Biosimilars Market Size, Share, and Trends Analysis Report

CAGR :

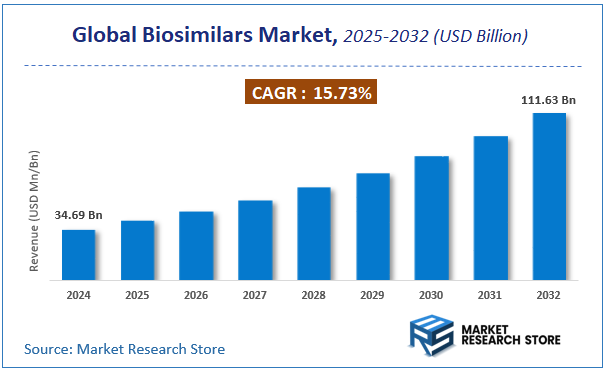

| Market Size 2024 (Base Year) | USD 34.69 Billion |

| Market Size 2032 (Forecast Year) | USD 111.63 Billion |

| CAGR | 15.73% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global biosimilars market, estimating its value at USD 34.69 Billion in 2024, with projections indicating it will reach USD 111.63 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 15.73% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the biosimilars industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Biosimilars Market: Overview

The growth of the biosimilars market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The biosimilars market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the biosimilars market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Product, Application, Manufacturer, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global biosimilars market is estimated to grow annually at a CAGR of around 15.73% over the forecast period (2025-2032).

- In terms of revenue, the global biosimilars market size was valued at around USD 34.69 Billion in 2024 and is projected to reach USD 111.63 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for affordable biologic treatments, increasing prevalence of chronic diseases, and rising regulatory approvals are boosting the Biosimilars market.

- Based on the Product, the Monoclonal Antibodies segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Oncology segment is anticipated to command the largest market share.

- In terms of Manufacturer, the Contract Research and Manufacturing Services segment is projected to lead the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Biosimilars Market: Report Scope

This report thoroughly analyzes the biosimilars market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Biosimilars Market |

| Market Size in 2024 | USD 34.69 Billion |

| Market Forecast in 2032 | USD 111.63 Billion |

| Growth Rate | CAGR of 15.73% |

| Number of Pages | 212 |

| Key Companies Covered | Amgen Inc., F Hoffman-La Roche Ltd., Sandoz International GmbH, Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Samsung Biopis, Biocon, Viatris Inc., Celltrion Healthcare Co., Ltd., AbbVie Inc |

| Segments Covered | By Product, By Application, By Manufacturer, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biosimilars Market: Dynamics

Key Growth Drivers :

The primary growth driver for the biosimilars market is the impending patent expiration of numerous blockbuster biologic drugs. This opens a window for biosimilar manufacturers to enter the market with more affordable, yet highly similar, versions of these life-saving medications. This trend is further amplified by increasing pressure on healthcare systems globally to contain costs and improve patient access to high-priced treatments for chronic and life-threatening diseases like cancer, diabetes, and autoimmune disorders. Favorable government policies and regulatory frameworks in regions like Europe and the United States, which actively promote the use and reimbursement of biosimilars, are also a major catalyst for market expansion. The rising prevalence of chronic diseases and the growing geriatric population, who are more susceptible to these conditions, also fuels the demand for cost-effective treatment options.

Restraints :

Despite the robust growth drivers, the biosimilars market faces several significant restraints. The high cost and complexity of the development and manufacturing processes are major hurdles, requiring significant capital investment and specialized expertise. Unlike small-molecule generics, biosimilars are large, complex protein molecules derived from living cells, making them difficult and expensive to replicate with precision. Additionally, the stringent and evolving regulatory pathways, including the requirement for extensive clinical trials to demonstrate "no clinically meaningful differences" with the reference product, can lead to lengthy and costly approval processes. Originator companies also employ strategies such as "patent thickets" and aggressive pricing, including rebates, to maintain their market share and delay biosimilar entry, which creates a challenging competitive environment. A lack of physician and patient awareness or a general reluctance to switch from a familiar brand-name biologic can also hinder market adoption.

Opportunities :

The biosimilars market is presented with significant opportunities for future growth. The development of next-generation biosimilars for complex therapeutic areas, such as oncology and immunology, offers a high-value opportunity. The expansion into emerging markets in the Asia-Pacific and Latin America regions, which are experiencing a rapid increase in healthcare expenditure and a high prevalence of chronic diseases, represents a substantial, untapped market. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), can optimize and accelerate the development and manufacturing of biosimilars, leading to more efficient and cost-effective production. Furthermore, the growing trend of strategic partnerships and collaborations between established pharmaceutical companies and smaller biotech firms can help mitigate development risks, share costs, and accelerate market entry.

Challenges :

A key challenge for the biosimilars market is the intense price erosion that often occurs after a few biosimilar competitors enter the market. The high initial development cost coupled with aggressive price competition can impact profitability and discourage future R&D investment for new biosimilars. The issue of interchangeability, where a biosimilar can be substituted for the reference product at the pharmacy level without the prescribing physician's approval, remains a significant challenge, especially in the US, as it requires additional, expensive clinical trials to achieve this designation. Ensuring a consistent, high-quality supply chain and managing the inherent risks of product immunogenicity and other safety concerns associated with a biological product are also persistent challenges that require continuous monitoring and rigorous quality control.

Biosimilars Market: Segmentation Insights

The global biosimilars market is segmented based on Product, Application, Manufacturer, and Region. All the segments of the biosimilars market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Product, the global biosimilars market is divided into Monoclonal Antibodies, Insulin, Granulocyte Colony-Stimulating Factor, Erythropoietin, Recombinant Human Growth Hormone, Etanercept, Follitropin, Teriparatide, Interferons, Anticoagulants, Other.

On the basis of Application, the global biosimilars market is bifurcated into Oncology, Growth Hormonal Deficiency, Blood Disorders, Chronic & Autoimmune Disorders, Infectious Disease, Others.

In terms of Manufacturer, the global biosimilars market is categorized into Contract Research and Manufacturing Services, In-house.

Biosimilars Market: Regional Insights

Europe is the established and dominant region in the global biosimilars market, serving as the pioneer in regulatory approval and commercialization. This leadership is attributed to a proactive regulatory framework led by the European Medicines Agency (EMA), strong government policies promoting cost-containment in healthcare, and high acceptance among physicians and patients. Countries like Germany, the UK, and France have successfully integrated biosimilars into their healthcare systems, driving significant cost savings and market competition.

While North America is a major market with growing uptake, and the Asia-Pacific region shows rapid expansion, Europe's early start, mature reimbursement pathways, and extensive portfolio of approved biosimilars cement its position as the most developed and influential regional market.

Biosimilars Market: Competitive Landscape

The biosimilars market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Biosimilars Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Amgen Inc.

- F Hoffman-La Roche Ltd.

- Sandoz International GmbH

- Dr. Reddy’s Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Samsung Biopis

- Biocon

- Viatris Inc.

- Celltrion Healthcare Co.

- Ltd.

- AbbVie Inc

The Global Biosimilars Market is Segmented as Follows:

By Product

- Monoclonal Antibodies

- Insulin

- Granulocyte Colony-Stimulating Factor

- Erythropoietin

- Recombinant Human Growth Hormone

- Etanercept

- Follitropin

- Teriparatide

- Interferons

- Anticoagul

By Application

- Oncology

- Growth Hormonal Deficiency

- Blood Disorders

- Chronic & Autoimmune Disorders

- Infectious Disease

- Others

By Manufacturer

- Contract Research and Manufacturing Services

- In-house

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Biosimilars Market Share by Type (2020-2026) 1.5.2 Human Growth Hormone 1.5.3 Erythropoietin 1.5.4 Monoclonal Antibodies 1.5.5 Insulin 1.5.6 Interferon 1.5.7 Granulocyte-Colony Stimulating Factor 1.5.8 Others 1.6 Market by Application 1.6.1 Global Biosimilars Market Share by Application (2020-2026) 1.6.2 Oncology 1.6.3 Blood Disorders 1.6.4 Growth Hormonal Deficiency 1.6.5 Chronic and Autoimmune Disorders 1.6.6 Others 1.7 Biosimilars Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Biosimilars Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Biosimilars Market 3.1 Value Chain Status 3.2 Biosimilars Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Biosimilars 3.2.3 Labor Cost of Biosimilars 3.2.3.1 Labor Cost of Biosimilars Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 F. Hoffmann-La Roche AG 4.1.1 F. Hoffmann-La Roche AG Basic Information 4.1.2 Biosimilars Product Profiles, Application and Specification 4.1.3 F. Hoffmann-La Roche AG Biosimilars Market Performance (2015-2020) 4.1.4 F. Hoffmann-La Roche AG Business Overview 4.2 Mylan N.V 4.2.1 Mylan N.V Basic Information 4.2.2 Biosimilars Product Profiles, Application and Specification 4.2.3 Mylan N.V Biosimilars Market Performance (2015-2020) 4.2.4 Mylan N.V Business Overview 4.3 Samsung Bioepis 4.3.1 Samsung Bioepis Basic Information 4.3.2 Biosimilars Product Profiles, Application and Specification 4.3.3 Samsung Bioepis Biosimilars Market Performance (2015-2020) 4.3.4 Samsung Bioepis Business Overview 4.4 Biocon 4.4.1 Biocon Basic Information 4.4.2 Biosimilars Product Profiles, Application and Specification 4.4.3 Biocon Biosimilars Market Performance (2015-2020) 4.4.4 Biocon Business Overview 4.5 Dr. Reddy’s Laboratories Ltd. 4.5.1 Dr. Reddy’s Laboratories Ltd. Basic Information 4.5.2 Biosimilars Product Profiles, Application and Specification 4.5.3 Dr. Reddy’s Laboratories Ltd. Biosimilars Market Performance (2015-2020) 4.5.4 Dr. Reddy’s Laboratories Ltd. Business Overview 4.6 Sandoz International GmbH 4.6.1 Sandoz International GmbH Basic Information 4.6.2 Biosimilars Product Profiles, Application and Specification 4.6.3 Sandoz International GmbH Biosimilars Market Performance (2015-2020) 4.6.4 Sandoz International GmbH Business Overview 4.7 Teva Pharmaceutical Industries Ltd. 4.7.1 Teva Pharmaceutical Industries Ltd. Basic Information 4.7.2 Biosimilars Product Profiles, Application and Specification 4.7.3 Teva Pharmaceutical Industries Ltd. Biosimilars Market Performance (2015-2020) 4.7.4 Teva Pharmaceutical Industries Ltd. Business Overview 4.8 Pfizer Inc. 4.8.1 Pfizer Inc. Basic Information 4.8.2 Biosimilars Product Profiles, Application and Specification 4.8.3 Pfizer Inc. Biosimilars Market Performance (2015-2020) 4.8.4 Pfizer Inc. Business Overview 4.9 Amgen Inc 4.9.1 Amgen Inc Basic Information 4.9.2 Biosimilars Product Profiles, Application and Specification 4.9.3 Amgen Inc Biosimilars Market Performance (2015-2020) 4.9.4 Amgen Inc Business Overview 5 Global Biosimilars Market Analysis by Regions 5.1 Global Biosimilars Sales, Revenue and Market Share by Regions 5.1.1 Global Biosimilars Sales by Regions (2015-2020) 5.1.2 Global Biosimilars Revenue by Regions (2015-2020) 5.2 North America Biosimilars Sales and Growth Rate (2015-2020) 5.3 Europe Biosimilars Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Biosimilars Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Biosimilars Sales and Growth Rate (2015-2020) 5.6 South America Biosimilars Sales and Growth Rate (2015-2020) 6 North America Biosimilars Market Analysis by Countries 6.1 North America Biosimilars Sales, Revenue and Market Share by Countries 6.1.1 North America Biosimilars Sales by Countries (2015-2020) 6.1.2 North America Biosimilars Revenue by Countries (2015-2020) 6.1.3 North America Biosimilars Market Under COVID-19 6.2 United States Biosimilars Sales and Growth Rate (2015-2020) 6.2.1 United States Biosimilars Market Under COVID-19 6.3 Canada Biosimilars Sales and Growth Rate (2015-2020) 6.4 Mexico Biosimilars Sales and Growth Rate (2015-2020) 7 Europe Biosimilars Market Analysis by Countries 7.1 Europe Biosimilars Sales, Revenue and Market Share by Countries 7.1.1 Europe Biosimilars Sales by Countries (2015-2020) 7.1.2 Europe Biosimilars Revenue by Countries (2015-2020) 7.1.3 Europe Biosimilars Market Under COVID-19 7.2 Germany Biosimilars Sales and Growth Rate (2015-2020) 7.2.1 Germany Biosimilars Market Under COVID-19 7.3 UK Biosimilars Sales and Growth Rate (2015-2020) 7.3.1 UK Biosimilars Market Under COVID-19 7.4 France Biosimilars Sales and Growth Rate (2015-2020) 7.4.1 France Biosimilars Market Under COVID-19 7.5 Italy Biosimilars Sales and Growth Rate (2015-2020) 7.5.1 Italy Biosimilars Market Under COVID-19 7.6 Spain Biosimilars Sales and Growth Rate (2015-2020) 7.6.1 Spain Biosimilars Market Under COVID-19 7.7 Russia Biosimilars Sales and Growth Rate (2015-2020) 7.7.1 Russia Biosimilars Market Under COVID-19 8 Asia-Pacific Biosimilars Market Analysis by Countries 8.1 Asia-Pacific Biosimilars Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Biosimilars Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Biosimilars Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Biosimilars Market Under COVID-19 8.2 China Biosimilars Sales and Growth Rate (2015-2020) 8.2.1 China Biosimilars Market Under COVID-19 8.3 Japan Biosimilars Sales and Growth Rate (2015-2020) 8.3.1 Japan Biosimilars Market Under COVID-19 8.4 South Korea Biosimilars Sales and Growth Rate (2015-2020) 8.4.1 South Korea Biosimilars Market Under COVID-19 8.5 Australia Biosimilars Sales and Growth Rate (2015-2020) 8.6 India Biosimilars Sales and Growth Rate (2015-2020) 8.6.1 India Biosimilars Market Under COVID-19 8.7 Southeast Asia Biosimilars Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Biosimilars Market Under COVID-19 9 Middle East and Africa Biosimilars Market Analysis by Countries 9.1 Middle East and Africa Biosimilars Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Biosimilars Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Biosimilars Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Biosimilars Market Under COVID-19 9.2 Saudi Arabia Biosimilars Sales and Growth Rate (2015-2020) 9.3 UAE Biosimilars Sales and Growth Rate (2015-2020) 9.4 Egypt Biosimilars Sales and Growth Rate (2015-2020) 9.5 Nigeria Biosimilars Sales and Growth Rate (2015-2020) 9.6 South Africa Biosimilars Sales and Growth Rate (2015-2020) 10 South America Biosimilars Market Analysis by Countries 10.1 South America Biosimilars Sales, Revenue and Market Share by Countries 10.1.1 South America Biosimilars Sales by Countries (2015-2020) 10.1.2 South America Biosimilars Revenue by Countries (2015-2020) 10.1.3 South America Biosimilars Market Under COVID-19 10.2 Brazil Biosimilars Sales and Growth Rate (2015-2020) 10.2.1 Brazil Biosimilars Market Under COVID-19 10.3 Argentina Biosimilars Sales and Growth Rate (2015-2020) 10.4 Columbia Biosimilars Sales and Growth Rate (2015-2020) 10.5 Chile Biosimilars Sales and Growth Rate (2015-2020) 11 Global Biosimilars Market Segment by Types 11.1 Global Biosimilars Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Biosimilars Sales and Market Share by Types (2015-2020) 11.1.2 Global Biosimilars Revenue and Market Share by Types (2015-2020) 11.2 Human Growth Hormone Sales and Price (2015-2020) 11.3 Erythropoietin Sales and Price (2015-2020) 11.4 Monoclonal Antibodies Sales and Price (2015-2020) 11.5 Insulin Sales and Price (2015-2020) 11.6 Interferon Sales and Price (2015-2020) 11.7 Granulocyte-Colony Stimulating Factor Sales and Price (2015-2020) 11.8 Others Sales and Price (2015-2020) 12 Global Biosimilars Market Segment by Applications 12.1 Global Biosimilars Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Biosimilars Sales and Market Share by Applications (2015-2020) 12.1.2 Global Biosimilars Revenue and Market Share by Applications (2015-2020) 12.2 Oncology Sales, Revenue and Growth Rate (2015-2020) 12.3 Blood Disorders Sales, Revenue and Growth Rate (2015-2020) 12.4 Growth Hormonal Deficiency Sales, Revenue and Growth Rate (2015-2020) 12.5 Chronic and Autoimmune Disorders Sales, Revenue and Growth Rate (2015-2020) 12.6 Others Sales, Revenue and Growth Rate (2015-2020) 13 Biosimilars Market Forecast by Regions (2020-2026) 13.1 Global Biosimilars Sales, Revenue and Growth Rate (2020-2026) 13.2 Biosimilars Market Forecast by Regions (2020-2026) 13.2.1 North America Biosimilars Market Forecast (2020-2026) 13.2.2 Europe Biosimilars Market Forecast (2020-2026) 13.2.3 Asia-Pacific Biosimilars Market Forecast (2020-2026) 13.2.4 Middle East and Africa Biosimilars Market Forecast (2020-2026) 13.2.5 South America Biosimilars Market Forecast (2020-2026) 13.3 Biosimilars Market Forecast by Types (2020-2026) 13.4 Biosimilars Market Forecast by Applications (2020-2026) 13.5 Biosimilars Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Biosimilars

Request Sample

Biosimilars