Low-Alcohol Beverages Market Size, Share, and Trends Analysis Report

CAGR :

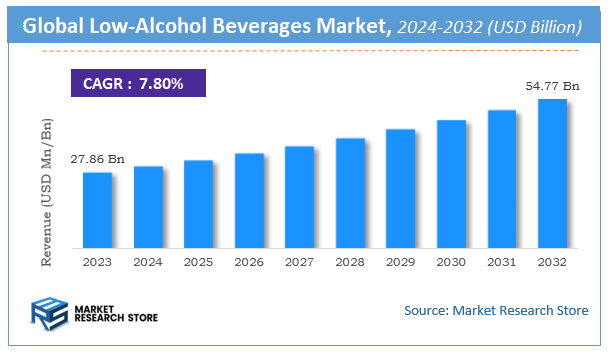

| Market Size 2023 (Base Year) | USD 27.86 Billion |

| Market Size 2032 (Forecast Year) | USD 54.77 Billion |

| CAGR | 7.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Low-Alcohol Beverages Market Insights

According to Market Research Store, the global low-alcohol beverages market size was valued at around USD 27.86 billion in 2023 and is estimated to reach USD 54.77 billion by 2032, to register a CAGR of approximately 7.8% in terms of revenue during the forecast period 2024-2032.

The low-alcohol beverages report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Low-Alcohol Beverages Market: Overview

Low-alcohol beverages are drinks that contain a reduced level of ethanol compared to traditional alcoholic beverages, typically ranging from 0.5% to 3.5% alcohol by volume (ABV). These beverages span a variety of categories including beer, wine, spirits, ciders, cocktails, and ready-to-drink (RTD) options, and are crafted to deliver familiar flavors and social experiences with significantly less intoxicating effect. They are often created through techniques such as fermentation control, dilution, or alcohol removal processes like vacuum distillation and reverse osmosis, ensuring that taste profiles remain appealing and authentic despite the reduced alcohol content.

The growth of low-alcohol beverages is primarily driven by shifting consumer preferences toward healthier lifestyles and moderation in alcohol consumption. Increasing awareness of wellness, fitness, and mental clarity is encouraging individuals—especially millennials and Gen Z—to seek out alternatives that offer social enjoyment without the drawbacks of high alcohol intake. Furthermore, the rise of mindful drinking movements, stricter drink-driving laws, and the demand for functional beverages with added ingredients such as botanicals or adaptogens are also fueling innovation in this space. Beverage companies are responding with a diverse range of low-alcohol offerings that cater to evolving tastes, dietary considerations, and occasions, making this category a dynamic and expanding segment within the broader beverage market.

Key Highlights

- The low-alcohol beverages market is anticipated to grow at a CAGR of 7.8% during the forecast period.

- The global low-alcohol beverages market was estimated to be worth approximately USD 27.86 billion in 2023 and is projected to reach a value of USD 54.77 billion by 2032.

- The growth of the low-alcohol beverages market is being driven by increasingly seeking healthier lifestyle choices that include moderating or reducing alcohol intake.

- Based on the type, the wine segment is growing at a high rate and is projected to dominate the market.

- On the basis of distribution channel, the store-based segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Low-Alcohol Beverages Market: Dynamics

Key Growth Drivers:

- Growing Health and Wellness Trend: A significant driver is the increasing consumer focus on health, mindfulness, and well-being. Many individuals are seeking healthier alternatives to traditional alcoholic beverages, which often have fewer calories and less sugar.

- Rise of Mindful Drinking and Sober Curious Movements: A growing number of consumers, particularly among younger demographics (Millennials and Gen Z), are actively reducing their alcohol consumption for various reasons, including personal health, avoiding hangovers, and managing social interactions without excessive alcohol.

- Product Innovation and Improved Taste Profiles: Manufacturers are investing heavily in research and development to create low-alcohol beverages that closely mimic the taste, complexity, and overall experience of their full-strength counterparts, overcoming historical taste perceptions.

- Increased Availability and Accessibility: Low-alcohol options are becoming more widely available in supermarkets, hypermarkets, online retailers, and even on-premise establishments like bars and restaurants, making them easier for consumers to access.

- Desire for Social Inclusion without Intoxication: Low-alcohol beverages allow individuals to participate in social drinking occasions without the intoxicating effects of higher-ABV drinks, fostering a sense of inclusion for those moderating or abstaining.

- Shifting Demographics and Lifestyle Choices: Younger consumers are more open to trying new and innovative beverage options, including low-alcohol variants, and are driven by social influence and training for sports.

- Premiumization of Low-Alcohol Offerings: Brands are introducing premium and craft low-alcohol options, emphasizing quality ingredients, sophisticated flavor profiles, and artisanal production methods, appealing to discerning consumers.

Restraints:

- Taste Perception and Consumer Skepticism: Despite improvements, some consumers may still harbor skepticism about the taste and overall experience of low-alcohol beverages compared to their full-strength equivalents, particularly for wine and spirits.

- Higher Production Costs for Flavor Retention: Replicating the complex flavor profiles of alcoholic beverages while reducing or removing alcohol can involve specialized and often more expensive production processes (e.g., advanced fermentation, de-alcoholization).

- Limited Awareness and Availability in Certain Regions: While growing, the market is still nascent in some areas, and a lack of consumer awareness or limited product availability can hinder wider adoption.

- Competition from Non-Alcoholic Beverages: The low-alcohol segment faces competition from a vast array of completely non-alcoholic alternatives like soft drinks, juices, specialty teas, and mocktails.

- Regulatory Ambiguity and Varying Definitions: The definitions of "low-alcohol" and "alcohol-free" can vary significantly across different countries and regions, leading to confusion for both manufacturers and consumers regarding labeling and marketing.

- Price Disparity: In some markets, low-alcohol beverages, particularly in the on-trade (bars, restaurants), can be priced higher than their full-strength counterparts or even other non-alcoholic options, which can be a deterrent.

- Perceived "Health Halo" Misconceptions: While generally healthier, some consumers might overcompensate and consume larger quantities of low-alcohol beverages, potentially negating the intended health benefits if not consumed mindfully.

Opportunities:

- Development of Innovative Flavors and Formulations: Continuous innovation in flavor profiles, botanicals, plant infusions, and functional ingredients (e.g., adaptogens, nootropics) can attract new consumers and differentiate products.

- Focus on Specific Occasions and Consumption Moments: Tailoring low-alcohol offerings for specific social settings, mealtimes, or wellness-focused events can expand their appeal and integration into daily life.

- Expansion in Foodservice and On-Trade Channels: Increasing stocking and promotion of low-alcohol options in restaurants, bars, and cafes can significantly boost consumption and mainstream acceptance.

- Integration with Holistic Wellness Trends: Positioning low-alcohol beverages as part of a broader healthy lifestyle, offering benefits like hydration, immunity, or stress reduction.

- Strategic Partnerships and Collaborations: Alliances between major beverage companies, craft brewers, and food and wellness brands can accelerate product development, distribution, and market reach.

- Leveraging E-commerce and Direct-to-Consumer (DTC) Sales: Online platforms provide a vast reach for low-alcohol brands, especially for niche or premium offerings, allowing for direct engagement with consumers.

- Sustainable Packaging and Clean Labeling: Adopting eco-friendly packaging and emphasizing natural, minimally processed ingredients (clean labels) can resonate strongly with health- and environmentally-conscious consumers.

- Targeting the "Occasional Moderator" Segment: The largest growth potential lies in consumers who still drink alcohol but are looking to reduce their intake, rather than complete abstainers.

Challenges:

- Maintaining Taste Parity and Consumer Expectations: Continuously improving the taste and mouthfeel of low-alcohol versions to genuinely satisfy consumers accustomed to full-strength alcoholic beverages.

- Navigating Complex and Evolving Regulations: Keeping abreast of varying and often inconsistent regulations concerning alcohol content thresholds, labeling, marketing, and taxation across different jurisdictions.

- Educating Consumers and Overcoming Stigma: Dispelling misconceptions about taste, quality, and social acceptance of low-alcohol drinks, and clearly communicating their benefits.

- Supply Chain and Production Scalability: Scaling up production for innovative low-alcohol products while maintaining quality and managing potentially complex manufacturing processes.

- Marketing and Branding Strategies: Developing effective marketing campaigns that resonate with target consumers, balancing health messaging with the enjoyment of the drinking experience, and avoiding confusion with traditional alcoholic brands.

- Managing Price Perception: Justifying the price point of low-alcohol products, especially if production costs are high, to avoid consumer perception of overpricing compared to full-strength or non-alcoholic alternatives.

- Competition from Traditional Alcoholic Beverages: The deeply ingrained consumption habits and strong brand loyalty for traditional alcoholic beverages remain a significant competitive challenge.

Low-Alcohol Beverages Market: Report Scope

This report thoroughly analyzes the Low-Alcohol Beverages Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Low-Alcohol Beverages Market |

| Market Size in 2023 | USD 27.86 Billion |

| Market Forecast in 2032 | USD 54.77 Billion |

| Growth Rate | CAGR of 7.8% |

| Number of Pages | 197 |

| Key Companies Covered | Anheuser-Busch Inbev, Carlsberg, Constellation Brands, Bacardi, Other Prominent Vendors, Abita Brewing, Aftershock Brewing, A. Le Coq, Asahi Premium Beverages, Bell'S Brewery, Blake'S Hard Cider, Blue Moon Brewing |

| Segments Covered | By Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Low-Alcohol Beverages Market: Segmentation Insights

The global low-alcohol beverages market is divided by type, distribution channel, and region.

Segmentation Insights by Type

Based on type, the global low-alcohol beverages market is divided into wine, beer, and spirits.

Wine dominates the low-alcohol beverages market, accounting for a significant share due to its premium appeal and strong alignment with the growing health-conscious consumer trend. The segment benefits from widespread acceptance across diverse age groups and demographics, especially among millennials and women. Innovations such as low-alcohol and alcohol-removed wines with retained flavor profiles have enhanced the category's appeal. The increasing popularity of moderate alcohol consumption, along with the demand for sophisticated, low-calorie alternatives, continues to position wine as the leading type in this market.

Beer holds a substantial share in the low-alcohol beverages market, supported by a large global consumer base and the long-standing cultural presence of beer in many regions. While it trails behind wine in dominance, beer's segment is growing steadily due to innovation in brewing techniques and the introduction of flavorful low- and non-alcoholic variants. The segment's affordability, accessibility, and extensive distribution channels contribute to its ongoing popularity among casual drinkers and younger consumers.

Spirits represent a niche but rapidly growing segment within the low-alcohol beverages market. Although it holds a smaller market share compared to wine and beer, it is gaining traction as consumers explore reduced-alcohol versions of gin, vodka, and pre-mixed cocktails. The rise in mindful drinking habits and demand for novel flavors is encouraging innovation in this space. However, despite the segment’s growth potential, wine remains the preferred and dominant choice in the global low-alcohol beverages landscape.

Segmentation Insights by Distribution Channel

On the basis of distribution channel, the global low-alcohol beverages market is bifurcated into store-based and non-store based.

Store-based distribution channels dominate the low-alcohol beverages market, accounting for the majority of global sales. This channel includes supermarkets, hypermarkets, specialty liquor stores, and convenience stores, which offer consumers the advantage of immediate product availability, physical inspection, and in-store promotions. The dominance of wine in this segment is particularly strong, as wine is widely featured in store-based retail due to its premium image and consumer preference for visual packaging cues when purchasing. Additionally, dedicated wine sections in major retail chains and staff-assisted purchasing further enhance wine’s visibility and sales performance in this channel.

Non-store based distribution channels, primarily encompassing online retail platforms and direct-to-consumer services, are experiencing significant growth. The rise of e-commerce in the beverage sector, accelerated by changing consumer behavior and pandemic-era restrictions, has enabled low-alcohol brands to reach broader audiences with minimal overhead. This channel is particularly favorable for personalized marketing and subscription-based wine clubs, helping wine maintain a strong presence here as well. However, despite its rapid growth and convenience, non-store based distribution remains secondary to traditional brick-and-mortar outlets in terms of volume.

Low-Alcohol Beverages Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Low-Alcohol Beverages Market, driven by shifting consumer preferences toward wellness, moderation, and responsible drinking. The United States leads regional consumption, fueled by rising demand for low-ABV (alcohol by volume) wines, beers, seltzers, and ready-to-drink cocktails. Health-conscious millennials and Gen Z consumers are significantly influencing product innovation, with breweries and distilleries offering functional beverages containing adaptogens and botanicals. Retailers and e-commerce channels are expanding low-alcohol product visibility, while major players are launching reduced-alcohol variants of popular labels to capture market share. In Canada, the trend is supported by wellness campaigns and growing interest in “mindful drinking” lifestyles.

Europe holds a prominent share in the global Low-Alcohol Beverages Market, with countries such as the UK, Germany, and France leading the way. The region benefits from a mature alcohol industry and early adoption of non-alcoholic and low-alcohol alternatives. The UK is a frontrunner with a dynamic craft beer sector and a booming zero-to-low ABV spirits segment. Germany has a long tradition of alcohol-free beers, now evolving into a broader portfolio of lightly fermented and health-forward drinks. European consumers are increasingly choosing low-alcohol options for weekday and social consumption, with strong support from government-backed health initiatives promoting reduced alcohol intake.

Asia-Pacific is experiencing rapid growth in the Low-Alcohol Beverages Market, fueled by rising health awareness, urbanization, and evolving drinking habits. Japan is at the forefront, with established demand for low- and zero-alcohol beers and chu-hi (shochu highballs). Major Japanese beverage companies are innovating in taste and functionality, targeting middle-aged and younger adults. In China, the market is expanding due to the popularity of low-alcohol fruit wines and lightly fermented beverages, especially among female consumers. Australia and South Korea are also adopting low-alcohol drinks in bars and restaurants, driven by fitness-conscious millennials and increased availability in retail chains.

Latin America is emerging as a growing market for low-alcohol beverages, particularly in Brazil, Mexico, and Argentina. Brazil is seeing increased demand for light beers and low-ABV cocktails, supported by urbanization and a strong wellness movement. In Mexico, flavored low-alcohol beverages such as ready-to-drink margaritas and light cervezas are gaining ground, especially among younger consumers in urban centers. Although overall market penetration remains moderate due to entrenched high-alcohol preferences, regional beverage companies are launching innovative lighter versions to appeal to health-conscious drinkers and casual social occasions.

Middle East and Africa are developing markets for low-alcohol beverages, shaped by cultural, legal, and religious factors. In the Middle East, particularly the UAE and parts of Saudi Arabia, there is a growing niche for halal-certified, low-alcohol, or alcohol-free beverages, especially in hospitality and tourism sectors. Increasing Western influence, rising expatriate populations, and health-conscious trends are driving interest in this category. In Africa, South Africa leads regional adoption with a growing craft beverage industry offering low-ABV wines and beers. However, affordability and limited awareness still constrain broader market expansion across the continent.

Low-Alcohol Beverages Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the low-alcohol beverages market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global low-alcohol beverages market include:

- Anheuser-Busch Inbev

- Carlsberg

- Constellation Brands

- Bacardi

- Other Prominent Vendors

- Abita Brewing

- Aftershock Brewing

- A. Le Coq

- Asahi Premium Beverages

- Bell'S Brewery

- Blake'S Hard Cider

- Blue Moon Brewing

The global low-alcohol beverages market is segmented as follows:

By Type

- Wine

- Beer

- Spirits

By Distribution Channel

- Store-based

- Non-store based

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Low-Alcohol Beverages

Request Sample

Low-Alcohol Beverages