startup manager software peaks here as these companies seek efficient solutions to support their accelerated growth.

Early Stage Startups come next, as they also rely on startup management software but with more basic needs. These startups prioritize affordable, easy-to-use tools that can handle core functions like project management, time tracking, and team communication. Their focus is on lean operations and rapid development, which often leads them to adopt cloud-based and modular solutions that can grow with their business.

Established Startups, while still significant users, rank slightly lower in dominance. These are startups that have matured but maintain a startup culture and operational structure. At this stage, they may transition to more advanced, enterprise-grade software systems tailored to larger teams and complex operations, sometimes outgrowing typical startup-specific solutions.

Lastly, Industry-Specific Startups represent the least dominant segment. While there is growing demand for vertical-specific features—like compliance tracking in health startups or inventory tools in retail—the diversity of industry requirements makes it challenging for one-size-fits-all solutions to capture a large market share. These startups often opt for niche or customized software solutions tailored to their specific operational environments, which results in a more fragmented and less dominant segment within the broader startup manager software market.

Segmentation Insights by Deployment Model

On the basis of deployment model, the global startup manager software market is bifurcated into public cloud, private cloud, hybrid cloud, and dedicated servers.

Public Cloud leads the market due to its affordability, scalability, and ease of access. Startups are drawn to public cloud platforms because they offer rapid deployment, minimal upfront investment, and access to a wide range of tools and integrations. Public cloud solutions also support remote work and global collaboration, which are common traits in today’s startup environment. Major providers like AWS, Microsoft Azure, and Google Cloud offer startup-friendly packages, making this deployment model highly attractive and widely adopted.

Hybrid Cloud follows as the second most dominant model. It offers a balance between the scalability of public cloud and the control of private environments. Growth-stage startups, especially those in regulated industries or handling sensitive customer data, often adopt hybrid solutions to meet compliance requirements while maintaining operational flexibility. However, hybrid models can be more complex and costly to implement and manage, limiting their use to startups with specific needs or greater technical resources.

Private Cloud ranks third, appealing to startups with heightened security concerns or those operating in sectors with strict data governance regulations, such as healthcare or fintech. While private clouds provide greater control and customization, they also demand more in terms of infrastructure and IT expertise, which many early-stage startups lack. As a result, adoption is typically limited to well-funded or technically sophisticated startups.

Dedicated Servers are the least dominant deployment model in startup manager software market. They involve significant capital expenditure, require in-house technical support, and lack the scalability and flexibility of cloud-based alternatives. Most startups avoid this model unless they have highly specialized performance or security needs that cannot be met through cloud solutions. The trend toward digital transformation and cloud-native applications continues to marginalize dedicated servers in the startup software landscape.

Segmentation Insights by Pricing Model

On the basis of pricing model, the global startup manager software market is bifurcated into subscription-based pricing, one-time purchase, freemium model, and pay-per-use.

Subscription-Based Pricing leads the startup manager software market because it offers predictable, recurring costs and access to continuous updates and support. Startups benefit from the ability to choose plans that suit their team size and feature requirements, often starting with a lower-tier plan and upgrading as they scale. This model also allows software providers to offer cloud-based services with ongoing value, making it a win-win for both vendors and customers.

Next is the Freemium Model, which is especially attractive to early-stage startups seeking to minimize upfront costs. This model allows users to access basic functionality for free and pay for premium features as their needs grow. It lowers the barrier to entry and encourages widespread adoption, giving startups the opportunity to test software before committing financially. Many popular startup tools, particularly in project management and collaboration, have successfully leveraged this model.

Pay-per-Use comes third, offering a more granular and usage-based pricing structure. This model is ideal for startups with fluctuating workloads or seasonal operations, allowing them to pay only for what they use. While it provides flexibility, the unpredictability of costs can be a drawback, making it less common than subscriptions or freemium tiers.

Lastly, the One-Time Purchase model is the least dominant. Although it may appeal to startups that prefer capital expenditures over operational expenses, it lacks the flexibility and scalability needed for fast-growing businesses. This model often comes with limitations in terms of updates, support, and cloud access—critical features for modern startups—making it a less popular choice in today’s SaaS-dominated market.

Startup Manager Software Market: Regional Insights

- North America is expected to dominates the global market

North America dominates the startup manager software market, benefiting from its advanced technological infrastructure and a high concentration of key industry players. The region experiences strong demand across diverse sectors such as healthcare, finance, and automotive, driving continuous innovation in software capabilities. The United States plays a crucial role, with significant investments in research and development contributing to the region’s leadership and ongoing expansion.

Europe holds a substantial share in the startup manager software market, bolstered by strict regulatory frameworks and increasing attention to sustainability. Countries like Germany, France, and the United Kingdom are spearheading growth, leveraging their industrial maturity and favorable policy environments. The region’s commitment to digital transformation and eco-friendly solutions continues to foster the adoption of sophisticated software platforms.

Asia Pacific is the fastest-growing region in the startup manager software market, supported by rapid urbanization, growing industrial bases, and expanding digital ecosystems. Key markets such as China, India, and Japan are witnessing increased software adoption due to economic growth, government initiatives, and rising demand from small and medium enterprises. The region’s competitive pricing and innovation-focused landscape further enhance its appeal.

Latin America shows moderate growth in the startup manager software market, with momentum driven by modernization efforts in countries like Brazil and Mexico. Increasing digital transformation across sectors such as retail and logistics is contributing to the uptake of advanced software tools. However, economic volatility and infrastructural limitations remain challenges that could restrict more accelerated market expansion.

Middle East and Africa are emerging as new frontiers for the startup manager software market, with growing interest from countries like the United Arab Emirates, Saudi Arabia, South Africa, and Nigeria. The regions are gradually investing in digital technologies as part of broader diversification strategies. While demand is increasing, progress is still uneven due to disparities in technological readiness and access to capital.

Startup Manager Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the startup manager software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global startup manager software market include:

- Systweak Software

- MacPaw

- Piriform

- Corel Corporation

- IObit

- Nir Soft

- Codestuff

The global startup manager software market is segmented as follows:

By Type of Software

- Cloud-based Solutions

- On-premise Solutions

- Mobile Applications

- Hybrid Solutions

By Functionality

- Project Management

- Team Collaboration

- Time Tracking

- Financial Management

- Customer Relationship Management (CRM)

- Reporting and Analytics

By Target Audience

- Startups in Early Stage

- Growth Stage Startups

- Established Startups

- Industry-Specific Startups (e.g.

- Tech

- Health

- Retail)

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Dedicated Servers

By Pricing Model

- Subscription-Based Pricing

- One-Time Purchase

- Freemium Model

- Pay-per-Use

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Startup Manager Software

Request Sample

Startup Manager Software