IT Infrastructure Outsourcing Market Size, Share, and Trends Analysis Report

CAGR :

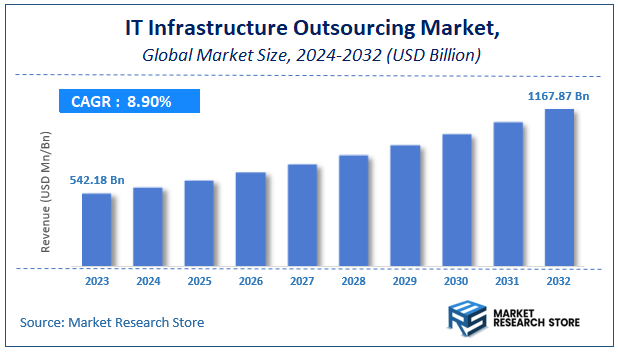

| Market Size 2023 (Base Year) | USD 542.18 Billion |

| Market Size 2032 (Forecast Year) | USD 1167.87 Billion |

| CAGR | 8.9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

IT Infrastructure Outsourcing Market Insights

According to Market Research Store, the global IT infrastructure outsourcing market size was valued at around USD 542.18 billion in 2023 and is estimated to reach USD 1167.87 billion by 2032, to register a CAGR of approximately 8.90% in terms of revenue during the forecast period 2024-2032.

The IT infrastructure outsourcing report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global IT Infrastructure Outsourcing Market: Overview

IT infrastructure outsourcing involves delegating an organization’s IT infrastructure management, operations, and maintenance to a third-party service provider. This typically includes services such as data center management, network management, server maintenance, cloud services, and technical support. By outsourcing, companies aim to reduce operational costs, enhance efficiency, access specialized expertise, and focus on core business activities. Outsourcing providers leverage their technical expertise, economies of scale, and advanced technologies to deliver scalable and reliable IT solutions tailored to the client’s needs.

Key Highlights

- The IT infrastructure outsourcing market is anticipated to grow at a CAGR of 8.90% during the forecast period.

- The global IT infrastructure outsourcing market was estimated to be worth approximately USD 542.18 billion in 2023 and is projected to reach a value of USD 1167.87 billion by 2032.

- The growth of the IT infrastructure outsourcing market is being driven by increasing adoption of cloud computing, rising demand for digital transformation, and the need for cost optimization across industries.

- Based on the service type, the data center outsourcing segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the cloud infrastructure services segment is projected to swipe the largest market share.

- In terms of vertical, the BFSI segment is expected to dominate the market.

- Based on the organization size, the large enterprises segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

IT Infrastructure Outsourcing Market: Dynamics

Key Growth Drivers:

- Cost Reduction: Outsourcing can significantly lower operational costs by eliminating the need for in-house IT staff, infrastructure maintenance, and hardware investments.

- Focus on Core Business: By outsourcing IT, companies can free up internal resources to concentrate on their core business activities and strategic initiatives.

- Access to Expertise: Outsourcing provides access to specialized IT skills and expertise that may not be readily available in-house, such as cloud computing, cybersecurity, and data analytics.

- Scalability and Flexibility: Outsourcing allows businesses to scale their IT resources up or down quickly to meet changing demands, providing greater flexibility and agility.

- Improved Efficiency: Outsourcing can streamline IT operations, improve service delivery, and enhance overall IT efficiency through the use of best practices and standardized processes.

Restraints:

- Data Security and Privacy Concerns: Outsourcing sensitive data to third-party providers raises concerns about data security and privacy breaches.

- Vendor Lock-in: Long-term outsourcing contracts can create vendor lock-in, making it difficult or expensive to switch providers.

- Loss of Control: Outsourcing can lead to a loss of control over IT infrastructure and operations, potentially impacting responsiveness and decision-making.

- Integration Challenges: Integrating outsourced IT services with existing internal systems and processes can be complex and time-consuming.

- Communication and Cultural Differences: Effective communication and collaboration between the client and the outsourcing provider can be challenging, especially when dealing with different cultures and time zones.

Opportunities:

- Cloud Computing Adoption: The increasing adoption of cloud computing services presents significant opportunities for IT infrastructure outsourcing providers.

- Rise of Digital Transformation: The growing need for digital transformation initiatives across various industries is driving demand for IT outsourcing services.

- Focus on Innovation: Outsourcing can enable companies to leverage the latest technologies and innovations in IT, such as artificial intelligence, machine learning, and the Internet of Things.

- Emerging Markets: Emerging markets offer significant growth potential for IT infrastructure outsourcing due to their lower labor costs and skilled workforce.

- Managed Services: The demand for managed services, such as cybersecurity, data center management, and IT support, is on the rise, creating new opportunities for outsourcing providers.

Challenges:

- Maintaining Service Quality: Ensuring consistent service quality and meeting service level agreements (SLAs) can be challenging for outsourcing providers.

- Keeping Pace with Technological Advancements: The rapid pace of technological change requires outsourcing providers to constantly adapt and invest in new skills and technologies.

- Managing Global Teams: Effectively managing and coordinating global teams across different time zones and cultures can be complex.

- Competition: The IT infrastructure outsourcing market is highly competitive, with numerous players vying for market share.

- Economic Uncertainty: Economic downturns can negatively impact IT spending and outsourcing budgets, creating challenges for providers.

IT Infrastructure Outsourcing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IT Infrastructure Outsourcing Market |

| Market Size in 2023 | USD 542.18 Billion |

| Market Forecast in 2032 | USD 1167.87 Billion |

| Growth Rate | CAGR of 8.9% |

| Number of Pages | 140 |

| Key Companies Covered | Accenture, TCS, Cognizant, Wipro, IBM, HCL Technologies, Infosys, CapGemini, DXC Technologies, NTT Data |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IT Infrastructure Outsourcing Market: Segmentation Insights

The global IT infrastructure outsourcing market is divided by service type, end-user, vertical, organization size, and region.

Segmentation Insights by Service Type

Based on service type, the global IT infrastructure outsourcing market is divided into data center outsourcing and network outsourcing.

The data center outsourcing segment dominates the IT infrastructure outsourcing market, primarily due to the growing demand for scalable, secure, and cost-effective solutions to manage increasing data volumes. Organizations across industries are adopting data center outsourcing to reduce capital expenditures, improve operational efficiency, and leverage advanced technologies offered by third-party providers. This segment benefits from the rise in cloud computing, disaster recovery requirements, and the need for seamless data management. Service providers often offer customized solutions, including hybrid cloud models, backup solutions, and enhanced cybersecurity measures, making data center outsourcing an appealing choice for large enterprises and SMEs alike.

The network outsourcing segment is growing steadily as organizations focus on enhancing connectivity, reducing network latency, and improving end-user experience. This segment includes services like managed WAN, LAN, and SD-WAN, which help businesses optimize their network infrastructure while lowering operational costs. Network outsourcing is particularly appealing to companies seeking to expand their global footprint, as it allows them to rely on third-party expertise for establishing and maintaining complex network ecosystems. While it currently lags behind data center outsourcing in terms of market share, the increasing adoption of IoT, 5G technologies, and software-defined networking is expected to drive growth in this segment.

Segmentation Insights by End-User

On the basis of end-user, the global IT infrastructure outsourcing market is bifurcated into computing outsourcing, managed hosting, and cloud infrastructure services.

The cloud infrastructure services segment leads the IT infrastructure outsourcing market by end-user, driven by the rapid adoption of cloud-based solutions across industries. Businesses are increasingly migrating to cloud platforms to benefit from scalability, flexibility, and cost efficiency. These services enable companies to access advanced infrastructure without significant capital investments, making them especially appealing for organizations prioritizing digital transformation. Cloud infrastructure services also support multi-cloud and hybrid cloud models, allowing seamless integration of on-premises and cloud systems, thus enhancing operational agility. The demand is further fueled by trends like remote work, big data analytics, and artificial intelligence (AI).

The managed hosting segment follows closely, as enterprises seek comprehensive solutions to host and manage their IT systems securely and reliably. Managed hosting providers offer tailored services that include server maintenance, security updates, and performance monitoring, ensuring consistent uptime and data security. This segment is particularly favored by organizations with limited IT resources or those looking for predictable operational costs. Managed hosting is also popular in industries requiring high compliance and security standards, such as healthcare, finance, and e-commerce.

The computing outsourcing segment is a key player but holds a smaller share compared to the other two. This segment involves delegating tasks like application hosting, IT support, and hardware maintenance to external providers. It is especially beneficial for businesses seeking to reduce operational complexity and focus on core activities. While its growth is steady, the rise of cloud computing and managed hosting services has slightly shifted demand away from traditional computing outsourcing. However, it remains relevant for industries requiring specialized IT expertise without significant in-house resources.

Segmentation Insights by Vertical

In terms of vertical, the global IT infrastructure outsourcing market is categorized into healthcare, BFSI, retail, manufacturing, and telecommunications.

The BFSI (Banking, Financial Services, and Insurance) sector dominates the IT infrastructure outsourcing market by vertical. This dominance stems from the industry's heavy reliance on robust, scalable, and secure IT systems to handle critical operations, ensure regulatory compliance, and protect sensitive customer data. Outsourcing allows BFSI organizations to leverage advanced technologies, such as cloud computing and cybersecurity solutions, to improve operational efficiency and enhance customer experience. With the sector's ongoing digital transformation and increased adoption of fintech innovations, demand for outsourced IT infrastructure services remains strong.

The telecommunications sector follows closely, driven by the need to manage complex network infrastructures, support the rollout of 5G, and optimize operational costs. Telecom providers increasingly outsource data centers, network management, and cloud services to meet growing customer demands for high-speed connectivity and reliable communication services. The rise of IoT devices and edge computing further amplifies the need for scalable and efficient outsourced IT infrastructure in this vertical.

The healthcare sector is another significant contributor, as the industry increasingly adopts IT outsourcing to manage electronic health records (EHR), telemedicine platforms, and compliance with data protection regulations like HIPAA. Outsourcing helps healthcare providers focus on patient care while ensuring secure and efficient IT operations. The COVID-19 pandemic accelerated digital transformation in healthcare, boosting demand for cloud-based solutions and IT support services.

The retail sector leverages IT infrastructure outsourcing to enhance e-commerce platforms, improve customer analytics, and support omnichannel strategies. As consumer preferences shift toward online shopping and personalized experiences, retail companies rely on outsourced IT solutions to maintain competitiveness. Services like managed hosting, cloud infrastructure, and network optimization are integral to achieving these objectives.

The manufacturing sector represents a smaller but growing share of the market. Manufacturers outsource IT infrastructure to enable smart manufacturing, industrial IoT (IIoT), and predictive maintenance capabilities. These services are crucial for optimizing supply chains, reducing downtime, and improving overall productivity. As Industry 4.0 adoption accelerates, manufacturing’s demand for IT outsourcing services is expected to grow steadily.

Segmentation Insights by Organization Size

In terms of organization size, the global IT infrastructure outsourcing market is categorized into SMEs and large enterprises.

The large enterprises segment dominates the IT infrastructure outsourcing market by organization size, primarily due to their substantial IT requirements and the need for scalable, secure, and efficient infrastructure management. Large enterprises often have complex IT ecosystems that span multiple regions and require seamless integration of data centers, cloud platforms, and network systems. Outsourcing allows these organizations to focus on their core business activities while leveraging advanced technologies, such as hybrid cloud solutions, AI, and machine learning, offered by specialized service providers. Additionally, outsourcing helps large enterprises optimize costs, ensure compliance with stringent regulatory requirements, and maintain a competitive edge in the global market.

The SMEs (Small and Medium Enterprises) segment is rapidly gaining traction as these organizations increasingly recognize the benefits of IT infrastructure outsourcing. SMEs often face resource constraints, making it challenging to establish and maintain in-house IT teams. Outsourcing provides them access to enterprise-grade IT services, including managed hosting, cloud infrastructure, and cybersecurity, without significant capital investment. The growing adoption of digital tools and cloud-based solutions among SMEs has further propelled their reliance on IT outsourcing to improve operational efficiency, reduce costs, and scale operations as needed. While smaller in market share compared to large enterprises, SMEs represent a significant growth opportunity in the IT infrastructure outsourcing market.

IT Infrastructure Outsourcing Market: Regional Insights

- North America is expected to dominates the global market

The global IT infrastructure outsourcing market exhibits distinct regional dynamics, with North America leading in market share. This dominance is attributed to the region's advanced technological landscape and the high demand for outsourcing services. The United States and Canada, in particular, have well-established IT sectors that drive substantial outsourcing activities. The presence of numerous multinational corporations and a mature market for IT services further bolster North America's leading position.

Europe holds a significant portion of the global IT infrastructure outsourcing market, benefiting from a robust IT infrastructure and supportive regulatory frameworks. Countries such as the United Kingdom, Germany, and France have mature markets that contribute to the region's substantial share. The European market is characterized by a strong emphasis on data protection and compliance, influencing outsourcing strategies and partnerships.

The Asia-Pacific region is experiencing rapid growth in the IT infrastructure outsourcing market, driven by emerging economies like India and China. These countries offer cost-effective labor and a growing pool of skilled IT professionals, making them attractive destinations for outsourcing. The region's increasing focus on digital transformation and technological advancements contributes to its expanding market share.

Latin America is gradually increasing its presence in the IT infrastructure outsourcing market, with countries like Brazil and Argentina becoming notable players. The region offers competitive labor costs and a growing talent pool, attracting companies seeking nearshore outsourcing options. Economic reforms and investments in technology infrastructure are further enhancing Latin America's appeal in the global outsourcing landscape.

The Middle East and Africa region holds a smaller share of the global IT infrastructure outsourcing market. However, there is a growing interest in outsourcing services, particularly in countries like South Africa and the United Arab Emirates. Investments in technology hubs and initiatives to diversify economies beyond traditional sectors are contributing to the gradual development of the outsourcing market in this region.

Recent Developments:

- In June 2023, Hewlett Packard Enterprise (HPE) strengthened its partnership with Amazon Web Services (AWS) to streamline hybrid cloud transformation. This collaboration enables enterprises to efficiently manage and transfer workloads between HPE's on-premises infrastructure and AWS.

- In June 2023, IBM and Adobe expanded their partnership to boost content supply chains with AI. By leveraging Adobe's AI tools, including Sensei GenAI and Firefly, the collaboration helps brands create, manage, and deliver content more efficiently.

IT Infrastructure Outsourcing Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the IT infrastructure outsourcing market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global IT infrastructure outsourcing market include:

- Accenture

- TCS

- Cognizant

- Wipro

- IBM

- HCL Technologies

- Infosys

- CapGemini

- DXC Technologies

- NTT Data

The global IT infrastructure outsourcing market is segmented as follows:

By Service Type

- Data Center Outsourcing

- Network Outsourcing

By End-User

- Computing Outsourcing

- Managed Hosting

- Cloud Infrastructure Services

By Vertical

- Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Manufacturing

- Telecommunications

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global IT infrastructure outsourcing market size was projected at approximately US$ 542.18 billion in 2023. Projections indicate that the market is expected to reach around US$ 1167.87 billion in revenue by 2032.

The global IT infrastructure outsourcing market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 8.90% during the forecast period from 2024 to 2032.

North America is expected to dominate the global IT infrastructure outsourcing market.

The global IT infrastructure outsourcing market is driven by cost optimization, increasing focus on core business operations, rapid technological advancements, and the growing demand for scalable and flexible IT solutions.

Some of the prominent players operating in the global IT infrastructure outsourcing market are; Accenture, TCS, Cognizant, Wipro, IBM, HCL Technologies, Infosys, CapGemini, DXC Technologies, NTT Data, and others.

Table Of Content

Inquiry For Buying

IT Infrastructure Outsourcing

Request Sample

IT Infrastructure Outsourcing