Stationary Beveling Machine Market Size, Share, and Trends Analysis Report

CAGR :

| Market Size 2023 (Base Year) | USD 59.42 Billion |

| Market Size 2032 (Forecast Year) | USD 111.65 Billion |

| CAGR | 7.26% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Stationary Beveling Machine Market Insights

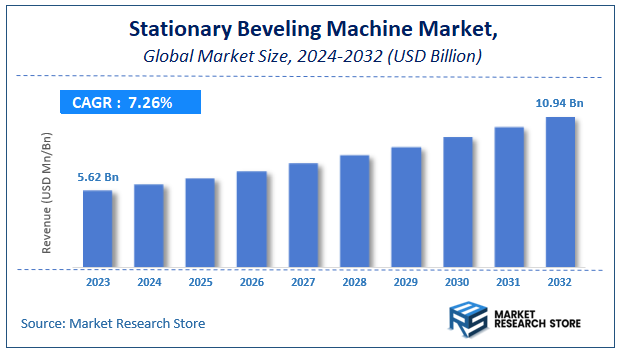

According to Market Research Store, the global stationary beveling machine market size was valued at around USD 59.42 billion in 2023 and is estimated to reach USD 111.65 billion by 2032, to register a CAGR of approximately 7.26% in terms of revenue during the forecast period 2024-2032.

The stationary beveling machine report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Stationary Beveling Machine Market: Overview

A stationary beveling machine is a specialized industrial tool used to create beveled edges on metal plates, pipes, or components while the material remains stationary during the operation. Unlike portable beveling machines, stationary models are typically mounted and used in fixed settings such as fabrication shops or production lines. These machines are crucial in industries where precise edge preparation is required before welding, as they enhance weld quality and reduce preparation time.

They work by clamping the metal workpiece and cutting a consistent bevel angle using rotating cutting tools or milling heads. Stationary beveling machines are commonly used for processing steel, stainless steel, aluminum, and other metals, particularly in shipbuilding, construction, heavy equipment manufacturing, and pipeline applications.

Key Highlights

- The stationary beveling machine market is anticipated to grow at a CAGR of 7.26% during the forecast period.

- The global stationary beveling machine market was estimated to be worth approximately USD 59.42 billion in 2023 and is projected to reach a value of USD 111.65 billion by 2032.

- The growth of the stationary beveling machine market is being driven by increased demand for automation in metal fabrication and the growing need for high-precision welding processes across various industries.

- Based on the type, the automatic beveling machines segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the metal fabrication segment is projected to swipe the largest market share.

- In terms of end-user, the manufacturing segment is expected to dominate the market.

- Based on the machine size, the medium-sized beveling machines segment is expected to dominate the market.

- On the basis of technology, the mechanical beveling technology segment is projected to swipe the largest market share.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Stationary Beveling Machine Market: Dynamics

Key Growth Drivers:

- Increasing Demand for Precision Welding: The need for accurate and consistent bevels for high-quality welding in various industries like shipbuilding, pressure vessel manufacturing, and construction is a primary driver. Proper beveling ensures strong and reliable welds.

- Growing Adoption in Metal Fabrication Industries: As metal fabrication activities increase globally to support infrastructure development and manufacturing, the demand for efficient beveling solutions like stationary machines rises.

- Focus on Automation and Efficiency: Stationary beveling machines often offer higher precision, speed, and automation capabilities compared to manual methods or portable beveling tools, driving adoption for increased productivity.

- Stringent Safety Regulations and Quality Standards: Industries are adhering to stricter safety regulations and quality standards for welded joints, making precise beveling a crucial step in the manufacturing process.

- Technological Advancements in Beveling Technology: Innovations in machine design, cutting tools, and control systems are leading to more efficient, versatile, and user-friendly stationary beveling machines.

Restraints:

- High Initial Investment Cost: Stationary beveling machines, especially those with advanced features and automation, can have a significant upfront investment cost, which might be a barrier for smaller enterprises.

- Space Requirements and Installation: These machines typically require dedicated floor space and proper installation, which can be a limitation for facilities with limited space or infrastructure.

- Limited Portability: Being stationary, these machines are not suitable for on-site beveling work or applications requiring movement of the beveling equipment to the workpiece.

- Requirement for Skilled Operators: Operating and maintaining stationary beveling machines often requires trained personnel, adding to the operational costs.

- Economic Downturns and Industrial Slowdown: Economic recessions or slowdowns in key industrial sectors can reduce capital expenditure on new machinery, including stationary beveling machines.

Opportunities:

- Integration with Automated Production Lines: The increasing trend towards automated manufacturing processes creates opportunities for integrating stationary beveling machines with robotic arms and other automated equipment for seamless production.

- Development of Multi-Functional Machines: There is a growing opportunity for stationary machines that can perform multiple beveling angles and processes, increasing their versatility and value proposition.

- Catering to Specialized Beveling Needs: Developing machines tailored for specific materials (e.g., high-strength steel, aluminum) or complex bevel geometries can address niche market demands.

- Focus on Energy Efficiency and Sustainability: Designing and manufacturing more energy-efficient stationary beveling machines can appeal to environmentally conscious businesses and potentially reduce operational costs.

- Providing Comprehensive Service and Support: Offering robust after-sales service, training, and spare parts can enhance customer satisfaction and create opportunities for long-term relationships.

Challenges:

- Competition from Portable Beveling Tools: Portable beveling machines offer greater flexibility and lower initial costs, posing a competitive challenge to stationary machines for certain applications.

- Ensuring Precision and Consistency Over Time: Maintaining the accuracy and consistency of bevels produced by stationary machines over extended periods of operation requires regular maintenance and calibration.

- Adapting to Diverse Material Properties: Beveling different types of metals and alloys with varying hardness and thickness can be challenging and may require specific tooling and machine adjustments.

- Meeting Evolving Industry Standards: Stationary beveling machine manufacturers need to continuously adapt their machines to meet changing industry standards and customer requirements.

- Integrating Advanced Control Systems: Implementing and troubleshooting sophisticated CNC and automated control systems in stationary beveling machines can be complex and require specialized expertise.

Stationary Beveling Machine Market: Report Scope

This report thoroughly analyzes the stationary beveling machine market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Stationary Beveling Machine Market |

| Market Size in 2023 | USD 59.42 Billion |

| Market Forecast in 2032 | USD 111.65 Billion |

| Growth Rate | CAGR of 7.26% |

| Number of Pages | 150 |

| Key Companies Covered | Protem, CS Unitec, Promotech, Euroboor, H & M, DWT GmbH, Steelmax, JET Tools, SAAR USA |

| Segments Covered | By Type, By Application, By End-User, By Machine Size, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Stationary Beveling Machine Market: Segmentation Insights

The global stationary beveling machine market is divided by type, application, end-user, machine size, technology, and region.

Segmentation Insights by Type

Based on type, the global stationary beveling machine market is divided into manual beveling machines, automatic beveling machines, electric beveling machines, pneumatic beveling machines, and hydraulic beveling machines.

In the stationary beveling machine market, automatic beveling machines stand out as the most dominant segment. Their dominance is primarily driven by increased demand for precision, efficiency, and reduced labor costs across industrial sectors such as shipbuilding, automotive, and heavy machinery. Automatic beveling machines offer consistent and high-speed performance, making them highly desirable for high-volume production lines. Their ability to reduce manual error and ensure uniform edge preparation makes them the preferred choice in modern manufacturing environments.

Manual beveling machines follow closely behind, primarily due to their affordability, simplicity, and versatility in small-scale or customized applications. These machines are favored in workshops and by small and medium enterprises (SMEs) where flexibility and lower capital investment are prioritized over automation. Despite being labor-intensive, they remain widely used due to their straightforward operation and lower maintenance costs.

Electric beveling machines are gaining traction as a convenient and portable solution for many users. Their electric motors eliminate the need for compressed air or hydraulic systems, making them suitable for environments with limited infrastructure. These machines provide a balance between performance and portability, appealing to users who require decent productivity without the complexities of pneumatic or hydraulic systems.

Pneumatic beveling machines are typically chosen for environments that already utilize compressed air systems, such as heavy-duty fabrication shops. While they offer good power and durability, their usage is often limited by the requirement for air compressors, which adds to setup costs and complexity. As a result, they occupy a niche segment within the market.

Hydraulic beveling machines represent the least dominant segment due to their high cost, bulkiness, and specific application requirements. They are primarily used in industries dealing with extremely thick and tough materials where immense force is needed. Their use is limited to specialized heavy industrial settings, which restricts their broader market appeal and adoption.

Segmentation Insights by Application

On the basis of application, the global stationary beveling machine market is bifurcated into metal fabrication, shipbuilding, construction, aerospace, and automotive.

In terms of application, metal fabrication is the most dominant segment in the stationary beveling machine market. This dominance stems from the widespread use of beveling machines in metal processing tasks such as preparing edges for welding, removing burrs, and improving joint quality. The versatility of beveling machines in handling different metal types and thicknesses makes them essential equipment in fabrication shops and manufacturing units, especially where high-quality welds are required.

Shipbuilding is the next most significant application area, where stationary beveling machines are critical for processing large steel plates and structural components. Given the demanding nature of marine construction and the need for precise edge preparation in thick, corrosion-resistant materials, beveling machines contribute greatly to welding accuracy and structural integrity. Their role is particularly vital in shipyards focused on producing commercial vessels, military ships, and offshore platforms.

Construction also represents a sizable portion of the market, driven by the increasing need for prefabricated steel components in buildings, bridges, and infrastructure projects. Stationary beveling machines help ensure strong weld joints and reduce rework time in structural steel assembly, thereby supporting the growing adoption of modular and pre-engineered building systems.

Aerospace applications, though smaller in scale compared to others, rely heavily on precision and quality, especially when working with high-strength, lightweight alloys. Beveling machines are used to ensure high-tolerance joint preparation, which is crucial for aircraft safety and performance. However, the limited volume of production and high material costs in this sector make it a more specialized, less dominant market.

Automotive is the least dominant segment, as most beveling in automotive manufacturing is handled through integrated robotic systems or CNC machining processes. While stationary beveling machines are still used in some parts of the vehicle manufacturing and prototyping process, their role is comparatively minor due to the industry's high automation and standardized component requirements.

Segmentation Insights by End-User

Based on end-user, the global stationary beveling machine market is divided into manufacturing, construction, mining, oil & gas, and power generation.

In the stationary beveling machine market, manufacturing is the most dominant end-user segment. This is primarily because beveling machines are heavily utilized across various manufacturing sectors including metal fabrication, machinery production, and component assembly. These machines enable precise and efficient edge preparation, which is essential for welding, assembling, and finishing metal parts. The growing emphasis on automation, productivity, and quality control in manufacturing environments further strengthens the demand for stationary beveling machines.

Construction follows closely as a major end-user, especially with the rise of steel-intensive infrastructure and building projects. Beveling machines are widely used for preparing structural steel components, beams, and frames to ensure solid welds and structural stability. As construction companies increasingly turn to prefabrication and modular building systems, the need for efficient edge processing equipment like beveling machines continues to grow.

Mining also presents a significant market, albeit more niche, where beveling machines are used in the maintenance and fabrication of heavy-duty equipment and structural supports. Given the harsh working conditions and the demand for durable welds, especially in underground and open-pit mining operations, the role of beveling machines is critical in ensuring safety and equipment longevity.

Oil & gas is another important sector, where stationary beveling machines are essential for preparing pipes, tanks, and structural components used in drilling rigs, refineries, and offshore platforms. These applications demand high precision and safety, and beveling machines help ensure weld integrity under extreme pressures and corrosive environments. However, the market here is often tied to fluctuating oil prices and capital investments, which can impact demand variability.

Power generation represents the least dominant end-user segment. While beveling machines are used in the fabrication and maintenance of boilers, turbines, and pipelines, the relatively low frequency of new power plant construction—especially in traditional fossil fuel segments—limits consistent demand. Nevertheless, with the growth of renewable energy infrastructure and nuclear projects, there is potential for steady, if modest, use of beveling machines in this sector.

Segmentation Insights by Machine Size

On the basis of machine size, the global stationary beveling machine market is bifurcated into small beveling machines, medium-sized beveling machines, and larger industrial beveling machines.

In the stationary beveling machine market, medium-sized beveling machines represent the most dominant segment. These machines offer the optimal balance between power, precision, and versatility, making them ideal for a wide range of industrial applications, including metal fabrication, construction, and general manufacturing. Their ability to handle various materials and thicknesses while maintaining a compact enough footprint for workshop environments contributes to their broad adoption. Medium-sized machines are especially favored by mid-sized enterprises that require consistent performance without the space and investment demands of larger systems.

Small beveling machines are the next most significant segment, driven by demand from small workshops, repair facilities, and maintenance departments. These machines are typically more affordable, portable, and easier to operate, making them well-suited for light-duty applications, occasional use, or environments with limited space. While they may lack the power and processing speed of larger models, their convenience and lower cost make them a popular choice among smaller end-users and businesses focused on light fabrication.

Larger industrial beveling machines are the least dominant in terms of volume but are essential in heavy industries like shipbuilding, oil & gas, and large-scale infrastructure. These machines are designed for high-capacity, continuous use and can handle extremely thick and hard materials with high precision. However, their size, complexity, and cost restrict them to large industrial facilities with specific heavy-duty processing needs. As such, their market share is limited compared to the more flexible and broadly applicable medium-sized units.

Segmentation Insights by Technology

On the basis of technology, the global stationary beveling machine market is bifurcated into traditional beveling methods, laser beveling technology, plasma beveling technology, waterjet beveling technology, and mechanical beveling technology.

In the stationary beveling machine market, mechanical beveling technology is the most dominant segment. This traditional yet evolving method involves using rotary cutters or milling heads to create precise bevels on metal edges. Mechanical beveling is favored for its reliability, ability to handle a wide range of materials and thicknesses, and suitability for both standard and complex bevel geometries. Its cost-effectiveness, minimal setup requirements, and widespread familiarity in the industry have secured its leading position, especially in sectors like metal fabrication and construction.

Traditional beveling methods, which include manual grinding or torch-based techniques, come next in terms of market share. These methods are still widely used in small workshops and low-budget operations due to their low equipment cost and simplicity. However, they are labor-intensive, less precise, and generate more waste and inconsistencies compared to modern technologies, which limits their appeal in high-precision or large-scale applications.

Plasma beveling technology ranks next, offering a high-speed solution for cutting and beveling thick metals. This technology is particularly beneficial in industries that work with carbon steel or other conductive metals. Its high cutting speed and automation potential make it appealing for medium to large manufacturing operations, though the initial investment and operating costs are higher than mechanical systems, limiting its adoption to more capital-intensive environments.

Laser beveling technology is gaining momentum due to its unparalleled precision, minimal heat distortion, and ability to process complex shapes. It is especially valuable in the aerospace and automotive sectors where tight tolerances are critical. Despite these advantages, laser beveling remains less dominant due to high equipment costs, maintenance complexity, and material limitations (e.g., reflective metals like aluminum).

Waterjet beveling technology is the least dominant segment, used mainly in niche applications requiring cold cutting without thermal impact. This makes it ideal for heat-sensitive materials and applications where metallurgical integrity must be preserved. However, waterjet systems are expensive, slower, and generate high operational costs due to abrasive use and water handling requirements, which limits their widespread adoption.

Stationary Beveling Machine Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific region is the most dominant in the stationary beveling machine market. This is largely attributed to rapid industrialization, especially in countries like China, India, and Japan, where demand for precision metal processing equipment is high. The booming construction and infrastructure sectors, combined with strong manufacturing output and increased adoption of automation, have significantly driven the need for stationary beveling machines. The region’s competitive manufacturing landscape and cost-effective production capabilities further consolidate its leading position.

The North American market holds a significant share, with the United States acting as the key contributor. The region's mature industrial base, particularly in sectors like aerospace, automotive, and energy, continues to drive demand for high-performance metal processing tools. The emphasis on production efficiency, technological innovation, and stringent quality standards supports the use of advanced beveling machines in both OEM and aftermarket applications.

The European market also plays an important role in the global stationary beveling machine landscape. Countries such as Germany, France, and Italy contribute heavily due to their strong manufacturing sectors and focus on precision engineering. Stringent safety regulations and environmental standards further push the adoption of advanced, automated beveling equipment to maintain compliance and improve productivity.

The Latin American market is developing steadily, with growing investments in infrastructure, manufacturing, and energy driving gradual demand. While the region is not yet a major player, emerging economies like Brazil and Mexico are beginning to recognize the value of automation and efficiency in metalworking processes, creating opportunities for expansion in the coming years.

The Middle East & Africa region holds the smallest market share, with growth primarily concentrated around infrastructure development and the oil & gas industry. Although political instability and limited access to advanced manufacturing technologies pose challenges, ongoing diversification efforts and infrastructure investments may spur incremental market growth over time.

Stationary Beveling Machine Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the stationary beveling machine market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global stationary beveling machine market include:

- Protem

- CS Unitec

- Promotech

- Euroboor

- H & M

- DWT GmbH

- Steelmax

- JET Tools

- SAAR USA

The global stationary beveling machine market is segmented as follows:

By Type

- Manual Beveling Machines

- Automatic Beveling Machines

- Electric Beveling Machines

- Pneumatic Beveling Machines

- Hydraulic Beveling Machines

By Application

- Metal Fabrication

- Shipbuilding

- Construction

- Aerospace

- Automotive

By End-User

- Manufacturing

- Construction

- Mining

- Oil and Gas

- Power Generation

By Machine Size

- Small Beveling Machines

- Medium-sized Beveling Machines

- Larger Industrial Beveling Machines

By Technology

- Traditional Beveling Methods

- Laser Beveling Technology

- Plasma Beveling Technology

- Waterjet Beveling Technology

- Mechanical Beveling Technology

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Stationary Beveling Machine

Request Sample

Stationary Beveling Machine