Restaurant CRM Market Size, Share, and Trends Analysis Report

CAGR :

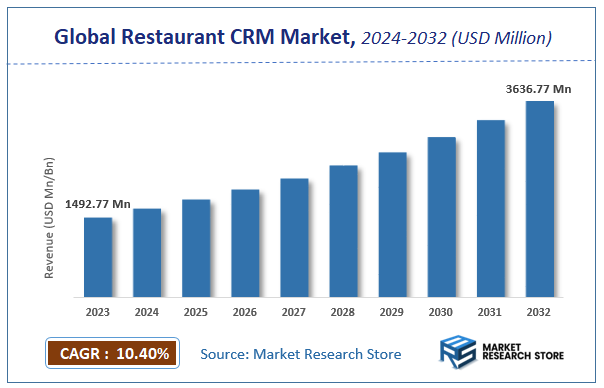

| Market Size 2023 (Base Year) | USD 1492.77 Million |

| Market Size 2032 (Forecast Year) | USD 3636.77 Million |

| CAGR | 10.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Restaurant CRM Market Insights

According to Market Research Store, the global restaurant CRM market size was valued at around USD 1492.77 million in 2023 and is estimated to reach USD 3636.77 million by 2032, to register a CAGR of approximately 10.4% in terms of revenue during the forecast period 2024-2032.

The restaurant CRM report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Restaurant CRM Market: Overview

A Restaurant CRM (Customer Relationship Management) system is a specialized software solution designed to help restaurants manage and enhance their relationships with customers by collecting, analyzing, and utilizing customer data to improve service, loyalty, and sales. It enables restaurants to track guest preferences, dining history, feedback, contact details, reservation patterns, and promotional responses, allowing for highly personalized communication and targeted marketing campaigns. These systems often integrate with POS (Point of Sale) systems, reservation platforms, online ordering, loyalty programs, and email marketing tools to create a unified view of each customer.

The growth of restaurant CRM adoption is driven by increasing competition in the hospitality industry and the rising importance of customer engagement in driving repeat business. By leveraging CRM data, restaurants can segment customers, send timely offers, recognize loyal patrons, and recover dissatisfied diners with tailored outreach. Additionally, the integration of artificial intelligence and analytics into CRM platforms helps restaurant owners make informed decisions based on behavior trends and customer lifetime value. With consumers expecting seamless, customized dining experiences across digital and physical touchpoints, CRM systems have become essential tools for restaurants looking to foster loyalty, boost revenue, and maintain a competitive edge in a dynamic market.

Key Highlights

- The restaurant CRM market is anticipated to grow at a CAGR of 10.4% during the forecast period.

- The global restaurant CRM market was estimated to be worth approximately USD 1492.77 million in 2023 and is projected to reach a value of USD 3636.77 million by 2032.

- The growth of the restaurant CRM market is being driven by the increasing demand for personalized customer experiences and enhanced customer loyalty within a highly competitive industry.

- Based on the type of establishment, the fast casual restaurants segment is growing at a high rate and is projected to dominate the market.

- On the basis of customer base, the individual consumers segment is projected to swipe the largest market share.

- In terms of functionality offered, the reservation management segment is expected to dominate the market.

- Based on the technology stack, the cloud-based solutions segment is expected to dominate the market.

- Based on the size of the business, the small restaurants segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Restaurant CRM Market: Dynamics

Key Growth Drivers:

- Increasing Competition and Need for Customer Retention: The restaurant industry is highly competitive. With numerous dining options available, retaining existing customers is often more cost-effective than acquiring new ones. Restaurant CRM enables personalized engagement, loyalty programs, and targeted communications, which are crucial for building customer loyalty and reducing churn.

- Growing Demand for Personalized Customer Experiences: Modern diners expect more than just good food; they seek personalized experiences. CRM systems allow restaurants to remember customer preferences (e.g., allergies, favorite dishes, seating preferences), track visit history, and tailor recommendations, making guests feel valued and enhancing their overall dining experience.

- Rise of Data-Driven Decision Making: Restaurants are increasingly recognizing the value of data. CRM platforms collect vast amounts of customer data that, when analyzed, provide actionable insights into consumer behavior, peak dining times, popular menu items, and marketing campaign effectiveness. This data empowers restaurants to make informed business decisions to optimize operations and revenue.

- Expansion of Omnichannel Engagement: Customers interact with restaurants through various touchpoints: online ordering, social media, reservations platforms, in-person dining, and delivery apps. Restaurant CRM helps centralize data from all these channels, enabling a consistent and seamless customer journey across all interactions, crucial for modern restaurant operations.

- Integration with Existing Restaurant Technologies (POS, Online Ordering): The seamless integration of CRM systems with Point-of-Sale (POS) systems, online ordering platforms, reservation management software, and marketing automation tools is a significant driver. This integration creates comprehensive guest profiles, automates data capture, and streamlines operations, making CRM more valuable.

- Influence of Loyalty Programs and Digital Marketing: CRM is the backbone of effective loyalty programs, allowing restaurants to track points, manage rewards, and send personalized offers. It also facilitates targeted email and SMS marketing campaigns, automating promotions and communications based on customer segments, leading to higher engagement and ROI.

- Focus on Online Reputation Management and Feedback: CRM systems often include tools for collecting customer feedback (e.g., post-dining surveys) and managing online reviews. This allows restaurants to address issues promptly, build positive relationships, and maintain a strong online reputation, which is vital in today's digital age.

Restraints:

- High Initial Implementation Costs and Perceived ROI: For many small and medium-sized restaurants, the upfront investment in CRM software, hardware, integration, and training can be a significant barrier. The perceived complexity and unclear immediate return on investment can deter adoption, especially for businesses operating on tight margins.

- Data Quality and Management Challenges: The effectiveness of a CRM heavily relies on accurate and up-to-date data. Challenges include inconsistent data entry by staff, duplicate customer profiles, stale data (outdated contact information), and the sheer volume of data, which can make it difficult to maintain data quality and extract meaningful insights.

- Resistance to Change and Staff Training: Implementing a new CRM system often requires changes to existing workflows and demands staff to learn new processes. Resistance from employees, lack of adequate training, and high staff turnover rates in the restaurant industry can lead to poor adoption and underutilization of CRM features.

- Data Privacy and Security Concerns: Restaurant CRM systems store sensitive customer information. Concerns about data breaches, compliance with evolving data privacy regulations (like GDPR or CCPA), and potential misuse of customer data are major restraints. Any security lapse can severely damage a restaurant's reputation and lead to legal penalties.

- Integration Complexities with Legacy Systems: Many established restaurants use older, legacy POS or management systems. Integrating a modern CRM with these outdated systems can be technically complex, time-consuming, and costly, often requiring custom development or workarounds.

- Complexity for Small, Independent Restaurants: While large chains can justify extensive CRM deployments, independent or smaller restaurants may find comprehensive CRM solutions too complex, feature-rich, and expensive for their scale of operations, leading to underutilization of features or opting for simpler, less robust tools.

- Vendor Fragmentation and Interoperability: The restaurant technology market has many CRM vendors, each with proprietary solutions. This can lead to fragmentation, making it challenging for restaurants to choose a system that integrates seamlessly with all their existing tools or switch vendors without significant data migration issues.

Opportunities:

- Hyper-Personalization with AI and Predictive Analytics: Leveraging AI and machine learning can take restaurant CRM to the next level. This includes predictive analytics to anticipate customer preferences, AI-driven recommendations for menu items or promotions, and highly personalized communication based on past behavior, driving higher engagement and average check sizes.

- Enhanced Mobile Experience and App Integration: Integrating CRM functionalities deeper into restaurant mobile apps (for ordering, reservations, loyalty) can create a seamless and highly convenient experience for customers. This includes personalized push notifications, in-app special offers, and easy access to loyalty program details.

- Voice AI and Conversational Interfaces: Integrating voice AI for reservations, order placement, or customer service interactions can enhance convenience and efficiency. CRM can capture insights from these conversations to further enrich customer profiles and personalize future interactions.

- Targeting the QSR (Quick Service Restaurant) and Fast Casual Segments: While full-service restaurants have been early adopters, the fast-growing QSR and fast-casual segments present significant opportunities for simplified, scalable CRM solutions focused on loyalty, mobile ordering integration, and customer feedback.

- Focus on Post-Dining Feedback and Reputation Management: Developing more sophisticated tools for collecting, analyzing, and acting upon customer feedback (both positive and negative) can be a major differentiator. This includes automated feedback requests, sentiment analysis, and seamless integration with online review platforms.

- Development of Specialized CRM for Niche Restaurants: Creating CRM solutions tailored for specific restaurant types (e.g., fine dining with emphasis on guest recognition, catering businesses with robust event management, or multi-location chains with advanced reporting) can address unique needs and capture niche markets.

- Subscription-Based and SaaS Models for Affordability: The prevalence of Software-as-a-Service (SaaS) models with flexible subscription plans makes CRM more accessible and affordable for restaurants of all sizes, reducing the initial capital outlay and driving wider adoption.

Challenges:

- Ensuring Data Security and Compliance Amidst Evolving Regulations: With increasingly stringent data privacy laws globally, a primary challenge is to ensure absolute security of sensitive customer data and maintain continuous compliance with regulations, which can be costly and require ongoing vigilance.

- Achieving Seamless Integration Across a Fragmented Tech Stack: The restaurant industry often uses a patchwork of disparate technologies (POS, online ordering, delivery platforms, reservation systems). The challenge is to create truly seamless and real-time integrations with all these systems to centralize customer data effectively without major technical hurdles.

- Proving Clear ROI for Smaller Operators: While benefits are clear for large chains, effectively demonstrating a tangible and rapid return on investment to skeptical small and independent restaurant owners remains a significant hurdle. This requires providing clear metrics and success stories tailored to their scale.

- Staff Adoption and Ongoing Training: High employee turnover in the restaurant industry makes continuous staff training on CRM systems a significant challenge. Ensuring consistent data entry, proper utilization of features, and a customer-centric mindset among all staff is crucial for CRM success.

- Managing Customer Expectations for Personalization: As CRM drives personalization, customers' expectations for tailored experiences will rise. The challenge is to consistently deliver on these heightened expectations without becoming intrusive or "creepy" with data usage.

- Combating Data Silos and Inconsistent Data: Despite having CRM, many restaurants struggle with data existing in silos across different systems (e.g., POS data separate from reservation data). The challenge is to effectively unify all customer data into a single, comprehensive profile for truly actionable insights.

- The "Human Touch" vs. Automation Balance: While automation through CRM can enhance efficiency, the restaurant industry thrives on human connection. The challenge is to leverage CRM to enable and empower the human touch (e.g., allowing staff to personalize service) rather than replace it, ensuring technology complements, not detracts from, guest experience.

Restaurant CRM Market: Report Scope

This report thoroughly analyzes the Restaurant CRM Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Restaurant CRM Market |

| Market Size in 2023 | USD 1492.77 Million |

| Market Forecast in 2032 | USD 3636.77 Million |

| Growth Rate | CAGR of 10.4% |

| Number of Pages | 187 |

| Key Companies Covered | Salesforce.com, HubSpot CRM, Infusionsoft, Results CRM, ProsperWorks CRM, NetSuite, Base, Less Annoying CRM, Claritysoft, Freshdesk, Hatchbuck, KIZEN |

| Segments Covered | By Type of Establishment, By Customer Base, By Functionality Offered, By Technology Stack, By Size of the Business, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Restaurant CRM Market: Segmentation Insights

The global restaurant CRM market is divided by type of establishment, customer base, functionality offered, technology stack, size of the business, and region.

Segmentation Insights by Type of Establishment

Based on type of establishment, the global restaurant CRM market is divided into fast casual restaurants, fine dining restaurants, quick service restaurants (QSR), food trucks and mobile vendors, and catering services.

Fast Casual Restaurants dominate the Restaurant CRM Market due to their hybrid service model that blends the speed of quick service with the quality of casual dining. These establishments emphasize a tech-forward customer experience, making them early adopters of CRM platforms to handle customer loyalty, online ordering, personalized promotions, and feedback collection. The consistent expansion of fast casual chains and their focus on digital transformation to engage tech-savvy millennials and Gen Z further drives CRM adoption. Enhanced customer segmentation and real-time communication capabilities offered by CRM solutions have become essential tools for these establishments to stay competitive and build strong repeat customer bases.

Fine Dining Restaurants are increasingly integrating CRM solutions to offer personalized, high-end guest experiences. These restaurants rely heavily on building strong customer relationships, managing reservations, and delivering individualized service based on guest preferences, visit history, and spending behavior. CRM systems in this segment help store rich customer profiles, support VIP treatment, and maintain high service standards. While the adoption rate is relatively slower due to traditional operational models, premium restaurants in urban and luxury markets are embracing CRM tools to enhance exclusivity and loyalty.

Quick Service Restaurants (QSR) leverage CRM platforms to handle high-volume transactions and promote brand loyalty across multiple locations. Their dependency on customer data analytics, mobile ordering, digital coupons, and targeted promotions has led to increasing CRM integration. Large QSR chains, in particular, use CRM systems to optimize marketing strategies, track customer preferences, and integrate with POS and mobile apps. Although their operations are often automated, CRM platforms enable these establishments to deliver personalized outreach and foster engagement at scale.

Food Trucks and Mobile Vendors are gradually adopting CRM solutions as they seek to build loyal customer bases in an increasingly competitive market. These vendors use CRM tools primarily for mobile marketing, location-based promotions, and social media engagement. While CRM penetration is lower compared to fixed establishments, the need for real-time feedback and direct customer interaction drives interest. The flexibility and affordability of cloud-based and mobile-friendly CRM systems have made them more accessible for small-scale operators looking to enhance their brand visibility and customer retention.

Catering Services utilize CRM systems to manage client relationships, track past events, and personalize service offerings. In this segment, CRM solutions help streamline client communications, schedule follow-ups, and maintain records of preferences and dietary requirements. These features are particularly critical for recurring corporate and private events. Catering businesses benefit from CRM platforms by improving operational efficiency, ensuring consistent client experiences, and increasing referral opportunities through better engagement and service quality.

Segmentation Insights by Customer Base

On the basis of customer base, the global restaurant CRM market is bifurcated into individual consumers, corporate clients, event organizers, food enthusiasts and influencers, and tourists and travelers.

Individual Consumers dominate the Restaurant CRM Market as they represent the largest and most consistent customer base across all restaurant types. CRM platforms are primarily designed to gather, analyze, and act on data generated by individual diners, such as visit frequency, order preferences, and feedback. Restaurants use this data to craft personalized promotions, loyalty programs, birthday rewards, and automated re-engagement campaigns. With the rise of mobile apps, online reservations, and digital menus, CRM systems allow establishments to directly connect with individuals, making their experience more tailored and increasing the chances of repeat visits and word-of-mouth referrals.

Corporate Clients represent a growing segment in the CRM market as restaurants increasingly cater to business lunches, corporate catering, and company events. CRM solutions help manage relationships with these high-value clients by maintaining records of previous orders, billing preferences, contact persons, and event requirements. Restaurants use CRM systems to automate invoicing, schedule repeat orders, and offer exclusive deals or corporate loyalty programs. This segment is particularly important for fine dining and catering services, where recurring business and high transaction volumes contribute significantly to revenue stability.

Event Organizers form a specialized but highly strategic customer base, especially for restaurants offering event hosting, private dining, or offsite catering. CRM platforms are used to manage complex event details, including menus, seating arrangements, dietary restrictions, and communication timelines. Restaurants that frequently host weddings, parties, and business functions rely on CRM tools to provide seamless coordination and maintain a history of past events. This enables them to deliver consistent service and upsell future bookings. Integration with calendar systems and automated follow-ups are key CRM features that serve this segment effectively.

Food Enthusiasts and Influencers are an emerging and influential customer group in the restaurant CRM space. While smaller in number, their impact on brand visibility and reputation is significant. CRM platforms help restaurants identify and engage with these individuals through social listening, engagement tracking, and tailored invitations to soft openings or exclusive tastings. Restaurants may also track their content performance and establish long-term collaboration opportunities. As influencer marketing becomes more prevalent, CRM systems offer tools to manage these relationships more systematically, turning positive experiences into powerful promotional assets.

Tourists and Travelers constitute a seasonal and transient yet valuable customer segment. Restaurants use CRM systems to tailor experiences based on geolocation data, travel behavior, language preferences, and feedback from global review platforms. CRM tools support the delivery of multi-language communications, mobile-based offers, and location-sensitive advertising. For restaurants in tourist hotspots, CRM integration with travel apps and hotel concierge services can help capture and retain tourist traffic. Although their repeat business potential may be limited, high-quality engagement during visits can result in strong online reviews and recommendations, reinforcing brand credibility across global audiences.

Segmentation Insights by Functionality Offered

On the basis of functionality offered, the global restaurant CRM market is bifurcated into reservation management, loyalty programs, order and payment processing, customer feedback and reviews, and marketing automation.

Reservation Management dominates the Restaurant CRM Market as it forms the core functionality for both fine dining and casual dining establishments aiming to streamline guest experiences and optimize table turnover. CRM platforms enable restaurants to manage reservations in real time, reduce no-shows through automated confirmations and reminders, and accommodate special requests such as seating preferences or dietary restrictions. This functionality is crucial for enhancing operational efficiency and customer satisfaction. Integration with online booking platforms and centralized reservation logs helps restaurants deliver a personalized and professional experience, which is especially critical in high-traffic or high-value customer environments.

Loyalty Programs represent a highly impactful CRM function, enabling restaurants to retain customers and increase lifetime value through points systems, discounts, and exclusive rewards. These programs are driven by detailed data captured from customer behavior, such as order history, visit frequency, and average spend. CRM platforms allow restaurants to create tiered loyalty structures, track engagement across channels, and deliver customized incentives that foster brand loyalty. This functionality is especially valuable for quick service and fast casual restaurants that rely heavily on repeat visits and mobile app-based engagement.

Order and Payment Processing is a critical CRM function that enhances customer convenience and improves operational flow. Modern CRM systems often integrate with POS (Point-of-Sale) terminals to provide real-time transaction data, enabling restaurants to track customer preferences and refine service delivery. This functionality supports personalized upselling, loyalty tracking, and detailed purchase histories. As digital ordering and contactless payments become increasingly common, especially in QSR and mobile vendor segments, CRM platforms that support seamless order and payment integration gain a competitive edge in customer service delivery.

Customer Feedback and Reviews functionality plays a central role in improving service quality and customer satisfaction. CRM systems collect structured and unstructured feedback through post-visit surveys, review platform integrations, and social media monitoring. This feedback loop allows restaurants to identify service gaps, address complaints proactively, and recognize high-performing staff. Tracking sentiment trends and automating follow-ups with dissatisfied customers help retain brand trust and prevent reputational damage. This function is especially critical in competitive markets where customer experience is a key differentiator.

Marketing Automation enables restaurants to create and deploy personalized campaigns based on customer data insights. CRM platforms with this functionality allow for email, SMS, and push notification campaigns targeted by demographics, past orders, visit frequency, and behavior patterns. Automation helps in promoting seasonal offers, birthday deals, loyalty rewards, and new menu launches with minimal manual effort. It also supports A/B testing and performance analytics, which empower restaurants to refine their messaging for better engagement. This feature is particularly vital for chains and franchises that need consistent marketing across multiple locations.

Segmentation Insights by Technology Stack

On the basis of technology stack, the global restaurant CRM market is bifurcated into cloud-based solutions, on-premises solutions, mobile applications, integration with POS systems, and data analytics and reporting tools.

Cloud-Based Solutions dominate the Restaurant CRM Market due to their scalability, cost-effectiveness, and accessibility. These solutions allow restaurants of all sizes to deploy CRM functionalities without heavy infrastructure investments. Cloud platforms enable real-time data synchronization across locations, seamless software updates, and remote access for management and staff. With growing demand for mobility and centralization, cloud-based CRM tools support multi-unit restaurant chains and franchises in maintaining consistent customer engagement and loyalty programs. Their compatibility with third-party applications, integration ease, and subscription-based pricing models make them the most widely adopted option in the industry.

On-Premises Solutions continue to serve niche segments of the restaurant industry that require greater control over data security and system customization. These solutions are typically preferred by high-end restaurants, large hospitality groups, or businesses operating in areas with limited internet connectivity. On-premises CRM platforms provide full ownership and allow integration with proprietary systems, although they require higher upfront investment and ongoing maintenance. Despite a declining share in favor of cloud models, on-premises CRM systems remain relevant where data privacy and compliance regulations are a priority.

Mobile Applications are an essential component of modern CRM platforms, enabling staff and managers to access customer data, manage reservations, send promotions, and gather feedback from smartphones and tablets. Mobile CRM tools enhance flexibility and real-time responsiveness, allowing front-line staff to offer personalized service on the floor. Customers also interact with CRM features through mobile apps—making reservations, joining loyalty programs, receiving push notifications, and submitting reviews. As mobile usage continues to rise, CRM vendors increasingly prioritize mobile-first interfaces, particularly in fast casual and QSR environments.

Integration with POS Systems is a foundational requirement for comprehensive restaurant CRM platforms. By linking CRM with POS systems, restaurants can automatically capture order histories, track spending patterns, and associate sales data with individual customer profiles. This integration enables effective loyalty tracking, upselling strategies, and targeted marketing efforts based on real-time transactional insights. It also helps streamline operations by reducing manual data entry and ensuring consistency between service and marketing functions. POS integration is especially valuable for high-volume operations such as QSRs and multi-location chains.

Data Analytics and Reporting Tools are critical for deriving actionable insights from customer interactions. CRM systems equipped with advanced analytics provide restaurants with detailed reports on customer behavior, campaign performance, reservation trends, and feedback sentiment. These tools empower decision-makers to identify patterns, segment customer bases, and adjust strategies in real time. Predictive analytics and AI-driven recommendations are increasingly being used to anticipate customer preferences and automate engagement. This functionality is vital for restaurants seeking to optimize their marketing ROI and enhance service personalization.

Segmentation Insights by Size of the Business

On the basis of size of the business, the global restaurant CRM market is bifurcated into small restaurants, medium-sized restaurants, large chains and franchises, startup food businesses, and established brands with multiple locations.

Small Restaurants dominate the Restaurant CRM Market in terms of volume, as they make up the largest portion of the global restaurant ecosystem. These independent or family-owned establishments increasingly adopt CRM solutions to compete with larger players by improving customer relationships, managing reservations, and launching basic loyalty programs. Cloud-based and mobile CRM platforms have become especially appealing to small restaurants due to their affordability, ease of use, and scalability. With limited marketing resources, these businesses rely on CRM tools to automate outreach, retain local customers, and encourage repeat visits, making CRM an essential part of their growth strategy.

Medium-Sized Restaurants are significant adopters of CRM technology as they aim to balance operational efficiency with personalized customer service. These establishments typically have more structured workflows and a broader customer base than small restaurants, which necessitates more advanced CRM features such as detailed analytics, loyalty segmentation, and feedback management. Medium-sized restaurants often use CRM platforms to coordinate multi-channel engagement strategies, maintain reservation consistency, and manage periodic promotions. Their growing investment in digital transformation places CRM solutions at the center of both customer service and revenue optimization efforts.

Large Chains and Franchises leverage CRM systems to deliver consistent, personalized experiences across numerous locations. These businesses require robust, scalable CRM solutions capable of integrating with enterprise-level POS systems, mobile apps, loyalty platforms, and marketing automation tools. CRM enables them to centralize customer data, create uniform promotional strategies, and execute region-specific campaigns based on analytics. These establishments often utilize CRM to manage large-scale loyalty programs, track brand engagement, and optimize marketing performance, making it a strategic asset for brand consistency and customer retention at scale.

Startup Food Businesses increasingly adopt CRM tools to accelerate customer acquisition, differentiate their brand, and create a loyal following from the outset. These startups often operate with lean teams and prioritize digital engagement, making cloud-based and mobile-friendly CRM systems ideal. CRM tools help them collect early customer feedback, manage digital campaigns, and test loyalty initiatives with agility. Startups use CRM to build brand identity, improve customer responsiveness, and gather insights to guide product and service development in their early growth stages.

Established Brands with Multiple Locations rely heavily on CRM systems to harmonize customer experience across diverse geographic markets. These brands benefit from advanced CRM features such as centralized data management, cross-location customer profiles, and integrated feedback analytics. CRM solutions help these businesses ensure uniform service quality, track brand loyalty, and run multi-site promotions with precision. The ability to analyze performance at each location while maintaining a holistic view of customer engagement makes CRM platforms indispensable for strategic planning and long-term growth among well-established, multi-location restaurant operators.

Restaurant CRM Market: Regional Insights

- North America is expected to dominate the global market

North America is the dominant region in the global Restaurant CRM market, largely due to the high concentration of technologically advanced restaurant chains and a strong emphasis on personalized customer experiences. The U.S. leads in adoption, driven by large franchises such as McDonald’s, Chipotle, Starbucks, and Taco Bell, all of which integrate CRM platforms to enhance customer loyalty, streamline reservations, and personalize marketing campaigns. The presence of leading CRM vendors such as Salesforce, Oracle, Toast, and Upserve supports a mature ecosystem with seamless integration into POS systems and mobile ordering platforms. Additionally, increasing consumer demand for digital loyalty programs, AI-driven recommendations, and omni-channel engagement tools further accelerates CRM implementation across restaurants of all sizes.

Europ is a significant player in the Restaurant CRM market, with widespread adoption across countries like the United Kingdom, Germany, France, and Italy. European restaurants focus heavily on compliance with data privacy standards such as GDPR, making CRM systems with strong data governance features particularly valuable. The market is characterized by a growing trend toward AI-powered analytics, predictive customer behavior tools, and cloud-based CRM solutions that support multilingual and multi-currency functionalities. The use of mobile applications for reservation management, feedback collection, and personalized discounts is expanding among both large hotel restaurants and mid-sized establishments across urban centers.

Asia-Pacific is experiencing rapid expansion in CRM adoption, fueled by the explosive growth of the restaurant industry and mobile-first consumer behavior in markets such as China, India, Japan, South Korea, and Southeast Asia. The rise of food delivery aggregators like Zomato, Swiggy, Meituan, and Grab has prompted restaurants to integrate CRM platforms for better customer relationship handling, order tracking, and feedback management. There is also increasing uptake among small and medium-sized restaurants, which prefer cost-effective and scalable CRM platforms. The region benefits from large-scale digital transformation efforts and a young, tech-savvy population that demands real-time engagement, loyalty tracking, and seamless online-to-offline dining experiences.

Latin America is showing steady growth in Restaurant CRM adoption, especially in countries like Brazil, Mexico, Argentina, and Colombia. The region’s restaurant operators are increasingly using CRM systems to improve customer retention, manage online reservations, and run targeted promotions. Larger chains and urban eateries are leading in digital CRM deployment, while smaller businesses are slowly transitioning from manual to automated customer engagement models. Despite infrastructural challenges in rural regions, there is a rising interest in mobile CRM tools and cloud-based platforms that offer multilingual support and user-friendly interfaces.

Middle East & Africa region is gradually embracing restaurant CRM solutions, particularly in the UAE, Saudi Arabia, and South Africa. In these areas, hospitality and tourism-driven growth is prompting luxury dining establishments and hotel-based restaurants to deploy CRM systems for VIP guest management, table reservation optimization, and personalized offers. While the adoption rate is slower in other parts of the region, the increasing availability of mobile internet and rising consumer expectations for digital interactions are encouraging restaurants to modernize their customer engagement strategies. The market remains fragmented but promising, especially in urban centers.

Restaurant CRM Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the restaurant CRM market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global restaurant CRM market include:

- Salesforce.com

- HubSpot CRM

- Infusionsoft

- Results CRM

- ProsperWorks CRM

- NetSuite

- Base

- Less Annoying CRM

- Claritysoft

- Freshdesk

- Hatchbuck

- KIZEN

The global restaurant CRM market is segmented as follows:

By Type of Establishment

- Fast Casual Restaurants

- Fine Dining Restaurants

- Quick Service Restaurants (QSR)

- Food Trucks and Mobile Vendors

- Catering Services

By Customer Base

- Individual Consumers

- Corporate Clients

- Event Organizers

- Food Enthusiasts and Influencers

- Tourists and Travelers

By Functionality Offered

- Reservation Management

- Loyalty Programs

- Order and Payment Processing

- Customer Feedback and Reviews

- Marketing Automation

By Technology Stack

- Cloud-Based Solutions

- On-Premises Solutions

- Mobile Applications

- Integration with POS Systems

- Data Analytics and Reporting Tools

By Size of the Business

- Small Restaurants

- Medium-Sized Restaurants

- Large Chains and Franchises

- Startup Food Businesses

- Established Brands with Multiple Locations

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Restaurant CRM

Request Sample

Restaurant CRM