Melt-Blown Nonwovens Market Size, Share, and Trends Analysis Report

CAGR :

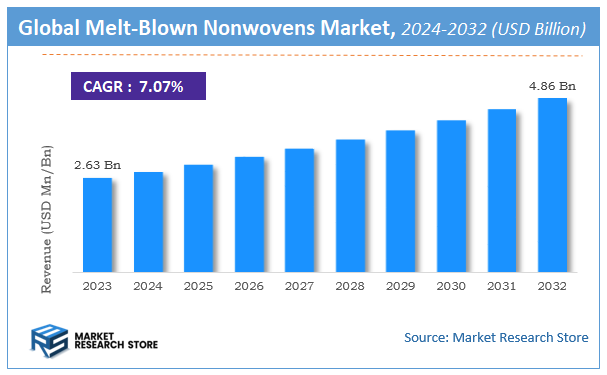

| Market Size 2023 (Base Year) | USD 2.63 Billion |

| Market Size 2032 (Forecast Year) | USD 4.86 Billion |

| CAGR | 7.07% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Melt-Blown Nonwovens Market Insights

According to Market Research Store, the global melt-blown nonwovens market size was valued at around USD 2.63 billion in 2023 and is estimated to reach USD 4.86 billion by 2032, to register a CAGR of approximately 7.07% in terms of revenue during the forecast period 2024-2032.

The melt-blown nonwovens report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Melt-Blown Nonwovens Market: Overview

Melt-blown nonwovens are a type of nonwoven fabric made by extruding thermoplastic polymers such as polypropylene through small nozzles surrounded by high-speed blowing gas, which creates ultra-fine fibers that are collected on a conveyor belt to form a web-like structure. These fabrics are characterized by their fine fiber diameter, high surface area, and superior filtration efficiency, making them ideal for use in medical masks, air and liquid filters, hygiene products, insulation materials, and various industrial applications. The unique structure of melt-blown nonwovens allows them to trap particles effectively while maintaining breathability and flexibility.

The growth of the melt-blown nonwovens market is driven by rising demand for high-performance filtration media, increasing healthcare awareness, and expanding use in personal protective equipment (PPE). The ongoing emphasis on air and water purification, especially in urban and industrial environments, further boosts the adoption of these materials. Technological advancements in polymer processing and nonwoven manufacturing have enabled higher productivity, better material uniformity, and the development of composite nonwovens with enhanced properties. As industries seek lightweight, cost-effective, and high-efficiency materials for environmental and safety applications, melt-blown nonwovens continue to play a critical role across multiple sectors.

Key Highlights

- The melt-blown nonwovens market is anticipated to grow at a CAGR of 7.07% during the forecast period.

- The global melt-blown nonwovens market was estimated to be worth approximately USD 2.63 billion in 2023 and is projected to reach a value of USD 4.86 billion by 2032.

- The growth of the melt-blown nonwovens market is being driven by increasing demand across healthcare, filtration, personal care, and industrial applications due to the material’s exceptional filtration efficiency, fine fiber diameter, and high surface area.

- Based on the material, the polyester segment is growing at a high rate and is projected to dominate the market.

- On the basis of end user, the construction segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Melt-Blown Nonwovens Market: Dynamics

Key Growth Drivers:

- Growing Demand from the Healthcare and Hygiene Industries: This is a core driver for the market. Melt-blown nonwovens are essential for a variety of products, including surgical masks, N95 respirators, disposable surgical gowns, and medical wipes, as well as in absorbent hygiene products like diapers and feminine care items. The increasing global focus on health, hygiene, and infection control, coupled with the rising disposable income in developing nations, is fueling this demand.

- Stringent Regulations on Air and Water Quality: As global awareness of environmental health increases, so do the regulations on air and water purity. Melt-blown nonwovens are exceptionally effective as a filter medium for both liquid and air filtration systems. Their use in HVAC systems, industrial filters, and automotive cabin air filters is a major growth driver, helping industries and consumers comply with stricter quality standards.

- Technological Advancements in Material Science: The market is benefiting from continuous innovation in the development of new polymer materials and manufacturing processes. Advancements are leading to the creation of nonwovens with enhanced properties, such as improved filtration efficiency, better breathability, and increased durability. The use of bi-component and multi-layer nonwovens is also expanding the range of applications.

- Increasing Demand from the Automotive Industry: Melt-blown nonwovens are increasingly being used in the automotive sector for applications beyond just cabin air filters. They are used for sound insulation, fuel filters, and battery separators in electric vehicles (EVs). The growth of the global automotive industry, especially the shift towards electric vehicles, is creating a new and significant market for these materials.

Restraints:

- Fluctuations in Raw Material Prices: The primary raw materials for melt-blown nonwovens are thermoplastic polymers, predominantly polypropylene. The price of these polymers is linked to the volatile petrochemical market. Fluctuations in the cost of these raw materials can directly impact production costs, squeeze profit margins for manufacturers, and hinder long-term investment.

- High Manufacturing and Capital Costs: The melt-blown manufacturing process requires specialized, high-cost machinery, including extruders, winders, and sophisticated air-blowing equipment. This high initial capital investment and the technical complexity of the process can be a significant barrier to entry for new players, leading to a concentrated market and limiting new production capacity.

- Overcapacity Post-Pandemic: The global demand for melt-blown nonwovens surged during the COVID-19 pandemic, leading many companies to rapidly install new production lines. Now, as the demand for medical masks has normalized, the market faces a significant overcapacity issue. This has created a highly competitive environment and led to price pressure, which is a major challenge for manufacturers.

- Environmental Concerns and Competition from Sustainable Alternatives: The market is facing increasing scrutiny over the environmental impact of synthetic polymers, especially in single-use applications. This has led to growing consumer demand for more sustainable and biodegradable nonwoven alternatives. The development and adoption of eco-friendly materials and recycling technologies, while an opportunity, also presents a challenge to traditional polymer-based products.

Opportunities:

- Expansion into New and Niche Applications: There is a significant opportunity to explore new applications beyond the traditional healthcare and filtration sectors. This includes uses in construction (e.g., roofing and house wraps), sorbent materials for oil spill cleanup, and advanced applications in electronics and energy storage (e.g., battery separators).

- Focus on Sustainable and Biodegradable Solutions: The growing environmental concerns present a major opportunity for innovation. Developing and marketing melt-blown nonwovens made from biodegradable polymers, recycled materials, or plant-based extracts can give companies a competitive edge and appeal to environmentally conscious consumers and businesses.

- Growth in Emerging Markets: The rising industrialization, increasing urbanization, and expanding healthcare and automotive industries in emerging economies like China, India, and other parts of Asia-Pacific and Latin America present a vast, untapped market. As these regions continue to develop, the demand for melt-blown nonwovens for a variety of applications will grow.

- Advancements in Nanofiber and Microfiber Technology: The development of melt-blown nonwovens with even finer nanofibers and microfibers offers an opportunity to create products with superior filtration efficiency and higher performance. This can open up new markets for high-efficiency filters used in specialized industrial and medical applications.

Challenges:

- Balancing High Performance with Cost-Effectiveness: A key challenge is to continuously innovate and improve the performance of melt-blown nonwovens while keeping production costs in check. The need to balance superior filtration efficiency, durability, and other desirable properties with a competitive price point is a constant challenge, especially in a price-sensitive market.

- Maintaining Quality Control and Consistency: The melt-blown process is technically complex, and maintaining consistent product quality and uniformity can be a challenge. Any variations in fiber diameter, web density, or other properties can affect the performance of the final product, which is particularly critical in applications like medical masks and high-efficiency filters.

- Navigating a Fragmented Supply Chain: The supply chain for melt-blown nonwovens, from polymer resin suppliers to end-product manufacturers, can be fragmented. This can lead to supply chain disruptions and a lack of control over quality and cost. Building robust and resilient supply chains is a critical challenge.

- Competition from Other Nonwoven Technologies: The market faces competition from other nonwoven manufacturing technologies, such as spunbond, spunlace, and air-laid, which may be more cost-effective or better suited for certain applications. The challenge for melt-blown nonwovens is to maintain its competitive edge by highlighting its unique properties, especially in filtration and absorbency.

Melt-Blown Nonwovens Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Melt-Blown Nonwovens Market |

| Market Size in 2023 | USD 2.63 Billion |

| Market Forecast in 2032 | USD 4.86 Billion |

| Growth Rate | CAGR of 7.07% |

| Number of Pages | 150 |

| Key Companies Covered | Don & Low Limited, The Dow Chemical Company, PEGAS NONWOVENS, Fiberweb, Mogul, Atex, Irema Ireland, E. I. Du Pont De Nemours and Company, and Kimberly-Clarke Corporation among others |

| Segments Covered | By Product Type, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Melt-Blown Nonwovens Market: Segmentation Insights

The global melt-blown nonwovens market is divided by material, end user, and region.

Based on material, the global melt-blown nonwovens market is divided into polyester, polypropylene, rayon, polyethylene, and others. Polypropylene is the dominant material segment in the Melt-Blown Nonwovens Market, primarily due to its exceptional filtration efficiency, lightweight characteristics, cost-effectiveness, and compatibility with the melt-blown manufacturing process. It is extensively used in applications such as medical face masks, N95 respirators, air and liquid filters, and hygiene products, where high-performance barrier properties are essential. Polypropylene’s hydrophobic nature and ability to generate fine fiber diameters make it ideal for producing nonwoven fabrics with superior breathability and filtration performance. The material continues to be the preferred choice across industrial, healthcare, and personal care sectors, especially in regions with high demand for medical-grade protective equipment.

On the basis of end user, the global melt-blown nonwovens market is bifurcated into construction, textiles, healthcare, automotive, and others. Healthcare is the dominant end-user segment in the Melt-Blown Nonwovens Market, driven by the material's critical role in the production of high-performance medical and hygiene products. Melt-blown nonwovens are widely used in surgical masks, N95 respirators, gowns, drapes, and wound care dressings due to their superior filtration efficiency, barrier properties, and breathability. The COVID-19 pandemic further accelerated the demand for medical-grade melt-blown fabrics, and this momentum continues with increased investments in healthcare infrastructure and ongoing emphasis on infection prevention and control. The segment benefits from stringent safety standards, which further reinforce the need for high-quality nonwoven materials.

Melt-Blown Nonwovens Market: Regional Insights

- North America is expected to dominate the global market

North America stands as the dominating region in the Melt-Blown Nonwovens Market, driven by high consumption across medical, filtration, hygiene, and industrial sectors. The region benefits from advanced manufacturing technologies, strong regulatory standards, and significant investments in product innovation. The United States is the leading contributor, with widespread application of melt-blown nonwovens in the production of N95 masks, air and liquid filtration systems, industrial insulation, and high-performance hygiene products. The post-pandemic emphasis on domestic production of PPE and medical textiles has further strengthened local supply chains. Additionally, the automotive sector's growing preference for lightweight, durable nonwoven materials in interior components and cabin air filtration systems adds momentum to regional demand. Strategic partnerships, R&D initiatives, and government support programs continue to reinforce North America’s market leadership.

Asia Pacific is the second-largest and fastest-growing region in the melt-blown nonwovens market, characterized by large-scale production, rising domestic consumption, and strong export capabilities. China is the most dominant country within the region due to its extensive manufacturing infrastructure and status as a global supplier of medical-grade nonwovens and filtration media. India and Southeast Asian countries are also experiencing significant growth, fueled by expanding healthcare access, population-driven demand for disposable hygiene products, and increasing adoption of industrial filtration systems. The region benefits from cost-effective raw materials and labor, which enhance its competitiveness in the global market. Government initiatives to boost local medical textile manufacturing and infrastructure investments are also playing a crucial role in regional development.

Europe represents a technologically mature market, with steady demand for melt-blown nonwovens across healthcare, hygiene, and environmental protection applications. The region is marked by strong environmental regulations and a growing emphasis on sustainability, which is driving the adoption of biodegradable and recyclable nonwoven materials. Germany, France, and the United Kingdom are the primary contributors, with well-developed manufacturing bases and advanced research capabilities. European companies are investing heavily in eco-friendly production technologies and bio-based polymers to align with the EU’s circular economy goals. Applications in air purification, water filtration, and medical textiles continue to expand, supported by public health policies and industrial emission control measures. Despite its slower growth rate compared to Asia Pacific, Europe maintains a stable and innovation-driven market presence.

Latin America is an emerging region in the melt-blown nonwovens market, showing gradual but consistent growth driven by rising hygiene awareness, improving healthcare services, and expanding urbanization. Countries such as Brazil, Mexico, and Argentina are at the forefront of regional consumption, supported by increasing demand for sanitary products like diapers, adult incontinence items, and feminine hygiene goods. The pandemic accelerated demand for melt-blown fabrics in surgical masks and hospital-grade medical products, which spurred temporary capacity expansions. However, the region still faces challenges such as limited domestic production, reliance on imports for machinery and polymers, and price volatility. Efforts to enhance local manufacturing capabilities, along with government investments in public health infrastructure, are expected to gradually boost market development in the coming years.

Middle East & Africa constitutes a developing region in the melt-blown nonwovens market, where demand is steadily increasing across medical, construction, hygiene, and industrial filtration applications. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are key contributors, driven by their efforts to modernize healthcare systems, expand urban infrastructure, and strengthen industrial capabilities. The demand for melt-blown nonwovens in the region is influenced by growing awareness of hygiene and infection control, particularly in response to global health events. The construction industry’s adoption of nonwovens for insulation and filtration purposes is also gaining traction. However, the region continues to face challenges related to low local production capacity, dependence on imported raw materials, and limited R&D infrastructure. Despite these constraints, government-backed healthcare initiatives and increased investment in manufacturing diversification present opportunities for market growth over the long term.

Melt-Blown Nonwovens Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the melt-blown nonwovens market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global melt-blown nonwovens market include:

- Pegas Nonwovens

- Kimberly-Clark

- Sinopec Group

- Toray

- China Hi-Tech Group Corporation

- Don & Low Limited

- The Dow Chemical Company

- Fiberweb

- Mogul

- Atex

- Irema Ireland

- E. I. Du Pont De Nemours and Company

The global melt-blown nonwovens market is segmented as follows:

By Material

- Polyester

- Polypropylene

- Rayon

- Polyethylene

- Others

By End User

- Construction

- Textiles

- Healthcare

- Automotive

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 20

CHAPTER 2. Melt-Blown Non-Woven market – Product Type Analysis 22

2.1. Global Melt-Blown Non-Woven Market – Product Type Overview 22

2.2. Global Melt-Blown Non-Woven Market Share, by Product Type, 2018 & 2025 (USD Million) 22

2.3. Fine Fiber Meltblown Nonwovens 24

2.3.1. Global Fine Fiber Meltblown Nonwovens Melt-Blown Non-Woven Market, 2015-2025 (USD Million) 24

2.4. Dual Texture Meltblown Nonwovens 25

2.4.1. Global Dual Texture Meltblown Nonwovens Melt-Blown Non-Woven Market, 2015-2025 (USD Million) 25

CHAPTER 3. Melt-Blown Non-Woven market – Application Analysis 25

3.1. Global Melt-Blown Non-Woven Market – Application Overview 25

3.2. Global Melt-Blown Non-Woven Market Share, by Application, 2018 & 2025 (USD Million) 26

3.3. Automotive 27

3.3.1. Global Automotive Melt-Blown Non-Woven Market, 2015-2025 (USD Million) 27

3.4. Medical 28

3.4.1. Global Medical Melt-Blown Non-Woven Market, 2015-2025 (USD Million) 28

3.5. Environmental 29

3.5.1. Global Environmental Melt-Blown Non-Woven Market, 2015-2025 (USD Million) 29

3.6. Electronic 30

3.6.1. Global Electronic Melt-Blown Non-Woven Market, 2015-2025 (USD Million) 30

3.7. Others 31

3.7.1. Global Others Melt-Blown Non-Woven Market, 2015-2025 (USD Million) 31

CHAPTER 4. Melt-Blown Non-Woven market – Regional Analysis 32

4.1. Global Melt-Blown Non-Woven Market Regional Overview 32

4.2. Global Melt-Blown Non-Woven Market Share, by Region, 2018 & 2025 (Value) 32

4.3. North America 34

4.3.1. North America Melt-Blown Non-Woven Market size and forecast, 2015-2025 34

4.3.2. North America Melt-Blown Non-Woven Market, by Country, 2018 & 2025 (USD Million) 34

4.3.3. North America Melt-Blown Non-Woven Market, by Product Type, 2015-2025 36

4.3.3.1. North America Melt-Blown Non-Woven Market, by Product Type, 2015-2025 (USD Million) 36

4.3.4. North America Melt-Blown Non-Woven Market, by Application, 2015-2025 37

4.3.4.1. North America Melt-Blown Non-Woven Market, by Application, 2015-2025 (USD Million) 37

4.3.5. U.S. 38

4.3.5.1. U.S. Market size and forecast, 2015-2025 (USD Million) 38

4.3.6. Canada 39

4.3.6.1. Canada Market size and forecast, 2015-2025 (USD Million) 39

4.3.7. Mexico 40

4.3.7.1. Mexico Market size and forecast, 2015-2025 (USD Million) 40

4.4. Europe 41

4.4.1. Europe Melt-Blown Non-Woven Market size and forecast, 2015-2025 41

4.4.2. Europe Melt-Blown Non-Woven Market, by Country, 2018 & 2025 (USD Million) 41

4.4.3. Europe Melt-Blown Non-Woven Market, by Product Type, 2015-2025 43

4.4.3.1. Europe Melt-Blown Non-Woven Market, by Product Type, 2015-2025 (USD Million) 43

4.4.4. Europe Melt-Blown Non-Woven Market, by Application, 2015-2025 44

4.4.4.1. Europe Melt-Blown Non-Woven Market, by Application, 2015-2025 (USD Million) 44

4.4.5. Germany 45

4.4.5.1. Germany Market size and forecast, 2015-2025 (USD Million) 45

4.4.6. France 46

4.4.6.1. France Market size and forecast, 2015-2025 (USD Million) 46

4.4.7. U.K. 47

4.4.7.1. U.K. Market size and forecast, 2015-2025 (USD Million) 47

4.4.8. Italy 48

4.4.8.1. Italy Market size and forecast, 2015-2025 (USD Million) 48

4.4.9. Spain 49

4.4.9.1. Spain Market size and forecast, 2015-2025 (USD Million) 49

4.4.10. Nordic Countries 50

4.4.10.1. Nordic Countries Market size and forecast, 2015-2025 (USD Million) 50

4.4.11. Benelux Union 51

4.4.11.1. Benelux Union Market size and forecast, 2015-2025 (USD Million) 51

4.4.12. Rest of Europe 52

4.4.12.1. Rest of Europe Market size and forecast, 2015-2025 (USD Million) 52

4.5. Asia Pacific 53

4.5.1. Asia Pacific Melt-Blown Non-Woven Market size and forecast, 2015-2025 53

4.5.2. Asia Pacific Melt-Blown Non-Woven Market, by Country, 2018 & 2025 (USD Million) 53

4.5.3. Asia Pacific Melt-Blown Non-Woven Market, by Product Type, 2015-2025 55

4.5.3.1. Asia Pacific Melt-Blown Non-Woven Market, by Product Type, 2015-2025 (USD Million) 55

4.5.4. Asia Pacific Melt-Blown Non-Woven Market, by Application, 2015-2025 56

4.5.4.1. Asia Pacific Melt-Blown Non-Woven Market, by Application, 2015-2025 (USD Million) 56

4.5.5. China 57

4.5.5.1. China Market size and forecast, 2015-2025 (USD Million) 57

4.5.6. Japan 58

4.5.6.1. Japan Market size and forecast, 2015-2025 (USD Million) 58

4.5.7. India 59

4.5.7.1. India Market size and forecast, 2015-2025 (USD Million) 59

4.5.8. New Zealand 60

4.5.8.1. New Zealand Market size and forecast, 2015-2025 (USD Million) 60

4.5.9. Australia 61

4.5.9.1. Australia Market size and forecast, 2015-2025 (USD Million) 61

4.5.10. South Korea 62

4.5.10.1. South Korea Market size and forecast, 2015-2025 (USD Million) 62

4.5.11. South-East Asia 63

4.5.11.1. South-East Asia Market size and forecast, 2015-2025 (USD Million) 63

4.5.12. Rest of Asia Pacific 64

4.5.12.1. Rest of Asia Pacific Market size and forecast, 2015-2025 (USD Million) 64

4.6. Latin America 65

4.6.1. Latin America Melt-Blown Non-Woven Market size and forecast, 2015-2025 65

4.6.2. Latin America Melt-Blown Non-Woven Market, by Country, 2018 & 2025 (USD Million) 65

4.6.3. Latin America Melt-Blown Non-Woven Market, by Product Type, 2015-2025 67

4.6.3.1. Latin America Melt-Blown Non-Woven Market, by Product Type, 2015-2025 (USD Million) 67

4.6.4. Latin America Melt-Blown Non-Woven Market, by Application, 2015-2025 68

4.6.4.1. Latin America Melt-Blown Non-Woven Market, by Application, 2015-2025 (USD Million) 68

4.6.5. Brazil 69

4.6.5.1. Brazil Market size and forecast, 2015-2025 (USD Million) 69

4.6.6. Argentina 70

4.6.6.1. Argentina Market size and forecast, 2015-2025 (USD Million) 70

4.6.7. Rest of Latin America 71

4.6.7.1. Rest of Latin America Market size and forecast, 2015-2025 (USD Million) 71

4.7. The Middle-East and Africa 72

4.7.1. The Middle-East and Africa Melt-Blown Non-Woven Market size and forecast, 2015-2025 72

4.7.2. The Middle-East and Africa Melt-Blown Non-Woven Market, by Country, 2018 & 2025 (USD Million) 72

4.7.3. The Middle-East and Africa Melt-Blown Non-Woven Market, by Product Type, 2015-2025 74

4.7.3.1. The Middle-East and Africa Melt-Blown Non-Woven Market, by Product Type, 2015-2025 (USD Million) 74

4.7.4. The Middle-East and Africa Melt-Blown Non-Woven Market, by Application, 2015-2025 75

4.7.4.1. The Middle-East and Africa Melt-Blown Non-Woven Market, by Application, 2015-2025 (USD Million) 75

4.7.5. Saudi Arabia 76

4.7.5.1. Saudi Arabia Market size and forecast, 2015-2025 (USD Million) 76

4.7.6. UAE 77

4.7.6.1. UAE Market size and forecast, 2015-2025 (USD Million) 77

4.7.7. Egypt 78

4.7.7.1. Egypt Market size and forecast, 2015-2025 (USD Million) 78

4.7.8. Kuwait 79

4.7.8.1. Kuwait Market size and forecast, 2015-2025 (USD Million) 79

4.7.9. South Africa 80

4.7.9.1. South Africa Market size and forecast, 2015-2025 (USD Million) 80

4.7.10. Rest of Middle-East Africa 81

4.7.10.1. Rest of Middle-East Africa Market size and forecast, 2015-2025 (USD Million) 81

CHAPTER 5. Melt-Blown Non-Woven market – Competitive Landscape 82

5.1. Competitor Market Share – Revenue 82

5.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 84

5.3. Strategic Development 85

5.3.1. Acquisitions and Mergers 85

5.3.2. New Products 85

5.3.3. Research & Development Activities 85

CHAPTER 6. Company Profiles 86

6.1. Fiberweb 86

6.1.1. Company Overview 86

6.1.2. Fiberweb Revenue and Gross Margin 86

6.1.3. Product portfolio 87

6.1.4. Recent initiatives 88

6.2. Mogul 88

6.2.1. Company Overview 88

6.2.2. Mogul Revenue and Gross Margin 88

6.2.3. Product portfolio 89

6.2.4. Recent initiatives 90

6.3. Atex 90

6.3.1. Company Overview 90

6.3.2. Atex Revenue and Gross Margin 90

6.3.3. Product portfolio 91

6.3.4. Recent initiatives 92

6.4. Irema Ireland 92

6.4.1. Company Overview 92

6.4.2. Irema Ireland Revenue and Gross Margin 92

6.4.3. Product portfolio 93

6.4.4. Recent initiatives 94

6.5. PEGAS NONWOVENS 94

6.5.1. Company Overview 94

6.5.2. PEGAS NONWOVENS Revenue and Gross Margin 94

6.5.3. Product portfolio 95

6.5.4. Recent initiatives 96

6.6. Don & Low Limited 96

6.6.1. Company Overview 96

6.6.2. Don & Low Limited Revenue and Gross Margin 96

6.6.3. Product portfolio 97

6.6.4. Recent initiatives 98

6.7. The Dow Chemical Company 98

6.7.1. Company Overview 98

6.7.2. The Dow Chemical Company Revenue and Gross Margin 98

6.7.3. Product portfolio 99

6.7.4. Recent initiatives 100

6.8. E. I. Du Pont De Nemours and Company 100

6.8.1. Company Overview 100

6.8.2. E. I. Du Pont De Nemours and Company Revenue and Gross Margin 100

6.8.3. Product portfolio 101

6.8.4. Recent initiatives 102

6.9. Kimberly-Clarke Corporation 102

6.9.1. Company Overview 102

6.9.2. Kimberly-Clarke Corporation Revenue and Gross Margin 102

6.9.3. Product portfolio 103

6.9.4. Recent initiatives 104

CHAPTER 7. Melt-Blown Non-Woven — Industry Analysis 105

7.1. Melt-Blown Non-Woven Market – Key Trends 105

7.1.1. Market Drivers 106

7.1.2. Market Restraints 106

7.1.3. Market Opportunities 107

7.2. Value Chain Analysis 108

7.3. Technology Roadmap and Timeline 109

7.4. Melt-Blown Non-Woven Market – Attractiveness Analysis 110

7.4.1. By Product Type 110

7.4.2. By Application 110

7.4.3. By Region 112

CHAPTER 8. Marketing Strategy Analysis, Distributors 113

8.1. Marketing Channel 113

8.2. Direct Marketing 114

8.3. Indirect Marketing 114

8.4. Marketing Channel Development Trend 114

8.5. Economic/Political Environmental Change 115

CHAPTER 9. Report Conclusion 116

CHAPTER 10. Research Approach & Methodology 117

10.1. Report Description 117

10.2. Research Scope 118

10.3. Research Methodology 118

10.3.1. Secondary Research 119

10.3.2. Primary Research 120

10.3.3. Models 121

10.3.3.1. Company Share Analysis Model 121

10.3.3.2. Revenue Based Modeling 122

10.3.3.3. Research Limitations 122

Inquiry For Buying

Melt-Blown Nonwovens

Request Sample

Melt-Blown Nonwovens