TPEE in Industrial Market Size, Share, and Trends Analysis Report

CAGR :

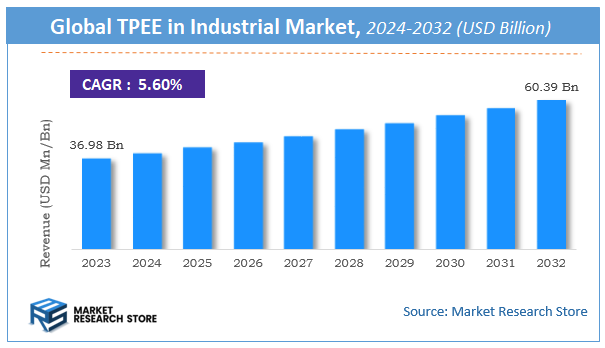

| Market Size 2023 (Base Year) | USD 36.98 Billion |

| Market Size 2032 (Forecast Year) | USD 60.39 Billion |

| CAGR | 5.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

TPEE in Industrial Market Insights

According to Market Research Store, the global TPEE in industrial market size was valued at around USD 36.98 billion in 2023 and is estimated to reach USD 60.39 billion by 2032, to register a CAGR of approximately 5.6% in terms of revenue during the forecast period 2024-2032.

The TPEE in industrial report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

TPEE in Industrial Market: Report Scope

This report thoroughly analyzes the TPEE in Industrial Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | TPEE in Industrial Market |

| Market Size in 2023 | USD 36.98 Billion |

| Market Forecast in 2032 | USD 60.39 Billion |

| Growth Rate | CAGR of 5.6% |

| Number of Pages | 163 |

| Key Companies Covered | DowDuPont, DSM, Toyobo, Taiwan Changchun, Jiangyin Hetron, Celanese, SK Chemicals, LG Chem, SABIC, Mitsubishi Chemical, RadiciGroup, Eastman, Sichuan Sunplas |

| Segments Covered | By Manufacturing Industry, By Construction Industry, By Energy Sector, By Transportation and Logistics, By Chemical Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global TPEE in Industrial Market: Overview

TPEE, or Thermoplastic Ether Ester, is a high-performance engineering plastic used in various industrial applications due to its superior properties. It combines the benefits of both thermoplastic elastomers and traditional engineering thermoplastics. TPEE offers excellent chemical resistance, high tensile strength, low moisture absorption, and exceptional dimensional stability, making it ideal for demanding environments. It is commonly used in industries such as automotive, electrical, electronics, and manufacturing for applications like connectors, hoses, gears, and bearings.

Key Highlights

- The TPEE in industrial market is anticipated to grow at a CAGR of 5.6% during the forecast period.

- The global TPEE in industrial market was estimated to be worth approximately USD 36.98 billion in 2023 and is projected to reach a value of USD 60.39 billion by 2032.

- The growth of the TPEE in industrial market is being driven by increasing demand in sectors like automotive for fuel-efficient and lightweight components, and the electrical industry for high-performance insulation materials.

- Based on the manufacturing industry, the automotive manufacturing segment is growing at a high rate and is projected to dominate the market.

- On the basis of construction industry, the residential construction segment is projected to swipe the largest market share.

- In terms of energy sector, the renewable energy segment is expected to dominate the market.

- Based on the transportation and logistics, the freight transportation segment is expected to dominate the market.

- In terms of chemical industry, the bulk chemicals segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

TPEE in Industrial Market: Dynamics

Key Growth Drivers:

- Increasing Demand for Lightweight Materials: TPEE's excellent combination of strength, flexibility, and lightness makes it ideal for automotive, aerospace, and industrial applications where weight reduction is crucial to performance and efficiency.

- Growing Automotive Industry Demand: TPEE is widely used in automotive components for applications such as connectors, fuel lines, and seals due to its durability and high resistance to chemicals and temperatures. As the automotive industry continues to grow, so does the demand for TPEE.

- Technological Advancements in TPEE Production: Advances in the manufacturing processes of TPEE have improved its properties, making it more versatile and cost-effective for industrial applications, driving its adoption across various sectors.

- Sustainability and Environmental Considerations: TPEE is recyclable and offers a lower environmental footprint compared to traditional materials. Its use in eco-friendly applications and demand for sustainable materials boosts its growth.

- Rise in Consumer Electronics and Electrical Appliances: TPEE's superior insulating properties and resistance to wear and tear make it an ideal material for electrical applications, which is increasingly in demand as the consumer electronics market expands.

Restraints:

- High Production Costs: The production of TPEE can be expensive due to the raw materials used and the complex manufacturing process. This could limit its adoption, especially in cost-sensitive markets or regions with less mature economies.

- Limited Availability of Raw Materials: The availability of the specialized raw materials required for TPEE production can be inconsistent, leading to supply chain issues and price volatility, which could hinder market growth.

- Competition from Other Thermoplastic Elastomers: Other thermoplastic elastomers (TPEs), such as TPUs (Thermoplastic Polyurethane) and TPOs (Thermoplastic Olefins), provide similar properties to TPEE at lower costs, which might limit the expansion of TPEE in certain sectors.

Opportunities:

- Expansion in Emerging Markets: With industrialization progressing in emerging economies, particularly in Asia-Pacific and Latin America, there is a growing demand for high-performance materials like TPEE in sectors like automotive, construction, and consumer goods.

- Growth of 3D Printing Technology: TPEE’s application in 3D printing is gaining traction due to its excellent strength-to-weight ratio, durability, and ease of processing, providing new opportunities for its use in additive manufacturing.

- Advancements in TPEE Blends and Composites: Researchers and manufacturers are focusing on developing advanced TPEE blends and composites that can be customized for specific industrial applications, offering more tailored solutions for a range of sectors.

- Increased Demand for Medical Applications: The growing healthcare industry is creating opportunities for TPEE, particularly in medical devices, where it’s valued for its biocompatibility, flexibility, and chemical resistance.

Challenges:

- Lack of Awareness in Certain Industries: Despite TPEE’s performance advantages, its relatively new entry into the market means that some industries may not be fully aware of its benefits, which can delay adoption.

- Complexity in Processing: TPEE requires specific processing conditions, such as precise temperature control and specialized equipment. This could make its adoption more challenging for small-scale or less technologically advanced manufacturers.

- Price Volatility in Raw Materials: As TPEE relies on petrochemical-based raw materials, fluctuations in oil prices can impact the cost structure of TPEE production, making it susceptible to price instability.

- Competition from Other Advanced Materials: Other advanced materials such as carbon fiber, fiberglass-reinforced plastics, and other high-performance thermoplastics could limit the growth of TPEE by offering similar or even superior mechanical properties at lower costs or with better processing flexibility.

TPEE in Industrial Market: Segmentation Insights

The global TPEE in industrial market is divided by manufacturing industry, construction industry, energy sector, transportation and logistics, chemical industry, and region.

Segmentation Insights by Manufacturing Industry

Based on manufacturing industry, the global TPEE in industrial market is divided into automotive manufacturing, electronics manufacturing, consumer goods production, aerospace manufacturing, and pharmaceutical manufacturing.

In the industrial market for Thermoplastic Elastomer (TPEE), the Automotive Manufacturing segment is the most dominant. TPEE is widely used in the automotive industry due to its high-performance properties, such as strength, flexibility, and resistance to heat and chemicals. These characteristics make it ideal for automotive components like fuel systems, seals, gaskets, interior trims, and wiring insulation. The growing demand for lightweight and durable materials in vehicles, particularly with the rise of electric vehicles (EVs), further boosts TPEE’s role in automotive manufacturing.

Following closely, the Electronics Manufacturing segment also plays a significant role in TPEE’s industrial market. TPEE’s high insulation properties, durability, and flexibility make it ideal for electronic components such as connectors, switches, and wiring. The increasing demand for electronic devices, along with the push for higher performance and more compact designs, makes TPEE a go-to material in the electronics industry.

The Consumer Goods Production segment is another prominent player in TPEE usage. TPEE is used in producing household appliances, sporting goods, and consumer electronics due to its ability to combine softness with strength. Its impact resistance and processability make it suitable for various applications, including non-stick coatings, containers, and flexible components in consumer goods.

The Aerospace Manufacturing segment utilizes TPEE for parts that require resistance to extreme conditions, such as high temperatures, pressure, and stress. TPEE’s lightweight yet durable properties make it suitable for aircraft parts like seals, gaskets, and cable insulation. However, this segment is less dominant compared to automotive or electronics manufacturing due to the more stringent regulatory requirements and the relatively lower volume of materials used.

Finally, the Pharmaceutical Manufacturing segment is the least dominant in TPEE usage. While TPEE is employed for some packaging applications and medical devices due to its biocompatibility and chemical resistance, its use is less widespread than in other industries. The regulatory complexities and specific material requirements in pharmaceutical manufacturing limit TPEE's role to specific, niche applications.

Segmentation Insights by Construction Industry

On the basis of construction industry, the global TPEE in industrial market is bifurcated into commercial construction, residential construction, infrastructure development, industrial construction, and renovation & remodeling.

In the construction industry, Residential Construction is the most dominant segment for TPEE in industrial market. The growing demand for durable, energy-efficient, and cost-effective materials in residential buildings drives the use of TPEE. Its applications include window seals, roofing membranes, flooring materials, and insulation. The rise in residential developments, particularly in urban areas and growing economies, has fueled the widespread adoption of TPEE in residential construction due to its performance and aesthetic benefits.

The Commercial Construction segment follows closely in dominance. TPEE is used in commercial projects for applications such as flooring, roofing, insulation, and sealants. Commercial buildings, including offices, shopping malls, and hotels, require materials that provide both strength and flexibility. TPEE's ability to withstand varying temperatures, moisture, and chemical exposure makes it a valuable material for these types of constructions. The growth of commercial real estate, especially in rapidly urbanizing regions, continues to drive demand for TPEE in this segment.

Next, Infrastructure Development represents a growing market for TPEE. Infrastructure projects such as bridges, tunnels, roads, and utilities often require materials that offer long-term durability and resistance to environmental stressors. TPEE is used in components such as seals, gaskets, and cables, which need to resist wear and tear from harsh environmental conditions. The ongoing development and expansion of infrastructure, particularly in emerging markets, further solidify TPEE’s role in this sector.

The Industrial Construction segment, which includes the construction of factories, warehouses, and plants, also benefits from TPEE's properties. TPEE is used in flooring, insulation, and sealing applications in industrial environments where high-performance materials are crucial for efficiency and safety. However, this segment is somewhat less dominant compared to residential, commercial, and infrastructure construction due to the more specialized nature of industrial building needs.

Finally, Renovation & Remodeling is the least dominant segment. Although TPEE is used in certain renovation applications, such as replacing aging sealants and insulating materials, the overall demand for TPEE in this sector is relatively low compared to new construction projects. Renovation and remodeling tend to involve more specific, localized uses of materials, rather than the extensive and widespread adoption seen in other construction segments.

Segmentation Insights by Energy Sector

Based on energy sector, the global TPEE in industrial market is divided into renewable energy (solar, wind, hydro), fossil fuels (oil and gas), nuclear power, electric utilities, and energy storage solutions.

In the energy sector, Renewable Energy (particularly Solar and Wind) is the most dominant segment for TPEE in industrial market. TPEE's excellent durability, flexibility, and resistance to environmental stressors make it highly suitable for components used in solar panels, wind turbines, and other renewable energy infrastructure. In solar energy, TPEE is used in cable insulation and components of solar panel frames, where it provides resistance to UV rays and weathering. In wind energy, TPEE's lightweight and robust properties make it ideal for seals, gaskets, and parts in wind turbine systems, where exposure to the elements is a constant challenge. As the global shift towards renewable energy sources accelerates, the demand for TPEE in this sector continues to grow.

Following renewable energy, Fossil Fuels (particularly Oil and Gas) is another significant segment in the energy market for TPEE. TPEE is used in various applications such as seals, gaskets, and valve components in oil and gas extraction, transportation, and refining processes. The material’s high resistance to heat, pressure, and chemicals makes it a preferred choice for harsh environments found in offshore drilling, pipelines, and refineries. Despite the growing focus on renewable energy, the oil and gas sector remain a major user of TPEE due to its critical role in global energy supply chains.

Electric Utilities comes next as a key user of TPEE. Electric utility companies require high-performance materials for cable insulation, connectors, and other electrical components that must withstand high voltages and environmental factors like moisture and extreme temperatures. TPEE’s insulating properties and durability make it ideal for use in power generation, transmission, and distribution systems, particularly in the face of aging infrastructure and the need for improved grid resilience. The expansion of smart grids and the electrification of various sectors also increases the demand for TPEE in this area.

The Nuclear Power segment, while important, is less dominant in terms of TPEE usage. TPEE is used in nuclear power plants for specific applications such as seals, gaskets, and insulation, where high resistance to heat and radiation is crucial. However, due to the highly regulated and specialized nature of nuclear energy, the overall volume of TPEE used in this sector is lower compared to renewable energy or fossil fuels.

Finally, Energy Storage Solutions is the least dominant segment for TPEE in the energy sector. While TPEE is used in certain energy storage systems, particularly in battery enclosures and cable insulation, the segment is still in a developing stage. With the increasing focus on energy storage solutions for renewable energy systems, such as in large-scale battery storage, the demand for TPEE is expected to grow but remains relatively small compared to other energy sectors.

Segmentation Insights by Transportation and Logistics

On the basis of transportation and logistics, the global TPEE in industrial market is bifurcated into freight transportation (air, land, sea), logistics services, supply chain management, warehousing solutions, and last-mile delivery services.

In the transportation and logistics sector, Freight Transportation (particularly Land, Air, and Sea) is the most dominant segment for TPEE in industrial market. TPEE is used extensively in the transportation industry due to its ability to withstand harsh conditions, such as exposure to high temperatures, moisture, and chemicals. In land freight, TPEE is utilized in various vehicle components, including seals, gaskets, and fuel system parts, where its resistance to heat, friction, and wear is essential. For air freight, TPEE's flexibility and lightweight properties are beneficial in the manufacture of seals and insulation materials for aircraft, ensuring durability and safety in extreme conditions. In sea freight, TPEE is used in marine applications, including gaskets, seals, and cable insulations, where it needs to endure saltwater exposure and extreme weather conditions. As global trade and the movement of goods continue to expand, the demand for TPEE in freight transportation remains robust.

Logistics Services follows closely in dominance. TPEE plays a crucial role in logistics operations through its use in packaging materials, protective covers, and seals for goods being transported. TPEE is particularly valuable in the logistics sector for applications that require strong, flexible materials to ensure the safe transport of goods over long distances. The increasing complexity of logistics services, driven by the rise of e-commerce and global trade, enhances the need for durable and efficient packaging solutions made from TPEE.

Next, Supply Chain Management involves significant use of TPEE, particularly in the area of tracking and monitoring systems. TPEE is often used in electronic components, sensors, and wireless communication systems that play a role in modern supply chain technologies. Its insulating properties and resistance to environmental factors make it suitable for ensuring the reliability and efficiency of tracking devices and other components used to monitor goods as they move through the supply chain. While its role in supply chain management is less directly visible compared to logistics or freight transportation, the increasing integration of technology into supply chain operations drives the demand for TPEE in this sector.

Warehousing Solutions is another segment that uses TPEE, although to a lesser extent. TPEE is used in warehouse operations for applications like conveyor belts, seals, and storage containers. It provides durability and flexibility to these systems, ensuring efficient movement and storage of goods. The growing trend of automation in warehouses, with robotic systems and automated guided vehicles (AGVs), has increased the use of TPEE for components that require flexibility, strength, and resistance to wear.

Finally, Last-Mile Delivery Services represents the least dominant segment for TPEE in transportation and logistics. While TPEE is used in certain packaging and insulation applications for last-mile delivery, its role is more limited compared to other areas. However, as the demand for efficient, sustainable last-mile delivery grows—especially with the rise of e-commerce and direct-to-consumer services—TPEE’s use in packaging, temperature-controlled containers, and flexible transport components may increase in the future.

Segmentation Insights by Chemical Industry

On the basis of chemical industry, the global TPEE in industrial market is bifurcated into bulk chemicals, specialty chemicals, petrochemicals, agrochemicals, and biochemicals.

In the chemical industry, Bulk Chemicals is the most dominant segment for TPEE in industrial market. Bulk chemicals, which include basic materials such as acids, solvents, and industrial chemicals, require highly durable and chemically resistant materials for packaging, storage, and transport. TPEE’s resistance to aggressive chemicals, heat, and abrasion makes it an ideal material for seals, gaskets, and protective linings in bulk chemical production and handling. As bulk chemical production is essential for various industries, including manufacturing, pharmaceuticals, and automotive, the demand for TPEE in this segment remains strong.

Specialty Chemicals follows closely behind in dominance. Specialty chemicals are used in more specific applications, such as coatings, adhesives, lubricants, and personal care products, often requiring advanced materials with specific performance characteristics. TPEE is used in formulations and production processes due to its superior mechanical properties and ability to withstand environmental factors like UV radiation, temperature extremes, and chemical exposure. The growing demand for customized chemical solutions in diverse industries boosts TPEE’s role in the specialty chemicals segment.

Next, Petrochemicals represents another important segment for TPEE, although it is slightly less dominant compared to bulk and specialty chemicals. TPEE’s high resistance to heat, chemicals, and pressure makes it suitable for applications in the production and transportation of petrochemicals, including fuels, lubricants, and other refined products. It is used in seals, gaskets, and tubing that must withstand harsh environments during petrochemical processing and distribution. Despite being a significant market for TPEE, the petrochemical segment is somewhat overshadowed by the widespread use of TPEE in bulk and specialty chemicals.

Agrochemicals is another segment where TPEE plays an essential role, though its dominance is less compared to the others. Agrochemicals, such as fertilizers, pesticides, and herbicides, require packaging and components that can withstand exposure to various chemicals, moisture, and environmental conditions. TPEE is used in protective materials, seals, and storage containers to ensure the safe handling and transportation of agrochemical products. While important, this segment is not as large as the others due to the more limited range of applications for TPEE in agrochemical production.

Finally, Biochemicals represents the least dominant segment for TPEE in the chemical industry. Biochemicals, which include bio-based chemicals, pharmaceuticals, and medical devices, require materials that are biocompatible and capable of handling biological processes. While TPEE is used in some applications, such as drug delivery systems and medical device components, its overall role is relatively niche compared to other chemical sectors. The demand for TPEE in biochemicals is growing, but it remains a smaller segment due to the specialized nature of biochemistry and the regulatory requirements involved.

TPEE in Industrial Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific (APAC) is the most dominant region in the global TPEE in industrial market, with countries like China, India, and Japan leading the demand. The strong manufacturing sectors in these nations, particularly in automotive, electronics, and industrial machinery, fuel the adoption of TPEE. Additionally, rapid urbanization and expanding infrastructure in APAC further support the growth of TPEE applications in various industries, making it the key player in the market.

North America follows as a significant region for TPEE, particularly driven by the United States and Canada. The demand in this region is largely driven by the automotive and electronics industries, where the need for lightweight, durable, and high-performance materials is crucial. With a strong focus on innovation and advanced manufacturing, North America continues to be a key market for TPEE in industrial applications.

Europe ranks third in the TPEE in industrial market, with major demand coming from countries like Germany, France, and the United Kingdom. The automotive industry's emphasis on fuel efficiency and lightweight components is a key driver for TPEE use in vehicle parts. Europe's commitment to sustainable manufacturing and technological advancements also plays a significant role in the growing adoption of TPEE in various industries.

Latin America is an emerging TPEE in industrial market, particularly in Brazil and Argentina. The region's expanding automotive and consumer electronics sectors are boosting the demand for TPEE. While still in the growth phase, Latin America shows strong potential for increasing adoption of TPEE, driven by the need for advanced materials that enhance product performance in various applications.

Middle East and Africa (MEA) is a developing TPEE in industrial market, with key players in Saudi Arabia, the UAE, and South Africa. The demand for TPEE in this region is driven by the automotive industry's growth, ongoing infrastructure development, and a rise in manufacturing activities. As the region diversifies and modernizes its industries, the adoption of TPEE is expected to grow steadily.

TPEE in Industrial Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the TPEE in industrial market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global TPEE in industrial market include:

- DowDuPont

- DSM

- Toyobo

- Taiwan Changchun

- Jiangyin Hetron

- Celanese

- SK Chemicals

- LG Chem

- SABIC

- Mitsubishi Chemical

- RadiciGroup

- Eastman

- Sichuan Sunplas

The global TPEE in industrial market is segmented as follows:

By Manufacturing Industry

- Automotive Manufacturing

- Electronics Manufacturing

- Consumer Goods Production

- Aerospace Manufacturing

- Pharmaceutical Manufacturing

By Construction Industry

- Commercial Construction

- Residential Construction

- Infrastructure Development

- Industrial Construction

- Renovation and Remodeling

By Energy Sector

- Renewable Energy (Solar, Wind, and Hydro)

- Fossil Fuels (Oil and Gas)

- Nuclear Power

- Electric Utilities

- Energy Storage Solutions

By Transportation and Logistics

- Freight Transportation (Air, Land, and Sea)

- Logistics Services

- Supply Chain Management

- Warehousing Solutions

- Last-Mile Delivery Services

By Chemical Industry

- Bulk Chemicals

- Specialty Chemicals

- Petrochemicals

- Agrochemicals

- Biochemicals

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

TPEE in Industrial

Request Sample

TPEE in Industrial