Telepresence Suites Market Size, Share, and Trends Analysis Report

CAGR :

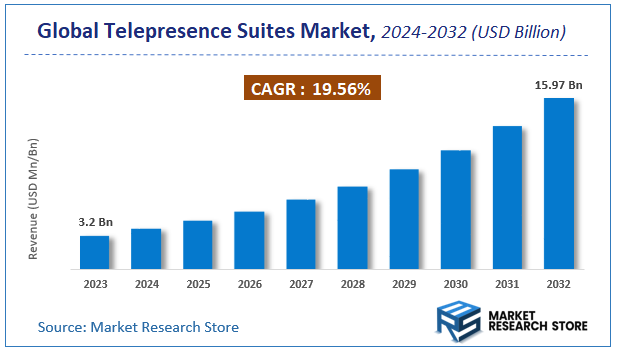

| Market Size 2023 (Base Year) | USD 3.2 Billion |

| Market Size 2032 (Forecast Year) | USD 15.97 Billion |

| CAGR | 19.56% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Telepresence Suites Market Insights

According to Market Research Store, the global telepresence suites market size was valued at around USD 3.2 billion in 2023 and is estimated to reach USD 15.97 billion by 2032, to register a CAGR of approximately 19.56% in terms of revenue during the forecast period 2024-2032.

The telepresence suites report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Telepresence Suites Market: Overview

Telepresence suites are advanced conferencing environments designed to deliver immersive, high-definition, real-time virtual communication experiences that closely mimic in-person meetings. These suites typically include large display screens, high-fidelity audio systems, multiple cameras, and strategically placed microphones arranged within a dedicated room to create a lifelike sense of eye contact, spatial audio, and presence. Unlike standard video conferencing setups, telepresence suites aim for a seamless and natural interaction by ensuring consistent lighting, sound quality, and visual angles across all participating locations.

The growth of telepresence suites is driven by the increasing demand for high-quality remote collaboration, especially among multinational corporations, government agencies, and large enterprises. As globalization and hybrid work models expand, organizations seek efficient ways to conduct cross-border meetings, reduce travel costs, and maintain high engagement levels in remote communication. Technological advancements in video compression, network optimization, and cloud-based collaboration platforms have made telepresence solutions more accessible and scalable. Additionally, the rising emphasis on sustainability and reducing carbon footprints has encouraged companies to invest in telepresence systems as an alternative to frequent business travel, contributing to their continued adoption across diverse industries.

Key Highlights

- The telepresence suites market is anticipated to grow at a CAGR of 19.56% during the forecast period.

- The global telepresence suites market was estimated to be worth approximately USD 3.2 billion in 2023 and is projected to reach a value of USD 15.97 billion by 2032.

- The growth of the telepresence suites market is being driven by the increasing adoption of remote and hybrid work models globally.

- Based on the type, the static telepresence segment is growing at a high rate and is projected to dominate the market.

- On the basis of component, the hardware segment is projected to swipe the largest market share.

- In terms of deployment model, the cloud-based segment is expected to dominate the market.

- Based on the enterprise size, the small & medium enterprises (SMES) segment is expected to dominate the market.

- Based on the application, the healthcare segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Telepresence Suites Market: Dynamics

Key Growth Drivers:

- Global Shift Towards Hybrid Work Models: The widespread adoption of hybrid work, where employees split their time between the office and remote locations, is a primary driver. Companies need sophisticated solutions that can seamlessly connect in-office and remote teams, making telepresence suites attractive for high-stakes meetings and collaborative sessions.

- Need for Enhanced Collaboration Across Geographies: As businesses become more globalized, the need for effective communication and collaboration across widely dispersed teams and international partners increases. Telepresence suites bridge geographical distances by providing a highly realistic virtual meeting environment, fostering stronger relationships and faster decision-making.

- Reduction in Business Travel Costs and Carbon Footprint: Companies are increasingly looking to reduce travel expenses and their environmental impact. Telepresence suites offer a compelling alternative to frequent business travel, providing a high-quality interaction experience without the associated costs, time, and carbon emissions.

- Technological Advancements in Audiovisual and AI: Continuous innovation in high-definition video (4K and beyond), spatial audio, AI-powered features (e.g., real-time language translation, intelligent framing, noise cancellation), and seamless integration with collaboration platforms (e.g., Microsoft Teams, Zoom Rooms) significantly enhances the user experience and drives adoption.

- Rising Demand in Specific High-Value Verticals: healthcare for remote consultations, surgical guidance, medical training, and multi-disciplinary team meetings (telemedicine). Education For distance learning, collaborative research, and virtual classrooms, providing a more engaging experience than standard video calls.

- Focus on Employee Engagement and Productivity: Organizations recognize that highly immersive collaboration tools can boost employee engagement, improve communication clarity, and enhance productivity by minimizing misunderstandings and fostering a sense of shared presence.

- Increasing Investment in Digital Infrastructure: Expanding global internet penetration, the rollout of 5G networks, and advancements in edge computing are providing the necessary high-bandwidth and low-latency infrastructure required for optimal telepresence suite performance.

Restraints:

- High Initial Investment and Total Cost of Ownership (TCO): Telepresence suites require significant upfront capital expenditure for specialized hardware, dedicated room setup, and network infrastructure. Ongoing maintenance, IT support, and potentially high bandwidth costs contribute to a considerable TCO, making them prohibitive for many small and medium-sized enterprises (SMEs).

- Complexity of Installation, Integration, and Maintenance: Setting up a telepresence suite involves complex audiovisual integration, network configuration, and calibration to achieve the desired immersive effect. This requires specialized technical expertise and can be challenging to maintain, especially across multiple global locations.

- Interoperability Issues Between Different Vendors: While improvements have been made, achieving seamless "telepresence-to-telepresence" communication between systems from different manufacturers can still be challenging, often forcing organizations into proprietary ecosystems.

- Bandwidth Requirements: Telepresence suites demand substantial and stable bandwidth to deliver high-definition video and audio without latency or quality degradation. This can be a limiting factor in regions with underdeveloped network infrastructure or for organizations with constrained IT budgets.

- User Familiarity and Adoption Challenges: Despite their benefits, some users may find the dedicated nature and specific protocols of telepresence suites less flexible or intuitive compared to the ubiquitous "click-to-join" ease of standard video conferencing platforms.

- Perceived Overkill for Routine Meetings: For many daily internal meetings or casual check-ins, the advanced features and cost of a telepresence suite might be considered excessive, with more basic video conferencing solutions being "good enough."

- Cybersecurity and Data Privacy Concerns: As these systems handle sensitive corporate communications and personal data, ensuring robust cybersecurity measures and compliance with data privacy regulations is paramount, and any breach could significantly erode trust.

Opportunities:

- Emergence of 3D Holographic Telepresence: The development of more advanced 3D holographic telepresence technologies promises an even more realistic and immersive experience, creating opportunities for high-value applications in fields like remote surgery, virtual product demonstrations, and cutting-edge education.

- Hybrid Telepresence Models and Smaller Form Factors: Innovating to create more flexible, scalable, and potentially cloud-based hybrid telepresence solutions that don't require dedicated, purpose-built rooms, or offering more compact and affordable personal telepresence devices, can broaden the market reach to SMEs and individual executives.

- Deeper AI and XR (Extended Reality) Integration: Further leveraging AI for features like behavioral analytics, sentiment analysis, real-time avatar representation, and integrating AR/VR elements into telepresence experiences can create entirely new forms of immersive collaboration.

- Expansion in Untapped Geographies and Industries: As digital transformation accelerates in emerging economies and new industries recognize the value of immersive collaboration (e.g., high-end design, remote cultural experiences), there are opportunities for market penetration.

- Focus on Sustainability and ESG Goals: Positioning telepresence as a sustainable alternative to business travel aligns with corporate environmental, social, and governance (ESG) goals, potentially driving adoption among environmentally conscious organizations.

- Managed Telepresence Services: The complexity of these systems creates an opportunity for service providers to offer fully managed telepresence solutions, handling installation, maintenance, and technical support, thereby lowering the barrier to entry for end-users.

- Strategic Partnerships and Ecosystem Development: Collaborations between telepresence vendors, IT service providers, cloud providers, and specialized content creators can lead to integrated solutions and value-added services.

Challenges:

- Competition from Feature-Rich Standard Video Conferencing: The rapid evolution of standard video conferencing platforms (Zoom, Microsoft Teams, Google Meet) which continuously add high-quality video, advanced audio, and collaboration features at a much lower cost, presents a significant competitive challenge to the premium telepresence suite market.

- Ensuring ROI and Demonstrating Tangible Benefits: A key challenge is to clearly demonstrate a compelling return on investment (ROI) for such a high-cost solution, especially when compared to more affordable alternatives. Quantifying benefits like improved decision-making, faster innovation, and stronger relationships can be difficult.

- Managing User Experience Consistency Across Diverse Environments: Ensuring a consistent and high-quality telepresence experience across different user locations, network conditions, and hardware configurations remains a significant technical and logistical challenge.

- Talent Acquisition and Training: The specialized nature of telepresence technology requires skilled IT and AV professionals for deployment, management, and troubleshooting. Finding and retaining this talent can be a challenge.

- Evolving User Expectations: As consumers become accustomed to highly sophisticated digital interactions, telepresence vendors must constantly innovate to meet and exceed these evolving expectations for realism, immersion, and ease of use.

- Security Vulnerabilities in a Highly Connected Ecosystem: As telepresence suites integrate more deeply with corporate networks, cloud services, and potentially AI-driven functionalities, managing and mitigating an expanding attack surface for cyber threats becomes increasingly complex.

- Ethical Considerations of Hyper-Realism: As telepresence approaches hyper-realism (e.g., with holography), ethical considerations around privacy, data manipulation, and the potential for "deepfakes" in a professional context may emerge, requiring careful navigation by vendors.

Telepresence Suites Market: Report Scope

This report thoroughly analyzes the Telepresence Suites Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Telepresence Suites Market |

| Market Size in 2023 | USD 3.2 Billion |

| Market Forecast in 2032 | USD 15.97 Billion |

| Growth Rate | CAGR of 19.56% |

| Number of Pages | 140 |

| Key Companies Covered | Array Telepresence Inc.,Avaya Inc.,Cisco Systems Inc.,Huawei Technologies Co. Ltd.,Lifesize Inc.,Microsoft Corporation,Polycom Inc.,Teliris Inc.,VGO Communications Inc.,Vidyo Inc.,ZTE Corp. |

| Segments Covered | By Type, By Component, By Deployment Model, By Enterprise Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Telepresence Suites Market: Segmentation Insights

The global telepresence suites market is divided by type, component, deployment model, enterprise size, application, and region.

Segmentation Insights by Type

Based on type, the global telepresence suites market is divided into static telepresence, remote telepresence systems, immersive telepresence, and personal telepresence.

Static Telepresence dominates the Telepresence Suites Market due to its superior performance, immersive experience, and widespread use in enterprise and government environments. These systems are typically installed in fixed locations such as executive boardrooms, high-level conference halls, and multinational corporate offices. Their setup includes large high-definition displays, multiple cameras, directional microphones, and integrated acoustics to simulate in-person interactions. Static telepresence is preferred for its reliability, consistent video and audio quality, and secure communication channels, especially in industries like finance, legal, and defense where confidentiality is crucial. The segment continues to hold a leading share due to growing demand for premium video conferencing infrastructure in formal, recurring business communications.

Remote Telepresence Systems are gaining rapid traction as organizations embrace hybrid and distributed work models. These solutions offer the flexibility to connect participants from remote locations using software-based platforms accessible on desktops, laptops, and mobile devices. While more cost-effective and scalable than static systems, remote telepresence often sacrifices some quality and stability in favor of convenience. It finds strong adoption in IT, education, consulting, and freelance sectors, where users prioritize mobility and fast deployment over high-end infrastructure.

Immersive Telepresence integrates emerging technologies such as virtual reality (VR) and augmented reality (AR) to create 3D, interactive meeting experiences. Though still at a nascent stage, this segment is poised for future growth as costs decline and VR/AR adoption increases. Immersive telepresence has applications in training, simulation, healthcare, and collaborative design—enabling participants to interact with digital content in shared virtual environments. However, its high equipment cost and technical complexity currently limit large-scale adoption.

Personal Telepresence caters to individual professionals and small teams by offering compact, affordable systems that maintain decent audio-visual quality. These systems are ideal for home offices and freelancers, often using plug-and-play cameras and microphones that work seamlessly with video conferencing platforms like Zoom and Teams. Personal telepresence is growing steadily, especially among startups and remote workers, though it typically lacks the robustness and presence of static telepresence setups.

Segmentation Insights by Component

On the basis of component, the global telepresence suites market is bifurcated into hardware, software, and services.

Hardware is the core component segment of the Telepresence Suites Market and contributes the dominate revenue share. This includes high-definition displays, cameras, microphones, speakers, codecs, and room-based integration systems. Hardware forms the backbone of telepresence installations, particularly in static and immersive setups where advanced audiovisual quality is essential. The increasing demand for seamless and lifelike communication, especially in corporate boardrooms, healthcare consultations, and international meetings, continues to drive investments in high-end telepresence hardware. Additionally, the shift toward 4K and 8K displays, AI-powered cameras, and spatial audio systems further supports the dominance of the hardware segment.

Software plays a critical role in enabling the functionality and interoperability of telepresence systems. It includes video conferencing platforms, content-sharing tools, virtual collaboration environments, and security encryption software. As enterprises increasingly adopt cloud-based solutions, the software segment is seeing notable growth. Advanced software allows integration with enterprise resource planning (ERP), customer relationship management (CRM), and other productivity tools, making telepresence suites more efficient and collaborative. Moreover, AI-driven features such as automated transcription, real-time translation, and background noise suppression are enhancing user experience and driving further software adoption.

Services encompass installation, maintenance, technical support, and managed services offered by vendors and third-party providers. As telepresence systems become more sophisticated, organizations often rely on service providers for setup, customization, user training, and ongoing performance optimization. Services are especially important for large-scale deployments in education, government, and multinational enterprises, where system uptime and operational continuity are critical. Additionally, the trend toward outsourcing telepresence infrastructure management is boosting demand for end-to-end managed services.

Segmentation Insights by Deployment Model

On the basis of deployment model, the global telepresence suites market is bifurcated into cloud-based and on-premise.

Cloud-based deployment is currently the dominant model in the Telepresence Suites Market, propelled by its affordability, ease of deployment, and alignment with the increasing demand for remote collaboration and flexible workplace environments. This model allows users to access telepresence services over the internet without the need for substantial investments in physical infrastructure. It is particularly advantageous for small and medium-sized enterprises (SMEs) and remote teams that require real-time, high-quality video conferencing but lack the budget or IT resources for full on-premise installations. The growing adoption of hybrid work models, global collaboration, and increasing emphasis on virtual business continuity planning are all contributing to the expansion of cloud-based telepresence solutions. Moreover, features such as automatic software updates, integration with productivity tools, and robust cybersecurity protocols further enhance the appeal of cloud deployments.

On-premise deployment refers to telepresence systems installed and operated within an organization’s internal IT infrastructure. This model is preferred by large enterprises, government bodies, and sectors like healthcare and finance that prioritize data control, security, and compliance. On-premise solutions provide greater customization, high performance with minimal latency, and complete ownership of system configurations. Although this model involves higher upfront capital investment and maintenance costs, it is often considered essential for mission-critical operations or environments with strict data residency requirements. The continued reliance on dedicated infrastructure in sensitive or highly regulated industries ensures that on-premise deployments remain relevant despite the growing trend toward cloud adoption.

Segmentation Insights by Enterprise Size

On the basis of enterprise size, the global telepresence suites market is bifurcated into small & medium enterprises (SMEs) and large enterprises.

Small & Medium Enterprises (SMEs) are currently the dominant segment in the Telepresence Suites Market. This dominance is primarily driven by the increasing need among SMEs to adopt efficient, affordable, and scalable communication tools to stay competitive in a digitally evolving global market. With the rising adoption of hybrid and remote work models, SMEs are seeking advanced collaboration platforms that offer high-quality audio and video capabilities without the heavy infrastructure investment required by traditional systems. Cloud-based and subscription-based telepresence suites are especially attractive to this group because they minimize upfront costs, reduce the need for in-house IT management, and allow rapid deployment. The flexibility to scale up or down based on changing operational requirements further strengthens the appeal of telepresence for SMEs. Moreover, startups and technology-driven small businesses are leveraging these systems for internal team collaboration, client interactions, investor meetings, and cross-border engagements, fueling their market leadership.

Large Enterprises, while still an important segment, are seeing slower growth compared to SMEs due to saturation and shifting priorities. These enterprises have long been early adopters of high-end telepresence systems, often investing in immersive, room-based suites with advanced features, including life-size HD visuals, multi-screen setups, and secure network integration. These systems are crucial in sectors like banking, government, legal, and healthcare, where secure and high-quality communication is non-negotiable. However, the trend among large corporations is now moving toward unified communication systems that consolidate telepresence with other digital collaboration tools, such as team chat, document sharing, and real-time editing. This consolidation reduces reliance on standalone telepresence systems and encourages integration into broader enterprise communication ecosystems.

Segmentation Insights by Application

On the basis of application, the global telepresence suites market is bifurcated into healthcare, commercial, manufacturing, education, government & defense, and media & entertainment.

Healthcare dominates the Telepresence Suites Market, primarily due to the rising demand for advanced remote communication tools that enable virtual consultations, diagnostics, and multidisciplinary coordination. Healthcare providers increasingly utilize telepresence suites to bridge gaps in accessibility, particularly in rural or underserved regions where specialists are scarce. These suites are employed for patient monitoring, post-operative care, and chronic disease management, enhancing clinical outcomes. Additionally, hospitals and research institutions integrate telepresence systems for virtual training, live surgeries, and knowledge exchange among global experts. The COVID-19 pandemic played a pivotal role in accelerating this adoption, and with ongoing digital transformation in healthcare, the reliance on immersive, real-time communication platforms continues to grow.

Commercial applications form a significant portion of the market, driven by globalization and the shift toward hybrid and remote work environments. Enterprises use telepresence suites for board meetings, international collaborations, strategic planning, and client interactions. The systems offer cost savings by minimizing business travel and improving the efficiency of real-time communication. Industries such as banking, consulting, law, and IT particularly benefit from these solutions, as they require frequent, high-stakes communication across geographically dispersed teams and stakeholders. The demand is further supported by the integration of telepresence with collaboration platforms and enterprise resource planning (ERP) systems.

Manufacturing sector adoption of telepresence suites is increasing due to the need for real-time operational coordination between different facilities and global supply chain partners. Engineers, designers, and production managers use telepresence to inspect equipment remotely, review prototypes, and address issues without physical presence on-site. This not only reduces downtime but also accelerates decision-making. For companies operating across multiple countries, telepresence supports lean manufacturing by enhancing visibility and control over distributed operations.

Education is leveraging telepresence technologies to redefine how learning is delivered. Schools, universities, and training institutes deploy these systems for distance learning, global classrooms, and virtual academic collaborations. Telepresence enhances student engagement, particularly in postgraduate and professional education where live interactions with international faculty and experts are highly valuable. Virtual labs, immersive workshops, and collaborative research projects are also made feasible with these advanced communication tools.

Government & Defense sectors require secure, real-time communication systems to support operations, intelligence sharing, and crisis management. Telepresence suites are implemented in defense command centers, disaster response teams, and international diplomatic missions. These tools facilitate encrypted, uninterrupted video conferencing for inter-departmental coordination, mission planning, and high-level governmental meetings. As national security and disaster preparedness increasingly depend on digital coordination, the demand for robust and secure telepresence systems grows.

Media & Entertainment industry benefits from telepresence in managing global creative teams, coordinating cross-border productions, and conducting virtual auditions or talent reviews. Content creators use these platforms to collaborate on storyboarding, post-production, and client presentations. As studios and agencies become more decentralized, telepresence ensures continuity in creative workflows and helps maintain production timelines, regardless of geographic barriers.

Telepresence Suites Market: Regional Insights

- North America is expected to dominate the global market

North America continues to dominate the Telepresence Suites Market, primarily driven by high enterprise IT spending and the rapid adoption of advanced communication technologies. The U.S. leads this trend with large-scale deployments across industries like healthcare (telemedicine), finance (virtual client meetings), education (remote learning), and government (digital public services). The growth is fueled by the shift toward hybrid and remote work models accelerated by the COVID-19 pandemic, alongside increasing demand for seamless, high-definition video conferencing and collaboration tools. The presence of global technology giants such as Cisco, Poly, and Microsoft enhances innovation in telepresence hardware and software. Additionally, investments in cloud infrastructure and AI-powered analytics improve user experience, offering features like real-time transcription, emotion detection, and meeting productivity tracking. However, cybersecurity and data privacy remain critical concerns, prompting adoption of secure end-to-end encrypted solutions.

Europe maintains a strong foothold with widespread telepresence adoption, especially in Western Europe, where digital transformation initiatives are prioritized to support post-pandemic workforce evolution. Germany, the UK, and France invest heavily in upgrading office environments with immersive telepresence suites to reduce travel costs and environmental impact. The European Union’s focus on sustainability policies encourages enterprises to embrace virtual collaboration as part of their carbon footprint reduction strategies. The region also sees growing telepresence use in education, facilitating remote lectures and international academic collaborations. Regulatory frameworks such as GDPR impact solution customization to ensure compliance with strict data protection laws. Furthermore, European companies show interest in integrating telepresence with augmented reality (AR) and virtual reality (VR) to create more interactive virtual environments.

Asia-Pacific is the fastest-growing market, with countries like China, Japan, South Korea, and India driving adoption due to expanding digital infrastructure, increased mobile and internet penetration, and large enterprises adopting global communication solutions. China’s booming tech industry and the government’s “Digital Silk Road” initiative support the development of smart cities, where telepresence suites are integral for remote monitoring and control operations. In India, the rise of IT outsourcing and startups, combined with governmental push for digital India programs, boosts demand in corporate and educational sectors. Japan and South Korea leverage high-speed internet and 5G networks to deploy advanced telepresence solutions for manufacturing and healthcare. Despite the rapid growth, challenges such as price sensitivity, varying technological maturity, and connectivity issues in rural areas remain.

Latin America is steadily increasing its telepresence adoption, with Brazil and Mexico leading due to improvements in internet connectivity and growing enterprise awareness of remote work benefits. The banking and telecommunications sectors are primary users, leveraging telepresence for client interactions and internal collaboration. Government agencies are also incorporating telepresence for public service delivery, especially in remote areas. However, economic instability and uneven broadband infrastructure in some countries restrict widespread deployment. International vendors are expanding their footprint in the region, tailoring solutions to meet cost and language preferences. Training and support services are emphasized to overcome resistance to new technology among traditional organizations.

Middle East and Africa are emerging markets for telepresence suites, where growth is concentrated in the UAE, Saudi Arabia, South Africa, and Egypt. The Middle East’s rapid urbanization, oil wealth, and government investments in smart infrastructure and digital governance projects fuel demand. Dubai and Riyadh are notable for hosting international business hubs that require advanced collaboration technologies. In Africa, the rising telecom sector and expanding IT services market underpin adoption, though challenges like power reliability and cybersecurity infrastructure need addressing. There is growing interest in telepresence in healthcare to overcome geographic barriers and improve specialist consultations. Regional companies are forming partnerships with global technology providers to customize solutions for local market needs, including multilingual support and flexible pricing models.

Telepresence Suites Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the telepresence suites market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global telepresence suites market include:

- Array Telepresence Inc.

- Avaya Inc.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Lifesize Inc.

- Microsoft Corporation

- Polycom Inc.

- Teliris Inc.

- VGO Communications Inc.

- Vidyo Inc.

- ZTE Corp.

The global telepresence suites market is segmented as follows:

By Type

- Static Telepresence

- Remote Telepresence Systems

- Immersive Telepresence

- Personal Telepresence

By Component

- Hardware

- Software

- Services

By Deployment Model

- Cloud-based

- On-premise

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Healthcare

- Commercial

- Manufacturing

- Education

- Government & Defense

- Media & Entertainment

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Telepresence Suites

Request Sample

Telepresence Suites