Water Automation and Instrumentation Market Size, Share, and Trends Analysis Report

CAGR :

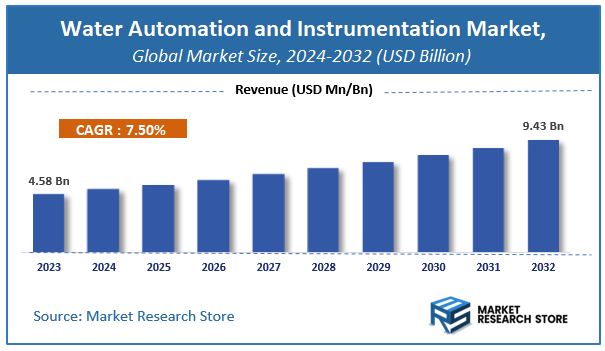

| Market Size 2023 (Base Year) | USD 4.58 Billion |

| Market Size 2032 (Forecast Year) | USD 9.43 Billion |

| CAGR | 7.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Water Automation and Instrumentation Market Insights

According to Market Research Store, the global water automation and instrumentation market size was valued at around USD 4.58 billion in 2023 and is estimated to reach USD 9.43 billion by 2032, to register a CAGR of approximately 7.5% in terms of revenue during the forecast period 2024-2032.

The water automation and instrumentation report provide a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Water Automation and Instrumentation Market: Overview

Water automation and instrumentation refer to the use of advanced technologies, control systems, and equipment to monitor, control, and optimize water-related processes. These systems include sensors, controllers, analyzers, and software that work together to ensure efficient water treatment, distribution, and management. Water automation helps in real-time monitoring of water quality, pressure, flow, and other parameters, enabling utilities and industries to reduce operational costs, improve accuracy, enhance safety, and ensure regulatory compliance. Instrumentation plays a crucial role in providing data that supports decision-making, predictive maintenance, and efficient water usage in sectors such as municipal water systems, industrial processes, irrigation, and wastewater management.

Key Highlights

- The water automation and instrumentation market is anticipated to grow at a CAGR of 7.5% during the forecast period.

- The global water automation and instrumentation market was estimated to be worth approximately USD 4.58 billion in 2023 and is projected to reach a value of USD 9.43 billion by 2032.

- The growth of the water automation and instrumentation market is being driven by increasing global focus on water conservation, the need for efficient water management systems, and rising regulatory requirements for water quality.

- Based on the process stage, the distribution of water segment is growing at a high rate and is projected to dominate the market.

- On the basis of automation technology, the supervisory control & data acquisition (scada) segment is projected to swipe the largest market share.

- In terms of instrumentation, the electromagnetic flow meters segment is expected to dominate the market.

- Based on the end-user, the drinking water segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Water Automation and Instrumentation Market: Dynamics

Key Growth Drivers

- Water Scarcity and Conservation Needs: Rising global water stress fuels demand for automated systems to optimize usage and reduce waste.

- Regulatory Compliance: Stricter water quality and usage mandates (e.g., EPA, EU Water Framework Directive) require advanced monitoring and reporting tools.

- Aging Infrastructure Modernization: Retrofitting outdated pipelines and treatment plants with IoT-enabled sensors and SCADA systems to prevent leaks and improve efficiency.

- Smart City Initiatives: Integration of automation in urban water networks for real-time data analytics and resource management.

Restraints

- High Implementation Costs: Expensive upfront investments in sensors, software, and skilled labor hinder adoption in budget-constrained regions.

- Skill Gaps: Shortage of technicians trained in advanced instrumentation, data analytics, and cybersecurity.

- Cybersecurity Risks: Vulnerability of interconnected systems to hacking and data breaches.

- Resistance to Change: Reluctance in traditional utilities to transition from manual processes to automated solutions.

Opportunities

- AI and Predictive Analytics: Machine learning for leak detection, demand forecasting, and predictive maintenance.

- Emerging Market Growth: Expanding water infrastructure investments in Asia-Pacific and Africa to address urbanization and scarcity.

- Public-Private Partnerships (PPPs): Collaborative funding models for large-scale smart water projects.

- Decentralized Water Systems: Modular automation solutions for rural and off-grid communities.

Challenges

- Interoperability Issues: Compatibility gaps between legacy infrastructure and modern IoT/automation technologies.

- Funding Limitations: Scarce public budgets and competing priorities delay automation adoption in municipal utilities.

- Rapid Technological Evolution: Need for continuous upgrades to keep pace with advancements in AI, edge computing, and 5G.

- Regulatory Fragmentation: Divergent regional standards for water quality and data reporting complicate global scalability.

Water Automation and Instrumentation Market: Report Scope

This report thoroughly analyzes the water automation and instrumentation market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Water Automation and Instrumentation Market |

| Market Size in 2023 | USD 4.58 Billion |

| Market Forecast in 2032 | USD 9.43 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 180 |

| Key Companies Covered | ABB Ltd., Jacobs Engineering Group Inc., Emerson Electric Co., Endress+Hauser AG, General Electric, Mitsubishi Electric Corp., Pepperl+Fuchs, Rockwell Automation Inc., Siemens AG, Yokogawa Electric Corporation, Schneider Electric, CH2M Hill |

| Segments Covered | By Process Stage, By Automation Technology, By Instrumentation, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Water Automation and Instrumentation Market: Segmentation Insights

The global water automation and instrumentation market is divided by process stage, automation technology, instrumentation, end-user, and region.

Segmentation Insights by Process Stage

Based on process stage, the global water automation and instrumentation market is divided into collection of water, treatment of water, and distribution of water.

In the water automation and instrumentation market, the Distribution of Water segment emerges as the most dominant among the three process stages. This dominance is largely attributed to the growing demand for real-time monitoring, leak detection, and pressure management systems in urban infrastructure. Smart distribution systems enable utilities to manage water flow efficiently, reduce non-revenue water losses, and ensure consistent water quality across end-user touchpoints. The use of IoT sensors, automated valves, and advanced SCADA systems is especially prevalent in this segment, allowing utilities to make data-driven decisions and respond proactively to system anomalies.

Following the distribution stage, the Treatment of Water segment holds a significant share of the market. This stage has gained importance due to increasing regulatory pressure on water quality, the need for sustainable treatment solutions, and the growing scarcity of clean water resources. Smart instrumentation in this segment includes sensors and analyzers for pH, turbidity, conductivity, and dissolved oxygen, enabling precise control of chemical dosing and filtration processes. Automation in water treatment ensures compliance with environmental standards, operational efficiency, and cost savings, particularly in industrial and municipal facilities.

The Collection of Water segment, although essential, is the least dominant in terms of market share. This stage involves the acquisition of raw water from sources such as rivers, lakes, and reservoirs. Smart technologies here are primarily used for monitoring water levels, flow rates, and source quality, which are critical for managing supply and mitigating risks from contamination or depletion. However, compared to distribution and treatment, the investment and technological intensity in water collection are relatively lower, contributing to its smaller share in the market.

Segmentation Insights by Automation Technology

On the basis of automation technology, the global water automation and instrumentation market is bifurcated into distributed control system-DCS, supervisory control & data acquisition-SCADA, programmable logic controller-plc, human machine interface-HMI, manufacturing execution-MES, identity & access management-IAM, and laboratory information management system-LIMS.

In the water automation and instrumentation market, the Supervisory Control & Data Acquisition (SCADA) segment is the most dominant among automation technologies. SCADA systems are critical in the water industry for providing centralized control, real-time data acquisition, and remote monitoring of water infrastructure, including treatment plants, pipelines, and distribution networks. Their ability to manage large-scale water systems, detect leaks, and issue alerts for maintenance or emergency responses makes them essential for operational efficiency and reliability, especially in municipal and industrial settings.

The Programmable Logic Controller (PLC) segment follows SCADA in dominance. PLCs are widely used in water management systems for their robust, flexible, and scalable control capabilities. They serve as the backbone of automation by controlling pumps, valves, and filtration units based on real-time sensor data. Their integration with other technologies like SCADA and HMI enhances their utility, particularly in automating repetitive processes and ensuring system stability during varying load conditions.

Next is the Distributed Control System (DCS) segment, which is mainly used in large-scale water treatment facilities. DCS provides seamless control over complex and distributed processes, ensuring consistent water quality and efficient process execution. It offers a higher level of integration and redundancy than PLCs, making it suitable for facilities with continuous operation demands and advanced process requirements.

The Human Machine Interface (HMI) segment also plays a key role, though with a slightly smaller market share. HMI provides operators with a graphical interface to interact with the automation system, monitor performance, and respond to alarms. It enhances user experience and decision-making by visualizing system data, which is critical in both treatment and distribution stages of water management.

The Manufacturing Execution System (MES) is next, helping bridge the gap between operational control and enterprise-level planning. MES is used to track and document the transformation of raw water into treated water, enabling better reporting, regulatory compliance, and process optimization. Its adoption is growing, especially in integrated water utilities aiming for smarter operations.

Identity & Access Management (IAM) follows, supporting cybersecurity and ensuring that only authorized personnel have access to control systems and sensitive data. As water infrastructure becomes more digitized, protecting against cyber threats has become increasingly important, making IAM a growing priority in modern water automation systems.

Lastly, the Laboratory Information Management System (LIMS) segment holds the smallest share but remains relevant for water quality analysis and regulatory compliance. LIMS is used to manage lab workflows, test results, and data from water sampling, which is vital for quality assurance and reporting in water treatment processes. Its role, while crucial, is more niche and complements other core automation technologies.

Segmentation Insights by Instrumentation

Based on instrumentation, the global water automation and instrumentation market is divided into pressure transmitter, level transmitter, electromagnetic flow meters, sludge density measurement, gas & liquid analyzer, leakage detection systems, control valves, high & low ac drives, and others.

In the water automation and instrumentation market, Electromagnetic Flow Meters are the most dominant instrumentation segment. These devices are critical for accurately measuring the flow rate of water without any moving parts, making them highly durable and maintenance-free—ideal for large-scale municipal and industrial applications. Their precision and adaptability to various pipe sizes and flow conditions have made them the preferred choice for real-time water flow monitoring in treatment plants and distribution networks.

Following closely are Pressure Transmitters, which play a vital role in maintaining system stability and safety across water collection, treatment, and distribution. These instruments monitor the pressure levels in pipes, tanks, and pumps to detect abnormalities like bursts or blockages. Their integration with SCADA and PLC systems ensures real-time alerts and system adjustments, improving efficiency and reducing downtime.

Control Valves come next in importance. These devices regulate water flow, pressure, and direction based on signals from automated systems. Their use in treatment processes and distribution networks allows for precise flow control, helping manage water usage, reduce wastage, and maintain consistent quality.

Leakage Detection Systems are rapidly gaining traction as utilities aim to minimize non-revenue water. These systems use sensors, acoustic tools, and analytics to identify and localize leaks in real-time. While not yet as widespread as flow meters or pressure transmitters, their role is expanding as infrastructure ages and water loss becomes a pressing concern.

Level Transmitters are also significant, particularly in monitoring the levels of water in reservoirs, tanks, and treatment chambers. They help in managing supply, preventing overflows, and ensuring optimal operation in storage and process tanks. Their application is essential for both operational control and inventory management.

Gas & Liquid Analyzers are vital for maintaining water quality by monitoring parameters such as chlorine, dissolved oxygen, pH, and turbidity. These analyzers are heavily used in the treatment stage to ensure compliance with health and safety regulations, especially in drinking water and wastewater plants.

Sludge Density Measurement instruments are used specifically in wastewater treatment plants to monitor the concentration of sludge. This helps optimize the sludge thickening and dewatering processes, improving treatment efficiency and reducing operational costs. While crucial, their application is limited to specific parts of the treatment process, giving them a more niche role.

High & Low AC Drives support motor control in pumps and other equipment, enhancing energy efficiency and operational flexibility. These drives are especially useful in optimizing variable-speed operations, such as in pumping stations, but are typically considered supporting components rather than primary instruments.

Segmentation Insights by End-User

On the basis of end-user, the global water automation and instrumentation market is bifurcated into drinking water, household water, commercial water, industrial water, agriculture, and others.

In the smart water automation and instrumentation market, the Drinking Water segment is the most dominant among end-users. This dominance is driven by the critical need for clean and safe drinking water, especially in urban areas with aging infrastructure and rising population density. Smart automation and instrumentation technologies are extensively deployed in this segment to monitor water quality parameters, manage distribution, detect leaks, and ensure regulatory compliance. Governments and utilities prioritize investments in smart systems for drinking water to reduce water loss, enhance operational efficiency, and provide consistent service to consumers.

The Industrial Water segment follows closely, fueled by industries’ increasing need for efficient water use, treatment, and recycling. Industrial facilities, particularly in sectors like chemicals, pharmaceuticals, and food processing, use a significant amount of water and are under pressure to minimize waste and meet environmental regulations. Automation technologies such as PLCs, SCADA, analyzers, and flow meters are widely adopted to monitor and optimize water processes in real time, making this segment a significant contributor to the overall market.

Commercial Water systems—serving office buildings, shopping centers, hospitals, and other large facilities—rank next. These facilities rely on automated water management for cost control, sustainability, and operational efficiency. Smart meters, leak detection, and flow control systems are commonly used in this segment to monitor usage patterns and identify inefficiencies, thereby helping reduce operational costs and water waste.

Agriculture is an emerging and increasingly important segment, driven by the need for smarter irrigation systems and better resource management amid global water scarcity. Technologies like soil moisture sensors, automated valves, and remote irrigation controllers are gaining traction in smart farming. Although its adoption rate still lags behind urban and industrial segments, the growth potential is strong due to increasing focus on precision agriculture.

The Household Water segment, while essential, is less dominant in terms of market share due to its fragmented nature and lower technology penetration. Smart water solutions in this space often include automated leak detectors, water quality monitors, and smart meters at the residential level. Although consumer awareness is growing, the scale and investment per unit are lower compared to industrial and municipal applications.

Water Automation and Instrumentation Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the water automation and instrumentation market. This dominance is primarily due to its advanced infrastructure, early adoption of smart water technologies, and stringent regulatory frameworks that push for efficient water management solutions. The United States leads within this region, driven by initiatives focused on upgrading aging water infrastructure and integrating automation into municipal and industrial water systems. Canada also contributes significantly, supported by modern water treatment facilities and investments in automation across industries such as food processing and manufacturing.

Europe holds the second position in the market, fueled by progressive environmental policies and a strong commitment to water sustainability. Countries such as Germany, the United Kingdom, France, and Italy have well-established water infrastructure and are early adopters of automation and digital instrumentation. Germany leads in terms of technological advancements, while France and the UK are actively implementing smart water grid systems to enhance efficiency and reduce water loss.

Asia-Pacific is rapidly emerging as a key player, with countries like China and India driving growth. China leads in this region due to large-scale investments in smart city projects and initiatives addressing water scarcity through advanced automation. India is also showing strong growth momentum with government-backed infrastructure development projects and increasing demand for efficient industrial water management. The region's industrialization and urban expansion are key contributors to rising adoption of automated solutions.

Latin America is witnessing gradual growth in the water automation and instrumentation market, mainly driven by rising industrialization and urban development. Countries like Brazil and Mexico are investing in improving water infrastructure and adopting automation to manage water resources more efficiently. While infrastructure challenges persist, the region is showing increasing interest in digital solutions for better operational control and regulatory compliance.

Middle East and Africa is the least dominant but steadily growing region, primarily driven by water scarcity and the urgent need for efficient water utilization. Countries in the Gulf Cooperation Council (GCC) are investing in desalination and smart water management systems. Africa, though still in early stages, is beginning to adopt automation technologies for water treatment and distribution in urban centers. This region’s market growth is supported by international collaborations and modernization projects focused on sustainable water practices.

Water Automation and Instrumentation Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the water automation and instrumentation market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global water automation and instrumentation market include:

- ABB Ltd.

- Jacobs Engineering Group Inc.

- Emerson Electric Co.

- Endress+Hauser AG

- General Electric

- Mitsubishi Electric Corp.

- Pepperl+Fuchs

- Rockwell Automation Inc.

- Siemens AG

- Yokogawa Electric Corporation

- Schneider Electric

- CH2M Hill

The global water automation and instrumentation market is segmented as follows:

By Process Stage

- Collection of Water

- Treatment of Water

- Distribution of Water

By Automation Technology

- Distributed Control System-DCS

- Supervisory Control and Data Acquisition-SCADA

- Programmable Logic Controller-PLC

- Human Machine Interface-HMI

- Manufacturing Execution-MES

- Identity & Access Management-IAM

By Instrumentation

- Pressure Transmitter

- Level Transmitter

- Electromagnetic Flow Meters

- Sludge Density Measurement

- Gas and Liquid Analyzer

- Leakage Detection Systems

- Control Valves

- High and Low AC Drives an

By End-User

- Drinking Water

- Household Water

- Commercial Water

- Industrial Water

- Agriculture

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Water Automation and Instrumentation

Request Sample

Water Automation and Instrumentation