Dental Wax Separator Market Size, Share, and Trends Analysis Report

CAGR :

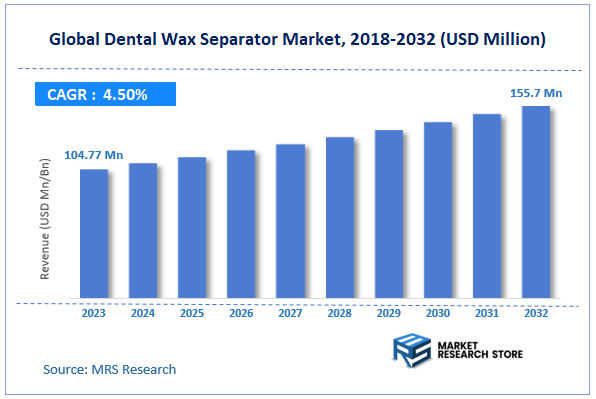

| Market Size 2023 (Base Year) | USD 104.77 Million |

| Market Size 2032 (Forecast Year) | USD 155.7 Million |

| CAGR | 4.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Global Dental Wax Separator Market Insights

According to Market Research Store, the global dental wax separator market size was valued at around USD 104.77 million in 2023 and is estimated to reach USD 155.7 million by 2032, to register a CAGR of approximately 4.5% in terms of revenue during the forecast period 2024-2032.

The dental wax separator report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Dental Wax Separator Market: Overview

A Dental Wax Separator is a crucial material used in dental laboratories and clinics during the modeling and fabrication process of dental prosthetics such as crowns, bridges, and dentures. It is typically a liquid or spray applied to models or molds to prevent wax from sticking to certain surfaces, ensuring clean separation of wax patterns from the underlying structure. This helps maintain accuracy in dental restorations and reduces the risk of damage during demolding. Dental wax separators are available in various formulations, including natural and synthetic types, depending on the application requirements and compatibility with dental materials.

Key Highlights

- The dental wax separator market is anticipated to grow at a CAGR of 4.5% during the forecast period.

- The global dental wax separator market was estimated to be worth approximately USD 104.77 million in 2023 and is projected to reach a value of USD 155.7 million by 2032.

- The growth of the dental wax separator market is being driven by the rising demand for precision in prosthodontic procedures and the growing adoption of digital dentistry techniques.

- Based on the product type, the utility wax segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the dental laboratories segment is projected to swipe the largest market share.

- In terms of end-user, the adult segment is expected to dominate the market.

- Based on the distribution channel, the dental supply stores segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Dental Wax Separator Market: Dynamics

Key Growth Drivers:

- Rising Demand for Dental Prosthetics: Increasing cases of tooth loss, aging populations, and aesthetic dental procedures are driving the need for precise prosthetic fabrication, boosting the use of dental wax separators.

- Advancement in Dental Technology: Growing adoption of digital dentistry and CAD/CAM systems requires more accurate and efficient dental processes, leading to higher demand for high-quality separator materials.

- Expansion of Dental Clinics and Labs: The global rise in dental service providers and laboratories, especially in emerging economies, is creating consistent demand for essential consumables like wax separators.

Restraints:

- High Cost of Advanced Dental Materials: Some high-performance wax separator solutions can be costly, limiting adoption among smaller clinics and in cost-sensitive markets.

- Limited Awareness in Developing Regions: In rural or less-developed areas, a lack of awareness about dental hygiene and restorative options slows market growth for dental tools and materials.

Opportunities:

- Emerging Markets and Dental Tourism: Rapid expansion of dental care facilities in Asia-Pacific and Latin America, along with booming dental tourism in countries like India and Thailand, presents strong growth potential.

- Product Innovation and Eco-Friendly Formulations: Development of biodegradable and patient-safe wax separators offers new market opportunities for manufacturers aiming to meet global sustainability goals.

Challenges:

- Regulatory Compliance and Product Standardization: Ensuring compliance with international dental health and safety standards can be complex and costly for manufacturers, particularly when entering new markets.

- Substitute Products and Techniques: Growth in digital impression methods and other wax-free techniques can gradually reduce dependence on traditional wax separator materials.

Dental Wax Separator Market: Report Scope

This report thoroughly analyzes the Dental Wax Separator Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Oxygen Barrier Films & Coatings For Dry Food Market |

| Market Size in 2023 | USD 104.77 Million |

| Market Forecast in 2032 | USD 155.7 Million |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 140 |

| Key Companies Covered | Dentsply Sirona, 3M Company, Ivoclar Vivadent AG, Kulzer GmbH, GC Corporation, Mitsui Chemicals Inc., Kerr Corporation, VOCO GmbH, Ultradent Products Inc., Septodont Holding, DenMat Holdings LLC, Zhermack SpA, Yamahachi Dental Mfg. Co., Keystone Industries, Kuraray Noritake Dental Inc., Shofu Dental Corporation, Henry Schein Inc., Patterson Companies Inc., Benco Dental Supply Co., Young Innovations Inc., and others. |

| Segments Covered | By Product Type, By Application, By End-User, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dental Wax Separator Market: Segmentation Insights

The global dental wax separator market is divided by product type, application, end-user, distribution channel, and region.

Segmentation Insights by Product Type

Based on product type, the global dental wax separator market is divided into utility wax, sticky wax, blockout wax, and others.

In the dental wax separator market, Utility Wax emerges as the most dominant product segment due to its versatile applications in various dental procedures. It is widely used for adapting impression trays, boxing impressions, and blocking undercuts, making it a critical material in daily lab operations. Its ease of handling, adaptability, and affordability contribute to its high demand across dental clinics and laboratories, particularly in prosthodontic and orthodontic procedures.

Sticky Wax follows as the next prominent segment, known for its strong adhesive properties when heated. It is primarily used for temporarily assembling or holding components in place during the fabrication process. Its quick setting time and high strength make it especially valuable during model repairs and alignments, ensuring precision in final dental products.

Blockout Wax is a niche but important segment, mainly utilized to fill undercuts and create smooth surfaces on dental models before forming vacuum-formed appliances. It plays a vital role in ensuring patient comfort and the proper fit of dental prosthetics. While it is not used as frequently as utility or sticky wax, it remains essential in specific applications within orthodontics and prosthetics.

Segmentation Insights by Application

On the basis of application, the global dental wax separator market is bifurcated into dental laboratories, dental clinics, and others.

In the dental wax separator market, Dental Laboratories represent the most dominant application segment. These laboratories are heavily involved in the fabrication of dental prosthetics such as crowns, bridges, dentures, and orthodontic appliances, all of which require precise modeling and wax elimination processes. Dental labs typically work on high-volume cases and complex restorations, necessitating consistent and efficient use of dental wax separators to maintain quality and accuracy across various procedures.

Dental Clinics form the second-largest segment, where wax separators are used during in-house prosthetic adjustments or minor appliance preparations. While clinics do not usually handle complex lab work, many have begun integrating advanced tools and materials to offer immediate services, including wax patterning for temporary restorations. This shift is especially prominent in larger or specialty clinics aiming to reduce turnaround times and increase procedural efficiency.

Segmentation Insights by End-User

Based on end-user, the global dental wax separator market is divided into adults, pediatrics, and geriatrics.

In the dental wax separator market, Adults are the most dominant end-user segment. This dominance is attributed to the high prevalence of dental conditions such as tooth decay, missing teeth, and the demand for cosmetic restorations in the adult population. Adults frequently seek dental prosthetics like crowns, bridges, and veneers, all of which require accurate modeling and the use of dental wax separators during fabrication. Additionally, lifestyle factors, increased disposable income, and aesthetic awareness contribute to the rising number of dental procedures among this age group.

Geriatrics represent the second-largest segment, driven by the increasing aging population and the high incidence of age-related dental issues such as edentulism (tooth loss), gum disease, and oral bone resorption. This age group often requires complete or partial dentures, which rely heavily on wax patterning during the prosthesis design process. As global life expectancy rises, the demand for dental care and restoration procedures in older adults continues to expand, boosting the use of wax separators.

Pediatrics form the least dominant end-user segment in this market. While children may require dental care for cavities, alignment, or trauma-related issues, the need for complex prosthetics or restorations involving wax separators is relatively low. Most pediatric dental treatments involve preventive or corrective care rather than extensive lab-based procedures. However, with increasing awareness of pediatric oral health and early orthodontic interventions, there is a gradual but limited rise in the use of dental wax materials in this segment.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global dental wax separator market is bifurcated into online stores, dental supply stores, and others.

In the dental wax separator market, Dental Supply Stores are the most dominant distribution channel. These specialized stores have long-standing relationships with dental professionals and institutions, offering a wide range of certified dental materials, including wax separators. They provide reliability, personalized service, and product guidance, which are crucial in clinical settings. Dental labs and clinics often prefer this channel due to its assurance of quality, direct access to technical support, and the ability to physically verify products before purchase.

Online Stores are emerging rapidly as the second most significant distribution channel, driven by the increasing digitization of procurement processes and the convenience of e-commerce platforms. Online stores offer a broader product range, competitive pricing, and doorstep delivery, making them increasingly attractive, especially for small to mid-sized clinics and labs in both developed and developing regions. Additionally, the ability to compare brands, read reviews, and access detailed specifications is encouraging more dental professionals to shift toward digital purchasing.

Dental Wax Separator Market: Regional Insights

- North America is expected to dominates the global market

The North America region is the most dominant in the dental wax separator market, owing to its advanced dental care infrastructure, widespread adoption of prosthodontic solutions, and strong presence of leading dental product manufacturers. The United States, in particular, drives market demand through high patient spending capacity, early adoption of innovative dental technologies, and a dense network of dental laboratories and clinics. Favorable reimbursement policies and increased awareness regarding oral aesthetics further contribute to North America’s leading position in the global market.

The Asia Pacific (APAC) region ranks second and is the fastest-growing market for dental wax separators. Countries such as China, India, Japan, and South Korea are witnessing a rapid rise in dental procedures due to increasing disposable incomes, growing urban populations, and improved access to dental care. Expanding dental tourism and government initiatives to enhance healthcare infrastructure have also contributed to the region’s growing demand for dental wax separators in both clinics and educational institutions.

Europe holds a strong position in the dental wax separator market, driven by well-established dental healthcare systems and high standards for dental product quality and safety. Key countries such as Germany, France, the United Kingdom, and Italy support the market through consistent demand for high-performance materials in dental laboratories. While the region shows moderate growth compared to APAC, its emphasis on regulatory compliance and preference for advanced dental technologies sustain its competitive standing.

The Latin America region shows emerging potential in the market, led by countries like Brazil and Mexico. Dental care awareness is gradually increasing, and urban areas are beginning to adopt modern dental technologies, including wax separator products. However, the region still faces challenges related to uneven healthcare access and affordability, which limits market expansion beyond major metropolitan areas.

Middle East and Africa (MEA) represents the least dominant region in the dental wax separator market. Market development is constrained by underdeveloped dental healthcare infrastructure in many parts of the region. However, certain countries like the UAE, Saudi Arabia, and South Africa are seeing improvements in dental facilities, with growing interest in cosmetic dentistry. This is slowly boosting demand for quality dental materials, though overall adoption remains at an early stage.

Dental Wax Separator Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the dental wax separator market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global dental wax separator market include:

- Dentsply Sirona

- 3M Company

- Ivoclar Vivadent AG

- Kulzer GmbH

- GC Corporation

- Mitsui Chemicals Inc.

- Kerr Corporation

- VOCO GmbH

- Ultradent Products Inc.

- Septodont Holding

- DenMat Holdings LLC

- Zhermack SpA

- Yamahachi Dental Mfg. Co.

- Keystone Industries

- Kuraray Noritake Dental Inc.

- Shofu Dental Corporation

- Henry Schein Inc.

- Patterson Companies Inc.

- Benco Dental Supply Co.

- Young Innovations Inc.

The global dental wax separator market is segmented as follows:

By Product Type

- Utility Wax

- Sticky Wax

- Blockout Wax

- Others

By Application

- Dental Laboratories

- Dental Clinics

- Others

By End-User

- Adults

- Pediatrics

- Geriatrics

By Distribution Channel

- Online Stores

- Dental Supply Stores

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Dental Wax Separator

Request Sample

Dental Wax Separator