Lung Cancer Liquid Biopsy Market Size, Share, and Trends Analysis Report

CAGR :

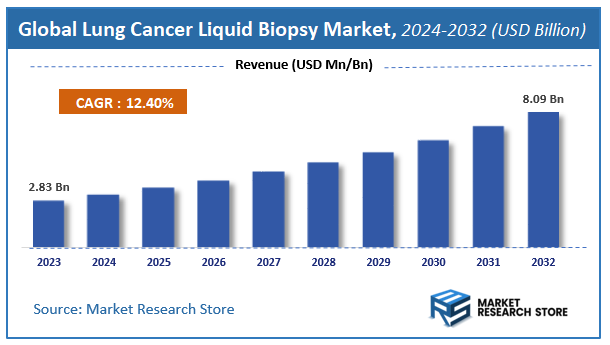

| Market Size 2023 (Base Year) | USD 2.83 Billion |

| Market Size 2032 (Forecast Year) | USD 8.09 Billion |

| CAGR | 12.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Lung Cancer Liquid Biopsy Market Insights

According to Market Research Store, the global lung cancer liquid biopsy market size was valued at around USD 2.83 billion in 2023 and is estimated to reach USD 8.09 billion by 2032, to register a CAGR of approximately 12.4% in terms of revenue during the forecast period 2024-2032.

The lung cancer liquid biopsy report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Lung Cancer Liquid Biopsy Market: Overview

A lung cancer liquid biopsy is a non-invasive diagnostic tool that detects genetic mutations and alterations associated with lung cancer through a blood sample. This method analyzes tumor DNA, RNA, and other biomarkers present in the bloodstream, providing valuable insights into the presence of cancer, its genetic profile, and the progression of the disease. Liquid biopsy is considered a less invasive and more accessible alternative to traditional tissue biopsy, offering advantages in monitoring treatment efficacy, identifying resistance mutations, and detecting early recurrence.

Key Highlights

- The lung cancer liquid biopsy market is anticipated to grow at a CAGR of 12.4% during the forecast period.

- The global lung cancer liquid biopsy market was estimated to be worth approximately USD 2.83 billion in 2023 and is projected to reach a value of USD 8.09 billion by 2032.

- The growth of the lung cancer liquid biopsy market is being driven by the rising incidence of lung cancer, the need for early detection, and the growing preference for minimally invasive procedures.

- Based on the sample type, the blood sample-based segment is growing at a high rate and is projected to dominate the market.

- On the basis of biomarker, the circulating nucleic acids segment is projected to swipe the largest market share.

- In terms of technology, the multi-gene parallel analysis segment is expected to dominate the market.

- Based on the end-use, the hospitals and laboratories segment is expected to dominate the market.

- On the basis of clinical application, the therapy selection segment is projected to swipe the largest market share.

- In terms of product, the consumables kits and reagents segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Lung Cancer Liquid Biopsy Market: Dynamics

Key Growth Drivers:

- Non-Invasive Nature: Liquid biopsies offer a less invasive alternative to traditional tissue biopsies, reducing patient discomfort and risks associated with surgical procedures. This is a major driver, especially for patients who are not suitable for or refuse tissue biopsies.

- Real-Time Monitoring: Liquid biopsies enable real-time monitoring of cancer progression, treatment response, and the emergence of drug resistance mutations. This allows for personalized treatment strategies and timely interventions.

- Early Cancer Detection: Liquid biopsies hold promise for early cancer detection, potentially improving patient outcomes. Detecting cancer at earlier stages increases the chances of successful treatment.

- Companion Diagnostics: Liquid biopsies are increasingly used as companion diagnostics to identify patients who are most likely to benefit from specific targeted therapies, optimizing treatment decisions and improving efficacy.

Restraints:

- Sensitivity and Specificity: While improving, the sensitivity and specificity of liquid biopsy tests can still be a challenge, particularly for detecting low levels of circulating tumor DNA (ctDNA) in early-stage cancers. False negatives and false positives can occur.

- Cost: The cost of liquid biopsy tests can be a barrier to widespread adoption, especially in resource-limited settings. Reimbursement policies can also be a factor.

- Standardization: Lack of standardized protocols and assays can lead to variability in results and hinder the widespread adoption of liquid biopsies in clinical practice.

- Regulatory Hurdles: Navigating regulatory pathways for the approval and commercialization of liquid biopsy tests can be complex and time-consuming.

Opportunities:

- Early Cancer Detection: Further research and development to improve the sensitivity and specificity of liquid biopsy tests can unlock the potential for early cancer detection and improved patient outcomes.

- Personalized Medicine: Liquid biopsies can play a crucial role in personalized medicine by providing real-time information about a patient's tumor, enabling tailored treatment strategies.

- Minimal Residual Disease (MRD) Monitoring: Liquid biopsies can be used to detect minimal residual disease after treatment, helping to identify patients at high risk of recurrence and guiding adjuvant therapy decisions.

- Drug Development: Liquid biopsies can be used in drug development to identify biomarkers for patient stratification and to monitor treatment response in clinical trials.

Challenges:

- Technical Challenges: Isolating and analyzing ctDNA from blood samples can be technically challenging due to its low concentration and fragmentation.

- Data Interpretation: Interpreting the complex data generated by liquid biopsy tests requires expertise and sophisticated bioinformatics tools.

- Clinical Validation: Large-scale clinical trials are needed to validate the clinical utility of liquid biopsies and establish their role in standard clinical practice.

- Ethical Considerations: Ethical considerations related to data privacy, informed consent, and the potential for misuse of genetic information need to be addressed.

Lung Cancer Liquid Biopsy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Lung Cancer Liquid Biopsy Market |

| Market Size in 2023 | USD 2.83 Billion |

| Market Forecast in 2032 | USD 8.09 Billion |

| Growth Rate | CAGR of 12.4% |

| Number of Pages | 140 |

| Key Companies Covered | Eurofins Scientific, MDxHealth, CareDx, Immucor, Thermo Fisher Scientific Inc., Menarini Silicon Biosystems, Qiagen, Guardant Health, Exact Sciences Corporation, Myriad Genetics Inc., LungLife AI Inc., Bio-Rad Laboratories, Agilent Technologies |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lung Cancer Liquid Biopsy Market: Segmentation Insights

The global lung cancer liquid biopsy market is divided by sample type, biomarker, technology, end-use, clinical application, product, and region.

Segmentation Insights by Sample Type

Based on sample type, the global lung cancer liquid biopsy market is divided into blood sample based and others.

In the lung cancer liquid biopsy market, the blood sample-based segment holds the dominant position due to its widespread use and advantages in non-invasive diagnostics. Blood samples are considered the gold standard for liquid biopsies because they are relatively easy to collect, minimizing patient discomfort.

Blood-based liquid biopsies allow for the detection of circulating tumor DNA (ctDNA), exosomes, and other biomarkers associated with lung cancer, providing insights into genetic mutations, disease progression, and treatment response. This method has gained significant attention due to its convenience, scalability, and potential for early detection of lung cancer.

Segmentation Insights by Biomarker

On the basis of biomarker, the global lung cancer liquid biopsy market is bifurcated into circulating nucleic acids, CTC, exosomes/microvesicles, and circulating proteins.

In the lung cancer liquid biopsy market, circulating nucleic acids (ctDNA and cfDNA) are the most dominant biomarker segment. Circulating tumor DNA (ctDNA), a type of nucleic acid, is derived from tumor cells and is highly informative for detecting mutations, gene fusions, and other genetic alterations associated with lung cancer. This biomarker is widely used because of its high sensitivity in identifying genetic mutations and its potential for early cancer detection and monitoring treatment response. ctDNA has shown strong promise in personalized medicine, enabling clinicians to tailor treatments based on the specific genetic profile of a patient's cancer.

Next in line are circulating tumor cells (CTCs), which are less dominant than circulating nucleic acids but still play a critical role in lung cancer liquid biopsy. CTCs are individual cancer cells shed from primary or metastatic tumors into the bloodstream. These cells can be isolated and analyzed to identify tumor characteristics, genetic mutations, and even drug resistance. While CTCs offer significant insights into disease progression, their clinical application is somewhat limited by challenges in detection, as these cells are rare and fragile in the bloodstream, making their isolation and analysis more complex compared to nucleic acids.

The exosomes/microvesicles segment, although growing in importance, is relatively less dominant than CTCs and circulating nucleic acids. Exosomes are small vesicles secreted by cells that contain various biomolecules, including proteins, lipids, and RNAs. They are thought to play a role in tumor progression and metastasis. Due to their ability to carry tumor-related information and be present in many biological fluids, including blood, exosomes have potential as a non-invasive biomarker for lung cancer diagnosis and monitoring. However, their clinical application is still in the research phase, with challenges related to the standardized isolation and characterization of exosomes.

Finally, circulating proteins, though valuable in lung cancer diagnostics, represent a less dominant biomarker segment in liquid biopsy. Circulating proteins, such as tumor markers (e.g., CEA, EGFR), provide insight into the biological activity of the tumor, but they may lack the sensitivity and specificity required for early-stage detection and comprehensive tumor profiling. These biomarkers are often used in conjunction with other methods rather than as standalone indicators for lung cancer.

Segmentation Insights by Technology

Based on technology, the global lung cancer liquid biopsy market is divided into multi-gene-parallel analysis (NGS) and single gene analysis (PCR microarrays).

In the lung cancer liquid biopsy market, multi-gene parallel analysis using Next-Generation Sequencing (NGS) is the dominant technology segment. NGS allows for the simultaneous analysis of multiple genes, providing a comprehensive profile of genetic mutations, alterations, and biomarkers associated with lung cancer. This high-throughput technology offers unmatched sensitivity and precision in detecting rare mutations, making it an invaluable tool for personalized medicine. NGS is particularly beneficial for identifying complex mutations or alterations in tumor genomes, guiding targeted therapies, and monitoring treatment response. Its ability to handle large volumes of genetic data efficiently has made it the preferred choice for both clinical and research applications in lung cancer diagnostics.

In contrast, single gene analysis using PCR (Polymerase Chain Reaction) and microarrays represents a less dominant segment in comparison to NGS, although it remains important in specific clinical contexts. PCR-based methods focus on detecting specific genetic mutations or alterations in individual genes, such as EGFR or KRAS, which are commonly associated with lung cancer. While PCR provides a more cost-effective and quicker option for testing a single gene, it lacks the ability to perform broad genetic profiling like NGS. Similarly, microarrays are used to detect the expression of specific genes but are generally limited to known biomarkers and are less flexible than NGS for uncovering a wider range of genetic changes in the tumor.

Segmentation Insights by End-use

On the basis of end-use, the global lung cancer liquid biopsy market is bifurcated into hospitals & laboratories, specialty clinics, academic & research centers, others.

In the lung cancer liquid biopsy market, the hospitals and laboratories segment is the most dominant end-use category. Hospitals and diagnostic laboratories are the primary settings for liquid biopsy tests due to their established infrastructure and ability to handle large patient volumes. These institutions are equipped with advanced diagnostic technologies, including NGS and PCR-based assays, making them the go-to providers for liquid biopsy services. Hospitals and labs are also essential for early diagnosis, disease monitoring, and guiding treatment decisions in lung cancer patients. Their widespread adoption of liquid biopsy technologies helps drive the market's growth.

Next in importance are specialty clinics, which focus on specific medical conditions or treatment areas, such as oncology. These clinics often provide personalized care and cutting-edge diagnostic services, including liquid biopsies for lung cancer. While they cater to a more targeted patient population, specialty clinics are increasingly incorporating liquid biopsy tests, especially for patients who require ongoing monitoring or advanced treatment strategies. However, the market share for this segment is smaller than that of hospitals and laboratories due to the specialized nature of these clinics and their more limited patient base.

Academic and research centers represent a smaller yet significant segment within the liquid biopsy market. These institutions are at the forefront of developing and validating new liquid biopsy techniques and biomarkers. Many of the advances in lung cancer liquid biopsy technologies emerge from research settings, where new methods for detection and treatment monitoring are explored. Academic centers play a crucial role in driving innovation and providing insights into the clinical applications of liquid biopsy, though their direct contribution to patient testing is more indirect compared to hospitals and specialty clinics.

Segmentation Insights by Clinical Application

Based on clinical application, the global lung cancer liquid biopsy market is divided into therapy selection, treatment monitoring, early cancer screening, recurrence monitoring, and others.

In the lung cancer liquid biopsy market, therapy selection is the most dominant clinical application. Liquid biopsies allow clinicians to identify genetic mutations, alterations, and biomarkers in tumor DNA, which can guide the selection of targeted therapies. This application has become crucial in personalized medicine, as it helps determine the most effective treatments based on the unique genetic profile of a patient's tumor. The ability to identify mutations like EGFR, ALK, and KRAS through liquid biopsy enables tailored therapy regimens that can significantly improve patient outcomes, making therapy selection the leading clinical application.

Following closely is treatment monitoring, which also holds significant importance in the liquid biopsy market. Liquid biopsy is used to track the effectiveness of treatments by detecting changes in tumor biomarkers or ctDNA levels over time. This application allows healthcare providers to assess whether the cancer is responding to therapy or if there are signs of resistance developing. Monitoring treatment response through non-invasive methods helps in adjusting treatment plans more dynamically, making it an essential tool for managing lung cancer patients throughout their treatment journey.

Early cancer screening comes next as a growing application of liquid biopsy in lung cancer. Early detection of cancer is critical for improving survival rates, and liquid biopsy offers a non-invasive method for identifying biomarkers associated with early-stage lung cancer. This application holds significant promise for population screening, especially in high-risk individuals, as it can help detect the disease before it becomes symptomatic. While this application is still being refined, it is expected to play a larger role in the market as more studies validate the effectiveness of liquid biopsy for early-stage cancer detection.

Recurrence monitoring is also an important clinical application but slightly less dominant than therapy selection and treatment monitoring. Liquid biopsy allows clinicians to detect minimal residual disease (MRD) or signs of recurrence in patients who have undergone treatment and achieved remission. By continuously monitoring tumor-derived biomarkers in the blood, recurrence can be detected earlier than with traditional imaging methods, offering an opportunity for timely intervention. This application is particularly valuable for patients who are in remission but still at risk of relapse.

Segmentation Insights by Product

On the basis of product, the global lung cancer liquid biopsy market is bifurcated into instruments, consumables kits & reagents, and software & services.

In the lung cancer liquid biopsy market, consumables kits and reagents are the most dominant product category. These include the various chemicals, kits, and reagents used for sample collection, preparation, and analysis in liquid biopsy tests. Consumables are essential for the daily operation of liquid biopsy testing in hospitals, laboratories, and diagnostic centers. They enable the extraction and analysis of biomarkers, including ctDNA, CTCs, and exosomes, and are integral to the accuracy and efficiency of the tests. The demand for consumables is driven by the growing adoption of liquid biopsy technologies and the increasing volume of diagnostic tests performed globally. As liquid biopsy testing becomes more widespread, consumables remain a crucial component of the market.

Following consumables are instruments, which encompass the advanced machines and equipment used for performing liquid biopsy assays, such as NGS platforms, PCR machines, and various diagnostic devices. These instruments are essential for the accurate and high-throughput processing of samples, and they represent a significant portion of the market value due to their technological complexity and high cost. Instruments allow for the analysis of large amounts of genetic data or specific biomarkers, making them indispensable in the clinical and research settings where liquid biopsies are performed. Although they are a critical part of the workflow, the instruments segment is not as dominant as consumables because consumables are needed more frequently during the testing process.

The software and services segment, while growing in importance, is relatively less dominant in comparison to consumables and instruments. This category includes the software platforms used to analyze genetic data, as well as the diagnostic and support services that complement liquid biopsy testing. The software enables the processing, interpretation, and visualization of complex genetic data, often integrating artificial intelligence (AI) and machine learning (ML) to improve accuracy and predictive capabilities. Services include patient support, training, and data management solutions provided by companies in the liquid biopsy space. While essential for data interpretation and clinical decision-making, this segment represents a smaller share of the market compared to the consumables and instruments that are directly involved in the testing process.

Lung Cancer Liquid Biopsy Market: Regional Insights

- North America is expected to dominates the global market

North America leads the lung cancer liquid biopsy market, driven by advanced healthcare infrastructure and high adoption rates of innovative diagnostic technologies. The United States, in particular, has a well-established healthcare system with cutting-edge technology, allowing for early detection and diagnosis of lung cancer. Liquid biopsies, which involve analyzing circulating tumor DNA (ctDNA) in the blood, are less invasive than traditional tissue biopsies and can be performed more frequently. This non-invasive nature, along with repeatability and real-time monitoring capabilities, has contributed to the widespread acceptance of liquid biopsy tests in the region.

Europe is experiencing significant growth in the lung cancer liquid biopsy market, with increasing partnerships for collaborative research endeavors to advance these technologies. Academic institutions, pharmaceutical companies, and diagnostic firms are increasingly joining forces to pool resources, expertise, and data to accelerate the development and validation of novel liquid biopsy assays. This collaborative approach is expected to drive innovation and improve the accuracy and reliability of liquid biopsy tests across European countries.

Asia Pacific is anticipated to witness significant growth in the lung cancer liquid biopsy market, with high incidence rates in countries such as China, India, and Japan. This increased prevalence naturally leads to a higher demand for diagnostic procedures such as biopsy. Tobacco use, particularly smoking, increases the risk of lung cancer, necessitating more biopsies for diagnosis and treatment. Air pollution in the region is a significant concern, with high levels of particulate matter and other pollutants contributing to respiratory issues and lung cancer risk. This further increases the need for lung cancer screening and biopsies.

Latin America is expected to experience growth in the lung cancer liquid biopsy market, driven by increased awareness among patients and healthcare professionals. This heightened awareness has led to a higher number of lung cancer cases being diagnosed in the region. The non-invasive nature of liquid biopsy tests has made them an attractive option for both patients and healthcare providers, contributing to their growing adoption in Latin American countries.

The Middle East and Africa region is anticipated to witness growth in the lung cancer liquid biopsy market, with increasing awareness among patients and healthcare professionals leading to a higher number of lung cancer cases being diagnosed. The non-invasive nature of liquid biopsy tests has made them an attractive option for both patients and healthcare providers, contributing to their growing adoption in the region.

Recent Developments:

- In November 2023, Illumina introduced an advanced liquid biopsy assay for detecting non-small-cell lung cancer, enhancing cancer research insights.

- In October 2023, Delfi Diagnostics launched its first biopsy test for lung cancer screening, adding a new blood-based tool for cancer detection.

Lung Cancer Liquid Biopsy Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the lung cancer liquid biopsy market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global lung cancer liquid biopsy market include:

- Biocept

- Exosome Diagnostics

- F. Hoffmann-La Roche

- Qiagen

- Accuragen

- Agena Bioscience

- Bard1

- Bgi

- Eurofins Scientific

- MDxHealth

- CareDx

- Immucor

- Thermo Fisher Scientific Inc.

- Menarini Silicon Biosystems

- Guardant Health

- Exact Sciences Corporation

- Myriad Genetics, Inc.

- LungLife AI Inc.

- Bio-Rad Laboratories

- Agilent Technologies

The global lung cancer liquid biopsy market is segmented as follows:

By Sample Type

- Blood Sample Based

- Others

By Biomarker

- Circulating Nucleic Acids

- CTC

- Exosomes/Microvesicles

- Circulating Proteins

By Technology

- Multi-gene-parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

By End-use

- Hospitals & Laboratories

- Specialty Clinics

- Academic & Research Centers

- Others

By Clinical Application

- Therapy Selection

- Treatment Monitoring

- Early Cancer Screening

- Recurrence Monitoring

- Others

By Product

- Instruments

- Consumables Kits and Reagents

- Software and Services

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global lung cancer liquid biopsy market size was projected at approximately US$ 2.83 billion in 2023. Projections indicate that the market is expected to reach around US$ 8.09 billion in revenue by 2032.

The global lung cancer liquid biopsy market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 12.4% during the forecast period from 2024 to 2032.

North America is expected to dominate the global lung cancer liquid biopsy market.

The significant factors driving the global lung cancer liquid biopsy market include the rising prevalence of lung cancer, growing demand for non-invasive diagnostic methods, and advancements in precision medicine, which enable personalized treatment options and early detection. Additionally, increasing healthcare spending and technological innovations further fuel market growth.

Some of the prominent players operating in the global lung cancer liquid biopsy market are; Biocept, Exosome Diagnostics, F. Hoffmann-La Roche, Qiagen, Accuragen, Agena Bioscience, Bard1, Bgi, Eurofins Scientific, MDxHealth, CareDx, Immucor, Thermo Fisher Scientific Inc., Menarini Silicon Biosystems, Guardant Health, Exact Sciences Corporation, Myriad Genetics, Inc., LungLife AI Inc., Bio-Rad Laboratories, Agilent Technologies, and others.

Table Of Content

Inquiry For Buying

Lung Cancer Liquid Biopsy

Request Sample

Lung Cancer Liquid Biopsy