Natural L-Lactic Acid Market Size, Share, and Trends Analysis Report

CAGR :

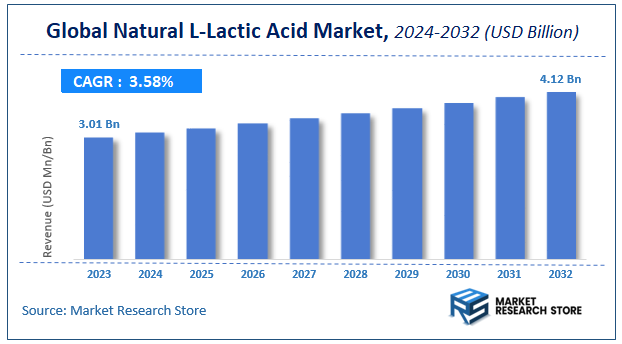

| Market Size 2023 (Base Year) | USD 3.01 Billion |

| Market Size 2032 (Forecast Year) | USD 4.12 Billion |

| CAGR | 3.58% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Natural L-Lactic Acid Market Insights

According to Market Research Store, the global natural l-lactic acid market size was valued at around USD 3.01 billion in 2023 and is estimated to reach USD 4.12 billion by 2032, to register a CAGR of approximately 3.58% in terms of revenue during the forecast period 2024-2032.

The natural l-lactic acid report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Natural L-Lactic Acid Market: Overview

The Natural L-Lactic Acid Market focuses on the production and application of L-lactic acid, a naturally occurring organic acid primarily derived from renewable sources such as corn, sugarcane, and other carbohydrates through fermentation. L-lactic acid is widely used across industries, including food and beverages, pharmaceuticals, cosmetics, and biodegradable plastics. It serves as a key ingredient in food preservation, personal care products, biopolymer production, and medical applications.

The growth of the market is driven by the rising demand for sustainable and bio-based chemicals, increasing consumer preference for natural and clean-label products, and the expanding application of polylactic acid (PLA) in biodegradable plastics. The growing use of L-lactic acid in skin care formulations due to its exfoliating and moisturizing properties further contributes to its market expansion. Additionally, advancements in fermentation technology and bio-based production processes are improving efficiency and reducing costs.

Key Highlights

- The natural l-lactic acid market is anticipated to grow at a CAGR of 3.58% during the forecast period.

- The global natural l-lactic acid market was estimated to be worth approximately USD 3.01 billion in 2023 and is projected to reach a value of USD 4.12 billion by 2032.

- The growth of the natural l-lactic acid market is being driven by a surge in consumer demand for natural and sustainable products across various sectors.

- Based on the application, the biodegradable plastics segment is growing at a high rate and is projected to dominate the market.

- On the basis of end user, the industrial manufacturing segment is projected to swipe the largest market share.

- In terms of source, the fermented sources segment is expected to dominate the market.

- Based on the formulation, the liquid formulations segment is expected to dominate the market.

- Based on the purity level, the pharmaceutical grade [≥99% purity] segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Natural L-Lactic Acid Market: Dynamics

Key Drivers

- Growing Demand for Natural and Organic Products: Consumers are increasingly seeking natural and organic products across various sectors, including food and beverages, personal care, and pharmaceuticals. Natural L-lactic acid, derived from renewable sources like sugar beets or corn, aligns with this consumer preference.

- Rise of Bio-based Products: The growing demand for bio-based and biodegradable materials, driven by environmental concerns and sustainability initiatives, is boosting the market for natural L-lactic acid.

- Application in Bioplastics: L-lactic acid is a key building block for polylactic acid (PLA), a biodegradable plastic used in various applications like packaging, textiles, and 3D printing. The increasing demand for bioplastics is driving the demand for natural L-lactic acid.

- Food and Beverage Industry: L-lactic acid is widely used in the food and beverage industry as a flavoring agent, preservative, and acidity regulator.

Restraints

- Price Volatility of Raw Materials: Fluctuations in the prices of raw materials used for lactic acid production, such as sugar beets and corn, can impact production costs.

- Competition from Synthetic L-lactic Acid: Competition from synthetically produced L-lactic acid, which can be more cost-effective in some cases.

- Technological Limitations: Challenges in improving the efficiency and cost-effectiveness of natural L-lactic acid production processes.

- Environmental Concerns: While considered more sustainable than synthetic alternatives, the environmental impact of natural L-lactic acid production, such as land use and water usage, needs to be carefully considered.

Opportunities

- Development of New Applications: Exploring new and emerging applications for natural L-lactic acid, such as in pharmaceuticals, cosmetics, and agriculture.

- Focus on Sustainability: Emphasizing sustainable production practices, such as using renewable energy sources and minimizing waste generation.

- Innovation in Production Processes: Developing more efficient and cost-effective production processes for natural L-lactic acid.

- Collaboration with Other Industries: Collaborating with other industries, such as the bioplastics and biofuels industries, to promote the use of natural L-lactic acid.

Challenges

- Maintaining Competitive Pricing: Ensuring that natural L-lactic acid can compete effectively with synthetic alternatives in terms of price and performance.

- Meeting Growing Demand: Scaling up production to meet the growing demand for natural L-lactic acid while maintaining quality and sustainability.

- Addressing Environmental Concerns: Mitigating the environmental impact of natural L-lactic acid production and ensuring sustainable sourcing of raw materials.

- Staying Competitive: Remaining competitive in a dynamic market with increasing competition from other bio-based chemicals and materials.

Natural L-Lactic Acid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Natural L-Lactic Acid Market |

| Market Size in 2023 | USD 3.01 Billion |

| Market Forecast in 2032 | USD 4.12 Billion |

| Growth Rate | CAGR of 3.58% |

| Number of Pages | 140 |

| Key Companies Covered | Prathista Industries Limited, Jungbunzlauer Suisse AG, Corbion, Penta Manufacturing Company, Galactic, Tripura Biotech Limited, Lee Biosolutions, Wuhan Sanjiang Space Good Biotech |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Natural L-Lactic Acid Market: Segmentation Insights

The global natural l-lactic acid market is divided by application, end user, source, formulation, purity level and region.

Segmentation Insights by Application

Based on application, the global natural l-lactic acid market is divided into biodegradable plastics, personal care & cosmetics, food preservation, pharmaceuticals, and food & beverage industry.

The Biodegradable Plastics segment dominates the market, driven by the increasing demand for sustainable alternatives to conventional plastics. Natural L-Lactic Acid is a key raw material in the production of polylactic acid (PLA), a biodegradable polymer used in eco-friendly packaging, disposable utensils, and medical implants. Stringent regulations on plastic waste and growing environmental awareness are accelerating the adoption of biodegradable plastics, making this the leading segment.

The Personal Care & Cosmetics segment holds a substantial share in the Natural L-Lactic Acid Market due to its widespread use in skincare, haircare, and cosmetic formulations. It functions as a gentle exfoliant, pH regulator, and humectant, making it a popular ingredient in anti-aging creams, moisturizers, and peels. The increasing consumer preference for natural and organic beauty products further boosts demand in this segment.

The Food Preservation segment benefits from Natural L-Lactic Acid’s antimicrobial properties, which help extend shelf life and prevent bacterial growth in food products. It is widely used as a preservative in dairy, meat, and processed foods, aligning with the growing demand for clean-label and natural food preservation solutions. The shift away from synthetic preservatives drives continued market growth in this application.

The Pharmaceuticals segment utilizes Natural L-Lactic Acid in drug formulations, biopolymer-based drug delivery systems, and topical treatments. Its biocompatibility and role in controlled-release medications make it essential in pharmaceutical applications. The rising adoption of biopharmaceuticals and bio-based medical formulations supports the expansion of this segment.

The Food & Beverage Industry segment benefits from Natural L-Lactic Acid’s role as an acidulant, pH regulator, and flavor enhancer in dairy products, confectionery, and fermented foods. The demand for natural acidulants in clean-label food and beverage formulations continues to grow, driving market expansion in this application.

Segmentation Insights by End-User

On the basis of end user, the global natural l-lactic acid market is bifurcated into industrial manufacturing, healthcare providers, cosmetic manufacturers, food processors, and research institutions.

The Industrial Manufacturing segment dominates the market, fueled by the growing shift toward biodegradable plastics and sustainable industrial solutions. Natural L-Lactic Acid serves as a key raw material for polylactic acid (PLA) production, widely used in eco-friendly packaging, disposable tableware, and biopolymer-based industrial products. The increasing focus on sustainability and regulatory support for biodegradable materials further propel growth in this segment.

The Healthcare Providers segment benefits from Natural L-Lactic Acid’s role in pharmaceutical formulations, medical-grade biopolymers, and controlled drug delivery systems. Its biocompatibility makes it essential in topical treatments, wound healing solutions, and implantable medical devices. The rising adoption of bio-based medical materials contributes to steady demand from hospitals, clinics, and healthcare facilities.

The Cosmetic Manufacturers segment leverages Natural L-Lactic Acid for its exfoliating, moisturizing, and pH-regulating properties in skincare, haircare, and personal care products. The growing consumer preference for natural and organic beauty products drives demand in this segment, making it a key contributor to market expansion. The rise of clean-label formulations and regulatory approvals for natural ingredients further support growth.

The Food Processors segment extensively uses Natural L-Lactic Acid as a food preservative, acidulant, and pH regulator. It enhances shelf life and flavor in dairy, meat, confectionery, and fermented food products. The increasing demand for natural food additives and clean-label ingredients strengthens the presence of this segment in the market.

The Research Institutions segment plays a crucial role in the development of new applications for Natural L-Lactic Acid, particularly in biopolymers, pharmaceuticals, and biotechnology. Ongoing R&D efforts in sustainable materials, bio-based chemicals, and advanced medical applications drive consistent demand from academic and industrial research centers.

Segmentation Insights by Source

On the basis of source, the global natural l-lactic acid market is bifurcated into fermented sources, synthetic sources, and bio-based sources.

The Fermented Sources segment holds a dominant share in the Natural L-Lactic Acid Market, driven by its widespread use in food, pharmaceuticals, cosmetics, and biodegradable plastics. Fermentation-derived L-Lactic Acid is primarily produced using renewable feedstocks such as corn, sugarcane, and tapioca, making it a sustainable and eco-friendly option. Its high purity and biocompatibility make it ideal for applications in biopolymers, food preservation, and pharmaceutical formulations. The increasing preference for naturally sourced ingredients and the demand for bio-based alternatives further boost this segment's growth.

The Synthetic Sources segment accounts for a smaller market share, as synthetic production methods involve petrochemical-based processes. While synthetic L-Lactic Acid can provide consistent quality and controlled production, it is less favored due to environmental concerns and the push for sustainable sourcing. However, it finds applications in industrial processes where cost-effectiveness and high production efficiency are priorities.

The Bio-Based Sources segment is experiencing significant growth due to the rising demand for sustainable and renewable raw materials. Derived from biomass and agricultural residues, bio-based L-Lactic Acid serves as a key component in biodegradable plastics, green chemicals, and eco-friendly industrial applications. The push for reducing carbon footprints, coupled with regulatory policies promoting bio-based products, accelerates the adoption of this segment.

Segmentation Insights by Formulation

On the basis of formulation, the global natural l-lactic acid market is bifurcated into liquid formulations, powdered formulations, gel formulations, and solid formulations.

The Liquid Formulations segment holds a dominant share in the Natural L-Lactic Acid Market, primarily due to its high solubility, ease of handling, and widespread use across industries. In food and beverage applications, liquid L-Lactic Acid serves as an acidulant, preservative, and pH regulator, ensuring product stability and enhanced shelf life. In pharmaceuticals and cosmetics, its ability to blend seamlessly with other ingredients makes it a preferred choice for skincare formulations, topical treatments, and drug delivery systems. The rising demand for bio-based liquid acidulants in food processing and personal care products further strengthens this segment’s position.

The Powdered Formulations segment is gaining traction, particularly in the food, pharmaceutical, and industrial sectors. Powdered L-Lactic Acid offers longer shelf life, easier transportation, and controlled release properties, making it ideal for dry food formulations, dietary supplements, and biopolymer production. This form is especially valued in applications requiring precise dosing, such as pharmaceuticals and specialty chemicals. The growing demand for powdered lactic acid in biodegradable plastics and industrial manufacturing is contributing to its increasing market share.

The Gel Formulations segment is primarily used in cosmetics, personal care, and pharmaceutical applications. Gel-based L-Lactic Acid formulations are known for their controlled-release properties, making them suitable for skincare products, wound healing gels, and medical ointments. Their ability to provide deep hydration and exfoliation enhances their appeal in dermatology and cosmetic formulations. The increasing demand for bio-based skincare and medical gels is driving growth in this segment.

The Solid Formulations segment, though smaller in market share, plays a crucial role in industrial and pharmaceutical applications. Solid L-Lactic Acid is used in compressed tablets, biopolymer synthesis, and industrial catalysts. Its stable composition and slow-release properties make it suitable for niche applications such as biodegradable materials and extended-release pharmaceutical formulations.

Segmentation Insights by Purity Level

On the basis of purity level, the global natural l-lactic acid market is bifurcated into pharmaceutical grade (≥99% purity), food grade (≥88% purity), and industrial grade (≤88% purity).

The Pharmaceutical Grade (≥99% purity) segment holds a dominant share in the Natural L-Lactic Acid Market due to its critical role in medical, pharmaceutical, and high-end cosmetic applications. This high-purity grade is widely used in drug formulations, injectable solutions, and advanced wound care products due to its superior biocompatibility and stringent regulatory compliance. Additionally, its use in premium skincare products and biomedical applications, such as biodegradable sutures and controlled drug delivery systems, further drives its demand. The increasing focus on high-purity bio-based chemicals in pharmaceuticals and biotechnology fuels the growth of this segment.

The Food Grade (≥88% purity) segment is experiencing significant growth, driven by the rising use of L-Lactic Acid as a natural acidulant, preservative, and pH regulator in food and beverage applications. This grade is commonly used in dairy products, baked goods, beverages, and processed foods to enhance flavor, improve texture, and extend shelf life. With growing consumer demand for natural and organic food ingredients, the adoption of food-grade L-Lactic Acid is expanding. Additionally, its application in probiotic and functional food formulations is contributing to its increasing market presence.

The Industrial Grade (≤88% purity) segment plays a vital role in the production of biodegradable plastics, green solvents, and other industrial applications. While it has a smaller share compared to pharmaceutical and food-grade counterparts, its demand is growing due to the increasing shift toward sustainable and bio-based industrial chemicals. Industrial-grade L-Lactic Acid is a key component in polylactic acid (PLA) production, which is used in bioplastics, packaging materials, and eco-friendly coatings. The rising adoption of bio-based alternatives in various industrial sectors is fueling demand for this segment.

Natural L-Lactic Acid Market: Regional Insights

- North America is expected to dominates the global market

North America dominates the natural L-lactic acid market due to its strong demand for biodegradable plastics, well-established food and beverage industry, and increasing consumer preference for natural and sustainable products. The strong demand for biodegradable plastics, increasing consumer preference for natural and organic food products, and rising applications in personal care and cosmetics drive market growth. The presence of key manufacturers and growing investments in biopolymer production further contribute to the region’s market expansion.

Europe is a major market for natural L-lactic acid, with Germany, France, and the UK leading in adoption. Strict environmental regulations promoting the use of bio-based and sustainable materials, along with high demand for biodegradable packaging, fuel market growth. The region’s strong personal care industry, with a growing preference for natural ingredients in skincare and cosmetic products, further drives demand for L-lactic acid.

Asia-Pacific region is experiencing rapid growth, driven by China, Japan, India, and South Korea. Increasing industrialization, rising demand for bioplastics, and government initiatives to promote sustainable materials contribute to market expansion. China is a leading producer and consumer of natural L-lactic acid, particularly for biodegradable plastics and food applications. The growing personal care and pharmaceutical industries in Japan and South Korea also support market growth.

Latin America is an emerging market, with Brazil and Mexico leading in adoption. The rising demand for bio-based products, increasing application in food preservation, and growing biodegradable plastic industry drive market expansion. However, high production costs and limited infrastructure for biopolymer processing may pose challenges.

Middle East and Africa region is gradually expanding in the natural L-lactic acid market, with the UAE and South Africa showing increased adoption. Growing interest in sustainable packaging solutions, coupled with rising demand for natural ingredients in cosmetics and food, supports market growth. However, limited local production capacity may impact market development.

Natural L-Lactic Acid Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the natural l-lactic acid market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global natural l-lactic acid market include:

- Corbion

- Galactic

- Jungbunzlauer Suisse AG

- Lee Biosolutions

- Penta Manufacturing Company

- Prathista Industries Limited

- Tripura Biotech Limited

- Wuhan Sanjiang Space Good Biotech

The global natural l-lactic acid market is segmented as follows:

By Application

- Personal Care & Cosmetics

- Food Preservation

- Pharmaceuticals

- Biodegradable Plastics

- Food & Beverage Industry

By End User

- Industrial Manufacturing

- Healthcare Providers

- Cosmetic Manufacturers

- Food Processors

- Research Institutions

By Source

- Fermented Sources (e.g., co, sugarcane)

- Synthetic Sources

- Bio-based Sources

By Formulation

- Liquid Formulations

- Powdered Formulations

- Gel Formulations

- Solid Formulations

By Purity Level

- Pharmaceutical Grade (≥99% Purity)

- Food Grade (≥88% Purity)

- Industrial Grade (≤88% Purity)

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global natural l-lactic acid market size was projected at approximately US$ 3.01 billion in 2023. Projections indicate that the market is expected to reach around US$ 4.12 billion in revenue by 2032.

The global natural l-lactic acid market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 3.58% during the forecast period from 2024 to 2032.

North America is expected to dominate the global natural l-lactic acid market.

The global natural L-lactic acid market is primarily driven by the increasing demand for bio-based and biodegradable products, driven by growing environmental concerns and the need for sustainable solutions.

Some of the prominent players operating in the global natural l-lactic acid market are; Corbion, Galactic, Jungbunzlauer Suisse AG, Lee Biosolutions, Penta Manufacturing Company, Prathista Industries Limited, Tripura Biotech Limited, Wuhan Sanjiang Space Good Biotech, and others.

competitivThe global natural l-lactic acid market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

Natural L-Lactic Acid

Request Sample

Natural L-Lactic Acid