Outdoor Education Market Size, Share, and Trends Analysis Report

CAGR :

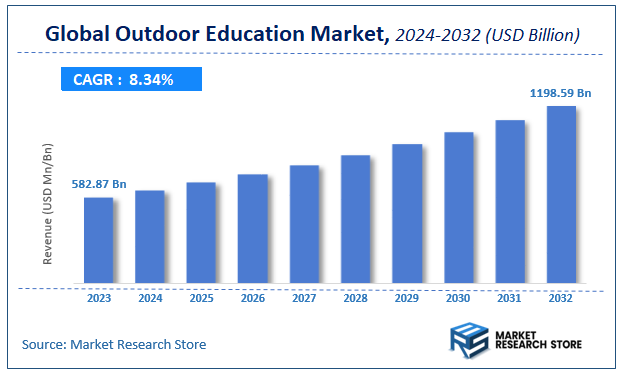

| Market Size 2023 (Base Year) | USD 582.87 Billion |

| Market Size 2032 (Forecast Year) | USD 1198.59 Billion |

| CAGR | 8.34% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Outdoor Education Market Insights

According to Market Research Store, the global outdoor education market size was valued at around USD 582.87 billion in 2023 and is estimated to reach USD 1198.59 billion by 2032, to register a CAGR of approximately 8.34% in terms of revenue during the forecast period 2024-2032.

The outdoor education report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Outdoor Education Market: Overview

Outdoor education is a structured learning approach that takes place in natural environments, integrating experiential, adventure-based, and environmental learning activities to promote personal development, social skills, and academic enrichment. It emphasizes direct interaction with the outdoors through activities such as hiking, camping, team-building exercises, wilderness survival training, ecological studies, and field-based science education. This educational model is applied across schools, youth organizations, and therapeutic programs, offering participants hands-on experiences that foster critical thinking, problem-solving, resilience, and a deeper connection to the environment.

The growth of outdoor education is driven by increasing recognition of its benefits in promoting physical health, emotional well-being, and environmental awareness, especially in contrast to technology-driven indoor lifestyles. Educators and policymakers are increasingly incorporating outdoor learning into curricula to enhance student engagement, reduce stress, and improve cognitive performance. Additionally, global interest in sustainability and climate change education has further elevated the role of outdoor education in nurturing ecological literacy and responsible citizenship. As both formal and informal education sectors strive to create holistic learning experiences, outdoor education is gaining momentum as a vital complement to traditional classroom instruction.

Key Highlights

- The outdoor education market is anticipated to grow at a CAGR of 8.34% during the forecast period.

- The global outdoor education market was estimated to be worth approximately USD 582.87 billion in 2023 and is projected to reach a value of USD 1198.59 billion by 2032.

- The growth of the outdoor education market is being driven by increasing emphasis on experiential learning, rising awareness of the mental and physical health benefits associated with nature-based activities, and growing demand for holistic, student-centered educational models.

- Based on the age-group, the less than 15 years segment is growing at a high rate and is projected to dominate the market.

- On the basis of duration, the less than 7 days segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Outdoor Education Market: Dynamics

Key Growth Drivers:

- Growing Recognition of the Holistic Benefits of Outdoor Learning: There is increasing research and public awareness about the positive impact of outdoor education on mental, physical, and emotional well-being. Activities in nature have been shown to reduce stress, improve concentration, and foster resilience, creativity, and problem-solving skills. This is a significant driver, as parents, educators, and organizations are actively seeking these benefits for children and adults alike.

- Post-Pandemic Shift in Educational and Recreational Preferences: The COVID-19 pandemic highlighted the limitations of indoor, screen-based learning and spurred a renewed interest in outdoor activities. People are increasingly seeking nature-based experiences for both recreation and education, fueling a demand for programs that offer a blend of adventure, learning, and personal growth.

- Government Support and Policy Integration: In some regions, governments and educational bodies are recognizing the value of outdoor education and integrating it into formal curricula. Policies that support and fund outdoor learning initiatives, whether through school-based programs or partnerships with non-profit organizations, are a key driver that legitimizes and expands the market.

- Rise of Experiential and Interdisciplinary Learning: The outdoor education market is benefiting from a broader shift in pedagogy towards experiential and hands-on learning. Outdoor settings provide a natural laboratory for subjects like science, geography, and history. This interdisciplinary approach makes learning more engaging and relevant, appealing to students who may struggle in a traditional classroom environment.

Restraints:

- High Costs and Financial Barriers: The cost of outdoor education programs, including specialized equipment, trained staff, transportation, and accommodation, can be a major barrier for many families and schools. Financial constraints can limit access for students from low-income backgrounds and for public schools with limited budgets, leading to inequality in opportunity.

- Safety and Liability Concerns: Outdoor activities inherently carry certain risks, and concerns about student safety are a significant restraint for schools and parents. The potential for accidents, injuries, or adverse weather conditions, coupled with the liability associated with these risks, can make institutions hesitant to implement or endorse outdoor education programs.

- Lack of Trained Educators and Infrastructure: A shortage of teachers and facilitators with the necessary skills and certifications to lead outdoor activities is a major challenge. Many educators lack confidence in their ability to teach effectively in outdoor settings. Additionally, a lack of accessible and well-maintained outdoor spaces and infrastructure can hinder the implementation of programs.

- Competition from Digital Education and Traditional Sports: The market faces competition from the dominant trends of digital education and organized sports. As schools and parents allocate time and resources, outdoor education programs must compete with the allure of technology-based learning and the popularity of traditional team sports, which often have established funding and infrastructure.

Opportunities:

- Development of Specialized and Niche Programs: There is a significant opportunity to develop programs that cater to specific interests and needs, such as wilderness therapy for mental health, sustainability and conservation-focused courses, or adventure programs tailored for corporate team building. This specialization can create new market segments and appeal to a broader clientele.

- Integration with Technology: Technology, rather than being a competitor, can be integrated to enhance outdoor education. This includes the use of GPS-enabled devices for navigation, virtual reality (VR) to prepare for expeditions, and mobile apps for identifying flora and fauna. This blend of technology and nature can make programs more engaging and accessible.

- Targeting the Adult and Corporate Market: While a significant portion of the market is focused on youth, there is a growing opportunity to expand into the adult and corporate sectors. Adventure-based learning and wilderness retreats are gaining popularity for leadership development, employee well-being, and team cohesion, offering a new avenue for growth.

- Leveraging the "Green" and Sustainable Tourism Trend: The rise of eco-tourism and sustainable travel aligns perfectly with the values of outdoor education. Businesses in this market can partner with sustainable tourism providers to offer programs that not only educate participants but also promote environmental stewardship, capitalizing on a growing consumer trend.

Challenges:

- Ensuring Inclusivity and Accessibility: A key challenge is to make outdoor education accessible to a diverse range of people, including those with physical disabilities, different cultural backgrounds, or from urban, low-income communities. Overcoming barriers such as cost, transportation, and a lack of representative role models is critical for the long-term health of the market.

- Navigating Evolving Environmental Conditions: The outdoor education market is highly sensitive to environmental factors, including climate change and extreme weather events. The challenge is to adapt programs and safety protocols to a changing environment, which can include managing heatwaves, wildfires, or other natural disasters that could impact the safety and feasibility of outdoor activities.

- Demonstrating Clear Educational Outcomes: A persistent challenge is to quantify and demonstrate the educational value of outdoor programs in a way that resonates with schools and parents who are focused on standardized testing and academic performance. Providing clear metrics on skill development and learning outcomes is crucial for justifying the investment in these programs.

- Standardization and Professionalization: The outdoor education market is often fragmented, with a wide variety of providers and a lack of standardized certifications and quality control. This can lead to inconsistent program quality and safety standards. The challenge is to professionalize the industry through standardized training, accreditation, and a clear code of ethics.

Outdoor Education Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Outdoor Education Market |

| Market Size in 2023 | USD 582.87 Billion |

| Market Forecast in 2032 | USD 1198.59 Billion |

| Growth Rate | CAGR of 8.34% |

| Number of Pages | 220 |

| Key Companies Covered | Breckenridge Outdoor Education Center, Colorado Outdoor Education Center, Environmental Education Commission, Los Angeles Unified School District Office of Outdoor & Environmental Education, National Outdoor Leadership School, Northern Michigan University, Outdoor Education Center, Outward Bound, San Mateo County Office of Education, Strathcona Park Lodge & Outdoor Education Centre, The Guelph Outdoor School, The Irvine Ranch Outdoor Education Center, Ventures Outdoor Education, Wildwood Outdoor Education Center, Yale University, and The National Center for Outdoor & Adventure Education |

| Segments Covered | By Age-Group, By Duration, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Outdoor Education Market: Segmentation Insights

The global outdoor education market is divided by age-group, duration, and region.

Based on age-group, the global outdoor education market is divided into less than 15 years, 15 to 20 years, 20 to 30 years, and 30 years & more. Less than 15 Years is the dominant age-group segment in the Outdoor Education Market, driven by the widespread inclusion of outdoor learning in school curricula and youth development programs. This group benefits from nature-based learning, environmental awareness activities, adventure camps, and team-building exercises that promote cognitive, emotional, and physical development. Educational institutions, non-profit organizations, and government initiatives frequently target this demographic to enhance early childhood education through experiential and play-based learning.

On the basis of duration, the global outdoor education market is bifurcated into less than 7 days, 7 to 15 days, 15 to 30 days, and more than 30 days. Less than 7 Days is the dominant duration segment in the Outdoor Education Market, primarily due to its alignment with school schedules, weekend retreats, and short-term corporate or community programs. These programs typically include day trips, weekend camps, and 3–5-day residential outdoor experiences that are easy to organize, cost-effective, and accessible for participants of all age groups. Schools, youth organizations, and educational institutions prefer this format for introducing outdoor learning without disrupting academic calendars. Its flexibility and scalability make it the most widely adopted duration across global markets.

Outdoor Education Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Outdoor Education Market, supported by a long-standing cultural emphasis on experiential learning, abundant natural landscapes, and well-established institutional frameworks. The United States and Canada have integrated outdoor education into school curriculums, summer camps, scouting programs, and nonprofit environmental initiatives. Organizations such as Outward Bound, National Outdoor Leadership School (NOLS), and numerous regional wilderness programs have institutionalized structured outdoor learning across age groups. The growing awareness of the mental health benefits of nature-based learning, especially post-pandemic, has also led to an increase in outdoor preschool models and school-led field expeditions. Additionally, outdoor education is widely adopted in higher education and corporate team-building programs, reinforcing its growth across diverse age brackets.

Asia Pacific is an emerging and fast-growing region in the Outdoor Education Market, driven by increasing interest in holistic and experiential learning among educators and parents. Countries such as Australia, New Zealand, Japan, South Korea, and India are gradually expanding outdoor education programs through schools, universities, and independent organizations. Australia and New Zealand, in particular, have strong outdoor recreation cultures, where schools actively conduct adventure learning, bushcraft, and ecological studies as part of formal education. In East Asia, academic pressure traditionally limited outdoor learning, but growing awareness of mental health, physical well-being, and life skills is encouraging more schools to adopt nature-based education models. The region also sees increasing integration of indigenous ecological knowledge into outdoor learning frameworks.

Europe is the second-largest region in the outdoor education market, with a rich history of incorporating nature-based learning into formal education systems. Countries like the United Kingdom, Germany, Sweden, and Norway have embedded forest schools, adventure-based learning, and environmental education into their national curriculums. Scandinavian countries, in particular, have led the way with philosophies such as "friluftsliv" (open-air life), which promote outdoor learning from early childhood. Government support, structured policy integration, and public-private collaboration have enabled the sustained development of outdoor education facilities and teacher training across the region. The growing demand for sustainable living and environmental stewardship further drives outdoor learning adoption in both rural and urban settings.

Latin America is experiencing a gradual expansion of the outdoor education market, especially in countries like Brazil, Chile, and Argentina. While traditionally focused on classroom-based education, the region is witnessing a shift toward inclusive, activity-based learning due to growing environmental concerns and recognition of the benefits of hands-on education. Eco-tourism, community-based conservation programs, and national park initiatives are increasingly collaborating with schools and NGOs to deliver outdoor learning experiences. However, disparities in access, funding, and teacher training pose challenges to widespread adoption, particularly in rural and low-income areas. Nevertheless, localized programs in biodiversity-rich regions are paving the way for the market’s future growth.

Middle East & Africa remains a developing region in the outdoor education landscape, with growing but uneven progress. In the Middle East, countries such as the United Arab Emirates and Saudi Arabia are promoting outdoor education through school-based environmental awareness programs and outdoor adventure curricula. These initiatives are supported by government efforts to promote sustainability and diversify educational experiences. In Africa, outdoor education is often community-led or tied to conservation education around national parks and reserves. South Africa, Kenya, and Ghana are notable for their integration of ecological education with wildlife conservation efforts. However, limited resources, urbanization, and infrastructural challenges continue to restrict broad market development across many parts of the region.

Outdoor Education Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the outdoor education market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global outdoor education market include:

- Breckenridge Outdoor Education Center

- Colorado Outdoor Education Center

- Environmental Education Commission

- National Outdoor Leadership School

- Northern Michigan University

- Los Angeles Unified School District Office of Outdoor & Environmental Education

- Outward Bound

- Strathcona Park Lodge & Outdoor Education Centre

- The Guelph Outdoor School

- San Mateo County Office of Education

- The Irvine Ranch Outdoor Education Center

- Ventures Outdoor Education

- Wildwood Outdoor Education Center

- Yale University

- The National Center for Outdoor & Adventure Education.

The global outdoor education market is segmented as follows:

By Age-Group

- Less than 15 years

- 15 to 20 years

- 20 to 30 years

- 30 years & more

By Duration

- Less than 7 days

- 7 to 15 days

- 15 to 30 days

- More than 30 days

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 21 CHAPTER 2. Outdoor Education market – Age-Group Analysis 23 2.1. Global Outdoor Education Market – Age-Group Overview 23 2.2. Global Outdoor Education Market Share, by Age-Group, 2018 & 2025 (USD Million) 23 2.3. Less than 15 years 24 2.3.1. Global Less than 15 years Outdoor Education Market, 2015-2025 (USD Million) 24 2.4. 15 to 20 years 25 2.4.1. Global 15 to 20 years Outdoor Education Market, 2015-2025 (USD Million) 25 2.5. 20 to 30 years 26 2.5.1. Global 20 to 30 years Outdoor Education Market, 2015-2025 (USD Million) 26 2.6. 30 years & more 27 2.6.1. Global 30 years & more Outdoor Education Market, 2015-2025 (USD Million) 27 CHAPTER 3. Outdoor Education market – Duration Analysis 28 3.1. Global Outdoor Education Market – Duration Overview 28 3.2. Global Outdoor Education Market Share, by Duration, 2018 & 2025 (USD Million) 28 3.3. Less than 7 days 29 3.3.1. Global Less than 7 days Outdoor Education Market, 2015-2025 (USD Million) 29 3.4. 7 to 15 days 30 3.4.1. Global 7 to 15 days Outdoor Education Market, 2015-2025 (USD Million) 30 3.5. 15 to 30 days 31 3.5.1. Global 15 to 30 days Outdoor Education Market, 2015-2025 (USD Million) 31 3.6. More than 30 days 32 3.6.1. Global More than 30 days Outdoor Education Market, 2015-2025 (USD Million) 32 CHAPTER 4. Outdoor Education market – Regional Analysis 33 4.1. Global Outdoor Education Market Regional Overview 33 4.2. Global Outdoor Education Market Share, by Region, 2018 & 2025 (Value) 33 4.3. North America 34 4.3.1. North America Outdoor Education Market size and forecast, 2015-2025 34 4.3.2. North America Outdoor Education Market, by Country, 2018 & 2025 (USD Million) 35 4.3.3. North America Outdoor Education Market, by Age-Group, 2015-2025 35 4.3.3.1. North America Outdoor Education Market, by Age-Group, 2015-2025 (USD Million) 35 4.3.4. North America Outdoor Education Market, by Duration, 2015-2025 36 4.3.4.1. North America Outdoor Education Market, by Duration, 2015-2025 (USD Million) 36 4.3.5. U.S. 37 4.3.5.1. U.S. Market size and forecast, 2015-2025 (USD Million) 37 4.3.6. Canada 38 4.3.6.1. Canada Market size and forecast, 2015-2025 (USD Million) 38 4.3.7. Mexico 39 4.3.7.1. Mexico Market size and forecast, 2015-2025 (USD Million) 39 4.4. Europe 40 4.4.1. Europe Outdoor Education Market size and forecast, 2015-2025 40 4.4.2. Europe Outdoor Education Market, by Country, 2018 & 2025 (USD Million) 41 4.4.3. Europe Outdoor Education Market, by Age-Group, 2015-2025 42 4.4.3.1. Europe Outdoor Education Market, by Age-Group, 2015-2025 (USD Million) 42 4.4.4. Europe Outdoor Education Market, by Duration, 2015-2025 42 4.4.4.1. Europe Outdoor Education Market, by Duration, 2015-2025 (USD Million) 42 4.4.5. Germany 43 4.4.5.1. Germany Market size and forecast, 2015-2025 (USD Million) 43 4.4.6. France 44 4.4.6.1. France Market size and forecast, 2015-2025 (USD Million) 44 4.4.7. U.K. 45 4.4.7.1. U.K. Market size and forecast, 2015-2025 (USD Million) 45 4.4.8. Italy 46 4.4.8.1. Italy Market size and forecast, 2015-2025 (USD Million) 46 4.4.9. Spain 47 4.4.9.1. Spain Market size and forecast, 2015-2025 (USD Million) 47 4.4.10. Nordic Countries 48 4.4.10.1. Nordic Countries Market size and forecast, 2015-2025 (USD Million) 48 4.4.11. Benelux Union 49 4.4.11.1. Benelux Union Market size and forecast, 2015-2025 (USD Million) 49 4.4.12. Rest of Europe 50 4.4.12.1. Rest of Europe Market size and forecast, 2015-2025 (USD Million) 50 4.5. Asia Pacific 51 4.5.1. Asia Pacific Outdoor Education Market size and forecast, 2015-2025 51 4.5.2. Asia Pacific Outdoor Education Market, by Country, 2018 & 2025 (USD Million) 52 4.5.3. Asia Pacific Outdoor Education Market, by Age-Group, 2015-2025 53 4.5.3.1. Asia Pacific Outdoor Education Market, by Age-Group, 2015-2025 (USD Million) 53 4.5.4. Asia Pacific Outdoor Education Market, by Duration, 2015-2025 53 4.5.4.1. Asia Pacific Outdoor Education Market, by Duration, 2015-2025 (USD Million) 53 4.5.5. China 54 4.5.5.1. China Market size and forecast, 2015-2025 (USD Million) 54 4.5.6. Japan 55 4.5.6.1. Japan Market size and forecast, 2015-2025 (USD Million) 55 4.5.7. India 56 4.5.7.1. India Market size and forecast, 2015-2025 (USD Million) 56 4.5.8. New Zealand 57 4.5.8.1. New Zealand Market size and forecast, 2015-2025 (USD Million) 57 4.5.9. Australia 58 4.5.9.1. Australia Market size and forecast, 2015-2025 (USD Million) 58 4.5.10. South Korea 59 4.5.10.1. South Korea Market size and forecast, 2015-2025 (USD Million) 59 4.5.11. South-East Asia 60 4.5.11.1. South-East Asia Market size and forecast, 2015-2025 (USD Million) 60 4.5.12. Rest of Asia Pacific 61 4.5.12.1. Rest of Asia Pacific Market size and forecast, 2015-2025 (USD Million) 61 4.6. Latin America 62 4.6.1. Latin America Outdoor Education Market size and forecast, 2015-2025 62 4.6.2. Latin America Outdoor Education Market, by Country, 2018 & 2025 (USD Million) 62 4.6.3. Latin America Outdoor Education Market, by Age-Group, 2015-2025 64 4.6.3.1. Latin America Outdoor Education Market, by Age-Group, 2015-2025 (USD Million) 64 4.6.4. Latin America Outdoor Education Market, by Duration, 2015-2025 65 4.6.4.1. Latin America Outdoor Education Market, by Duration, 2015-2025 (USD Million) 65 4.6.5. Brazil 66 4.6.5.1. Brazil Market size and forecast, 2015-2025 (USD Million) 66 4.6.6. Argentina 67 4.6.6.1. Argentina Market size and forecast, 2015-2025 (USD Million) 67 4.6.7. Rest of Latin America 68 4.6.7.1. Rest of Latin America Market size and forecast, 2015-2025 (USD Million) 68 4.7. The Middle-East and Africa 69 4.7.1. The Middle-East and Africa Outdoor Education Market size and forecast, 2015-2025 69 4.7.2. The Middle-East and Africa Outdoor Education Market, by Country, 2018 & 2025 (USD Million) 69 4.7.3. The Middle-East and Africa Outdoor Education Market, by Age-Group, 2015-2025 71 4.7.3.1. The Middle-East and Africa Outdoor Education Market, by Age-Group, 2015-2025 (USD Million) 71 4.7.4. The Middle-East and Africa Outdoor Education Market, by Duration, 2015-2025 72 4.7.4.1. The Middle-East and Africa Outdoor Education Market, by Duration, 2015-2025 (USD Million) 72 4.7.5. Saudi Arabia 73 4.7.5.1. Saudi Arabia Market size and forecast, 2015-2025 (USD Million) 73 4.7.6. UAE 74 4.7.6.1. UAE Market size and forecast, 2015-2025 (USD Million) 74 4.7.7. Egypt 75 4.7.7.1. Egypt Market size and forecast, 2015-2025 (USD Million) 75 4.7.8. Kuwait 76 4.7.8.1. Kuwait Market size and forecast, 2015-2025 (USD Million) 76 4.7.9. South Africa 77 4.7.9.1. South Africa Market size and forecast, 2015-2025 (USD Million) 77 4.7.10. Rest of Middle-East Africa 78 4.7.10.1. Rest of Middle-East Africa Market size and forecast, 2015-2025 (USD Million) 78 CHAPTER 5. Outdoor Education market – Competitive Landscape 79 5.1. Competitor Market Share – Revenue 79 5.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 81 5.3. Strategic Development 82 5.3.1. Acquisitions and Mergers 82 5.3.2. New Products 82 5.3.3. Research & Development Activities 82 CHAPTER 6. Company Profiles 83 6.1. Breckenridge Outdoor Education Center 83 6.1.1. Company Overview 83 6.1.2. Breckenridge Outdoor Education Center Revenue and Gross Margin 83 6.1.3. Product portfolio 84 6.1.4. Recent initiatives 85 6.2. Colorado Outdoor Education Center 85 6.2.1. Company Overview 85 6.2.2. Colorado Outdoor Education Center Revenue and Gross Margin 85 6.2.3. Product portfolio 86 6.2.4. Recent initiatives 87 6.3. Environmental Education Commission 87 6.3.1. Company Overview 87 6.3.2. Environmental Education Commission Revenue and Gross Margin 87 6.3.3. Product portfolio 88 6.3.4. Recent initiatives 89 6.4. Los Angeles Unified School District Office of Outdoor & Environmental Education 89 6.4.1. Company Overview 89 6.4.2. Los Angeles Unified School District Office of Outdoor & Environmental Education Revenue and Gross Margin 89 6.4.3. Product portfolio 90 6.4.4. Recent initiatives 92 6.5. National Outdoor Leadership School 92 6.5.1. Company Overview 92 6.5.2. National Outdoor Leadership School Revenue and Gross Margin 92 6.5.3. Product portfolio 93 6.5.4. Recent initiatives 94 6.6. Northern Michigan University 94 6.6.1. Company Overview 94 6.6.2. Northern Michigan University Revenue and Gross Margin 94 6.6.3. Product portfolio 95 6.6.4. Recent initiatives 96 6.7. Outdoor Education Center 96 6.7.1. Company Overview 96 6.7.2. Outdoor Education Center Revenue and Gross Margin 96 6.7.3. Product portfolio 97 6.7.4. Recent initiatives 98 6.8. Outward Bound 98 6.8.1. Company Overview 98 6.8.2. Outward Bound Revenue and Gross Margin 98 6.8.3. Product portfolio 99 6.8.4. Recent initiatives 100 6.9. San Mateo County Office of Education 100 6.9.1. Company Overview 100 6.9.2. San Mateo County Office of Education Revenue and Gross Margin 100 6.9.3. Product portfolio 101 6.9.4. Recent initiatives 102 6.10. Strathcona Park Lodge & Outdoor Education Centre 102 6.10.1. Company Overview 102 6.10.2. Strathcona Park Lodge & Outdoor Education Centre Revenue and Gross Margin 102 6.10.3. Product portfolio 103 6.10.4. Recent initiatives 104 6.11. The Guelph Outdoor School 104 6.11.1. Company Overview 104 6.11.2. The Guelph Outdoor School Revenue and Gross Margin 104 6.11.3. Product portfolio 105 6.11.4. Recent initiatives 106 6.12. The Irvine Ranch Outdoor Education Center 106 6.12.1. Company Overview 106 6.12.2. The Irvine Ranch Outdoor Education Center Revenue and Gross Margin 106 6.12.3. Product portfolio 107 6.12.4. Recent initiatives 108 6.13. Ventures Outdoor Education 108 6.13.1. Company Overview 108 6.13.2. Ventures Outdoor Education Revenue and Gross Margin 108 6.13.3. Product portfolio 109 6.13.4. Recent initiatives 110 6.14. Wildwood Outdoor Education Center 110 6.14.1. Company Overview 110 6.14.2. Wildwood Outdoor Education Center Revenue and Gross Margin 110 6.14.3. Product portfolio 111 6.14.4. Recent initiatives 112 6.15. Yale University 112 6.15.1. Company Overview 112 6.15.2. Yale University Revenue and Gross Margin 112 6.15.3. Product portfolio 113 6.15.4. Recent initiatives 114 6.16. The National Center for Outdoor & Adventure Education 114 6.16.1. Company Overview 114 6.16.2. The National Center for Outdoor & Adventure Education Revenue and Gross Margin 114 6.16.3. Product portfolio 115 6.16.4. Recent initiatives 116 CHAPTER 7. Outdoor Education — Industry Analysis 117 7.1. Outdoor Education Market – Key Trends 117 7.1.1. Market Drivers 118 7.1.2. Market Restraints 118 7.1.3. Market Opportunities 119 7.2. Value Chain Analysis 120 7.3. Technology Roadmap and Timeline 121 7.4. Outdoor Education Market – Attractiveness Analysis 122 7.4.1. By Age-Group 122 7.4.2. By Duration 122 7.4.3. By Region 124 CHAPTER 8. Marketing Strategy Analysis, Distributors 125 8.1. Marketing Channel 125 8.2. Direct Marketing 126 8.3. Indirect Marketing 126 8.4. Marketing Channel Development Trend 126 8.5. Economic/Political Environmental Change 127 CHAPTER 9. Report Conclusion 128 CHAPTER 10. Research Approach & Methodology 129 10.1. Report Description 129 10.2. Research Scope 130 10.3. Research Methodology 130 10.3.1. Secondary Research 131 10.3.2. Primary Research 132 10.3.3. Models 133 10.3.3.1. Company Share Analysis Model 133 10.3.3.2. Revenue Based Modeling 134 10.3.3.3. Research Limitations 134

Inquiry For Buying

Outdoor Education

Request Sample

Outdoor Education