Acute Lymphoblastic Testing Market Size, Share, and Trends Analysis Report

CAGR :

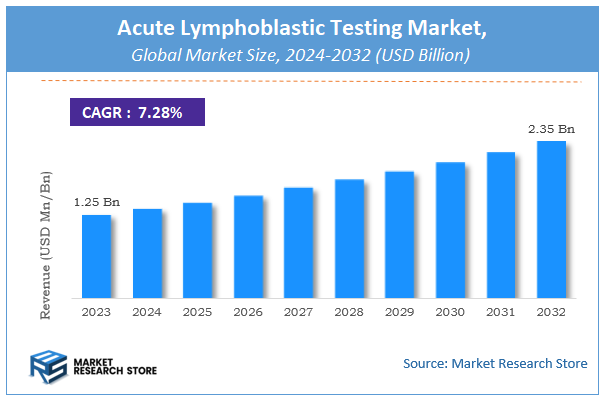

| Market Size 2023 (Base Year) | USD 1.25 Billion |

| Market Size 2032 (Forecast Year) | USD 2.35 Billion |

| CAGR | 7.28% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Acute Lymphoblastic Testing Market Insights

According to Market Research Store, the global acute lymphoblastic testing market size was valued at around USD 1.25 billion in 2023 and is estimated to reach USD 2.35 billion by 2032, to register a CAGR of approximately 7.28% in terms of revenue during the forecast period 2024-2032.

The acute lymphoblastic testing report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Acute Lymphoblastic Testing Market: Overview

Acute Lymphoblastic Testing refers to a range of diagnostic procedures used to detect and monitor Acute Lymphoblastic Leukemia (ALL), a fast-growing cancer of the blood and bone marrow that primarily affects white blood cells. This testing typically involves blood tests, bone marrow biopsy, flow cytometry, cytogenetic analysis, and molecular testing to identify the presence, type, and genetic markers of ALL. These tests help determine the subtype of leukemia, assess disease progression, and guide personalized treatment strategies such as chemotherapy, targeted therapy, or bone marrow transplantation.

Key Highlights

- The acute lymphoblastic testing market is anticipated to grow at a CAGR of 7.28% during the forecast period.

- The global acute lymphoblastic testing market was estimated to be worth approximately USD 1.25 billion in 2023 and is projected to reach a value of USD 2.35 billion by 2032.

- The growth of the acute lymphoblastic testing market is being driven by the rising incidence of ALL, particularly among children and older adults, and the increasing demand for accurate and early diagnostic tools.

- Based on the leukemia type, the B-Cell acute lymphoblastic leukemia (B-ALL) segment is growing at a high rate and is projected to dominate the market.

- On the basis of treatment, the product & service segment is projected to swipe the largest market share.

- In terms of technology, the polymerase chain reaction (PCR) segment is expected to dominate the market.

- Based on the end user, the clinical laboratories segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Acute Lymphoblastic Testing Market: Dynamics

Key Growth Drivers

- Rising Incidence of Acute Lymphoblastic Leukemia (ALL): Increasing global cases of ALL, especially among children and the elderly, are boosting the demand for early and accurate diagnostic testing.

- Advancements in Molecular and Genetic Testing: New technologies like next-generation sequencing (NGS), flow cytometry, and cytogenetic analysis are improving detection accuracy and enabling personalized treatment strategies.

- Government and Private Funding for Cancer Diagnostics: Substantial investments in cancer research and diagnostic infrastructure are driving the adoption of comprehensive testing methods.

- Growing Awareness and Early Detection Programs: Public health initiatives promoting early leukemia screening have increased testing rates, especially in high-risk populations.

Restraints

- High Cost of Advanced Testing Techniques: Technologies like NGS and specialized immunophenotyping are expensive, limiting access in cost-sensitive or resource-limited regions.

- Limited Access in Low- and Middle-Income Countries: Inadequate diagnostic infrastructure and uneven healthcare access hinder widespread implementation of ALL testing in developing areas.

- Lack of Skilled Professionals: Shortage of trained pathologists and laboratory technicians in some regions slows the adoption of complex testing methods.

Opportunities

- Expansion of Diagnostic Services in Emerging Markets: Rapid development of healthcare systems in Asia-Pacific, Latin America, and Africa presents growth opportunities for test providers and equipment manufacturers.

- Integration of AI and Automation in Testing: The use of artificial intelligence and automated platforms in laboratory diagnostics can improve testing speed, accuracy, and efficiency.

- Development of Point-of-Care Testing Solutions: Simplified, rapid testing kits suitable for remote or low-resource settings can help expand early diagnosis and monitoring efforts.

Challenges

- Regulatory and Reimbursement Issues: Variability in regulatory approval processes and inconsistent insurance coverage for new tests can delay market entry and limit patient access.

- Complexity of Disease Heterogeneity: The genetic and molecular diversity of ALL makes standardized testing difficult, requiring customized approaches that can be time-consuming and costly.

- Data Management and Interpretation: Advanced testing generates large volumes of data that require expert analysis, making data interpretation a challenge in under-resourced labs.

Acute Lymphoblastic Testing Market: Report Scope

This report thoroughly analyzes the Acute Lymphoblastic Testing Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Acute Lymphoblastic Testing Market |

| Market Size in 2023 | USD 1.25 Billion |

| Market Forecast in 2032 | USD 2.35 Billion |

| Growth Rate | CAGR of 7.28% |

| Number of Pages | 167 |

| Key Companies Covered | Mayo Foundation for Medical Education and Research, DrLal Path Labs, Bio-Rad Lab, QIAGEN, Invivoscribe, Illumina, ArcherDx, ASURAGEN, Adaptive Biotechnologies, NeoGenomics Lab, Laboratory Corporation of America Holdings, and ARUP Lab. |

| Segments Covered | By Leukemia Type, By Product & Service, By Technologies, By End-User Industries, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Acute Lymphoblastic Testing Market: Segmentation Insights

The global acute lymphoblastic testing market is divided by leukemia type, treatment, technology, end user, and region.

Segmentation Insights by Leukemia Type

Based on leukemia type, the global acute lymphoblastic testing market is divided into philadelphia chromosome, B-cell, T-cell, and others.

In the acute lymphoblastic testing market, B-Cell Acute Lymphoblastic Leukemia (B-ALL) is the most dominant segment. This type is the most common form of ALL, particularly in children, accounting for a significant portion of global diagnoses. Testing for B-ALL typically involves immunophenotyping, flow cytometry, and genetic analysis to detect specific markers such as CD19, CD22, and others. The widespread prevalence of B-ALL, combined with its responsiveness to treatment and well-established diagnostic protocols, has driven the demand for accurate and early testing in this segment.

T-Cell Acute Lymphoblastic Leukemia (T-ALL) follows as the second most prominent segment. While less common than B-ALL, T-ALL is more aggressive and often diagnosed in older children and young adults. Diagnostic testing for T-ALL is essential for identifying high-risk cases and guiding intensive treatment plans. Tests focus on detecting markers like CD3, CD7, and other T-cell lineage-specific antigens. Due to its more challenging nature, T-ALL testing is critical in determining treatment intensity and prognosis.

Philadelphia Chromosome-Positive ALL (Ph+ ALL) is a distinct and clinically significant subtype, but it represents a smaller share of cases. This segment involves the presence of the BCR-ABL fusion gene, which is detected using PCR, FISH, or karyotyping. Although it is less prevalent, its aggressive course and targeted treatment options—such as tyrosine kinase inhibitors—make precise testing vital. Increasing awareness and targeted therapies have elevated its importance, though its volume remains lower compared to B- and T-cell types.

Segmentation Insights by Treatment

On the basis of treatment, the global acute lymphoblastic testing market is bifurcated into product & service, chemotherapy, radiation therapy, bone marrow transplant, targeted therapy, and immunotherapy.

In the acute lymphoblastic testing market, Product & Service is the most dominant segment under the treatment category, as accurate diagnosis is the first and most critical step in the treatment pathway. This includes a wide range of testing kits, reagents, laboratory equipment, and diagnostic services that enable early detection, disease monitoring, and treatment planning. The high demand for precise diagnostic tools, advancements in molecular testing, and growing use of companion diagnostics make this segment the backbone of the market.

Chemotherapy is the next leading segment, as it remains the standard first-line treatment for most ALL patients, particularly children. It involves the use of powerful drugs to destroy leukemia cells and is often administered in multiple phases. The widespread application and established protocols for chemotherapy, especially in pediatric settings, ensure its continued dominance in treatment-related market demand.

Targeted Therapy has gained strong momentum and stands as a rapidly growing segment. It involves drugs designed to specifically attack leukemia cells with certain genetic mutations, such as those found in Philadelphia chromosome-positive ALL. These therapies offer fewer side effects compared to conventional chemotherapy and are increasingly being used alongside diagnostic testing for personalized treatment.

Immunotherapy is an emerging but promising segment, with therapies such as CAR T-cell therapy showing high success rates in refractory or relapsed ALL cases. The growing adoption of immunotherapies, especially in developed markets, reflects a shift toward precision medicine and biologic-based interventions.

Bone Marrow Transplant is reserved for high-risk or relapsed cases where other treatments have not been successful. While it plays a critical role in patient survival for certain individuals, its market share is relatively limited due to high costs, complexity, and the need for a suitable donor match.

Radiation Therapy holds the smallest segment share, used mainly for central nervous system involvement or as a preparatory step before bone marrow transplantation. Advances in other treatment modalities have reduced its standalone application, limiting its overall impact on the market compared to other segments.

Segmentation Insights by Technology

Based on technology, the global acute lymphoblastic testing market is divided into PCR, IHC, NGS, cytogenetics, and others.

In the acute lymphoblastic testing market, Polymerase Chain Reaction (PCR) is the most dominant technology segment. PCR is widely used for its high sensitivity in detecting genetic mutations, translocations like the Philadelphia chromosome, and minimal residual disease (MRD). Its rapid turnaround time, cost-effectiveness, and ability to amplify minute quantities of DNA or RNA make it a preferred method in both initial diagnosis and ongoing monitoring of acute lymphoblastic leukemia.

Cytogenetics holds the second-largest market share, as it plays a crucial role in identifying chromosomal abnormalities and risk stratification in ALL patients. Techniques like karyotyping and fluorescent in situ hybridization (FISH) help detect structural chromosomal changes, which are essential for determining treatment protocols and predicting disease progression. Cytogenetics remains a foundational tool in hematologic cancer diagnostics due to its diagnostic accuracy and prognostic relevance.

Next-Generation Sequencing (NGS) is a fast-growing segment driven by its ability to provide comprehensive genomic insights. NGS is used to identify rare mutations, gene fusions, and complex genetic profiles that influence treatment decisions. While it offers greater precision than traditional methods, its adoption is still growing due to higher costs and the need for specialized infrastructure.

Immunohistochemistry (IHC) is commonly used for detecting protein markers on leukemic cells through tissue staining. While it is less prominent than molecular methods, IHC remains important for subtyping leukemia and confirming lineage-specific markers, especially in tissue biopsies.

Segmentation Insights by End User

On the basis of end user, the global acute lymphoblastic testing market is bifurcated into clinical laboratories, hospitals, academic & research institutes, and others.

In the acute lymphoblastic testing market, Clinical Laboratories are the most dominant end-user segment. These laboratories perform a high volume of diagnostic tests, offering specialized services in molecular, cytogenetic, and immunophenotypic testing. Their ability to handle large-scale sample processing, advanced testing technologies, and skilled workforce makes them the preferred choice for healthcare providers seeking accurate and timely results.

Hospitals follow as the second-largest segment, playing a crucial role in both diagnosis and treatment. Many hospitals have in-house diagnostic departments that allow for immediate testing and integration of results into patient care. The convenience of on-site testing, especially in tertiary care and oncology-focused hospitals, supports the segment’s strong presence in the market.

Academic & Research Institutes contribute significantly to innovation and clinical study development, although their market share is smaller compared to clinical settings. These institutions focus on understanding the molecular basis of ALL, evaluating new biomarkers, and testing advanced technologies, which help refine existing diagnostic tools and create new therapeutic pathways.

Acute Lymphoblastic Testing Market: Regional Insights

- North America is expected to dominates the global market

North America leads the acute lymphoblastic testing market, primarily due to its highly developed healthcare infrastructure, strong presence of diagnostic technology providers, and significant funding in cancer research. The region also benefits from higher disease awareness, well-established screening programs, and advanced diagnostic capabilities, especially in the United States and Canada, where early detection is emphasized through routine testing and clinical trials.

Europe holds the second-largest market share, driven by government-supported healthcare systems, growing investments in precision medicine, and widespread availability of advanced diagnostic techniques. Countries like Germany, the UK, and France are at the forefront of incorporating molecular diagnostics and cytogenetics into standard leukemia testing, improving early diagnosis and personalized treatment approaches across the region.

Asia-Pacific is experiencing the fastest growth in the market due to increasing healthcare access, rising leukemia incidence, and growing awareness of early cancer detection. Rapid urbanization, improving diagnostic infrastructure in countries like China, India, and Japan, and a strong push from both public and private sectors are contributing to the region’s expanding adoption of acute lymphoblastic testing.

Latin America shows moderate growth potential, with countries like Brazil, Argentina, and Mexico making gradual progress in strengthening their healthcare systems and expanding oncology diagnostics. However, limited resources, regional disparities, and slower implementation of advanced technologies continue to affect market penetration, though efforts to improve early cancer detection are underway.

Middle East and Africa account for the smallest share of the market, mainly due to infrastructure challenges and restricted access to advanced diagnostic tools. While urban centers in the UAE, Saudi Arabia, and South Africa are beginning to adopt modern testing methods, rural and underserved areas still face limited availability. Nonetheless, rising healthcare investment and regional initiatives in cancer care suggest potential for future growth.

Acute Lymphoblastic Testing Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the acute lymphoblastic testing market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global acute lymphoblastic testing market include:

- Medical Education and Research

- DrLal Path Labs

- Bio-Rad Lab

- QIAGEN

- Invivoscribe

- Illumina

- ArcherDx

- ASURAGEN

- Adaptive Biotechnologies

- NeoGenomics Lab

- Laboratory Corporation of America Holdings

- ARUP Lab

The global acute lymphoblastic testing market is segmented as follows:

By Leukemia Type

- Philadelphia Chromosome

- B-Cell

- T-Cell

- Others

By Treatment

- Product and Service

- Chemotherapy

- Radiation Therapy

- Bone Marrow Transplant

- Targeted Therapy

- Immunotherapy

By Technology

- PCR (Polymerase Chain Reaction)

- IHC (Immunohistochemistry)

- NGS (Next-Generation Sequencing)

- Cytogenetics

- Others

By End User

- Clinical Laboratories

- Hospitals

- Academic and Research Institutes

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Acute Lymphoblastic Testing

Request Sample

Acute Lymphoblastic Testing