PAD Medical Device Market Size, Share, and Trends Analysis Report

CAGR :

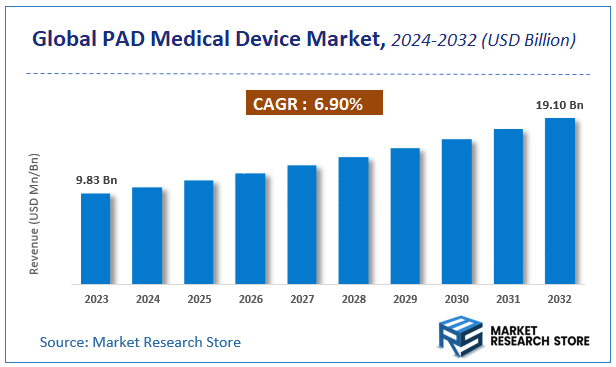

| Market Size 2023 (Base Year) | USD 9.83 Billion |

| Market Size 2032 (Forecast Year) | USD 19.10 Billion |

| CAGR | 6.9% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

PAD Medical Device Market Insights

According to Market Research Store, the global PAD medical device market size was valued at around USD 9.83 billion in 2023 and is estimated to reach USD 19.10 billion by 2032, to register a CAGR of approximately 6.9% in terms of revenue during the forecast period 2024-2032.

The PAD medical device report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global PAD Medical Device Market: Overview

A PAD (Peripheral Artery Disease) medical device is designed to diagnose, manage, and treat PAD, a condition caused by narrowed or blocked arteries that reduce blood flow to the limbs, particularly the legs. These devices include angioplasty balloons, stents, atherectomy devices, and drug-coated balloons, which help restore proper circulation by opening blocked arteries. Additionally, diagnostic tools such as ankle-brachial index (ABI) measuring devices and imaging systems assist in early detection and monitoring of the disease.

Key Highlights

- The PAD medical device market is anticipated to grow at a CAGR of 6.9% during the forecast period.

- The global PAD medical device market was estimated to be worth approximately USD 9.83 billion in 2023 and is projected to reach a value of USD 19.10 billion by 2032.

- The growth of the PAD medical device market is being driven by the rising prevalence of peripheral artery disease, particularly among aging populations and individuals with diabetes, hypertension, and obesity.

- Based on the type, the peripheral vascular stent segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the hospitals segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

PAD Medical Device Market: Dynamics

Key Growth Drivers

- Rising Prevalence of PAD: Increasing incidence of diabetes, obesity, and aging populations contribute to higher PAD cases, driving demand for treatment devices.

- Technological Advancements: Innovations like drug-coated balloons, bioresorbable stents, and minimally invasive devices improve treatment outcomes and adoption.

- Growing Awareness: Improved patient and physician awareness about early diagnosis and treatment options boosts market growth.

- Favorable Reimbursement Policies: Government and private insurance coverage for PAD treatments encourages patient access to advanced devices.

- Increasing Healthcare Expenditure: Rising healthcare spending in emerging markets supports the adoption of advanced medical devices.

Restraints

- High Cost of Devices: Advanced PAD treatment devices are expensive, limiting their adoption in low- and middle-income countries.

- Stringent Regulatory Approvals: Lengthy and complex regulatory processes delay product launches and increase development costs.

- Lack of Skilled Professionals: Limited availability of trained healthcare professionals for performing advanced PAD procedures restricts market growth.

- Risk of Complications: Potential complications associated with devices, such as restenosis or thrombosis, hinder patient and physician confidence.

Opportunities

- Emerging Markets: Untapped potential in developing regions due to improving healthcare infrastructure and rising disposable incomes.

- Development of Bioresorbable Devices: Growing focus on bioresorbable stents and scaffolds that reduce long-term complications.

- Partnerships and Collaborations: Strategic alliances between device manufacturers and healthcare providers to expand market reach.

- Telemedicine and Remote Monitoring: Integration of digital health solutions for post-procedure monitoring and patient management.

Challenges

- Intense Market Competition: High competition among key players leads to pricing pressures and reduced profit margins.

- Limited Patient Awareness in Rural Areas: Lack of awareness about PAD symptoms and treatment options in rural and underserved regions.

- Product Recalls and Safety Concerns: Instances of device recalls due to safety issues can damage brand reputation and reduce trust.

- Economic Instability: Fluctuations in global economies and healthcare budgets can impact market growth.

PAD Medical Device Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | PAD Medical Device Market |

| Market Size in 2023 | USD 9.83 Billion |

| Market Forecast in 2032 | USD 19.10 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 140 |

| Key Companies Covered | Gore, Boston Scientific, FierceBiotech, Medtronic, C.R. Bard, Johnson & Johnson, Abbott Laboratories, Angioscore Inc., Edward Lifesciences, Teleflex Medical, Abbott, Volcano, Cook Group, Cordis, Bayer |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

PAD Medical Device Market: Segmentation Insights

The global PAD medical device market is divided by type, end-user, and region.

Segmentation Insights by Type

Based on type, the global PAD medical device market is divided into peripheral vascular stent, peripheral transluminal angioplasty balloon catheters, PTA guidewires, atherectomy devices, chronic total occlusion devices, aortic stents, synthetic surgical grafts, embolic protection device, and inferior vena cava filters.

The Peripheral Vascular Stent segment holds the dominant position in the PAD (Peripheral Artery Disease) medical device market. These stents are widely used to keep arteries open and restore proper blood flow, especially in patients with atherosclerosis. The increasing prevalence of PAD, along with advancements in stent technology such as drug-eluting and bioresorbable stents, has driven their adoption. Additionally, a growing number of minimally invasive procedures and favorable reimbursement policies further support the dominance of this segment.

Following closely, Peripheral Transluminal Angioplasty (PTA) Balloon Catheters represent a significant share of the market. These catheters are crucial in PAD treatment as they help expand narrowed arteries, improving blood circulation. Their widespread use in both standalone procedures and in conjunction with stents has led to sustained demand. The growing preference for balloon angioplasty as a first-line treatment before stent placement further boosts its market position.

The PTA Guidewires segment is another vital category, supporting the use of balloon catheters and stents by providing precise navigation through the vascular system. These guidewires are essential in ensuring the safety and success of endovascular interventions, making them indispensable tools in PAD treatment.

Atherectomy Devices also play a crucial role in the market, particularly for patients with heavily calcified lesions that are difficult to treat with stents or balloons alone. These devices help remove plaque buildup from arteries, reducing restenosis rates and improving long-term treatment outcomes. Their growing adoption is driven by the increasing use of atherectomy as an adjunctive therapy in PAD procedures.

The Chronic Total Occlusion (CTO) Devices segment is gaining attention as a specialized category within PAD treatment. These devices are specifically designed to address completely blocked arteries, which are among the most challenging cases in PAD interventions. The rising incidence of total occlusions, combined with advancements in CTO crossing techniques, has contributed to the expansion of this segment.

Aortic Stents hold a smaller but significant share in the market. These devices are primarily used to treat complex aortic aneurysms and occlusions, which can sometimes be associated with PAD. Their adoption is primarily driven by advancements in endovascular aneurysm repair (EVAR) techniques.

Synthetic Surgical Grafts are widely used in open surgical bypass procedures for PAD patients who are not candidates for endovascular treatments. While the trend is shifting toward minimally invasive procedures, these grafts remain essential for complex and high-risk cases where stents and balloons may not be effective.

The Embolic Protection Devices segment is relatively smaller but plays a critical role in preventing complications during PAD interventions. These devices capture and remove embolic debris that may be dislodged during procedures, reducing the risk of stroke and other complications. Their adoption is increasing due to a greater focus on patient safety and procedural efficiency.

Finally, Inferior Vena Cava (IVC) Filters represent the least dominant segment in the PAD medical device market. While these filters are essential for preventing pulmonary embolism in patients with deep vein thrombosis (DVT), their direct relevance to PAD treatment is limited. However, in cases where PAD patients have concurrent venous thromboembolic conditions, IVC filters are still utilized.

Segmentation Insights by End-User

On the basis of end-user, the global PAD medical device market is bifurcated into hospitals, cardiac centers, and others.

Hospitals represent the most dominant end-user segment in the PAD (Peripheral Artery Disease) medical device market. The dominance of hospitals is attributed to their well-established infrastructure, availability of advanced medical technologies, and the presence of skilled healthcare professionals. Hospitals handle a large volume of PAD-related procedures, including angioplasty, stent placements, and bypass surgeries, making them the primary choice for treatment. Additionally, the rising prevalence of PAD, coupled with government funding and reimbursement support for hospital-based procedures, further strengthens this segment’s position in the market.

Cardiac Centers follow hospitals as a significant segment in the PAD medical device market. These specialized centers focus on cardiovascular diseases, offering dedicated facilities for PAD diagnosis and treatment. The increasing preference for outpatient care, combined with the growth of standalone cardiac centers, is driving the demand for PAD medical devices in this segment. Additionally, advancements in minimally invasive procedures, such as endovascular interventions, have led to more PAD patients seeking treatment in these centers.

PAD Medical Device Market: Regional Insights

- North America is expected to dominates the global market

North America leads the global Peripheral Artery Disease (PAD) medical device market, driven by a high prevalence of PAD and advanced healthcare infrastructure. The United States, in particular, contributes significantly due to its large patient population and substantial healthcare spending. The presence of leading medical device manufacturers and continuous technological advancements further bolster the market in this region. Additionally, favorable reimbursement policies and increasing awareness about PAD have led to the adoption of advanced treatment solutions, ensuring North America's dominance in the market.

Europe holds a substantial share in the PAD medical device market, supported by a well-established healthcare system and a growing elderly population. Countries like Germany, France, and the United Kingdom are major contributors, with a high prevalence of diabetes and cardiovascular diseases leading to increased PAD cases. The region's focus on research and development, along with favorable reimbursement policies, has facilitated the adoption of innovative PAD devices. Collaborations between medical institutions and device manufacturers further enhance the market's growth in Europe.

The Asia-Pacific region is experiencing rapid growth in the PAD medical device market, attributed to improving healthcare infrastructure and a rising awareness of PAD. Nations such as China, India, and Japan are witnessing an increase in PAD cases due to lifestyle changes and an aging population. Government initiatives aimed at enhancing healthcare access and significant investments in medical technology are propelling the market forward. The availability of affordable treatment options and the adoption of minimally invasive procedures are also contributing to the market's expansion in this region.

Latin America, the Middle East, and Africa (LAMEA) represent emerging markets for PAD medical devices, with growth driven by increasing healthcare investments and rising awareness of PAD. In Latin America, countries like Brazil and Argentina are focusing on improving their healthcare infrastructure to address the growing burden of vascular diseases. The Middle East and Africa are also witnessing advancements, with government initiatives aimed at early diagnosis and treatment of PAD. However, challenges such as limited access to advanced medical technologies and economic constraints may affect the pace of market growth in these regions.

PAD Medical Device Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the PAD medical device market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global PAD medical device market include:

- Gore

- Boston Scientific

- FierceBiotech

- Medtronic

- C.R. Bard

- Johnson & Johnson

- Abbott Laboratories

- Angioscore Inc.

- Edward Lifesciences

- Teleflex Medical

- Abbott

- Volcano

- Cook Group

- Cordis

- Bayer

The global PAD medical device market is segmented as follows:

By Type

- Peripheral Vascular Stent

- Peripheral Transluminal Angioplasty Balloon Catheters

- PTA Guidewires

- Atherectomy Devices

- Chronic Total Occlusion Devices

- Aortic Stents

- Synthetic Surgical Grafts

- Embolic Protection Device

- Inferior Vena Cava Filters

By End-User

- Hospitals

- Cardiac Centers

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global PAD medical device market size was projected at approximately US$ 9.83 billion in 2023. Projections indicate that the market is expected to reach around US$ 19.10 billion in revenue by 2032.

The global PAD medical device market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 6.9% during the forecast period from 2024 to 2032.

North America is expected to dominate the global PAD medical device market.

The global PAD medical device market is driven by the rising prevalence of peripheral artery disease due to aging populations, diabetes, and cardiovascular conditions. Advancements in minimally invasive treatments, increasing awareness, and favorable reimbursement policies further boost market growth. Expanding healthcare infrastructure in emerging regions also contributes to market expansion.

Some of the prominent players operating in the global PAD medical device market are; Gore, Boston Scientific, FierceBiotech, Medtronic, C.R. Bard, Johnson & Johnson, Abbott Laboratories, Angioscore Inc., Edward Lifesciences, Teleflex Medical, Abbott, Volcano, Cook Group, Cordis, Bayer, and others.

The global PAD medical device market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

PAD Medical Device

Request Sample

PAD Medical Device