Vendor Neutral Archive (VNA) & PACS Market Size, Share, and Trends Analysis Report

CAGR :

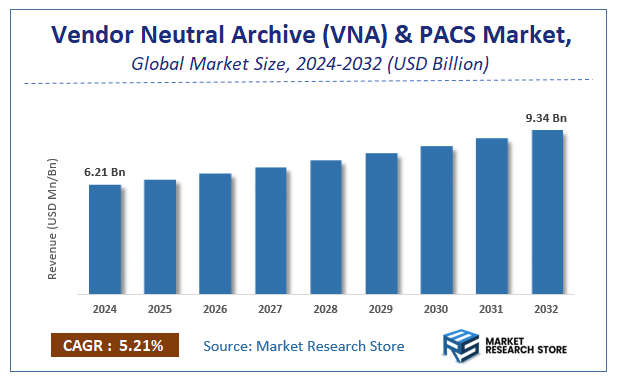

| Market Size 2024 (Base Year) | USD 6.21 Billion |

| Market Size 2032 (Forecast Year) | USD 9.34 Billion |

| CAGR | 5.21% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global vendor neutral archive (VNA) & PACS market, estimating its value at USD 6.21 Billion in 2024, with projections indicating it will reach USD 9.34 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 5.21% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the vendor neutral archive (VNA) & PACS industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Vendor Neutral Archive (VNA) & PACS Market: Overview

The growth of the vendor neutral archive (VNA) & PACS market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The vendor neutral archive (VNA) & PACS market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the vendor neutral archive (VNA) & PACS market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, Deployment, Application, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global vendor neutral archive (VNA) & PACS market is estimated to grow annually at a CAGR of around 5.21% over the forecast period (2024-2032).

- In terms of revenue, the global vendor neutral archive (VNA) & PACS market size was valued at around USD 6.21 Billion in 2024 and is projected to reach USD 9.34 Billion by 2032.

- The market is projected to grow at a significant rate due to Rising need for centralized, interoperable medical imaging systems drives adoption.

- Based on the Type, the VNA segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Deployment, the On-Premise segment is anticipated to command the largest market share.

- In terms of Application, the Radiology segment is projected to lead the global market.

- By End-User, the Hospitals segment is predicted to dominate the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Vendor Neutral Archive (VNA) & PACS Market: Report Scope

This report thoroughly analyzes the vendor neutral archive (VNA) & PACS market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Vendor Neutral Archive (VNA) & PACS Market |

| Market Size in 2024 | USD 6.21 Billion |

| Market Forecast in 2032 | USD 9.34 Billion |

| Growth Rate | CAGR of 5.21% |

| Number of Pages | 219 |

| Key Companies Covered | Canon Medical Systems, Hyland Software, Agfa-Gevaert, Intelerad Medical Systems, Fujifilm Holdings, GE Healthcare, Merative, Sectra, Siemens Healthineers, BridgeHead Software, Canopy Partners, Novarad, POSTDICOM, Mach7, IBM Corporation, Dell Technologies, NetApp, Hitachi Vantara, Hewlett Packard Enterprise |

| Segments Covered | By Type, By Deployment, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vendor Neutral Archive (VNA) & PACS Market: Dynamics

The Vendor Neutral Archive (VNA) and Picture Archiving and Communication System (PACS) market is a critical component of modern healthcare IT, enabling the digital management, storage, and retrieval of medical images. While PACS traditionally focuses on departmental image management, VNA offers a more expansive, enterprise-wide solution that consolidates images from various modalities and systems, ensuring vendor neutrality and enhanced interoperability.

Key Growth Drivers:

The primary driver for the VNA & PACS market is the exponential increase in the volume of medical imaging data generated globally, propelled by the rising prevalence of chronic diseases, an aging population, and advancements in diagnostic imaging technologies (e.g., higher-resolution CT, MRI, and ultrasound). The rapid transition toward digital imaging and the widespread adoption of Electronic Health Records (EHRs) and Electronic Medical Records (EMRs) in healthcare settings necessitate robust, scalable, and centralized solutions for image storage and management. The critical need for interoperability and seamless data integration across different healthcare systems, facilities, and departments is also accelerating the adoption of VNA, which breaks down traditional data silos created by proprietary PACS systems, enabling better coordinated patient care and remote diagnostics, especially with the growth of telemedicine.

Restraints:

Despite the robust growth drivers, the VNA & PACS market faces several significant restraints. One major obstacle is the substantial initial investment cost associated with purchasing, implementing, and integrating these complex solutions, particularly for smaller clinics and healthcare providers with limited budgets. The technical complexities involved in migrating vast amounts of legacy imaging data from disparate systems to a new VNA or PACS, ensuring data accuracy and preventing loss, pose a significant challenge. Furthermore, the persistence of vendor lock-in with older, proprietary PACS systems can make it difficult and costly for healthcare organizations to transition to a more vendor-neutral architecture. Data security and privacy concerns, given the highly sensitive nature of patient imaging data and the stringent regulatory requirements (e.g., HIPAA, GDPR), also add a layer of complexity and cost for robust system implementation.

Opportunities:

The VNA & PACS market presents numerous opportunities for innovation and expansion. The accelerating adoption of cloud-based VNA and PACS solutions offers significant avenues for growth, providing enhanced scalability, accessibility, cost savings (by reducing on-premise infrastructure), and improved disaster recovery capabilities, essential for modern healthcare. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) into imaging workflows presents a major opportunity, enabling AI-powered image analysis for faster and more accurate diagnoses, automated reporting, and predictive analytics for patient outcomes. The expansion of these solutions to manage non-DICOM imaging data (e.g., pathology slides, endoscopy videos) within an enterprise imaging strategy further broadens the market scope. Moreover, the push for universal medical-image archiving and deep integration with EHRs creates a demand for comprehensive platforms that centralize all patient health information, improving clinical decision-making.

Challenges:

The VNA & PACS market confronts several critical challenges that demand strategic attention. A major challenge is ensuring seamless interoperability between various imaging modalities, different departmental PACS systems, and broader hospital information systems (HIS/EHRs), given the inconsistent use of DICOM tags and proprietary data formats. This fragmentation can hinder real-time data sharing and create workflow inefficiencies. The long product lifecycle of existing PACS systems can slow down replacement sales and the adoption of newer, more advanced VNA solutions. Furthermore, unpredictable cloud egress fees can inhibit the full adoption of cloud VNA solutions for some organizations. Overcoming the inherent resistance to change among medical professionals and providing adequate training for complex new systems are also crucial for successful implementation and user adoption.

Vendor Neutral Archive (VNA) & PACS Market: Segmentation Insights

The global vendor neutral archive (VNA) & PACS market is segmented based on Type, Deployment, Application, End-User, and Region. All the segments of the vendor neutral archive (VNA) & PACS market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global vendor neutral archive (VNA) & PACS market is divided into VNA, PACS.

On the basis of Deployment, the global vendor neutral archive (VNA) & PACS market is bifurcated into On-Premise, Cloud-Based, Hybrid.

In terms of Application, the global vendor neutral archive (VNA) & PACS market is categorized into Radiology, Cardiology, Orthopedics, Oncology, Others.

Based on End-User, the global vendor neutral archive (VNA) & PACS market is split into Hospitals, Diagnostic Centers, Clinics, Research Institutes.

Vendor Neutral Archive (VNA) & PACS Market: Regional Insights

The Vendor Neutral Archive (VNA) & PACS (Picture Archiving and Communication System) market is experiencing significant growth, with North America dominating the global market due to advanced healthcare IT infrastructure, high adoption of digital imaging systems, and strong government support for interoperability. According to recent market reports, North America held over 40% of the global market share in 2023, driven by the U.S., where hospitals and diagnostic centers increasingly adopt VNA solutions to manage multi-departmental imaging data efficiently.

Europe follows as the second-largest market, supported by stringent regulatory standards (e.g., GDPR) and increasing investments in healthcare digitization. Meanwhile, the Asia-Pacific (APAC) region is expected to witness the highest CAGR due to rising medical imaging demand, expanding hospital networks, and government initiatives promoting telemedicine and AI-driven diagnostics.Key players like GE Healthcare, Fujifilm Holdings, Siemens Healthineers, and IBM are strengthening their presence through strategic acquisitions and cloud-based VNA solutions, further accelerating market expansion. The shift toward cloud-based VNA and hybrid PACS models is a major trend, with enterprises prioritizing scalability, cybersecurity, and interoperability in medical imaging archives.

Vendor Neutral Archive (VNA) & PACS Market: Competitive Landscape

The vendor neutral archive (VNA) & PACS market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Vendor Neutral Archive (VNA) & PACS Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Canon Medical Systems

- Hyland Software

- Agfa-Gevaert

- Intelerad Medical Systems

- Fujifilm Holdings

- GE Healthcare

- Merative

- Sectra

- Siemens Healthineers

- BridgeHead Software

- Canopy Partners

- Novarad

- POSTDICOM

- Mach7

- IBM Corporation

- Dell Technologies

- NetApp

- Hitachi Vantara

- Hewlett Packard Enterprise

The Global Vendor Neutral Archive (VNA) & PACS Market is Segmented as Follows:

By Type

- VNA

- PACS

By Deployment

- On-Premise

- Cloud-Based

- Hybrid

By Application

- Radiology

- Cardiology

- Orthopedics

- Oncology

- Others

By End-User

- Hospitals

- Diagnostic Centers

- Clinics

- Research Institutes

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Evolution

This section evaluates the market position of the product or service by examining its development pathway and competitive dynamics. It provides a detailed overview of the product's growth stages, including the early (historical) phase, the mid-stage, and anticipated future advancements influenced by innovation and emerging technologies.

Porter’s Analysis

Porter’s Five Forces framework offers a strategic lens for assessing competitor behavior and the positioning of key players in the vendor neutral archive (VNA) & PACS industry. This section explores the external factors shaping competitive dynamics and influencing market strategies in the years ahead. The analysis focuses on five critical forces:

- Competitive Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Supplier Bargaining Power

- Buyer Bargaining Power

Value Chain & Market Attractiveness Analysis

The value chain analysis helps businesses optimize operations by mapping the product flow from suppliers to end consumers, identifying opportunities to streamline processes and gain a competitive edge. Segment-wise market attractiveness analysis evaluates key dimensions like product categories, demographics, and regions, assessing growth potential, market size, and profitability. This enables businesses to focus resources on high-potential segments for better ROI and long-term value.

PESTEL Analysis

PESTEL analysis is a powerful tool in market research reports that enhances market understanding by systematically examining the external macro-environmental factors influencing a business or industry. The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors. By evaluating these dimensions, PESTEL analysis provides a comprehensive overview of the broader context within which a market operates, helping businesses identify potential opportunities and threats.

- Political factors assess government policies, stability, trade regulations, and political risks that could impact market operations.

- Economic factors examine variables like inflation, exchange rates, economic growth, and consumer spending power to determine market viability.

- Social factors explore cultural trends, demographics, and lifestyle changes that shape consumer behavior and preferences.

- Technological factors evaluate innovation, R&D, and technological advancements affecting product development and operational efficiencies.

- Environmental factors focus on sustainability, climate change impacts, and eco-friendly practices shaping market trends.

- Legal factors address compliance requirements, industry regulations, and intellectual property laws impacting market entry and operations.

Import-Export Analysis & Pricing Analysis

An import-export analysis is vital for market research, revealing global trade dynamics, trends, and opportunities. It examines trade volumes, product categories, and regional competitiveness, offering insights into supply chains and market demand. This section also analyzes past and future pricing trends, helping businesses optimize strategies and enabling consumers to assess product value effectively.

Vendor Neutral Archive (VNA) & PACS Market: Company Profiles

The report identifies key players in the vendor neutral archive (VNA) & PACS market through a competitive landscape and company profiles, evaluating their offerings, financial performance, strategies, and market positioning. It includes a SWOT analysis of the top 3-5 companies, assessing strengths, weaknesses, opportunities, and threats. The competitive landscape highlights rankings, recent activities (mergers, acquisitions, partnerships, product launches), and regional footprints using the Ace matrix. Customization is available to meet client-specific needs.

Regional & Industry Footprint

This section details the geographic reach, sales networks, and market penetration of companies profiled in the vendor neutral archive (VNA) & PACS report, showcasing their operations and distribution across regions. It analyzes the alignment of companies with specific industry verticals, highlighting the industries they serve and the scope of their products and services within those sectors.

Ace Matrix

This section categorizes companies into four distinct groups—Active, Cutting Edge, Innovator, and Emerging—based on their product and business strategies. The evaluation of product strategy focuses on aspects such as the range and depth of offerings, commitment to innovation, product functionalities, and scalability. Key elements like global reach, sector coverage, strategic acquisitions, and long-term growth plans are considered for business strategy. This analysis provides a detailed view of companies' position within the market and highlights their potential for future growth and development.

Research Methodology

The qualitative and quantitative insights for the vendor neutral archive (VNA) & PACS market are derived through a multi-faceted research approach, combining input from subject matter experts, primary research, and secondary data sources. Primary research includes gathering critical information via face-to-face or telephonic interviews, surveys, questionnaires, and feedback from industry professionals, key opinion leaders (KOLs), and customers. Regular interviews with industry experts are conducted to deepen the analysis and reinforce the existing data, ensuring a robust and well-rounded market understanding.

Secondary research for this report was carried out by the Market Research Store team, drawing on a variety of authoritative sources, such as:

- Official company websites, annual reports, financial statements, investor presentations, and SEC filings

- Internal and external proprietary databases, as well as relevant patent and regulatory databases

- Government publications, national statistical databases, and industry-specific market reports

- Media coverage, including news articles, press releases, and webcasts about market participants

- Paid industry databases for detailed market insights

Market Research Store conducted in-depth consultations with various key opinion leaders in the industry, including senior executives from top companies and regional leaders from end-user organizations. This effort aimed to gather critical insights on factors such as the market share of dominant brands in specific countries and regions, along with pricing strategies for products and services.

To determine total sales data, the research team conducted primary interviews across multiple countries with influential stakeholders, including:

- Distributors

- Marketing, Brand, and Product Managers

- Procurement and Production Managers

- Sales and Regional Sales Managers, Country Managers

- Technical Specialists

- C-Level Executives

These subject matter experts, with their extensive industry experience, helped validate and refine the findings. For secondary research, data were sourced from a wide range of materials, including online resources, company annual reports, industry publications, research papers, association reports, and government websites. These various sources provide a comprehensive and well-rounded perspective on the market.

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Vendor Neutral Archive (VNA) & PACS Market Share by Type (2020-2026) 1.5.2 RIS 1.5.3 PACS 1.5.4 VNA Software 1.6 Market by Application 1.6.1 Global Vendor Neutral Archive (VNA) & PACS Market Share by Application (2020-2026) 1.6.2 Single Department 1.6.3 Multiple Departments 1.6.4 Multiple Sites 1.7 Vendor Neutral Archive (VNA) & PACS Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Vendor Neutral Archive (VNA) & PACS Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Vendor Neutral Archive (VNA) & PACS Market 3.1 Value Chain Status 3.2 Vendor Neutral Archive (VNA) & PACS Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Vendor Neutral Archive (VNA) & PACS 3.2.3 Labor Cost of Vendor Neutral Archive (VNA) & PACS 3.2.3.1 Labor Cost of Vendor Neutral Archive (VNA) & PACS Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Novarad Corporation 4.1.1 Novarad Corporation Basic Information 4.1.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.1.3 Novarad Corporation Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.1.4 Novarad Corporation Business Overview 4.2 McKesson Corporation 4.2.1 McKesson Corporation Basic Information 4.2.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.2.3 McKesson Corporation Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.2.4 McKesson Corporation Business Overview 4.3 GE Healthcare 4.3.1 GE Healthcare Basic Information 4.3.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.3.3 GE Healthcare Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.3.4 GE Healthcare Business Overview 4.4 Dell Technologies Inc. 4.4.1 Dell Technologies Inc. Basic Information 4.4.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.4.3 Dell Technologies Inc. Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.4.4 Dell Technologies Inc. Business Overview 4.5 Koninklijke Philips NV 4.5.1 Koninklijke Philips NV Basic Information 4.5.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.5.3 Koninklijke Philips NV Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.5.4 Koninklijke Philips NV Business Overview 4.6 Lexmark International Inc. 4.6.1 Lexmark International Inc. Basic Information 4.6.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.6.3 Lexmark International Inc. Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.6.4 Lexmark International Inc. Business Overview 4.7 IBM Corporation 4.7.1 IBM Corporation Basic Information 4.7.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.7.3 IBM Corporation Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.7.4 IBM Corporation Business Overview 4.8 Fujifilm Holdings Corporation 4.8.1 Fujifilm Holdings Corporation Basic Information 4.8.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.8.3 Fujifilm Holdings Corporation Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.8.4 Fujifilm Holdings Corporation Business Overview 4.9 Agfa Healthcare NV 4.9.1 Agfa Healthcare NV Basic Information 4.9.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.9.3 Agfa Healthcare NV Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.9.4 Agfa Healthcare NV Business Overview 4.10 Siemens AG 4.10.1 Siemens AG Basic Information 4.10.2 Vendor Neutral Archive (VNA) & PACS Product Profiles, Application and Specification 4.10.3 Siemens AG Vendor Neutral Archive (VNA) & PACS Market Performance (2015-2020) 4.10.4 Siemens AG Business Overview 5 Global Vendor Neutral Archive (VNA) & PACS Market Analysis by Regions 5.1 Global Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Regions 5.1.1 Global Vendor Neutral Archive (VNA) & PACS Sales by Regions (2015-2020) 5.1.2 Global Vendor Neutral Archive (VNA) & PACS Revenue by Regions (2015-2020) 5.2 North America Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 5.3 Europe Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 5.6 South America Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 6 North America Vendor Neutral Archive (VNA) & PACS Market Analysis by Countries 6.1 North America Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Countries 6.1.1 North America Vendor Neutral Archive (VNA) & PACS Sales by Countries (2015-2020) 6.1.2 North America Vendor Neutral Archive (VNA) & PACS Revenue by Countries (2015-2020) 6.1.3 North America Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 6.2 United States Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 6.2.1 United States Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 6.3 Canada Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 6.4 Mexico Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 7 Europe Vendor Neutral Archive (VNA) & PACS Market Analysis by Countries 7.1 Europe Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Countries 7.1.1 Europe Vendor Neutral Archive (VNA) & PACS Sales by Countries (2015-2020) 7.1.2 Europe Vendor Neutral Archive (VNA) & PACS Revenue by Countries (2015-2020) 7.1.3 Europe Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 7.2 Germany Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 7.2.1 Germany Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 7.3 UK Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 7.3.1 UK Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 7.4 France Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 7.4.1 France Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 7.5 Italy Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 7.5.1 Italy Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 7.6 Spain Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 7.6.1 Spain Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 7.7 Russia Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 7.7.1 Russia Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 8 Asia-Pacific Vendor Neutral Archive (VNA) & PACS Market Analysis by Countries 8.1 Asia-Pacific Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Vendor Neutral Archive (VNA) & PACS Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Vendor Neutral Archive (VNA) & PACS Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 8.2 China Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 8.2.1 China Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 8.3 Japan Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 8.3.1 Japan Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 8.4 South Korea Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 8.4.1 South Korea Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 8.5 Australia Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 8.6 India Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 8.6.1 India Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 8.7 Southeast Asia Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 9 Middle East and Africa Vendor Neutral Archive (VNA) & PACS Market Analysis by Countries 9.1 Middle East and Africa Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Vendor Neutral Archive (VNA) & PACS Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Vendor Neutral Archive (VNA) & PACS Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 9.2 Saudi Arabia Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 9.3 UAE Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 9.4 Egypt Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 9.5 Nigeria Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 9.6 South Africa Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 10 South America Vendor Neutral Archive (VNA) & PACS Market Analysis by Countries 10.1 South America Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Countries 10.1.1 South America Vendor Neutral Archive (VNA) & PACS Sales by Countries (2015-2020) 10.1.2 South America Vendor Neutral Archive (VNA) & PACS Revenue by Countries (2015-2020) 10.1.3 South America Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 10.2 Brazil Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 10.2.1 Brazil Vendor Neutral Archive (VNA) & PACS Market Under COVID-19 10.3 Argentina Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 10.4 Columbia Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 10.5 Chile Vendor Neutral Archive (VNA) & PACS Sales and Growth Rate (2015-2020) 11 Global Vendor Neutral Archive (VNA) & PACS Market Segment by Types 11.1 Global Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Vendor Neutral Archive (VNA) & PACS Sales and Market Share by Types (2015-2020) 11.1.2 Global Vendor Neutral Archive (VNA) & PACS Revenue and Market Share by Types (2015-2020) 11.2 RIS Sales and Price (2015-2020) 11.3 PACS Sales and Price (2015-2020) 11.4 VNA Software Sales and Price (2015-2020) 12 Global Vendor Neutral Archive (VNA) & PACS Market Segment by Applications 12.1 Global Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Vendor Neutral Archive (VNA) & PACS Sales and Market Share by Applications (2015-2020) 12.1.2 Global Vendor Neutral Archive (VNA) & PACS Revenue and Market Share by Applications (2015-2020) 12.2 Single Department Sales, Revenue and Growth Rate (2015-2020) 12.3 Multiple Departments Sales, Revenue and Growth Rate (2015-2020) 12.4 Multiple Sites Sales, Revenue and Growth Rate (2015-2020) 13 Vendor Neutral Archive (VNA) & PACS Market Forecast by Regions (2020-2026) 13.1 Global Vendor Neutral Archive (VNA) & PACS Sales, Revenue and Growth Rate (2020-2026) 13.2 Vendor Neutral Archive (VNA) & PACS Market Forecast by Regions (2020-2026) 13.2.1 North America Vendor Neutral Archive (VNA) & PACS Market Forecast (2020-2026) 13.2.2 Europe Vendor Neutral Archive (VNA) & PACS Market Forecast (2020-2026) 13.2.3 Asia-Pacific Vendor Neutral Archive (VNA) & PACS Market Forecast (2020-2026) 13.2.4 Middle East and Africa Vendor Neutral Archive (VNA) & PACS Market Forecast (2020-2026) 13.2.5 South America Vendor Neutral Archive (VNA) & PACS Market Forecast (2020-2026) 13.3 Vendor Neutral Archive (VNA) & PACS Market Forecast by Types (2020-2026) 13.4 Vendor Neutral Archive (VNA) & PACS Market Forecast by Applications (2020-2026) 13.5 Vendor Neutral Archive (VNA) & PACS Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Vendor Neutral Archive (VNA) & PACS

Request Sample

Vendor Neutral Archive (VNA) & PACS