TPEE in Consumer Products Market Size, Share, and Trends Analysis Report

CAGR :

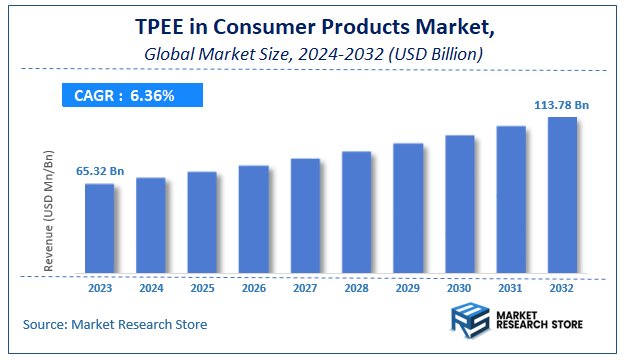

| Market Size 2023 (Base Year) | USD 65.32 Billion |

| Market Size 2032 (Forecast Year) | USD 113.78 Billion |

| CAGR | 6.36% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

TPEE in Consumer Products Market Insights

According to Market Research Store, the global TPEE in consumer products market size was valued at around USD 65.32 billion in 2023 and is estimated to reach USD 113.78 billion by 2032, to register a CAGR of approximately 6.36% in terms of revenue during the forecast period 2024-2032.

The TPEE in consumer products report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global TPEE in Consumer Products Market: Overview

Thermoplastic Polyester Elastomer (TPEE) is a versatile polymer that plays a significant role in the consumer products market due to its unique blend of flexibility, strength, and durability. Unlike traditional elastomers, TPEE combines the elastic properties of rubber with the processing ease of thermoplastics, allowing for the manufacture of lightweight, durable, and highly resilient products. Its excellent resistance to abrasion, chemicals, and high temperatures makes it suitable for a wide range of applications, including footwear soles, sports equipment, flexible tubing, electronic device casings, and automotive interior parts. The ability of TPEE to maintain performance under harsh conditions enhances product longevity, making it a preferred material for manufacturers focused on quality and durability.

Key Highlights

- The TPEE in consumer products market is anticipated to grow at a CAGR of 6.36% during the forecast period.

- The global TPEE in consumer products market was estimated to be worth approximately USD 65.32 billion in 2023 and is projected to reach a value of USD 113.78 billion by 2032.

- The growth of the TPEE in consumer products market is being driven by increasing consumer demand for high-performance, sustainable, and recyclable materials.

- Based on the product type, the injection molding segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the consumer goods segment is projected to swipe the largest market share.

- In terms of end-user, the footwear segment is expected to dominate the market.

- Based on the distribution channel, the specialty stores segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

TPEE in Consumer Products Market: Dynamics

Key Growth Drivers:

- High Performance and Durability: TPEE offers excellent flexibility, chemical resistance, and thermal stability, making it ideal for durable consumer products like footwear, electronics, and sports equipment.

- Sustainability and Recyclability: Being a thermoplastic elastomer, TPEE can be melted and reprocessed multiple times, aligning with growing environmental regulations and consumer preference for eco-friendly materials.

- Rising Demand in Automotive and Electronics: Increasing production of lightweight, flexible components in automotive interiors and electronic devices boosts TPEE consumption due to its mechanical strength and design versatility.

Restraints:

- High Raw Material Costs: The price of polyester-based raw materials can be volatile and higher compared to some conventional plastics, limiting cost-sensitive applications.

- Competition from Alternative Materials: Other elastomers like TPU and TPE, which may offer lower costs or different property balances, can limit TPEE’s market share in certain segments.

Opportunities:

- Growing Sports and Footwear Industry: Expansion of these industries, especially in emerging economies, presents opportunities for TPEE use in durable, lightweight soles and flexible components.

- Innovations in Sustainable Manufacturing: Advances in bio-based and recycled TPEE variants could unlock new markets focused on green consumer products.

- Expansion in Emerging Markets: Rising disposable income and industrialization in regions like Asia Pacific and Latin America offer strong growth potential for TPEE in consumer goods.

Challenges:

- Processing Complexity: TPEE requires precise processing conditions and equipment, which may increase production costs and complexity for some manufacturers.

- Market Awareness: Limited awareness among small and medium manufacturers about the benefits and handling of TPEE can slow its adoption.

- Regulatory and Compliance Issues: Navigating diverse environmental and safety regulations globally can pose challenges for manufacturers using TPEE in consumer products.

TPEE in Consumer Products Market: Report Scope

This report thoroughly analyzes the TPEE in Consumer Products Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | TPEE in Consumer Products Market |

| Market Size in 2023 | USD 65.32 Billion |

| Market Forecast in 2032 | USD 113.78 Billion |

| Growth Rate | CAGR of 6.36% |

| Number of Pages | 128 |

| Key Companies Covered | DowDuPont, DSM, Toyobo, Taiwan Changchun, Jiangyin Hetron, Celanese, SK Chemicals, LG Chem, SABIC, Mitsubishi Chemical, RadiciGroup, Eastman, Sichuan Sunplas |

| Segments Covered | By Product Type, By Application, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

TPEE in Consumer Products Market: Segmentation Insights

The global TPEE in consumer products market is divided by product type, application, end-user, distribution channel, and region.

Segmentation Insights by Product Type

Based on product type, the global TPEE in consumer products market is divided into injection molding, extrusion, blow molding, and others.

In the TPEE in consumer products market, Injection Molding stands out as the most dominant product type segment due to its versatility and ability to produce complex, high-precision parts with excellent surface finish. This process is widely used in manufacturing consumer goods such as electronic housings, automotive interior components, and durable sports equipment parts, where intricate designs and tight tolerances are required. Injection molding also allows for efficient mass production, making it ideal for high-volume applications that demand consistent quality and performance.

The Extrusion segment follows as a significant method, primarily used for producing continuous profiles such as tubing, films, and sheets. TPEE’s excellent flexibility and chemical resistance make extruded products suitable for flexible consumer goods like seals, protective covers, and cable jacketing. Extrusion enables the creation of long, uniform shapes efficiently and economically, catering to applications where durability and elasticity are essential.

Blow Molding occupies a smaller share in the TPEE consumer products market but is important for manufacturing hollow parts like containers, bottles, and flexible packaging components. Although TPEE is less commonly used in blow molding compared to other thermoplastics, its unique properties can offer benefits in specialized packaging applications that require toughness and flexibility.

Segmentation Insights by Application

On the basis of application, the global TPEE in consumer products market is bifurcated into automotive, consumer goods, industrial, electrical & electronics, and others.

In the TPEE in consumer products market, the Consumer Goods application segment is the most dominant, driven by the material’s excellent flexibility, durability, and aesthetic appeal. TPEE is widely used in products like footwear soles, sports equipment, household appliances, and personal care items, where comfort, resilience, and design versatility are essential. The growing demand for lightweight, high-performance, and sustainable consumer products continues to propel TPEE’s adoption in this segment.

Following consumer goods, the Automotive segment holds significant importance due to TPEE’s ability to withstand harsh environments while providing flexibility and strength. It is commonly used in automotive interiors, such as dashboards, seals, and trims, where durability and resistance to heat and chemicals are critical. The increasing focus on lightweight materials to improve fuel efficiency further boosts TPEE’s use in automotive applications.

The Electrical & Electronics segment is another key area where TPEE finds application in manufacturing durable and flexible components like cable jacketing, connectors, and protective housings. Its excellent insulation properties and resistance to abrasion and heat make it suitable for the demanding conditions of electronic devices.

The Industrial segment, while smaller than the above, utilizes TPEE for seals, gaskets, and flexible tubing in machinery and equipment, benefiting from the material’s chemical resistance and mechanical strength. Though niche compared to other segments, industrial applications contribute steadily to market growth.

Segmentation Insights by End-User

Based on end-user, the global TPEE in consumer products market is divided into household appliances, sporting goods, footwear, toys, and others.

In the TPEE in consumer products market, the Footwear end-user segment is the most dominant due to the material’s superior flexibility, durability, and comfort. TPEE is extensively used in manufacturing shoe soles, midsoles, and other footwear components that require excellent wear resistance and cushioning. The growing demand for lightweight, comfortable, and high-performance footwear, especially in athletic and casual shoes, drives strong adoption of TPEE in this segment.

The Sporting Goods segment follows closely, benefiting from TPEE’s toughness and elasticity, which make it ideal for equipment such as grips, protective gear, and flexible components used in sports and outdoor activities. The increasing participation in sports and fitness worldwide fuels demand for durable, lightweight materials, boosting TPEE’s presence in this sector.

The Household Appliances segment also holds a significant share, where TPEE is used in parts requiring resilience and flexibility, such as seals, handles, and protective casings. Its ability to withstand heat and chemicals makes it suitable for appliances that undergo frequent use and exposure to varying conditions.

The Toys segment utilizes TPEE for its safety, flexibility, and durability, making it a preferred material for manufacturing flexible and safe toy parts that can endure rough handling. Although smaller than footwear and sporting goods, the toy industry steadily contributes to the market growth.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global TPEE in consumer products market is bifurcated into online stores, supermarkets/hypermarkets, specialty stores, and others.

In the TPEE in consumer products market, Specialty Stores dominate as the primary distribution channel, primarily because they cater to specific industries like footwear, sporting goods, and electronics where TPEE-based products are highly specialized. These stores often provide expert guidance and a wide range of high-performance products, making them the preferred choice for consumers seeking quality and durability associated with TPEE materials.

Online Stores are rapidly gaining traction as a distribution channel due to the growing trend of e-commerce and the convenience it offers. The rise in digital shopping, especially for consumer goods like footwear, sporting equipment, and household appliances, supports increased availability of TPEE-based products. Online platforms allow manufacturers and brands to reach a broader audience, including emerging markets, and provide detailed product information that helps consumers make informed purchasing decisions.

Supermarkets and Hypermarkets represent a moderate share of the distribution channel for TPEE in consumer products, mainly because they typically focus on fast-moving consumer goods rather than specialized products requiring TPEE. However, with expanding product ranges in household appliances and some sporting goods, these retail formats contribute steadily to market access, particularly for mass-market consumer goods.

TPEE in Consumer Products Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific leads the TPEE in consumer products market due to rapid industrialization, expanding manufacturing capabilities, and rising consumer demand for innovative, durable goods. Key countries such as China, Japan, South Korea, and India drive growth with strong electronics, automotive, and footwear industries that extensively utilize TPEE for its flexibility and resilience. The growing focus on lightweight, high-performance materials in these sectors, coupled with urbanization and increasing disposable incomes, significantly boosts the consumption of consumer products made with TPEE.

North America holds a major share in the TPEE in consumer products market, supported by advanced manufacturing infrastructure and a high demand for premium, technologically advanced products. The region’s automotive, sports equipment, and electronics sectors heavily use TPEE to enhance product durability and performance. Additionally, strong trends toward sustainability and recyclable materials align well with TPEE’s properties, fostering wider adoption. Regulatory frameworks promoting eco-friendly solutions also contribute to steady market growth.

Europe represents an important market for TPEE in consumer products, driven by demand from automotive, footwear, and consumer electronics industries. High consumer awareness of quality and sustainability encourages manufacturers to incorporate TPEE, valued for its durability and recyclability. Leading countries like Germany, France, and Italy are key hubs for production where TPEE’s superior mechanical and thermal properties support consistent market expansion.

Latin America is witnessing moderate growth in the TPEE in consumer products market, fueled by the development of automotive and footwear sectors alongside increasing consumer expenditure. Though smaller than Asia Pacific, North America, and Europe, investments in manufacturing infrastructure and material innovation are advancing the market. Countries such as Brazil and Mexico benefit from economic growth and urbanization, which further stimulate demand for durable, lightweight TPEE-based consumer goods.

Middle East and Africa (MEA) currently holds the smallest share of the TPEE in consumer products market but offers potential for growth due to ongoing industrialization and infrastructure projects. Expansion in automotive and electronics sectors supports demand, although market penetration is constrained by economic and political challenges and lower consumer purchasing power. Increased awareness and investment in advanced polymers like TPEE are expected to open new opportunities in the region over time.

TPEE in Consumer Products Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the TPEE in consumer products market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global TPEE in consumer products market include:

- DowDuPont

- DSM

- Toyobo

- Taiwan Changchun

- Jiangyin Hetron

- Celanese

- SK Chemicals

- LG Chem

- SABIC

- Mitsubishi Chemical

- RadiciGroup

- Eastman

- Sichuan Sunplas

The global TPEE in consumer products market is segmented as follows:

By Product Type

- Injection Molding

- Extrusion

- Blow Molding

- Others

By Application

- Automotive

- Consumer Goods

- Industrial

- Electrical & Electronics

- Others

By End-User

- Household Appliances

- Sporting Goods

- Footwear

- Toys

- Others

By Distribution Channel

- Online Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

TPEE in Consumer Products

Request Sample

TPEE in Consumer Products