Whitening Foundation Market Size, Share, and Trends Analysis Report

CAGR :

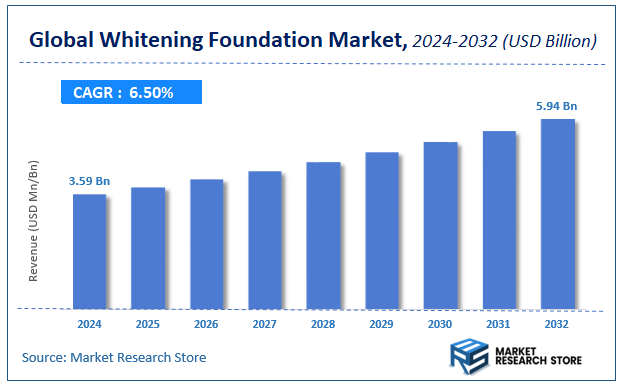

| Market Size 2024 (Base Year) | USD 3.59 Billion |

| Market Size 2032 (Forecast Year) | USD 5.94 Billion |

| CAGR | 6.5% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global whitening foundation market, estimating its value at USD 3.59 Billion in 2024, with projections indicating it will reach USD 5.94 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 6.5% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the whitening foundation industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Whitening Foundation Market: Overview

The growth of the whitening foundation market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The whitening foundation market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the whitening foundation market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Product Type, Coverage Level, Skin Type, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global whitening foundation market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2032).

- In terms of revenue, the global whitening foundation market size was valued at around USD 3.59 Billion in 2024 and is projected to reach USD 5.94 Billion by 2032.

- The market is projected to grow at a significant rate due to rising popularity of brightening and skin-tone-evening cosmetics.

- Based on the Product Type, the Liquid segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Coverage Level, the Light segment is anticipated to command the largest market share.

- In terms of Skin Type, the Normal segment is projected to lead the global market.

- By End-User, the Women segment is predicted to dominate the global market.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Whitening Foundation Market: Report Scope

This report thoroughly analyzes the whitening foundation market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Whitening Foundation Market |

| Market Size in 2024 | USD 3.59 Billion |

| Market Forecast in 2032 | USD 5.94 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 202 |

| Key Companies Covered | 3LAB, Cle de Peau, La Prairie, Maybelline, Dior, AMOREPACIFIC, Bobbi Brown, YVES SAINT LAURENT, L’Oral Paris, Lancome |

| Segments Covered | By Product Type, By Coverage Level, By Skin Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Whitening Foundation Market: Dynamics

Key Growth Drivers :

The whitening foundation market is primarily driven by a deep-rooted cultural preference for fair or "brightened" skin tones, particularly in the Asia-Pacific region. This aesthetic ideal, often linked to youthfulness and social status, is a major consumption driver. The market is also fueled by the increasing popularity of multi-functional makeup products. Whitening foundations, which combine the coverage of a traditional foundation with the benefits of a skin-whitening or brightening cream, appeal to consumers seeking an all-in-one solution that simplifies their beauty routine. The rise of social media and the influence of beauty bloggers and celebrities have further amplified these beauty standards and increased product visibility.

Restraints :

A significant restraint on the whitening foundation market is the growing global movement against colorism and the promotion of natural beauty. Social and cultural campaigns, particularly in Western markets, are challenging the idea that fair skin is superior, which can deter some consumers from purchasing these products. The market also grapples with serious health and safety concerns related to certain ingredients. Products containing high levels of mercury, hydroquinone, or corticosteroids, which have been banned in many regions, can cause severe skin damage and other health complications. This has led to stricter regulations and a decline in consumer trust, which is a major hurdle for the industry.

Opportunities :

The whitening foundation market has several key opportunities for innovation and growth. A major one is the development of safer, natural, and organic formulations that use plant-based extracts and are free from harmful chemicals. Brands that can effectively communicate a clean-label and transparent ingredient list can attract a new generation of health-conscious consumers. There is also an opportunity to re-brand products, focusing on "brightening" or "radiance" rather than "whitening" to align with more inclusive beauty standards. The expansion of e-commerce and direct-to-consumer (D2C) channels provides a powerful tool for brands to directly address consumer concerns and educate them about product benefits and safety.

Challenges :

The whitening foundation market faces several significant challenges. The most critical is the ongoing ethical debate and negative perception of products that promote skin lightening. The industry is often criticized for perpetuating harmful beauty standards and contributing to a sense of inadequacy among people with darker skin tones. The proliferation of counterfeit products is another major challenge, as they not only damage brand reputation but also pose a serious health risk to consumers. The industry must also contend with a complex and inconsistent global regulatory landscape, where ingredients and labeling requirements can vary widely, making international distribution and compliance a constant challenge.

Whitening Foundation Market: Segmentation Insights

The global whitening foundation market is segmented based on Product Type, Coverage Level, Skin Type, End-User, and Region. All the segments of the whitening foundation market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Product Type, the global whitening foundation market is divided into Liquid, Cream, Powder, Stick.

On the basis of Coverage Level, the global whitening foundation market is bifurcated into Light, Medium, Full.

In terms of Skin Type, the global whitening foundation market is categorized into Normal, Oily, Dry, Combination, Sensitive.

Based on End-User, the global whitening foundation market is split into Women, Men, Unisex.

Whitening Foundation Market: Regional Insights

Asia-Pacific (APAC) is the overwhelmingly dominant region in the global whitening foundation market, accounting for the largest revenue share, estimated at over 65% as of recent market analyses. This supremacy is driven by deeply ingrained cultural beauty standards that prioritize fair and even-toned skin, particularly in East Asian countries like South Korea, Japan, and China, as well as across Southeast Asia. The market is characterized by intense innovation, with products offering not just coverage but also skincare benefits like brightening agents (e.g., niacinamide, vitamin C) and sun protection.

While the Middle East & Africa is a significant and growing secondary market due to similar preferences for skin brightening, its size is vastly overshadowed by APAC. In contrast, Western markets in North America and Europe focus primarily on tanning or coverage with minimal demand for whitening-specific benefits, making them niche segments for such products. The APAC region's cultural drivers, major local brands, and vast consumer base solidify its position as the undisputed core of the global whitening foundation industry.

Whitening Foundation Market: Competitive Landscape

The whitening foundation market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Whitening Foundation Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- 3LAB

- Cle de Peau

- La Prairie

- Maybelline

- Dior

- AMOREPACIFIC

- Bobbi Brown

- YVES SAINT LAURENT

- L’Oral Paris

- Lancome

The Global Whitening Foundation Market is Segmented as Follows:

By Product Type

- Liquid

- Cream

- Powder

- Stick

By Coverage Level

- Light

- Medium

- Full

By Skin Type

- Normal

- Oily

- Dry

- Combination

- Sensitive

By End-User

- Women

- Men

- Unisex

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Global Whitening Foundation Industry Market Research Report 1 Whitening Foundation Introduction and Market Overview 1.1 Objectives of the Study 1.2 Definition of Whitening Foundation 1.3 Whitening Foundation Market Scope and Market Size Estimation 1.3.1 Market Concentration Ratio and Market Maturity Analysis 1.3.2 Global Whitening Foundation Value ($) and Growth Rate from 2014-2024 1.4 Market Segmentation 1.4.1 Types of Whitening Foundation 1.4.2 Applications of Whitening Foundation 1.4.3 Research Regions 1.4.3.1 North America Whitening Foundation Production Value ($) and Growth Rate (2014-2019) 1.4.3.2 Europe Whitening Foundation Production Value ($) and Growth Rate (2014-2019) 1.4.3.3 China Whitening Foundation Production Value ($) and Growth Rate (2014-2019) 1.4.3.4 Japan Whitening Foundation Production Value ($) and Growth Rate (2014-2019) 1.4.3.5 Middle East & Africa Whitening Foundation Production Value ($) and Growth Rate (2014-2019) 1.4.3.6 India Whitening Foundation Production Value ($) and Growth Rate (2014-2019) 1.4.3.7 South America Whitening Foundation Production Value ($) and Growth Rate (2014-2019) 1.5 Market Dynamics 1.5.1 Drivers 1.5.1.1 Emerging Countries of Whitening Foundation 1.5.1.2 Growing Market of Whitening Foundation 1.5.2 Limitations 1.5.3 Opportunities 1.6 Industry News and Policies by Regions 1.6.1 Industry News 1.6.2 Industry Policies 2 Industry Chain Analysis 2.1 Upstream Raw Material Suppliers of Whitening Foundation Analysis 2.2 Major Players of Whitening Foundation 2.2.1 Major Players Manufacturing Base and Market Share of Whitening Foundation in 2018 2.2.2 Major Players Product Types in 2018 2.3 Whitening Foundation Manufacturing Cost Structure Analysis 2.3.1 Production Process Analysis 2.3.2 Manufacturing Cost Structure of Whitening Foundation 2.3.3 Raw Material Cost of Whitening Foundation 2.3.4 Labor Cost of Whitening Foundation 2.4 Market Channel Analysis of Whitening Foundation 2.5 Major Downstream Buyers of Whitening Foundation Analysis 3 Global Whitening Foundation Market, by Type 3.1 Global Whitening Foundation Value ($) and Market Share by Type (2014-2019) 3.2 Global Whitening Foundation Production and Market Share by Type (2014-2019) 3.3 Global Whitening Foundation Value ($) and Growth Rate by Type (2014-2019) 3.4 Global Whitening Foundation Price Analysis by Type (2014-2019) 4 Whitening Foundation Market, by Application 4.1 Global Whitening Foundation Consumption and Market Share by Application (2014-2019) 4.2 Downstream Buyers by Application 4.3 Global Whitening Foundation Consumption and Growth Rate by Application (2014-2019) 5 Global Whitening Foundation Production, Value ($) by Region (2014-2019) 5.1 Global Whitening Foundation Value ($) and Market Share by Region (2014-2019) 5.2 Global Whitening Foundation Production and Market Share by Region (2014-2019) 5.3 Global Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 5.4 North America Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 5.5 Europe Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 5.6 China Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 5.7 Japan Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 5.8 Middle East & Africa Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 5.9 India Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 5.10 South America Whitening Foundation Production, Value ($), Price and Gross Margin (2014-2019) 6 Global Whitening Foundation Production, Consumption, Export, Import by Regions (2014-2019) 6.1 Global Whitening Foundation Consumption by Regions (2014-2019) 6.2 North America Whitening Foundation Production, Consumption, Export, Import (2014-2019) 6.3 Europe Whitening Foundation Production, Consumption, Export, Import (2014-2019) 6.4 China Whitening Foundation Production, Consumption, Export, Import (2014-2019) 6.5 Japan Whitening Foundation Production, Consumption, Export, Import (2014-2019) 6.6 Middle East & Africa Whitening Foundation Production, Consumption, Export, Import (2014-2019) 6.7 India Whitening Foundation Production, Consumption, Export, Import (2014-2019) 6.8 South America Whitening Foundation Production, Consumption, Export, Import (2014-2019) 7 Global Whitening Foundation Market Status and SWOT Analysis by Regions 7.1 North America Whitening Foundation Market Status and SWOT Analysis 7.2 Europe Whitening Foundation Market Status and SWOT Analysis 7.3 China Whitening Foundation Market Status and SWOT Analysis 7.4 Japan Whitening Foundation Market Status and SWOT Analysis 7.5 Middle East & Africa Whitening Foundation Market Status and SWOT Analysis 7.6 India Whitening Foundation Market Status and SWOT Analysis 7.7 South America Whitening Foundation Market Status and SWOT Analysis 8 Competitive Landscape 8.1 Competitive Profile 8.2 3LAB 8.2.1 Company Profiles 8.2.2 Whitening Foundation Product Introduction 8.2.3 3LAB Production, Value ($), Price, Gross Margin 2014-2019 8.2.4 3LAB Market Share of Whitening Foundation Segmented by Region in 2018 8.3 Cle de Peau 8.3.1 Company Profiles 8.3.2 Whitening Foundation Product Introduction 8.3.3 Cle de Peau Production, Value ($), Price, Gross Margin 2014-2019 8.3.4 Cle de Peau Market Share of Whitening Foundation Segmented by Region in 2018 8.4 La Prairie 8.4.1 Company Profiles 8.4.2 Whitening Foundation Product Introduction 8.4.3 La Prairie Production, Value ($), Price, Gross Margin 2014-2019 8.4.4 La Prairie Market Share of Whitening Foundation Segmented by Region in 2018 8.5 Maybelline 8.5.1 Company Profiles 8.5.2 Whitening Foundation Product Introduction 8.5.3 Maybelline Production, Value ($), Price, Gross Margin 2014-2019 8.5.4 Maybelline Market Share of Whitening Foundation Segmented by Region in 2018 8.6 Dior 8.6.1 Company Profiles 8.6.2 Whitening Foundation Product Introduction 8.6.3 Dior Production, Value ($), Price, Gross Margin 2014-2019 8.6.4 Dior Market Share of Whitening Foundation Segmented by Region in 2018 8.7 AMOREPACIFIC 8.7.1 Company Profiles 8.7.2 Whitening Foundation Product Introduction 8.7.3 AMOREPACIFIC Production, Value ($), Price, Gross Margin 2014-2019 8.7.4 AMOREPACIFIC Market Share of Whitening Foundation Segmented by Region in 2018 8.8 Bobbi Brown 8.8.1 Company Profiles 8.8.2 Whitening Foundation Product Introduction 8.8.3 Bobbi Brown Production, Value ($), Price, Gross Margin 2014-2019 8.8.4 Bobbi Brown Market Share of Whitening Foundation Segmented by Region in 2018 8.9 YVES SAINT LAURENT 8.9.1 Company Profiles 8.9.2 Whitening Foundation Product Introduction 8.9.3 YVES SAINT LAURENT Production, Value ($), Price, Gross Margin 2014-2019 8.9.4 YVES SAINT LAURENT Market Share of Whitening Foundation Segmented by Region in 2018 8.10 L’Oral Paris 8.10.1 Company Profiles 8.10.2 Whitening Foundation Product Introduction 8.10.3 L’Oral Paris Production, Value ($), Price, Gross Margin 2014-2019 8.10.4 L’Oral Paris Market Share of Whitening Foundation Segmented by Region in 2018 8.11 Lancome 8.11.1 Company Profiles 8.11.2 Whitening Foundation Product Introduction 8.11.3 Lancome Production, Value ($), Price, Gross Margin 2014-2019 8.11.4 Lancome Market Share of Whitening Foundation Segmented by Region in 2018 9 Global Whitening Foundation Market Analysis and Forecast by Type and Application 9.1 Global Whitening Foundation Market Value ($) & Volume Forecast, by Type (2019-2024) 9.1.1 Liquid Foundation Market Value ($) and Volume Forecast (2019-2024) 9.1.2 Foundation Cream Market Value ($) and Volume Forecast (2019-2024) 9.1.3 Others Market Value ($) and Volume Forecast (2019-2024) 9.2 Global Whitening Foundation Market Value ($) & Volume Forecast, by Application (2019-2024) 9.2.1 Supermarket & Malls Market Value ($) and Volume Forecast (2019-2024) 9.2.2 Brand Store Market Value ($) and Volume Forecast (2019-2024) 9.2.3 E-commerce Market Value ($) and Volume Forecast (2019-2024) 9.2.4 Others Market Value ($) and Volume Forecast (2019-2024) 10 Whitening Foundation Market Analysis and Forecast by Region 10.1 North America Market Value ($) and Consumption Forecast (2019-2024) 10.2 Europe Market Value ($) and Consumption Forecast (2019-2024) 10.3 China Market Value ($) and Consumption Forecast (2019-2024) 10.4 Japan Market Value ($) and Consumption Forecast (2019-2024) 10.5 Middle East & Africa Market Value ($) and Consumption Forecast (2019-2024) 10.6 India Market Value ($) and Consumption Forecast (2019-2024) 10.7 South America Market Value ($) and Consumption Forecast (2019-2024) 11 New Project Feasibility Analysis 11.1 Industry Barriers and New Entrants SWOT Analysis 11.2 Analysis and Suggestions on New Project Investment 12 Research Finding and Conclusion 13 Appendix 13.1 Discussion Guide 13.2 Knowledge Store: Maia Subscription Portal 13.3 Research Data Source 13.4 Research Assumptions and Acronyms Used

Inquiry For Buying

Whitening Foundation

Request Sample

Whitening Foundation