Wedding Planning Apps Market Size, Share, and Trends Analysis Report

CAGR :

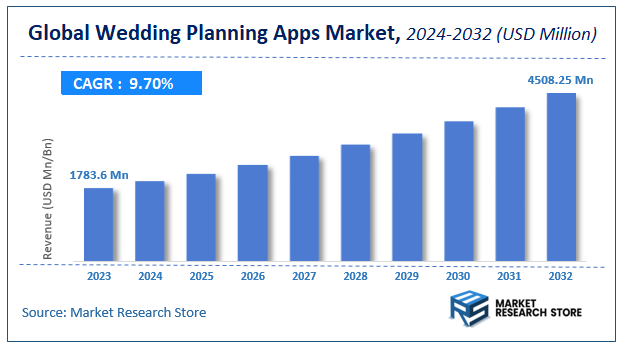

| Market Size 2023 (Base Year) | USD 1783.6 Million |

| Market Size 2032 (Forecast Year) | USD 4508.25 Million |

| CAGR | 9.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Wedding Planning Apps Market Insights

According to Market Research Store, the global wedding planning apps market size was valued at around USD 1783.6 million in 2023 and is estimated to reach USD 4508.25 million by 2032, to register a CAGR of approximately 9.7% in terms of revenue during the forecast period 2024-2032.

The wedding planning apps report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Wedding Planning Apps Market: Overview

Wedding planning apps are digital tools designed to assist couples in organizing and managing every aspect of their wedding, from budgeting and guest lists to vendor coordination and timeline tracking. These apps typically feature interactive checklists, budget calculators, seating chart planners, RSVP tracking, and customizable to-do lists that guide users through the wedding planning process. Many also offer integrated platforms for exploring and booking venues, photographers, caterers, florists, and other wedding services, along with inspiration boards for dresses, themes, and decor. Some advanced apps include collaboration tools, allowing couples, family members, and planners to work together in real time.

The growth of wedding planning apps is driven by several key factors. The rising reliance on mobile technology and the preference for DIY wedding planning have increased demand for user-friendly, on-the-go solutions. Today’s couples, particularly millennials and Gen Z, are tech-savvy and seek digital convenience for organizing complex events like weddings. Additionally, the trend toward personalized weddings and the desire for cost control make planning apps an attractive option, offering transparency and real-time tracking of expenses and progress. Integration with social media and e-commerce platforms also enhances user experience, enabling easy sharing, shopping, and vendor outreach. As destination weddings and themed celebrations grow in popularity, wedding planning apps are becoming essential tools for streamlined coordination, regardless of location.

Key Highlights

- The wedding planning apps market is anticipated to grow at a CAGR of 9.7% during the forecast period.

- The global wedding planning apps market was estimated to be worth approximately USD 1783.6 million in 2023 and is projected to reach a value of USD 4508.25 million by 2032.

- The growth of the wedding planning apps market is being driven by the increasing reliance on smartphones and the desire for a streamlined and organized approach to managing the complexities of wedding planning.

- Based on the type, the android systems segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the commercial users segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Wedding Planning Apps Market: Dynamics

Key Growth Drivers:

- Increasing Smartphone Penetration and Usage: The widespread adoption of smartphones provides a readily accessible platform for couples to utilize wedding planning apps anytime, anywhere.

- Demand for Convenience and Organization: Planning a wedding involves numerous tasks and details, and apps offer a centralized and organized way to manage everything, reducing stress and saving time.

- Access to Vast Vendor Marketplaces: Many apps provide curated lists and search functionalities for various wedding vendors (venues, photographers, caterers, etc.), simplifying the often overwhelming vendor selection process.

- Budgeting and Cost Tracking Features: Apps often include tools to help couples set a budget, track expenses, and stay within their financial limits, a crucial aspect of wedding planning.

- Guest List Management and Communication Tools: Managing guest lists, RSVPs, seating charts, and communicating with guests (e.g., sharing updates, directions) is streamlined through app features.

- Timeline and Task Management: Apps help couples create and manage timelines for various planning milestones, ensuring tasks are completed on schedule.

- Inspiration and Idea Generation: Many apps offer visual inspiration through photo galleries, style guides, and real wedding features, aiding in decision-making.

Restraints:

- Data Privacy and Security Concerns: Wedding planning apps often collect sensitive personal and financial information, raising concerns about data privacy and security.

- Reliance on Internet Connectivity: Full functionality of most apps requires a stable internet connection, which may not always be available to users.

- Potential for Technical Issues and Bugs: Like any software, wedding planning apps can experience technical glitches, bugs, or crashes, which can be frustrating for users during a stressful planning period.

- Subscription Costs and Freemium Models: While some apps offer free basic features, premium functionalities often require subscriptions, adding to the overall cost of wedding planning.

- Learning Curve and User Adoption: Some couples, particularly those less tech-savvy, may find it challenging to navigate and fully utilize all the features of a wedding planning app.

- Competition from Traditional Planning Methods: Some couples still prefer traditional methods like physical planners, spreadsheets, or hiring professional wedding planners.

- Information Overload and Decision Fatigue: While apps offer a wealth of information, it can sometimes lead to information overload and decision fatigue for couples.

Opportunities:

- Integration of AI and Machine Learning: Incorporating AI-powered features like personalized vendor recommendations, budget optimization suggestions, and automated task scheduling can enhance app value.

- Augmented Reality (AR) and Virtual Reality (VR) Features: Implementing AR for visualizing décor or VR for virtual venue tours can provide immersive and helpful experiences.

- Enhanced Collaboration Tools for Couples and Planners: Developing more robust collaboration features that allow seamless communication and task sharing between couples and their hired wedding planners.

- Personalized Recommendations and Content: Tailoring vendor suggestions, inspiration content, and planning advice based on the couple's preferences, budget, and style.

- Integration with Local Wedding Businesses and Services: Partnering with local vendors to offer exclusive deals and streamlined booking processes through the app.

- Expansion into Destination Wedding Planning: Developing features specifically catering to the unique challenges of planning weddings in different locations.

- Monetization Through Affiliate Marketing and Premium Services: Generating revenue through partnerships with vendors and offering tiered subscription models with advanced features.

Challenges:

- Maintaining Data Security and User Trust: Implementing robust security measures to protect user data and build trust in the app's reliability.

- Ensuring Seamless Integration and User Experience: Providing a user-friendly interface and smooth functionality across different devices and operating systems.

- Standing Out in a Crowded App Marketplace: Differentiating the app from competitors by offering unique features and a compelling value proposition.

- Keeping Up with Evolving Wedding Trends and Preferences: Continuously updating the app with the latest styles, vendor options, and planning advice.

- Monetizing Effectively Without Alienating Users: Finding a balance between offering valuable free features and charging for premium functionalities in a way that resonates with users.

- Providing Reliable Customer Support: Offering timely and helpful support to users who encounter technical issues or have questions about the app.

- Adapting to Regional Differences in Wedding Customs and Practices: Catering to the diverse traditions and planning processes associated with weddings in different cultures and regions.

Wedding Planning Apps Market: Report Scope

This report thoroughly analyzes the Wedding Planning Apps Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Wedding Planning Apps Market |

| Market Size in 2023 | USD 1783.6 Million |

| Market Forecast in 2032 | USD 4508.25 Million |

| Growth Rate | CAGR of 9.7% |

| Number of Pages | 176 |

| Key Companies Covered | Lisa Vorce, Alison Events, KT Merry, Easton Events, Oren Co, David Stark, Chic Weddings, Holly-Kate&Company, Erigo Event, Event Chapters, Glam Events, Home Raven, BAQAAWDC, ZZEEH, Genius Eventi, Zest Events, Classy Kay Events, The Artful Event Company, Le Wedding Mill, Arabia Weddings, Rosemary Events, Countrywide Events, Shannon Leahy Events, Beth Helmstetter Events, Duet Weddings, Geller Events, Wedlock, J.Lemons Events, Snapdragon, Elisa Mocci |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wedding Planning Apps Market: Segmentation Insights

The global wedding planning apps market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global wedding planning apps market is divided into android systems, IOS systems, and others.

Android Systems hold the dominant position in the Wedding Planning Apps Market due to their extensive global user base and affordability. Android smartphones account for the majority of mobile devices worldwide, particularly in developing regions such as Asia-Pacific, Africa, and South America. This vast user base provides a broad platform for developers to launch and scale wedding planning applications. The Android ecosystem allows greater flexibility in app development and customization, enabling the creation of regionally localized and cost-effective apps that cater to a diverse demographic of users. These apps typically offer a range of features including budget tracking, to-do lists, guest list management, vendor contacts, seating arrangements, and integrated calendars. Moreover, many Android wedding planning apps adopt a freemium model or ad-supported structure, making them appealing to users who are planning weddings with limited budgets. As digital adoption increases in mid-income and rural areas, Android-based solutions continue to lead in volume and reach.

iOS Systems, while accounting for a smaller share of the overall market, command a strong presence among users in North America, Western Europe, and other high-income regions. Wedding planning apps developed for iOS platforms are often associated with premium service offerings, superior design aesthetics, and high-security standards. These apps frequently include advanced features such as real-time cloud synchronization across Apple devices, integration with Siri and Apple Calendar, and seamless photo or vendor gallery management via iCloud. iOS users are more likely to engage with paid apps or subscription-based services, which has encouraged developers to launch exclusive features and personalized experiences for the Apple ecosystem. Despite a smaller user base compared to Android, iOS-based apps generate significant revenue due to higher average in-app purchases and subscription fees.

Segmentation Insights by Application

On the basis of application, the global wedding planning apps market is bifurcated into commercial users and private users.

Commercial Users dominate the Wedding Planning Apps Market in terms of revenue generation and demand for feature-rich, scalable solutions. This segment includes professional wedding planners, event management companies, venue operators, and other service providers who rely on digital platforms to coordinate multiple weddings and clients simultaneously. Unlike individual users, commercial users often require advanced capabilities such as multi-project dashboards, integrated vendor databases, contract and invoice management, automated reminders, and team collaboration tools. These platforms are critical for managing timelines, communicating with clients, and ensuring seamless execution of large or complex wedding events. Commercial users are also more inclined to invest in premium subscriptions, enterprise packages, and customized features, making them a high-value segment for app developers. As the wedding planning industry becomes more digitized and competitive, commercial users continue to seek platforms that enhance efficiency, reduce operational complexity, and improve client satisfaction—solidifying their dominance in the market's professional and B2B segments.

Private Users, including engaged couples and family members, still form a substantial portion of the user base in terms of downloads and engagement. They typically use wedding planning apps for personal event management, such as creating budgets, managing guest lists, selecting vendors, and accessing planning checklists. While this segment contributes significantly to overall user numbers, their usage is often limited to a single event, and they are less likely to subscribe to premium features or long-term services. As a result, their monetization potential is lower compared to commercial users.

Wedding Planning Apps Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Wedding Planning Apps Market due to a highly digital-savvy population, a strong culture of personalized wedding experiences, and widespread smartphone usage. In the United States and Canada, wedding planning has become increasingly app-centric, with platforms offering tools for budgeting, guest list management, vendor search, and timeline organization. High disposable income and the willingness to invest in curated wedding experiences contribute to robust app adoption. Additionally, leading app developers such as The Knot and WeddingWire are based in this region, offering highly integrated planning ecosystems that appeal to tech-forward millennials and Gen Z users.

Asia-Pacific is experiencing rapid growth in the Wedding Planning Apps Market due to rising smartphone penetration, growing middle-class populations, and changing wedding trends in countries such as India, China, Japan, and South Korea. In India, where weddings are often elaborate and involve extensive coordination, there is a strong demand for localized apps that cater to traditional customs, regional languages, and multi-day ceremonies. In China and South Korea, the trend toward modern, minimalist weddings has led to demand for streamlined planning platforms. As digital payment adoption rises, wedding apps that integrate vendor payments and guest RSVP systems are gaining popularity.

Europe holds a significant share of the market, driven by the increasing preference for customized and destination weddings in countries like the UK, Germany, France, and Italy. European consumers often use wedding planning apps for logistics coordination, vendor bookings, and style inspiration. The growth of multicultural weddings and cross-border celebrations further drives the use of digital tools for language support, budgeting in different currencies, and virtual coordination. The rising influence of social media and fashion-driven aesthetics has also encouraged app developers to integrate visual mood boards and real-time sharing features in this region.

Latin America is an emerging market with growing adoption of wedding planning apps in countries like Brazil, Mexico, and Argentina. Increasing internet and mobile access, especially among urban youth, is fueling interest in digital wedding planning solutions. These apps are primarily used for budget tracking, venue selection, and guest list management. While the market is still developing, growing social media influence and the desire for organized, Instagram-worthy events are driving future adoption. However, limited app localization and language support remain barriers for wider usage.

Middle East and Africa are gradually adopting wedding planning apps, particularly in the Gulf Cooperation Council (GCC) countries such as UAE and Saudi Arabia, where lavish weddings are the norm. There is a growing preference for apps that offer luxury vendor listings, live coordination tools, and integration with social media platforms for sharing highlights. In South Africa and parts of North Africa, app usage is increasing with the rise of modern wedding trends and internet accessibility. However, traditional practices and limited digital penetration in rural areas still limit overall market growth in some regions.

Wedding Planning Apps Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the wedding planning apps market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global wedding planning apps market include:

- Lisa Vorce

- Alison Events

- KT Merry

- Easton Events

- Oren Co

- David Stark

- Chic Weddings

- Holly-Kate&Company

- Erigo Event

- Event Chapters

- Glam Events

- Home Raven

- BAQAAWDC

- ZZEEH

- Genius Eventi

- Zest Events

- Classy Kay Events

- The Artful Event Company

- Le Wedding Mill

- Arabia Weddings

- Rosemary Events

- Countrywide Events

- Shannon Leahy Events

- Beth Helmstetter Events

- Duet Weddings

- Geller Events

- Wedlock

- J.Lemons Events

- Snapdragon

- Elisa Mocci

The global wedding planning apps market is segmented as follows:

By Type

- Android Systems

- IOS Systems

- Others

By Application

- Commercial Users

- Private Users

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Wedding Planning Apps Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Wedding Planning Apps Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Wedding Planning Apps Overall Market Size 2.1 Global Wedding Planning Apps Market Size: 2021 VS 2028 2.2 Global Wedding Planning Apps Market Size, Prospects & Forecasts: 2017-2028 2.3 Key Market Trends, Opportunity, Drivers and Restraints 2.3.1 Market Opportunities & Trends 2.3.2 Market Drivers 2.3.3 Market Restraints 3 Company Landscape 3.1 Top Wedding Planning Apps Players in Global Market 3.2 Top Global Wedding Planning Apps Companies Ranked by Revenue 3.3 Global Wedding Planning Apps Revenue by Companies 3.4 Top 3 and Top 5 Wedding Planning Apps Companies in Global Market, by Revenue in 2021 3.5 Global Companies Wedding Planning Apps Product Type 3.6 Tier 1, Tier 2 and Tier 3 Wedding Planning Apps Players in Global Market 3.6.1 List of Global Tier 1 Wedding Planning Apps Companies 3.6.2 List of Global Tier 2 and Tier 3 Wedding Planning Apps Companies 4 Market Sights by Product 4.1 Overview 4.1.1 by Type - Global Wedding Planning Apps Market Size Markets, 2021 & 2028 4.1.2 Android Systems 4.1.3 IOS Systems 4.1.4 Others 4.2 By Type - Global Wedding Planning Apps Revenue & Forecasts 4.2.1 By Type - Global Wedding Planning Apps Revenue, 2017-2022 4.2.2 By Type - Global Wedding Planning Apps Revenue, 2023-2028 4.2.3 By Type - Global Wedding Planning Apps Revenue Market Share, 2017-2028 5 Sights by Application 5.1 Overview 5.1.1 By Application - Global Wedding Planning Apps Market Size, 2021 & 2028 5.1.2 Commercial Users 5.1.3 Private Users 5.2 By Application - Global Wedding Planning Apps Revenue & Forecasts 5.2.1 By Application - Global Wedding Planning Apps Revenue, 2017-2022 5.2.2 By Application - Global Wedding Planning Apps Revenue, 2023-2028 5.2.3 By Application - Global Wedding Planning Apps Revenue Market Share, 2017-2028 6 Sights by Region 6.1 By Region - Global Wedding Planning Apps Market Size, 2021 & 2028 6.2 By Region - Global Wedding Planning Apps Revenue & Forecasts 6.2.1 By Region - Global Wedding Planning Apps Revenue, 2017-2022 6.2.2 By Region - Global Wedding Planning Apps Revenue, 2023-2028 6.2.3 By Region - Global Wedding Planning Apps Revenue Market Share, 2017-2028 6.3 North America 6.3.1 By Country - North America Wedding Planning Apps Revenue, 2017-2028 6.3.2 US Wedding Planning Apps Market Size, 2017-2028 6.3.3 Canada Wedding Planning Apps Market Size, 2017-2028 6.3.4 Mexico Wedding Planning Apps Market Size, 2017-2028 6.4 Europe 6.4.1 By Country - Europe Wedding Planning Apps Revenue, 2017-2028 6.4.2 Germany Wedding Planning Apps Market Size, 2017-2028 6.4.3 France Wedding Planning Apps Market Size, 2017-2028 6.4.4 U.K. Wedding Planning Apps Market Size, 2017-2028 6.4.5 Italy Wedding Planning Apps Market Size, 2017-2028 6.4.6 Russia Wedding Planning Apps Market Size, 2017-2028 6.4.7 Nordic Countries Wedding Planning Apps Market Size, 2017-2028 6.4.8 Benelux Wedding Planning Apps Market Size, 2017-2028 6.5 Asia 6.5.1 By Region - Asia Wedding Planning Apps Revenue, 2017-2028 6.5.2 China Wedding Planning Apps Market Size, 2017-2028 6.5.3 Japan Wedding Planning Apps Market Size, 2017-2028 6.5.4 South Korea Wedding Planning Apps Market Size, 2017-2028 6.5.5 Southeast Asia Wedding Planning Apps Market Size, 2017-2028 6.5.6 India Wedding Planning Apps Market Size, 2017-2028 6.6 South America 6.6.1 By Country - South America Wedding Planning Apps Revenue, 2017-2028 6.6.2 Brazil Wedding Planning Apps Market Size, 2017-2028 6.6.3 Argentina Wedding Planning Apps Market Size, 2017-2028 6.7 Middle East & Africa 6.7.1 By Country - Middle East & Africa Wedding Planning Apps Revenue, 2017-2028 6.7.2 Turkey Wedding Planning Apps Market Size, 2017-2028 6.7.3 Israel Wedding Planning Apps Market Size, 2017-2028 6.7.4 Saudi Arabia Wedding Planning Apps Market Size, 2017-2028 6.7.5 UAE Wedding Planning Apps Market Size, 2017-2028 7 Players Profiles 7.1 XO Group 7.1.1 XO Group Corporate Summary 7.1.2 XO Group Business Overview 7.1.3 XO Group Wedding Planning Apps Major Product Offerings 7.1.4 XO Group Wedding Planning Apps Revenue in Global Market (2017-2022) 7.1.5 XO Group Key News 7.2 Honeyfund 7.2.1 Honeyfund Corporate Summary 7.2.2 Honeyfund Business Overview 7.2.3 Honeyfund Wedding Planning Apps Major Product Offerings 7.2.4 Honeyfund Wedding Planning Apps Revenue in Global Market (2017-2022) 7.2.5 Honeyfund Key News 7.3 Zola 7.3.1 Zola Corporate Summary 7.3.2 Zola Business Overview 7.3.3 Zola Wedding Planning Apps Major Product Offerings 7.3.4 Zola Wedding Planning Apps Revenue in Global Market (2017-2022) 7.3.5 Zola Key News 7.4 WeddingHappy 7.4.1 WeddingHappy Corporate Summary 7.4.2 WeddingHappy Business Overview 7.4.3 WeddingHappy Wedding Planning Apps Major Product Offerings 7.4.4 WeddingHappy Wedding Planning Apps Revenue in Global Market (2017-2022) 7.4.5 WeddingHappy Key News 7.5 Iwedplanner 7.5.1 Iwedplanner Corporate Summary 7.5.2 Iwedplanner Business Overview 7.5.3 Iwedplanner Wedding Planning Apps Major Product Offerings 7.5.4 Iwedplanner Wedding Planning Apps Revenue in Global Market (2017-2022) 7.5.5 Iwedplanner Key News 7.6 Sevenlogics 7.6.1 Sevenlogics Corporate Summary 7.6.2 Sevenlogics Business Overview 7.6.3 Sevenlogics Wedding Planning Apps Major Product Offerings 7.6.4 Sevenlogics Wedding Planning Apps Revenue in Global Market (2017-2022) 7.6.5 Sevenlogics Key News 7.7 Snapp Mobile Germany 7.7.1 Snapp Mobile Germany Corporate Summary 7.7.2 Snapp Mobile Germany Business Overview 7.7.3 Snapp Mobile Germany Wedding Planning Apps Major Product Offerings 7.7.4 Snapp Mobile Germany Wedding Planning Apps Revenue in Global Market (2017-2022) 7.7.5 Snapp Mobile Germany Key News 7.8 Fotavo 7.8.1 Fotavo Corporate Summary 7.8.2 Fotavo Business Overview 7.8.3 Fotavo Wedding Planning Apps Major Product Offerings 7.8.4 Fotavo Wedding Planning Apps Revenue in Global Market (2017-2022) 7.8.5 Fotavo Key News 8 Conclusion 9 Appendix 9.1 Note 9.2 Examples of Clients 9.3 Disclaimer

Inquiry For Buying

Wedding Planning Apps

Request Sample

Wedding Planning Apps