Dental Periodontics Market Size, Share, and Trends Analysis Report

CAGR :

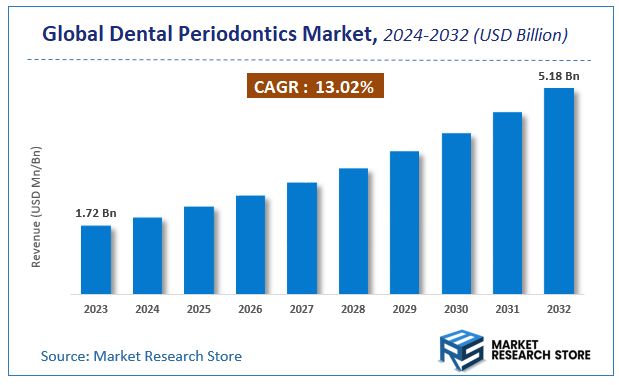

| Market Size 2023 (Base Year) | USD 1.72 Billion |

| Market Size 2032 (Forecast Year) | USD 5.18 Billion |

| CAGR | 13.02% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Dental Periodontics Market Insights

According to Market Research Store, the global dental periodontics market size was valued at around USD 1.72 billion in 2023 and is estimated to reach USD 5.18 billion by 2032, to register a CAGR of approximately 13.02% in terms of revenue during the forecast period 2024-2032.

The dental periodontics report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Dental Periodontics Market: Overview

Dental periodontics is a specialized branch of dentistry focused on the prevention, diagnosis, and treatment of diseases affecting the periodontium—the supporting structures of the teeth—which include the gums, alveolar bone, periodontal ligament, and cementum. Periodontists are dental professionals trained to manage conditions such as gingivitis, periodontitis, gum recession, and bone loss around the teeth. Common procedures within periodontics include scaling and root planning (deep cleaning), gum grafts, bone grafting, pocket reduction surgery, and dental implant placement for patients with tooth loss due to severe periodontal disease.

The growth of dental periodontics is largely driven by the rising prevalence of periodontal diseases, particularly among aging populations and individuals with risk factors such as diabetes, smoking, and poor oral hygiene. Increased awareness of the link between periodontal health and systemic conditions like cardiovascular disease, respiratory infections, and adverse pregnancy outcomes has also underscored the importance of early periodontal intervention.

Key Highlights

- The dental periodontics market is anticipated to grow at a CAGR of 13.02% during the forecast period.

- The global dental periodontics market was estimated to be worth approximately USD 1.72 billion in 2023 and is projected to reach a value of USD 5.18 billion by 2032.

- The growth of the dental periodontics market is being driven by rising prevalence of periodontal diseases, increasing awareness of oral hygiene, advancements in treatment technologies, and the growing demand for aesthetic and functional dental restoration.

- Based on the product, the injectable anesthetics segment is growing at a high rate and is projected to dominate the market.

- On the basis of type, the mild periodontics segment is projected to swipe the largest market share.

- In terms of application, the dental laboratories segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Dental Periodontics Market: Dynamics

Key Growth Drivers:

- Increasing Prevalence of Oral Diseases and the Aging Population: The rising global incidence of periodontal diseases, driven by factors such as poor oral hygiene, unhealthy lifestyles, and an aging population, is a primary market driver. As people live longer, they are more susceptible to chronic conditions, including advanced periodontitis, which creates a continuous demand for periodontal treatments and care.

- Growing Awareness of the Link Between Oral and Systemic Health: There is a heightened public and professional understanding that periodontal disease is not just an oral health issue but is linked to systemic conditions such as diabetes, cardiovascular disease, and respiratory diseases. This awareness is encouraging more people to seek treatment, recognizing that good periodontal health is a crucial component of overall well-being.

- Technological Advancements in Diagnostics and Treatment: The market is being propelled by the emergence of innovative technologies that enhance the effectiveness and efficiency of periodontal care. This includes advanced diagnostic tools (e.g., digital X-rays, 3D imaging, and AI-powered analysis), as well as minimally invasive treatment options like laser therapy and microsurgery, which improve patient outcomes and comfort.

- Rise of Cosmetic and Aesthetic Dentistry: The increasing demand for cosmetic dental procedures, such as gum contouring and smile makeovers, is driving growth in the periodontics market. These aesthetic treatments often require a foundation of healthy gums and supporting bone, creating a parallel demand for periodontal procedures to ensure the long-term success and appearance of cosmetic work.

Restraints:

- High Cost of Advanced Periodontal Treatments and Inadequate Reimbursement: Many advanced and regenerative periodontal procedures, such as bone grafting and guided tissue regeneration, are expensive. The high cost, coupled with limited or inadequate reimbursement policies from dental insurance providers, can be a major financial barrier for patients, particularly in regions with low dental insurance penetration.

- Shortage of Skilled Dental Professionals: There is a global shortage of trained periodontists and skilled dental professionals, especially in developing countries and rural areas. This scarcity limits access to specialized periodontal care, as a small number of specialists cannot meet the rising demand for treatment, which acts as a significant restraint on market growth.

- Patient Reluctance and Fear of Invasive Procedures: Many patients have a strong aversion to dental procedures, especially surgical ones. The fear of pain, long recovery times, and the invasive nature of traditional periodontal surgeries can cause patients to delay or avoid necessary treatment, allowing their condition to worsen and creating a barrier to seeking professional care.

- Regulatory Hurdles and Stringent Approval Processes: The development and commercialization of new periodontal equipment, biologics, and therapeutic products are subject to stringent regulatory approval processes. The time and cost associated with gaining regulatory clearance can slow down the introduction of innovative products to the market, which can be a restraint on growth and innovation.

Opportunities:

- Minimally Invasive and Regenerative Therapies: The demand for less painful and faster-recovering treatments is creating a huge opportunity for minimally invasive procedures like laser-assisted periodontal therapy. Furthermore, the market for regenerative medicine, including the use of biomaterials, growth factors, and stem cell therapy to regenerate lost bone and gum tissue, presents a significant long-term growth opportunity.

- Integration of AI and Digital Health: The integration of Artificial Intelligence (AI) and digital health tools in periodontics is a key opportunity. AI-powered diagnostic software can analyze dental radiographs to detect early signs of bone loss with high accuracy. Additionally, digital platforms and mobile apps can assist with patient monitoring and personalized treatment planning, enhancing patient engagement and outcomes.

- Expansion in Emerging Economies: Emerging economies in the Asia-Pacific and Latin America regions offer vast growth opportunities. As these regions experience rising disposable incomes, improving dental infrastructure, and increasing awareness of oral health, there will be a surge in demand for periodontal treatments, both through dental tourism and local care.

- Focus on Preventive and Personalized Care: A shift in focus from reactive treatment to proactive prevention is a key opportunity. By using advanced diagnostics and predictive analytics, periodontists can identify at-risk patients and create personalized preventive care plans. This focus on early intervention and patient-specific treatments will not only improve patient outcomes but also create new revenue streams for the market.

Challenges:

- Ensuring Consistent Treatment Outcomes: A key challenge is to ensure that a variety of treatments, from non-surgical to advanced surgical procedures, produce consistent and predictable outcomes across a diverse patient population. Factors such as patient compliance, underlying health conditions, and the skill of the practitioner can all affect the success of a treatment, making it a difficult variable to control.

- Educating the Public and General Dentists: A significant challenge is to increase public awareness about the symptoms and risks of periodontal disease and to educate general dentists on the importance of early diagnosis and when to refer patients to a periodontist. Many cases go undiagnosed or are treated in their advanced stages, which is less effective and more costly.

- The "Black Box" of New Technologies: As new technologies, such as AI-powered diagnostic tools, enter the market, there is a challenge related to the "black box" problem. The lack of transparency in how algorithms arrive at a diagnosis can create a trust issue for practitioners who need to be accountable for their clinical decisions.

- Managing Data and Patient Privacy: The use of digital diagnostics and patient monitoring tools involves the collection and storage of sensitive patient data. Ensuring compliance with strict data privacy regulations (e.g., HIPAA, GDPR) and protecting this information from cyber threats is a continuous and complex challenge for the industry.

Dental Periodontics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Dental Periodontics Market |

| Market Size in 2023 | USD 1.72 Billion |

| Market Forecast in 2032 | USD 5.18 Billion |

| Growth Rate | CAGR of 13.02% |

| Number of Pages | 175 |

| Key Companies Covered | Altura Periodontics,Pennsylvania Center for Dental Implants & Periodontics,Colgate-Palmolive Company,Biolectrics LLC, American Dental Systems, Western Dental, Glendale Periodontics& Dental Implants, Acharya Periodontics and Dental Implants, Southern California Periodontics &Implantology, and Simpladent |

| Segments Covered | By Type, By Periodontal Treatments & Procedures, By End-User, By Product, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Dental Periodontics Market: Segmentation Insights

The global dental periodontics market is divided by product, type, application, and region.

Based on product, the global dental periodontics market is divided into injectable anesthetics, gelatin-based hemostats, topical anesthetics, dental hemostats, and dental anesthetics. Injectable Anesthetics dominate the dental periodontics market due to their widespread use in various periodontal procedures such as scaling, root planning, flap surgeries, and dental implant placements. These anesthetics provide deep and long-lasting numbness, enabling precise control over pain management during invasive treatments. Lidocaine and articaine are among the most commonly used agents in this category. Their rapid onset of action, reliable efficacy, and compatibility with vasoconstrictors like epinephrine make them a preferred choice for both general dentists and periodontists. The increasing number of surgical interventions in periodontal therapy continues to drive the demand for injectable anesthetics globally.

On the basis of type, the global dental periodontics market is bifurcated into mild periodontics and advanced periodontics. Mild Periodontics holds the dominant position in the dental periodontics market due to the high prevalence of early-stage periodontal conditions such as gingivitis and initial periodontitis across various demographics. These conditions typically require less invasive interventions including scaling and root planning, antimicrobial therapy, and routine oral hygiene reinforcement. The growing awareness of oral health, increased access to preventive dental care, and the emphasis on early diagnosis have significantly expanded the mild periodontics segment. Additionally, the widespread use of diagnostic tools in general dental practices allows for the early identification of periodontal issues, further driving this segment’s growth. Insurance reimbursement for non-surgical treatments and preventive services also supports higher patient turnout for mild periodontal care.

In terms of application, the global dental periodontics market is bifurcated into dental laboratories, dental hospital, dental clinics, and others. Dental Laboratories dominate the dental periodontics market by application, owing to their critical role in fabricating custom periodontal appliances such as periodontal splints, crowns, and implants. These laboratories are increasingly incorporating digital workflows, CAD/CAM systems, and 3D printing to improve precision and turnaround times, which enhances their appeal among periodontists and general dentists alike. As periodontal treatments often require prosthetic or restorative components post-treatment, dental labs are integral in ensuring continuity of care, especially in cases involving advanced periodontitis. Their collaborations with dental clinics and hospitals further cement their role as a key segment driving innovation and efficiency in periodontics.

Dental Periodontics Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the dental periodontics market, primarily driven by the high prevalence of periodontal diseases, advanced dental care infrastructure, and a strong emphasis on oral health education. The United States, in particular, leads the regional market due to a robust network of specialized dental practitioners, high healthcare spending, and widespread access to insurance coverage that includes periodontal services. Increasing awareness about the systemic links between periodontal health and chronic conditions such as diabetes and cardiovascular disease is boosting demand for early diagnosis and treatment. Furthermore, technological advancements such as laser-assisted periodontal therapy, 3D imaging, and minimally invasive surgical techniques are widely adopted across North America, enhancing the precision and effectiveness of periodontal treatments. Continued investments in dental research and education, along with growing acceptance of cosmetic gum surgeries and regenerative procedures, reinforce the region’s leadership in the global market.

Asia-Pacific dental periodontics market is growing rapidly due to rising oral health awareness, increasing disposable income, and the expansion of private dental care services. Countries like Japan, South Korea, China, and Australia are seeing growing demand for periodontal treatments, especially in urban areas where modern dental clinics and hospitals offer advanced procedures. The link between periodontal diseases and systemic illnesses is gaining attention, prompting more proactive dental check-ups and early intervention. While public insurance schemes in some nations provide basic periodontal care, private insurance and out-of-pocket expenditures account for a growing share of treatment financing. Moreover, the adoption of advanced diagnostic tools and minimally invasive procedures is expanding, especially among the younger population focused on aesthetic and preventive oral care.

Europe holds a significant share in the dental periodontics market, supported by a strong base of dental professionals and well-regulated public and private dental care systems. Countries such as Germany, the United Kingdom, France, and Italy are at the forefront, with national dental associations promoting awareness of periodontal disease prevention and management. Public dental coverage often includes periodontal evaluations and scaling services, while private insurance supplements more advanced treatments. Aging populations and increasing rates of systemic diseases associated with poor oral health are also contributing to rising demand for specialized periodontics. Additionally, innovations in biomaterials, guided tissue regeneration, and implantology are becoming more accessible across Europe, helping periodontists offer more effective and patient-friendly solutions.

Latin America dental periodontics market is expanding steadily, with Brazil, Mexico, and Argentina leading the way. The region faces a relatively high incidence of periodontal diseases due to lifestyle habits, low oral health literacy, and limited preventive care access in rural areas. However, urban populations are increasingly accessing periodontal services through private dental clinics and insurance providers. Periodontists in the region are adopting global best practices and technologies such as bone grafts, tissue engineering, and dental lasers to improve treatment outcomes. Government-led oral health initiatives and partnerships with academic institutions are also supporting the training and availability of skilled periodontal professionals.

Middle East & Africa region represents a growing opportunity in the dental periodontics market, particularly in the UAE, Saudi Arabia, and South Africa. In the Gulf countries, the rising number of dental clinics offering specialized periodontal services, combined with mandatory health insurance coverage for expatriates, is helping increase treatment accessibility. Cosmetic periodontal procedures such as crown lengthening and gum contouring are gaining popularity among affluent populations. In Africa, however, limited access to periodontal care in rural areas and low public awareness remain major challenges. Nonetheless, investments in dental infrastructure and targeted awareness campaigns are helping to slowly raise the profile of periodontal health across the region.

Dental Periodontics Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the dental periodontics market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global dental periodontics market include:

- Young Innovations Inc.

- Align Technology Inc.

- LED Medical Diagnostics Inc.

- Henry Schein Inc.

- PLANMECA OY

- Western Dental

- Orval

- Dentsply Sirona

- Nobel Biocare Services AG

- Zimmer Biomet

- BEGO GmbH & Co. KG

- Midmark Corporation

- Glidewell Laboratories

- Institut Straumann AG

- Carestream Dental LLC

- VATECH

- Ultradent Products Inc.

- Apteryx Inc.

- Flow Dental

- Altura Periodontics

- Biolectrics LLC

- American Dental Systems

The global dental periodontics market is segmented as follows:

By Product

- Injectable Anesthetics

- Gelatin-Based Hemostats

- Topical Anesthetics

- Dental Hemostats

- Dental Anesthetics

By Type

- Mild Periodontics

- Advanced Periodontics

By Application

- Dental Laboratories

- Dental Hospital

- Dental Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 24 CHAPTER 2. Dental Periodontics market – Type Analysis 27 2.1. Global Dental Periodontics Market – Type Overview 27 2.2. Global Dental Periodontics Market Share, by Type, 2018 & 2025 (USD Million) 27 2.3. Mild Periodontitis 29 2.3.1. Global Mild Periodontitis Dental Periodontics Market, 2013-2027 (USD Million) 29 2.4. Advanced Periodontitis 30 2.4.1. Global Advanced Periodontitis Dental Periodontics Market, 2013-2027 (USD Million) 30 CHAPTER 3. Dental Periodontics market – End User Analysis 30 3.1. Global Dental Periodontics Market – End User Overview 30 3.2. Global Dental Periodontics Market Share, by End User, 2018 & 2025 (USD Million) 31 3.3. Dental Laboratories 32 3.3.1. Global Dental Laboratories Dental Periodontics Market, 2013-2027 (USD Million) 32 3.4. Dental Hospital 33 3.4.1. Global Dental Hospital Dental Periodontics Market, 2013-2027 (USD Million) 33 3.5. Dental Clinics 34 3.5.1. Global Dental Clinics Dental Periodontics Market, 2013-2027 (USD Million) 34 3.6. Others 35 3.6.1. Global Others Dental Periodontics Market, 2013-2027 (USD Million) 35 CHAPTER 4. Dental Periodontics market – Products Analysis 35 4.1. Global Dental Periodontics Market – Products Overview 35 4.2. Global Dental Periodontics Market Share, by Products, 2018 & 2025 (USD Million) 36 4.3. Scalpels 37 4.3.1. Global Scalpels Dental Periodontics Market, 2013-2027 (USD Million) 37 4.4. Surgical Instruments 38 4.4.1. Global Surgical Instruments Dental Periodontics Market, 2013-2027 (USD Million) 38 4.5. Sutures 39 4.5.1. Global Sutures Dental Periodontics Market, 2013-2027 (USD Million) 39 4.6. Optical Systems 40 4.6.1. Global Optical Systems Dental Periodontics Market, 2013-2027 (USD Million) 40 4.7. Others 41 4.7.1. Global Others Dental Periodontics Market, 2013-2027 (USD Million) 41 CHAPTER 5. Dental Periodontics market – Periodontal Treatments & Procedures Analysis 41 5.1. Global Dental Periodontics Market – Periodontal Treatments & Procedures Overview 41 5.2. Global Dental Periodontics Market Share, by Periodontal Treatments & Procedures, 2018 & 2025 (USD Million) 42 5.3. Non-Surgical Treatments 44 5.3.1. Global Non-Surgical Treatments Dental Periodontics Market, 2013-2027 (USD Million) 44 5.4. Gum Graft Surgery 45 5.4.1. Global Gum Graft Surgery Dental Periodontics Market, 2013-2027 (USD Million) 45 5.5. Antimicrobial Therapy 46 5.5.1. Global Antimicrobial Therapy Dental Periodontics Market, 2013-2027 (USD Million) 46 5.6. Laser Treatment 47 5.6.1. Global Laser Treatment Dental Periodontics Market, 2013-2027 (USD Million) 47 5.7. Regenerative Procedures 48 5.7.1. Global Regenerative Procedures Dental Periodontics Market, 2013-2027 (USD Million) 48 5.8. Dental Crown Lengthening Procedures 49 5.8.1. Global Dental Crown Lengthening Procedures Dental Periodontics Market, 2013-2027 (USD Million) 49 5.9. Dental Implants 50 5.9.1. Global Dental Implants Dental Periodontics Market, 2013-2027 (USD Million) 50 5.10. Periodontal Pocket Reduction Procedures 51 5.10.1. Global Periodontal Pocket Reduction Procedures Dental Periodontics Market, 2013-2027 (USD Million) 51 5.11. Periodontal Plastic Surgery Procedures 52 5.11.1. Global Periodontal Plastic Surgery Procedures Dental Periodontics Market, 2013-2027 (USD Million) 52 CHAPTER 6. Dental Periodontics market – Regional Analysis 53 6.1. Global Dental Periodontics Market Regional Overview 53 6.2. Global Dental Periodontics Market Share, by Region, 2018 & 2025 (Value) 53 6.3. North America 55 6.3.1. North America Dental Periodontics Market size and forecast, 2013-2027 55 6.3.2. North America Dental Periodontics Market, by Country, 2018 & 2025 (USD Million) 55 6.3.3. North America Dental Periodontics Market, by Type, 2013-2027 57 6.3.3.1. North America Dental Periodontics Market, by Type, 2013-2027 (USD Million) 57 6.3.4. North America Dental Periodontics Market, by End User, 2013-2027 58 6.3.4.1. North America Dental Periodontics Market, by End User, 2013-2027 (USD Million) 58 6.3.5. North America Dental Periodontics Market, by Products, 2013-2027 59 6.3.5.1. North America Dental Periodontics Market, by Products, 2013-2027 (USD Million) 59 6.3.6. North America Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 60 6.3.6.1. North America Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 (USD Million) 60 6.3.7. U.S. 61 6.3.7.1. U.S. Market size and forecast, 2013-2027 (USD Million) 61 6.3.8. Canada 62 6.3.8.1. Canada Market size and forecast, 2013-2027 (USD Million) 62 6.3.9. Mexico 63 6.3.9.1. Mexico Market size and forecast, 2013-2027 (USD Million) 63 6.4. Europe 64 6.4.1. Europe Dental Periodontics Market size and forecast, 2013-2027 64 6.4.2. Europe Dental Periodontics Market, by Country, 2018 & 2025 (USD Million) 64 6.4.3. Europe Dental Periodontics Market, by Type, 2013-2027 66 6.4.3.1. Europe Dental Periodontics Market, by Type, 2013-2027 (USD Million) 66 6.4.4. Europe Dental Periodontics Market, by End User, 2013-2027 67 6.4.4.1. Europe Dental Periodontics Market, by End User, 2013-2027 (USD Million) 67 6.4.5. Europe Dental Periodontics Market, by Products, 2013-2027 68 6.4.5.1. Europe Dental Periodontics Market, by Products, 2013-2027 (USD Million) 68 6.4.6. Europe Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 69 6.4.6.1. Europe Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 (USD Million) 69 6.4.7. Germany 70 6.4.7.1. Germany Market size and forecast, 2013-2027 (USD Million) 70 6.4.8. France 71 6.4.8.1. France Market size and forecast, 2013-2027 (USD Million) 71 6.4.9. U.K. 72 6.4.9.1. U.K. Market size and forecast, 2013-2027 (USD Million) 72 6.4.10. Italy 73 6.4.10.1. Italy Market size and forecast, 2013-2027 (USD Million) 73 6.4.11. Spain 74 6.4.11.1. Spain Market size and forecast, 2013-2027 (USD Million) 74 6.4.12. Nordic Countries 75 6.4.12.1. Nordic Countries Market size and forecast, 2013-2027 (USD Million) 75 6.4.13. Benelux Union 76 6.4.13.1. Benelux Union Market size and forecast, 2013-2027 (USD Million) 76 6.4.14. Rest of Europe 77 6.4.14.1. Rest of Europe Market size and forecast, 2013-2027 (USD Million) 77 6.5. Asia Pacific 78 6.5.1. Asia Pacific Dental Periodontics Market size and forecast, 2013-2027 78 6.5.2. Asia Pacific Dental Periodontics Market, by Country, 2018 & 2025 (USD Million) 78 6.5.3. Asia Pacific Dental Periodontics Market, by Type, 2013-2027 80 6.5.3.1. Asia Pacific Dental Periodontics Market, by Type, 2013-2027 (USD Million) 80 6.5.4. Asia Pacific Dental Periodontics Market, by End User, 2013-2027 81 6.5.4.1. Asia Pacific Dental Periodontics Market, by End User, 2013-2027 (USD Million) 81 6.5.5. Asia Pacific Dental Periodontics Market, by Products, 2013-2027 82 6.5.5.1. Asia Pacific Dental Periodontics Market, by Products, 2013-2027 (USD Million) 82 6.5.6. Asia Pacific Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 83 6.5.6.1. Asia Pacific Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 (USD Million) 83 6.5.7. China 84 6.5.7.1. China Market size and forecast, 2013-2027 (USD Million) 84 6.5.8. Japan 85 6.5.8.1. Japan Market size and forecast, 2013-2027 (USD Million) 85 6.5.9. India 86 6.5.9.1. India Market size and forecast, 2013-2027 (USD Million) 86 6.5.10. New Zealand 87 6.5.10.1. New Zealand Market size and forecast, 2013-2027 (USD Million) 87 6.5.11. Australia 88 6.5.11.1. Australia Market size and forecast, 2013-2027 (USD Million) 88 6.5.12. South Korea 89 6.5.12.1. South Korea Market size and forecast, 2013-2027 (USD Million) 89 6.5.13. South-East Asia 90 6.5.13.1. South-East Asia Market size and forecast, 2013-2027 (USD Million) 90 6.5.14. Rest of Asia Pacific 91 6.5.14.1. Rest of Asia Pacific Market size and forecast, 2013-2027 (USD Million) 91 6.6. Latin America 92 6.6.1. Latin America Dental Periodontics Market size and forecast, 2013-2027 92 6.6.2. Latin America Dental Periodontics Market, by Country, 2018 & 2025 (USD Million) 92 6.6.3. Latin America Dental Periodontics Market, by Type, 2013-2027 94 6.6.3.1. Latin America Dental Periodontics Market, by Type, 2013-2027 (USD Million) 94 6.6.4. Latin America Dental Periodontics Market, by End User, 2013-2027 95 6.6.4.1. Latin America Dental Periodontics Market, by End User, 2013-2027 (USD Million) 95 6.6.5. Latin America Dental Periodontics Market, by Products, 2013-2027 96 6.6.5.1. Latin America Dental Periodontics Market, by Products, 2013-2027 (USD Million) 96 6.6.6. Latin America Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 97 6.6.6.1. Latin America Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 (USD Million) 97 6.6.7. Brazil 98 6.6.7.1. Brazil Market size and forecast, 2013-2027 (USD Million) 98 6.6.8. Argentina 99 6.6.8.1. Argentina Market size and forecast, 2013-2027 (USD Million) 99 6.6.9. Rest of Latin America 100 6.6.9.1. Rest of Latin America Market size and forecast, 2013-2027 (USD Million) 100 6.7. The Middle-East and Africa 101 6.7.1. The Middle-East and Africa Dental Periodontics Market size and forecast, 2013-2027 101 6.7.2. The Middle-East and Africa Dental Periodontics Market, by Country, 2018 & 2025 (USD Million) 101 6.7.3. The Middle-East and Africa Dental Periodontics Market, by Type, 2013-2027 103 6.7.3.1. The Middle-East and Africa Dental Periodontics Market, by Type, 2013-2027 (USD Million) 103 6.7.4. The Middle-East and Africa Dental Periodontics Market, by End User, 2013-2027 104 6.7.4.1. The Middle-East and Africa Dental Periodontics Market, by End User, 2013-2027 (USD Million) 104 6.7.5. The Middle-East and Africa Dental Periodontics Market, by Products, 2013-2027 105 6.7.5.1. The Middle-East and Africa Dental Periodontics Market, by Products, 2013-2027 (USD Million) 105 6.7.6. The Middle-East and Africa Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 106 6.7.6.1. The Middle-East and Africa Dental Periodontics Market, by Periodontal Treatments & Procedures, 2013-2027 (USD Million) 106 6.7.7. Saudi Arabia 107 6.7.7.1. Saudi Arabia Market size and forecast, 2013-2027 (USD Million) 107 6.7.8. UAE 108 6.7.8.1. UAE Market size and forecast, 2013-2027 (USD Million) 108 6.7.9. Egypt 109 6.7.9.1. Egypt Market size and forecast, 2013-2027 (USD Million) 109 6.7.10. Kuwait 110 6.7.10.1. Kuwait Market size and forecast, 2013-2027 (USD Million) 110 6.7.11. South Africa 111 6.7.11.1. South Africa Market size and forecast, 2013-2027 (USD Million) 111 6.7.12. Rest of Middle-East Africa 112 6.7.12.1. Rest of Middle-East Africa Market size and forecast, 2013-2027 (USD Million) 112 CHAPTER 7. Dental Periodontics market – Competitive Landscape 113 7.1. Competitor Market Share – Revenue 113 7.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 115 7.3. Strategic Development 116 7.3.1. Acquisitions and Mergers 116 7.3.2. New Products 116 7.3.3. Research & Development Activities 116 CHAPTER 8. Company Profiles 117 8.1. Colgate-Palmolive Company 117 8.1.1. Company Overview 117 8.1.2. Colgate-Palmolive Company Revenue and Gross Margin 117 8.1.3. Product portfolio 118 8.1.4. Recent initiatives 119 8.2. Glendale Periodontics & Dental Implants 119 8.2.1. Company Overview 119 8.2.2. Glendale Periodontics & Dental Implants Revenue and Gross Margin 119 8.2.3. Product portfolio 120 8.2.4. Recent initiatives 121 8.3. Western Dental 121 8.3.1. Company Overview 121 8.3.2. Western Dental Revenue and Gross Margin 121 8.3.3. Product portfolio 122 8.3.4. Recent initiatives 123 8.4. Pennsylvania Center for Dental Implants & Periodontics 123 8.4.1. Company Overview 123 8.4.2. Pennsylvania Center for Dental Implants & Periodontics Revenue and Gross Margin 123 8.4.3. Product portfolio 124 8.4.4. Recent initiatives 125 8.5. Southern California Periodontics & Implantology 125 8.5.1. Company Overview 125 8.5.2. Southern California Periodontics & Implantology Revenue and Gross Margin 125 8.5.3. Product portfolio 126 8.5.4. Recent initiatives 127 8.6. American Dental Systems 127 8.6.1. Company Overview 127 8.6.2. American Dental Systems Revenue and Gross Margin 127 8.6.3. Product portfolio 128 8.6.4. Recent initiatives 129 8.7. Biolectrics LLC 129 8.7.1. Company Overview 129 8.7.2. Biolectrics LLC Revenue and Gross Margin 129 8.7.3. Product portfolio 130 8.7.4. Recent initiatives 131 8.8. Acharya Periodontics and Dental Implants 131 8.8.1. Company Overview 131 8.8.2. Acharya Periodontics and Dental Implants Revenue and Gross Margin 131 8.8.3. Product portfolio 132 8.8.4. Recent initiatives 133 8.9. Altura Periodontics 133 8.9.1. Company Overview 133 8.9.2. Altura Periodontics Revenue and Gross Margin 133 8.9.3. Product portfolio 134 8.9.4. Recent initiatives 135 8.10. Simpladent 135 8.10.1. Company Overview 135 8.10.2. Simpladent Revenue and Gross Margin 135 8.10.3. Product portfolio 136 8.10.4. Recent initiatives 137 CHAPTER 9. Dental Periodontics — Industry Analysis 138 9.1. Dental Periodontics Market – Key Trends 138 9.1.1. Market Drivers 139 9.1.2. Market Restraints 139 9.1.3. Market Opportunities 140 9.2. Value Chain Analysis 141 9.3. Technology Roadmap and Timeline 142 9.4. Dental Periodontics Market – Attractiveness Analysis 143 9.4.1. By Type 143 9.4.2. By End User 143 9.4.3. By Products 144 9.4.4. By Periodontal Treatments & Procedures 145 9.4.5. By Region 146 CHAPTER 10. Marketing Strategy Analysis, Distributors 147 10.1. Marketing Channel 147 10.2. Direct Marketing 148 10.3. Indirect Marketing 148 10.4. Marketing Channel Development Trend 148 10.5. Economic/Political Environmental Change 149 CHAPTER 11. Report Conclusion 150 CHAPTER 12. Research Approach & Methodology 151 12.1. Report Description 151 12.2. Research Scope 152 12.3. Research Methodology 152 12.3.1. Secondary Research 153 12.3.2. Primary Research 154 12.3.3. Models 155 12.3.3.1. Company Share Analysis Model 155 12.3.3.2. Revenue Based Modeling 156 12.3.3.3. Research Limitations 156

Inquiry For Buying

Dental Periodontics

Request Sample

Dental Periodontics