Vitamin C Powder Market Size, Share, and Trends Analysis Report

CAGR :

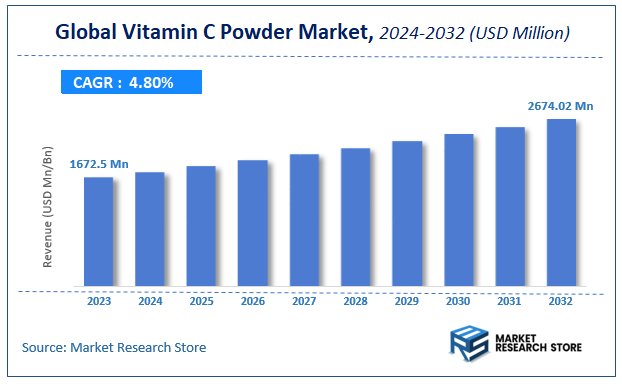

| Market Size 2023 (Base Year) | USD 1672.5 Million |

| Market Size 2032 (Forecast Year) | USD 2674.02 Million |

| CAGR | 4.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Vitamin C Powder Market Insights

According to Market Research Store, the global vitamin c powder market size was valued at around USD 1672.5 million in 2023 and is estimated to reach USD 2674.02 million by 2032, to register a CAGR of approximately 4.8% in terms of revenue during the forecast period 2024-2032.

The vitamin c powder report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Vitamin C Powder Market: Overview

Vitamin C powder is a concentrated, powdered form of ascorbic acid, a water-soluble vitamin essential for various bodily functions. It is commonly used as a dietary supplement to support immune health, promote collagen synthesis, improve skin appearance, and enhance antioxidant protection. The powder format allows for flexible dosing and easy incorporation into beverages, skincare products, and other health formulations. Vitamin C powder is widely favored for its stability, longer shelf life compared to liquid versions, and its application in both oral and topical uses. It is popular among health-conscious consumers and professionals in the cosmetics and nutraceutical industries.

Key Highlights

- The vitamin c powder market is anticipated to grow at a CAGR of 4.8% during the forecast period.

- The global vitamin c powder market was estimated to be worth approximately USD 1672.5 million in 2023 and is projected to reach a value of USD 2674.02 million by 2032.

- The growth of the vitamin c powder market is being driven by increasing consumer awareness about preventive healthcare, skin health, and nutritional supplementation.

- Based on the product type, the ascorbic acid segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the nutritional supplements segment is projected to swipe the largest market share.

- In terms of end user, the individual’s segment is expected to dominate the market.

- Based on the distribution channel, the online retail segment is expected to dominate the market.

- In terms of formulation, the pure vitamin c powder segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Vitamin C Powder Market: Dynamics

Key Growth Drivers:

- Rising Health Awareness Among Consumers: Growing consumer awareness regarding the benefits of vitamin C in boosting immunity, skin health, and overall wellness is driving demand for vitamin C powder as a daily supplement.

- Expansion of the Nutraceutical Industry: The rapid growth of the nutraceuticals sector, especially in developing economies, is boosting the demand for vitamin C powder as a functional ingredient in dietary supplements and health drinks.

- Increased Use in Food and Beverage Fortification: Vitamin C powder is increasingly used in fortified foods and beverages to enhance nutritional value, supporting its market growth across various application segments.

- Growth of Vegan and Natural Product Trends: As more consumers seek plant-based, clean-label, and natural health products, vitamin C powder (often derived from natural sources like acerola) aligns well with this trend.

- Rising Demand in Cosmetics and Personal Care: Vitamin C is widely used in skincare and cosmetic products for its antioxidant and anti-aging properties, driving additional demand from the beauty and personal care industry.

Restraints:

- Fluctuating Raw Material Prices: Price volatility of raw materials like ascorbic acid and citrus fruits can affect production costs and profit margins for manufacturers.

- Stringent Regulatory Frameworks: Regulatory restrictions related to product labeling, health claims, and ingredient sourcing vary across regions, creating hurdles for market entry and expansion.

- Limited Shelf Life and Stability Issues: Vitamin C is sensitive to light, heat, and oxygen, leading to stability concerns that may hinder its effectiveness in certain formulations and packaging.

Opportunities:

- Emerging Demand in Developing Regions: Rising disposable income and health consciousness in regions like Asia-Pacific, Latin America, and the Middle East create strong growth opportunities for vitamin C powder products.

- Innovation in Delivery Formats: Opportunities exist in developing new formats such as effervescent tablets, sachets, gummies, and ready-to-mix powders to cater to convenience-seeking consumers.

- Expansion into Sports and Fitness Nutrition: With the surge in fitness culture and athletic lifestyles, vitamin C powder is gaining popularity as a recovery aid, opening new market segments.

- E-commerce and Direct-to-Consumer Channels: Online retail platforms provide greater visibility and accessibility for vitamin C powder brands, especially among health-conscious millennials and Gen Z consumers.

Challenges:

- High Market Competition and Price Pressure: The presence of numerous global and local players leads to intense competition, driving down prices and affecting margins.

- Consumer Skepticism Toward Supplement Claims: Misleading or exaggerated health claims by some brands can reduce consumer trust and require more transparency and education to maintain credibility.

- Supply Chain Disruptions: Global disruptions, such as pandemics or geopolitical tensions, can affect the steady supply of raw materials and finished products.

- Awareness Gap in Rural or Underserved Markets: In certain regions, a lack of awareness about the health benefits of vitamin C supplementation limits market penetration.

Vitamin C Powder Market: Report Scope

This report thoroughly analyzes the Vitamin C Powder Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Vitamin C Powder Market |

| Market Size in 2023 | USD 1672.5 Million |

| Market Forecast in 2032 | USD 2674.02 Million |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 175 |

| Key Companies Covered | DSM, CSPC Pharma, Shandong Luwei, Northeast Pharma, North China Pharma, Shandong Tianli, Ningxia Qiyuan, Zhengzhou Tuoyang, Henan Huaxing, Anhui Tiger, Zhejiang Minsheng Biotechnology |

| Segments Covered | By Product Type, By Application, By End User, By Distribution Channel, By Formulation, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vitamin C Powder Market: Segmentation Insights

The global vitamin c powder market is divided by product type, application, end user, distribution channel, formulation, and region.

Segmentation Insights by Product Type

Based on product type, the global vitamin c powder market is divided into ascorbic acid, sodium ascorbate, calcium ascorbate, and other forms.

In the vitamin C powder market, Ascorbic Acid stands as the most dominant product type segment. This form of vitamin C is widely recognized for its purity and potency, making it the preferred choice for dietary supplements, cosmetics, and food fortification. Its strong antioxidant properties, coupled with broad industrial applications, especially in the pharmaceutical and nutraceutical industries, reinforce its market leadership. Ascorbic acid is often used in its crystalline powder form for its versatility and effectiveness in boosting immune health, skin care, and food preservation.

Following Ascorbic Acid, Calcium Ascorbate holds the second most significant share. It is a mineral ascorbate form of vitamin C that combines calcium with ascorbic acid. This buffered form is gentler on the stomach compared to pure ascorbic acid, making it ideal for consumers with sensitive gastrointestinal systems. It is commonly used in health supplements aimed at individuals seeking both vitamin C and calcium intake without causing gastric irritation.

Sodium Ascorbate ranks next and is another mineral salt of ascorbic acid. It is often chosen for its lower acidity, which makes it less irritating to the digestive tract, and it is frequently used in intravenous therapies and dietary supplements. Despite its advantages, it is slightly less preferred than calcium ascorbate due to sodium intake concerns among certain consumer groups, particularly those with hypertension or sodium-restricted diets.

Lastly, the Other Forms segment, which includes forms like magnesium ascorbate, potassium ascorbate, and liposomal vitamin C, holds the smallest market share. These specialized variants serve niche markets and are generally more expensive, limiting their widespread adoption. However, they are gaining traction among health-conscious consumers seeking enhanced absorption or additional health benefits, though their market penetration remains relatively limited compared to the mainstream forms.

Segmentation Insights by Application

On the basis of application, the global vitamin c powder market is bifurcated into nutritional supplements, food & beverage, cosmetics & personal care, and pharmaceuticals.

In the vitamin C powder market by application, Nutritional Supplements represent the most dominant segment. This dominance is driven by the widespread demand for vitamin C as a daily dietary supplement to support immune function, combat oxidative stress, and promote overall well-being. The growing trend of preventive healthcare and increased consumer awareness of immunity-boosting products—especially after the COVID-19 pandemic—has significantly amplified the demand for vitamin C powder in tablet, capsule, and drink mix formats. Its easy integration into various supplement forms further contributes to its market leadership.

The Food & Beverage segment follows closely as the second most prominent application. Vitamin C powder is widely used as a food additive and preservative due to its antioxidant properties, helping extend shelf life and enhance nutritional value. It is commonly added to juices, cereals, snacks, and dairy products. The clean-label movement and rising consumer preference for fortified and functional foods continue to support the growth of this segment, although regulatory standards and formulation challenges slightly temper its pace compared to supplements.

Cosmetics & Personal Care is the next segment, leveraging vitamin C powder for its skin-brightening, anti-aging, and antioxidant benefits. It is a popular ingredient in serums, creams, masks, and powders aimed at reducing pigmentation, promoting collagen synthesis, and protecting the skin from environmental damage. Although this segment is smaller than the nutritional and food sectors, it is growing steadily due to increased interest in natural and functional skincare products.

Lastly, the Pharmaceuticals segment holds the smallest share in this market. While vitamin C powder is used in therapeutic formulations, especially for treating scurvy and aiding wound healing, its role is often limited to supportive or adjunct therapy. Moreover, the regulated nature of pharmaceutical formulations and the preference for tablet or injectable forms over powders constrain this segment’s growth relative to the others.

Segmentation Insights by End User

Based on end user, the global vitamin c powder market is divided into individuals, health enthusiasts, fitness professionals, and healthcare providers.

In the vitamin C powder market by end user, Individuals form the most dominant segment. This group includes everyday consumers using vitamin C powder as part of their daily wellness routine, particularly for immune support and general health maintenance. The convenience, affordability, and availability of vitamin C powder in retail and online channels have made it a staple supplement for households. Increased health awareness and proactive self-care behaviors have significantly expanded this segment’s reach across various age groups.

Next in line are Health Enthusiasts, who are more informed and selective about their nutritional intake. They often seek out high-quality, pure, and sometimes specialized forms of vitamin C powder, including buffered or liposomal versions. This segment values clean-label products, bioavailability, and synergistic formulations, often integrating vitamin C into personalized wellness regimens or combining it with other supplements like zinc or collagen for enhanced results.

Fitness Professionals follow as a specialized but growing segment. These users incorporate vitamin C powder into their routines primarily for its role in recovery, reducing exercise-induced oxidative stress, and supporting joint and tissue repair. While their share is smaller than the general health-focused users, fitness professionals often serve as influencers, promoting supplement use among broader consumer groups and thus indirectly driving demand.

Finally, Healthcare Providers constitute the smallest segment. This group includes doctors, dietitians, and integrative medicine practitioners who recommend or administer vitamin C powder in clinical or therapeutic settings. Though limited in number, this segment holds high influence, particularly in specialized cases like intravenous therapy, immune-compromised patients, or recovery protocols. However, stringent regulatory requirements and the preference for pharmaceutical-grade formats limit its widespread adoption compared to consumer-driven segments.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global vitamin c powder market is bifurcated into online retail, offline retail, direct sales, and health food stores.

In the vitamin C powder market by distribution channel, Online Retail emerges as the most dominant segment. The surge in e-commerce platforms, coupled with increased digital literacy and convenience, has made online shopping the preferred choice for consumers. Online channels offer a wider range of products, detailed ingredient information, competitive pricing, and consumer reviews that enhance trust and ease of purchase. The availability of subscription models and doorstep delivery further strengthens the online segment’s lead, especially among tech-savvy and health-conscious buyers.

Offline Retail follows as the second-largest channel. This includes supermarkets, pharmacies, and departmental stores where consumers can physically inspect products before purchasing. Despite the growth of online options, offline retail remains strong due to its immediate availability, especially for impulse purchases or when quick replenishment is needed. Additionally, brick-and-mortar stores benefit from brand visibility and customer service, which help in building loyalty.

Health Food Stores come next, serving a niche but loyal customer base. These stores specialize in natural, organic, and functional food products, including vitamin C powder, often attracting health-focused consumers looking for premium or specialty formulations. While their market share is smaller compared to mainstream retail channels, health food stores are valued for their curated selections, knowledgeable staff, and alignment with wellness lifestyles.

Direct Sales represent the smallest segment in this category. This includes companies that sell vitamin C powder directly to consumers through independent distributors, consultants, or their own network marketing models. While direct sales can build strong customer relationships and brand loyalty, the model is limited in scalability and reach compared to digital and retail channels. Nonetheless, it retains relevance in certain markets where trust and personalization play a key role in purchasing decisions.

Segmentation Insights by Formulation

On the basis of formulation, the global vitamin c powder market is bifurcated into pure vitamin c powder, vitamin c blends, enhanced formulations (with probiotics, etc.), and organic vitamin c powder.

In the vitamin C powder market by formulation, Pure Vitamin C Powder dominates as the most significant segment. This formulation is favored for its simplicity, purity, and high potency, offering consumers an effective way to boost their vitamin C intake without additional ingredients. It is widely used in nutritional supplements, food & beverage fortification, and skincare products due to its versatility and high antioxidant content. The demand for pure vitamin C powder is especially strong among those who prefer straightforward, no-frills supplementation for immune health and overall wellness.

The Vitamin C Blends segment comes next in terms of market share. These formulations combine vitamin C with other beneficial ingredients, such as vitamins, minerals, or herbs, to enhance their synergistic effects. For example, vitamin C blends may include ingredients like zinc or echinacea for immune support, making them popular in the wellness and supplement markets. This category is growing due to the rising consumer preference for all-in-one supplements that address multiple health concerns in a single product.

Enhanced Formulations, which include products with added ingredients such as probiotics, amino acids, or herbal extracts, rank third. These formulations cater to consumers seeking more than just the benefits of vitamin C. Probiotic-infused vitamin C powders, for instance, offer digestive health benefits alongside the immune-boosting properties of vitamin C. While the demand for enhanced formulations is growing, it remains a niche segment compared to pure powders and blends due to the higher complexity in production and cost.

Lastly, the Organic Vitamin C Powder segment holds a smaller share but is growing steadily. These powders are made from organic sources like acerola cherries, camu camu, or other plant-based, organic sources of vitamin C. This formulation appeals to consumers who prioritize natural, sustainable, and organic products free from synthetic ingredients or chemicals. Despite its smaller market share, the demand for organic vitamin C powder is expected to increase as consumers become more health-conscious and environmentally aware.

Vitamin C Powder Market: Regional Insights

- Asia Pacific is expected to dominates the global market

Asia Pacific is the most dominant region in the global vitamin C powder market. This region leads primarily due to the large-scale production capacities in countries like China, which is a key global supplier of vitamin C. Rising health awareness, increasing use of vitamin C in food and beverage fortification, and the expanding pharmaceutical and nutraceutical industries drive significant demand. Furthermore, widespread application in cosmetics and animal nutrition boosts market growth. The region’s strong manufacturing infrastructure and cost-effective production give it a competitive edge over other regions.

North America holds a significant position in the vitamin C powder market, with the United States being a major contributor. The market is characterized by a strong consumer preference for health and wellness products, a mature supplements industry, and high adoption of preventive healthcare practices. Vitamin C is widely used not only in dietary supplements but also in pharmaceutical formulations and skincare products, further enhancing its demand across this region.

Europe maintains a solid share in the vitamin C powder market, driven by increasing health consciousness, especially among the aging population. Countries such as Germany, the UK, and France lead consumption due to their well-established pharmaceutical sectors and growing interest in immune-supporting nutrients. The trend of clean-label and natural ingredients also supports the region’s adoption of vitamin C in both food and personal care applications.

Latin America is showing steady growth in the vitamin C powder market. Countries like Brazil and Mexico are experiencing rising demand due to growing urbanization, improved healthcare infrastructure, and increasing consumer inclination towards functional foods and supplements. Although the market is relatively smaller compared to more developed regions, it presents growth opportunities through expanding awareness and regional investment.

Middle East and Africa represent the least dominant region in the vitamin C powder market, though there is gradual growth due to improving economic conditions and increased focus on healthcare development. The region is beginning to see a rise in demand for nutritional supplements, including vitamin C, particularly in urban centers. However, limited manufacturing facilities and lower consumer awareness restrict more rapid market expansion.

Vitamin C Powder Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the vitamin c powder market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global vitamin c powder market include:

- DSM

- CSPC Pharma

- Shandong Luwei

- Northeast Pharma

- North China Pharma

- Shandong Tianli

- Ningxia Qiyuan

- Zhengzhou Tuoyang

- Henan Huaxing

- Anhui Tiger

- Zhejiang Minsheng Biotechnology

The global vitamin c powder market is segmented as follows:

By Product Type

- Ascorbic Acid

- Sodium Ascorbate

- Calcium Ascorbate

- Other Forms

By Application

- Nutritional Supplements

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceuticals

By End User

- Individuals

- Health Enthusiasts

- Fitness Professionals

- Healthcare Providers

By Distribution Channel

- Online Retail

- Offline Retail

- Direct Sales

- Health Food Stores

By Formulation

- Pure Vitamin C Powder

- Vitamin C Blends

- Enhanced Formulations (with probiotics etc.)

- Organic Vitamin C Powder

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Vitamin C Powder

Request Sample

Vitamin C Powder