Patient Recliners Market Size, Share, and Trends Analysis Report

CAGR :

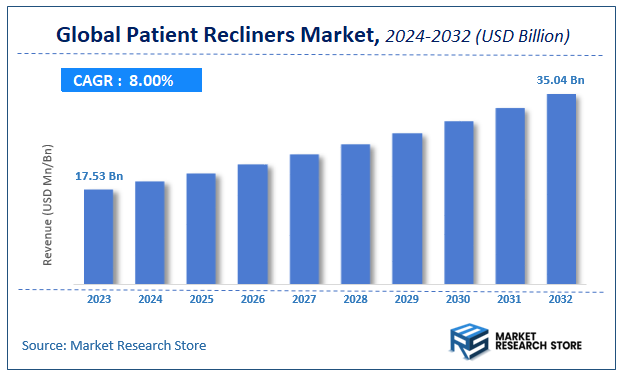

| Market Size 2023 (Base Year) | USD 17.53 Billion |

| Market Size 2032 (Forecast Year) | USD 35.04 Billion |

| CAGR | 8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Patient Recliners Market Insights

According to Market Research Store, the global patient recliners market size was valued at around USD 17.53 billion in 2023 and is estimated to reach USD 35.04 billion by 2032, to register a CAGR of approximately 8% in terms of revenue during the forecast period 2024-2032.

The patient recliners report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Patient Recliners Market: Overview

Patient recliners are specialized seating solutions designed to provide comfort, support, and mobility for patients in healthcare settings such as hospitals, clinics, rehabilitation centers, and long-term care facilities. These recliners are typically adjustable, allowing for multiple seating and reclining positions to accommodate various patient needs, such as rest, treatment, or recovery. Key features often include padded armrests, ergonomic back and leg support, caster wheels for portability, locking mechanisms for safety, and optional accessories like IV poles, trays, or incontinence-friendly upholstery.

The growth of the patient recliners market is driven by increasing hospital admissions, a growing elderly population, and the rising demand for patient-centered care environments that enhance comfort and mobility. Healthcare facilities are investing in advanced recliners that support therapeutic applications, including dialysis, chemotherapy, and postoperative recovery, thereby reducing the need for constant repositioning or transfer to beds. Technological advancements in materials and design like antimicrobial fabrics, motorized adjustments, and bariatric models are also improving hygiene, accessibility, and durability. As healthcare providers continue to focus on improving patient experience and operational efficiency, the adoption of versatile and ergonomic patient recliners is expanding across both acute and long-term care settings.

Key Highlights

- The patient recliners market is anticipated to grow at a CAGR of 8% during the forecast period.

- The global patient recliners market was estimated to be worth approximately USD 17.53 billion in 2023 and is projected to reach a value of USD 35.04 billion by 2032.

- The growth of the patient recliners market is being driven by the rising demand for enhanced patient comfort, the growing elderly population, increasing hospital admissions, and the expansion of healthcare infrastructure globally.

- Based on the type, the patient room recliners segment is growing at a high rate and is projected to dominate the market.

- On the basis of weighing capacity, the less than 250 lbs segment is projected to swipe the largest market share.

- In terms of end-user, the hospitals segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Patient Recliners Market: Dynamics

Key Growth Drivers:

- Aging Global Population and Rising Chronic Diseases: A significant driver is the increasing number of elderly people worldwide. This demographic often requires long-term care and has a higher prevalence of chronic conditions like arthritis and cardiovascular diseases. Patient recliners provide a comfortable, supportive, and safe seating option for these patients, both in healthcare facilities and at home.

- Emphasis on Patient Comfort and Experience: Healthcare providers are increasingly recognizing the importance of patient comfort in the overall recovery process and for improving patient satisfaction scores. Patient recliners offer ergonomic support, help prevent pressure sores, and provide a more comfortable alternative to beds for patients who are able to sit up, thereby enhancing their experience during hospital stays or outpatient treatments.

- Expansion of Outpatient and Homecare Services: There is a notable shift in healthcare delivery from traditional inpatient settings to outpatient care and homecare. This trend is fueling the demand for patient recliners that are versatile, easy to use, and suitable for non-hospital environments. Recliners designed for home use and rehabilitation centers are a key segment of this market.

- Technological Advancements and Product Innovation: The market is being propelled by the integration of technology and advanced materials. This includes the development of electric recliners with motorized reclining mechanisms, advanced ergonomic designs, and the use of antimicrobial and easy-to-clean fabrics. The focus is on creating multi-functional recliners that can be used for a variety of purposes, from examination to transport.

Restraints:

- High Cost of Advanced Recliners: While basic recliners are relatively affordable, advanced and specialized models with features like electric controls, integrated health monitoring, and bariatric capacity can be very expensive. This high cost can be a significant barrier for smaller healthcare facilities or for individual patients who do not have adequate insurance coverage.

- Maintenance and Durability Concerns: In a high-traffic environment like a hospital, patient recliners are subject to heavy use and can be damaged. The cost and complexity of maintaining these recliners, especially the advanced electrical components, can be a deterrent. Concerns about the long-term durability and potential for costly repairs can be a restraint on purchasing decisions.

- Competition from Traditional Seating Solutions: The patient recliners market faces competition from a wide range of traditional seating and hospital furniture. While recliners offer superior functionality, some institutions may opt for more conventional chairs or standard hospital beds for cost-saving reasons, especially in developing regions where budgets are tight.

- Lack of Awareness in Developing Regions: In many developing nations, there is a lack of awareness about the specific benefits of patient recliners over standard chairs. A traditional focus on basic, low-cost equipment, coupled with a lack of established healthcare infrastructure, means that the adoption of specialized recliners is often slow.

Opportunities:

- Customization and Specialization for Niche Markets: There is a significant opportunity to develop highly customized recliners for specific patient needs and clinical applications. This includes recliners for dialysis, cardiac care, bariatric patients, and pediatrics. By offering specialized solutions, manufacturers can tap into niche markets and provide a better fit for a variety of healthcare settings.

- Integration of Smart Technology and IoT: The market can be enhanced by integrating smart technologies into patient recliners. This includes embedding sensors for health monitoring (e.g., heart rate, temperature), providing connectivity for data transfer to EHRs, and offering features like USB charging ports. This move from a simple piece of furniture to a smart medical device is a major opportunity.

- Expansion into Emerging Markets: As developing economies in the Asia-Pacific and Latin America regions invest in their healthcare infrastructure, there is a vast, untapped market for patient recliners. Companies can focus on providing cost-effective, high-quality products to these regions, which are experiencing a rapid growth in their aging and chronically ill populations.

- Leveraging Online Distribution Channels: The proliferation of e-commerce and online marketplaces offers a significant opportunity for market growth. This channel allows manufacturers to reach a broader customer base, including individual patients and smaller clinics, and to showcase their product's features with rich media content, thereby increasing sales and brand visibility.

Challenges:

- Ensuring Patient and Caregiver Safety: A key challenge is to ensure that patient recliners are designed with a primary focus on safety for both the patient and the caregiver. This includes preventing falls, providing easy patient transfers, and ensuring that the electrical components are safe and reliable. Compliance with stringent safety standards is critical.

- Navigating the Competitive and Fragmented Landscape: The market is highly competitive and fragmented, with many established furniture manufacturers and new entrants. The challenge for companies is to differentiate their products through innovation, quality, and customer service while navigating a landscape of aggressive pricing and marketing strategies.

- Balancing Functionality with Aesthetics: In a patient-centric environment, there is a growing demand for recliners that are not only functional but also aesthetically pleasing. The challenge is to design products that meet all the clinical and ergonomic requirements of a medical device while also having a design that makes them look less "clinical" and more inviting to the patient.

- Adapting to Evolving Regulatory Requirements: The market faces the continuous challenge of adapting to evolving regulatory requirements and quality standards for medical devices and furniture. Ensuring that products meet the necessary certifications in different countries and that they are manufactured with compliant materials is a complex and ongoing process.

Patient Recliners Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Patient Recliners Market |

| Market Size in 2023 | USD 17.53 Billion |

| Market Forecast in 2032 | USD 35.04 Billion |

| Growth Rate | CAGR of 8% |

| Number of Pages | 220 |

| Key Companies Covered | Nemschoff, Inc., Medline Industries, Inc., Steelcase, Inc., Hill-Rom, Champion Manufacturing, Inc., GF HEALTH PRODUCTS, INC., UMF Medical, Flexsteel Industries, Inc., PHC, Future Health Concepts, Medical Depot, Inc., Kemper Medical Inc., and Winco Mfg. LLC |

| Segments Covered | By Types, By Weighing Capacity, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Patient Recliners Market: Segmentation Insights

The global patient recliners market is divided by type, weighing capacity, end-user, and region.

Based on type, the global patient recliners market is divided into patient room recliners, long-term care recliners, trendelenburg recliners, treatment recliners, pediatric recliners, bariatric recliners, and cardiac care recliners. Patient Room Recliners dominate the Patient Recliners Market due to their widespread application across general hospital settings, surgical recovery rooms, and outpatient facilities. These recliners are specifically designed to offer comfort, adjustability, and ergonomic support to patients who are resting, recuperating, or receiving visitors. Features typically include multi-position recline functions, swivel casters for mobility, antimicrobial upholstery for infection control, and easy-to-clean surfaces that meet hospital hygiene standards. Patient room recliners are also often designed to be compact and aesthetically neutral to blend into various room environments. Their versatility, cost-efficiency, and ability to support both short-term and extended stays make them essential components of modern healthcare infrastructure.

On the basis of weighing capacity, the global patient recliners market is bifurcated into less than 250 lbs, 250–500 lbs, and more than 500 lbs. Less Than 250 Lbs is the dominant segment in the Patient Recliners Market, as this weight range covers the majority of average-sized patients in general healthcare settings. Recliners in this category are widely used across hospitals, outpatient clinics, and rehabilitation centers for standard patient needs, including post-operative recovery, routine care, and general patient seating. These recliners are typically lightweight, cost-effective, and designed with standard ergonomic and mobility features. Their widespread use, ease of integration into varied care environments, and suitability for both short- and long-term care contribute to their high demand across global healthcare infrastructures.

In terms of end-users, the global patient recliners market is bifurcated into hospitals, clinics, patient examination areas, nursing homes, dialysis centers, physician’s office, home care settings, and therapy centers. Hospitals are the dominant end-user segment in the Patient Recliners Market, driven by their high patient volume and need for multipurpose seating in patient rooms, surgical recovery units, oncology departments, and intensive care units. Hospitals require a wide variety of recliners ranging from standard patient room recliners to specialized cardiac, treatment, and Trendelenburg recliners. These recliners enhance patient comfort during recovery, support clinical procedures, and assist in mobility and repositioning. Hospitals prioritize durability, infection control, and ease of cleaning, making recliners with antimicrobial materials and ergonomic adjustability key to this segment's growth.

Patient Recliners Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Patient Recliners Market due to its advanced healthcare infrastructure, high rate of chronic illness, and increasing demand for patient comfort in both clinical and home settings. The United States and Canada lead the region in terms of product adoption, supported by large hospital networks, long-term care centers, and rehabilitation facilities. A key factor driving growth is the rising elderly population, which has increased the demand for mobility support and ergonomic seating solutions. Hospitals and outpatient centers are investing in specialty recliners designed for oncology, dialysis, and cardiac care, while home healthcare patients increasingly prefer motorized recliners with features like powered lift, heat therapy, and antimicrobial upholstery. The region also benefits from a strong presence of key manufacturers and consistent regulatory support for advanced medical furniture. Additionally, technological advancements—such as wireless controls, integrated medical device attachments, and recliners with caregiver-assist features—continue to drive innovation and upgrade cycles across facilities.

Asia Pacific is the fastest-growing region in the Patient Recliners Market, supported by improving healthcare infrastructure, increasing healthcare expenditure, and rising awareness about patient comfort and safety. Countries such as China, India, Japan, South Korea, and Australia are experiencing rapid growth in healthcare construction and modernization projects, driving demand for versatile patient seating solutions. The region's growing middle class and the expansion of private hospitals and specialty clinics are fueling the adoption of technologically advanced recliners, particularly in oncology and dialysis departments. Home healthcare is also a growing trend in Asia Pacific, with families investing in semi-powered or manually adjustable recliners for elderly and chronically ill patients. The market is further driven by government investments in healthcare accessibility, especially in rural areas, and by a shift toward non-invasive outpatient procedures that require short-term recovery in recliners. Manufacturers are focusing on providing durable, space-saving, and cost-effective recliners tailored to regional preferences and economic conditions.

Europe is the second most prominent region in the Patient Recliners Market, driven by an aging demographic, rising prevalence of chronic diseases, and strong public healthcare funding. Countries like Germany, the United Kingdom, France, Italy, and Spain are emphasizing patient-centered care, where comfort and ergonomics are central to treatment settings. European healthcare institutions are prioritizing recliners that promote postural alignment, reduce pressure ulcer risks, and enhance caregiver access. The demand is particularly high in oncology, geriatric, and palliative care units, where recliners are used for prolonged patient stays. Environmental sustainability and regulatory compliance also shape purchasing decisions, with preference for recliners made of recyclable materials and low-emission manufacturing processes. The region’s growing shift toward ambulatory care and outpatient treatment centers has expanded the use of compact and mobile recliner designs. Additionally, patient recliners that support multi-positional adjustments and accommodate patients with reduced mobility are increasingly favored across both public and private facilities.

Latin America is an emerging region in the Patient Recliners Market, where increasing healthcare access and urbanization are contributing to gradual growth in demand. Countries such as Brazil, Mexico, Argentina, and Chile are witnessing improvements in healthcare delivery, especially in urban centers, where hospitals and clinics are upgrading medical furniture to meet international care standards. The market is driven by rising cases of chronic illnesses, including diabetes, renal disorders, and cancer, which require regular patient monitoring and treatment in comfortable reclined positions. Patient recliners are gaining popularity in outpatient chemotherapy units, dialysis centers, and rehabilitation facilities. However, public sector budget constraints, disparities in access to advanced medical infrastructure, and a reliance on low-cost alternatives continue to limit widespread adoption. Despite these challenges, growing awareness about the importance of patient comfort and institutional investments in facility upgrades are gradually opening up new opportunities for market expansion in the region.

Middle East & Africa is a developing market for patient recliners, with notable progress in select countries driven by healthcare modernization and private sector growth. Countries like Saudi Arabia, the United Arab Emirates, South Africa, and Egypt are investing heavily in state-of-the-art hospitals, specialty clinics, and rehabilitation centers. In these regions, demand is rising for high-end patient recliners equipped with advanced features such as motorized controls, antimicrobial coatings, and multi-position adjustability. The adoption of recliners in oncology, cardiac, and dialysis departments is increasing as healthcare institutions focus on improving patient comfort, especially in long-duration treatments. Although the availability of such products is limited in less-developed areas, efforts are underway to improve healthcare equity through public-private partnerships and foreign investment. In wealthier parts of the region, premium recliners are being integrated into VIP hospital suites and homecare environments, reflecting a growing market for luxury and comfort-focused healthcare furniture.

Patient Recliners Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the patient recliners market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global patient recliners market include:

- Sauder MFG

- Medline Industries

- Nemschoff

- Krueger International

- Steelcase

- Herdegen

- J.D. Honigberg International

- DeVilbiss Healthcare

- Regency Healthcare

- Krug

- Stryker Corporation.

The global patient recliners market is segmented as follows:

By Type Analysis

- Patient Room Recliners

- Long-Term Care Recliners

- Trendelenburg Recliners

- Treatment Recliners

- Pediatric Recliners

- Bariatric Recliners

- Cardiac Care Recliners

By Weighing Capacity Analysis

- Less Than 250 Lbs

- 250–500 Lbs

- More than 500 Lbs

By End-User Analysis

- Hospitals

- Clinics

- Patient Examination Areas

- Nursing Homes

- Dialysis Centers

- Physician’s Office

- Home Care Settings

- Therapy Centers

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 23 CHAPTER 2. Patient Recliners market – Types Analysis 25 2.1. Global Patient Recliners Market – Types Overview 25 2.2. Global Patient Recliners Market Share, by Types, 2018 & 2025 (USD Million) 25 2.3. Patient Room Recliners 27 2.3.1. Global Patient Room Recliners Patient Recliners Market, 2015-2027 (USD Million) 27 2.4. Long Term Care Recliners 28 2.4.1. Global Long Term Care Recliners Patient Recliners Market, 2015-2027 (USD Million) 28 2.5. Trendelenburg Recliners 29 2.5.1. Global Trendelenburg Recliners Patient Recliners Market, 2015-2027 (USD Million) 29 2.6. Treatment Recliners 30 2.6.1. Global Treatment Recliners Patient Recliners Market, 2015-2027 (USD Million) 30 2.7. Pediatric Recliners 31 2.7.1. Global Pediatric Recliners Patient Recliners Market, 2015-2027 (USD Million) 31 2.8. Bariatric Recliners 32 2.8.1. Global Bariatric Recliners Patient Recliners Market, 2015-2027 (USD Million) 32 2.9. Cardiac Care Recliners 33 2.9.1. Global Cardiac Care Recliners Patient Recliners Market, 2015-2027 (USD Million) 33 CHAPTER 3. Patient Recliners market – Weighing Capacity Analysis 33 3.1. Global Patient Recliners Market – Weighing Capacity Overview 33 3.2. Global Patient Recliners Market Share, by Weighing Capacity, 2018 & 2025 (USD Million) 34 3.3. Less than 250 Lbs 35 3.3.1. Global Less than 250 Lbs Patient Recliners Market, 2015-2027 (USD Million) 35 3.4. 250 – 500 Lbs 36 3.4.1. Global 250 – 500 Lbs Patient Recliners Market, 2015-2027 (USD Million) 36 3.5. > 500 Lbs 37 3.5.1. Global > 500 Lbs Patient Recliners Market, 2015-2027 (USD Million) 37 CHAPTER 4. Patient Recliners market – End User Analysis 37 4.1. Global Patient Recliners Market – End User Overview 37 4.2. Global Patient Recliners Market Share, by End User, 2018 & 2025 (USD Million) 38 4.3. Hospitals 39 4.3.1. Global Hospitals Patient Recliners Market, 2015-2027 (USD Million) 39 4.4. Clinics 40 4.4.1. Global Clinics Patient Recliners Market, 2015-2027 (USD Million) 40 4.5. Patient Examination Areas 41 4.5.1. Global Patient Examination Areas Patient Recliners Market, 2015-2027 (USD Million) 41 4.6. Nursing Homes 42 4.6.1. Global Nursing Homes Patient Recliners Market, 2015-2027 (USD Million) 42 4.7. Dialysis Centers 43 4.7.1. Global Dialysis Centers Patient Recliners Market, 2015-2027 (USD Million) 43 4.8. Physician’s Office 44 4.8.1. Global Physician’s Office Patient Recliners Market, 2015-2027 (USD Million) 44 4.9. Home Care Settings 45 4.9.1. Global Home Care Settings Patient Recliners Market, 2015-2027 (USD Million) 45 4.10. Therapy Centers 46 4.10.1. Global Therapy Centers Patient Recliners Market, 2015-2027 (USD Million) 46 CHAPTER 5. Patient Recliners market – Regional Analysis 47 5.1. Global Patient Recliners Market Regional Overview 47 5.2. Global Patient Recliners Market Share, by Region, 2018 & 2025 (Value) 47 5.3. North America 49 5.3.1. North America Patient Recliners Market size and forecast, 2015-2027 49 5.3.2. North America Patient Recliners Market, by Country, 2018 & 2025 (USD Million) 49 5.3.3. North America Patient Recliners Market, by Types, 2015-2027 51 5.3.3.1. North America Patient Recliners Market, by Types, 2015-2027 (USD Million) 51 5.3.4. North America Patient Recliners Market, by Weighing Capacity, 2015-2027 52 5.3.4.1. North America Patient Recliners Market, by Weighing Capacity, 2015-2027 (USD Million) 52 5.3.5. North America Patient Recliners Market, by End User, 2015-2027 53 5.3.5.1. North America Patient Recliners Market, by End User, 2015-2027 (USD Million) 53 5.3.6. U.S. 54 5.3.6.1. U.S. Market size and forecast, 2015-2027 (USD Million) 54 5.3.7. Canada 55 5.3.7.1. Canada Market size and forecast, 2015-2027 (USD Million) 55 5.3.8. Mexico 56 5.3.8.1. Mexico Market size and forecast, 2015-2027 (USD Million) 56 5.4. Europe 57 5.4.1. Europe Patient Recliners Market size and forecast, 2015-2027 57 5.4.2. Europe Patient Recliners Market, by Country, 2018 & 2025 (USD Million) 57 5.4.3. Europe Patient Recliners Market, by Types, 2015-2027 59 5.4.3.1. Europe Patient Recliners Market, by Types, 2015-2027 (USD Million) 59 5.4.4. Europe Patient Recliners Market, by Weighing Capacity, 2015-2027 60 5.4.4.1. Europe Patient Recliners Market, by Weighing Capacity, 2015-2027 (USD Million) 60 5.4.5. Europe Patient Recliners Market, by End User, 2015-2027 61 5.4.5.1. Europe Patient Recliners Market, by End User, 2015-2027 (USD Million) 61 5.4.6. Germany 62 5.4.6.1. Germany Market size and forecast, 2015-2027 (USD Million) 62 5.4.7. France 63 5.4.7.1. France Market size and forecast, 2015-2027 (USD Million) 63 5.4.8. U.K. 64 5.4.8.1. U.K. Market size and forecast, 2015-2027 (USD Million) 64 5.4.9. Italy 65 5.4.9.1. Italy Market size and forecast, 2015-2027 (USD Million) 65 5.4.10. Spain 66 5.4.10.1. Spain Market size and forecast, 2015-2027 (USD Million) 66 5.4.11. Nordic Countries 67 5.4.11.1. Nordic Countries Market size and forecast, 2015-2027 (USD Million) 67 5.4.12. Benelux Union 68 5.4.12.1. Benelux Union Market size and forecast, 2015-2027 (USD Million) 68 5.4.13. Rest of Europe 69 5.4.13.1. Rest of Europe Market size and forecast, 2015-2027 (USD Million) 69 5.5. Asia Pacific 70 5.5.1. Asia Pacific Patient Recliners Market size and forecast, 2015-2027 70 5.5.2. Asia Pacific Patient Recliners Market, by Country, 2018 & 2025 (USD Million) 70 5.5.3. Asia Pacific Patient Recliners Market, by Types, 2015-2027 72 5.5.3.1. Asia Pacific Patient Recliners Market, by Types, 2015-2027 (USD Million) 72 5.5.4. Asia Pacific Patient Recliners Market, by Weighing Capacity, 2015-2027 73 5.5.4.1. Asia Pacific Patient Recliners Market, by Weighing Capacity, 2015-2027 (USD Million) 73 5.5.5. Asia Pacific Patient Recliners Market, by End User, 2015-2027 74 5.5.5.1. Asia Pacific Patient Recliners Market, by End User, 2015-2027 (USD Million) 74 5.5.6. China 75 5.5.6.1. China Market size and forecast, 2015-2027 (USD Million) 75 5.5.7. Japan 76 5.5.7.1. Japan Market size and forecast, 2015-2027 (USD Million) 76 5.5.8. India 77 5.5.8.1. India Market size and forecast, 2015-2027 (USD Million) 77 5.5.9. New Zealand 78 5.5.9.1. New Zealand Market size and forecast, 2015-2027 (USD Million) 78 5.5.10. Australia 79 5.5.10.1. Australia Market size and forecast, 2015-2027 (USD Million) 79 5.5.11. South Korea 80 5.5.11.1. South Korea Market size and forecast, 2015-2027 (USD Million) 80 5.5.12. South-East Asia 81 5.5.12.1. South-East Asia Market size and forecast, 2015-2027 (USD Million) 81 5.5.13. Rest of Asia Pacific 82 5.5.13.1. Rest of Asia Pacific Market size and forecast, 2015-2027 (USD Million) 82 5.6. Latin America 83 5.6.1. Latin America Patient Recliners Market size and forecast, 2015-2027 83 5.6.2. Latin America Patient Recliners Market, by Country, 2018 & 2025 (USD Million) 83 5.6.3. Latin America Patient Recliners Market, by Types, 2015-2027 84 5.6.3.1. Latin America Patient Recliners Market, by Types, 2015-2027 (USD Million) 84 5.6.4. Latin America Patient Recliners Market, by Weighing Capacity, 2015-2027 85 5.6.4.1. Latin America Patient Recliners Market, by Weighing Capacity, 2015-2027 (USD Million) 85 5.6.5. Latin America Patient Recliners Market, by End User, 2015-2027 86 5.6.5.1. Latin America Patient Recliners Market, by End User, 2015-2027 (USD Million) 86 5.6.6. Brazil 87 5.6.6.1. Brazil Market size and forecast, 2015-2027 (USD Million) 87 5.6.7. Argentina 88 5.6.7.1. Argentina Market size and forecast, 2015-2027 (USD Million) 88 5.6.8. Rest of Latin America 89 5.6.8.1. Rest of Latin America Market size and forecast, 2015-2027 (USD Million) 89 5.7. The Middle-East and Africa 90 5.7.1. The Middle-East and Africa Patient Recliners Market size and forecast, 2015-2027 90 5.7.2. The Middle-East and Africa Patient Recliners Market, by Country, 2018 & 2025 (USD Million) 90 5.7.3. The Middle-East and Africa Patient Recliners Market, by Types, 2015-2027 92 5.7.3.1. The Middle-East and Africa Patient Recliners Market, by Types, 2015-2027 (USD Million) 92 5.7.4. The Middle-East and Africa Patient Recliners Market, by Weighing Capacity, 2015-2027 93 5.7.4.1. The Middle-East and Africa Patient Recliners Market, by Weighing Capacity, 2015-2027 (USD Million) 93 5.7.5. The Middle-East and Africa Patient Recliners Market, by End User, 2015-2027 94 5.7.5.1. The Middle-East and Africa Patient Recliners Market, by End User, 2015-2027 (USD Million) 94 5.7.6. Saudi Arabia 95 5.7.6.1. Saudi Arabia Market size and forecast, 2015-2027 (USD Million) 95 5.7.7. UAE 96 5.7.7.1. UAE Market size and forecast, 2015-2027 (USD Million) 96 5.7.8. Egypt 97 5.7.8.1. Egypt Market size and forecast, 2015-2027 (USD Million) 97 5.7.9. Kuwait 98 5.7.9.1. Kuwait Market size and forecast, 2015-2027 (USD Million) 98 5.7.10. South Africa 99 5.7.10.1. South Africa Market size and forecast, 2015-2027 (USD Million) 99 5.7.11. Rest of Middle-East Africa 100 5.7.11.1. Rest of Middle-East Africa Market size and forecast, 2015-2027 (USD Million) 100 CHAPTER 6. Patient Recliners market – Competitive Landscape 101 6.1. Competitor Market Share – Revenue 101 6.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 103 6.3. Strategic Development 104 6.3.1. Acquisitions and Mergers 104 6.3.2. New Products 104 6.3.3. Research & Development Activities 104 CHAPTER 7. Company Profiles 105 7.1. Champion Manufacturing, Inc. 105 7.1.1. Company Overview 105 7.1.2. Champion Manufacturing, Inc. Revenue and Gross Margin 105 7.1.3. Product portfolio 106 7.1.4. Recent initiatives 107 7.2. Flexsteel Industries, Inc. 107 7.2.1. Company Overview 107 7.2.2. Flexsteel Industries, Inc. Revenue and Gross Margin 107 7.2.3. Product portfolio 108 7.2.4. Recent initiatives 109 7.3. Future Health Concepts, Inc. 109 7.3.1. Company Overview 109 7.3.2. Future Health Concepts, Inc. Revenue and Gross Margin 109 7.3.3. Product portfolio 110 7.3.4. Recent initiatives 111 7.4. GF HEALTH PRODUCTS, INC. 111 7.4.1. Company Overview 111 7.4.2. GF HEALTH PRODUCTS, INC. Revenue and Gross Margin 111 7.4.3. Product portfolio 112 7.4.4. Recent initiatives 113 7.5. Hill–Rom Services Inc. 113 7.5.1. Company Overview 113 7.5.2. Hill–Rom Services Inc. Revenue and Gross Margin 113 7.5.3. Product portfolio 114 7.5.4. Recent initiatives 115 7.6. Kemper Medical Inc. 115 7.6.1. Company Overview 115 7.6.2. Kemper Medical Inc. Revenue and Gross Margin 115 7.6.3. Product portfolio 116 7.6.4. Recent initiatives 117 7.7. Nemschoff, Inc. 117 7.7.1. Company Overview 117 7.7.2. Nemschoff, Inc. Revenue and Gross Margin 117 7.7.3. Product portfolio 118 7.7.4. Recent initiatives 119 7.8. Medical Depot, Inc. 119 7.8.1. Company Overview 119 7.8.2. Medical Depot, Inc. Revenue and Gross Margin 119 7.8.3. Product portfolio 120 7.8.4. Recent initiatives 121 7.9. Preferred Health Choice 121 7.9.1. Company Overview 121 7.9.2. Preferred Health Choice Revenue and Gross Margin 121 7.9.3. Product portfolio 122 7.9.4. Recent initiatives 123 7.10. Medline Industries, Inc. 123 7.10.1. Company Overview 123 7.10.2. Medline Industries, Inc. Revenue and Gross Margin 123 7.10.3. Product portfolio 124 7.10.4. Recent initiatives 125 7.11. Steelcase, Inc. 125 7.11.1. Company Overview 125 7.11.2. Steelcase, Inc. Revenue and Gross Margin 125 7.11.3. Product portfolio 126 7.11.4. Recent initiatives 127 7.12. UMF Medical 127 7.12.1. Company Overview 127 7.12.2. UMF Medical Revenue and Gross Margin 127 7.12.3. Product portfolio 128 7.12.4. Recent initiatives 129 7.13. Winco Mfg., LLC 129 7.13.1. Company Overview 129 7.13.2. Winco Mfg., LLC Revenue and Gross Margin 129 7.13.3. Product portfolio 130 7.13.4. Recent initiatives 131 CHAPTER 8. Patient Recliners — Industry Analysis 132 8.1. Patient Recliners Market – Key Trends 132 8.1.1. Market Drivers 133 8.1.2. Market Restraints 133 8.1.3. Market Opportunities 134 8.2. Value Chain Analysis 135 8.3. Technology Roadmap and Timeline 136 8.4. Patient Recliners Market – Attractiveness Analysis 137 8.4.1. By Types 137 8.4.2. By Weighing Capacity 137 8.4.3. By End User 138 8.4.4. By Region 140 CHAPTER 9. Marketing Strategy Analysis, Distributors 141 9.1. Marketing Channel 141 9.2. Direct Marketing 142 9.3. Indirect Marketing 142 9.4. Marketing Channel Development Trend 142 9.5. Economic/Political Environmental Change 143 CHAPTER 10. Report Conclusion 144 CHAPTER 11. Research Approach & Methodology 145 11.1. Report Description 145 11.2. Research Scope 146 11.3. Research Methodology 146 11.3.1. Secondary Research 147 11.3.2. Primary Research 148 11.3.3. Models 149 11.3.3.1. Company Share Analysis Model 149 11.3.3.2. Revenue Based Modeling 150 11.3.3.3. Research Limitations 150

Inquiry For Buying

Patient Recliners

Request Sample

Patient Recliners