Volume Booster Software Market Size, Share, and Trends Analysis Report

CAGR :

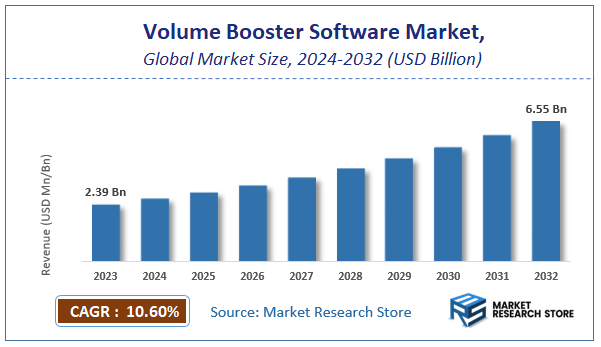

| Market Size 2023 (Base Year) | USD 2.39 Billion |

| Market Size 2032 (Forecast Year) | USD 6.55 Billion |

| CAGR | 10.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Volume Booster Software Market Insights

According to Market Research Store, the global volume booster software market size was valued at around USD 2.39 billion in 2023 and is estimated to reach USD 6.55 billion by 2032, to register a CAGR of approximately 10.6% in terms of revenue during the forecast period 2024-2032.

The volume booster software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Volume Booster Software Market: Overview

Volume booster software is designed to enhance the audio output of devices beyond their standard maximum levels, providing users with a more immersive and amplified sound experience. These software solutions are widely used across various platforms, including Windows, macOS, Android, and iOS, allowing users to boost audio in media players, streaming services, gaming, and virtual communication applications. The increasing demand for better sound quality in entertainment, online meetings, and gaming has significantly driven the adoption of these tools. Additionally, advancements in AI-based sound enhancement and equalization technologies have further contributed to the market’s growth by offering improved clarity and dynamic range adjustments.

Key Highlights

- The volume booster software market is anticipated to grow at a CAGR of 10.6% during the forecast period.

- The global volume booster software market was estimated to be worth approximately USD 2.39 billion in 2023 and is projected to reach a value of USD 6.55 billion by 2032.

- The growth of the volume booster software market is being driven by increasing demand for enhanced audio experiences in personal entertainment, gaming, and professional applications.

- Based on the type of software, the mobile applications segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the individual users segment is projected to swipe the largest market share.

- In terms of operating system, the android segment is expected to dominate the market.

- Based on the features, the equalizer functionality segment is expected to dominate the market.

- On the basis of distribution channel, the online marketplaces segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Volume Booster Software Market: Dynamics

Key Growth Drivers:

- Rising Demand for Enhanced Audio Experience – Increasing consumer preference for high-quality sound in entertainment, gaming, and online communication is driving the demand for volume booster software.

- Growth in Streaming Services & Online Content – The expansion of video and music streaming platforms like Netflix, Spotify, and YouTube is encouraging users to enhance their audio output.

- Increasing Adoption of Remote Work & Online Learning – The surge in virtual meetings and e-learning has increased the need for clear and amplified audio solutions.

- Advancements in AI-based Sound Optimization – AI-driven audio enhancement features are improving the effectiveness of volume booster applications, making them more appealing.

Restraints:

- Compatibility Issues with Devices & Platforms – Some volume booster software may not work efficiently across all operating systems and device types, limiting their adoption.

- Potential Audio Distortion & Quality Loss – Excessive amplification can lead to reduced audio clarity, deterring professional users and audiophiles.

- Legal & Copyright Concerns – Modifying audio output beyond intended levels may lead to copyright and licensing issues, particularly for DRM-protected content.

Opportunities:

- Integration with Smart Devices & IoT – The growing use of smart speakers, home theaters, and wearable devices presents new integration possibilities.

- Expansion into the Gaming Industry – Gamers seek immersive sound experiences, creating demand for software that enhances in-game audio clarity and depth.

- Emerging Markets with Rising Digital Adoption – Developing regions with increasing smartphone penetration and internet access provide a lucrative user base.

Challenges:

- Competition from Built-in Audio Enhancement Features – Many modern devices now include built-in sound optimization, reducing the need for third-party software.

- Cybersecurity & Privacy Risks – Free and unverified volume booster applications may pose security threats such as malware and data breaches.

- Regulatory Restrictions on Sound Amplification – Certain jurisdictions impose restrictions on excessive audio amplification due to potential hearing damage concerns.

Volume Booster Software Market: Report Scope

This report thoroughly analyzes the Volume Booster Software Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Volume Booster Software Market |

| Market Size in 2023 | USD 2.39 Billion |

| Market Forecast in 2032 | USD 6.55 Billion |

| Growth Rate | CAGR of 10.6% |

| Number of Pages | 170 |

| Key Companies Covered | Global Delight Technologies, Fxsound, Fidelizer Audio, Vb-audio, Audioretoucher, Equalizer Apo, Letasoft, Bongiovi Acoustic Labs |

| Segments Covered | By Type of Software, By End-User, By Operating System, By Features, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Volume Booster Software Market: Segmentation Insights

The global volume booster software market is divided by type of software, end-user, operating system, features, distribution channel, and region.

Segmentation Insights by Type of Software

Based on type of software, the global volume booster software market is divided into desktop applications, mobile applications, web-based solutions, plugins and extensions.

The mobile applications segment dominates the volume booster software market, driven by the widespread use of smartphones and tablets for media consumption. Mobile users seek applications that enhance audio output for streaming services, gaming, and calls, making mobile-based volume boosters highly popular. These apps cater to both Android and iOS users, often featuring equalizers and sound enhancement tools that improve audio quality beyond default device capabilities. The demand for such solutions is further fueled by the increasing use of wireless earbuds and Bluetooth speakers, where users seek better sound control.

Following closely, desktop applications hold a significant share, particularly among users who rely on PCs and laptops for professional work, gaming, and entertainment. These applications allow users to boost volume levels beyond system defaults, making them valuable for multimedia professionals, content creators, and gamers who require precise sound customization. Many desktop volume booster tools integrate with music production software and video editing platforms, offering additional control over sound output.

Plugins and extensions are another important segment, mainly utilized by users who prefer lightweight solutions integrated directly into their browsers or media players. These tools allow users to enhance the audio experience without installing full-fledged applications. They are especially popular among users who frequently stream content through web browsers and need a quick, efficient way to amplify audio levels without affecting system-wide settings.

Web-based solutions represent a smaller but emerging segment, catering to users who prefer cloud-based audio enhancement without the need for downloads or installations. These solutions work through online platforms and are beneficial for users who frequently switch devices or need temporary volume boosting for streaming and virtual meetings. However, their reliance on internet connectivity and limited customization options make them less dominant than other segments.

Segmentation Insights by End-User

On the basis of end-user, the global volume booster software market is bifurcated into individual users, small and medium-sized enterprises (SMEs), large enterprises, and educational institutions.

The individual users segment dominates the volume booster software market, as personal entertainment, gaming, and media consumption drive demand for enhanced audio solutions. Individuals use these applications on smartphones, tablets, and computers to amplify sound for streaming services, video calls, and gaming experiences. The growing trend of wireless earbuds and Bluetooth speakers further fuels the need for volume-enhancing software, making this segment the most significant in terms of market share.

Small and Medium-sized Enterprises (SMEs) hold the second-largest share, particularly in industries where audio clarity is crucial, such as content creation, digital marketing, and customer service. SMEs use volume booster software for virtual meetings, presentations, and multimedia projects, ensuring clear communication and high-quality audio output. The increasing reliance on remote work and online collaboration tools has also contributed to the adoption of such software in this segment.

Large enterprises follow closely, leveraging volume booster software in corporate settings where audio clarity is essential for conference calls, webinars, and training sessions. Organizations that operate call centers, media production companies, or online education platforms integrate volume enhancement tools to improve customer interactions and content quality. Although this segment has a stable demand, its market share is lower than that of individual users and SMEs due to the availability of enterprise-grade audio solutions.

Educational institutions represent the smallest segment, but their adoption of volume booster software is growing with the rise of digital learning and virtual classrooms. Schools, universities, and e-learning platforms use these tools to enhance lecture recordings, improve audio in online classes, and provide better accessibility for students with hearing impairments. However, this segment remains relatively niche compared to others, as many institutions rely on built-in audio solutions or professional sound equipment.

Segmentation Insights by Operating System

Based on operating system, the global volume booster software market is divided into windows, macOS, linux, android, and iOS.

The Android segment dominates the volume booster software market, driven by the widespread use of Android smartphones and tablets for media consumption, gaming, and communication. Android users frequently seek third-party apps to enhance their device’s audio output, as many built-in volume settings are limited. The flexibility of the Android ecosystem allows developers to create feature-rich volume booster apps with equalizers, bass enhancers, and other customization tools, further fueling demand.

Following closely, Windows holds a significant share, primarily due to its dominance in the PC and laptop market. Many users rely on Windows-based volume booster applications for gaming, media playback, virtual meetings, and content creation. These applications cater to a broad audience, including professionals, students, and gamers who need advanced audio control beyond the default system settings. The availability of third-party software, browser extensions, and built-in enhancements contributes to this segment's strong position.

iOS comes next, benefiting from Apple’s vast user base, but with more restrictions compared to Android. iOS volume booster apps are limited due to Apple's strict app policies, which prevent significant system-wide audio modifications. However, users still download such apps for enhancing music playback, streaming audio, and video calls. The increasing use of AirPods and other wireless accessories further drives demand for audio enhancement solutions.

macOS holds a smaller but steady share, as Mac users, particularly professionals in content creation and multimedia industries, use volume enhancement software for better audio control in music production, video editing, and streaming. The macOS ecosystem offers fewer options than Windows, but high-end users still seek reliable volume booster tools for work and entertainment.

Linux represents the smallest segment, as its user base is relatively niche, consisting mainly of developers and tech-savvy individuals. While Linux offers open-source volume enhancement solutions, the demand is lower compared to other operating systems. Most Linux users rely on built-in system configurations or terminal-based commands to modify audio settings rather than dedicated volume booster applications.

Segmentation Insights by Features

On the basis of features, the global volume booster software market is bifurcated into equalizer functionality, pre-set audio profiles, real-time audio monitoring, multi-device support, and audio format compatibility.

The equalizer functionality segment dominates the volume booster software market, as users prioritize customization and audio enhancement beyond simple volume amplification. Equalizers allow users to adjust sound frequencies, improve bass, and fine-tune treble for a better listening experience across different media types, including music, movies, and games. This feature is particularly popular among audiophiles, gamers, and content creators who seek a more immersive and personalized sound experience.

Pre-set audio profiles follow closely, catering to users who prefer one-click solutions for different listening scenarios. These profiles optimize audio settings for music, gaming, movies, or calls, making them convenient for users who don’t want to manually adjust settings. Many volume booster applications include pre-sets for specific genres or activities, enhancing the overall user experience. This feature is widely adopted in both mobile and desktop applications, further strengthening its market presence.

Real-time audio monitoring is another significant segment, especially useful for professionals in music production, streaming, and broadcasting. This feature allows users to adjust sound levels dynamically while listening, ensuring optimal audio quality during live performances, recordings, or voice communication. It is particularly valued in professional settings where precise audio control is crucial, such as podcasting, DJing, and video editing.

Multi-device support is gaining traction, especially as users seek seamless audio control across multiple platforms. This feature enables synchronization of audio settings across smartphones, tablets, PCs, and smart speakers, providing a consistent listening experience. Businesses, gamers, and frequent travelers benefit from this feature as it allows them to maintain preferred audio settings across various devices.

Audio format compatibility represents the smallest segment, but it remains essential for users dealing with diverse media formats. Advanced volume booster applications support multiple audio file types, ensuring consistent performance across MP3, FLAC, WAV, and other formats. This feature is especially relevant for professionals working with high-resolution audio files or those using niche formats that require specialized enhancement.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global volume booster software market is bifurcated into direct sales, online marketplaces, software as a service (SaaS), and retail sales.

The online marketplaces segment dominates the volume booster software market, driven by the widespread availability of applications on platforms like Google Play Store, Apple App Store, and Microsoft Store. These marketplaces offer users easy access to free and paid volume booster apps, making them the most popular distribution channel. With mobile and desktop users increasingly relying on app stores for software downloads, this segment continues to experience strong growth. Additionally, customer reviews, ratings, and regular updates on these platforms further enhance user confidence and adoption rates.

Software as a Service (SaaS) follows closely, particularly in enterprise and professional environments. SaaS-based volume booster solutions provide cloud-based audio enhancement tools, enabling businesses, content creators, and streamers to access high-quality sound control without requiring installations. This model is popular among companies offering remote work solutions, video conferencing platforms, and online media production services, as it allows for flexible pricing, subscription-based access, and seamless updates.

Direct sales represent a significant segment, mainly driven by software companies selling premium volume booster solutions through their official websites. Many developers offer direct downloads, exclusive features, and customer support, making this a preferred channel for users seeking high-end audio enhancement tools. Direct sales are particularly relevant for businesses and professionals who require dedicated audio solutions with technical assistance.

Retail sales hold the smallest market share, as physical distribution of software has declined with the rise of digital downloads. While some volume booster software is still bundled with hardware devices, such as speakers, headphones, or PCs, most users prefer the convenience of digital distribution. However, retail sales remain relevant in niche markets where software is pre-installed on devices or sold as part of audio enhancement kits.

Volume Booster Software Market: Regional Insights

- North America is expected to dominates the global market

The most dominant segment in the volume booster software market is North America. This dominance is driven by high consumer demand for premium audio experiences, widespread adoption of advanced audio equipment, and the increasing use of streaming platforms. The region's tech-savvy user base values applications with advanced features like customizable equalizers, surround sound enhancements, and AI-driven sound optimization. Additionally, strong investments in digital entertainment, gaming, and content creation further boost the demand for high-quality volume enhancement tools, making North America the leading market for volume booster software.

In Europe, the market is notably influenced by stringent data protection regulations and a heightened awareness of privacy concerns. Consumers in this region tend to favor volume booster applications that demonstrate clear compliance with legal frameworks like the General Data Protection Regulation (GDPR). This preference underscores the importance of transparency and data security in software offerings, making regulatory adherence a critical factor for market success.

The Asia-Pacific region presents a rapidly expanding market for volume booster software, driven by increasing smartphone penetration and a growing middle-class population. Consumers in countries such as China and India show a preference for user-friendly and cost-effective applications, reflecting the region's diverse economic landscape. The proliferation of affordable smartphones has further fueled demand for applications that enhance audio experiences without compromising device performance.

In South America, the market is experiencing growth propelled by urbanization and a burgeoning youth demographic. Users in this region exhibit a strong inclination towards applications that integrate social sharing features, enabling them to share audio settings and playlists on social media platforms. This trend highlights the cultural emphasis on community engagement and shared experiences, influencing the development of socially integrated software solutions.

The Middle East and Africa region presents a varied market landscape, with differences in technological infrastructure and economic development influencing consumer preferences. In urban centers with robust connectivity, there is a demand for sophisticated sound enhancement tools. Conversely, in areas with limited technological infrastructure, users prioritize basic functionality and offline usability, necessitating a tailored approach from software developers to address these diverse needs.

Volume Booster Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the volume booster software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global volume booster software market include:

- Global Delight Technologies

- Fxsound

- Fidelizer Audio

- Vb-audio

- Audioretoucher

- Equalizer Apo

- Letasoft

- Bongiovi Acoustic Labs

The global volume booster software market is segmented as follows:

By Type of Software

- Desktop Applications

- Mobile Applications

- Web-Based Solutions

- Plugins and Extensions

By End-User

- Individual Users

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- Educational Institutions

By Operating System

- Windows

- macOS

- Linux

- Android

- iOS

By Features

- Equalizer Functionality

- Pre-set Audio Profiles

- Real-time Audio Monitoring

- Multi-device Support

- Audio Format Compatibility

By Distribution Channel

- Direct Sales

- Online Marketplaces

- Software as a Service (SaaS)

- Retail Sales

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Volume Booster Software

Request Sample

Volume Booster Software