Video Equipment Market Size, Share, and Trends Analysis Report

CAGR :

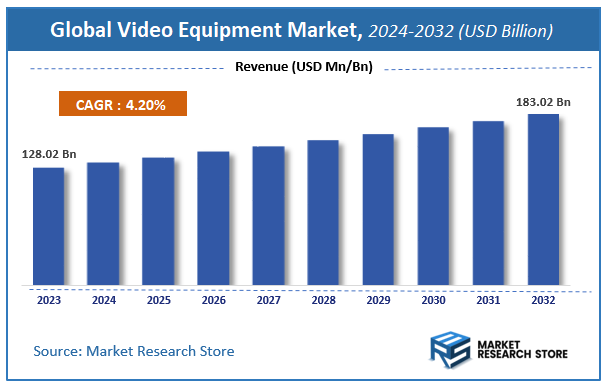

| Market Size 2023 (Base Year) | USD 128.02 Billion |

| Market Size 2032 (Forecast Year) | USD 183.02 Billion |

| CAGR | 4.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Video Equipment Market Insights

According to Market Research Store, the global video equipment market size was valued at around USD 128.02 billion in 2023 and is estimated to reach USD 183.02 billion by 2032, to register a CAGR of approximately 4.2% in terms of revenue during the forecast period 2024-2032.

The video equipment report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Video Equipment Market: Overview

Video equipment refers to a broad range of devices and tools used for capturing, recording, editing, transmitting, and displaying video content. This category includes cameras (such as digital camcorders, DSLR/mirrorless cameras with video capabilities, and professional broadcast cameras), tripods, lighting systems, microphones, monitors, switchers, recorders, and editing hardware or software. Video equipment is essential across various industries, including film and television production, broadcasting, education, corporate communications, surveillance, and online content creation.

The growth of the video equipment market is driven by the increasing demand for high-quality video content in social media, streaming platforms, virtual events, and online learning. The rise of remote work and virtual collaboration has further spurred investment in video conferencing equipment and studio setups. Technological innovation, along with the convergence of video and digital media, continues to fuel demand for multifunctional, high-performance, and user-friendly video equipment across both professional and consumer segments.

Key Highlights

- The video equipment market is anticipated to grow at a CAGR of 4.2% during the forecast period.

- The global video equipment market was estimated to be worth approximately USD 128.02 billion in 2023 and is projected to reach a value of USD 183.02 billion by 2032.

- The growth of the video equipment market is being driven by increased internet penetration and smartphone usage.

- Based on the product, the televisions segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the online segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Video Equipment Market: Dynamics

Key Growth Drivers:

- Explosive Growth of Video Consumption: The insatiable demand for video content across platforms like streaming services, social media, online education, and enterprise communication fuels the need for diverse video equipment.

- Technological Advancements in Imaging and Processing: Continuous innovations in sensor technology, image processing, resolution (4K, 8K), frame rates, and dynamic range drive demand for newer and higher-performing video equipment.

- Proliferation of Content Creation: The rise of individual content creators, YouTubers, vloggers, and social media influencers creates a significant market for affordable and user-friendly video equipment.

- Increasing Adoption of Live Streaming: Live streaming for gaming, events, news, and social interaction is becoming increasingly popular, driving demand for live streaming cameras, encoders, and related gear.

- Growing Use of Video in Enterprise and Education: Video conferencing, online learning, training videos, and marketing content are becoming integral to businesses and educational institutions, boosting demand for relevant video equipment.

- Integration of AI and Machine Learning in Video Processing: AI-powered features like object recognition, automated editing, and intelligent video analytics are driving the development and adoption of advanced video equipment.

- Demand for High-Quality Visual Experiences: Consumers increasingly expect high-resolution, immersive video experiences, driving demand for 4K/8K displays, projectors, and high-fidelity capture devices.

Restraints:

- High Cost of Professional-Grade Equipment: Professional video cameras, editing suites, and high-end displays can be expensive, limiting their accessibility to individual creators and smaller businesses.

- Rapid Technological Obsolescence: The video equipment market is characterized by rapid technological advancements, leading to quick obsolescence of older equipment and potentially discouraging frequent upgrades.

- Complexity of Advanced Features and Workflows: Operating professional-grade video equipment and mastering complex editing software can require significant technical expertise and training.

- Standardization and Interoperability Issues: Lack of universal standards can sometimes lead to compatibility problems between different video equipment and software from various manufacturers.

- Piracy and Unauthorized Distribution of Video Content: Concerns about piracy can impact investment in high-end video production equipment and distribution technologies.

- Bandwidth Limitations for High-Resolution Streaming: Delivering high-resolution video streams (4K, 8K) requires significant bandwidth, which can be a limitation in areas with poor internet infrastructure.

- Economic Downturns Affecting Capital Expenditure: Economic recessions can lead to reduced spending on non-essential equipment, including video production and display technologies.

Opportunities:

- Development of More Affordable Professional-Grade Equipment: Making high-quality video equipment more accessible to a wider range of creators and businesses through cost-effective manufacturing and innovative designs.

- Focus on User-Friendly Interfaces and Simplified Workflows: Designing video equipment and software with intuitive interfaces and streamlined workflows to cater to both professionals and amateur users.

- Integration with Cloud-Based Platforms and Services: Leveraging cloud technologies for video storage, editing, collaboration, and distribution, offering greater flexibility and accessibility.

- Advancements in Virtual and Augmented Reality (VR/AR) Video: The growing interest in VR/AR creates opportunities for specialized video capture and display equipment for immersive experiences.

- Development of AI-Powered Video Enhancement and Editing Tools: Creating intelligent software that automates and simplifies complex video editing tasks, enhances video quality, and provides insightful analytics.

- Growth in Niche Markets like Esports and Live Event Production: Catering to the specific needs of rapidly growing sectors like esports and live event streaming with specialized video equipment and solutions.

- Sustainable and Environmentally Friendly Video Equipment: Designing and manufacturing video equipment with energy-efficient components and using sustainable materials.

Challenges:

- Keeping Pace with the Rapid Pace of Technological Innovation: Continuously adapting to and integrating new technologies into video equipment to remain competitive.

- Meeting the Diverse Needs of Different User Segments: Catering to the varying requirements of individual creators, small businesses, large enterprises, and broadcast professionals.

- Ensuring Data Security and Privacy in Video Communication and Storage: Protecting sensitive video data from unauthorized access and ensuring compliance with privacy regulations.

- Managing the Increasing Complexity of Video Workflows: Simplifying complex production and post-production workflows to improve efficiency and reduce costs.

- Maintaining Image Quality Across Different Devices and Platforms: Ensuring consistent and high-quality video playback across a wide range of screens and streaming platforms.

- Combating Counterfeit and Low-Quality Video Equipment: Protecting consumers and the industry from the proliferation of fake or substandard video products.

- Adapting to Evolving Content Consumption Habits: Understanding and catering to changing viewer preferences and the ways in which video content is being consumed.

Video Equipment Market: Report Scope

This report thoroughly analyzes the Video Equipment Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Video Equipment Market |

| Market Size in 2023 | USD 128.02 Billion |

| Market Forecast in 2032 | USD 183.02 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 168 |

| Key Companies Covered | Samsung Electronics, LG Electronics, Sony, Panasonic, Toshiba |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Video Equipment Market: Segmentation Insights

The global video equipment market is divided by product, application, and region.

Segmentation Insights by Product

Based on product, the global video equipment market is divided into televisions, home theatre systems, DVD players, and others.

Televisions dominate the Video Equipment Market and represent the largest and most technologically advanced product segment. The demand for televisions continues to surge due to rapid advancements in display technologies such as OLED, QLED, and 4K/8K ultra-high definition. Consumers are increasingly investing in larger screens and smart TV functionalities that offer integrated streaming, voice control, and seamless connectivity with other home devices. The widespread availability of affordable smart TVs and the rising popularity of on-demand video services like Netflix, Amazon Prime Video, and YouTube further drive this segment’s growth. Additionally, global sporting events and advancements in gaming consoles contribute to periodic boosts in television sales, reinforcing their dominance in the video equipment landscape.

Home Theatre Systems hold a significant share of the market and continue to grow, particularly among consumers seeking immersive audio-visual experiences at home. These systems, which typically include AV receivers, surround sound speakers, and subwoofers, are popular for replicating cinema-like sound quality. The integration of wireless technology, Dolby Atmos support, and compatibility with streaming platforms has enhanced their appeal in both premium and mid-range markets. While standalone soundbars have emerged as a simpler alternative, home theatre systems remain the preferred choice for audiophiles and high-end home entertainment setups. Their growth is supported by trends in smart home adoption and increased consumer spending on home entertainment.

DVD Players, once a dominant category, now account for the smallest share of the market and are in significant decline. The rise of digital streaming services and downloadable content has drastically reduced the demand for physical media playback devices. Although DVD players are still used in some regions and by consumers with legacy collections, they are largely being replaced by streaming-enabled smart TVs and set-top boxes. However, certain niche markets such as education, low-connectivity regions, and collectors continue to support minimal ongoing demand for basic DVD playback functionality.

Segmentation Insights by Application

On the basis of application, the global video equipment market is bifurcated into online and offline.

Online sales is dominant the video equipment application market, segment in recent years, driven by the rapid expansion of e-commerce platforms, digital retail infrastructure, and changing consumer shopping habits. The convenience of home delivery, competitive pricing, access to a wide product range, and the availability of product reviews and comparison tools have significantly boosted online purchases of video equipment, especially televisions and home theatre systems. Major online retailers like Amazon, Flipkart, Best Buy, and regional e-commerce platforms play a crucial role in distributing products across urban and rural markets. The rise of online-exclusive models, flash sales, and bundled offers has also incentivized consumers to make high-ticket purchases through digital channels. Furthermore, the growth of mobile commerce and digital payment options continues to accelerate the shift toward online buying, particularly in developing regions where e-commerce penetration is increasing rapidly.

Offline sales, while experiencing a relative decline in market share, remain a vital part of the Video Equipment Market, especially for high-value or complex products where in-person evaluation is preferred. Physical retail stores, including consumer electronics outlets, department stores, and specialty showrooms, provide hands-on product demonstrations, personalized assistance, and immediate product availability. These advantages are particularly important for customers purchasing premium televisions or full home theatre systems, where sound and display quality are best assessed in-store. Additionally, offline sales continue to dominate in regions with limited internet access, low trust in online transactions, or cultural preferences for in-person shopping. Retail chains and local dealers also play a significant role in building customer loyalty and offering after-sales support.

Video Equipment Market: Regional Insights

- North America is expected to dominate the global market.

North America dominates the Video Equipment Market, primarily driven by a strong entertainment industry, widespread adoption of video streaming services, and rapid advancements in broadcast and production technologies. The United States accounts for the largest share, with high demand from film studios, sports broadcasting companies, educational institutions, and corporate sectors. There is a strong emphasis on adopting high-resolution equipment such as 4K and 8K cameras, advanced video switchers, and live production gear. The region also benefits from the presence of key market players, robust infrastructure, and high consumer spending on professional-grade video equipment and home theater systems.

Asia-Pacific region is witnessing rapid growth in the Video Equipment Market, fueled by a booming media and entertainment sector, the rise of social media influencers, and expanding digital infrastructure. Countries such as China, India, Japan, and South Korea are major contributors, with growing investments in film production, online content creation, and educational video platforms. The rise in smartphone usage and internet penetration is also increasing demand for affordable, high-quality video gear for content creators and small businesses. Additionally, local manufacturers are making significant strides in offering competitively priced professional video equipment, supporting regional market expansion.

Europe holds a significant share of the Video Equipment Market, led by countries like Germany, France, the United Kingdom, and Italy, where digital content creation, OTT platforms, and e-learning applications are flourishing. Broadcasters and production houses across the region are investing heavily in UHD and IP-based video production tools to enhance quality and efficiency. Furthermore, the increasing number of music festivals, sports events, and corporate conferences is supporting the growth of video equipment used for live streaming and on-site production. Europe’s focus on sustainability is also pushing demand for energy-efficient and modular video devices.

Latin America represents an emerging region in the Video Equipment Market, with growing demand from countries like Brazil, Mexico, and Argentina. The expansion of digital TV services, online education platforms, and local video content production is driving the need for upgraded cameras, editing software, and audio-visual integration systems. Although the market is still in its developmental phase compared to more mature regions, increasing investment in broadcasting infrastructure and the proliferation of independent content creators are positively impacting growth. Economic challenges and import dependency may limit growth to some extent, but government support for digital transformation is improving market outlook.

Middle East and Africa region is experiencing steady growth in the Video Equipment Market, led by countries such as United Arab Emirates, Saudi Arabia, and South Africa. The demand is primarily driven by rapid urbanization, the growth of event management sectors, and rising adoption of video conferencing and distance learning solutions. Regional broadcasters and entertainment channels are investing in modernizing their equipment to deliver high-definition content. While certain regions still face infrastructure limitations, ongoing investments in media hubs and smart city projects are creating opportunities for expansion of advanced video technology.

Video Equipment Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the video equipment market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global video equipment market include:

- Samsung Electronics

- LG Electronics

- Sony

- Panasonic

- Toshiba

The global video equipment market is segmented as follows:

By Product

- Televisions

- Home Theatre Systems

- DVD Players

- Others

By Application

- Online

- Offline

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Video Equipment

Request Sample

Video Equipment