Polybutylene Naphthalate (PBN) Resin Market Size, Share, and Trends Analysis Report

CAGR :

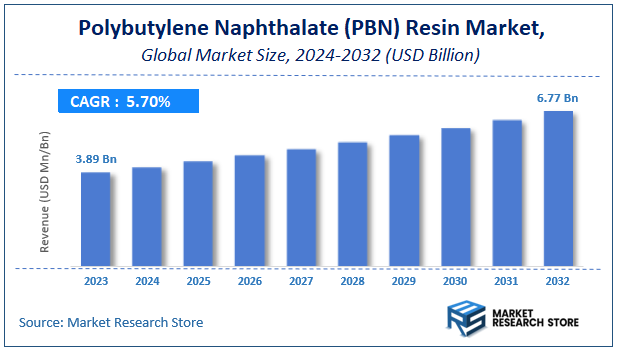

| Market Size 2023 (Base Year) | USD 3.89 Billion |

| Market Size 2032 (Forecast Year) | USD 6.77 Billion |

| CAGR | 5.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Polybutylene Naphthalate (PBN) Resin Market Insights

According to Market Research Store, the global polybutylene naphthalate (PBN) resin market size was valued at around USD 3.89 billion in 2023 and is estimated to reach USD 6.77 billion by 2032, to register a CAGR of approximately 5.7% in terms of revenue during the forecast period 2024-2032.

The polybutylene naphthalate (PBN) resin report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Polybutylene Naphthalate (PBN) Resin Market: Overview

Polybutylene naphthalate (PBN) resin is a high-performance thermoplastic polyester known for its excellent mechanical strength, thermal stability, and chemical resistance. It is derived from 2,6-naphthalene dicarboxylic acid and butanediol, offering superior properties compared to conventional polyesters like PET and PBT. PBN resin is valued for its high glass transition temperature, low moisture absorption, and exceptional dimensional stability, making it an ideal material for applications in the electrical, automotive, and industrial sectors. It is commonly used in electrical insulation, connectors, and high-performance industrial components requiring resistance to heat and wear.

Key Highlights

- The polybutylene naphthalate (PBN) resin market is anticipated to grow at a CAGR of 5.7% during the forecast period.

- The global polybutylene naphthalate (PBN) resin market was estimated to be worth approximately USD 3.89 billion in 2023 and is projected to reach a value of USD 6.77 billion by 2032.

- The growth of the polybutylene naphthalate (PBN) resin market is being driven by increasing demand for advanced engineering plastics in various industries.

- Based on the resin type, the polybutylene naphthalate (PBN) resin segment is growing at a high rate and is projected to dominate the market.

- On the basis of functionality, the flame retardant segment is projected to swipe the largest market share.

- In terms of manufacturing process, the polymerization segment is expected to dominate the market.

- Based on the application, the plastics segment is expected to dominate the market.

- On the basis of end-user, the automotive segment is projected to swipe the largest market share.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Polybutylene Naphthalate (PBN) Resin Market: Dynamics

Key Growth Drivers

- High-Performance Applications: PBN resin is widely used in high-temperature and high-strength applications, such as automotive, electronics, and industrial components, due to its excellent thermal and mechanical properties.

- Growing Demand in Electronics: The rise in demand for miniaturized and high-performance electronic components drives the need for PBN resin, which offers superior electrical insulation and heat resistance.

- Automotive Industry Expansion: Increasing adoption of lightweight and durable materials in the automotive sector to improve fuel efficiency and reduce emissions boosts PBN resin demand.

- Sustainability Trends: PBN resin is recyclable and aligns with the growing focus on sustainable materials, attracting environmentally conscious industries.

Restraints

- High Production Costs: The complex manufacturing process and raw material costs make PBN resin expensive, limiting its adoption in cost-sensitive industries.

- Competition from Alternatives: The availability of cheaper alternatives like polybutylene terephthalate (PBT) and other engineering plastics can hinder market growth.

- Limited Awareness: Lack of awareness about PBN resin's benefits in emerging markets may slow its adoption.

Opportunities

- Emerging Markets: Rapid industrialization and urbanization in Asia-Pacific and other developing regions present significant growth opportunities for PBN resin.

- Innovation in Material Science: Advancements in polymer technology can lead to the development of enhanced PBN resin grades, expanding its application scope.

- Renewable Energy Sector: The growing renewable energy industry, particularly in wind turbines and solar panels, creates demand for durable and heat-resistant materials like PBN resin.

Challenges

- Supply Chain Disruptions: Fluctuations in raw material availability and geopolitical issues can impact the supply chain, affecting production and pricing.

- Regulatory Compliance: Stringent environmental and safety regulations may increase production costs and limit market expansion.

- Technical Limitations: PBN resin's brittleness and processing difficulties in certain applications can pose challenges for manufacturers.

Polybutylene Naphthalate (PBN) Resin Market: Report Scope

This report thoroughly analyzes the Polybutylene Naphthalate (PBN) Resin Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Polybutylene Naphthalate (PBN) Resin Market |

| Market Size in 2023 | USD 3.89 Billion |

| Market Forecast in 2032 | USD 6.77 Billion |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 175 |

| Key Companies Covered | Teijin Limited, Solvay S.A., BASF SE, DuPont, Mitsubishi Chemical Corporation, and EMS-CHEMIE AG |

| Segments Covered | By Resin Type, By End-Use, By Application, By Manufacturing Process, By Functionality, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polybutylene Naphthalate (PBN) Resin Market: Segmentation Insights

The global polybutylene naphthalate (PBN) resin market is divided by resin type, functionality, manufacturing process, application, end-user, and region.

Segmentation Insights by Resin Type

Based on resin type, the global polybutylene naphthalate (PBN) resin market is divided into polybutylene naphthalate (PBN) resin, and others.

The Polybutylene Naphthalate (PBN) Resin segment is the most dominant in the market due to its superior thermal and mechanical properties, making it a preferred choice across various industries. PBN resin exhibits excellent heat resistance, dimensional stability, and chemical resistance, which enhances its suitability for applications in electrical and electronic components, automotive parts, and industrial machinery.

Additionally, its high-performance characteristics, such as low moisture absorption and excellent electrical insulation, contribute to its increasing adoption, particularly in advanced engineering applications. The rising demand for lightweight and durable materials in automotive and electronic manufacturing further strengthens the dominance of this segment.

Segmentation Insights by Functionality

Based on functionality, the global polybutylene naphthalate (PBN) resin market is divided into flame retardant, heat resistant, and wear resistance.

The Flame Retardant segment is the most dominant in the Polybutylene Naphthalate (PBN) resin market due to its critical role in enhancing fire safety across various industries. PBN resin with flame-retardant properties is widely used in electrical and electronic components, automotive interiors, and industrial applications where fire resistance is essential. Regulations and safety standards in industries like consumer electronics and transportation have further fueled the demand for flame-retardant PBN resins, making this segment the largest in the market.

The Heat Resistant segment follows as the second most significant, driven by the need for materials that can withstand high operating temperatures without degrading. PBN resin’s excellent thermal stability makes it a preferred choice in applications such as engine components, electrical insulation, and industrial machinery parts. The increasing demand for high-temperature-resistant materials in automotive and aerospace industries supports the growth of this segment.

The Wear Resistance segment, while smaller than the other two, plays a crucial role in applications where durability and mechanical performance are essential. PBN resin with wear-resistant properties is utilized in gears, bearings, and mechanical parts that require long-lasting performance under friction and mechanical stress. Although this segment is smaller, its demand remains steady in industrial and automotive applications where material longevity is a priority.

Segmentation Insights by Manufacturing Process

Based on manufacturing process, the global polybutylene naphthalate (PBN) resin market is divided into polymerization, extrusion, and molding.

The Polymerization segment is the most dominant in the Polybutylene Naphthalate (PBN) resin market, as it serves as the foundational manufacturing process for producing high-quality PBN resins. This process involves chemically synthesizing monomers to create PBN polymer chains, ensuring precise control over molecular weight and material properties. The increasing demand for high-performance engineering plastics across industries like automotive, electronics, and industrial manufacturing drives the growth of this segment. Manufacturers prioritize polymerization to achieve consistent quality and superior mechanical and thermal properties in PBN resins.

The Extrusion segment follows as the second most significant, primarily used to process PBN resins into films, sheets, and continuous profiles. This method is widely employed in applications requiring lightweight and durable materials, such as packaging, electrical insulation, and automotive components. The growing demand for extruded PBN products in the electronics and automotive sectors contributes to the steady expansion of this segment.

The Molding segment, while the least dominant, plays a vital role in producing finished parts and components. Injection molding and compression molding techniques are used to shape PBN resin into complex geometries, making it ideal for manufacturing precision parts in automotive, medical, and industrial applications. Though this segment is smaller in market share compared to polymerization and extrusion, it remains crucial for end-use industries that require customized and intricate PBN resin components.

Segmentation Insights by Application

On the basis of application, the global polybutylene naphthalate (PBN) resin market is bifurcated into coatings, plastics, adhesives, and films.

The Plastics segment is the most dominant in the Polybutylene Naphthalate (PBN) resin market due to its extensive use in high-performance engineering applications. PBN-based plastics are widely utilized in the automotive, electronics, and industrial sectors, where superior mechanical strength, heat resistance, and chemical stability are required. The increasing demand for lightweight yet durable materials in automotive and electronic components has further fueled the growth of this segment, making it the largest in the market.

The Films segment follows as the second most significant, primarily driven by its applications in flexible packaging, electrical insulation, and industrial coatings. PBN films offer excellent thermal stability, moisture resistance, and mechanical strength, making them ideal for high-temperature and high-stress environments. The rising use of advanced films in electronics and specialty packaging solutions contributes to the expansion of this segment.

The Coatings segment ranks third, playing a crucial role in protecting surfaces from heat, chemicals, and mechanical wear. PBN-based coatings are used in industrial machinery, automotive parts, and electronic components to enhance durability and performance. Although this segment is smaller than plastics and films, its demand remains steady, particularly in industries where surface protection and longevity are essential.

The Adhesives segment is the least dominant but still significant, mainly utilized in high-performance bonding applications. PBN-based adhesives offer strong adhesion, chemical resistance, and thermal stability, making them valuable in aerospace, automotive, and electronics manufacturing. While this segment holds a smaller share in the market, its niche applications ensure a steady demand.

Segmentation Insights by End-User

Based on resin type, the global polybutylene naphthalate (PBN) resin market is divided into automotive, electronics, packaging, construction, and medical.

The Automotive segment is the most dominant in the Polybutylene Naphthalate (PBN) resin market due to the increasing demand for lightweight, heat-resistant, and durable materials in vehicle manufacturing. PBN resin is widely used in automotive electrical components, connectors, and under-the-hood applications where high thermal stability and mechanical strength are essential. The growing trend toward electric vehicles (EVs) has further accelerated the need for advanced polymers like PBN, as they contribute to weight reduction and improved energy efficiency.

The Electronics segment follows as the second most significant, driven by the need for high-performance materials in circuit boards, connectors, and insulation components. PBN resin offers excellent electrical insulation, low moisture absorption, and superior dimensional stability, making it an ideal choice for electronic applications. With the rapid expansion of consumer electronics and 5G technology, the demand for advanced polymers in electronic components continues to grow.

The Packaging segment ranks third, benefiting from PBN resin’s exceptional barrier properties, chemical resistance, and thermal stability. PBN is used in specialty packaging applications where high-performance films and coatings are required to protect sensitive products. The rise of sustainable and high-performance packaging solutions in the food and pharmaceutical industries supports the steady growth of this segment.

The Construction segment, while smaller than the top three, plays a crucial role in applications such as coatings, adhesives, and insulation materials. PBN’s durability and resistance to environmental factors make it valuable in infrastructure projects, though its use is more limited compared to automotive and electronics.

The Medical segment is the least dominant but still significant, particularly in applications requiring biocompatibility, chemical resistance, and sterilization stability. PBN resin is used in medical device housings, surgical instruments, and pharmaceutical packaging. While this segment holds a smaller market share, advancements in healthcare technology and the demand for high-performance materials in medical applications ensure steady growth.

Polybutylene Naphthalate (PBN) Resin Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

The Asia-Pacific region stands as the most dominant market for polybutylene naphthalate (PBN) resin, driven by robust manufacturing sectors in countries like China, Japan, and South Korea. The region's thriving automotive and electronics industries have significantly increased the demand for high-performance materials such as PBN resin. China, in particular, has a substantial packaging and electronics manufacturing base, further propelling the consumption of PBN resin. The growing investments in research and development activities related to advanced materials and technologies are also contributing to market growth in the Asia-Pacific region.

North America has emerged as a prominent market for polybutylene naphthalate (PBN) resin, owing to the strong presence of aerospace and defense industries in countries like the United States and Canada. The use of PBN resin in applications such as aerospace components, missile systems, and satellite technologies has surged in this region due to its superior thermal stability and high purity characteristics. Moreover, technological advancements and the emphasis on enhancing performance efficiencies in various industries are driving the demand for PBN resin in North America.

Europe also plays a significant role in the polybutylene naphthalate (PBN) resin market, with countries like Germany, France, and the United Kingdom leading in consumption. The region's stringent environmental regulations and the automotive industry's focus on lightweight and durable materials have spurred the adoption of PBN resin. Additionally, the electronics sector's demand for high-performance materials contributes to the market's growth in Europe.

Latin America is experiencing moderate growth in the polybutylene naphthalate (PBN) resin market, with countries like Brazil and Argentina contributing to the demand. Economic development and industrial expansion, particularly in the automotive and electronics sectors, are driving the consumption of PBN resin in this region. The increasing investments in packaging and electronics industries, along with the growing demand for high-performance materials, are expected to drive market growth in Latin America.

The Middle East and Africa region is expected to witness moderate growth in the polybutylene naphthalate (PBN) resin market during the forecast period. The increasing investments in the packaging and electronics industries, along with the growing demand for high-performance materials in these regions, are expected to drive the market growth. However, the relatively lower adoption of advanced technologies and the presence of alternative materials may limit the growth potential of the PBN resin market in these regions compared to the Asia-Pacific, North American, and European markets.

Polybutylene Naphthalate (PBN) Resin Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the polybutylene naphthalate (PBN) resin market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global polybutylene naphthalate (PBN) resin market include:

- Teijin Limited

- Polyplastics Co. Ltd.

- Celanese Corporation

- BASF SE

- DuPont de Nemours Inc.

- Mitsubishi Engineering-Plastics Corporation

- SABIC

- Toray Industries Inc.

- Evonik Industries AG

- Sumitomo Chemical Co. Ltd.

The global polybutylene naphthalate (PBN) resin market is segmented as follows:

By Resin Type

- Polybutylene Naphthalate (PBN) Resin

- Others

By Functionality

- Flame Retardant

- Heat Resistant

- Wear Resistance

By Manufacturing Process

- Polymerization

- Extrusion

- Molding

By Application

- Coatings

- Plastics

- Adhesives

- Films

By End-User

- Automotive

- Electronics

- Packaging

- Construction

- Medical

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Polybutylene Naphthalate (PBN) Resin

Request Sample

Polybutylene Naphthalate (PBN) Resin