Brand Management Software Market Size, Share, and Trends Analysis Report

CAGR :

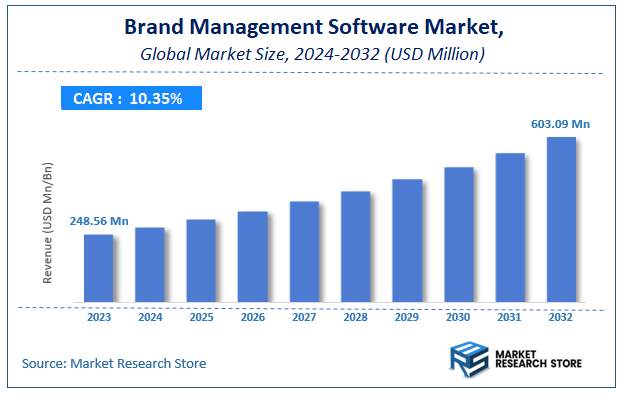

| Market Size 2023 (Base Year) | USD 248.56 Million |

| Market Size 2032 (Forecast Year) | USD 603.09 Million |

| CAGR | 10.35% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Brand Management Software Market Insights

According to Market Research Store, the global brand management software market size was valued at around USD 248.56 million in 2023 and is estimated to reach USD 603.09 million by 2032, to register a CAGR of approximately 10.35% in terms of revenue during the forecast period 2024-2032.

The brand management software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Brand Management Software Market: Overview

Brand Management Software is a digital solution designed to help businesses create, maintain, and enhance their brand identity consistently across all channels. It enables companies to manage brand assets such as logos, images, videos, marketing collateral, and messaging guidelines in a centralized platform, ensuring uniformity in branding across campaigns, social media, websites, and partner networks. The software often includes features for digital asset management, content approval workflows, collaboration tools, analytics, and reporting, allowing marketing teams to streamline operations, maintain compliance, and monitor brand performance effectively.

Key Highlights

- The brand management software market is anticipated to grow at a CAGR of 10.35% during the forecast period.

- The global brand management software market was estimated to be worth approximately USD 248.56 million in 2023 and is projected to reach a value of USD 603.09 million by 2032.

- The growth of the brand management software market is being driven by increasing demand for consistent brand experiences, especially in digital and global markets.

- Based on the deployment type, the cloud-based segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the corporate segment is projected to swipe the largest market share.

- In terms of application, the customer management segment is expected to dominate the market.

- Based on the vertical, the BFSI segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Brand Management Software Market: Dynamics

Brand Management Software refers to a suite of tools and platforms designed to help organizations centrally manage, protect, and promote their brand identity, assets, guidelines, and performance across all channels and touchpoints.

Key Growth Drivers

- Increasing Digitalization and Multi-Channel Presence: The proliferation of digital channels (social media, e-commerce, mobile apps, websites) means brands must maintain a consistent and unified identity everywhere. Brand management software is essential for centralizing, distributing, and controlling brand assets and guidelines across these complex multi-channel ecosystems.

- Growing Need for Brand Consistency and Compliance: Organizations recognize that brand consistency is crucial for building trust, equity, and recognition. Brand management software enforces compliance with corporate identity guidelines, preventing unauthorized or outdated usage of logos, colors, and messaging, which directly impacts market value.

- Rise in Remote Work and Global Teams: With the increase in remote and distributed workforces, brand management software provides a centralized digital hub for all employees, partners, and agencies globally to access the correct, up-to-date brand assets and guidelines, ensuring alignment regardless of location.

Restraints

- High Initial Implementation Cost and Customization: Implementing a comprehensive brand management software suite, particularly for large enterprises, involves substantial initial investment, licensing fees, and costs for integration with existing MarTech (Marketing Technology) stacks (e.g., DAM, CMS). Customization to meet unique brand needs adds further complexity and cost.

- Resistance to Adoption and Change Management: Organizations often face resistance from various internal departments (e.g., marketing, legal, sales) that are accustomed to using fragmented tools and processes. Ensuring widespread user adoption and driving a cultural shift towards centralized brand governance requires significant change management effort.

- Data Security and Intellectual Property Concerns: Centralizing all sensitive brand assets and guidelines within one software platform raises critical concerns about data security, intellectual property (IP) protection, and unauthorized access. Ensuring robust security protocols and access controls is paramount but adds complexity to the solution.

Opportunities

- Integration with AI and Machine Learning (ML): Integrating AI/ML for automated brand compliance checks (e.g., detecting off-brand content on external sites), intelligent asset tagging, and predictive analytics (e.g., forecasting the impact of brand variations) presents a massive opportunity for enhanced efficiency and deeper insights.

- Expansion into Digital Asset Management (DAM) and Product Information Management (PIM): Vendors can expand their offerings by tightly integrating brand management features with DAM (for asset storage and version control) and PIM (for product data integrity), offering a unified "single source of truth" for both brand and product information.

- Focus on Small and Medium Enterprises (SMEs): Offering affordable, scalable, and easy-to-deploy cloud-based (SaaS) brand management solutions tailored for the specific needs and budgets of SMEs presents a large, untapped market opportunity.

Challenges

- Ensuring Data Governance and Asset Integrity: A continuous challenge is maintaining the integrity and governance of digital assets. Ensuring that the correct version of an asset is always used and retired when outdated, especially across multiple integrated systems, requires meticulous and complex governance mechanisms.

- Keeping Pace with Evolving Digital Standards and Platforms: Brand management software must constantly adapt to the rapidly changing requirements of third-party platforms (e.g., social media APIs, e-commerce site formats) to ensure brand assets are correctly rendered and distributed, requiring continuous development cycles.

Brand Management Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Brand Management Software Market |

| Market Size in 2023 | USD 248.56 Million |

| Market Forecast in 2032 | USD 603.09 Million |

| Growth Rate | CAGR of 10.35% |

| Number of Pages | 150 |

| Key Companies Covered | BLUE Software, LLC, Brandworkz Ltd., Brand24 Global Inc., Brandware, Bynder, Cordeo, Delivra, Inc., Frontify AG, Lucid Software Inc., KIZEN, Libris Systems Ltd., MediaHoVe B.V., MediaValet Inc., Meltwater, Open Text Corporation, NiceJob, and Templafy |

| Segments Covered | By Deployment Type, By End-User, By Application, By Vertical, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Brand Management Software Market: Segmentation Insights

The global brand management software market is divided by deployment type, end-user, application, vertical, and region.

Based on deployment type, the global brand management software market is divided into cloud-based and on-premise. Cloud-based deployment is the most dominant segment in the Brand Management Software market, driven by its flexibility, scalability, and cost-effectiveness. Organizations increasingly prefer cloud solutions as they allow remote access, real-time collaboration, and seamless updates without the need for heavy IT infrastructure. Cloud-based platforms also support integration with other digital marketing, analytics, and workflow tools, making them ideal for enterprises looking to manage brand assets efficiently across multiple teams, locations, and digital channels. The ease of deployment, subscription-based pricing, and enhanced data security features further strengthen its dominance in the market. On-premise deployment, while still relevant, holds a smaller share compared to cloud-based solutions. On-premise software is installed and managed on the company’s own servers, providing complete control over data, customization, and security.

On the basis of end-user, the global brand management software market is bifurcated into corporate and individual. Corporate end-users are the most dominant segment in the Brand Management Software market, as large and medium-sized enterprises rely heavily on these solutions to maintain brand consistency across multiple departments, regions, and marketing channels. Corporations benefit from centralized management of digital assets, workflow automation, analytics, and compliance features that ensure unified brand messaging and efficient collaboration among marketing, design, and sales teams. The scale of operations, global presence, and complex branding requirements make corporate adoption the primary driver of market growth. Individual end-users represent a smaller segment, typically including freelancers, small business owners, or personal brands who use brand management software to organize assets, streamline content creation, and maintain a professional image.

Based on application, the global brand management software market is divided into lead management, customer management, data management, and review management. Customer management is the most dominant application segment in the Brand Management Software market, as businesses prioritize maintaining strong relationships with their customers and ensuring consistent brand experiences across touchpoints. This application helps companies track interactions, manage communications, and deliver personalized experiences, which are critical for brand loyalty and retention. Integration with marketing and analytics tools further enhances its value by enabling insights-driven strategies and real-time engagement. Data management follows as a key application, focusing on organizing, storing, and securing brand-related assets, digital content, and marketing information. Efficient data management ensures that brand guidelines are consistently applied, assets are easily accessible, and compliance requirements are met, making it vital for companies managing large volumes of digital content.

In terms of vertical, the global brand management software market is bifurcated into BFSI (banking financial services & insurance), IT telecommunication, manufacturing, retail energy & utilities, and others. BFSI (Banking, Financial Services & Insurance) is the most dominant vertical in the Brand Management Software market, driven by the sector’s focus on maintaining brand trust, compliance, and consistent communication across multiple channels. Banks, insurance companies, and financial service providers require centralized control over marketing assets, regulatory-compliant messaging, and customer engagement strategies, making brand management solutions critical for preserving reputation and driving customer loyalty. IT and Telecommunication follows closely, as companies in this sector leverage brand management software to handle global marketing campaigns, digital content, and partner communications. The fast-paced nature of the industry, coupled with frequent product launches and the need for consistent branding across multiple platforms, fuels adoption in this vertical.

Brand Management Software Market: Regional Insights

- North America is expected to dominates the global market

North America leads the global Brand Management Software market due to its mature digital infrastructure, widespread adoption of cloud-based solutions, and a strong focus on data-driven decision-making. The region benefits from advanced marketing practices and the presence of major technology providers, with enterprises prioritizing brand consistency across multiple channels, reinforcing its position as the largest market for brand management solutions.

Europe follows closely, characterized by a well-established digital ecosystem, stringent regulatory standards, and a growing emphasis on brand compliance and sustainability. Industries such as retail, automotive, and consumer goods are increasingly adopting brand management software to maintain brand consistency and meet regulatory requirements across diverse markets.

Asia Pacific is a rapidly growing region driven by urbanization, digital transformation, and the expansion of e-commerce platforms. Businesses in countries like India, China, and Japan are increasingly seeking brand management solutions to effectively manage brand assets across multiple digital touchpoints and geographies, making it a key growth market.

Latin America is gradually expanding as internet penetration, mobile device usage, and digital marketing rise across the region. Companies in retail and consumer goods are recognizing the importance of consistent brand management to enhance customer engagement and build brand loyalty, supporting steady market adoption.

Middle East & Africa is the least dominated region, with gradual adoption driven by increasing digitalization, urbanization, and e-commerce expansion. Enterprises are beginning to invest in brand management software to streamline operations and maintain brand consistency across diverse and emerging markets.

Recent Developments:

- In June 2023, Frontify, a leading brand management platform, acquired the French company TwicPics. This strategic acquisition addresses market demand for centralized solutions, boosting brand efficiency and offering a complete, user-friendly brand management solutions.

Brand Management Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the brand management software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global brand management software market include:

- BLUE Software LLC

- Brandworkz Ltd.

- Brand24 Global Inc.

- Brandware

- Bynder

- Cordeo

- Delivra Inc.

- Frontify AG

- Lucid Software Inc.

- KIZEN

- Libris Systems Ltd.

- MediaHoVe B.V.

- MediaValet Inc.

- Meltwater

- Open Text Corporation

- NiceJob

- Templafy

The global brand management software market is segmented as follows:

By Deployment Type

- Cloud-Based

- On-Premise

By End-User

- Corporate

- Individual

By Application

- Lead Management

- Customer Management

- Data Management

- Review Management

By Vertical

- BFSI (Banking Financial Services & Insurance)

- IT Telecommunication

- Manufacturing

- Retail Energy & Utilities

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 23

CHAPTER 2. Brand Management Software market – Deployment Analysis 26

2.1. Global Brand Management Software Market – Deployment Overview 26

2.2. Global Brand Management Software Market Share, by Deployment, 2018 & 2025 (USD Million) 26

2.3. Cloud-Based 28

2.3.1. Global Cloud-Based Brand Management Software Market, 2019-2025 (USD Million) 28

2.4. On-Premise 29

2.4.1. Global On-Premise Brand Management Software Market, 2019-2025 (USD Million) 29

CHAPTER 3. Brand Management Software market – End-User Analysis 29

3.1. Global Brand Management Software Market – End-User Overview 29

3.2. Global Brand Management Software Market Share, by End-User , 2018 & 2025 (USD Million) 30

3.3. Corporate 31

3.3.1. Global Corporate Brand Management Software Market, 2019-2025 (USD Million) 31

3.4. Individual 32

3.4.1. Global Individual Brand Management Software Market, 2019-2025 (USD Million) 32

CHAPTER 4. Brand Management Software market – Application Analysis 32

4.1. Global Brand Management Software Market – Application Overview 32

4.2. Global Brand Management Software Market Share, by Application, 2018 & 2025 (USD Million) 33

4.3. Lead Management 34

4.3.1. Global Lead Management Brand Management Software Market, 2019-2025 (USD Million) 34

4.4. Customer Management 35

4.4.1. Global Customer Management Brand Management Software Market, 2019-2025 (USD Million) 35

4.5. Data Management 36

4.5.1. Global Data Management Brand Management Software Market, 2019-2025 (USD Million) 36

4.6. Review Management 37

4.6.1. Global Review Management Brand Management Software Market, 2019-2025 (USD Million) 37

CHAPTER 5. Brand Management Software market – Vertical Analysis 37

5.1. Global Brand Management Software Market – Vertical Overview 37

5.2. Global Brand Management Software Market Share, by Vertical, 2018 & 2025 (USD Million) 38

5.3. BFSI 39

5.3.1. Global BFSI Brand Management Software Market, 2019-2025 (USD Million) 39

5.4. IT & Telecommunication 40

5.4.1. Global IT & Telecommunication Brand Management Software Market, 2019-2025 (USD Million) 40

5.5. Manufacturing 41

5.5.1. Global Manufacturing Brand Management Software Market, 2019-2025 (USD Million) 41

5.6. Retail 42

5.6.1. Global Retail Brand Management Software Market, 2019-2025 (USD Million) 42

5.7. Energy & Utilities 43

5.7.1. Global Energy & Utilities Brand Management Software Market, 2019-2025 (USD Million) 43

5.8. Others 44

5.8.1. Global Others Brand Management Software Market, 2019-2025 (USD Million) 44

CHAPTER 6. Brand Management Software market – Regional Analysis 45

6.1. Global Brand Management Software Market Regional Overview 45

6.2. Global Brand Management Software Market Share, by Region, 2018 & 2025 (Value) 45

6.3. North America 47

6.3.1. North America Brand Management Software Market size and forecast, 2019-2025 47

6.3.2. North America Brand Management Software Market, by Country, 2018 & 2025 (USD Million) 47

6.3.3. North America Brand Management Software Market, by Deployment, 2019-2025 49

6.3.3.1. North America Brand Management Software Market, by Deployment, 2019-2025 (USD Million) 49

6.3.4. North America Brand Management Software Market, by End-User , 2019-2025 50

6.3.4.1. North America Brand Management Software Market, by End-User , 2019-2025 (USD Million) 50

6.3.5. North America Brand Management Software Market, by Application, 2019-2025 51

6.3.5.1. North America Brand Management Software Market, by Application, 2019-2025 (USD Million) 51

6.3.6. North America Brand Management Software Market, by Vertical, 2019-2025 52

6.3.6.1. North America Brand Management Software Market, by Vertical, 2019-2025 (USD Million) 52

6.3.7. U.S. 53

6.3.7.1. U.S. Market size and forecast, 2019-2025 (USD Million) 53

6.3.8. Canada 54

6.3.8.1. Canada Market size and forecast, 2019-2025 (USD Million) 54

6.3.9. Mexico 55

6.3.9.1. Mexico Market size and forecast, 2019-2025 (USD Million) 55

6.4. Europe 56

6.4.1. Europe Brand Management Software Market size and forecast, 2019-2025 56

6.4.2. Europe Brand Management Software Market, by Country, 2018 & 2025 (USD Million) 56

6.4.3. Europe Brand Management Software Market, by Deployment, 2019-2025 58

6.4.3.1. Europe Brand Management Software Market, by Deployment, 2019-2025 (USD Million) 58

6.4.4. Europe Brand Management Software Market, by End-User , 2019-2025 59

6.4.4.1. Europe Brand Management Software Market, by End-User , 2019-2025 (USD Million) 59

6.4.5. Europe Brand Management Software Market, by Application, 2019-2025 60

6.4.5.1. Europe Brand Management Software Market, by Application, 2019-2025 (USD Million) 60

6.4.6. Europe Brand Management Software Market, by Vertical, 2019-2025 61

6.4.6.1. Europe Brand Management Software Market, by Vertical, 2019-2025 (USD Million) 61

6.4.7. Germany 62

6.4.7.1. Germany Market size and forecast, 2019-2025 (USD Million) 62

6.4.8. France 63

6.4.8.1. France Market size and forecast, 2019-2025 (USD Million) 63

6.4.9. U.K. 64

6.4.9.1. U.K. Market size and forecast, 2019-2025 (USD Million) 64

6.4.10. Italy 65

6.4.10.1. Italy Market size and forecast, 2019-2025 (USD Million) 65

6.4.11. Spain 66

6.4.11.1. Spain Market size and forecast, 2019-2025 (USD Million) 66

6.4.12. Nordic Countries 67

6.4.12.1. Nordic Countries Market size and forecast, 2019-2025 (USD Million) 67

6.4.13. Benelux Union 68

6.4.13.1. Benelux Union Market size and forecast, 2019-2025 (USD Million) 68

6.4.14. Rest of Europe 69

6.4.14.1. Rest of Europe Market size and forecast, 2019-2025 (USD Million) 69

6.5. Asia Pacific 70

6.5.1. Asia Pacific Brand Management Software Market size and forecast, 2019-2025 70

6.5.2. Asia Pacific Brand Management Software Market, by Country, 2018 & 2025 (USD Million) 70

6.5.3. Asia Pacific Brand Management Software Market, by Deployment, 2019-2025 72

6.5.3.1. Asia Pacific Brand Management Software Market, by Deployment, 2019-2025 (USD Million) 72

6.5.4. Asia Pacific Brand Management Software Market, by End-User , 2019-2025 73

6.5.4.1. Asia Pacific Brand Management Software Market, by End-User , 2019-2025 (USD Million) 73

6.5.5. Asia Pacific Brand Management Software Market, by Application, 2019-2025 74

6.5.5.1. Asia Pacific Brand Management Software Market, by Application, 2019-2025 (USD Million) 74

6.5.6. Asia Pacific Brand Management Software Market, by Vertical, 2019-2025 75

6.5.6.1. Asia Pacific Brand Management Software Market, by Vertical, 2019-2025 (USD Million) 75

6.5.7. China 76

6.5.7.1. China Market size and forecast, 2019-2025 (USD Million) 76

6.5.8. Japan 77

6.5.8.1. Japan Market size and forecast, 2019-2025 (USD Million) 77

6.5.9. India 78

6.5.9.1. India Market size and forecast, 2019-2025 (USD Million) 78

6.5.10. New Zealand 79

6.5.10.1. New Zealand Market size and forecast, 2019-2025 (USD Million) 79

6.5.11. Australia 80

6.5.11.1. Australia Market size and forecast, 2019-2025 (USD Million) 80

6.5.12. South Korea 81

6.5.12.1. South Korea Market size and forecast, 2019-2025 (USD Million) 81

6.5.13. South-East Asia 82

6.5.13.1. South-East Asia Market size and forecast, 2019-2025 (USD Million) 82

6.5.14. Rest of Asia Pacific 83

6.5.14.1. Rest of Asia Pacific Market size and forecast, 2019-2025 (USD Million) 83

6.6. Latin America 84

6.6.1. Latin America Brand Management Software Market size and forecast, 2019-2025 84

6.6.2. Latin America Brand Management Software Market, by Country, 2018 & 2025 (USD Million) 84

6.6.3. Latin America Brand Management Software Market, by Deployment, 2019-2025 86

6.6.3.1. Latin America Brand Management Software Market, by Deployment, 2019-2025 (USD Million) 86

6.6.4. Latin America Brand Management Software Market, by End-User , 2019-2025 87

6.6.4.1. Latin America Brand Management Software Market, by End-User , 2019-2025 (USD Million) 87

6.6.5. Latin America Brand Management Software Market, by Application, 2019-2025 88

6.6.5.1. Latin America Brand Management Software Market, by Application, 2019-2025 (USD Million) 88

6.6.6. Latin America Brand Management Software Market, by Vertical, 2019-2025 89

6.6.6.1. Latin America Brand Management Software Market, by Vertical, 2019-2025 (USD Million) 89

6.6.7. Brazil 90

6.6.7.1. Brazil Market size and forecast, 2019-2025 (USD Million) 90

6.6.8. Argentina 91

6.6.8.1. Argentina Market size and forecast, 2019-2025 (USD Million) 91

6.6.9. Rest of Latin America 92

6.6.9.1. Rest of Latin America Market size and forecast, 2019-2025 (USD Million) 92

6.7. The Middle-East and Africa 93

6.7.1. The Middle-East and Africa Brand Management Software Market size and forecast, 2019-2025 93

6.7.2. The Middle-East and Africa Brand Management Software Market, by Country, 2018 & 2025 (USD Million) 93

6.7.3. The Middle-East and Africa Brand Management Software Market, by Deployment, 2019-2025 95

6.7.3.1. The Middle-East and Africa Brand Management Software Market, by Deployment, 2019-2025 (USD Million) 95

6.7.4. The Middle-East and Africa Brand Management Software Market, by End-User , 2019-2025 96

6.7.4.1. The Middle-East and Africa Brand Management Software Market, by End-User , 2019-2025 (USD Million) 96

6.7.5. The Middle-East and Africa Brand Management Software Market, by Application, 2019-2025 97

6.7.5.1. The Middle-East and Africa Brand Management Software Market, by Application, 2019-2025 (USD Million) 97

6.7.6. The Middle-East and Africa Brand Management Software Market, by Vertical, 2019-2025 98

6.7.6.1. The Middle-East and Africa Brand Management Software Market, by Vertical, 2019-2025 (USD Million) 98

6.7.7. Saudi Arabia 99

6.7.7.1. Saudi Arabia Market size and forecast, 2019-2025 (USD Million) 99

6.7.8. UAE 100

6.7.8.1. UAE Market size and forecast, 2019-2025 (USD Million) 100

6.7.9. Egypt 101

6.7.9.1. Egypt Market size and forecast, 2019-2025 (USD Million) 101

6.7.10. Kuwait 102

6.7.10.1. Kuwait Market size and forecast, 2019-2025 (USD Million) 102

6.7.11. South Africa 103

6.7.11.1. South Africa Market size and forecast, 2019-2025 (USD Million) 103

6.7.12. Rest of Middle-East Africa 104

6.7.12.1. Rest of Middle-East Africa Market size and forecast, 2019-2025 (USD Million) 104

CHAPTER 7. Brand Management Software market – Competitive Landscape 105

7.1. Competitor Market Share – Revenue 105

7.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 107

7.3. Strategic Development 108

7.3.1. Acquisitions and Mergers 108

7.3.2. New Products 108

7.3.3. Research & Development Activities 108

CHAPTER 8. Company Profiles 109

8.1. BLUE Software LLC 109

8.1.1. Company Overview 109

8.1.2. BLUE Software LLC Revenue and Gross Margin 109

8.1.3. Product portfolio 110

8.1.4. Recent initiatives 111

8.2. Brandworkz Ltd. 111

8.2.1. Company Overview 111

8.2.2. Brandworkz Ltd. Revenue and Gross Margin 111

8.2.3. Product portfolio 112

8.2.4. Recent initiatives 113

8.3. Brand24 Global Inc. 113

8.3.1. Company Overview 113

8.3.2. Brand24 Global Inc. Revenue and Gross Margin 113

8.3.3. Product portfolio 114

8.3.4. Recent initiatives 115

8.4. Brandware 115

8.4.1. Company Overview 115

8.4.2. Brandware Revenue and Gross Margin 115

8.4.3. Product portfolio 116

8.4.4. Recent initiatives 117

8.5. Bynder 117

8.5.1. Company Overview 117

8.5.2. Bynder Revenue and Gross Margin 117

8.5.3. Product portfolio 118

8.5.4. Recent initiatives 119

8.6. Cordeo 119

8.6.1. Company Overview 119

8.6.2. Cordeo Revenue and Gross Margin 119

8.6.3. Product portfolio 120

8.6.4. Recent initiatives 121

8.7. Delivra Inc. 121

8.7.1. Company Overview 121

8.7.2. Delivra Inc. Revenue and Gross Margin 121

8.7.3. Product portfolio 122

8.7.4. Recent initiatives 123

8.8. Frontify AG 123

8.8.1. Company Overview 123

8.8.2. Frontify AG Revenue and Gross Margin 123

8.8.3. Product portfolio 124

8.8.4. Recent initiatives 125

8.9. Lucid Software Inc. 125

8.9.1. Company Overview 125

8.9.2. Lucid Software Inc. Revenue and Gross Margin 125

8.9.3. Product portfolio 126

8.9.4. Recent initiatives 127

8.10. KIZEN 127

8.10.1. Company Overview 127

8.10.2. KIZEN Revenue and Gross Margin 127

8.10.3. Product portfolio 128

8.10.4. Recent initiatives 129

8.11. Libris Systems Ltd. 129

8.11.1. Company Overview 129

8.11.2. Libris Systems Ltd. Revenue and Gross Margin 129

8.11.3. Product portfolio 130

8.11.4. Recent initiatives 131

8.12. MediaHoVe B.V. 131

8.12.1. Company Overview 131

8.12.2. MediaHoVe B.V. Revenue and Gross Margin 131

8.12.3. Product portfolio 132

8.12.4. Recent initiatives 133

8.13. MediaValet Inc. 133

8.13.1. Company Overview 133

8.13.2. MediaValet Inc. Revenue and Gross Margin 133

8.13.3. Product portfolio 134

8.13.4. Recent initiatives 135

8.14. Meltwater 135

8.14.1. Company Overview 135

8.14.2. Meltwater Revenue and Gross Margin 135

8.14.3. Product portfolio 136

8.14.4. Recent initiatives 137

8.15. Open Text Corporation 137

8.15.1. Company Overview 137

8.15.2. Open Text Corporation Revenue and Gross Margin 137

8.15.3. Product portfolio 138

8.15.4. Recent initiatives 139

8.16. NiceJob 139

8.16.1. Company Overview 139

8.16.2. NiceJob Revenue and Gross Margin 139

8.16.3. Product portfolio 140

8.16.4. Recent initiatives 141

8.17. Templafy 141

8.17.1. Company Overview 141

8.17.2. Templafy Revenue and Gross Margin 141

8.17.3. Product portfolio 142

8.17.4. Recent initiatives 143

CHAPTER 9. Brand Management Software — Industry Analysis 144

9.1. Brand Management Software Market – Key Trends 144

9.1.1. Market Drivers 145

9.1.2. Market Restraints 145

9.1.3. Market Opportunities 146

9.2. Value Chain Analysis 147

9.3. Technology Roadmap and Timeline 148

9.4. Brand Management Software Market – Attractiveness Analysis 149

9.4.1. By Deployment 149

9.4.2. By End-User 149

9.4.3. By Application 150

9.4.4. By Vertical 151

9.4.5. By Region 152

CHAPTER 10. Marketing Strategy Analysis, Distributors 153

10.1. Marketing Channel 153

10.2. Direct Marketing 154

10.3. Indirect Marketing 154

10.4. Marketing Channel Development Trend 154

10.5. Economic/Political Environmental Change 155

CHAPTER 11. Report Conclusion 156

CHAPTER 12. Research Approach & Methodology 157

12.1. Report Description 157

12.2. Research Scope 158

12.3. Research Methodology 158

12.3.1. Secondary Research 159

12.3.2. Primary Research 160

12.3.3. Models 161

12.3.3.1. Company Share Analysis Model 161

12.3.3.2. Revenue Based Modeling 162

12.3.3.3. Research Limitations 162

Inquiry For Buying

Brand Management Software

Request Sample

Brand Management Software