Switchgear And Switchboard Apparatus Market Size, Share, and Trends Analysis Report

CAGR :

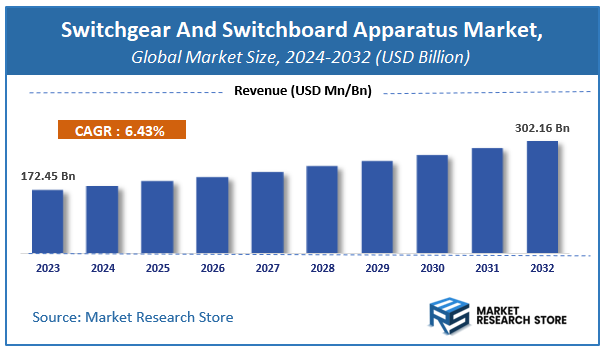

| Market Size 2023 (Base Year) | USD 172.45 Billion |

| Market Size 2032 (Forecast Year) | USD 302.16 Billion |

| CAGR | 6.43% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Switchgear And Switchboard Apparatus Market Insights

According to Market Research Store, the global switchgear and switchboard apparatus market size was valued at around USD 172.45 billion in 2023 and is estimated to reach USD 302.16 billion by 2032, to register a CAGR of approximately 6.43% in terms of revenue during the forecast period 2024-2032.

The switchgear and switchboard apparatus report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Switchgear and Switchboard Apparatus Market: Overview

Switchgear and switchboard apparatus are critical components in electrical power systems, used to control, protect, and distribute electricity. Switchgear includes devices like circuit breakers, fuses, and relays, which manage power flow and prevent damage from electrical faults, typically in medium to high-voltage applications. Switchboards are panel-based systems that distribute power to different circuits, often at lower voltages, and include switches, meters, and monitoring equipment for efficient energy management.

The global switchgear and switchboard apparatus market is growing due to rising electricity demand, infrastructure upgrades, and the expansion of renewable energy systems. Key factors driving demand include urbanization, industrial automation, and the need for reliable power distribution. The market is segmented by voltage level, insulation type, and application across utilities, industries, and commercial sectors. With increasing investments in smart grids and sustainable energy solutions, the market is projected to see steady growth in the coming years.

Key Highlights

- The switchgear and switchboard apparatus market is anticipated to grow at a CAGR of 6.43% during the forecast period.

- The global switchgear and switchboard apparatus market was estimated to be worth approximately USD 172.45 billion in 2023 and is projected to reach a value of USD 302.16 billion by 2032.

- The market is projected to grow at a significant rate due to increasing electricity demand, grid modernization, renewable energy integration, and industrial expansion.

- Based on the type of equipment, the circuit breakers segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of voltage level, the low voltage (up to 1 kV) segment is anticipated to command the largest market share.

- In terms of installation type, the indoor switchgear and switchboard segment is projected to lead the global market.

- By end-use, the utilities segment is predicted to dominate the global market.

- Based on the component type, the switching components segment is expected to swipe the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Switchgear and Switchboard Apparatus Market: Dynamics

Key Growth Drivers

- Increasing Demand for Electricity & Energy Infrastructure Development: The fundamental driver is the ever-growing global demand for electricity, fueled by population growth, urbanization, and industrialization. This necessitates continuous expansion and upgrading of power generation, transmission, and distribution (T&D) networks, directly driving the need for new switchgear and switchboard installations. India, with its rapidly growing economy and ambitious infrastructure projects, is a prime example of this driver.

- Integration of Renewable Energy Sources: The global shift towards renewable energy (solar, wind, hydro) requires sophisticated switchgear and switchboard apparatus to efficiently integrate intermittent power sources into the grid. Smart switchgear is crucial for managing the bidirectional power flow and ensuring grid stability with a higher penetration of renewables. India's significant investments in solar and wind power are directly boosting this segment.

- Modernization and Upgradation of Aging Grid Infrastructure: Many existing electrical grids, particularly in developed economies, are aging and inefficient. There's a strong global push to modernize these grids with advanced switchgear that offers better reliability, safety, and smart functionalities to prevent outages and improve power quality.

- Growth in Industrial Automation and Commercial/Residential Construction: The Industry 4.0 revolution and the increasing adoption of automation across manufacturing sectors (e.g., automotive, pharmaceuticals, FMCG) in India and globally require robust and reliable electrical control systems, including switchgear and switchboards, to ensure continuous and efficient operation of machinery.

- Focus on Energy Efficiency and Safety Standards: Increasing awareness and stringent regulations regarding energy efficiency and electrical safety are driving demand for advanced switchgear that offers better protection, reduced energy losses, and enhanced monitoring capabilities.

Restraints

- High Initial Installation and Maintenance Costs: Advanced switchgear and switchboard apparatus, especially those with smart features and higher voltage ratings, can involve significant upfront investment. Furthermore, the specialized nature of these systems often leads to higher maintenance and servicing costs, which can be a barrier for smaller enterprises or those with limited budgets, particularly in price-sensitive markets.

- Complex Regulatory and Compliance Requirements: The electrical equipment industry is heavily regulated, with stringent safety standards, environmental norms, and local grid codes. Adhering to these diverse and evolving regulations across different regions can be complex, time-consuming, and add to manufacturing and deployment costs.

- Volatility in Raw Material Prices and Supply Chain Disruptions: The manufacturing of switchgear and switchboard apparatus relies on key raw materials like copper, aluminum, steel, and various electronic components. Fluctuations in the prices of these commodities, coupled with potential global supply chain disruptions (as seen during recent global events), can impact production costs, lead times, and overall profitability.

- Integration Challenges with Legacy Infrastructure: While modernization is a driver, the sheer scale of existing legacy electrical infrastructure can pose significant challenges for seamless integration of new, technologically advanced switchgear. Compatibility issues and the need for extensive retrofitting can delay projects and increase costs.

- Skill Gap in Installation and Maintenance: The complexity of modern switchgear, particularly smart and digital variants, requires a skilled workforce for proper installation, commissioning, operation, and maintenance. A shortage of such qualified personnel can hinder adoption and efficient utilization.

Opportunities

- Development of Smart and Digital Switchgear: The ongoing digital transformation of power grids presents a significant opportunity for smart switchgear that offers real-time monitoring, predictive maintenance, remote control, and advanced fault detection. This aligns with global smart grid initiatives, including those in India.

- Microgrids and Distributed Energy Resources (DERs): The proliferation of microgrids and DERs (like rooftop solar, battery storage) at local levels creates a new demand for compact, intelligent, and flexible switchgear solutions to manage localized power generation and consumption.

- Expansion of Electrified Transportation (EV Charging Infrastructure): The rapid growth of electric vehicles (EVs) and the associated development of extensive charging infrastructure necessitate reliable and efficient power distribution, driving demand for specialized switchgear and switchboard solutions for EV charging stations.

- Switchgear-as-a-Service (SaaS) and Predictive Maintenance: The shift towards service-based models and the adoption of IoT-enabled devices can create opportunities for vendors to offer switchgear as a service, including predictive maintenance solutions, reducing operational burden for end-users.

- Sustainable and Eco-Friendly Switchgear Solutions: The increasing focus on environmental sustainability drives demand for gas-insulated switchgear (GIS) with lower global warming potential (GWP) gases (e.g., SF6 alternatives), air-insulated switchgear (AIS) in indoor settings, and other eco-friendly designs.

- Growth in Developing Economies (Specific to India/Asia-Pacific): The robust economic growth, massive infrastructure investments, and rapid urbanization in countries like India (e.g., Smart Cities Mission, makes in India initiatives) create immense opportunities for the switchgear and switchboard apparatus market, particularly in the medium and low voltage segments.

Challenges

- Cybersecurity Risks in Smart Switchgear: As switchgear becomes more digital and connected (part of the Industrial Internet of Things - IIoT), it becomes vulnerable to cyberattacks, posing a significant challenge for data security and grid stability. Ensuring robust cybersecurity measures is paramount.

- Technological Obsolescence and Rapid Innovation: The rapid pace of technological advancements in power electronics, digital controls, and communication technologies means that existing switchgear designs can quickly become outdated. Manufacturers face the challenge of continuous R&D and managing product lifecycles.

- Pricing Pressure from Competition: The market is highly competitive, especially in the low and medium voltage segments. This intense competition often leads to pricing pressure, impacting profit margins for manufacturers and suppliers.

- Ensuring Reliability and Durability in Harsh Environments: Switchgear often operates in demanding industrial environments, extreme weather conditions, or remote locations. Ensuring long-term reliability, durability, and resistance to environmental factors is a constant engineering challenge.

- Land Acquisition and Grid Expansion Challenges: For large-scale T&D projects that require new substations and associated switchgear, challenges related to land acquisition, environmental clearances, and public opposition can significantly delay projects in countries like India.

Switchgear And Switchboard Apparatus Market: Report Scope

This report thoroughly analyzes the Switchgear And Switchboard Apparatus Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Switchgear And Switchboard Apparatus Market |

| Market Size in 2023 | USD 172.45 Billion |

| Market Forecast in 2032 | USD 302.16 Billion |

| Growth Rate | CAGR of 6.43% |

| Number of Pages | 150 |

| Key Companies Covered | China XD Electric, ABB, General Electric, Siemens, Schneider Electric, Eaton Corporation, Mitsubishi Electric, Hitachi, Legrand, Hyundai Electric, Fuji Electric, Toshiba |

| Segments Covered | By Type of Equipment, By Voltage Level, By Installation Type, By End-Use, By Component Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Switchgear and Switchboard Apparatus Market: Segmentation Insights

The global switchgear and switchboard apparatus market is segmented based on type of equipment, voltage level, installation type, end-use, component type, and region.

Segmentation Insights by Type of Equipment

Based on Type of Equipment, the global switchgear and switchboard apparatus market is divided into circuit breakers, switchgears, relay and protection devices, fuse gear, transfer switches, electrical panels.

In the switchgear and switchboard apparatus market, circuit breakers represent the most dominant segment. Their critical role in protecting electrical systems from overloads, short circuits, and other faults makes them indispensable across industrial, commercial, and residential applications. With growing infrastructure development, rising power demand, and increasing focus on grid reliability and safety, circuit breakers are widely adopted due to their ability to interrupt high fault currents quickly and safely.

Following closely are switchgears, which serve as essential components for controlling, protecting, and isolating electrical equipment. They are used extensively in substations, industrial plants, and renewable energy installations. Switchgears help ensure system stability and reliability, and the trend toward smart grids and automation has further fueled demand for advanced switchgear systems, especially those that support real-time monitoring and diagnostics.

Electrical panels come next, acting as central hubs that distribute power to various circuits in a system. These panels are crucial in both residential and commercial buildings and are increasingly integrated with digital controls and energy management systems. With modernization of infrastructure and increased construction activity, the demand for advanced and modular panels is steadily rising.

Relay and protection devices are vital for detecting abnormal electrical conditions and triggering protective actions such as circuit isolation. While not as visible as breakers or switchgears, they play a crucial role in system safety and automation, especially in high-voltage transmission networks and industrial settings. Their adoption is growing with the need for smarter, more responsive electrical protection systems.

Transfer switches are slightly less dominant but essential for managing power continuity between main and backup sources, especially in sectors where power reliability is critical such as healthcare, data centers, and manufacturing. As the use of backup generators and renewable energy sources increases, so does the relevance of automated transfer switches.

Finally, fuse gear represents the least dominant segment. Although still used for basic overcurrent protection, fuses are gradually being replaced by circuit breakers in many applications due to their single-use nature and lack of remote reset capabilities. However, fuse gear remains relevant in specific low-cost, low-maintenance, or compact applications.

Segmentation Insights by Voltage Level,

On the basis of Voltage Level, the global switchgear and switchboard apparatus market is bifurcated into low voltage (up to 1 kV), medium voltage (1 kV - 36 kV), high voltage (above 36 kV).

In the switchgear and switchboard apparatus market, the low voltage (up to 1 kV) segment is the most dominant by voltage level. This dominance is driven by the widespread use of low voltage equipment in residential, commercial, and light industrial applications. Low voltage switchgear is essential for building power distribution, machinery control, and infrastructure projects, offering ease of installation, cost-efficiency, and safety. The rise in urbanization, construction, and smart building technologies continues to fuel demand in this segment.

Medium voltage (1 kV – 36 kV) follows as the second most significant segment. Medium voltage switchgear is crucial in industrial facilities, utility substations, and renewable energy integration where higher capacity and more robust protection are needed. It offers a balance between performance and cost, making it suitable for grid distribution networks and large infrastructure projects. As countries invest in modernizing electrical grids and expanding power access, medium voltage systems are seeing steady growth.

High voltage (above 36 kV) switchgear, while the least dominant in terms of volume, plays a critical role in transmission networks and large-scale industrial operations. These systems are designed for long-distance power transfer and are essential in national grid operations and high-capacity substations. Although their adoption is limited compared to low and medium voltage systems, high voltage equipment sees significant investment in regions expanding their transmission infrastructure and integrating renewable energy at a grid scale.

Segmentation Insights by Installation Type

In terms of Installation Type, the global switchgear and switchboard apparatus market is categorized into indoor switchgear and switchboard, outdoor switchgear and switchboard.

In the switchgear and switchboard apparatus market, indoor switchgear and switchboard is the most dominant segment by installation type. This dominance is largely driven by the demand in residential, commercial, and industrial facilities where space constraints, environmental protection, and accessibility are key factors. Indoor switchgear is typically used in buildings, factories, data centers, and commercial complexes where controlled environments help ensure safety, reduce maintenance needs, and extend equipment life. The trend toward smart buildings and integrated energy systems has further accelerated the use of compact, modular indoor solutions.

Outdoor switchgear and switchboard installations, while less dominant, are essential for applications where equipment must withstand harsh environmental conditions—such as in substations, utilities, renewable energy farms, and remote industrial sites. Outdoor systems are designed with weatherproof enclosures and enhanced insulation to handle moisture, dust, temperature extremes, and UV exposure. They play a crucial role in transmission and distribution networks, especially in rural or large-scale infrastructure projects.

Segmentation Insights by End-Use

Based on End-Use, the global switchgear and switchboard apparatus market is split into power generation, construction, manufacturing, utilities, transportation, commercial buildings.

Utilities represent the most dominant end-use segment in the switchgear and switchboard apparatus market. Utilities are responsible for the generation, transmission, and distribution of electricity, and rely heavily on switchgear to protect and control the electrical grid. The need for high reliability, grid stability, and expanding electrification in both developed and developing regions continues to drive significant investment in utility-scale switchgear and switchboard systems.

Power generation follows closely, particularly in thermal, hydro, nuclear, and renewable energy plants. Switchgear is essential for isolating faults, controlling output, and ensuring safety during maintenance. As global energy demand grows and countries integrate more renewable sources, power plants require advanced switchgear for efficient energy dispatch and grid connection.

The manufacturing sector is another major end-user, utilizing switchgear for machinery operation, process control, and facility power management. Modern factories rely on automated and reliable electrical systems, and as industries increasingly adopt smart manufacturing technologies, demand for intelligent and modular switchgear continues to rise.

Construction ranks next, driven by the development of residential complexes, commercial real estate, and infrastructure projects. Temporary and permanent electrical distribution systems on construction sites require compact, safe, and easily deployable switchgear solutions. Urbanization and smart city initiatives further fuel this demand.

Commercial buildings, including office complexes, malls, and institutions, depend on switchgear to ensure safe and efficient power distribution. Though smaller in scale compared to utilities or industrial plants, the growing emphasis on energy efficiency, smart metering, and building automation systems is boosting demand in this segment.

Lastly, transportation including railways, airports, and metro systems—represents the least dominant but still significant segment. Switchgear in this sector ensures safe power supply to critical infrastructure and operational systems. Electrification of rail networks and upgrades in airport infrastructure are slowly increasing demand, but overall market share remains comparatively lower.

Segmentation Insights by Component Type

By Component Type, the global switchgear and switchboard apparatus market is divided into control components, protection components, insulators, switching components, connectors and terminals.

Switching components are the most dominant by component type in the switchgear and switchboard apparatus market. These include circuit breakers, disconnectors, and switches—critical elements that control the flow of electricity and isolate faults. Their essential role in managing power distribution and ensuring system reliability across all voltage levels makes them the backbone of any switchgear setup. With the rise of smart grids and increased demand for automation and real-time control, the use of advanced switching technologies is rapidly expanding.

Protection components follow as the next key segment. These include relays, fuses, and protective devices designed to detect faults and prevent equipment damage or safety hazards. As electrical systems grow in complexity, especially in industrial and utility settings, the need for fast, accurate protection mechanisms becomes more vital, driving steady demand for these components.

Control components come next, encompassing items like control switches, monitoring devices, and communication modules. These components enable the operation, automation, and remote management of switchgear systems. As industries shift toward digitalization and smart infrastructure, the importance of control components is rising, particularly in facilities integrating IoT and energy management platforms.

Connectors and terminals are also crucial, though less dominant. They ensure secure and efficient electrical connections between components, supporting system integrity and safety. While not as visible as other components, they are essential for performance reliability, especially in modular or compact switchgear designs.

Insulators represent the least dominant segment. These components provide electrical isolation between conductive parts to prevent short circuits and ensure user safety. Although critical to system safety and performance, insulators typically do not drive purchasing decisions or technological innovation to the same extent as active components like switches or relays.

Switchgear and Switchboard Apparatus Market: Regional Insights

- Asia Pacific is expected to dominate the global market

The global switchgear and switchboard apparatus market demonstrates distinct regional dynamics, with Asia-Pacific (APAC) emerging as the undisputed leader in terms of market share and technological adoption. APAC's dominance is particularly evident in China, which commands over 60% of the regional market, driven by massive state-led investments in ultra-high voltage transmission networks and renewable energy integration projects. The country's ongoing grid modernization program, valued at approximately $300 billion, focuses on deploying smart grid technologies and enhancing transmission capacity to support its energy transition goals.

India represents the second-largest market within APAC, with its growth fueled by ambitious rural electrification programs and large-scale renewable energy installations. The Indian government's commitment to establishing 500 GW of renewable capacity by 2030 has spurred significant investments in transmission infrastructure, including substation upgrades and new switching stations. Japan and South Korea maintain strong positions in the high-tech segment, specializing in compact, gas-insulated switchgear solutions for urban applications and critical infrastructure.

North America maintains its position as the second-largest regional market, characterized by substantial investments in grid resilience and modernization. The United States accounts for the majority of regional demand, with particular growth in the industrial and commercial sectors. The country's aging electrical infrastructure, with an estimated 70% of transformers and switches exceeding 25 years of service life, has created a robust replacement market. Canada's market shows steady growth, particularly in provinces with active oil sands operations and renewable energy projects.

Europe's market is distinguished by its rapid transition toward environmentally friendly switchgear technologies. The European Union's stringent regulations on SF6 gas emissions have accelerated the adoption of alternative insulation technologies, particularly in Germany and Scandinavia. The region's focus on offshore wind energy development has driven demand for specialized switchgear capable of handling high-voltage direct current transmission. France and the UK are leading markets for digital substation technologies, integrating advanced monitoring and control systems into their transmission networks.

The Middle East exhibits strong growth potential, particularly in Gulf Cooperation Council countries where large-scale infrastructure projects and energy diversification initiatives are underway. Saudi Arabia's NEOM project and the UAE's clean energy initiatives are creating substantial demand for high-voltage switchgear solutions. Africa's market remains in development, with South Africa and Egypt showing the most significant activity in transmission infrastructure upgrades.

Latin America presents a mixed landscape, with Brazil dominating the regional market through investments in hydroelectric and wind power infrastructure. Mexico's growing manufacturing sector and energy reforms are driving demand for industrial-grade switchgear, while Chile's renewable energy boom is creating opportunities for transmission and distribution equipment suppliers.

Switchgear and Switchboard Apparatus Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the switchgear and switchboard apparatus market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global switchgear and switchboard apparatus market include:

- China XD Electric

- ABB

- General Electric

- Siemens

- Schneider Electric

- Eaton Corporation

- Mitsubishi Electric

- Hitachi

- Legrand

- Hyundai Electric

- Fuji Electric

- Toshiba

The global switchgear and switchboard apparatus market is segmented as follows:

By Type of Equipment

- Circuit Breakers

- Switchgears

- Relay and Protection Devices

- Fuse Gear

- Transfer Switches

- Electrical Panels

By Voltage Level

- Low Voltage (up to 1 kV)

- Medium Voltage (1 kV - 36 kV)

- High Voltage (above 36 kV)

By Installation Type

- Indoor Switchgear and Switchboard

- Outdoor Switchgear and Switchboard

By End-Use

- Power Generation

- Construction

- Manufacturing

- Utilities

- Transportation

- Commercial Buildings

By Component Type

- Control Components

- Protection Components

- Insulators

- Switching Components

- Connectors and Terminals

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Switchgear And Switchboard Apparatus

Request Sample

Switchgear And Switchboard Apparatus