Tobacco Products Market Size, Share, and Trends Analysis Report

CAGR :

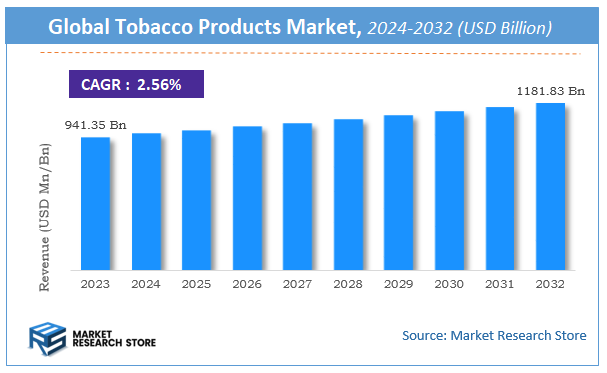

| Market Size 2023 (Base Year) | USD 941.35 Billion |

| Market Size 2032 (Forecast Year) | USD 1181.83 Billion |

| CAGR | 2.56% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Tobacco Products Market Insights

According to Market Research Store, the global tobacco products market size was valued at around USD 941.35 billion in 2023 and is estimated to reach USD 1181.83 billion by 2032, to register a CAGR of approximately 2.56% in terms of revenue during the forecast period 2024-2032.

The tobacco products report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Tobacco Products Market: Overview

Tobacco products are items made from the processed leaves of the tobacco plant and are primarily used for smoking, chewing, or snuffing. These products include cigarettes, cigars, pipe tobacco, chewing tobacco, snuff, and newer alternatives such as e-cigarettes and heated tobacco devices. The main psychoactive component in tobacco is nicotine, a substance known for its addictive properties. While traditional tobacco products are often combusted and inhaled, modern forms like e-cigarettes and smokeless tobacco offer alternative consumption methods that appeal to different demographics, particularly younger users. Despite global health concerns, tobacco remains widely consumed due to social habits, nicotine dependency, and marketing by manufacturers.

Key Highlights

- The tobacco products market is anticipated to grow at a CAGR of 2.56% during the forecast period.

- The global tobacco products market was estimated to be worth approximately USD 941.35 billion in 2023 and is projected to reach a value of USD 1181.83 billion by 2032.

- The growth of the tobacco products market is being driven by strong demand in emerging economies and innovation in product offerings.

- Based on the type, the virginia segment is growing at a high rate and is projected to dominate the market.

- On the basis of product type, the cigarettes segment is projected to swipe the largest market share.

- In terms of packaging type, the paper packaging segment is expected to dominate the market.

- Based on the distribution channel, the supermarkets segment is expected to dominate the market.

- In terms of end use, the smoking tobacco segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Tobacco Products Market: Dynamics

Key Growth Drivers:

- Growing Demand in Developing Economies: Rapid urbanization, rising disposable incomes, and population growth in countries like India, Indonesia, and Bangladesh are driving higher consumption of tobacco products.

- Product Innovation and Brand Diversification: Companies are expanding product lines with flavored tobacco, slim cigarettes, and heated tobacco products to attract younger consumers and retain brand loyalty.

- Strong Distribution and Retail Networks: Widespread availability of tobacco products through traditional and modern retail channels ensures market penetration even in remote areas.

- Cultural and Social Acceptance in Certain Regions: In many regions, especially parts of Asia and Eastern Europe, smoking is culturally ingrained and socially accepted, sustaining steady demand.

Restraints:

- Stringent Government Regulations and Bans: Increasing taxes, advertising bans, plain packaging laws, and smoking restrictions are making it more difficult for tobacco companies to market and sell their products.

- Rising Health Awareness: Consumers are becoming more conscious of the health risks associated with tobacco use, contributing to a decline in consumption, particularly in developed markets.

- Legal Actions and Anti-Tobacco Campaigns: Lawsuits and public health campaigns are intensifying, negatively impacting the brand image and market scope of tobacco products.

Opportunities:

- Expansion of Smokeless and Alternative Products: Products like snus, nicotine pouches, and heat-not-burn devices offer growth potential, especially among health-conscious consumers looking for alternatives to smoking.

- Digital Marketing and E-Commerce Growth: Online platforms offer new ways to reach and engage consumers, particularly in regions with limited physical retail infrastructure.

- Emerging Markets and Rural Penetration: Untapped rural areas and smaller towns in emerging countries present significant growth opportunities for traditional tobacco products.

- Cannabis-Infused and Herbal Tobacco Products: The increasing legalization of cannabis and interest in herbal blends open opportunities for innovation and new customer segments.

Challenges:

- Illicit Trade and Counterfeit Products: The black market for tobacco undermines legitimate sales, harms brand reputation, and results in significant revenue losses for manufacturers and governments.

- Sustainability and Environmental Pressures: The tobacco industry faces growing scrutiny over its environmental impact, including deforestation, water usage, and packaging waste.

- Changing Consumer Preferences: A shift towards wellness-oriented lifestyles and reduced interest in smoking among younger demographics challenge long-term market sustainability.

- Global Supply Chain Disruptions: Events such as pandemics, geopolitical conflicts, and trade barriers can disrupt the production and distribution of raw tobacco and finished products.

Tobacco Products Market: Report Scope

This report thoroughly analyzes the Tobacco Products Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Tobacco Products Market |

| Market Size in 2023 | USD 941.35 Billion |

| Market Forecast in 2032 | USD 1181.83 Billion |

| Growth Rate | CAGR of 2.56% |

| Number of Pages | 170 |

| Key Companies Covered | Philip Morris International Inc. (US) , Japan Tobacco International (Japan) , British American Tobacco PLC (UK) , Imperial Brands PLC (UK) , China National Tobacco Corporation (China) , Altria Group Inc. (US) , ITC Limited (India) , Korea Tobacco & Ginseng Corporation (South Korea) , Eastern Company SAE (Egypt) , Scandinavian Tobacco Group A/S (Denmark) , KT&G Corporation (South Korea) , Godfrey Phillips India Ltd. (India) , JTI-Macdonald Corp. (Canada) , Habanos S.A. (Cuba) , National Tobacco Corporation (Zimbabwe) , Nakhla Tobacco Company SAE (Egypt) , Vietnam National Tobacco Corporation (Vietnam) , Taiwan Tobacco & Liquor Corporation (Taiwan) , Universal Corporation (US) |

| Segments Covered | By Type, By Product Type, By Packaging Type, By Distribution Channel, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Tobacco Products Market: Segmentation Insights

The global tobacco products market is divided by type, product type, packaging type, distribution channel, end use, and region.

Segmentation Insights by Type

Based on type, the global tobacco products market is divided into virginia, burley, nicotina rustica, oriental, and others.

In the tobacco products market, Virginia tobacco holds the position as the most dominant segment by type. Also known as flue-cured tobacco, Virginia tobacco is widely favored for its bright, mild flavor and relatively high sugar content, making it the preferred choice for manufacturing cigarettes. Its versatility and widespread use in both traditional and blended tobacco products significantly contribute to its market dominance, especially in regions like North America, Europe, and parts of Asia.

Following Virginia, Burley tobacco is the second most prominent type. Known for its air-curing process, Burley tobacco has a light brown color and a dry, slightly bitter taste due to its low sugar content. It is commonly used in cigarette blends to balance sweetness and in some pipe and chewing tobacco products. Burley's high nicotine content and blending qualities ensure its strong position in the market.

Nicotiana rustica ranks next and is notable for its extremely high nicotine concentration—often several times higher than that of Virginia or Burley varieties. This makes it especially popular in regions such as Eastern Europe, South Asia, and parts of Africa, where it is used in traditional smokeless tobacco products and local smoking blends. Its limited cultivation and niche application make it less dominant globally but highly significant in specific markets.

Oriental tobacco, though less dominant overall, plays a key role in providing aromatic qualities to tobacco blends. Grown mainly in the Balkans and parts of the Middle East, Oriental tobacco is sun-cured and valued for its small leaves, low nicotine content, and unique aroma. It is primarily used as a flavor enhancer in premium cigarette blends, especially in European and Middle Eastern markets.

Segmentation Insights by Product Type

On the basis of product type, the global tobacco products market is bifurcated into cigar, cigarette, kretek, snuff, electronic cigarette, and others.

In the tobacco products market by product type, cigarettes are the most dominant segment. They account for the largest share due to their widespread global consumption, ease of use, and strong presence in both legal and illicit markets. Cigarettes are mass-produced and widely distributed, with billions sold annually, particularly in Asia-Pacific, Europe, and parts of Africa. Their popularity is reinforced by longstanding consumer habits and aggressive marketing in certain regions, despite growing health concerns and regulatory pressures.

Cigars follow as the second most dominant product type. Although consumed less frequently than cigarettes, cigars are associated with premium, luxury positioning and appeal to a niche yet high-spending demographic. They are especially popular in North America, Central America, and parts of Europe, where the tradition of hand-rolled cigars remains strong. Their higher price points and longer smoking experience contribute to their solid market presence.

Kretek, a clove-flavored cigarette native to Indonesia, is the third most significant segment. Predominantly consumed in Southeast Asia, particularly in Indonesia where it is deeply embedded in the culture, kretek combines tobacco and cloves for a distinctive aroma and flavor. While its global reach is limited compared to cigarettes and cigars, its dominance in specific markets makes it an important category.

Electronic cigarettes (e-cigarettes) are growing rapidly and now hold a notable position. They are seen as alternatives to traditional smoking, often marketed as harm-reduction tools. E-cigarettes are especially popular among younger consumers in North America, Europe, and parts of Asia due to the variety of flavors and perceived reduced health risks. Although they are not yet as dominant as traditional cigarettes, their increasing adoption is reshaping the tobacco landscape.

Snuff, a smokeless tobacco product consumed either nasally or orally, ranks lower in terms of global market share. Its usage is largely confined to specific regions, such as South Africa, Sweden (in the form of snus), and parts of South Asia. Despite its niche presence, snuff maintains a loyal user base and is seen as a less harmful alternative to smoking in some areas.

Segmentation Insights by Packaging Type

On the basis of packaging type, the global tobacco products market is bifurcated into paper, paper box, plastic, jute, and others.

In the tobacco products market, the paper packaging type stands as the most dominant. This is primarily due to its wide applicability, low cost, and ease of customization. Paper packaging is commonly used for cigarettes and cigars, where it is often used for wrapping and to create cigarette cartons and packs. Paper is favored for its ability to be printed with branding and regulatory information, making it the most popular choice for packaging in both developed and developing markets.

Following paper, paper box packaging ranks as the second most significant segment. This type is often used for premium cigars and high-end tobacco products, as it offers an aesthetic and protective benefit. Paper boxes are sturdy, allow for customization, and provide a premium feel, making them ideal for luxury products. They are also used in larger cigarette packs and multi-pack formats, providing extra durability and brand distinction.

Plastic packaging is another widely used option, particularly for smaller packs or certain smokeless tobacco products such as snuff or moist snuff. Plastic provides a moisture-resistant, durable, and lightweight solution, ideal for protecting products during transportation and storage. However, due to environmental concerns, the segment faces increasing scrutiny and may experience regulatory pressure, especially in regions with high environmental awareness.

Jute packaging, although less commonly used, holds niche appeal, particularly for specialty and artisanal tobacco products. Jute's eco-friendly appeal and its natural, rustic aesthetic make it an ideal choice for premium products marketed as environmentally conscious or organic. It is typically used for larger quantities or for products targeting a specific consumer base.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global tobacco products market is bifurcated into supermarkets, hypermarkets, e-commerce websites, and others.

Supermarkets dominate the distribution of tobacco products, particularly in regions where tobacco consumption is common and convenient retail access is highly valued. Supermarkets offer a broad range of tobacco products, such as cigarettes and cigars, making them a primary point of sale for many consumers. The advantage of supermarkets lies in their wide geographic presence and the ease with which consumers can pick up tobacco products while shopping for other items.

Hypermarkets are similar to supermarkets but on a larger scale, offering an even more extensive variety of tobacco products. These outlets cater to a diverse customer base, and their larger size allows for more comprehensive product displays and a broader selection. Hypermarkets are especially important in countries with large urban centers where consumers prefer large-scale retail outlets. Their prominence is significant in regions like North America, Europe, and parts of Asia.

E-commerce websites are an increasingly important channel in the tobacco products market, particularly as online shopping trends grow. While the sale of tobacco products online faces regulation and legal barriers in some countries, the convenience of online shopping, often paired with discreet delivery options, makes this channel an attractive option for consumers, especially in regions where brick-and-mortar stores may be limited or less convenient. The rise of e-commerce platforms specializing in tobacco and vape products has further cemented its role as a viable distribution channel.

Segmentation Insights by End Use

On the basis of end use, the global tobacco products market is bifurcated into smoking tobacco, smokeless tobacco, raw tobacco, and others.

Smoking Tobacco is by far the most dominant segment in the tobacco products market. This category includes products like cigarettes, cigars, and rolled tobacco, which are designed for smoking. The large-scale consumption of cigarettes worldwide keeps this segment at the forefront. Smoking tobacco products are widely distributed through numerous channels, from traditional retail outlets to e-commerce platforms, making it the most prevalent end use of tobacco globally. This segment continues to be the primary revenue generator for the tobacco industry.

Smokeless Tobacco comes next in terms of market share. This includes products such as snuff, chewing tobacco, and dip, which are consumed without being burned. Smokeless tobacco products are particularly popular in certain regions like North America, Scandinavia, and parts of Asia, where they serve as alternatives to smoking. The growing awareness of the potential health risks associated with smoking has driven some consumers toward smokeless tobacco as a less harmful option, although it still faces significant regulatory scrutiny in many regions.

Raw Tobacco includes unprocessed or minimally processed tobacco used primarily for making cigars, cigarettes, or other tobacco products. This segment is significant in regions where the tobacco industry is more fragmented, with a larger proportion of products being manufactured locally or domestically. While raw tobacco is crucial for production, it has a smaller consumer-facing market than smoking or smokeless tobacco products.

Tobacco Products Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific is the most dominant region in the global tobacco products market, primarily led by China and India. China alone accounts for a significant share of global consumption, driven by its massive population and the dominance of the China National Tobacco Corporation. The region shows strong demand for both traditional cigarettes and emerging alternatives such as heated tobacco products. Despite regulatory tightening and health campaigns, cultural acceptance and high consumption rates keep the market expanding steadily.

North America holds a substantial share in the global tobacco products market, with the United States being a major contributor. The market is characterized by a growing preference for smokeless and next-generation products like e-cigarettes and heated tobacco devices. This shift is driven by evolving consumer preferences, rising health consciousness, and strict regulations on combustible tobacco. Key players in the region are increasingly focused on innovative product portfolios to maintain market relevance.

Europe represents a mature market where traditional tobacco consumption is stabilizing, while alternative products are gaining ground. Regulatory pressures and anti-smoking campaigns have led to increased adoption of e-cigarettes and other reduced-risk products, especially in countries like Germany, the UK, and France. Market players are emphasizing product diversification and harm-reduction strategies to adapt to shifting demand patterns and regulatory environments.

Latin America is seeing modest but steady growth in tobacco product consumption, fueled by a young and urbanizing population. Brazil and Mexico lead the regional market with consistent demand for both conventional and alternative tobacco offerings. While economic instability and health regulations pose challenges, market development continues through retail expansion and product variety catering to diverse consumer bases.

Middle East and Africa show the lowest dominance in the global tobacco products market but still represent areas of potential growth. In the Middle East, social habits contribute to the popularity of water pipes and cigarettes. In Africa, rising population and disposable incomes are increasing tobacco use. However, both subregions are facing growing regulatory efforts and awareness campaigns, which are beginning to influence consumer behavior and slow down the rate of growth.

Recent Developments:

- In February 2023, Scandinavian Tobacco Group A/S acquired Alec Bradley Cigar Distributors Inc. and its associated companies, aiming to expand its product portfolio and enhance its position in the cigar market.

Tobacco Products Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the tobacco products market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global tobacco products market include:

- Philip Morris International Inc. (US)

- Japan Tobacco International (Japan)

- British American Tobacco PLC (UK)

- Imperial Brands PLC (UK)

- China National Tobacco Corporation (China)

- Altria Group Inc. (US)

- ITC Limited (India)

- Korea Tobacco & Ginseng Corporation (South Korea)

- Eastern Company SAE (Egypt)

- Scandinavian Tobacco Group A/S (Denmark)

- KT&G Corporation (South Korea)

- Godfrey Phillips India Ltd. (India)

- JTI-Macdonald Corp. (Canada)

- Habanos S.A. (Cuba)

- National Tobacco Corporation (Zimbabwe)

- Nakhla Tobacco Company SAE (Egypt)

- Vietnam National Tobacco Corporation (Vietnam)

- Taiwan Tobacco & Liquor Corporation (Taiwan)

- Universal Corporation (US)

The global tobacco products market is segmented as follows:

By Type

- Virginia

- Burley

- Nicotina Rustica

- Oriental

- Others

By Product Type

- Cigar

- Cigarette

- Kretek

- Snuff

- Electronic cigarette

- Others

By Packaging Type

- Paper

- Paper Box

- Plastic

- Jute

- Others

By Distribution Channel

- Supermarkets

- Hypermarkets

- E-commerce websites

- Others

By End Use

- Smoking Tobacco

- Smokeless Tobacco

- Raw Tobacco

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Tobacco Products

Request Sample

Tobacco Products