Treasury and Risk Management Software Market Size, Share, and Trends Analysis Report

CAGR :

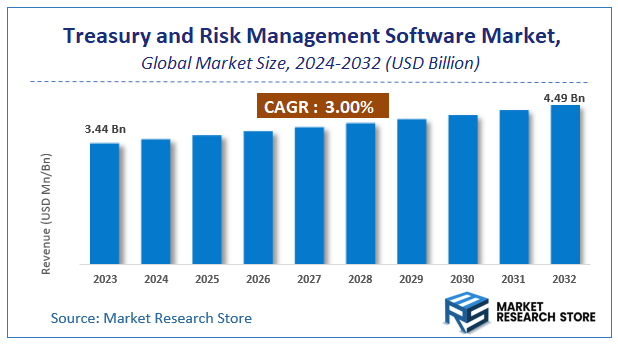

| Market Size 2023 (Base Year) | USD 3.44 Billion |

| Market Size 2032 (Forecast Year) | USD 4.49 Billion |

| CAGR | 3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Treasury and Risk Management Software Market Insights

According to Market Research Store, the global treasury and risk management software market size was valued at around USD 3.44 billion in 2023 and is estimated to reach USD 4.49 billion by 2032, to register a CAGR of approximately 3.00 in terms of revenue during the forecast period 2024-2032.

The treasury and risk management software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Treasury and Risk Management Software Market: Overview

Treasury and risk management (TRM) software is a specialized solution designed to help organizations efficiently manage their financial operations, particularly focusing on cash flow, liquidity, investments, debt, and risk exposure. It streamlines complex treasury functions such as cash and liquidity management, financial forecasting, hedging strategies, and compliance with regulatory frameworks. In addition, the software aids in identifying, analyzing, and mitigating financial risks including market risk, credit risk, and operational risk. By integrating real-time financial data and analytics, TRM software empowers CFOs and treasury professionals to make informed, data-driven decisions while enhancing control, visibility, and security across global operations.

Key Highlights

- The treasury and risk management software market is anticipated to grow at a CAGR of 3.00 during the forecast period.

- The global treasury and risk management software market was estimated to be worth approximately USD 3.44 billion in 2023 and is projected to reach a value of USD 4.49 billion by 2032.

- The growth of the treasury and risk management software market is being driven by increasing globalization of businesses, growing financial complexity, and heightened regulatory scrutiny.

- Based on the type, the treasury management segment is growing at a high rate and is projected to dominate the market.

- In terms of deployment, the cloud-based segment is expected to dominate the market.

- On the basis of application, the commercial banks segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Treasury and Risk Management Software Market: Dynamics

Key Growth Drivers:

- Increasing Need for Real-Time Financial Visibility: This is driving the adoption of advanced treasury and risk management software as organizations demand real-time insights into cash flows, liquidity positions, and risk exposures.

- Rising Regulatory Compliance Requirements: Businesses are turning to automated software solutions to ensure compliance and reduce risk as financial regulations like Basel III and IFRS 9 continue to evolve.

- Digital Transformation in Finance Departments: Enterprises are investing in digital tools to streamline treasury operations and risk management, resulting in an increased adoption of such software.

- Growing Incidences of Financial Fraud and Cyber Threats: The increasing complexity and frequency of cyberattacks are pushing businesses to adopt risk management solutions that offer better detection and prevention capabilities.

- Adoption of Cloud-Based Solutions: Cloud deployment models provide flexibility, cost-efficiency, and scalability, making businesses more likely to adopt cloud-based treasury and risk management software.

Restraints:

- High Initial Investment and Implementation Costs: The cost of acquiring, customizing, and integrating treasury management systems can be significant, particularly for small and medium-sized enterprises (SMEs).

- Complexity in Integration with Legacy Systems: Integrating modern software with outdated or fragmented legacy systems can present technical challenges and increase implementation time.

- Data Security and Privacy Concerns: Concerns over the confidentiality and security of financial data, especially in cloud environments, may deter adoption, particularly among risk-averse organizations.

Opportunities:

- Expansion in Emerging Markets: Increasing digitization and financial sophistication in growing economies in Asia-Pacific, Latin America, and Africa create strong growth opportunities for market players.

- AI and Machine Learning Integration: The integration of AI and machine learning enhances predictive analytics, automated anomaly detection, and risk forecasting, making these tools more attractive and powerful.

- Partnerships and Acquisitions: Strategic collaborations between fintech firms and traditional financial institutions are expanding product capabilities and increasing market reach.

- Customization and Modular Deployment Options: Offering modular, customizable solutions that are tailored to specific industry needs opens up new segments and boosts client satisfaction.

Challenges:

- Rapidly Changing Regulatory Landscape: Businesses must stay updated and compliant with frequently changing financial regulations, requiring constant software updates and reconfigurations.

- Shortage of Skilled Professionals: A limited pool of professionals capable of efficiently managing and operating advanced treasury and risk management software creates operational bottlenecks.

- Resistance to Change in Traditional Finance Teams: Some finance departments are resistant to transitioning from manual to digital systems due to unfamiliarity or fear of disruption.

- Vendor Lock-In Risks: Once a system is in place, switching vendors can be difficult, leading to long-term dependency and reduced flexibility for enterprises.

Treasury and Risk Management Software Market: Report Scope

This report thoroughly analyzes the Treasury and Risk Management Software Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Treasury and Risk Management Software Market |

| Market Size in 2023 | USD 3.44 Billion |

| Market Forecast in 2032 | USD 4.49 Billion |

| Growth Rate | CAGR of 3% |

| Number of Pages | 161 |

| Key Companies Covered | Finastra, ION, Murex, SAP, Sage Group, Kyriba, Calypso Technology, MORS Software, Wolters Kluwer, and PREFIS, FIS Global, Edgeverve, Broadridge Financial Solutions, JSC |

| Segments Covered | By Type, By Deployment, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Treasury and Risk Management Software Market: Segmentation Insights

The global treasury and risk management software market is divided by type, deployment, application, and region.

Segmentation Insights by Type

Based on type, the global treasury and risk management software market is divided into treasury and investment management.

In the treasury and risk management software market, Treasury Management emerges as the most dominant segment. This dominance is largely attributed to the increasing complexity of cash flow management, liquidity forecasting, and payment processing in modern enterprises. Treasury management solutions are critical for companies to maintain real-time visibility over their cash positions, optimize working capital, and ensure regulatory compliance. As businesses continue to expand across borders and deal with multiple currencies, the demand for efficient treasury operations has surged, making this segment essential for both large enterprises and mid-sized firms. Additionally, the integration of AI, automation, and analytics in treasury management systems has further elevated its significance in strategic decision-making.

On the other hand, Investment Management represents the comparatively less dominant segment, though it still plays a vital role in the market. This segment focuses on managing a company’s investment portfolios, including assets, securities, and risk-adjusted returns. It is especially relevant for financial institutions, asset managers, and firms with significant investment holdings. While not as widely adopted as treasury management tools in general corporate settings, investment management software is growing in importance with the rising need for real-time risk analysis, portfolio optimization, and regulatory reporting. However, its niche focus limits its reach compared to the broader applications of treasury management systems.

Segmentation Insights by Deployment

On the basis of deployment, the global treasury and risk management software market is bifurcated into on-premise and cloud-based.

In terms of deployment, Cloud-based treasury and risk management software is the most dominant segment. This dominance is driven by the increasing shift of enterprises towards digital transformation, favoring flexible, scalable, and cost-effective solutions. Cloud-based platforms offer real-time data access, automatic updates, and enhanced collaboration across geographically dispersed teams, which is particularly valuable for global financial operations. Moreover, they eliminate the need for heavy upfront infrastructure investments and reduce the burden of in-house IT maintenance. Enhanced security protocols, compliance support, and integration capabilities with other enterprise systems further strengthen the appeal of cloud-based deployment, especially for mid-sized and large organizations.

On-Premise deployment, while still in use, has become the less dominant segment. It is primarily favored by organizations with strict data control requirements, such as banks or government entities, that prefer to host software internally for security or regulatory reasons. On-premise solutions offer greater customization and control but come with higher costs related to installation, infrastructure, and ongoing maintenance. The need for dedicated IT staff and longer deployment times has led many businesses to gradually move away from this model, especially with the proven security and efficiency of modern cloud-based alternatives. Nonetheless, certain industries continue to rely on on-premise systems where data sensitivity and legacy infrastructure dictate the need.

Segmentation Insights by Application

On the basis of application, the global treasury and risk management software market is bifurcated into commercial banks, clearing brokers & CCPS, central banks & public agencies, buy side, corporates, and others.

Among the application segments of the treasury and risk management software market, Commercial Banks stand as the most dominant. These institutions deal with complex and high-volume financial operations, including cash management, liquidity planning, risk assessment, and regulatory compliance. Treasury and risk management software is indispensable for commercial banks to manage interest rate risks, monitor foreign exchange exposures, and streamline internal and external reporting. As these banks face increased regulatory scrutiny and demand for transparency, the need for robust, real-time, and integrated solutions continues to drive adoption in this segment.

Corporates represent the next significant application segment. Large and mid-sized corporations use treasury and risk management software to optimize working capital, forecast cash flow, manage debts and investments, and hedge financial risks. With the rise of multinational operations and increasing market volatility, corporates are seeking more dynamic and intelligent financial tools to enhance visibility and control over their financial functions. This segment is also increasingly adopting cloud-based solutions for flexibility and real-time decision-making.

Buy Side institutions, which include asset managers, hedge funds, and insurance firms, also make up a notable portion of the market. These entities utilize the software to manage investment portfolios, analyze risk exposures, and ensure regulatory compliance across various jurisdictions. Their reliance on accurate market data and performance analytics makes advanced treasury and risk solutions essential.

Clearing Brokers & Central Counterparties (CCPs) and Central Banks & Public Agencies form more niche but important application areas. Clearing brokers and CCPs use such systems to manage margining, settlement risks, and counterparty exposures, which are critical for maintaining financial market stability. Central banks and public agencies, although fewer in number, depend on these solutions to oversee national liquidity positions, monitor systemic risks, and support financial policy implementation.

Treasury and Risk Management Software Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the treasury and risk management (TRM) software market. This leadership is primarily driven by the presence of a mature financial sector, highly regulated business environment, and widespread adoption of advanced technologies such as artificial intelligence and cloud computing. Financial institutions and multinational corporations across the United States and Canada rely heavily on TRM software to manage complex portfolios, enhance liquidity, and ensure compliance with strict regulatory standards. The emphasis on real-time financial visibility, risk mitigation, and digital transformation continues to fuel the demand for robust treasury solutions in this region.

Europe follows closely as a major player in the TRM software market, underpinned by a highly regulated financial landscape and strong governance practices. Countries like Germany, the United Kingdom, and France are key contributors, driven by the need to comply with evolving financial regulations and manage cross-border operations effectively. The region also benefits from a rising focus on sustainable finance, data transparency, and operational efficiency, which is pushing organizations to adopt modern treasury systems to stay competitive and compliant in a dynamic market environment.

Asia-Pacific is emerging as a rapidly growing region in the TRM software market, bolstered by the economic expansion of countries such as China, India, and Japan. Increased foreign investments, growing industrialization, and digital transformation initiatives are encouraging businesses to adopt advanced financial management tools. As firms become more global and complex, there is a rising need for risk management and liquidity optimization. The region’s growing fintech ecosystem and government support for digital finance are further accelerating the adoption of TRM software.

Latin America presents moderate growth in the TRM software market, with countries like Brazil and Mexico making notable progress in financial digitization. While the market is still developing, there is increasing awareness of the need for better financial control, risk management, and regulatory compliance. The region is gradually embracing digital tools to enhance treasury functions, although challenges such as economic instability and limited infrastructure may hinder rapid expansion.

Middle East and Africa represent emerging markets with significant potential for future growth in the TRM software space. Economic diversification efforts, especially in the Gulf countries, and infrastructure investments are prompting interest in advanced treasury solutions. In Africa, financial inclusion and digital banking trends are contributing to the early stages of market development. As regulatory frameworks improve and awareness increases, the adoption of TRM software is expected to gain momentum in these regions.

Treasury and Risk Management Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the treasury and risk management software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global treasury and risk management software market include:

- Finastra

- ION

- Murex

- SAP

- Sage Group

- Kyriba

- Calypso Technology

- MORS Software

- Wolters Kluwer

- and PREFIS

- FIS Global

- Edgeverve

- Broadridge Financial Solutions

- JSC

The global treasury and risk management software market is segmented as follows:

By Type

- Treasury

- Investment Management

By Deployment

- On-Premise

- Cloud-based

By Application

- Commercial Banks

- Clearing Brokers and CCPs

- Central Banks and Public Agencies

- Buy Side

- Corporates

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Treasury and Risk Management Software

Request Sample

Treasury and Risk Management Software