Mitigation Banking Market Size, Share, and Trends Analysis Report

CAGR :

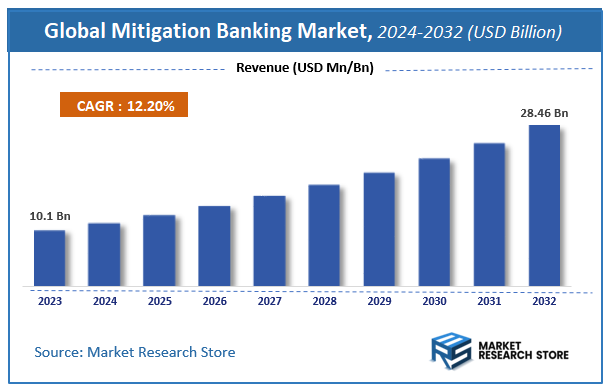

| Market Size 2023 (Base Year) | USD 10.1 Billion |

| Market Size 2032 (Forecast Year) | USD 28.46 Billion |

| CAGR | 12.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Mitigation Banking Market Insights

According to Market Research Store, the global mitigation banking market size was valued at around USD 10.1 billion in 2023 and is estimated to reach USD 28.46 billion by 2032, to register a CAGR of approximately 12.2% in terms of revenue during the forecast period 2024-2032.

The mitigation banking report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Mitigation Banking Market: Overview

Mitigation banking is an environmental conservation practice that involves the restoration, creation, enhancement, or preservation of natural habitats like wetlands, streams, or endangered species habitats to offset the environmental impacts of development projects elsewhere. Developers or project sponsors who impact ecological resources are required by regulatory agencies to compensate for that loss. Instead of performing their own mitigation, they can purchase credits from a mitigation bank, which is a legally established site that has already undertaken and maintained ecological restoration efforts approved by environmental authorities.

The growth of mitigation banking is driven by increasing regulatory requirements under frameworks such as the Clean Water Act and the Endangered Species Act, which mandate compensatory mitigation for environmental degradation. It offers an efficient, scalable, and ecologically sound alternative to piecemeal, on-site mitigation by consolidating conservation efforts in strategic locations that offer higher ecological value and better long-term management. Additionally, mitigation banking promotes early restoration and allows for development to proceed without delays associated with planning and executing individual mitigation projects. As demand for infrastructure development and land use intensifies alongside a growing emphasis on biodiversity protection and ecosystem services, mitigation banking continues to gain importance as a market-driven tool for balancing development with environmental stewardship.

Key Highlights

- The mitigation banking market is anticipated to grow at a CAGR of 12.2% during the forecast period.

- The global mitigation banking market was estimated to be worth approximately USD 10.1 billion in 2023 and is projected to reach a value of USD 28.46 billion by 2032.

- The growth of the mitigation banking market is being driven by increasing environmental regulations, the expansion of infrastructure development projects, and heightened awareness of ecosystem conservation.

- Based on the type, the wetland or stream banks segment is growing at a high rate and is projected to dominate the market.

- On the basis of verticals, the construction & mining segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Mitigation Banking Market: Dynamics

Key Growth Drivers

- Stringent Regulatory Frameworks: The primary driver of the mitigation banking market is the existence of robust and enforceable environmental regulations. In the United States, for example, the "no net loss" policy of the Clean Water Act and the Endangered Species Act compel developers to compensate for unavoidable environmental damage. Similar regulations are emerging in other parts of the world, pushing developers towards market-based solutions like mitigation banking to fulfill their compliance obligations.

- Efficiency and Predictability for Developers: Mitigation banking offers a streamlined and more efficient alternative for developers compared to creating their own on-site mitigation projects. By purchasing pre-approved credits from a mitigation bank, developers can secure their environmental permits more quickly, with greater cost certainty and less regulatory risk. This efficiency is a powerful incentive for project proponents.

- Ecological and Financial Economies of Scale: Mitigation banks are often large-scale, consolidated projects that are more ecologically effective than numerous small, individual mitigation sites. The economies of scale achieved through professional management, specialized expertise, and bulk land acquisition result in higher-quality ecological outcomes and a more cost-effective solution for both developers and the environment.

- Increasing Corporate Sustainability and ESG Initiatives: Beyond regulatory compliance, many corporations are voluntarily adopting environmental, social, and governance (ESG) goals. Investing in mitigation credits aligns with these sustainability objectives, allowing companies to demonstrate their commitment to environmental stewardship and biodiversity conservation. This trend is creating a new source of demand for the market.

- Rapid Urbanization and Industrialization: The continuous expansion of human settlements, infrastructure, and industrial activities globally, particularly in emerging economies, inevitably leads to environmental impact. As development projects increase, so does the need for a mechanism to offset their ecological footprint, driving the core demand for mitigation credits.

Restraints

- Complex and Lengthy Regulatory Approval Process: Despite offering efficiency to developers, the process of establishing a mitigation bank itself is complex, time-consuming, and expensive. Obtaining the necessary permits and approvals from multiple federal, state, and local regulatory agencies can take years and requires significant upfront capital investment, which can be a major barrier to entry for new players.

- Geographic and Ecological Restrictions: Mitigation banks operate within specific "service areas" and must provide a "like-for-like" replacement of the affected habitat. This means a developer can only purchase credits from a bank that is ecologically and geographically relevant to their project. This restriction can limit the supply of available credits in certain areas, particularly for a specific type of habitat.

- Economic Downturns: The demand for mitigation credits is directly linked to the volume of construction and development projects. During economic recessions or slowdowns, construction activity decreases, leading to a reduced demand for credits and impacting the profitability and financial viability of mitigation banks.

- Uncertainty in Credit Pricing and Demand: The mitigation banking market lacks a transparent, centralized pricing mechanism. The price of credits can vary significantly based on location, habitat type, and demand, making it difficult for both developers to budget accurately and for new bankers to assess the financial feasibility of their projects.

- High Upfront Capital and Long-Term Investment Horizon: Establishing a mitigation bank requires a large initial capital outlay for land acquisition, restoration work, and the regulatory process. Furthermore, credits are often released in phases over many years as the bank meets performance milestones, meaning investors must be prepared for a long investment horizon before realizing full returns.

Opportunities

- Development of New Habitat Types: While historically focused on wetlands and streams, there is a growing opportunity to expand mitigation banking to other ecological areas, such as conservation banks for endangered species, and forest or coastal restoration. This diversification can unlock new markets and address a broader range of environmental impacts.

- Increased Focus on Carbon and Water Markets: The mitigation banking model can be applied to other environmental assets. The growing emphasis on carbon sequestration and water quality trading presents a significant opportunity for mitigation bankers to generate additional revenue streams by selling carbon credits or water quality credits.

- Technological Integration: The use of advanced technology such as GIS mapping, satellite imagery, drones, and AI-powered monitoring can streamline the ecological assessment and monitoring of mitigation banks, improving efficiency, reducing costs, and providing more transparent data to regulators and buyers.

- Global Market Expansion: While the market is most mature in North America, particularly the U.S., there is a significant opportunity for growth in other regions. As developing economies become more aware of environmental issues and implement similar regulatory frameworks, the mitigation banking model could be adopted to balance development with conservation.

- Public-Private Partnerships: There is an opportunity for greater collaboration between private mitigation bankers and government agencies. Public-private partnerships can leverage private sector expertise and capital to undertake large-scale, complex restoration projects that would otherwise be challenging for government agencies to execute alone.

Challenges

- Ensuring Long-Term Ecological Success: The core challenge of mitigation banking is ensuring that the restored habitats are ecologically successful and sustainable in the long term. This requires ongoing monitoring and management, and a failure to meet performance standards can result in a loss of credits and a reputational risk for the mitigation banker.

- Lack of Public Awareness and Trust: The concept of paying to offset environmental damage can be met with public skepticism. Educating stakeholders and building trust that mitigation banking is a genuine and effective tool for conservation, rather than a loophole for developers, is an ongoing challenge.

- Managing Regulatory Changes: The market is highly susceptible to changes in environmental policy. A shift in a key regulation or a new interpretation by a regulatory body could significantly impact the demand for credits, the rules for creating a bank, and the financial viability of existing projects.

- Balancing Financial and Ecological Goals: Mitigation bankers operate in a delicate balance between financial profitability and ecological integrity. The challenge lies in designing and managing banks that not only generate sufficient returns for investors but also provide high-quality, sustainable ecological benefits that meet or exceed regulatory requirements.

Mitigation Banking Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Mitigation Banking Market |

| Market Size in 2023 | USD 10.1 Billion |

| Market Forecast in 2032 | USD 28.46 Billion |

| Growth Rate | CAGR of 12.2% |

| Number of Pages | 150 |

| Key Companies Covered | Alafia River Wetland Mitigation Bank, Inc., Burns & McDonnell, EarthBalance, Ecosystem Services, LLC, Habitat Bank LLC, The Mitigation Banking Group, Inc., Ecosystem Investment Partners (EIP), The Wetlandsbank Company (TWC), Wetland Studies and Solutions, Inc., Weyerhaeuser, LJA Environmental Services, Inc., Wildwood Environmental Credit Company, WRA, Inc., The Loudermilk Companies, LLC, Great Ecology, and Mitigation Credit Services, LLC. |

| Segments Covered | By Type, By Verticals, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Mitigation Banking Market: Segmentation Insights

The global mitigation banking market is divided by type, verticals, and region.

Based on type, the global mitigation banking market is divided into wetland or stream banks, forest conservation, and conservation banks. Wetland or Stream Banks represent the dominant segment in the Mitigation Banking Market, owing to stringent regulatory frameworks such as the U.S. Clean Water Act Section 404, which mandates the replacement of lost wetland and stream functions through compensatory mitigation. These banks are established to restore, enhance, or preserve wetlands and streams, offering credits to developers who impact aquatic resources during construction or land development. The segment's leadership is driven by the high ecological value of wetlands, their role in flood control, water purification, and biodiversity, as well as increasing demand for sustainable land development practices. Governmental support and rising awareness of watershed protection continue to fuel this segment’s expansion across North America and other regulated markets.

On the basis of verticals, the global mitigation banking market is bifurcated into construction & mining, transportation, energy & utilities, healthcare, and manufacturing. Construction & Mining is the dominant vertical in the Mitigation Banking Market due to the significant environmental impact associated with land development, excavation, and resource extraction activities. These sectors often result in the disturbance or destruction of wetlands, streams, forests, and endangered species habitats, necessitating compensatory mitigation to comply with environmental regulations such as the Clean Water Act and Endangered Species Act. Mitigation banks provide a practical, pre-approved solution for developers to offset these ecological losses while avoiding delays in project approvals. The continued expansion of commercial infrastructure, residential housing, and mining operations globally reinforces the high demand for mitigation credits in this vertical.

Mitigation Banking Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Mitigation Banking Market due to its well-established regulatory framework and mature ecosystem for compensatory mitigation. The presence of strong environmental laws, such as the Clean Water Act, has institutionalized the use of mitigation banking for wetland and stream restoration. The region has a large number of approved banks, an active credit trading system, and participation from both public and private stakeholders. The United States, in particular, leads in the number of operational banks and the scale of credits traded. Major market players operate extensively in this region, supported by a robust infrastructure for ecological compliance, particularly in the infrastructure, mining, and energy sectors.

Asia Pacific is the fastest-growing region in the mitigation banking market, supported by rising urbanization, infrastructure development, and increasing environmental awareness. Countries like China, India, and Australia are exploring or implementing mitigation banking principles in response to ecological degradation and expanding industrial activity. Governments across the region are beginning to introduce legal frameworks for biodiversity conservation and wetland restoration, creating new opportunities for market expansion. The potential for future growth remains high, especially as environmental regulations continue to evolve and attract public-private partnerships in ecological restoration.

Europe holds the second-largest position in the global mitigation banking market, supported by biodiversity offsetting frameworks and environmental compliance mechanisms enforced across member states. The region emphasizes habitat and conservation banking in line with its long-term ecological restoration goals. European nations such as Germany, France, and the United Kingdom have adopted variations of mitigation banking under broader environmental policies. Although the market is less standardized compared to North America, the growing demand for ecological restoration and alignment with sustainability goals are contributing to steady regional development.

Latin America is an emerging region in the mitigation banking market, with interest growing in biodiversity offsetting and habitat restoration. Several countries in the region are adopting mitigation banking concepts in response to increasing mining, energy, and agricultural activities that impact sensitive ecosystems. Brazil and Colombia are at the forefront of regional initiatives, experimenting with policies that support compensatory mitigation and credit-based ecological banking. While institutional capacity is still developing, growing environmental concerns and international cooperation are expected to support long-term growth in this region.

Middle East & Africa is at a nascent stage in the mitigation banking market but shows gradual progress due to rising ecological awareness and regulatory reforms. Countries such as South Africa, the United Arab Emirates, and Saudi Arabia are beginning to explore habitat banking and environmental offset mechanisms in response to infrastructure and energy expansion. Though the adoption of mitigation banking remains limited, regional governments are showing increasing interest in sustainable development practices. Capacity-building efforts and the integration of global environmental frameworks are likely to support the future expansion of mitigation banking across this region.

Mitigation Banking Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the mitigation banking market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global mitigation banking market include:

- Wetland Studies and Solutions Inc.

- Burns & McDonnell

- THabitat Bank LLC

- Ecosystem Investment Partners (EIP)

- The Loudermilk Companies

- The Wetlandsbank Company (TWC)

- EarthBalance

- Weyerhaeuser

- WRA Inc. LLC

- Alafia River Wetland Mitigation Bank Inc.

- Wildwood Environmental Credit Company

- The Mitigation Banking Group Inc.

- Great Ecology

- LJA Environmental Services Inc.

- Ecosystem Services LLC

The global mitigation banking market is segmented as follows:

By Type

- Wetland or Stream Banks

- Forest Conservation

- Conservation Banks

By Verticals

- Construction & Mining

- Transportation

- Energy & Utilities

- Healthcare

- Manufacturing

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 20

CHAPTER 2. Mitigation Banking market – Type Analysis 23

2.1. Global Mitigation Banking Market – Type Overview 23

2.2. Global Mitigation Banking Market Share, by Type, 2018 & 2025 (USD Million) 23

2.3. Wetland or Stream Banks 25

2.3.1. Global Wetland or Stream Banks Mitigation Banking Market, 2015-2025 (USD Million) 25

2.4. Conservation Banks 26

2.4.1. Global Conservation Banks Mitigation Banking Market, 2015-2025 (USD Million) 26

2.5. Forest Conservation 27

2.5.1. Global Forest Conservation Mitigation Banking Market, 2015-2025 (USD Million) 27

CHAPTER 3. Mitigation Banking market – Application Analysis 27

3.1. Global Mitigation Banking Market – Application Overview 27

3.2. Global Mitigation Banking Market Share, by Application, 2018 & 2025 (USD Million) 28

3.3. Construction and Mining 29

3.3.1. Global Construction and Mining Mitigation Banking Market, 2015-2025 (USD Million) 29

3.4. Energy and Utilities 30

3.4.1. Global Energy and Utilities Mitigation Banking Market, 2015-2025 (USD Million) 30

3.5. Manufacturing 31

3.5.1. Global Manufacturing Mitigation Banking Market, 2015-2025 (USD Million) 31

3.6. Healthcare 32

3.6.1. Global Healthcare Mitigation Banking Market, 2015-2025 (USD Million) 32

3.7. Transportation 33

3.7.1. Global Transportation Mitigation Banking Market, 2015-2025 (USD Million) 33

3.8. Others 34

3.8.1. Global Others Mitigation Banking Market, 2015-2025 (USD Million) 34

CHAPTER 4. Mitigation Banking market – Regional Analysis 35

4.1. Global Mitigation Banking Market Regional Overview 35

4.2. Global Mitigation Banking Market Share, by Region, 2018 & 2025 (Value) 35

4.3. North America 37

4.3.1. North America Mitigation Banking Market size and forecast, 2015-2025 37

4.3.2. North America Mitigation Banking Market, by Country, 2018 & 2025 (USD Million) 37

4.3.3. North America Mitigation Banking Market, by Type, 2015-2025 39

4.3.3.1. North America Mitigation Banking Market, by Type, 2015-2025 (USD Million) 39

4.3.4. North America Mitigation Banking Market, by Application, 2015-2025 40

4.3.4.1. North America Mitigation Banking Market, by Application, 2015-2025 (USD Million) 40

4.3.5. U.S. 41

4.3.5.1. U.S. Market size and forecast, 2015-2025 (USD Million) 41

4.3.6. Canada 42

4.3.6.1. Canada Market size and forecast, 2015-2025 (USD Million) 42

4.3.7. Mexico 43

4.3.7.1. Mexico Market size and forecast, 2015-2025 (USD Million) 43

4.4. Europe 44

4.4.1. Europe Mitigation Banking Market size and forecast, 2015-2025 44

4.4.2. Europe Mitigation Banking Market, by Country, 2018 & 2025 (USD Million) 44

4.4.3. Europe Mitigation Banking Market, by Type, 2015-2025 46

4.4.3.1. Europe Mitigation Banking Market, by Type, 2015-2025 (USD Million) 46

4.4.4. Europe Mitigation Banking Market, by Application, 2015-2025 47

4.4.4.1. Europe Mitigation Banking Market, by Application, 2015-2025 (USD Million) 47

4.4.5. Germany 48

4.4.5.1. Germany Market size and forecast, 2015-2025 (USD Million) 48

4.4.6. France 49

4.4.6.1. France Market size and forecast, 2015-2025 (USD Million) 49

4.4.7. U.K. 50

4.4.7.1. U.K. Market size and forecast, 2015-2025 (USD Million) 50

4.4.8. Italy 51

4.4.8.1. Italy Market size and forecast, 2015-2025 (USD Million) 51

4.4.9. Spain 52

4.4.9.1. Spain Market size and forecast, 2015-2025 (USD Million) 52

4.4.10. Nordic Countries 53

4.4.10.1. Nordic Countries Market size and forecast, 2015-2025 (USD Million) 53

4.4.11. Benelux Union 54

4.4.11.1. Benelux Union Market size and forecast, 2015-2025 (USD Million) 54

4.4.12. Rest of Europe 55

4.4.12.1. Rest of Europe Market size and forecast, 2015-2025 (USD Million) 55

4.5. Asia Pacific 56

4.5.1. Asia Pacific Mitigation Banking Market size and forecast, 2015-2025 56

4.5.2. Asia Pacific Mitigation Banking Market, by Country, 2018 & 2025 (USD Million) 56

4.5.3. Asia Pacific Mitigation Banking Market, by Type, 2015-2025 58

4.5.3.1. Asia Pacific Mitigation Banking Market, by Type, 2015-2025 (USD Million) 58

4.5.4. Asia Pacific Mitigation Banking Market, by Application, 2015-2025 59

4.5.4.1. Asia Pacific Mitigation Banking Market, by Application, 2015-2025 (USD Million) 59

4.5.5. China 60

4.5.5.1. China Market size and forecast, 2015-2025 (USD Million) 60

4.5.6. Japan 61

4.5.6.1. Japan Market size and forecast, 2015-2025 (USD Million) 61

4.5.7. India 62

4.5.7.1. India Market size and forecast, 2015-2025 (USD Million) 62

4.5.8. New Zealand 63

4.5.8.1. New Zealand Market size and forecast, 2015-2025 (USD Million) 63

4.5.9. Australia 64

4.5.9.1. Australia Market size and forecast, 2015-2025 (USD Million) 64

4.5.10. South Korea 65

4.5.10.1. South Korea Market size and forecast, 2015-2025 (USD Million) 65

4.5.11. South-East Asia 66

4.5.11.1. South-East Asia Market size and forecast, 2015-2025 (USD Million) 66

4.5.12. Rest of Asia Pacific 67

4.5.12.1. Rest of Asia Pacific Market size and forecast, 2015-2025 (USD Million) 67

4.6. Latin America 68

4.6.1. Latin America Mitigation Banking Market size and forecast, 2015-2025 68

4.6.2. Latin America Mitigation Banking Market, by Country, 2018 & 2025 (USD Million) 68

4.6.3. Latin America Mitigation Banking Market, by Type, 2015-2025 70

4.6.3.1. Latin America Mitigation Banking Market, by Type, 2015-2025 (USD Million) 70

4.6.4. Latin America Mitigation Banking Market, by Application, 2015-2025 71

4.6.4.1. Latin America Mitigation Banking Market, by Application, 2015-2025 (USD Million) 71

4.6.5. Brazil 72

4.6.5.1. Brazil Market size and forecast, 2015-2025 (USD Million) 72

4.6.6. Argentina 73

4.6.6.1. Argentina Market size and forecast, 2015-2025 (USD Million) 73

4.6.7. Rest of Latin America 74

4.6.7.1. Rest of Latin America Market size and forecast, 2015-2025 (USD Million) 74

4.7. The Middle-East and Africa 75

4.7.1. The Middle-East and Africa Mitigation Banking Market size and forecast, 2015-2025 75

4.7.2. The Middle-East and Africa Mitigation Banking Market, by Country, 2018 & 2025 (USD Million) 75

4.7.3. The Middle-East and Africa Mitigation Banking Market, by Type, 2015-2025 77

4.7.3.1. The Middle-East and Africa Mitigation Banking Market, by Type, 2015-2025 (USD Million) 77

4.7.4. The Middle-East and Africa Mitigation Banking Market, by Application, 2015-2025 78

4.7.4.1. The Middle-East and Africa Mitigation Banking Market, by Application, 2015-2025 (USD Million) 78

4.7.5. Saudi Arabia 79

4.7.5.1. Saudi Arabia Market size and forecast, 2015-2025 (USD Million) 79

4.7.6. UAE 80

4.7.6.1. UAE Market size and forecast, 2015-2025 (USD Million) 80

4.7.7. Egypt 81

4.7.7.1. Egypt Market size and forecast, 2015-2025 (USD Million) 81

4.7.8. Kuwait 82

4.7.8.1. Kuwait Market size and forecast, 2015-2025 (USD Million) 82

4.7.9. South Africa 83

4.7.9.1. South Africa Market size and forecast, 2015-2025 (USD Million) 83

4.7.10. Rest of Middle-East Africa 84

4.7.10.1. Rest of Middle-East Africa Market size and forecast, 2015-2025 (USD Million) 84

CHAPTER 5. Mitigation Banking market – Competitive Landscape 85

5.1. Competitor Market Share – Revenue 85

5.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 87

5.3. Strategic Development 88

5.3.1. Acquisitions and Mergers 88

5.3.2. New Products 88

5.3.3. Research & Development Activities 88

CHAPTER 6. Company Profiles 89

6.1. Alafia River Wetland Mitigation Bank, Inc. 89

6.1.1. Company Overview 89

6.1.2. Alafia River Wetland Mitigation Bank, Inc. Revenue and Gross Margin 89

6.1.3. Product portfolio 90

6.1.4. Recent initiatives 91

6.2. Burns & McDonnell 91

6.2.1. Company Overview 91

6.2.2. Burns & McDonnell Revenue and Gross Margin 91

6.2.3. Product portfolio 92

6.2.4. Recent initiatives 93

6.3. EarthBalance 93

6.3.1. Company Overview 93

6.3.2. EarthBalance Revenue and Gross Margin 93

6.3.3. Product portfolio 94

6.3.4. Recent initiatives 95

6.4. Ecosystem Services, LLC 95

6.4.1. Company Overview 95

6.4.2. Ecosystem Services, LLC Revenue and Gross Margin 95

6.4.3. Product portfolio 96

6.4.4. Recent initiatives 97

6.5. Habitat Bank LLC 97

6.5.1. Company Overview 97

6.5.2. Habitat Bank LLC Revenue and Gross Margin 97

6.5.3. Product portfolio 98

6.5.4. Recent initiatives 99

6.6. The Mitigation Banking Group, Inc. 99

6.6.1. Company Overview 99

6.6.2. The Mitigation Banking Group, Inc. Revenue and Gross Margin 99

6.6.3. Product portfolio 100

6.6.4. Recent initiatives 101

6.7. Ecosystem Investment Partners 101

6.7.1. Company Overview 101

6.7.2. Ecosystem Investment Partners Revenue and Gross Margin 101

6.7.3. Product portfolio 102

6.7.4. Recent initiatives 103

6.8. The Wetlandsbank Company (TWC) 103

6.8.1. Company Overview 103

6.8.2. The Wetlandsbank Company (TWC) Revenue and Gross Margin 103

6.8.3. Product portfolio 104

6.8.4. Recent initiatives 105

6.9. Wetland Studies and Solutions, Inc. 105

6.9.1. Company Overview 105

6.9.2. Wetland Studies and Solutions, Inc. Revenue and Gross Margin 105

6.9.3. Product portfolio 106

6.9.4. Recent initiatives 107

6.10. Weyerhaeuser 107

6.10.1. Company Overview 107

6.10.2. Weyerhaeuser Revenue and Gross Margin 107

6.10.3. Product portfolio 108

6.10.4. Recent initiatives 109

6.11. LJA Environmental Services, Inc. 109

6.11.1. Company Overview 109

6.11.2. LJA Environmental Services, Inc. Revenue and Gross Margin 109

6.11.3. Product portfolio 110

6.11.4. Recent initiatives 111

6.12. Wildwood Environmental Credit Company 111

6.12.1. Company Overview 111

6.12.2. Wildwood Environmental Credit Company Revenue and Gross Margin 111

6.12.3. Product portfolio 112

6.12.4. Recent initiatives 113

6.13. WRA, Inc. 113

6.13.1. Company Overview 113

6.13.2. WRA, Inc. Revenue and Gross Margin 113

6.13.3. Product portfolio 114

6.13.4. Recent initiatives 115

6.14. The Loudermilk Companies, LLC 115

6.14.1. Company Overview 115

6.14.2. The Loudermilk Companies, LLC Revenue and Gross Margin 115

6.14.3. Product portfolio 116

6.14.4. Recent initiatives 117

6.15. Great Ecology 117

6.15.1. Company Overview 117

6.15.2. Great Ecology Revenue and Gross Margin 117

6.15.3. Product portfolio 118

6.15.4. Recent initiatives 119

6.16. Mitigation Credit Services, LLC 119

6.16.1. Company Overview 119

6.16.2. Mitigation Credit Services, LLC Revenue and Gross Margin 119

6.16.3. Product portfolio 120

6.16.4. Recent initiatives 121

CHAPTER 7. Mitigation Banking — Industry Analysis 122

7.1. Mitigation Banking Market – Key Trends 122

7.1.1. Market Drivers 123

7.1.2. Market Restraints 123

7.1.3. Market Opportunities 124

7.2. Value Chain Analysis 125

7.3. Technology Roadmap and Timeline 126

7.4. Mitigation Banking Market – Attractiveness Analysis 127

7.4.1. By Type 127

7.4.2. By Application 127

7.4.3. By Region 129

CHAPTER 8. Marketing Strategy Analysis, Distributors 130

8.1. Marketing Channel 130

8.2. Direct Marketing 131

8.3. Indirect Marketing 131

8.4. Marketing Channel Development Trend 131

8.5. Economic/Political Environmental Change 132

CHAPTER 9. Report Conclusion 133

CHAPTER 10. Research Approach & Methodology 134

10.1. Report Description 134

10.2. Research Scope 135

10.3. Research Methodology 135

10.3.1. Secondary Research 136

10.3.2. Primary Research 137

10.3.3. Models 138

10.3.3.1. Company Share Analysis Model 138

10.3.3.2. Revenue Based Modeling 139

10.3.3.3. Research Limitations 139

Inquiry For Buying

Mitigation Banking

Request Sample

Mitigation Banking