Plasmid Market Size, Share, and Trends Analysis Report

CAGR :

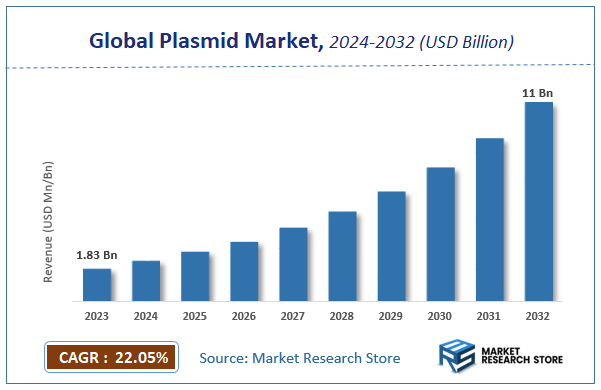

| Market Size 2023 (Base Year) | USD 1.83 Billion |

| Market Size 2032 (Forecast Year) | USD 11 Billion |

| CAGR | 22.05% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Plasmid Market Insights

According to Market Research Store, the global plasmid market size was valued at around USD 1.83 billion in 2023 and is estimated to reach USD 11 billion by 2032, to register a CAGR of approximately 22.05% in terms of revenue during the forecast period 2024-2032.

The plasmid report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Plasmid Market: Overview

A plasmid is a small, circular, double-stranded DNA molecule that exists independently of the chromosomal DNA in many bacteria and some eukaryotic organisms. Unlike chromosomal DNA, plasmids are not essential for the survival of the host cell under normal conditions, but they often carry genes that provide selective advantages, such as antibiotic resistance, toxin production, or the ability to metabolize unusual substances. Plasmids can replicate autonomously within the host cell and are commonly transferred between cells through horizontal gene transfer mechanisms such as conjugation, transformation, or transduction.

Plasmids play a critical role in molecular biology and biotechnology, where they are used as vectors to introduce foreign genes into host organisms for purposes such as gene cloning, protein production, or genetic modification. Their versatility, ease of manipulation, and capacity to carry and express inserted genes make them essential tools in genetic engineering, vaccine development, and synthetic biology. As research advances in genomics and therapeutic gene delivery, plasmids continue to be a fundamental component in both scientific investigation and commercial biotechnological applications.

Key Highlights

- The plasmid market is anticipated to grow at a CAGR of 22.05% during the forecast period.

- The global plasmid market was estimated to be worth approximately USD 1.83 billion in 2023 and is projected to reach a value of USD 11 billion by 2032.

- The growth of the plasmid market is being driven by the increasing demand for gene and cell therapies, the expanding field of genetic engineering, and the growing application of plasmids in DNA vaccines and biopharmaceutical production.

- Based on the product type, the cloning vectors segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the biotechnology segment is projected to swipe the largest market share.

- In terms of end-user, the biopharmaceutical companies segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Plasmid Market: Dynamics

Key Growth Drivers:

- Surge in Gene and Cell Therapy Development: The most significant driver is the explosive growth of the gene and cell therapy sectors. Plasmids are the fundamental building blocks of these therapies, serving as the delivery vehicle for therapeutic genes. The increasing number of clinical trials and approved gene therapies for conditions like cancer and genetic disorders is creating an immense and sustained demand for high-quality plasmid DNA.

- Rapid Growth in DNA and mRNA Vaccine Development: The success of mRNA vaccines, particularly during the COVID-19 pandemic, has highlighted the importance of plasmid DNA as a key starting material. Plasmids are used as templates to produce the large quantities of mRNA required for these vaccines. This acceleration in vaccine research and development is a major driver of the market.

- Rising R&D Investments in Biotechnology and Biopharmaceuticals: A consistent flow of investment from both the private and public sectors into biotechnology, molecular biology, and pharmaceutical research is fueling market growth. This funding supports the development of new plasmid-based therapies and the expansion of manufacturing capabilities to meet the growing demand.

- Advancements in Genetic Engineering and Synthetic Biology: The continuous evolution of genetic engineering tools, such as CRISPR-Cas9, and the rise of synthetic biology are creating new applications for plasmids. These technologies rely on plasmids to design and construct novel biological systems, which is driving demand from both academic and industrial laboratories.

Restraints:

- High Cost of GMP-Grade Plasmid Production: The manufacturing of high-quality, GMP-grade plasmid DNA is a complex and costly process. The expenses associated with specialized facilities, quality control, and adherence to stringent regulatory standards can be a significant barrier for many drug developers, particularly smaller biotech firms and academic institutions.

- Manufacturing Bottlenecks and Limited Production Capacity: The demand for plasmid DNA, especially for commercial-scale production, is currently outpacing the available manufacturing capacity. This has created a bottleneck in the supply chain, leading to long lead times and potential delays in clinical development. This lack of scalability is a major restraint on the market.

- Stringent Regulatory and Quality Control Hurdles: The use of plasmids in human therapies requires strict adherence to complex and evolving regulatory guidelines from bodies like the FDA. The process for ensuring the safety, purity, and consistency of plasmids can be difficult and resource-intensive, with any batch failures or quality issues potentially stalling a therapy's progress.

- Technical Challenges with Plasmid Stability and Yield: The production of plasmids can be technically challenging, with issues such as plasmid instability, low yield, and the presence of impurities like endotoxins and host cell DNA. These technical hurdles can compromise the quality of the final product, which is a major concern for regulatory bodies and for the effectiveness of the downstream therapies.

Opportunities:

- Growth of the Contract Development and Manufacturing Organization (CDMO) Sector: The complexities and high costs of in-house plasmid manufacturing have created a significant opportunity for CDMOs. Companies that specialize in plasmid production can offer their services to drug developers, providing a cost-effective and scalable solution that helps to alleviate the industry-wide manufacturing bottleneck.

- Technological Innovation in Manufacturing Processes: There is a major opportunity to develop more efficient and scalable manufacturing technologies. Innovations such as continuous manufacturing, enzymatic DNA production, and novel purification techniques could reduce costs, improve yields, and help the market overcome its current capacity limitations, paving the way for wider adoption.

- Expansion into Emerging Markets: As emerging economies in the Asia-Pacific region, such as China and India, invest heavily in their life sciences and biotechnology sectors, they present a vast, untapped market. The growth of local pharmaceutical companies and the increasing focus on R&D in these regions create a significant opportunity for plasmid suppliers and manufacturers.

- Development of "Off-the-Shelf" Plasmid Kits and Libraries: The creation of standardized, pre-validated plasmid kits and libraries for common applications (e.g., cloning, gene editing) offers an opportunity to streamline research and development workflows. This can reduce the time and effort required for scientists to create their own plasmids, accelerating the pace of innovation.

Challenges:

- Ensuring the Safety and Efficacy of the Final Therapy: The quality of the plasmid DNA is directly linked to the safety and efficacy of the final therapeutic product, whether it's a vaccine or a gene therapy. A major challenge is to maintain the highest levels of quality control throughout the entire manufacturing process to ensure that the plasmid vector is not immunogenic and that it delivers the therapeutic gene effectively.

- Standardization and Interoperability: A lack of standardization in plasmid design, nomenclature, and quality control metrics across the industry can create challenges for data exchange and product comparability. The development of common standards would help streamline regulatory approval processes and foster greater collaboration.

- Ethical and Social Concerns: The use of plasmids in gene therapy and genetic engineering raises ethical and social concerns about genetic modification and its long-term implications. Navigating these public perceptions and ensuring ethical use of the technology is a continuous challenge for the market.

- Competition from Alternative Technologies: While plasmids are the gold standard for many applications, the market faces competition from alternative gene delivery methods, such as viral vectors and non-viral methods. The challenge is for plasmids to maintain their competitive edge by continually improving their safety profile, efficiency, and ease of use.

Plasmid Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plasmid Market |

| Market Size in 2023 | USD 1.83 Billion |

| Market Forecast in 2032 | USD 11 Billion |

| Growth Rate | CAGR of 22.05% |

| Number of Pages | 222 |

| Key Companies Covered | MolMed S.p.A., Takara Bio Inc., Mirus Bio LLC, GenePharma,Oxford Genetics Ltd., InvivoGen,Aldevron, PlasmidFactory GmbH & Co. KG, VGXI, Inc., GenScript,Miltenyi Biotec, Applied StemCell, Altogen Biosystems, Copernicus Therapeutics, Inc., Medigene Sdn Bhd, Cobra Biologics, MaxCyte, Inc., and Polyplus Transfection |

| Segments Covered | By General, By Specific Plasmid, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plasmid Market: Segmentation Insights

The global plasmid market is divided by product type, application, end-user, and region.

Based on product type, the global plasmid market is divided into cloning vectors, expression vectors, gene therapy vectors, and others. Cloning Vectors dominate the Plasmid Market due to their widespread use in molecular biology research, gene cloning, and genetic engineering applications. These vectors are essential tools in the replication and manipulation of DNA sequences, allowing scientists to insert specific genes into host cells for further study or modification. Cloning vectors are commonly used in academic laboratories, research institutions, and pharmaceutical companies for the development of genetically modified organisms, synthetic biology research, and recombinant DNA technology. Their ease of use, high transformation efficiency, and ability to carry various inserts make them the most extensively utilized plasmid product type across both basic and applied research sectors.

On the basis of application, the global plasmid market is bifurcated into biotechnology, pharmaceuticals, gene therapy, research laboratories, and others. Biotechnology is the dominant application segment in the Plasmid Market, primarily driven by the extensive use of plasmids in genetic engineering, synthetic biology, and industrial-scale recombinant protein production. Plasmids serve as indispensable tools for modifying microbial strains used in biofuel production, enzyme synthesis, and agricultural biotechnology. Biotechnology companies leverage plasmid-based systems for large-scale fermentation, CRISPR-based genome editing, and metabolic pathway engineering. The continuous innovation in bio-based manufacturing processes and the expanding scope of synthetic biology are key contributors to the sustained dominance of this segment.

In terms of end-users, the global plasmid market is bifurcated into biopharmaceutical companies, academic and research institutes, contract research organizations, and others. Biopharmaceutical Companies are the dominant end-user segment in the Plasmid Market, primarily due to their extensive use of plasmids in drug development, therapeutic protein production, vaccine manufacturing, and gene therapy research. These companies require high-quality, GMP-grade plasmid DNA for producing biologics, viral vectors, and nucleic acid-based vaccines. Plasmids play a critical role in both upstream and downstream bioprocesses, including transfection, cloning, and expression. The growth of the biopharmaceutical industry, fueled by increasing demand for biologics and the rapid advancement of personalized and regenerative medicine, has made biopharmaceutical firms the largest consumers and investors in plasmid technologies.

Plasmid Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the plasmid market due to its strong presence of biotechnology and pharmaceutical companies, extensive research funding, and high adoption of advanced gene therapy and genetic engineering technologies. The United States leads the region, supported by the robust academic and research infrastructure, presence of leading gene therapy developers, and significant investment in DNA-based vaccines and cell therapies. Regulatory support from the FDA for clinical trials involving plasmid DNA also contributes to market growth. The expanding pipeline of plasmid-based therapies, increasing number of gene editing projects using CRISPR, and strategic collaborations between biotech startups and contract development and manufacturing organizations (CDMOs) further solidify North America’s leadership. Moreover, the region is witnessing rising demand for high-quality GMP-grade plasmids for preclinical and clinical applications, which is accelerating capacity expansion across contract manufacturers and CDMOs.

Asia-Pacific region is emerging as a high-growth market for plasmids due to a rapidly expanding biotechnology sector, increased R&D activity in genomics, and rising adoption of gene-based therapies and vaccines. Countries like China, Japan, South Korea, and India are investing in molecular biology research, genomic medicine, and biologics manufacturing. China, in particular, has witnessed a surge in plasmid-related research projects and is aggressively expanding its capacity for gene therapy production, including DNA vaccines. Japan and South Korea are leveraging strong government backing to accelerate innovations in gene editing and cell therapy, thus driving the need for plasmids. Additionally, the region benefits from cost-effective manufacturing capabilities and increasing outsourcing of plasmid production services to CDMOs across Asia-Pacific.

Europe holds a substantial share in the plasmid market, driven by government support for life sciences innovation, a growing gene therapy pipeline, and increasing investments in biopharmaceutical manufacturing. Countries such as Germany, the United Kingdom, France, and Switzerland are at the forefront of R&D involving plasmid DNA for therapeutics, DNA vaccines, and synthetic biology. The region is also seeing growing partnerships between academia, biotech companies, and public-private consortia to enhance capabilities in plasmid manufacturing and quality control. Regulatory advancements by the European Medicines Agency (EMA) to streamline gene therapy approvals and increasing focus on personalized medicine are also catalyzing growth. The demand for scalable plasmid production technologies in Europe is rising in tandem with the expansion of cell and gene therapy clinical trials.

Latin America represents a developing market for plasmids, with Brazil, Mexico, and Argentina leading regional growth. Academic and government research institutions are gradually increasing their participation in gene therapy, vaccine development, and synthetic biology studies involving plasmids. However, market development is restrained by limited infrastructure for large-scale biologics manufacturing and regulatory complexity surrounding gene-based products. Despite these challenges, Latin America is expected to see growing adoption of plasmid technologies through international collaborations, rising demand for biosimilars, and government interest in strengthening domestic biomanufacturing capabilities.

Middle East & Africa region is at a nascent stage in the plasmid market but is showing promising potential, especially in countries such as the UAE, Saudi Arabia, and South Africa. Efforts to modernize healthcare systems and invest in biotechnology infrastructure are creating opportunities for advanced therapies, including plasmid-based applications. Although the availability of skilled molecular biology personnel and production facilities is limited, growing awareness of gene therapies and increasing public-private initiatives to promote biotech R&D may stimulate regional demand in the coming years. South Africa, with its relatively developed research institutions, is expected to play a key role in driving plasmid-related studies and local production capabilities in sub-Saharan Africa.

Plasmid Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the plasmid market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global plasmid market include:

- Thermo Fisher Scientific Inc.

- Lonza Group AG

- QIAGEN N.V.

- Takara Bio Inc.

- GenScript Biotech Corporation

- Aldevron LLC

- Cobra Biologics

- PlasmidFactory GmbH & Co. KG

- VGXI, Inc.

- Nature Technology Corporation

- Bio-Rad Laboratories, Inc.

- Promega Corporation

- New England Biolabs, Inc.

- Addgene

- Cell and Gene Therapy Catapult

- Creative Biogene

- Eurofins Scientific

- Charles River Laboratories International, Inc.

- Waisman Biomanufacturing

- Aldevron, LLC

The global plasmid market is segmented as follows:

By Product Type

- Cloning Vectors

- Expression Vectors

- Gene Therapy Vectors

- Others

By Application

- Biotechnology

- Pharmaceuticals

- Gene Therapy

- Research Laboratories

- Others

By End-User

- Biopharmaceutical Companies

- Academic and Research Institutes

- Contract Research Organizations

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 23 CHAPTER 2. Plasmid market – General Type Plasmid Analysis 25 2.1. Global Plasmid Market – General Type Plasmid Overview 25 2.2. Global Plasmid Market Share, by General Type Plasmid, 2018 & 2025 (USD Million) 25 2.3. Conjugative 27 2.3.1. Global Conjugative Plasmid Market, 2015-2027 (USD Million) 27 2.4. Non-Conjugative 28 2.4.1. Global Non-Conjugative Plasmid Market, 2015-2027 (USD Million) 28 CHAPTER 3. Plasmid market – Specific Plasmid Types Analysis 28 3.1. Global Plasmid Market – Specific Plasmid Types Overview 28 3.2. Global Plasmid Market Share, by Specific Plasmid Types, 2018 & 2025 (USD Million) 29 3.3. F-Plasmids 30 3.3.1. Global F-Plasmids Plasmid Market, 2015-2027 (USD Million) 30 3.4. Resistance Plasmids 31 3.4.1. Global Resistance Plasmids Plasmid Market, 2015-2027 (USD Million) 31 3.5. Virulence Plasmids 32 3.5.1. Global Virulence Plasmids Plasmid Market, 2015-2027 (USD Million) 32 3.6. Degradative Plasmids 33 3.6.1. Global Degradative Plasmids Plasmid Market, 2015-2027 (USD Million) 33 3.7. Col Plasmids 34 3.7.1. Global Col Plasmids Plasmid Market, 2015-2027 (USD Million) 34 3.8. Cryptic Plasmids 35 3.8.1. Global Cryptic Plasmids Plasmid Market, 2015-2027 (USD Million) 35 CHAPTER 4. Plasmid market – Application Analysis 35 4.1. Global Plasmid Market – Application Overview 35 4.2. Global Plasmid Market Share, by Application, 2018 & 2025 (USD Million) 36 4.3. Transfection 37 4.3.1. Global Transfection Plasmid Market, 2015-2027 (USD Million) 37 4.4. Gene Therapy 38 4.4.1. Global Gene Therapy Plasmid Market, 2015-2027 (USD Million) 38 4.5. Recombinant DNA Technology 39 4.5.1. Global Recombinant DNA Technology Plasmid Market, 2015-2027 (USD Million) 39 4.6. Others 40 4.6.1. Global Others Plasmid Market, 2015-2027 (USD Million) 40 CHAPTER 5. Plasmid market – Regional Analysis 41 5.1. Global Plasmid Market Regional Overview 41 5.2. Global Plasmid Market Share, by Region, 2018 & 2025 (Value) 41 5.3. North America 43 5.3.1. North America Plasmid Market size and forecast, 2015-2027 43 5.3.2. North America Plasmid Market, by Country, 2018 & 2025 (USD Million) 43 5.3.3. North America Plasmid Market, by General Type Plasmid, 2015-2027 45 5.3.3.1. North America Plasmid Market, by General Type Plasmid, 2015-2027 (USD Million) 45 5.3.4. North America Plasmid Market, by Specific Plasmid Types, 2015-2027 46 5.3.4.1. North America Plasmid Market, by Specific Plasmid Types, 2015-2027 (USD Million) 46 5.3.5. North America Plasmid Market, by Application, 2015-2027 47 5.3.5.1. North America Plasmid Market, by Application, 2015-2027 (USD Million) 47 5.3.6. U.S. 48 5.3.6.1. U.S. Market size and forecast, 2015-2027 (USD Million) 48 5.3.7. Canada 49 5.3.7.1. Canada Market size and forecast, 2015-2027 (USD Million) 49 5.3.8. Mexico 50 5.3.8.1. Mexico Market size and forecast, 2015-2027 (USD Million) 50 5.4. Europe 51 5.4.1. Europe Plasmid Market size and forecast, 2015-2027 51 5.4.2. Europe Plasmid Market, by Country, 2018 & 2025 (USD Million) 51 5.4.3. Europe Plasmid Market, by General Type Plasmid, 2015-2027 53 5.4.3.1. Europe Plasmid Market, by General Type Plasmid, 2015-2027 (USD Million) 53 5.4.4. Europe Plasmid Market, by Specific Plasmid Types, 2015-2027 54 5.4.4.1. Europe Plasmid Market, by Specific Plasmid Types, 2015-2027 (USD Million) 54 5.4.5. Europe Plasmid Market, by Application, 2015-2027 55 5.4.5.1. Europe Plasmid Market, by Application, 2015-2027 (USD Million) 55 5.4.6. Germany 56 5.4.6.1. Germany Market size and forecast, 2015-2027 (USD Million) 56 5.4.7. France 57 5.4.7.1. France Market size and forecast, 2015-2027 (USD Million) 57 5.4.8. U.K. 58 5.4.8.1. U.K. Market size and forecast, 2015-2027 (USD Million) 58 5.4.9. Italy 59 5.4.9.1. Italy Market size and forecast, 2015-2027 (USD Million) 59 5.4.10. Spain 60 5.4.10.1. Spain Market size and forecast, 2015-2027 (USD Million) 60 5.4.11. Nordic Countries 61 5.4.11.1. Nordic Countries Market size and forecast, 2015-2027 (USD Million) 61 5.4.12. Benelux Union 62 5.4.12.1. Benelux Union Market size and forecast, 2015-2027 (USD Million) 62 5.4.13. Rest of Europe 63 5.4.13.1. Rest of Europe Market size and forecast, 2015-2027 (USD Million) 63 5.5. Asia Pacific 64 5.5.1. Asia Pacific Plasmid Market size and forecast, 2015-2027 64 5.5.2. Asia Pacific Plasmid Market, by Country, 2018 & 2025 (USD Million) 64 5.5.3. Asia Pacific Plasmid Market, by General Type Plasmid, 2015-2027 66 5.5.3.1. Asia Pacific Plasmid Market, by General Type Plasmid, 2015-2027 (USD Million) 66 5.5.4. Asia Pacific Plasmid Market, by Specific Plasmid Types, 2015-2027 67 5.5.4.1. Asia Pacific Plasmid Market, by Specific Plasmid Types, 2015-2027 (USD Million) 67 5.5.5. Asia Pacific Plasmid Market, by Application, 2015-2027 68 5.5.5.1. Asia Pacific Plasmid Market, by Application, 2015-2027 (USD Million) 68 5.5.6. China 69 5.5.6.1. China Market size and forecast, 2015-2027 (USD Million) 69 5.5.7. Japan 70 5.5.7.1. Japan Market size and forecast, 2015-2027 (USD Million) 70 5.5.8. India 71 5.5.8.1. India Market size and forecast, 2015-2027 (USD Million) 71 5.5.9. New Zealand 72 5.5.9.1. New Zealand Market size and forecast, 2015-2027 (USD Million) 72 5.5.10. Australia 73 5.5.10.1. Australia Market size and forecast, 2015-2027 (USD Million) 73 5.5.11. South Korea 74 5.5.11.1. South Korea Market size and forecast, 2015-2027 (USD Million) 74 5.5.12. South-East Asia 75 5.5.12.1. South-East Asia Market size and forecast, 2015-2027 (USD Million) 75 5.5.13. Rest of Asia Pacific 76 5.5.13.1. Rest of Asia Pacific Market size and forecast, 2015-2027 (USD Million) 76 5.6. Latin America 77 5.6.1. Latin America Plasmid Market size and forecast, 2015-2027 77 5.6.2. Latin America Plasmid Market, by Country, 2018 & 2025 (USD Million) 77 5.6.3. Latin America Plasmid Market, by General Type Plasmid, 2015-2027 79 5.6.3.1. Latin America Plasmid Market, by General Type Plasmid, 2015-2027 (USD Million) 79 5.6.4. Latin America Plasmid Market, by Specific Plasmid Types, 2015-2027 80 5.6.4.1. Latin America Plasmid Market, by Specific Plasmid Types, 2015-2027 (USD Million) 80 5.6.5. Latin America Plasmid Market, by Application, 2015-2027 81 5.6.5.1. Latin America Plasmid Market, by Application, 2015-2027 (USD Million) 81 5.6.6. Brazil 82 5.6.6.1. Brazil Market size and forecast, 2015-2027 (USD Million) 82 5.6.7. Argentina 83 5.6.7.1. Argentina Market size and forecast, 2015-2027 (USD Million) 83 5.6.8. Rest of Latin America 84 5.6.8.1. Rest of Latin America Market size and forecast, 2015-2027 (USD Million) 84 5.7. The Middle-East and Africa 85 5.7.1. The Middle-East and Africa Plasmid Market size and forecast, 2015-2027 85 5.7.2. The Middle-East and Africa Plasmid Market, by Country, 2018 & 2025 (USD Million) 85 5.7.3. The Middle-East and Africa Plasmid Market, by General Type Plasmid, 2015-2027 87 5.7.3.1. The Middle-East and Africa Plasmid Market, by General Type Plasmid, 2015-2027 (USD Million) 87 5.7.4. The Middle-East and Africa Plasmid Market, by Specific Plasmid Types, 2015-2027 88 5.7.4.1. The Middle-East and Africa Plasmid Market, by Specific Plasmid Types, 2015-2027 (USD Million) 88 5.7.5. The Middle-East and Africa Plasmid Market, by Application, 2015-2027 89 5.7.5.1. The Middle-East and Africa Plasmid Market, by Application, 2015-2027 (USD Million) 89 5.7.6. Saudi Arabia 90 5.7.6.1. Saudi Arabia Market size and forecast, 2015-2027 (USD Million) 90 5.7.7. UAE 91 5.7.7.1. UAE Market size and forecast, 2015-2027 (USD Million) 91 5.7.8. Egypt 92 5.7.8.1. Egypt Market size and forecast, 2015-2027 (USD Million) 92 5.7.9. Kuwait 93 5.7.9.1. Kuwait Market size and forecast, 2015-2027 (USD Million) 93 5.7.10. South Africa 94 5.7.10.1. South Africa Market size and forecast, 2015-2027 (USD Million) 94 5.7.11. Rest of Middle-East Africa 95 5.7.11.1. Rest of Middle-East Africa Market size and forecast, 2015-2027 (USD Million) 95 CHAPTER 6. Plasmid market – Competitive Landscape 96 6.1. Competitor Market Share – Revenue 96 6.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 98 6.3. Strategic Development 99 6.3.1. Acquisitions and Mergers 99 6.3.2. New Products 99 6.3.3. Research & Development Activities 99 CHAPTER 7. Company Profiles 100 7.1. Aldevron 100 7.1.1. Company Overview 100 7.1.2. Aldevron Revenue and Gross Margin 100 7.1.3. Product portfolio 101 7.1.4. Recent initiatives 102 7.2. GenScript 102 7.2.1. Company Overview 102 7.2.2. GenScript Revenue and Gross Margin 102 7.2.3. Product portfolio 103 7.2.4. Recent initiatives 104 7.3. PlasmidFactory GmbH & Co. KG 104 7.3.1. Company Overview 104 7.3.2. PlasmidFactory GmbH & Co. KG Revenue and Gross Margin 104 7.3.3. Product portfolio 105 7.3.4. Recent initiatives 106 7.4. VGXI, Inc. 106 7.4.1. Company Overview 106 7.4.2. VGXI, Inc. Revenue and Gross Margin 106 7.4.3. Product portfolio 107 7.4.4. Recent initiatives 108 7.5. Oxford Genetics Ltd. 108 7.5.1. Company Overview 108 7.5.2. Oxford Genetics Ltd. Revenue and Gross Margin 108 7.5.3. Product portfolio 109 7.5.4. Recent initiatives 110 7.6. Applied StemCell 110 7.6.1. Company Overview 110 7.6.2. Applied StemCell Revenue and Gross Margin 110 7.6.3. Product portfolio 111 7.6.4. Recent initiatives 112 7.7. Altogen Biosystems 112 7.7.1. Company Overview 112 7.7.2. Altogen Biosystems Revenue and Gross Margin 112 7.7.3. Product portfolio 113 7.7.4. Recent initiatives 114 7.8. Cobra Biologics 114 7.8.1. Company Overview 114 7.8.2. Cobra Biologics Revenue and Gross Margin 114 7.8.3. Product portfolio 115 7.8.4. Recent initiatives 116 7.9. Copernicus Therapeutics, Inc. 116 7.9.1. Company Overview 116 7.9.2. Copernicus Therapeutics, Inc. Revenue and Gross Margin 116 7.9.3. Product portfolio 117 7.9.4. Recent initiatives 118 7.10. Takara Bio Inc. 118 7.10.1. Company Overview 118 7.10.2. Takara Bio Inc. Revenue and Gross Margin 118 7.10.3. Product portfolio 119 7.10.4. Recent initiatives 120 7.11. InvivoGen 120 7.11.1. Company Overview 120 7.11.2. InvivoGen Revenue and Gross Margin 120 7.11.3. Product portfolio 121 7.11.4. Recent initiatives 122 7.12. Miltenyi Biotec 122 7.12.1. Company Overview 122 7.12.2. Miltenyi Biotec Revenue and Gross Margin 122 7.12.3. Product portfolio 123 7.12.4. Recent initiatives 124 7.13. Medigene Sdn Bhd 124 7.13.1. Company Overview 124 7.13.2. Medigene Sdn Bhd Revenue and Gross Margin 124 7.13.3. Product portfolio 125 7.13.4. Recent initiatives 126 7.14. MaxCyte, Inc. 126 7.14.1. Company Overview 126 7.14.2. MaxCyte, Inc. Revenue and Gross Margin 126 7.14.3. Product portfolio 127 7.14.4. Recent initiatives 128 7.15. Mirus Bio LLC 128 7.15.1. Company Overview 128 7.15.2. Mirus Bio LLC Revenue and Gross Margin 128 7.15.3. Product portfolio 129 7.15.4. Recent initiatives 130 7.16. MolMed S.p.A. 130 7.16.1. Company Overview 130 7.16.2. MolMed S.p.A. Revenue and Gross Margin 130 7.16.3. Product portfolio 131 7.16.4. Recent initiatives 132 7.17. GenePharma 132 7.17.1. Company Overview 132 7.17.2. GenePharma Revenue and Gross Margin 132 7.17.3. Product portfolio 133 7.17.4. Recent initiatives 134 7.18. Polyplus Transfection 134 7.18.1. Company Overview 134 7.18.2. Polyplus Transfection Revenue and Gross Margin 134 7.18.3. Product portfolio 135 7.18.4. Recent initiatives 136 CHAPTER 8. Plasmid — Industry Analysis 137 8.1. Plasmid Market – Key Trends 137 8.1.1. Market Drivers 138 8.1.2. Market Restraints 138 8.1.3. Market Opportunities 139 8.2. Value Chain Analysis 140 8.3. Technology Roadmap and Timeline 141 8.4. Plasmid Market – Attractiveness Analysis 142 8.4.1. By General Type Plasmid 142 8.4.2. By Specific Plasmid Types 142 8.4.3. By Application 143 8.4.4. By Region 145 CHAPTER 9. Marketing Strategy Analysis, Distributors 146 9.1. Marketing Channel 146 9.2. Direct Marketing 147 9.3. Indirect Marketing 147 9.4. Marketing Channel Development Trend 147 9.5. Economic/Political Environmental Change 148 CHAPTER 10. Report Conclusion 149 CHAPTER 11. Research Approach & Methodology 150 11.1. Report Description 150 11.2. Research Scope 151 11.3. Research Methodology 151 11.3.1. Secondary Research 152 11.3.2. Primary Research 153 11.3.3. Models 154 11.3.3.1. Company Share Analysis Model 154 11.3.3.2. Revenue Based Modeling 155 11.3.3.3. Research Limitations 155

Inquiry For Buying

Plasmid

Request Sample

Plasmid